What is the Industry 4.0 Market Size?

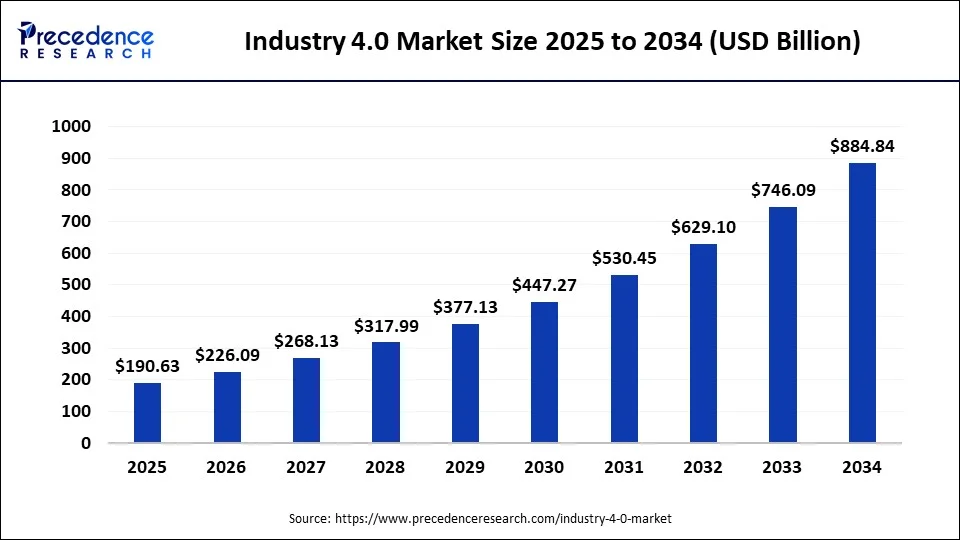

The global Industry 4.0 market size is valued at USD 190.63 billion in 2025, estimated at USD 226.09 billion in 2026, and is expected to reach around USD 1009.08 billion by 2035, expanding at a CAGR of 18.13% from 2026 to 2035.

Industry 4.0 Market Key Takeaways

- In terms of revenue, the market is valued at $190.87 billion in 2025.

- It is projected to reach $1009.08 billion by 2035.

- The market is expected to grow at a CAGR of 18.13% from 2026 to 2035.

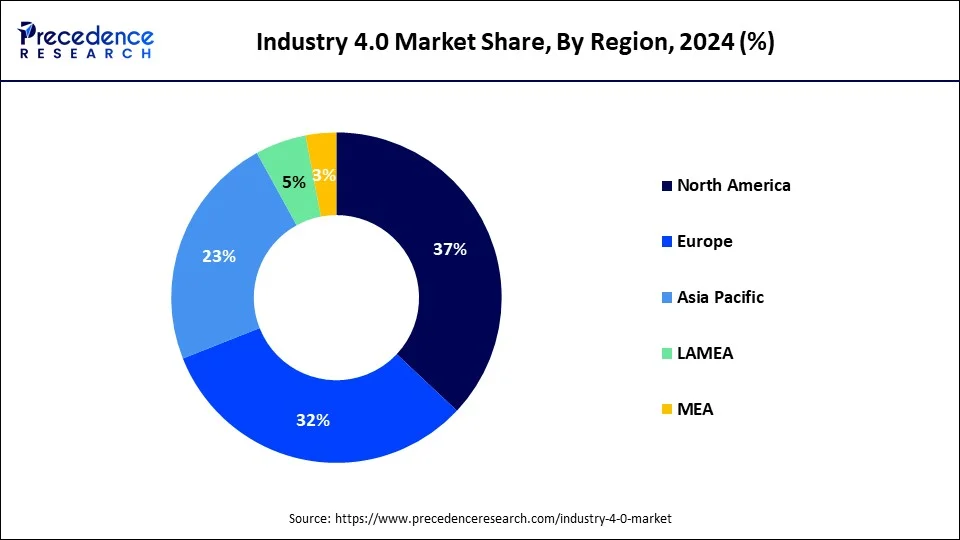

- North America led the global market with the highest market share of 37% in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Technology Type, the industry automation segment has held the largest revenue share in 2025.

- By End-User, the manufacturing segment has contributed more than 33% of revenue share in 2025.

Market Overview

The industry 4.0 market signifies a groundbreaking shift in the manufacturing and industry landscape, often referred to as the fourth industrial revolution. The revolution of Industry 4.0 encompasses the integration of advanced digital technologies and traditional industrial processes. The convergence of the two forces is leading to a wave of disruptive innovations, including the Internet of Things (IoT), artificial intelligence (AI), machine learning, big data analytics, robotics and advanced automation systems.

In principle, Industry 4.0 aims to establish "smart factories" whereby machines, processes and products are working together and communicating with a minimal level of intervention by humans. By fostering interconnected systems, real-time data exchange, predictive maintenance capabilities, and swift decision-making become possible.

In the world of Industry 4.0, companies are heavily investing in optimizing production processes, cutting down on operational costs, improving product quality, and enhancing flexibility to meet market demands effectively. This transformation empowers the customization of products at a large scale, often coined as "batch size one," where production is tailored precisely according to individual customer requirements. Moreover, leveraging data-driven insights enables predictive maintenance practices for reducing downtime and maximizing overall equipment effectiveness.

How Is Artificial Intelligence Driving the Breakthroughs of Industry 4.0?

Artificial Intelligence (AI) is the very heart of Industry 4.0 and is transforming the landscape for manufacturing with new levels of automation, predictive maintenance, and intelligent decision making. AI4Industry enabled robots, such as those used by Tesla and Siemens, now have the ability to adapt to the task being created in real-time, increasing production efficiency. IBM's Watson and NVIDIA's AI driven digital twins allow for real time process simulation, further helping manufacturers reduce downtime. In logistics, companies like Amazon use AI to optimize inventory and delivery systems. AI is also supporting quality control with computer vision systems capable of detecting manufactured defects significantly faster than humans. With advancements in edge AI and 5G, intelligent factories will be more autonomous, agile, and data-driven than ever before.

Industry 4.0 Market Growth Factors

Industry 4.0 is set to experience strong and consistent growth. This can be attributed to several factors that contribute to its widespread adoption and transformative impact across various sectors. One of the key drivers is the relentless pursuit of operational efficiency and productivity improvement. Companies are empowered by Industry 4.0 technologies such as automation, IoT sensors, AI, and advanced analytics.

These technologies allow for streamlining processes, reducing waste, and optimizing resource utilization, resulting in significant cost savings, increased output, and enhanced competitiveness. With modern supply chains becoming increasingly complex, Industry 4.0's expansion is further fueled. These technologies offer real-time visibility into supply chain operations, enhancing transparency, traceability, and responsiveness. These capabilities prove invaluable in mitigating risks, ensuring quality control, and meeting regulatory requirements. They enable companies to effectively overcome disruptions and uncertainties, as exemplified during the COVID-19 pandemic.

Therefore, the convergence of efficiency gains, customization demands, supply chain complexities, ongoing technological progress, innovation potential, and the global shift toward sustainability positions Industry 4.0 as a force that cannot be ignored in contemporary industry. It is transforming how businesses operate and deliver value, with expectations for its continuous growth and profound influence in the future.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 884.84 Billion |

| Market Size in 2025 | USD 190.87 Billion |

| Market Size in 2026 | USD 226.09 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.6% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Efficiency and productivity

In today's competitive business landscape, where companies face constant pressure to streamline operations and cut costs, Industry 4.0 technologies emerge as a game-changing solution. These groundbreaking tools encompass automation, IoT sensors, artificial intelligence, and advanced analytics, empowering businesses to optimize their processes with precision and intellect. One of the key advantages is a noticeable decrease in downtime and operational inefficiencies.

For instance, predictive maintenance leverages data analytics and IoT sensors to monitor machinery in real-time, enabling proactive maintenance actions before equipment failures occur. This not only minimizes expensive production stoppages but also extends the lifespan of critical assets. Another pivotal aspect is automation within Industry 4.0 which replaces labor-intensive tasks with autonomous systems, enhancing both production speed and accuracy in manufacturing processes. Robotics, equipped with AI algorithms, takes charge of repetitive tasks and ensures unparalleled consistency.

As a result, it leads to increased output and superior quality control. Furthermore, by incorporating data analytics, valuable insights into production bottlenecks and process optimization are gained. This allows for continuous improvement in operations. Reduced lead times and optimized resource utilization further enhance efficiency gains.

The drive for efficiency goes beyond the factory floor. Supply chains, which are crucial in many industries, benefit greatly from Industry 4.0's real-time visibility and predictive analytics. This allows companies to optimize inventory levels, swiftly respond to demand changes, and make well-informed decisions based on reliable data. Such a streamlined approach helps prevent delays, reduce costs, and minimize waste within the supply chain.

As the global market becomes more competitive and dynamic, efficiency and productivity are no longer just advantages but essential for business survival. With Industry 4.0, companies are equipped with the necessary tools to remain agile and responsive in rapidly changing environments. Furthermore, it enhances their ability to efficiently scale operations in order to meet growing demands.

Restraints

Complexity and integration challenges

Complexity and integration challenges hinder the growth of the Industry 4.0 market. This is due to the diverse nature of Industry 4.0 technologies, including IoT devices, data analytics platforms, and AI-driven systems. The implementation processes for these technologies can be intricate, posing hurdles for organizations. Moreover, legacy systems in many industries may not seamlessly integrate with modern technologies, leading to costly and time-consuming adaptations.

Ensuring interoperability among different devices and software solutions also presents a formidable task. To overcome these challenges, organizations must invest in specialized expertise such as system architects who can design integrated ecosystems and IT professionals who excel in managing data flows and connectivity.

Furthermore, integrating new processes can often disrupt ongoing operations. It requires meticulous planning and a strong commitment to minimizing potential downtime or inefficiencies. This challenge becomes particularly daunting for large-scale enterprises with entrenched systems. Consequently, many businesses encounter a steep learning curve and possible setbacks when transitioning to Industry 4.0, which can discourage adoption. To overcome these obstacles and fully unlock the transformative potential of Industry 4.0 while ensuring a smooth transition with minimal disruption, effective change management strategies and a strategic approach to integration are crucial.

Opportunities

Customization and personalization

In today's consumer-driven world, individuals are increasingly seeking products and experiences that cater to their unique preferences and needs. Thanks to Industry 4.0 technologies, businesses now have the power to deliver precisely that through a concept known as "mass customization." By combining the efficiency and scale of mass production with personalized choices, companies can offer a wide range of customized products. From tailor-made consumer electronics and clothing to individually crafted industrial equipment, manufacturers can meet diverse requirements.

The integration of IoT sensors allows gathering valuable data on customer preferences and usage patterns. This information is then translated into actionable insights through advanced AI and data analytics. Manufacturers now have the opportunity to design, assemble, and customize products according to their customers' specific needs. The level of personalization achieved today surpasses what was previously possible when relying solely on mass production techniques.

Additionally, incorporating personalization into business strategy can drive innovation. With the rise of Industry 4.0 and its powerful data generation capabilities, companies now have an unprecedented opportunity to delve deeper into customer behavior and market trends. This data-focused approach empowers them to develop innovative, personalized products and services, opening fresh revenue streams and captivating market prospects.

The ability to cater to individual preferences and deliver customized products and experiences drives the industry 4.0 market compellingly. Not only meets the demand of sophisticated consumers, but it also promotes innovation, improves customer loyalty and places businesses in a competitive position at a time when markets are rapidly evolving. In order to respond to the increasing need for personal services, more companies have begun adopting these technologies as they realize the potential of customization and personalization. The expansion of the industrial 4.0 market will be stimulated by this.

Segment Outlook

What made the hardware segment lead the industry 4.0 market in 2025?

The hardware segment dominated the market in 2025. The segment includes industrial robotics, sensors & actuators, industrial PCs & controllers, communication equipment, and 3D printers/additive manufacturing machines. The rising use of IoT devices continues to expand is likely to spur the demand for hardware components. The growth of the segment is driven by the rapid development of IoT technologies and the rising demand for modern technologies that can improve overall manufacturing efficiency and reduce downtime. On the other hand, the software/platforms segment is witnessing the fastest growth, owing to the rising demand for AI and ML technologies. Moreover, the increasing popularity of cloud computing is anticipated to drive the demand for software in Industry 4.0. Cloud-based platforms enable firms to get access to various software tools and services to optimize their production processes and enable data-driven decision-making in real-time.

What made the Industrial Internet of Things (IIoT) segment lead the industry 4.0 market in 2025?

The Industrial Internet of Things (IIoT) segment was dominant, with the biggest share of the global Industry 4.0 market in 2024. The growth of the segment is driven by the growing demand for industrial automation to streamline and optimize various industrial processes, which in turn enhances efficiency, productivity, and flexibility. The growth of the Industrial Internet of Things (IIoT) has led to the increasing utilization of automation systems, including robots, robotic process automation (RPA), and autonomous machinery. These advanced technologies excel in executing repetitive tasks with precision and consistency, leading to reduced dependence on human labor, decreased errors, and improved overall production quality. IoT sensors and devices gather real-time data from machinery and equipment, providing valuable insights into operational performance. Moreover, the automation of industries heavily relies on artificial intelligence (AI) and machine learning (ML) algorithms to analyze the data gathered by IoT devices. On the other hand, the edge computing & private 5G segment is also experiencing the fastest growth, owing to the rising adoption of industrial robots and IoT and the rising need for high-performance, low-latency connectivity provided by private 5G networks. Several businesses are increasingly adopting private 5G services to provide secure, reliable, and high-performance wireless connectivity, which plays a crucial role in connecting a massive number of devices within the industrial setting. Thus, bolstering the segment's expansion in the coming years.

How did the manufacturing segment dominate the Industry 4.0 market in 2025?

The manufacturing segment dominated the market in 2025. The manufacturing industry, a prominent consumer of Industry 4.0 technologies, has undergone a significant transformation that gave birth to the era of intelligent and interconnected factories. Artificial intelligence (AI) and machine learning algorithms play crucial roles in this transformative journey for the manufacturing segment. AI-powered systems leverage vast datasets generated by IoT devices to uncover patterns, identify anomalies, and autonomously make decisions. This leads to more precise demand forecasting, optimized production schedules, enhanced quality control measures, lowering waste reduction, and boosted productivity. On the other hand, the logistics & warehousing segment is expected to register the fastest growth, owing to the increasing need for efficiency through automation, AI, and IoT devices. The rapid expansion of e-commerce creates significant demand for faster and more efficient delivery, which leads to increasing investment in automated logistics solutions. Several companies are increasingly adopting Industry 4.0 technologies to lower operational costs associated with warehousing and transportation by improving inventory management and reducing downtime.

What has led the on-premises segment to dominate the Industry 4.0 market?

The on-premises segment held the largest segment of the industry 4.0 market in 2025, owing to the suitability for highly regulated industries that require complete control over their data. Numerous companies, particularly larger enterprises, are adopting on-premises infrastructure for critical or sensitive operations. On the other hand, the cloud-based segment is expected to grow significantly in the coming years. The rapid growth of the segment is facilitated by the wide cloud-based deployment for Industry 4.0 applications. Cloud-based deployments are gaining popularity due to their scalability, lower maintenance costs, and flexibility, favored for their remote accessibility.

Segment Insights

Technology Type Insights

According to the technology type, the industry automation sector has held the major revenue share in 2025. The industrial automation segment comprises various technologies and practices designed to streamline and optimize industrial processes, enhancing efficiency, productivity, and flexibility. A key component of this segment is the utilization of automation systems, including robots, robotic process automation (RPA), and autonomous machinery. These advanced technologies excel in executing repetitive tasks with precision and consistency, leading to reduced dependence on human labor, decreased errors, and improved overall production quality.

In addition, IoT sensors and devices gather real-time data from machinery and equipment, providing valuable insights into operational performance. Leveraging this data enables predictive maintenance wherein potential issues are identified proactively before they cause costly downtime. As a result, maintenance schedules become optimized while extending the lifespan of critical assets.

Moreover, the automation of industries heavily relies on artificial intelligence (AI) and machine learning algorithms to analyze the data gathered by IoT devices. These advanced technologies empower autonomous decision-making, optimize processes, and facilitate adaptive production. AI-driven systems have the capability to dynamically adjust manufacturing parameters, swiftly respond to market fluctuations, and streamline supply chain logistics.

End-User Insights

The manufacturing sector had the highest market share on the basis of the end-user in 2025. The manufacturing industry, a prominent consumer of Industry 4.0 technologies, has undergone a significant transformation that gave birth to the era of intelligent and interconnected factories. With Industry 4.0 in mind, manufacturing encompasses diverse sectors ranging from automotive and aerospace to electronics, pharmaceuticals, and consumer goods. These sectors have enthusiastically embraced digital technology integration to optimize production processes, improve product quality, and achieve unparalleled levels of flexibility and efficiency.

Artificial intelligence (AI) and machine learning algorithms play crucial roles in this transformative journey for the manufacturing segment. AI-powered systems leverage vast datasets generated by IoT devices to uncover patterns, identify anomalies, and autonomously make decisions. This leads to more precise demand forecasting, optimized production schedules, enhanced quality control measures resulting in waste reduction and heightened productivity.

Regional Insights

What is the U.S. Industry 4.0 Market Size?

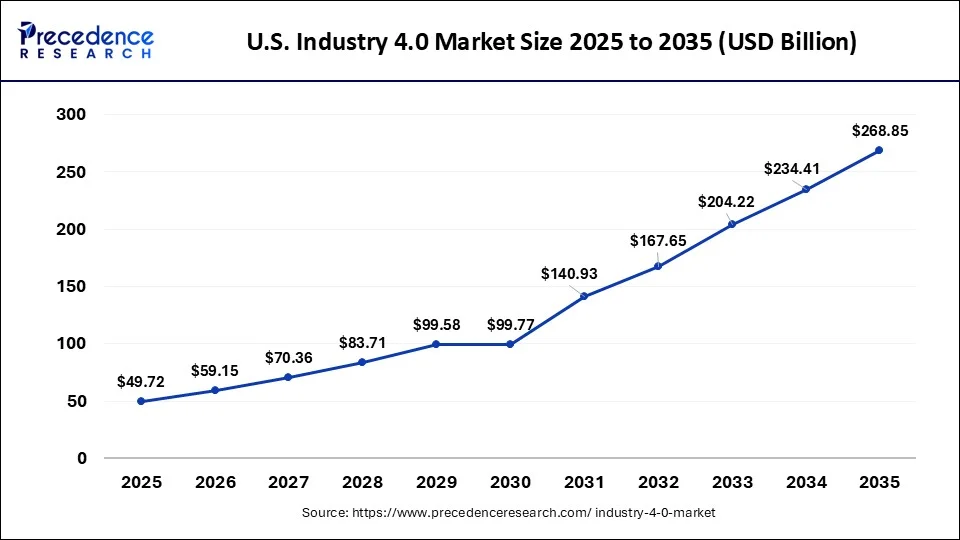

The U.S. industry 4.0 market size is valued at USD 49.72 billion in 2025 and is estimated to reach around USD 268.85 billion by 2035, growing at a CAGR of 18.39% from 2026 to 2035.

North America has held the largest revenue share in 2025. The region comprising the United States and Canada stands as a global leader in adopting and integrating advanced digital technologies across various industries. The Industry 4.0 market in North America owes its growth to several key drivers, including a thriving innovation ecosystem, vibrant startup culture, substantial investments in research and development, and a strong commitment towards technological advancements. Notably, tech hubs like Silicon Valley, Boston, and Austin have played instrumental roles in fostering innovation and nurturing Industry 4.0 technologies.

In these regions reside numerous startups alongside established tech giants, collectively driving the proliferation of cutting-edge solutions encompassing areas such as the Internet of Things (IoT), artificial intelligence (AI), and advanced manufacturing. Furthermore, North American governments display unwavering support for the advancement of Industry 4.0. They demonstrate their dedication through various means such as facilitating research grants, providing tax incentives, and implementing policies that foster digital transformation.

U.S. Industry 4.0 Market Analysis

The market in the U.S. is growing due to strong investments in automation, AI, IoT, and advanced manufacturing technologies. A robust, innovative technology ecosystem, the presence of leading tech companies, startup culture, and government support through research grants and policies are driving the market. Companies are focusing on optimizing production, reducing costs, and enhancing product quality, accelerating smart factory implementation nationwide.

What Potentiates the Asia Pacific Industry 4.0 Market?

The Asia-Pacific Industry 4.0 market is a rapidly expanding and dynamic landscape that holds great promise and potential. China stands out as a manufacturing and technological powerhouse driving Industry 4.0 in Asia-Pacific. The country's "Made in China 2025" initiative sets ambitious goals to upgrade its manufacturing capabilities by integrating technologies such as IoT, AI, and automation. Chinese companies eagerly embrace these advancements to enhance production efficiency, product quality, and global competitiveness. Japan, known for its precision manufacturing and robotics expertise, has been at the forefront of embracing Industry 4.0 principles.

Japan Industry 4.0 Market Analysis

Japanese companies lead in developing cutting-edge robotics, automation solutions, and revolutionary IoT applications, playing a vital role in the regional landscape of Industry 4.0. Conversely, India is rapidly emerging as a prominent hub for IT andsoftware services, crucial components of Industry 4.0 advancement. With its flourishing tech startup ecosystem fostering innovation in AI, data analytics, and IoT domains, Indian firms are successfully incorporating Industry 4.0 solutions into their operations and supply chains.

How is the Opportunistic Rise of Europe in the Industry 4.0 Market?

Europe is expected to grow at a notable rate in the market due to extensive adoption of automation, AI, and IoT technologies in manufacturing and industrial sectors. Government initiatives supporting digital transformation, investments in smart factories, and a focus on energy efficiency and sustainable production are driving innovation, improving productivity, and accelerating the region's shift toward advanced, connected industrial systems.

UK Industry 4.0 Market Analysis

The market in the UK is expanding due to the increasing adoption of smart manufacturing, automation, and AI-driven solutions. Strong government support through digital transformation initiatives, investments in advanced manufacturing, and a strong focus on innovation and technology startups are enhancing operational efficiency and reducing costs. These efforts are also enabling the development of connected, data-driven industrial systems, further accelerating market growth.

Industry 4.0 Market Companies

- International Business Machines Corporation: Provides advanced Industry 4.0 platforms including Watson IoT, cloud analytics, AI driven insights, digital twin capabilities, and enterprise integration to optimize manufacturing, predictive maintenance, and real time operations.

- Emerson Electric Co.: Delivers industrial automation and analytics through its PlantWeb Digital Ecosystem, enabling connected sensors, real time diagnostics, predictive maintenance, and data driven process optimization.

- Schneider Electric SE: Offers EcoStruxure, an IIoT enabled architecture for industrial automation, smart manufacturing, energy management, and process control that enhances connectivity, efficiency, and operational visibility.

- Cisco Systems Inc.: Provides secure IIoT networking, edge computing, industrial connectivity, and cybersecurity solutions to integrate OT and IT, enhance visibility, and support Industry 4.0 data flows and automation.

- Rockwell Automation Inc.: Supplies industrial automation hardware and software like FactoryTalk, enabling connected enterprises, real-time monitoring, process control, and analytics for smart manufacturing.

- Cognex Corporation: Specializes in machine vision systems and sensors for automated inspection, barcode reading, and real time production feedback to boost quality, throughput, and Industry  4.0 automation.

Other Major Key Players

- Honeywell International Inc.

- Honeywell International Inc.

- ABB Ltd.

Recent Developments

- In February 2025, Ericsson implemented a private 5G network at Jaguar Land Rover's Solihull facility as part of the UK-funded West Midlands 5G program, supporting real-time IoT data processing and vision analytics to enhance manufacturing operations.

(Source: https://www.ericsson.com ) - In May 2025, UST, T-Works To Accelerate Industry 4.0 solutions for manufacturing, semiconductor, automotives. UST's partnership with the prototyping centre to deliver turnkey solutions in automotive AI, industrial IoT and semiconductor testing. It also includes joint development and commercialisation of new IPs, such as 5G-enabled industrial IoT modules and the incubation of Industry 4.0 solutions for automotive suppliers.

(Source: https://www.ndtvprofit.com) - In February 2025, Germany's leading supply chain and operations consultancies, Staufen, has been acquired by Accenture. Staufen's service portfolio includes offerings for operational excellence, Industry 4.0 and digital manufacturing, supply chain management, lean and continuous improvement, and data and analytics.

(Source: https://www.consultancy.eu) - In March 2025, Ericsson, Volvo Group, and Bharti Airtel today announced their research partnership to explore the potential of Extended Reality (XR) ,Digital Twin technologies and AI in the manufacturing sector, accelerating Industry 4.0 and Industry 5.0 adoption in India. This collaboration aims to transform industrial operations, enhance workforce training, and drive real-time process optimization.

(Source: https://www.ericsson.com) - Software AG and SAP SE have joined forces to integrate SAP's S/4HANA Cloud with Software AG's analytics platform, TrendMiner. Such collaboration will enable companies to apply analytics to sensor-generated data, providing them with the opportunity to benefit from Industry 4.0 solutions.

- ABB Ltd. unveiled GoFa, a robot designed to help workers with repetitive and ergonomically tasks, in response to the increasing robots demand which can manage heavier payloads for increased productivity and flexibility.

Segments Covered in the Report

By Component

- Hardware

- Industrial Robotics

- Sensors & Actuators

- Industrial PCs & Controllers

- Communication Equipment

- 3D Printers/Additive Manufacturing Machines

- Software/Platforms

- Industrial Internet of Things (IIoT) Platforms

- Artificial Intelligence (AI) & Machine Learning (ML) Platforms

- Big Data & Advanced Analytics Solutions

- Digital Twin & Simulation Software

- Cloud Computing & Edge Computing Platforms

- Cybersecurity Solutions

- Manufacturing Execution Systems (MES) & Enterprise Resource Planning (ERP) Integration

- Extended Reality (XR) Software (AR/VR/MR)

- Blockchain Platforms

- Services

- Consulting Services

- Integration Services

- Managed Services

- Training and Education

- Predictive Maintenance as a Service (PMaaS)

- Factory Analytics Subscriptions

By Technology Type

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI) & Machine Learning (ML)

- Industrial Robotics & Automation

- Cloud Computing

- Edge Computing & Private 5G

- Digital Twin & Simulation

- Additive Manufacturing (3D Printing)

- Augmented Reality (AR) & Virtual Reality (VR)

- Big Data & Advanced Analytics

- Cybersecurity

- Blockchain

By End-User Industry/Vertical

- Manufacturing

- Discrete Manufacturing

- Process Manufacturing

- Automotive

- Oil & Gas

- Energy & Utilities

- Electronics and Semiconductor Foundry

- Food & Beverage

- Aerospace & Defense

- Healthcare & Pharmaceuticals

- Logistics & Warehousing

- Construction

- Metals & Mining

By Deployment Model

- On-Premises

- Cloud-based

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content