What is the Industrial Robotics Market Size?

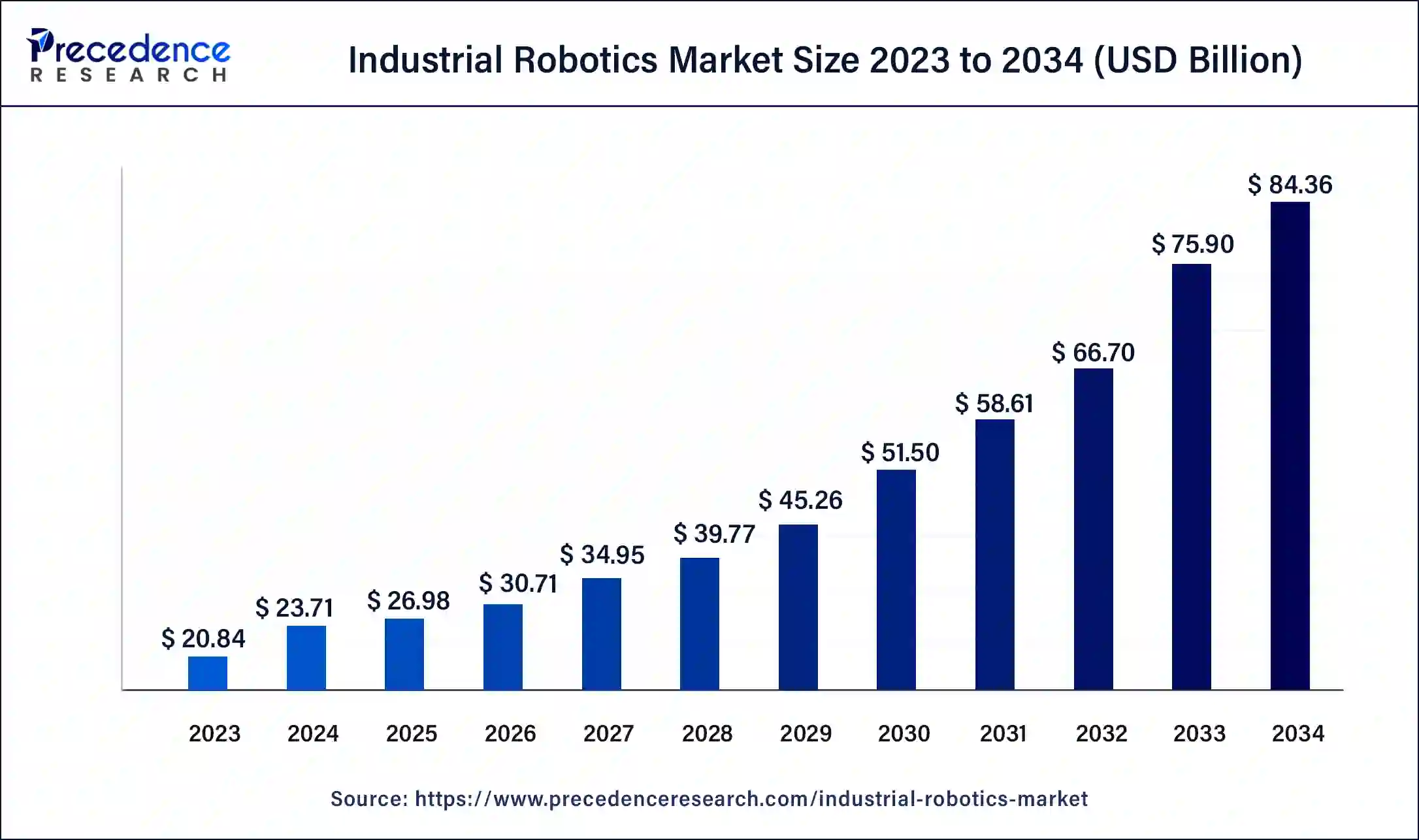

The global industrial robotics market size is calculated at USD 26.98 billion in 2025 and is predicted to increase from USD 30.71 billion in 2026 to approximately USD 93.31 billion by 2035, expanding at a CAGR of 13.21% from 2026 to 2035.

Industrial Robotics Market Key Takeaways

- In terms of revenue, the market is valued at $26.98 billion in 2025.

- It is projected to reach $26.98 billion by 2035.

- The market is expected to grow at a CAGR of 13.21% from 2026 to 2035.

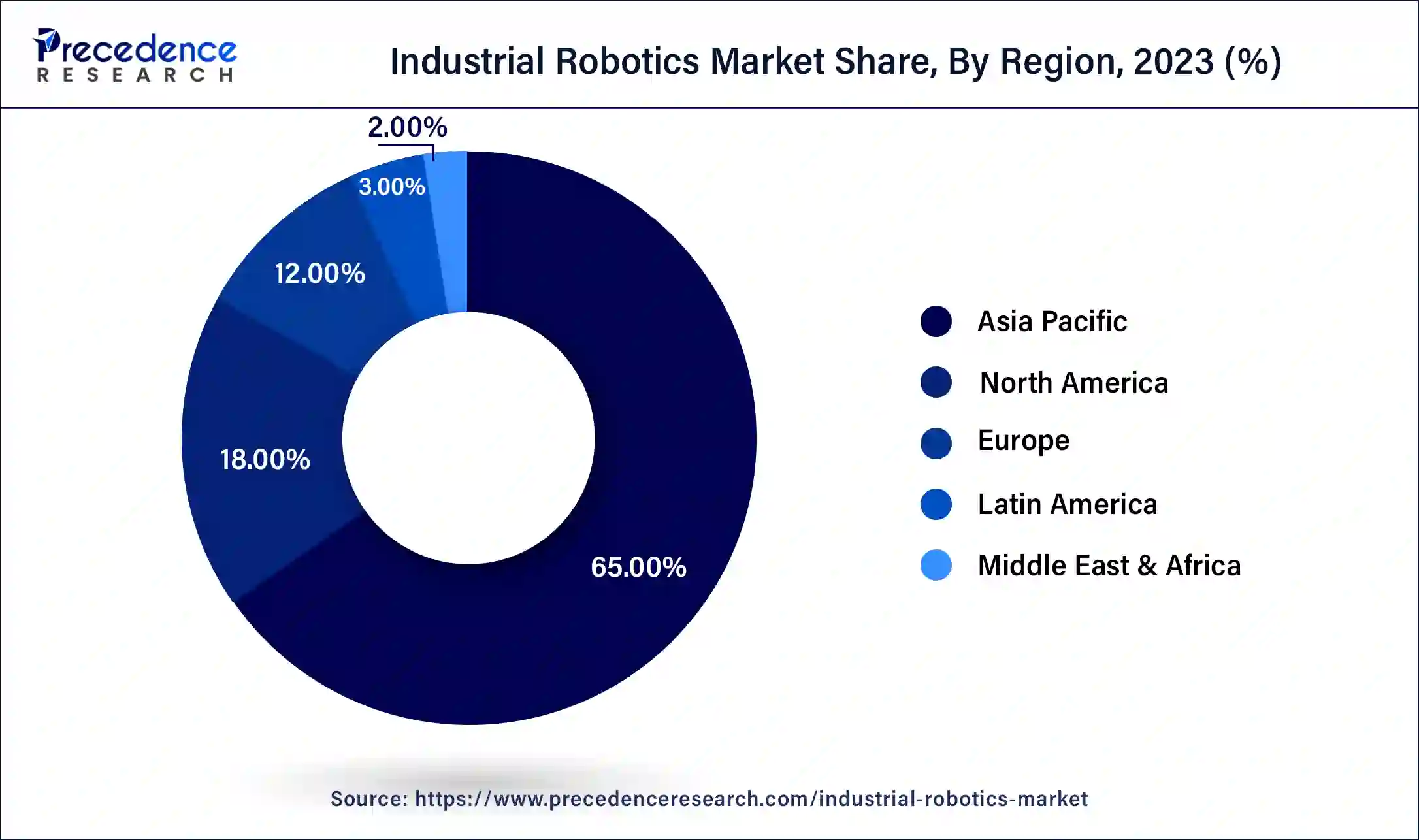

- Asia Pacific dominated the global market and contributed more than 65% of the revenue share in 2025.

- By Type, the SCARA Robots segment is predicted to grow at a faster CAGR between 2026 and 2035.

- By Application, the material handling segment generated the maximum market share in 2025.

- By End-User, the automotive segment captured the largest market share in 2025.

Market Overview

The market for industrial robots has witnessed a surge in growth owing to their ability to automate laborious production processes, particularly those that are part of a fast-paced assembly line. The adoption of robots in the manufacturing industry is on the rise due to various factors such as government policies, increasing labor costs in developed regions like North America and Europe, and the rise of small and medium-sized enterprises (SMEs) globally. Moreover, the trend of automation in industries such as automotive and electronic engineering, along with the focus on minimizing human labor, is expected to create significant growth opportunities for market players.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 26.98 Billion |

| Market Size in 2026 | USD 30.71 Billion |

| Market Size by 2035 | USD 93.31 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.21% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Robots are gradually being adopted in various industries, and manufacturing represents the oldest and most highly recognized use case. At first, large robotic arms were programmed to handle heavy objects, such as automobile parts, in factory settings. However, with the emergence of advanced technologies, such as visual recognition, machine learning, failure prediction, and collaborative robots (co-bots), machines have significantly improved their capabilities, revolutionizing the manufacturing processes.

Manufacturing robots are mainly utilized for repetitive tasks, leading to more streamlined assembly workflows. When working alongside humans, robots assist in producing high-quality products. Numerous manufacturing jobs involve dangerous materials or working conditions, which can put human workers at risk. Repetitive tasks can also cause employee fatigue or distraction, resulting in errors, even in the short run. In contrast, robots possess the necessary machine-learning abilities and dexterity to prevent such mistakes. Robots in manufacturing continue to expand, promoting efficiency, safety, and productivity.

According to the International Federation of Robotics, an all-time high of 517, 385 new industrial robots were installed in 2021 in factories worldwide. This represents a 31% year-on-year increase and a 22% increase over the pre-pandemic record of robot installation in 2018. Recently, the global stock of operational robots has reached a new high of approximately 3.5 million units.

Restraints

The advent of Industry 4.0 has paved the way for the integration of manufacturing processes with the external world, including the deployment of collaborative robots. However, with the increasing interconnectivity of processes, cybersecurity threats are also on the rise.

The vulnerability of cobots can result from a lack of software updates, which can leave them susceptible to cyber-attacks. Additionally, inadequate network administration can expose connected cobotics to malicious activities such as industrial espionage, malware installation, or automated attacks. It is crucial to address these security concerns to ensure the safety and integrity of collaborative robots and connected manufacturing processes in the Industry 4.0 landscape.

High cost of integration

Robot hardware affordability has recently increased, making it a more accessible option for businesses seeking to introduce automation to their manufacturing processes. However, the cost of purchasing a robot represents only a small fraction of the total expense associated with automation.

A study reveals that many businesses view high integration costs as a significant obstacle to the adoption of robotics in manufacturing. Large manufacturers using industrial robots face difficulties integrating new robotics technologies with 15- to 20-year-old infrastructures and technologies present on the same production line. For SMEs with smaller production processes, the prohibitive cost of integration often makes automation unjustifiable, particularly when dealing with smaller production lot sizes. Despite the numerous benefits that robotics can bring to manufacturing, the high cost of integration remains a significant challenge for businesses of all sizes.

Opportunity

Government support and policies for the adoption of industrial robots

Robots are gaining acceptance in both the public and private sectors in India. The government of India's technological push and experiments by the Ministry of Defence laboratory are regarded as key drivers of robot popularity. This has encouraged the manufacturing sector, particularly automotive and assembly, as well as start-ups and education, including T-schools, to pursue new experiments in this field.

Segment Insights

Type Insights

Based on the type, the market is segmented into Articulated robots, Cartesian coordinate robots, cylindrical coordinate robots, Spherical Coordinate robots, SCARA robots, and Others. SCARA robots segment is estimated to grow at a faster rate during the forecast period. The growth of this segment is driven by its rising adoption in the electronics industry. SCARA robots are widely used in manufacturing for pick-and-place and assembly operations that require high speed and accuracy. Their ability to operate at high speeds and with cleanroom specifications makes them particularly popular in the electronics industry, which is rapidly automating with industrial robots like the FANUC SR-3ia. SCARA robots are used to automate various processes in electronic manufacturing, including assembly, engraving, labeling, and material handling applications.

One of the primary reasons electronic manufacturers are adopting SCARA robots is their incredible speed, which is ideal for the high-volume production of electronic devices like smartphones. SCARA robots are among the fastest, second only to delta robots, but they have the edge over their counterparts due to their superior precision. Their small size makes them a popular choice for electronic manufacturers, as they can easily handle the numerous small components used in electronic devices. SCARA robots require little space and can be tabletop mounted, freeing up floor space and making integration into production lines easier.

Application Insights

Based on the application, global industrial robotics is segmented into material handling, welding & soldering, assembling & disassembling, dispensing, processing, and others. In 2025, the material handling segment accounted for the largest market share. The growth of this segment is driven by the demand from the food and beverages, pharmaceutical, and electrical and electronics industries. Material handling is also significant in the chemical and pharmaceutical industries as certain chemicals are concentrated and transport hazardous compounds. In such cases, robots are frequently used to reduce accidents and ensure employee safety.

End User Insights

Based on the end-user, the industrial robotics market is segmented into automotive, electrical & electronics, metals & machinery, plastics, rubber & chemicals, food & beverages, precision engineering & optics, pharmaceuticals & cosmetics, and others. In 2025, the automotive segment accounted for the highest market share. In the past decade, the production of passenger cars has undergone a significant transformation, with a growing need for robotic automation in various manufacturing processes.

Hybrid and electric vehicle manufacturers and traditional car makers are experiencing a surge in demand for a diverse range of vehicle models. Additionally, to meet the climate goals set for 2030, there will be a higher demand for low- and zero-emission cars. Automobile manufacturers are looking to invest in collaborative robots for their final assembly and finishing operations. Although SMEs, which make up the majority of second-tier automotive part suppliers, are taking longer to adapt to full automation, the trend is likely to change with the development of smaller, more versatile, easily programmable, and less capital-intensive robots.

Regional Insights

What is the Asia Pacific Industrial Robotics Market Size?

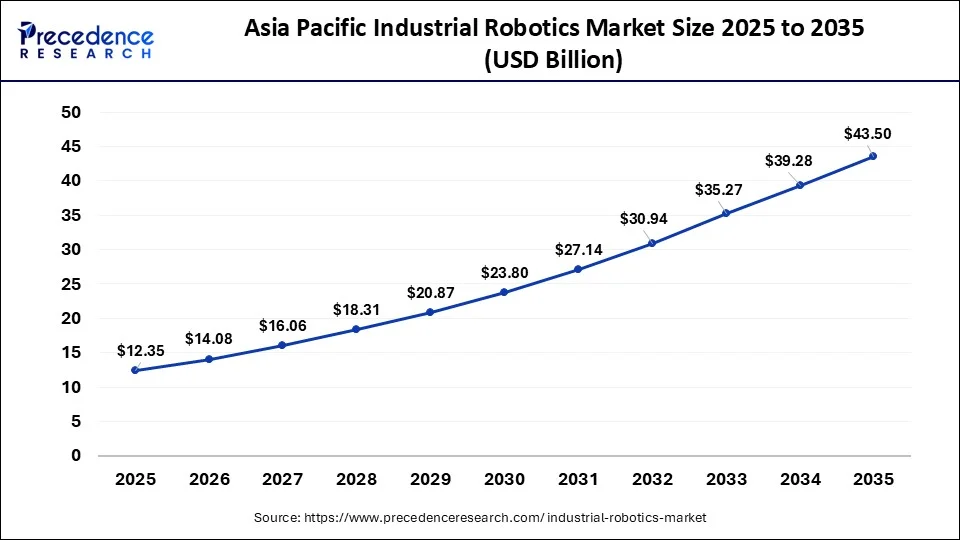

The Asia Pacific industrial robotics market size is estimated at USD 12.35 billion in 2025 and is predicted to be worth around USD 43.50 billion by 2035, at a CAGR of 13.42% from 2026 to 2035.

Asia Pacific dominated the global industrial robotics market and generated more than 65% of the revenue share in 2025. The dominance is due to rising automation, specifically in Japan, China, and India. China has massively invested in industrial robots, which has led them to be the top-ranking country for robot density, surpassing the US. The number of operational industrial robots per 10,000 employees in the manufacturing industry has reached 322 units. China is currently ranked fifth. South Korea, Singapore, Japan, Germany, and China are the top five most automated countries in manufacturing by 2021.

Korea hit an all-time high of 1000 industrial robots per 10,000 employees in 2021. This is more than three times the number achieved in China, placing the country first in the world. The Korean economy benefits from two large customer industries for industrial robots due to its globally recognized electronics industry and distinct automotive sector. Singapore ranks second, with 670 robots per 10,000 employees in 2021. Since 2016, Singapore's robot density has increased by 24% on average per year.

There is a significant difference between Japan (399 robots per 10,000 employees), which ranks third. Japan's robot density has increased by 6% on average per year. China has by far the world's fastest-growing robot market. The country has the most annual installations and the largest operational stock of robots.

North America is expected to grow significantly in the industrial robotics market during the forecast period. The industries in North America are increasing the demand for industrial robotics to enhance their productivity. At the same time, the increasing investments by the companies are enhancing their development. Moreover, the initiatives from the government are also contributing to the same. With the use of robotics, various complex and time-consuming tasks can be completed effectively with reduced errors. Furthermore, by integrating sensors and AI, the features of these industrial robots are being enhanced. Thus, all these factors are promoting the market growth.

What are the Advancements in the Industrial Robotics Market in Europe?

Europe is expected to grow at a significant rate throughout the forecast period. This growth and development are due to the presence of a well-developed technological sector and favorable reimbursement policies, which help to reduce expenditure and boost demand. The region is seen carrying out robust research activities on robots, which will foster innovation. Germany and France are leading players.

Germany Industrial Robotics Market Trends: The region's strong manufacturing base, coupled with government programs promoting robotics, is fueling the market's growth. There is also increasing demand for consumer electronics and automotive products, which is further driving adoption.

What are the Key Trends in the Industrial Robotics Market in Latin America?

Latin America is expected to witness substantial growth over the forecast period. This growth and development are due to the region's increasing emphasis on sustainability and green manufacturing. Collaborative robots (cobots) are also being widely adopted to improve efficiency while maintaining safety and flexibility in operations. In addition, stringent environmental regulations are pushing industries to utilize robotics for energy-efficient production and waste reduction.

Brazil Industrial Robotics Market Trends: The country is witnessing growth due to increasing investments and rising urbanization efforts. Additionally, the region also benefits from supportive government policies and collaborations with international technology providers.

How is the Middle East and Africa Growing in the Industrial Robotics Market?

The Middle East and Africa are expected to witness steady growth in the upcoming years. This growth and development is driven by rapid advancements in robotic technologies. The region is also witnessing growing investments in infrastructural and technological innovations, which are expected push the market forward even more. With a strong emphasis on research and innovation, coupled with supportive government policies, the industrial robotics market is expected to continue to grow.

Saudi Arabia Industrial Robotics Market Trends: The market's growth is driven by factors such as the need to enhance manufacturing efficiency, address labor shortages, and maintain product quality. Various industries, including automotive, electronics, and precision engineering, heavily rely on industrial robots for tasks such as assembly, welding, and quality control, thus driving market demand.

Value Chain Analysis of the Industrial Robotics Market

- Input Sourcing:Industrial robots require precision robotic arms, motors, sensors, cameras, and advanced imaging components. Software inputs also include aspects like control algorithms, user interfaces, and safety systems.

Key Players: Nabtesco, Bosch, Mitsubishi - Manufacturing Process: Here, manufacturers assemble complete systems including robotic arms, vision systems and instruments. The production process involves mechanical assembly, software integration as well as extensive system testing.

Key Players: FANUC, ABB, Yaskawa - Distribution Process:In this stage, industrial robots are packaged and distributed, primarily through direct OEM contracts, system integrators, and automation solution providers.

Key Players: ATS Automation, Honeywell, Dematic

Industrial Robotics Market Companies

- ABB

- FANUC CORPORATION

- KUKA AG

- YASKAWA ELECTRIC CORPORATION

- Comau S.p.A.

- Seiko Epson Corporation

- Kawasaki Heavy Industries, Ltd

- Mitsubishi Electric Corporation

- Staubli International AG.

- Universal Robots

Recent Developments

- In July 2025, an autonomous vehicle technology startup founded by veterans of Waymo and Segment, that is Bedrock Robotics, along with the help of investors Eclipse and 8VC, are launching an $80 million funding round. As per the company the Bedrock Robotics is developing a retrofitted self-driving kit for the construction and other worksite vehicles. Moreover, Boris Sofman, the co-founder and CEO, stated in his blog that the existing fleets with intelligence, sensors, and compute that can understand the aims of the project, execute work around the clock, and adapt to changing conditions, will be upgraded by Bedrock. (Source:https://www.msn.com)

- In April 2025, the world's first “Giantroid”, which is a term for AI-powered, 20-foot-tall, general-purpose construction robot, that is Zyrex, will be launched by RIC Robotics, which is a specialist developer of mobile 3D construction robotics. This robot is designed to conduct delicate as well as complex tasks at industrial and commercial job sites, and is said to be cognitive and completely autonomous. Thus, the launch of this robot will move closer to the evolution of robotic construction, and its prototype is expected to be launched in 2026. (Source: https://menafn.com)

- In 2022,DOBOT launched a collaborative robot CR3L at Automate 2022 in Detroit with an increased Max Reach of 11.5%

- In March 2022,Mitsubishi Electric announced the launch of its new industrial robotics system in 2023.

- In 2021,ABB launches next-generation cobots – CoFa and SWIFTI to unlock automation for new sectors and first-time users.

- In June 2020,Yaskawa launched two new collaborative robots for industrial applications – HC10DTP and HC20DTP. The company has described them as highly reliable robots that enrich easy capability for Yaskawa's HC-series line.

Segments Covered in the Report

By Type

- Articulated robots

- Cartesian coordinate robots

- Cylindrical-coordinate robots

- Spherical Coordinate robots

- SCARA robots

- Others

By Application

- Welding & Soldering

- Material Handling

- Assembling & Disassembling

- Dispensing

- Processing

- Others

By End-User

- Automotive

- Electrical & Electronics

- Metals & Machinery

- Plastics, Rubbers, & Chemicals

- Food & Beverages

- Precision Engineering & Optics

- Pharmaceuticals & Cosmetics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting