Industrial Services Market Size and Forecast 2025 to 2034

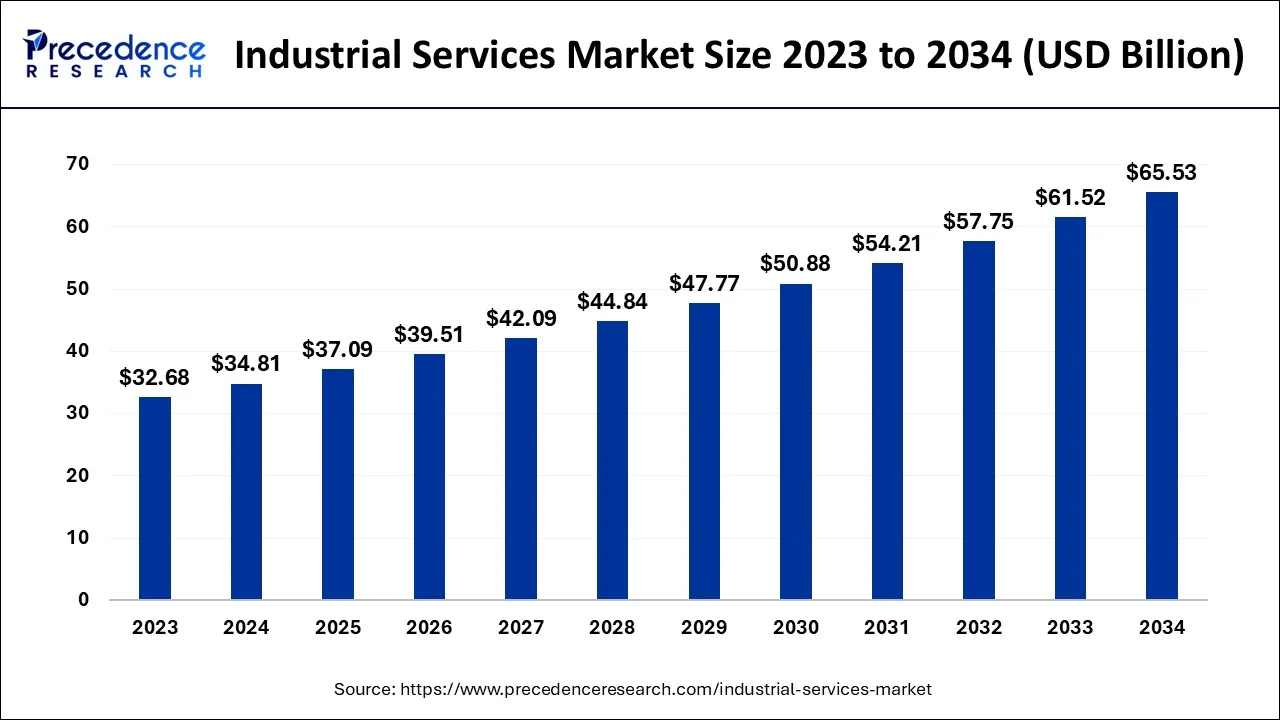

The global industrial services market size was estimated at 34.81 billion in 2024, and is projected to hit USD 37.09 billion by 2025, and is anticipated to reach around USD 65.53 billion by 2034, expanding at a CAGR of 6.53% from 2025 to 2034.

Industrial Services Market Key Takeways

- In terms of revenue, the market is valued at $37.09 billion in 2025.

- It is projected to reach $65.53 billion by 2034.

- The market is expected to grow at a CAGR of 6.53% from 2025 to 2034.

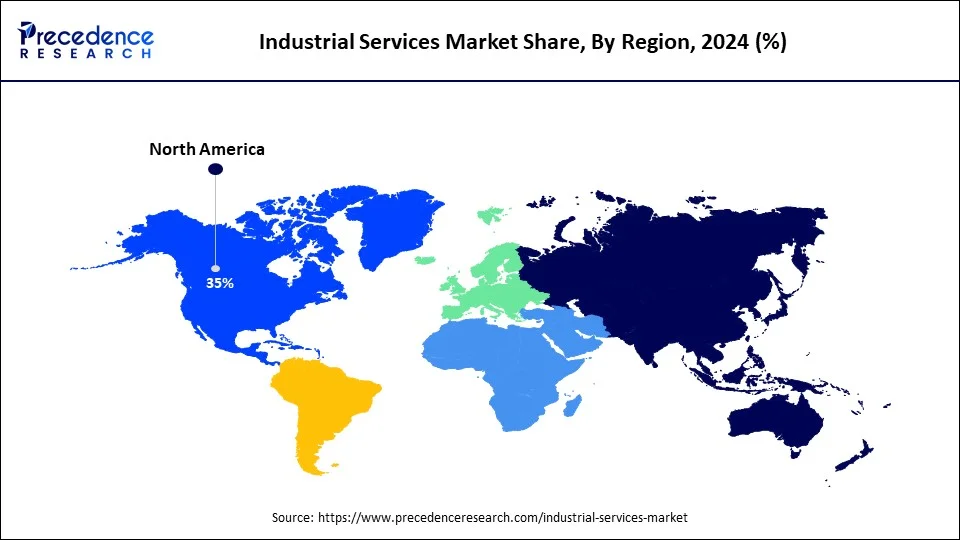

- North America dominated industrial service market in 2024.

- By application, MES segment led the market in 2024.

U.S. Industrial Services Market Size and Growth 2025 to 2034

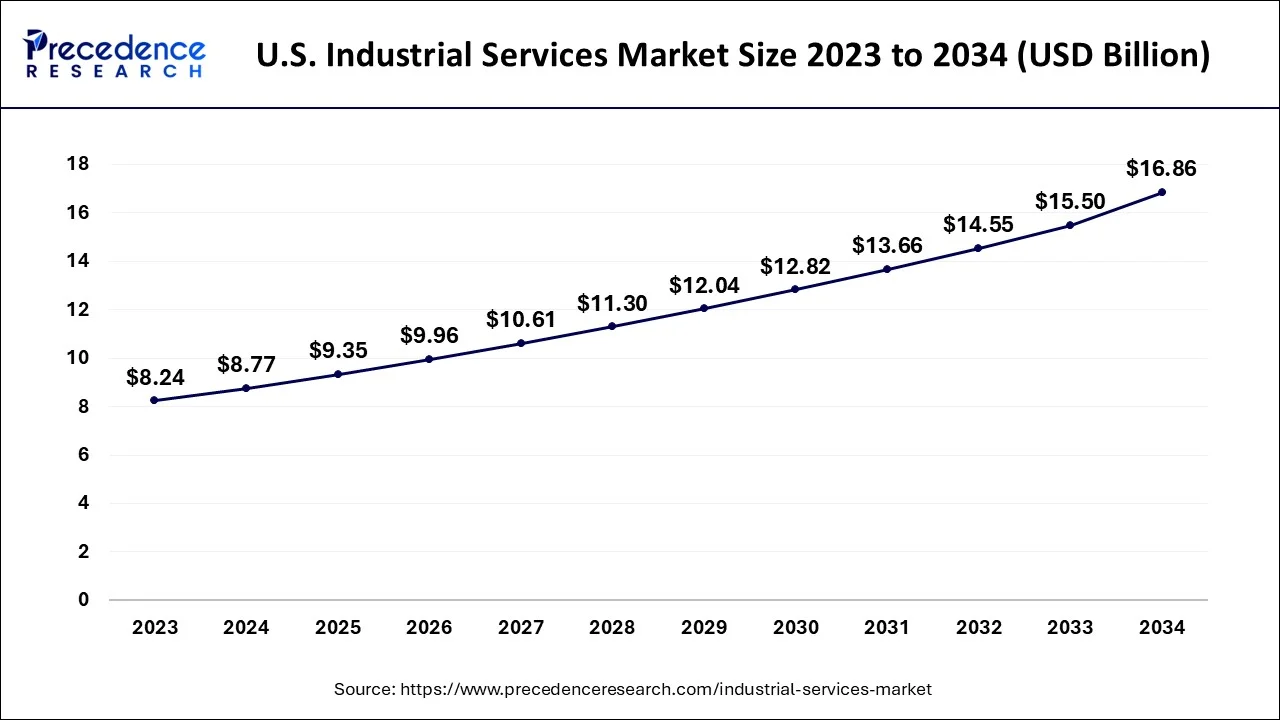

The U.S. industrial services market size was estimated at USD 8.77 billion in 2024 and is expected to be worth around USD 16.86 billion by 2034, rising at a CAGR of 6.73% from 2025 to 2034.

The North American market had modest growth in 2024, when it generated USD 9740 million in sales, and is projected to increase at a CAGR of 4.13% during the next five years. The market's expansion may be linked to the regional digital revolution as well as the ongoing evolution of various service model types. Additionally, the presence of several thriving industries, such as the food and beverage sector, in nations like the United States and Canada, as well as the increasing emphasis on functional safety in sectors like mining, chemicals, pharmaceuticals, and others, are some other factors that are anticipated to propel the market's growth.

What Factors Are Driving the Fastest Growth of the Asia Pacific Industrial Services Market in 2024?

The industrial services market in Asia Pacific is anticipated to grow at the fastest CAGR in 2024, supported by a fast rate of industrialization and growing production across the region. Such industrial development in countries such as China, India, and Southeast Asian countries results in the increased need for businesses to avail highly advanced industrial services to streamline their operations and enhance productivity.

The government programs emphasizing infrastructure development and economic growth in emerging economies are encouraging the market. Investment in the fields of energy, automotive, electronics, and construction promotes the increased demand for a specialised industrial service. Moreover, the necessity to improve operational efficiency and minimize downtime stimulates businesses to collaborate with service providers.

Market Overview

The kind of services that businesses offer to industries as needed is known as industrial services. This includes installation and commissioning, engineering and consulting services, and operational maintenance and improvement. Organizations exchange these kinds of services to facilitate the production of final goods or services.

Industrial Services Market Growth Factor

The need for predictive maintenance services will increase throughout the anticipated time period, driving the industrial service market. Since industrial organizations use expensive equipment and incur considerable depreciation costs, asset management is essential. Predictive maintenance can result in substantial financial savings. In essence, predictive maintenance is the next development in asset management. A number of strategies, including service contracts & agreements, key developments, and market expansions, are promoting the growth of the industrial services industry. Additionally, it is anticipated that the industrial services industry would expand in size as a result of the consequences of fluctuating oil prices. This market is expanding in the oil & gas sector, which has extremely high operational productivity. Operators may use industrial services, which integrate engineering and computational capabilities to support enterprises with yield estimation or resource maximization. In any place, governmental entities are crucial in defining conformity. The agreements are carried out in accordance with local environmental circumstances. Based on the area and sector, these laws vary. The region's laws and regulations may make it difficult for businesses to launch operations there. Tariffs on export and import, required certifications, capital constraints, and industry-specific regulations can all be roadblocks.

To control the market, industrial service providers compete with each another. Companies should regularly update their industrial services to capture a bigger share of the market. A customized portfolio of services can help a service provider become more market- and customer-focused. Predictive maintenance services regularly monitor equipment and systems to assess their condition and offer remedies if an issue arises. As the Internet of Things (IoT) develops, there will be greater demand for predictive maintenance services.

- Lack of technical knowledge frequently discourages end-users from adopting automation systems and results in operation inefficiencies because they view the downtime necessary for maintenance tasks as a significant loss in terms of capital, which is one of the key factors supporting the growth of the industrial services market.

- By providing round-the-clock remote assistance, solutions through cloud monitoring, and other improved services, vendors supplying industrial services such as engineering and consulting, operational improvement, and maintenance have solved the difficulties.

- Most importantly, suppliers must increasingly employ online and offline training and consulting techniques to make sure that end users are familiar with their technology if they want to maintain a competitive edge in the market. These elements boost the income of industrial service providers, particularly small and medium-sized businesses (SMEs), which in turn fuels the expansion of the industrial services sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 65.53 Billion |

| Market Size in 2025 | USD 37.09 Billion |

| Market Size in 2024 | USD 34.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.53% |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered |

Application,Industry,Type, and Region |

| Regions Covered |

North America.Europe,Asia-Pacific,Latin America,Middle East & Africa |

Market Dynamics

Drivers

- Demand for process-related services has increased dramatically over the past few years, driven by firms' need to save expenses associated with running their operations. Business operations that include giving advice, offering computer or financial services, or delivering other comparable vital services across many business verticals are expanding and are anticipated to soar in the approaching years. According to further WTO figures, telecommunication, computer, and information services made up 20% of all other commercial service exports in 2019 while financial, insurance, pension services, construction, and other business services were recorded at 15%, 4%, and 42%, respectively. In addition, the exports of telecommunication, computer, and information services increased by 11% in 2019 compared to the previous year, accounting for 81% of the total.

Lack of technical expertise

- One of the main factors promoting the expansion of the industrial services industry is a shortage of technical skills. It frequently discourages end users from using automation systems and causes operational inefficiencies because they view the downtime necessary for maintenance chores as a substantial financial loss. The difficulties have been solved by vendors who provide industrial services such as engineering and consulting, operational improvement, and maintenance by delivering round-the-clock remote assistance, solutions through cloud monitoring, and other improved services. Vendors must increasingly employ online and offline training and consulting methods to make sure that end users are familiar with their technology if they want to maintain a competitive edge in the market. These factors boost the income of industrial service providers, particularly small and medium-sized businesses (SMEs), which in turn fuels market expansion.

What Are the Key Drivers Behind the Steady Growth of the European Industrial Services Market?

The industrial services market in Europe is marked by steady growth, propelled by heavy regulations and a robust local interest in concentrating on safety, sustainability, as well as environmental responsibility. As the policies that seek to reduce the carbon footprint and to pursue energy efficiency, the European industries are facing the trend of investing in enhancing industrial services using advanced technologies. Also, Europe has well-established manufacturing industries that include automotive, aerospace, chemicals, and machinery, among others, that need industrial services to ensure a high level of operations. The government policies and incentives ensuring state backing to green initiatives and innovation ensure that there is constant investment in industrial services.

Key Market Challenges

Varying compliances across regions

- Government agencies have a major role in reducing compliance in every location. According to the local environmental circumstances, compliances are made. According to the areas and industries, these compliances change. Companies who seek to establish their commercial activities in the area may encounter obstacles due to local legislation and compliance requirements. Import and export taxes, necessary certificates, investment laws, and industry-specific mandates can all be obstacles. The aforementioned is a significant barrier to the market for industrial services' expansion.

Lack of end-to-end quality and process control

- It is one of the issues impeding the expansion of the industrial services sector. Engineering services are an example of an industrial service that includes managing, implementing, and maintaining crucial business systems, data, and operations. Low-quality goods may eventually result in the violation of the rights of relevant parties, such as purchasers' consumers or market end users. Manufacturers and OEMs are progressively handing over many of their duties and obligations to suppliers of engineering services as a result of the complexity and size of current projects growing more and more complicated. The expansion of the industrial services market will be hampered during the projection period, however, by a lack of end-to-end quality and process control.

Key Market Opportunities

Predicative maintenance services

- The suppliers of industrial services are vying with one another to dominate the industry. Market participants should regularly enhance their offering of industrial services if they want to get a larger market share. A personalized service portfolio can assist service providers in becoming more market- and customer-focused. Predictive maintenance services regularly monitor the systems and equipment to assess their status and offer fixes in the event of a failure. Predictive maintenance services will become more and more in demand as the internet of things develops.

The advent of maintenance as a service

- Due to the unstable industrial environment and expanding worldwide complexity, businesses are increasingly dealing with maintenance challenges. Industrial services, however, are mandated by law since they have many advantages. The market for industrial services will develop as a result in the upcoming years. Maintaining all real assets at their highest level of performance, it saves money over the long run. It also greatly extends shelf life and reduces the likelihood that the facility would be reduced due to service degradation. A maintenance service also makes sure that everyone is safe since it provides a safe working environment for everyone. Production enhancements will maintain the integrity of the entire assembly. Having a well-maintained building prevents the need for extensive preventative maintenance, which may be expensive and dangerous if neglected. Accidents and risks at work are terrible and often destructive. By doing the service on time and not disregarding even small maintenance concerns, this is entirely avoidable. Filters, fans, and other components become clogged with dust and grime, which reduces airflow between the vents. With all the appropriate checks and balances, this may fully be removed. It causes premature equipment failure.

Application Insights

Distributed Control Systems, Supervisory Control, Programmable Controller Logic & Data Acquisition, Valves & Actuators, Electric Motors & Drives, Manufacturing Execution Systems, and others are the market segments based on the application. Resource scheduling, order execution & dispatch, downtime management regarding optimal equipment performance, production analysis, and product life cycle management are all made easier by MES. The administration of all manufacturing data, including data from robots and workers and raw materials transformed into finished items and accompanying paperwork, is facilitated by MES as well. These factors are taken into account since, during the predicted term, MES will have the largest share in the industrial services sector.

Industry Insights

The market is divided into Oil and Gas, Chemicals, Automotive, Pharmaceuticals, and Others based on industry vertical. The automotive industry encompasses all aspects of vehicle development, design, and production. In this industry, automation is crucial for supply chain management, inventory management, and performance analysis. Automation helps businesses speed up the assembly process and cut down on production time.

Type Insights

The engineering and consulting, commissioning and installation, operational improvement, and maintenance segments of the market are divided on the basis of type. The category of operational maintenance and improvement services includes ad hoc or emergency maintenance, predictive maintenance, and planned maintenance. These services help discrete and process businesses prevent unexpected breakdowns and increase the lifespan of their systems and equipment. Operational improvement and maintenance services employ an integrated strategy that includes both organizational and technological solutions to raise a plant's operating effectiveness.

Industrial Services Market Companies

- General Electric (US)

- Siemens (Germany)

- Metso Corporation (Finland)

- John Wood Group PLC (UK)

- Honeywell International Inc (US)

- ABB (Sweden)

- Emerson Electric Co. (US)

- Rockwell Automation, Inc. (US)

- SAMSON AG (Germany)

- Schneider Electric (France)

- ATS Automation Tooling Systems Inc. (Canada)

- SKF (Sweden)

- Dynamysk Automation Ltd. (Canada)

- Wunderlich-Malec Engineering, Inc. (US)

- Yaskawa America, Inc. (Japan)

- Fuji Electric Co., Ltd. (Japan)

- Genpact (US)

- ICONICS, Inc. (US)

- Mitsubishi Electric Corporation (Japan)

Recent Developments

- In February 2025, ABB and Bilfinger announced a collaboration that aims to maximize efficiency and productivity for all industrial players that pursue productivity-based gain through automation tools. The two organizations cited their combined capabilities as providing holistic innovation opportunities, with a specific emphasis on sustainable energy solutions, including hydrogen and carbon capture for utilization within and across industries.

(Source: https://new.abb.com) - In November 2024, Rockwell Automation and Microsoft expanded the scope of their strategic alliance with plans to accelerate industrial transformation by integrating cloud and AI solutions to reduce friction in manufacturing operations through data-driven insights for larger scalability in industry.

(Source: https://www.automationmag.com) - In June 2024, Honeywell established its Battery Manufacturing Excellence Platform (Battery MXP), which was developed on the basis of artificial intelligence-supported software that allows it to optimize the real estate of a gigafactory, beginning at the soil level.

(Source: https://www.honeywell.com) - As of July 2019, Emerson has fulfilled a continuous five-year administration deal to support reliable, safe projects, and has completed its $ 48M agreement for robotization frameworks and cloud designing programming as-a-service to complete Shah Deniz 2 project in Azerbaijan.

Segment Covered in the Report

By Application

- Distributed Control System (DCS)

- Programmable Controller Logic (PLC)

- Supervisory Control and Data Acquisition (SCADA)

- Electric Motors & Drives

- Valves & Actuators

- Manufacturing Execution System

- Human Machine Interface

- Safety Systems

- Industrial PC

- Industrial 3D Printing

- Industrial Robotics

- Others

By Industry

- Oil and Gas

- Chemicals

- Automotive

- Pharmaceuticals

- Others

By Type

- Engineering & Consulting

- Installation & Commissioning

- Operational Improvement & Maintenance

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting