What is the Industrial IoT Market Size?

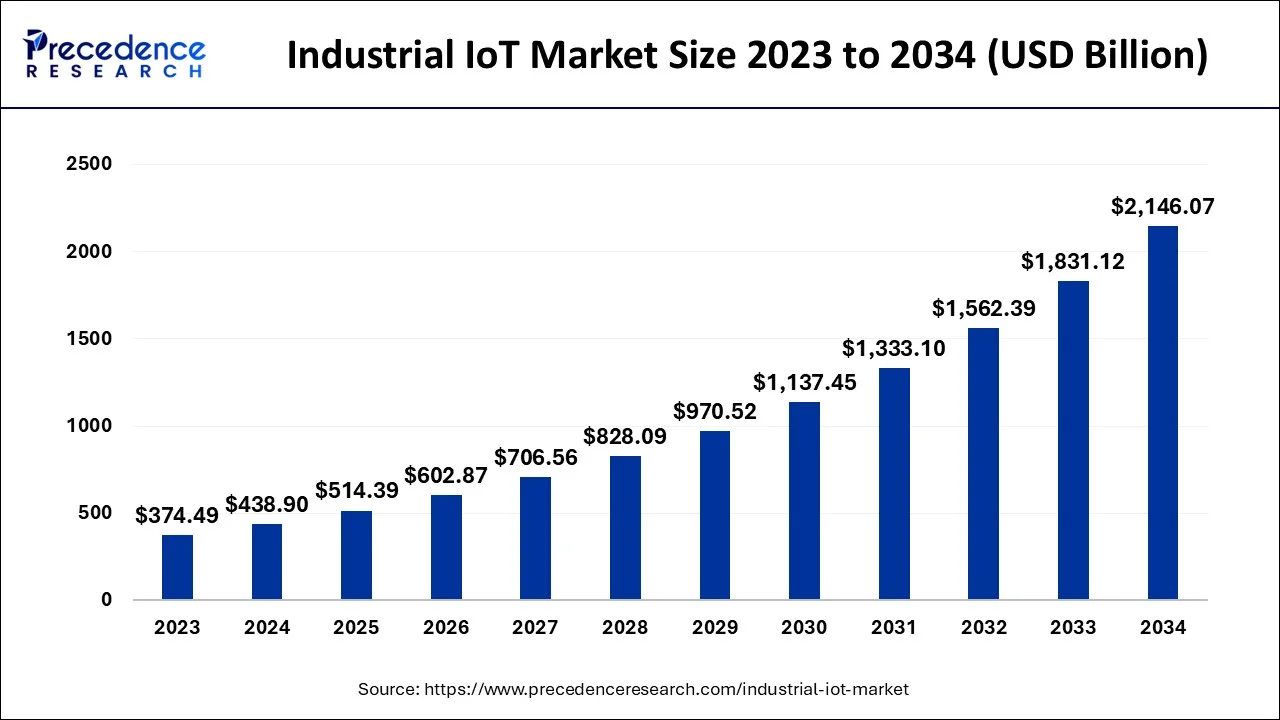

The global industrial IoT market size is valued at USD 514.39 billion in 2025 and is anticipated to reach around USD 2430.21 billion by 2035, expanding at a CAGR of 16.8% from 2026 to 2035

Market Highlights

- By end-use, the manufacturing segment accounted for 28.7% of the total revenue share in 2025.

- The logistics and transportation segment is growing at a CAGR of 25.6% from 2026 to 2035

- By component, the services segment is expected to hit a CAGR of 24.3% between 2026 to 2035

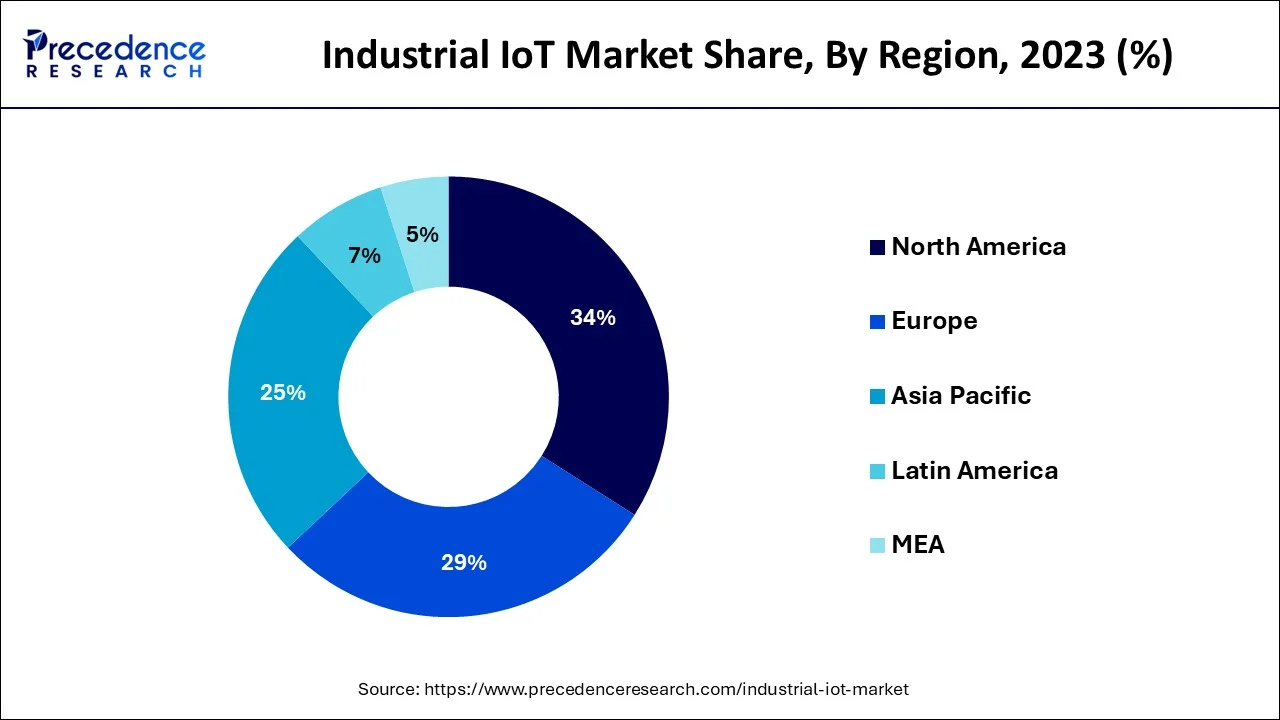

- North America dominated the market and accounted revenue share of around 34% in 2025.

- Asia Pacific region is predicted to reach a CAGR of 26.7% from 2026 to 2035

Market Overview

The Industrial internet of things is generally focused on big data, machine-to-machine communication, and machine learning to provide better efficiency and reliability to support industries and businesses in their operations. The industrial internet of things offers industrial applications such as software-defined production processes, medical devices, and robotics. Additionally, to increase efficiency and reliability of industries operations, IIoT support in terms of modern industrial workers, industrial internet, advanced predictive, brings together critical assets, and prescriptive analytics. IIoT helps to monitor, analyze, deliver, exchange, and deliver valuable new insights like never before. One of the most significant driving factors to the growth of the global industrial IoT market due to the new insights can support in terms of faster business decision-making for industries and helps to drive smarter.

Industrial IoT Market Growth Factors

- With better sensor technology, the data being collected from industrial machinery is said to be sitting in a database without falsification, as far as operational intelligence and reliability are concerned.

- AI and Machine Learning integrate context for prescriptive diagnostics, optimization of processes, and less downtime, hence strengthening adoption in all industries.

- With the expansion of 5G networks, data travel becomes seemingly untethered, thus supporting latency-critical applications and connected industrial ecosystems.

- Rising demand in automation in manufacturing and other industries is geared towards the reduction of errors, smoothing processes, and increasing productivity.

- Government-led initiatives such as smart city projects and increased investment in digital transformation act as a catalyst for further advancement of IIoT deployment in varying domains.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 514.39 Billion |

| Market Size in 2026 | USD 602.87 Billion |

| Market Size by 2035 | USD 2430.21 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 16.8% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

One of the significant factors driving the growth of the global Industrial IoT market is the increasing awareness related to IoT solutions and widespread adoption of different IoT solutions in various industrial applications such as robotics, medical devices, and software-defined production processes, among others. Industrial IoT has incorporated IoT with a number of industrial processes such as automation, optimization, maintenance, and networking, among others. Industrial IoT helps in providing enterprises and industries to have better efficiency and reliability in their operations. Henceforth, the Industry Internet of things is rising the growth of the market owing to the high level of efficiency, and performance offered by IIoT during operations.

The global Industrial IoT market is expected to benefit significantly from the technological advancements and new product launches in semiconductors and electronic devices. Additionally, the easy availability of low sensors and processors at an affordable cost helps in providing real-time access to the information. This in turn is expected to positively influence the growth of the global industrial IoT market. For instance, according to the CBI Ministry of Foreign Affairs In 2019, nearly 35 % of the internet of things market was estimated to reach due to hardware, 22% from connectivity, 27% from IoT services, and 16% from software.

Another factor driving the growth of the global Industrial IoT market is the growing adoption of artificial intelligence (AI) and IoT in the manufacturing sector. AI and IoT help in the optimization of industrial processes along with providing quality control, forecasting equipment failure, and sending emergency alerts, among others. This has in turn increased investment in AI and IoT in the U.S. In the U.S., private investment in AI reached USD23.6 billion in 2021. This has also increased the use cases of AI and IoT across various industries.

The growth of the global Industrial IoT market is also being driven by supportive government policies, schemes, and initiatives across the globe. Different governments across the globe are focusing on strengthening the company's capacities for change and competitiveness to cope with the industry 4.0 revolution. The governments are also focusing on improving the skillset and efficiency of the workforce thereby benefiting industrial IoT solution providers.

The industrial 4.0 companies are providing endpoints such as devices, automation, industry machinery OEMs, gateways for IoT automation, cellulars such as AGV/AMR, industrial equipment, sensors, and infrastructure providers are driving the growth of the IIoT market. The Industrial Internet of things rising the growth of the market with the help of new trends including the rising popularity of the IIoT digital twin, the development of an intelligent IIoT Edge, working with persona-based IIoT, improved Functional Safety for IIoT equipment, and addressing the expanded IIoT cyber-attack surface.

Furthermore, several research and development organizations are developing new potential usage of Industrial IoT. Major prominent vendors are investing in research and development for increasing productivity in operations is an important factor for the Industry Internet of Things. Additionally, involving operation technology on the internet could make industries or businesses more feasible. The Industrial Internet of Things opens many opportunities for the convergence of IT and OT. Moreover, many government bodies have also declared their investments in IIoT 4.0. This investment helps business planning to reach the highest proportion of their IT budgets on IoT projects. In August 2019, the South Korean government declared WON 4.7 trillion is investing in innovative sectors nearly up to USD 3.2 billion.

Segments Insights

Component Insights

Solutions dominate the market as industries focus on end-to-end platforms that combine devices, machines, and data analytics within a unified system. These solutions can perform predictive maintenance, automate operations, and streamline workflows, reducing inefficiencies and increasing the ability to make decisions. With bodies of demand about customized offerings adherent to a particular industry requirement, solutions are the backbone for IIoT adoption in manufacturing and further fields.

A rapid growth spurt is on for services as industries use consulting, integration, and managed offerings under all types of IIoT roadblocks. Companies now increasingly expect outside help to make deployments optimized, scalable, and secure. Managed services give organizations monitoring and support all the time so they can achieve seamless performance while concentrating on their core business.

End-Use Insights

Solutions dominate the market as industries focus on end-to-end platforms that combine devices, machines, and data analytics within a unified system. These solutions can perform predictive maintenance, automate operations, and streamline workflows, reducing inefficiencies and increasing the ability to make decisions. With bodies of demand about customized offerings adherent to a particular industry requirement, solutions are the backbone for IIoT adoption in manufacturing and further fields.

A rapid growth spurt is on for services as industries use consulting, integration, and managed offerings under all types of IIoT roadblocks. Companies now increasingly expect outside help to make deployments optimized, scalable, and secure. Managed services give organizations monitoring and support all the time so they can achieve seamless performance while concentrating on their core business.

Connectivity Insights

Wireless Technology is dominating due to flexibility, scalability, and connected environments. Wireless technologies ensure that advanced wireless standards deliver trustworthy, low-latency communication critical for real-time industrial operations. This connectivity allows the factories, logistics, and energy facilities to dynamically evolve, increasing effectiveness in allowing wider integration of IIoT applications across a distributed evolving infrastructure.

Wired connectivity has become a very hot topic for applications requiring stability, fast transfer, and tight security. Operating heavy machinery or distributed processes are some examples needing such set-ups to guarantee uninterrupted communication. For added reliability and protection of data integrity, industrial-grade solutions incorporate Ethernet and fiber optics into their product offerings.

Application Insights

Predictive maintenance dominates while organizations are moving from reactive to proactive approaches in asset management. Minimizing unplanned downtime through IIoT-enabled monitoring systems and advanced analytics extends the useful life of equipment and reduces associated costs. This capability has become the major pillar that turns industries competitive while ensuring operational continuity, reliability, and efficiency in industries where critical equipment is used.

The supply chain management is fast-growing as IIoT powers real-time tracking, inventory management, and demand forecasting. Connected devices and data analytics cut down logistics costs, optimize routing, and enhance responsiveness. The complexity of global supply chains and the promotion of e-commerce push for the adoption of IIoT-based supply chain solutions, thereby increasing the agility and transparency of operations.

Deployment Insights

On-premises dominated the market. Being able to control and give security and compliance for industrial data that is very sensitive to the end-user, on-premises, has been the order of the day. Organizations, especially in the critical industries, appreciate how reliable and fast local systems are-they minimize latency and give the maximum uptime. It also gives the operators a very secure integration with existing infrastructure while maintaining operational independence, and, therefore, industries with strict regulatory bodies prefer this model.

Cloud deployment is rapidly gaining preference as industries seek more scalability, flexibility, and cost efficiency. Cloud platforms are utilized for tasks like remote monitoring and AI-driven analytics, as well as collaboration among dispersed teams. Cloud costs are not only a deterrent to infrastructure investment but, more importantly, provide real-time insights; hence, cloud-based IIoT solutions help organizations innovate faster and work on digital transformation strategies with increased agility.

Regional Insights

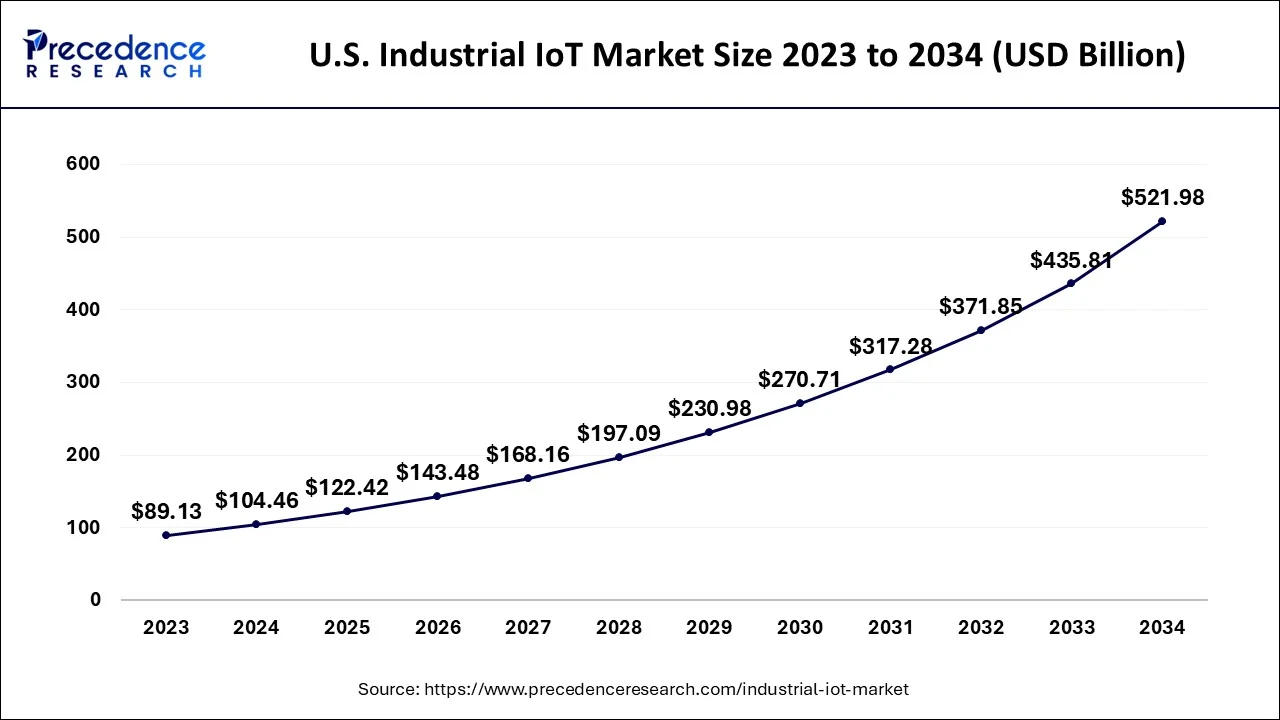

U.S. Industrial IoT Market Size and Growth 2026 to 2035

The U.S. industrial IoT market size is evaluated at USD 122.42 billion in 2025 and is predicted to be worth around USD 521.98 billion by 2035, rising at a CAGR of 17.43% from 2026 to 2035

U.S. Industrial IoT Market Trends

The rising adoption of automation technologies drives the U.S. market, along with the integration of advanced analytics and smart sensors, the growing demand for predictive maintenance, developments in 5G connectivity, a rising focus on energy efficiency and sustainability, improved cybersecurity measures, and even investments in digital transformation across major industrial sectors.

North America dominated the Industrial IoT market in 2024. The U.S. dominated the Industrial IoT market in the North American region. This can be attributed to the increase in IoT spending across countries in the region. For instance, the U.S. spent around USD 421 billion on IoT in 2021. Additionally, the early adoption of IoT across the industrial segment in different countries in the region is further expected to support the market growth during the forecast period. Also, the presence of a large number of well-established market players in the region further supports segmental growth. Besides, an increasing number of new emerging players providing industrial IoT solutions will create lucrative opportunities for market growth in the next few years. For instance, as of 2021, Canada had around 98 companies providing industrial IoT solutions.

On the other hand, APAC, is expected to develop at the fastest rate during the forecast period. Countries in the Asia Pacific region, especially China have emerged as a global manufacturing hubs. Similarly, India is having great opportunities for the manufacturing sector, in terms of availability of land, labor, and machinery at an affordable cost for setting up manufacturing units. As a result of this various companies are expanding in the region. Also, the governments across various countries in the region especially in China and India are providing incentives and relaxations in taxes to various companies expanding in the region, thereby creating opportunities for market growth in the next few years.

In the European market for the internet of things, solutions are accelerating the growth of the market. The UK, Germany, and the Netherlands are leading the European internet of things adoption. Although, Eastern European countries and the Nordics are succeeding thoroughly. The home, finance sectors, health, and manufacturers are accepting the internet of things adoption while enhancing the growth in the retail as well as the agricultural sector. European IoT spending was predicted to reach $ 184 billion in 2024 during the forecast period. Moreover, is expected to reach double-digit growth through 2034.

China Industrial IoT Market Trends

China's Industrial IoT market is driven by government initiatives such as "Made in China 2025," massive 5G or cellular IoT deployment, growing labor expenses pushing automation, and increasing focus on smart factories like Industry 4.0 for efficiency, with key sectors such as discrete production leading adoption, though challenges such as standardization remain. IIoT platforms integrated with edge computing, AI analytics, and 5G connectivity are enabling real-time monitoring, predictive maintenance, and automation, which reduce downtime and lower operating costs.

France Industrial IoT Market Trends

The increasing focus on Industry 4.0, which aims to create smart factories that are greatly automated and connected. IIoT technologies can assist in enabling this vision by offering real-time data on machine performance and production output, along with other key metrics, enabling manufacturers to improve their operations and decrease downtime.

Industrial IoT: Market Evolution in Latin America

Latin America's market shows notable growth during the forecast period. It is driven by rising rapidly as industries in manufacturing, energy, and logistics embrace advanced IoT technologies. By integrating IoT solutions, businesses are now achieving greater operational efficiency, cutting expenses, and improving productivity.

Brazil Industrial IoT Market Trends

Brazil's market is driven by government-led digital transformation initiatives along with the establishment of comprehensive semiconductor production projects. Along with substantial private sector commitments towards a few industrial modernization over the automotive and energy sectors.

Industrial IoT: Market Evolution in MEA

MEA's market shows a rapid growth rate during the forecast period. It is driven by the rising internet penetration, along with digitalization across the globe are an opportunity for the industrial IoT market. High installation expenses and difficulties in integrating IoT devices are considered a challenge to the Middle East and Africa industrial IoT market.

UAE Industrial IoT Market Trends

Advancements in connectivity, along with data analytics, drive the UAE's market. Organizations across numerous sectors are increasingly adopting IoT technologies to improve operational efficiency, reduce expenses, and enhance decision-making processes. This shift is featured by the integration of smart devices and sensors into manufacturing processes, allowing real-time monitoring and predictive maintenance.

Industrial IoT Market Companies

- ABB

- General Electric

- IBM Corporation

- Intel Corporation

- Rockwell Automation, Inc.

- Siemens

- Microsoft

- Cisco Systems, Inc.

- NEC Corporation

- KUKA AG

Recent Developments

- In September 2025, the industrial IoT sector is adopting software-defined edge nodes for cost-effective, flexible, reusable, secure, and data-generation-centric applications due to security concerns. (Source: https://www.engineering.com)

- In September 2025, Indiesemic launches India's first IoT Evolution Board at Semicon India 2025, integrating an indigenous VEGA processor, Bluetooth, and LoRa connectivity, aiming to accelerate prototyping, strengthen security, and reduce import reliance. (Source: https://smestreet.in)

Segments Covered in the Report

By Component

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

By End-Use

- Manufacturing

- Energy & Power

- Oil & Gas

- Healthcare

- Logistics & Transport

- Agriculture

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting