What is RFID Market Size?

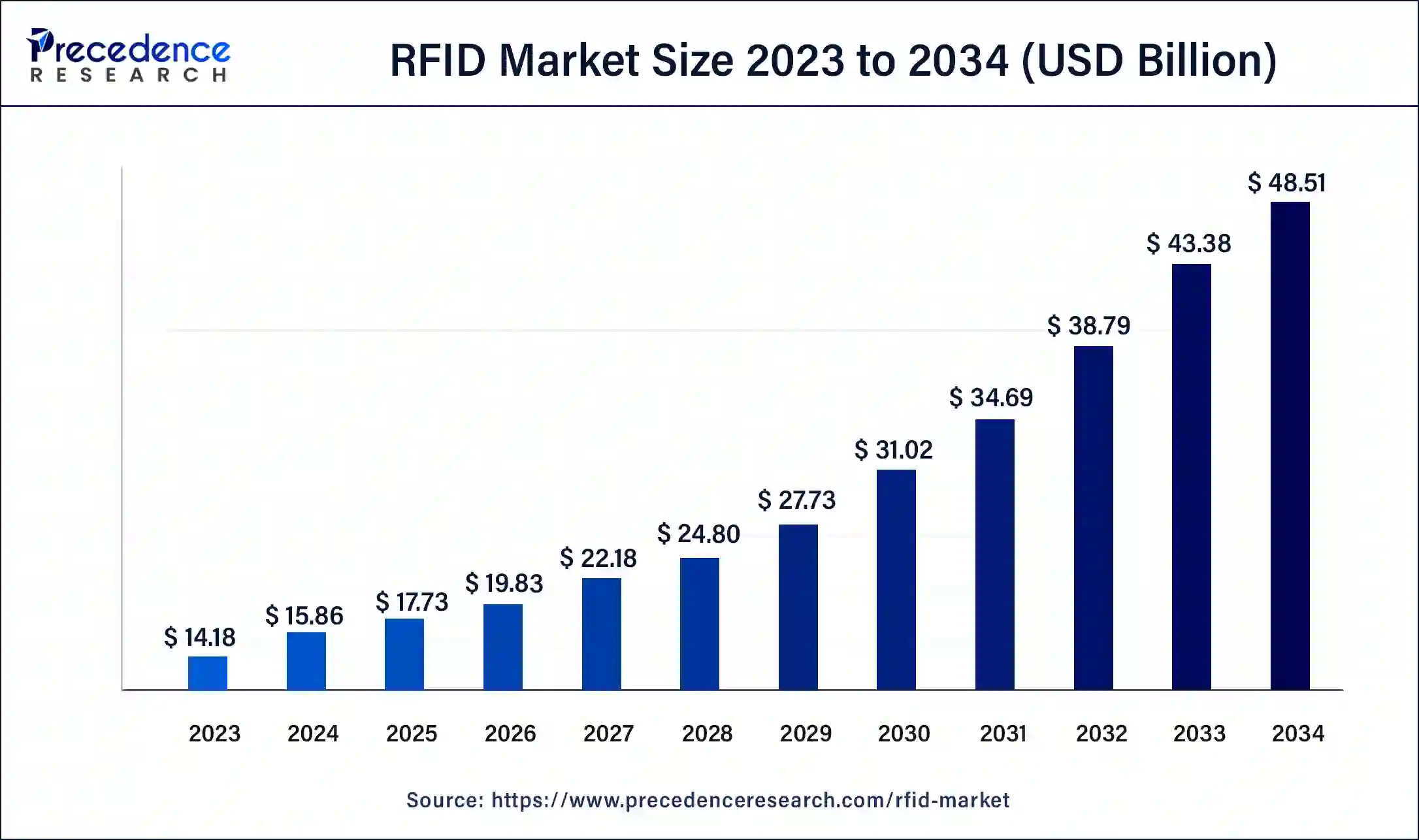

The global RFID market size is estimated at USD 17.73 billion in 2025 and is anticipated to reach around USD 48.51 billion by 2034, growing at a solid CAGR of 11.83% over the forecast period 2025 to 2034. Increasing adoption of RFID technology in various fields, from manufacturing to healthcare across the globe, while promising enhanced security and high operational efficiency with technological advancements in the RFID field, are the major factors propelling the RFID market globally.

Market Highlights

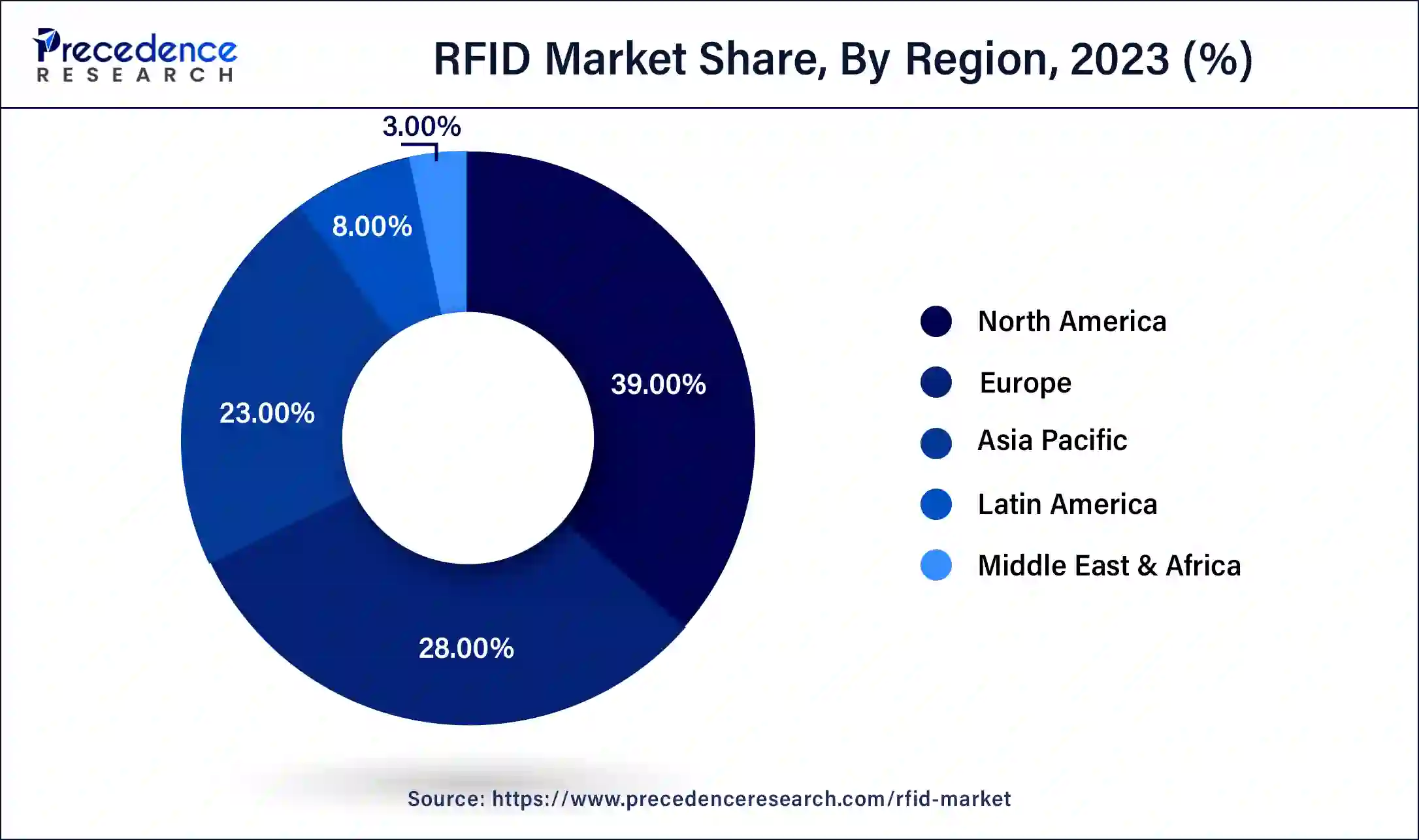

- North America dominated the global RFID market with the largest market share of 39% in 2024.

- Asia Pacific is anticipated to proliferate at a significant rate in the market over the forecast period.

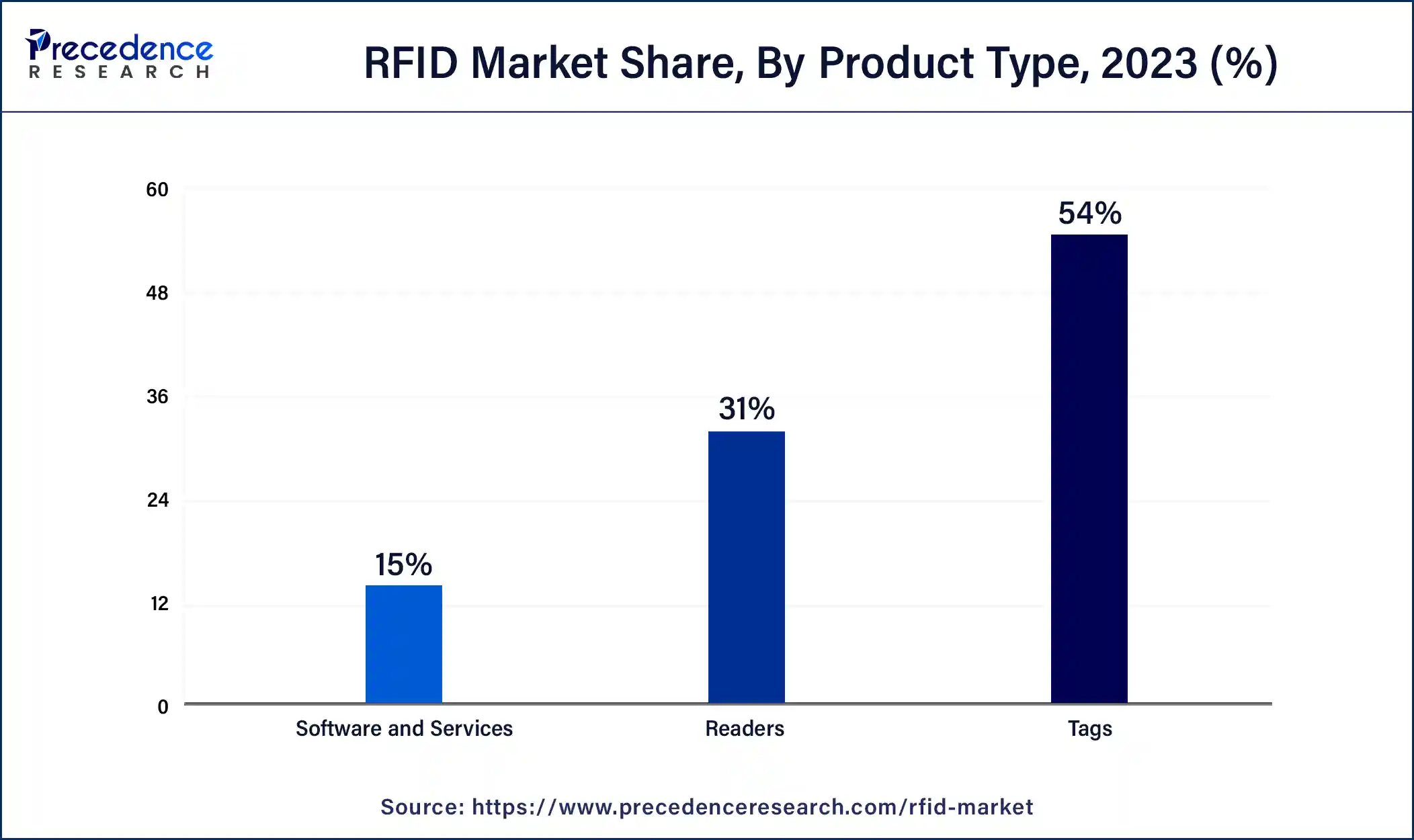

- By product type, the tags segment contributed the biggest market share of 54% in 2024.

- By product type, the readers segment is expected to grow at the highest CAGR in the market over the forecasted years.

- By frequency range, the high frequency (3MHz to 30MHz) segment held the largest share of the market in 2024.

- By frequency range, the ultra-high frequency (300MHz - 3GHz) segment is anticipated to showcase the fastest growth in the market in the upcoming years.

- By industry, the retail segment accounted for the largest share of the market in 2024.

- By industry, the transportation & logistics segment is expected to witness substantial growth in the market during the foreseeable period.

AI Impact on the RFID Sector

The integration of artificial intelligence (AI) with RFID technology is poised to significantly impact the market. AI enhances the capabilities of RFID systems by enabling advanced data analytics, predictive maintenance, and real-time decision-making. In retail, AI-driven RFID can optimize inventory management, personalize customer experiences, and improve supply chain efficiency through predictive analytics. In manufacturing, AI can analyze RFID data to streamline production processes and detect anomalies, reducing downtime and enhancing quality control. The RFID market benefits from AI by improving patient tracking and medical asset management.

- In October 2022, Avery Dennison Smartrac launched an AD Minidose U9 RAIN RFID inlay for pharmaceutical applications, unlocking critical RFID value for healthcare, pharmacies, and laboratory asset management.

Additionally, AI algorithms can process vast amounts of RFID data, identifying patterns and insights that drive operational improvements and strategic decision-making. This synergy between AI and RFID is expected to lead to innovative applications, increased efficiency, and a competitive edge for businesses, further propelling the RFID market growth.

Leading the Way in Smart Identification: Growth of the RFID Market

The global RFID market is experiencing significant growth, driven by increasing adoption across various sectors like retail, healthcare, logistics, and manufacturing. This technology enhances inventory management, reduces operational costs, and improves data accuracy. The market is segmented by product type, application, and region, with UHF RFID tags showing the highest demand due to their long-range reading capabilities.

North America leads in RFID market share, followed by Europe and Asia Pacific, where rising industrialization boosts demand. Key players include Zebra Technologies, Honeywell International, and Avery Dennison. Emerging trends like IoT integration and advancements in RFID technology are expected to further propel market growth in the coming years.

RFID Market Growth Factors

- The RFID market enhances inventory management, reduces theft, and improves customer experience.

- Streamlines patient tracking, medication management, and asset tracking.

- Improves tracking of goods, reduces errors, and enhances transparency.

- The RFID market enhances production efficiency and quality control.

- Improvements in RFID technology, such as greater read ranges and higher data capacity.

- Boosts the functionality and applications of the RFID market.

- Helps businesses meet regulatory requirements for tracking and traceability.

- Decreasing costs of RFID tags and readers makes the technology more accessible.

- Improved security features in RFID systems for sensitive applications.

- Increased demand from the emerging RFID market in Asia Pacific.

Market Outlook

- Industry Growth Offerings- The market is growing rapidly due to rising demand for real-time asset tracking, supply chain automation, and inventory management. Expanding adoption across retail, healthcare, logistics, and manufacturing sectors is driving market expansion globally.

- Major Investors-Major investors in the market include venture-capital firms and strategic corporate funds such as ARCH Venture Partners, Mobius Venture Capital, Polaris Venture Partners, GF Private Equity Group LLC, and UPS Strategic Enterprise Fund, backing chip, reader, and tag innovators.

- Startup Ecosystem- The startup ecosystem for the market features agile companies developing tag chips, IoT-enabled readers, and software platforms, especially in APAC and the US, focusing on cost-reduction, sensor integration, and new application verticals in logistics and retail.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 17.73 Billion |

| Market Size in 2026 | USD 19.83 Billion |

| Market Size in 2034 | USD 48.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.83% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Frequency Range, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Technological Advancements

Technological advancements are a significant driving factor in the RFID market. Innovations such as improved read range, enhanced data capacity, and better energy efficiency have made RFID systems more reliable and cost-effective. The development of ultra-high frequency (UHF) tags, which offer long-range reading capabilities, has expanded the use cases in logistics, retail, and healthcare. Additionally, advancements in RFID software, such as real-time tracking and data analytics, enable businesses to gain valuable insights and improve operational efficiency. As technology continues to evolve, the integration of RFID with other emerging technologies like the Internet of Things (IoT) is expected to create new opportunities and further drive market growth.

Increasing adoption in retail

The retail sector's increasing adoption of RFID technology is a crucial RFID market driver. Retailers are leveraging RFID to enhance inventory management, reduce shrinkage, and improve customer experience. By using RFID tags, stores can achieve near-perfect inventory accuracy, leading to better stock availability and fewer lost sales. This technology also enables efficient supply chain management, from manufacturing to point-of-sale, ensuring timely restocking and reducing out-of-stock scenarios.

Moreover, RFID's ability to provide real-time data helps retailers personalize customer experiences and streamline checkout processes. As e-commerce and omnichannel retailing grow, the need for efficient inventory and supply chain management further accelerates the adoption of RFID in the retail industry.

- In July 2023, Beontag launched four new RFID tags, leveraging the new Impinj RAIN RFID tag chips of the M800 series. These RFID tags are used for industrial and retail applications.

Restraint

High initial implementation cost

One major restraint of the RFID market is the high initial implementation cost. Setting up an RFID system involves significant expenses, including purchasing RFID tags, readers, and associated software, as well as integrating these components into existing systems. Additionally, businesses may incur costs related to employee training and ongoing maintenance. Small and medium-sized enterprises (SMEs) often find these upfront costs prohibitive, limiting widespread adoption. Furthermore, the complexity of RFID technology and the need for customized solutions can add to the overall expense. This financial barrier can deter potential users, especially in cost-sensitive industries, thereby restraining the growth of the RFID market.

Opportunity

Internet of things (IoT)

The integration of RFID with the Internet of Things (IoT) presents a significant opportunity for the RFID market expansion. IoT-enabled RFID systems can provide enhanced real-time tracking and data analytics, improving decision-making and operational efficiency across industries. In retail, this integration can revolutionize inventory management and customer engagement. In healthcare, it can enhance patient and asset tracking. Additionally, the growing trend of smart cities and automated supply chains relies heavily on IoT and RFID technologies, creating substantial opportunities for market growth. As these technologies evolve, their combined application is expected to drive significant advancements and adoption.

- In February 2022, Identiv, Inc. comprises a portfolio of near field communication (NFC)-enabled status detection tags for advanced IoT security. Identiv's range of NFC tags is among the first available with NXP NTAG Semiconductors 22x DNA chip devices add unique capabilities for advanced anti-counterfeiting, new-to-market tamper detection, and battery less condition sensing.

Segment Insights

Product Type Insights

The tags segment dominated the global RFID market in 2024. RFID tags are electronic devices used to label assets to track their physical appearance wirelessly by using other RFID equipment. These tags can be encoded with various data types. Each tag is integrated with an antenna and a circuit. Tags have 96-bit strings of data known as EPC-electronic product code, consisting of tag serial number, asset ID data, and company name that manages this tag. Every country has different frequency band allocations for RFID tags. Some of them are widely accepted and seem legitimate.

- In September 2023, the AD Pure line launches with AD Belt U9 Pure inlays and tags, which are ideally suited for global apparel, retail, industry, and supply-chain applications. They are compact in size and offer excellent performance on difficult-to-tag or low-detuning materials such as cardboard and plastic.

The readers segment is expected to grow at the highest CAGR in the RFID market over the forecasted years. The growth of this segment is attributed to their vast applications, ranging from inventory management and military vehicle tracking to patient tracking in the medical sector, which increases security and enhances efficiency. RFID readers are basically equipment that reads the data encoded in the RFID tags by sending out Radiofrequency and collecting the response, which is further sent to computer systems to gather meaningful insights from RFID tags.

Frequency Range Insights

The high frequency (3MHz to 30MHz) segment held the largest share of the RFID market in 2024. The growth of this segment is due to its ability to capture large amounts of data in a single scanning as compared to other frequency ranges. Such a high-speed data transfer is crucial in various sectors where time is constrained, like contactless payment transfer by using online platforms like Phonepe and Paytm, as well as asset tracking, in particular, military assets, retail sector, and healthcare settings.

The ultra-high frequency (300MHz - 3GHz) segment is anticipated to showcase the fastest growth in the RFID market in the upcoming years. The growth of this segment is related to the increasing demand for it in various fields, such as pharma applications, inventory management, and wireless transactions. The ultra-high frequency RFID can be more accessible as it has various applications in supply chain management, asset tracking, livestock monitoring, etc., further propelling market growth. However, their high cost per tag is a barrier for many vendors to adopt them widely, which can be troubleshoot as the technology matures with time.

Industry Insights

The retail segment accounted for the largest share of the RFID market in 2024. The growth of this segment is due to the enhanced visibility offered by RFID tags in terms of asset tracking from manufacturing to distribution to its destination with safety measures. RFID allows retailers to monitor the delivery schedules of the shipments while tracking their exact location and any potential loopholes that may delay the shipment delivery for specific reasons. Such clarity builds trust between enterprises and customers, which helps proliferate the retail segment widely on a large scale.

The transportation & logistics segment is expected to witness substantial growth in the RFID market during the foreseeable period. RFID technology is immensely helpful as it aids in automating the process of identifying and capturing the data regarding shipments. Such automation reduces human intervention, which further reduces the manpower needed for the transportation and logistics sector, eventually improving overall operational efficiency. These are the factors that help boost this segment's growth.

Regional Insights

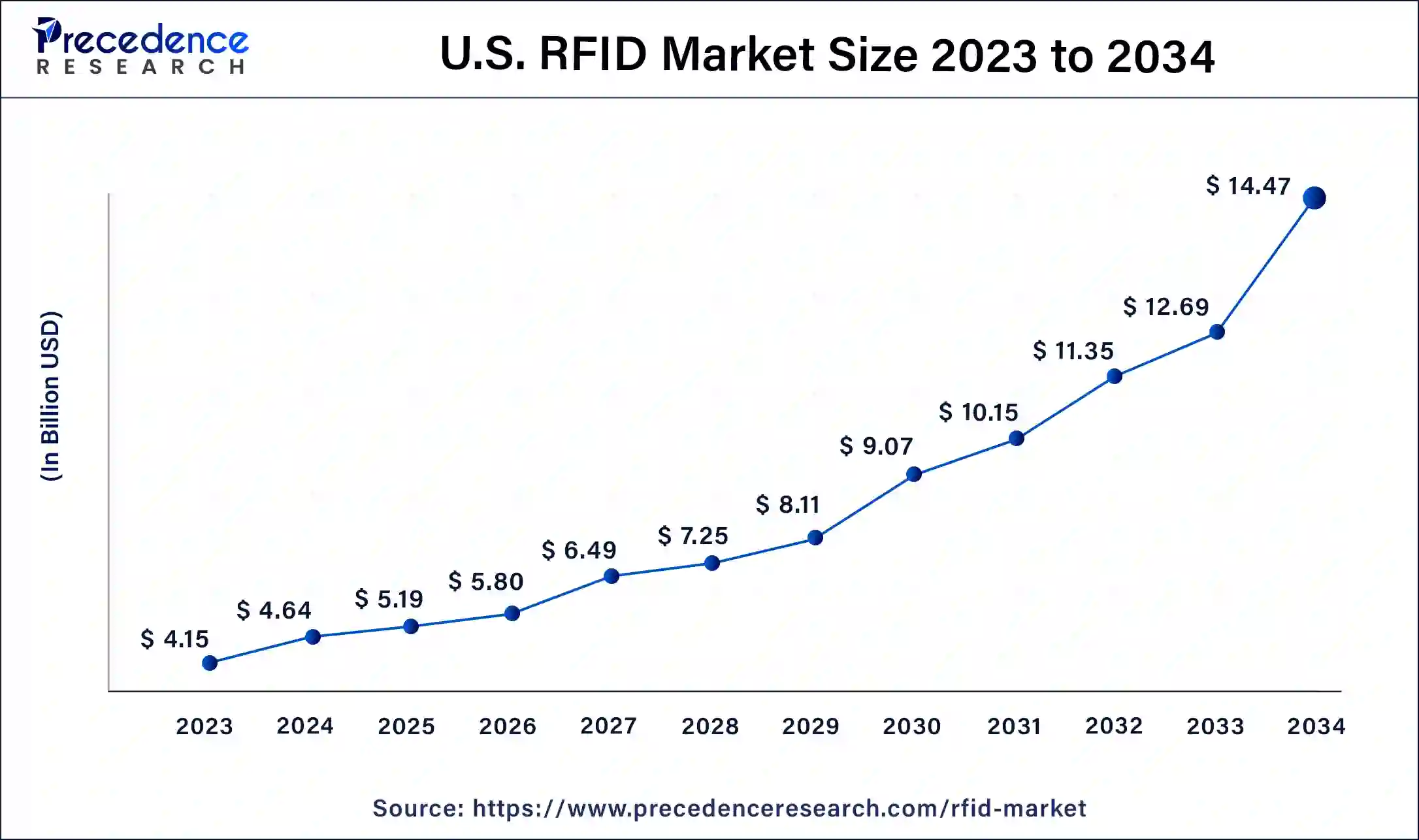

U.S. RFID Market Size and Growth 2025 to 2034

The U.S. RFID market size is exhibited at USD 5.19 billion in 2025 and is projected to be worth around USD 14.47 billion by 2034, poised to grow at a CAGR of 12.05% from 2025 to 2034.

Smart Tracking Revolution: RFID Technology Drives U.S. Market Expansion

The U.S. market is expanding due to strong adoption across retail, healthcare, logistics, and manufacturing sectors for efficient inventory tracking and automation. Growing integration with IoT and advanced data analytics enhances supply chain visibility and accuracy. Additionally, government initiatives supporting digital transformation, along with the presence of major players like Zebra Technologies and Honeywell, are driving continuous innovation and market growth nationwide.

North America at the Forefront of RFID Technology Growth.

North America registered the largest share of the global RFID market in 2024. North America dominates the RFID market due to early adoption and advanced technological infrastructure. The region's strong presence of key industry players, such as Zebra Technologies and Honeywell International, drives innovation and market growth. Retail giants like Walmart and Amazon leverage RFID for efficient inventory management and supply chain optimization, further boosting adoption. Additionally, sectors like healthcare, logistics, and manufacturing extensively use RFID for asset tracking and process automation.

- In September 2023 - The AD Pure line launches with, AD Belt U9 Pure inlays and tags which are ideally suited for global apparel, retail, industry and supply-chain applications. They are compact in size and offer excellent performance on difficult-to-tag or low-detuning materials such as cardboard and plastic.

Will Rapid Industrialization Boost RFID Adoption in the Asia Pacific?

Asia Pacific is anticipated to proliferate at a significant rate in the RFID market over the forecast period. The Asia Pacific RFID market is rapidly growing due to several factors. The region's increasing industrialization and robust economic growth, especially in countries like China and India, drive demand for efficient supply chain and inventory management solutions. Government initiatives supporting digital transformation and smart city projects further bolster RFID adoption.

- In July 2024, Indian technology company ID Tech Solutions released its IDT-87 UHF RFID reader to capture tag reads in outdoor industrial settings such as mine or factory gates and weigh bridges. The reader is the latest in the company's solutions, which are in use by groups like KEC International, banks, and the Indian railway.

Europe Leads the Way in RFID-Driven Supply Chain Innovation.

Europe is expected to showcase prominent growth in the global RFID market during the studied period. Fashion brands and the retail sector in Europe have already accepted RFID technology and its implementation in inventory management. This helps improve the overall customer experience, including the accuracy of inventories and their management, the identification of stockouts, and the enabling of burdenless checkout processes. The manufacturing and automotive sectors in European countries mostly leverage the benefits of RFID technology. According to the data,94% of European decision-makers, which is 91% globally, expect to use technology to increase supply chain visibility within the next five years.

- In September 2023, Zebra Technologies Corporation, a leading digital solution provider enabling businesses to intelligently connect data, assets, and people, released the findings of its 2023 Global Warehousing Study, which confirmed 58% of warehouse decision-makers plan to deploy radio frequency identification technology by 2028 which will help increase inventory visibility and reduce out-of-stocks.

How is RFID Technology Revolutionizing Across China?

The China market is growing rapidly due to rising adoption in manufacturing, logistics, retail, and public transportation for efficient tracking and automation. Government initiatives promoting digitalization and smart city projects are driving large-scale RFID deployment. Additionally, growing e-commerce activity, advancements in UHF RFID technology, and the presence of local manufacturers offering cost-effective solutions are further accelerating the expansion of the RFID market in China.

What makes the UK a Growing Hub for RFID Solutions?

The UK market is increasing due to growing adoption across retail, healthcare, logistics, and manufacturing sectors for efficient asset tracking and supply chain management. The rise of automation, smart inventory systems, and contactless payment technologies is boosting demand. Additionally, government support for digital transformation and the integration of RFID with IoT and AI solutions are driving continuous innovation and market expansion across the region.

Key Players in RFID Market and their Offerings

- Nedap N.V.: Offers advanced RFID solutions for vehicle and driver identification, access control, and retail management. Its products, like uPASS Target, TRANSIT Ultimate, and Harmony RFID platform, enable long-range identification and seamless integration for parking, logistics, and security applications.

- Zebra Technologies Corporation:Provides a full suite of RAIN (UHF) RFID products, including handheld and fixed readers, RFID printers, mobile computers, and tags. Zebra's solutions enhance asset visibility, real-time tracking, and inventory accuracy across retail, logistics, healthcare, and manufacturing sectors.

- Impinj, Inc.: Specializes in RAIN RFID platform components such as Monza tag chips, E910 reader chips, and connectivity gateways. Impinj enables item-level tracking, supply chain automation, and IoT connectivity for industries like retail, transportation, and logistics.

- HID Global Corporation: Offers a broad range of RFID tags, transponders, and readers operating on LF, HF, and UHF frequencies. HID's products like InLine Tag Ultra, Keg Tag, and Logi Tag are used for access control, asset tracking, industrial tagging, and authentication in logistics and manufacturing.

- Datalogic S.p.A.: Provides UHF RFID readers and hybrid barcode-RFID scanners for real-time data capture. Its PowerScan 9600 RFID series and DLR-DK001 readers support warehouse, production, and retail applications, ensuring reliable item tracking and workflow automation.

Recent Developments

- In March 2023, at EuroShop, Invengo brought and exhibited a variety of new-generation products such as UHF readers, tags, security gates, and antennas, as well as handheld readers from ATID, which demonstrated its advanced technology in the RFID industry.

- In October 2023, Fresenius Kabi reportedly revealed that it has launched +RFID smart labels for Diprivan Injectable Emulsion that are sold in the United States. These smart labels have become fully compatible with all prominent RFID kit and tray systems in the United States.

Segments Covered in the Report

By Product Type

- Tags

- Readers

- Software And Services

By Frequency Range

- Low Frequency (30kHz- 300kHz)

- High Frequency (3MHz-30MHz)

- Ultra-high Frequency (300MHz-3GHz)

By Industry

- Agriculture & Forestry

- Healthcare

- Manufacturing

- Retail

- Transportation & Logistics

- Others (Defense, Media, & Entertainment)

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content