What is RFID Printers Market Size?

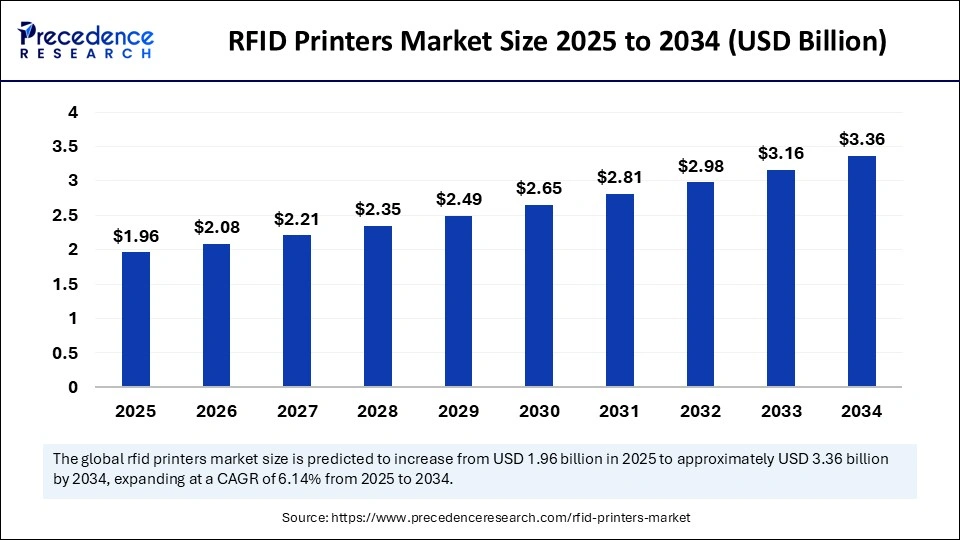

The global RFID printers market size accounted for USD 1.96 billion in 2025 and is predicted to increase from USD 2.08 billion in 2026 to approximately USD 3.36 billion by 2034, expanding at a CAGR of 6.14% from 2025 to 2034. The market is witnessing steady growth as industries increasingly adopt smart labelling solutions to enhance inventory tracking, supply chain transparency, and asset management. RFID printers enable the seamless encoding and printing of RFID tags, offering efficiency and accuracy across sectors like retail, logistics, and healthcare.

Market Highlights

- North America dominated the RFID printers market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the projection period.

- By type, the industrial printers segment contributed the largest market share in 2024.

- By type, the desktop printers segment is expected to grow at a significant CAGR between 2025 and 2034.

- By printing technology, the thermal transfer segment held the beggist market share in 2024.

- By printing technology, the direct thermal segment is expected to grow at a remarkable CAGR in the coming years.

- By frequency, the high frequency (HF) segment held the market with the largest market share in 2024.

- By frequency, the low frequency (LF) segment is expected to grow at a significant CAGR during the forecast period.

- By application, the retail segment captured the major market share in 2024.

- By application, the manufacturing segment is expected to grow at a significant CAGR between 2025 and 2034.

Strategic Overview of the Global RFID Printers Industry

The RFID printers market continues to evolve as businesses around the globe seek innovative, rapid, and precise solutions for identification, tracking, and data collection. Unlike traditional barcode printers, RFID printers ingeniously embed advanced radio-frequency chips within labels, enabling seamless wireless communication and instantaneous data exchange. This groundbreaking technology is fundamentally transforming asset and inventory management, ushering in a new era characterized by enhanced efficiency and unparalleled accuracy.

As the demand for RFID tags surges across various sectors, including retail, logistics, manufacturing, and healthcare, RFID printers become essential. The escalating complexity of the global supply chain, increasingly driven by data, heightens the necessity for intelligent labeling solutions, urging manufacturers, warehouses, and retailers to invest in robust RFID printing infrastructures. Moreover, the integration of cutting-edge technologies such as artificial intelligence (AI) and the Internet of Things (IoT) propels the growth of this market. This convergence of technologies not only enhances productivity but also cultivates a dynamic, responsive environment capable of adapting to the fast-paced demands of the modern marketplace. RFID printers have emerged as vital enablers of the smart industry and logistics era, facilitating operational efficiency and fostering a more interconnected and agile supply chain landscape.

AI Impact on the RFID Printers Market

Artificial intelligence (AI) is revolutionizing the market by enhancing the performance of RFID printers. AI ensures accurate data encoding and streamlines workflow. Integrating AI algorithms in RFID printers significantly enhances their capabilities to detect errors, ensuring precise label printing. Moreover, AI can monitor printer conditions in real-time and predict potential issues, enabling proactive maintenance and reducing downtime.

What are the Major Trends in the RFID Printers Market?

- AI-powered automation: RFID printers are becoming more intelligent with AI-driven features that enhance predictive maintenance, optimize printing workflows and auto-correct encoding errors. This results in greater efficiency, reduced downtime, and higher label accuracy in higher-volume environments.

- Shift towards on-demand and mobile printing: Businesses are moving toward portable and on-demand RFID printers for in-field operations like retail inventory checks or warehouse labeling. Compact, wireless models with user-friendly interfaces are gaining popularity for their flexibility and time-saving capabilities.

- Integration with cloud and IoT platforms: RFID printers are now part of broader IoT ecosystems. Labels printed are synced in real-time with cloud databases, enabling end-to-end visibility and actionable insights for inventory, logistics, and retail operations.

- Expanding the scope of applications: While logistics and retail remain core sectors, industries like healthcare, libraries, aviation, and even agriculture are exploring RFID printing to track equipment, monitor patients, manage livestock, and streamline services.

- Sustainability and eco-friendly labeling: As ESG goals become a priority, there's a growing demand for sustainable RFID printing materials and energy-efficient printers. Recyclable tags, minimal ink usage, and smart material management are trending among eco-conscious organizations.

- Customization and personalization capabilities: Modern RFID printers offer enhanced capabilities for high-resolution printing and tag customization, meeting sector-specific needs such as anti-counterfeit features, temperature-sensitive labels, and secure asset tagging.

- Growth of UHF and NFC tag printing: The rise of ultra-high-frequency (UHF) and near-field communication (NFC) applications is fueling demand for versatile printers that support a broader range of RFID tag types, enabling usage in contactless payments, access control, and intelligent packaging.

Market Outlook

- Market Growth Overview: The RFID Printers market is expected to grow significantly between 2025 and 2034, driven by the increasing demand for real-time tracking, automation, and supply chain efficiency in sectors like retail and logistics. The integration of IoT and AI for enhanced analytics, a shift toward more flexible mobile and desktop printers, and continuous innovation focused on durability and connectivity.

- Sustainability Trends: Sustainability trends involve eco-friendly tags and consumables, circular economy practices, and energy-efficient manufacturing and operations.

- Major Investors: Major investors in the market include Zebra Ventures, Honeywell International Inc., Avery Dennison Corporation, and SATO Holdings Corporation.

- Startup Economy: The startup economy is focused on the ecosystem component, driving sustainability, and enhancing IoT and AI integration.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.96 Billion |

| Market Size in 2026 | USD 2.08 Billion |

| Market Size by 2034 | USD 3.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Printing Technology, Frequency, Application,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Need for Real-Time Tracking

The rising need for real-time assets and inventory tracking across industries is a major factor driving the growth of the RFID printers market. In a global economy where speed, accuracy, and transparency are paramount, businesses are under increasing pressure to monitor goods from source to shelf with minimal error. RFID printers empower organizations to tag assets with intelligent labels that identify and communicate wirelessly, enabling seamless updates across digital platforms. This real-time traceability minimizes losses, boosts supply chain efficiency, reduces manual labor, and enhances customer satisfaction. From warehouse automation to smart retail shelves, the demand for instant data capture is fueling printer adoption like never before.

Restraint

High Cost

The high upfront cost of RFID printers and RFID-enabled tags remains a significant barrier, especially for small and medium-sized enterprises (SMEs). These businesses often lack the capital or justification to replace traditional barcode systems with more advanced, albeit costly, RFID infrastructure. Furthermore, complexity in setup and integration with existing enterprise systems can deter adoption. The need for staff training, data calibration, and standard compliance adds additional layers of challenge. Businesses sometimes face compatibility issues with different RFID frequencies or formats, leading to inefficiencies. Thus, while the technology is robust and the advantages clear, the economic and technical entry barriers must be addressed for widespread and inclusive market growth.

Opportunity

Emerging Markets

The future of the RFID printers market lies in expanding into emerging sectors and geographies where digital transformation is just beginning. Countries in Asia, Latin America, and Africa are rapidly upgrading their infrastructure and embracing technologies like AI, IoT, and Industry 4.0, creating a fertile ground for RFID labeling solutions. In addition, new applications are emerging beyond traditional logistics, such as in event ticketing, smart packaging, pharmaceuticals, agriculture, and even luxury retail, where authenticity tracking is vital. Customized RFID labels with embedded sensors, temperature tracking, or tamper detection are opening entirely new business models. The integration of RFID printing with blockchain, cloud, and analytics also presents a tremendous opportunity for data-driven decision-making and consumer transparency.

Segment Insights

Type Insights

How Industrial Printers Segment Dominated the RFID Printers Market in 2024?

The industrial printers segment dominated the market with the largest share in 2024 as they are the powerhouse of the RFID printing landscape, renowned for their exceptional durability, impressive speed, and robust capacity to handle large-scale labeling operations. Designed specifically for demanding environments such as warehouses, manufacturing facilities, and logistics hubs, these printers excel in delivering consistent, high-volume printing essential for maintaining operational efficiency. Equipped with advanced technology, industrial RFID printers produce superior print quality, ensuring clear and accurate labels that meet the rigorous standards of enterprise-level applications. Their long operational lifespan and efficient media handling capabilities further enhance their appeal, allowing businesses to streamline their labelling processes with confidence. Organizations rely on industrial RFID printers for their unwavering reliability, even in high-pressure situations and multi-shift operations. With seamless integration capabilities into complex inventory management systems, these printers stand as a vital component in the backbone of modern supply chain and logistics operations.

On the other hand, the desktop printers segment is expected to grow at a significant CAGR. This is mainly due to their high demand, particularly among small and medium enterprises (SMEs) and retail stores that are seeking space-efficient and cost-effective solutions. These printers are designed with user-friendly interfaces and require minimal setup, making them accessible even for those with limited technical expertise. Increasingly, they are being employed for a variety of moderate labeling tasks in point-of-sale areas, small-scale inventory management, and back-office applications. With the advent of cloud integration and enhanced remote connectivity, desktop printers are evolving into smarter and more versatile devices. This evolution allows businesses to scale their operations seamlessly without the need for substantial investments in industrial-grade setups, thus empowering them to adapt and grow in an increasingly competitive landscape.

Printing Technology Insights

What Made Thermal Transfer the Dominant Segment in 2024?

The thermal transfer segment dominated the RFID printers market in 2024, primarily because of its ability to produce long-lasting, smudge-resistant outputs. This durability makes it particularly well-suited for labels that must withstand challenging environments, such as those found in logistics, pharmaceuticals, and industrial applications. By employing heat along with resin-based ribbons, thermal transfer printing ensures that the labels not only maintain clarity over time but also endure the rigors of various conditions. As a result, this method has become the preferred choice in scenarios where the longevity and visibility of labels are paramount.

Moreover, the direct thermal segment is expected to grow at a remarkable CAGR in the coming years, primarily due to its ability to produce long-lasting, smudge-resistant outputs. This technology is particularly well-suited for labels that must withstand challenging environments, such as those found in logistics, pharmaceuticals, and industrial goods. By utilizing heat alongside resin-based ribbons, direct thermal printing ensures exceptional durability and resilience, making it the preferred choice in applications where the longevity and clarity of labels are of utmost importance.

Frequency Insights

Why did the High Frequency Segment Dominate the RFID Printers Market?

The high frequency (HF) segment dominated the market, capturing the largest revenue share in 2024. High-frequency (HF) RFID printers have firmly established themselves as critical technology across a wide range of sectors, including retail, access control, library systems, and healthcare applications. These printers excel in reading ranges typical of HF technology, often up to 1 meter, ensuring high reliability in densely populated environments. Their robust anti-collision capabilities allow multiple tags to be read simultaneously without interference, which is essential in busy settings such as retail stores and libraries. Moreover, their compatibility with Near Field Communication (NFC)-based devices significantly enhances their versatility, making them indispensable tools in today's tech-driven landscape, especially for applications requiring close-range interactions like ticketing and contactless payments. The widespread adoption of HF printers is largely attributable to their cost-effectiveness and exceptional stability, particularly in controlled environments where precision and efficiency are paramount, such as laboratory settings and patient tracking in healthcare. These factors ensure a lower total cost of ownership and improved operational workflows for organizations looking to streamline their processes.

On the other hand, the low frequency (LF) segment is expected to grow at a significant CAGR during the forecast period. RFID printers with low-frequency support longer read ranges of up to 12 meters, making them particularly well-suited for logistics, asset tracking, vehicle management, and comprehensive inventory control. UHF technology enables swift data transfers and the capability to read multiple tags in bulk, which is indispensable for industries demanding high-speed operations and extensive coverage areas, such as supply chain management and large-scale retail. The remarkable growth of UHF RFID printers is directly tied to the expansion of the Internet of Things (IoT) and the increasing prevalence of smart warehousing solutions. As businesses adopt automated systems for tracking assets and managing inventories in real-time, the need for faster, more efficient RFID solutions continues to rise, underscoring UHF technology's crucial role in modern operational strategies.

Application Insights

How does Retail Segment Dominated the RFID Printers Market in 2024?

The retail segment dominated the market in 2024, driven by a critical need to enhance inventory management, theft prevention, and expedited checkout processes. RFID labels empower retailers to manage stock levels in real-time, enabling them to improve their replenishment cycles substantially and create seamless omnichannel experiences for consumers. This technology finds applications in various areas, from tagging apparel to the implementation of smart fitting rooms, where customers can try on clothes and receive immediate stock information. As a result, the retail industry remains at the forefront of RFID-driven innovation, continually adapting and evolving to meet the demands of a rapidly changing market.

Meanwhile, the manufacturing segment is expected to grow at a significant CAGR in the coming years, driven by the widespread adoption of Industry 4.0 principles and increased automation. Manufacturers are increasingly utilizing RFID printers for precise real-time tracking of essential components such as parts, tools, and machinery, as well as monitoring production status. This capability ensures enhanced control over supply chains and robust quality management systems. As smart factories become more prevalent, RFID printers play a pivotal role in the digital transformation of manufacturing ecosystems, facilitating improved operational efficiency, reduced waste, and greater overall productivity. This integration of RFID technology is essential for manufacturers aiming to compete in a highly dynamic and technology-driven environment.

Regional Insights

What Factors Contributed to North America's Dominance in the RFID Printers Market?

North America registered dominance in the market by holding the largest revenue share in 2024. This is mainly due to its early adoption of advanced technologies like RFID printers, a robust industrial infrastructure, and well-established retail and logistics networks. The U.S. has witnessed widespread integration of RFID printers across various sectors, including major retail giants such as Walmart and Target, manufacturing units, defense logistics, and healthcare systems. In the retail sector, RFID printers are pivotal in inventory management, enabling real-time tracking of merchandise and enhancing supply chain efficiency. In manufacturing, companies leverage RFID technology to streamline operations and minimize errors in production lines. The defense sector benefits from precise inventory control and tracking of equipment, while healthcare systems utilize RFID printing for patient identification, medication tracking, and asset management.

Moreover, the presence of leading RFID printer manufacturers, including Zebra Technologies and SATO, alongside substantial investments in automation and supply chain digitization, significantly fuels the region's supremacy. Government regulations aimed at promoting accurate tracking and ensuring security compliance, especially in critical areas such as pharmaceuticals and food safety, further amplify market demand. These regulations not only reinforce the necessity for reliable RFID solutions but also encourage businesses to adopt these advanced technologies to meet compliance standards and enhance operational transparency. Overall, the combination of technological advancement, regulatory support, and strong industrial demand positions North America as a frontrunner in the RFID printing space.

U.S. RFID Printers Trends

U.S. strong growth in retail and logistics applications is seeking automation and real-time tracking. The integration of printers with IoT and AI for smarter supply chains, and a growing demand for flexible, compact mobile printers. The market is dominated by major players like Zebra and Honeywell, with growth driven by technological advancements in speed, accuracy, and connectivity.

Germany RFID Printers Trends

Germany's RFID printer market is aggressively adopting industry 4.0 technologies, with demand for durable and high-volume output in large enterprises within manufacturing and logistics, and a focus on high-frequency technology. The quality and durability requirements and healthcare and pharmaceutical applications.

What are the Key Drivers of Asia Pacific's Rapid Growth in the RFID Printers Market?

Asia Pacific is expected to grow at the highest CAGR during the forecast period, driven by its vast manufacturing capabilities, rapidly expanding retail sector, and ambitious digital transformation initiatives. Countries such as China, India, Japan, and South Korea are at the forefront of adopting RFID (Radio-Frequency Identification) printers. There is a high demand for RFID tags in various sectors, including warehousing, production lines, and supply chains. This adoption is aimed at enhancing visibility, streamlining operations, and reducing inefficiencies. The booming e-commerce sector, coupled with the establishment of advanced logistics hubs, is further propelling the need for efficient inventory management solutions.

Governments in the region are also heavily investing in digital infrastructure projects, which creates an environment conducive to the widespread use of RFID technology. Small and medium-sized enterprises (SMEs) that are both cost-sensitive and eager to leverage technology are increasingly embracing desktop RFID printers. This trend indicates a shift towards automation and improved operational efficiency, positioning the Asia-Pacific region as a promising hub for future growth in RFID technology and its applications.

What Opportunities Exist in the European RFID Printers Market?

Europe is emerging as a notably growing region, spurred by a significant technological renaissance and a strong emphasis on sustainability. Key players, particularly in countries like Germany, France, and the UK, are making substantial investments in Industry 4.0 initiatives, smart manufacturing processes, and green logistics systems, where RFID-enabled tracking plays an integral role in enhancing operational efficiency and sustainability. The shift towards RFID printing solutions is being driven by an increased focus on compliance, traceability, and eco-friendly labeling practices.

European companies are increasingly adopting these solutions to minimize waste and improve transparency across their processes. This growth is significantly supported by industries such as transportation, automotive, and fashion, which are actively leveraging RFID technology to combat counterfeiting and optimize inventory management. For instance, the automotive sector is utilizing RFID to streamline supply chain processes, ensuring that components are accurately tracked and accounted for. Similarly, the fashion industry is turning to RFID to enhance inventory accuracy and provide better visibility into product flows, ultimately leading to improved customer satisfaction. As sustainability becomes paramount, RFID printing not only fulfills regulatory requirements but also aligns with the growing consumer demand for responsible and transparent business practices.

RFID Printers Market Value Chain Analysis

- Raw Material & Component Sourcing

This stage involves the procurement of basic raw materials such as plastic polymers, metals for casing and mechanisms, and electronic components like chips, sensors, and print heads from a global supplier network.

Key Players: Electronic component manufacturers (e.g., Impinj for RFID chips, various sensor producers), materials suppliers. - Manufacturing and Assembly

In this stage, the sourced components are assembled into functional RFID printers through precision manufacturing processes.

Key Players: Zebra Technologies Corporation, Honeywell International Inc., SATO Holdings Corporation, Postek Electronics Co., Ltd.

Software Development and Integration

This critical stage involves developing the firmware that controls the printer's functions and the software drivers, labeling programs, and network connectivity tools that allow end-users to design, print, and encode tags.

Key Players: In-house software teams of printer OEMs (Zebra's Link-OS, Honeywell's operational intelligence software), third-party labeling software companies (e.g., BarTender by Seagull Scientific). - Distribution and Sales

The finished printers are distributed through a network of value-added resellers (VARs), distributors, and direct sales channels to businesses globally.

Key Players: Global distributors (e.g., Ingram Micro, BlueStar), local value-added resellers (VARs), OEM direct sales teams.

RFID Printers Market Companies

- Zebra Technologies Corporation: Zebra is a market leader that designs and manufactures a comprehensive portfolio of RFID printers, from rugged industrial units to mobile printers, integrated with their Link-OS software for seamless enterprise deployment and data management.

- Sato Holdings Corporation: This company provides reliable and durable RFID printing solutions used across manufacturing, logistics, and retail, offering a range of thermal printers that ensure precise encoding and high performance in demanding environments.

- Honeywell International Inc.: Honeywell contributes a wide array of RFID printers and integrated data collection solutions, focusing on industrial automation and supply chain efficiency with both hardware and cloud-based software offerings.

- Toshiba Corp.: Toshiba's contribution includes a robust line of industrial thermal RFID printers known for their durability and high-speed performance, catering to the demanding needs of logistics and manufacturing sectors.

- Avery Dennison Corporation: A key player primarily in the consumables segment, Avery Dennison manufactures the necessary RFID inlays, tags, and labels that are used in the printers, as well as printer systems themselves, enabling the market through material supply and innovation.

- Seiko Epson Corporation: Epson provides a range of business and industrial printers, including those with RFID capabilities, focusing on innovative, energy-efficient printing technologies used in retail and healthcare applications.

- Dascom: Dascom is a growing player offering cost-effective and reliable RFID-enabled printers designed for industrial applications, providing viable alternatives for businesses seeking durable tracking solutions.

- Printronix Auto ID: This manufacturer specializes in high-end, rugged industrial RFID printers that handle high-volume printing and encoding needs, particularly in automotive and durable goods manufacturing.

- ID Technology LLC: A division of ProMach, ID Technology provides integrated labeling, coding, and marking solutions, which include RFID printer systems tailored to specific client needs in the packaging and logistics industries.

Recent Development

- In May 2025, Elegoo, a Shenzhen-based 3D printer manufacturer, introduced a new RFID Ecosystem for its upcoming printer line, including the upcoming Elegoo Saturn 4 Ultra. This system integrates RFID-tagged resin bottles, an Elegoo-designed scanner, and cloud-connected print profiles. (Source: https://3dprintingindustry.com)

- In April 2022, TSC Printronix Auto ID introduced its first mobile RFID printer, the Alpha-40L RFID. This compact, mobile powerhouse is further evidence of TSC Printronix Auto ID's expertise in RFID and marks a resilient step forward in production and logistics processes.(Source: https://emea.tscprinters.com)

Segments Covered in the Report

By Type

- Industrial Printer

- Desktop Printers

- Mobile Printers

By Printing Technology

- Thermal Transfer

- Direct Thermal

- Inkjet

By Frequency

- Low Frequency (LF)

- High Frequency (HF)

- Ultra-High Frequency (UHF)

By Application

- Manufacturing

- Retail

- Transportation & Logistics

- Healthcare

- Government

- Entertainment

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting