3D Printers Market Size and Forecast 2025 to 2034

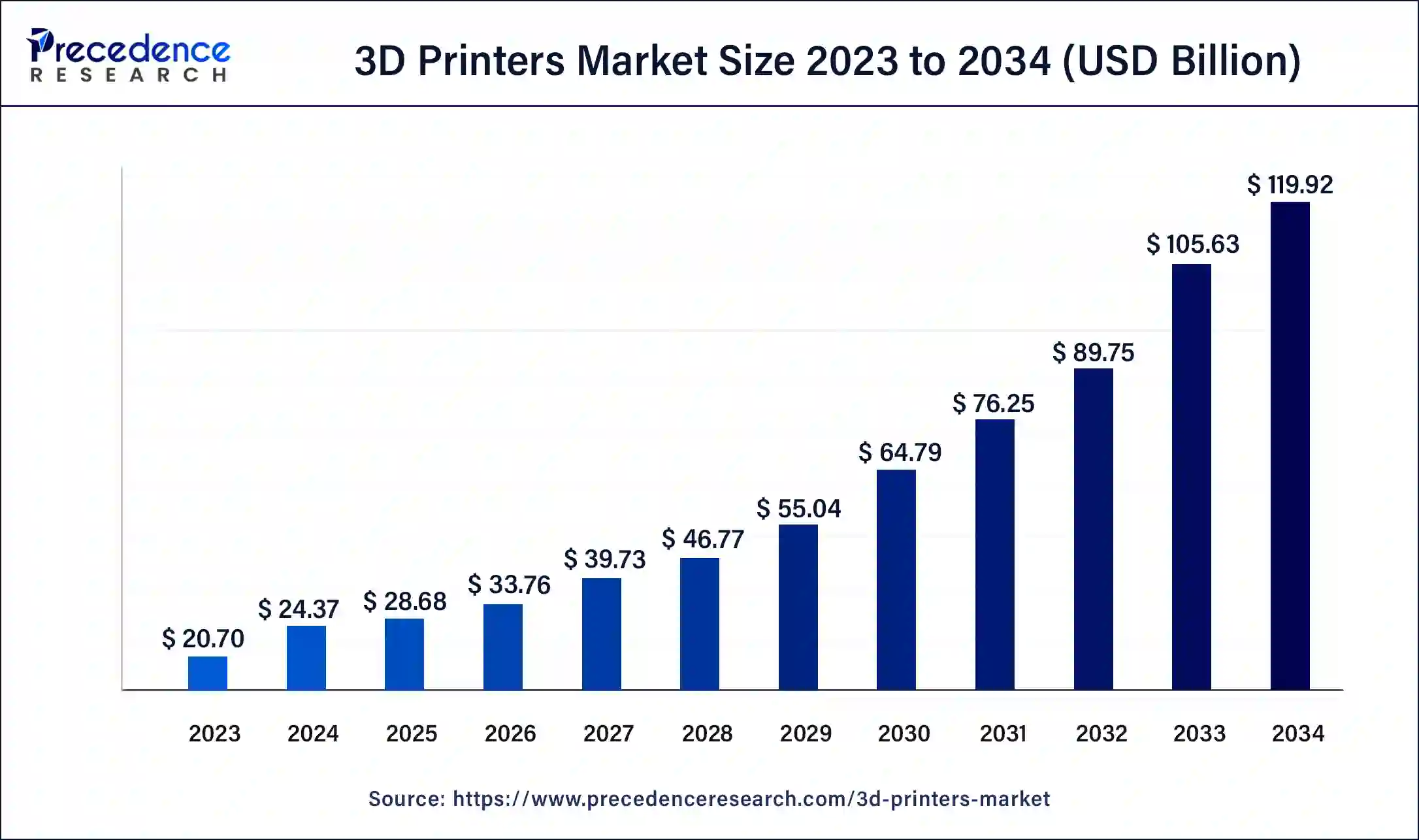

The global 3D printers market size accounted for USD 24.37 billion in 2024, and is expected to reach around USD 119.92 billion by 2034, expanding at a CAGR of 17.3% from 2025 to 2034. The North America 3D printers market size reached USD 6.62 billion in 2023.

3D Printers Market Key Takeaways

- In terms of revenue, the market is valued at $28.68 billion in 2025.

- It is projected to reach $119.92 billion by 2034.

- The market is expected to grow at a CAGR of 17.30% from 2025 to 2034.

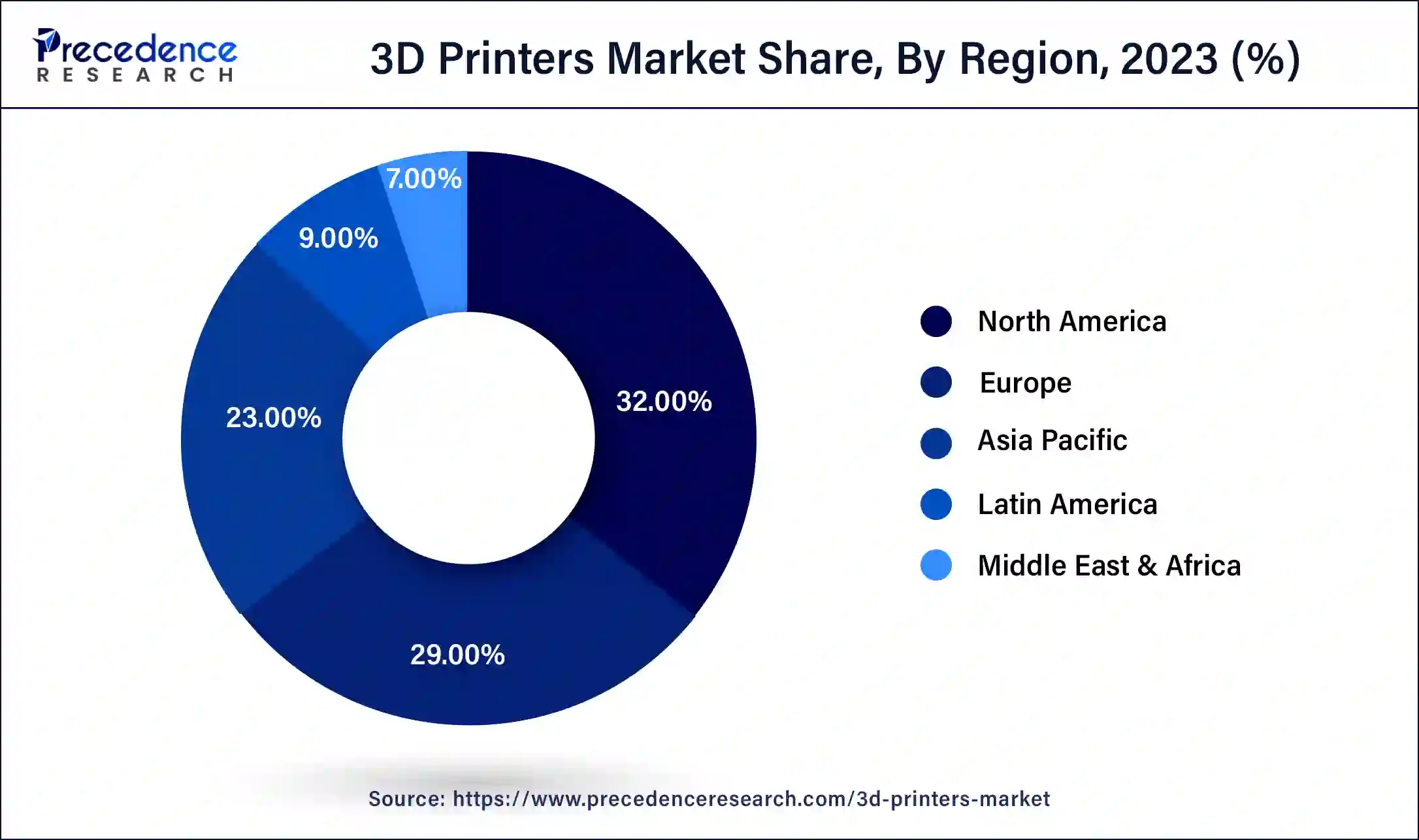

- By geography, North America dominates the market with the highest revenue share of around 32.14% in 2024.

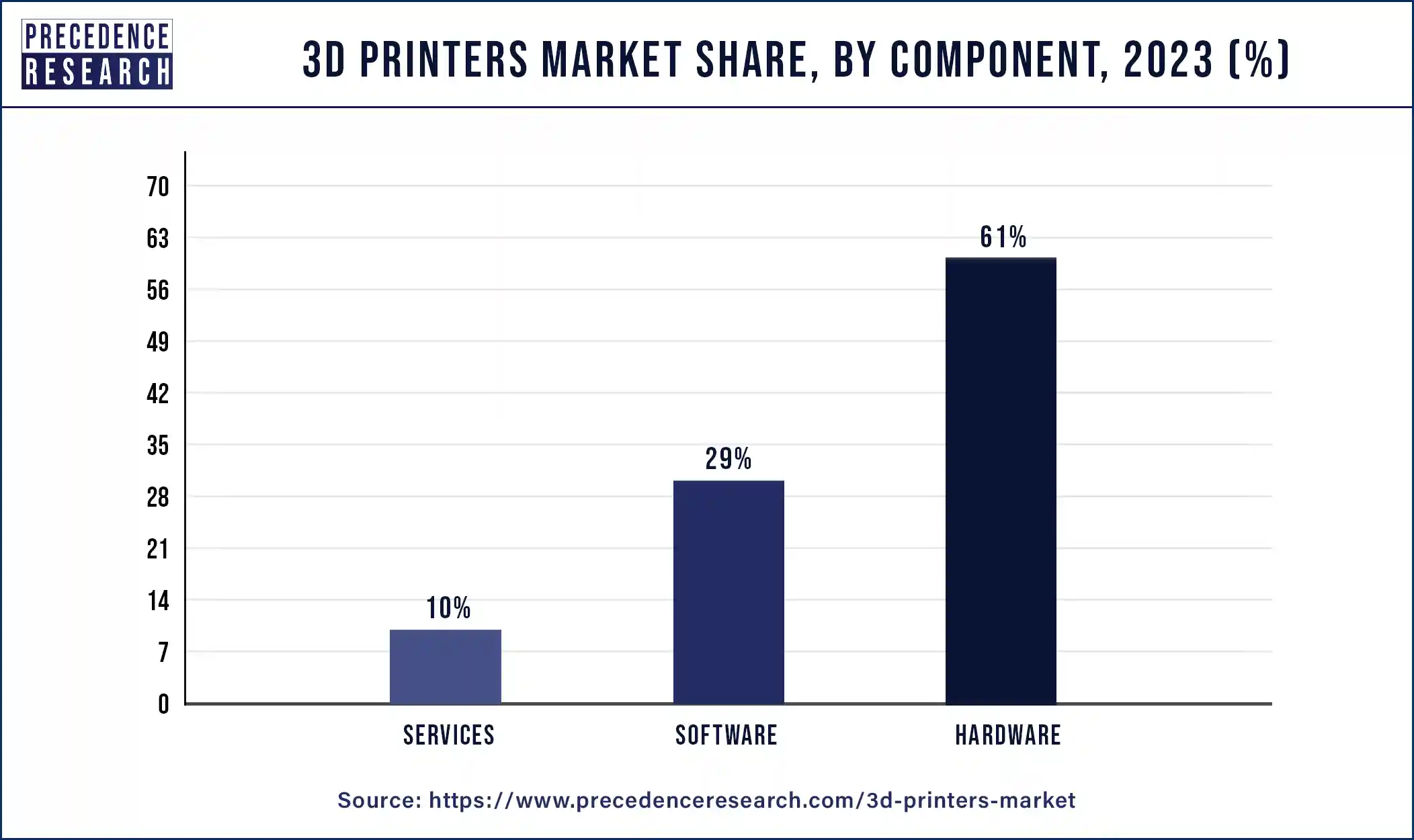

- By component, the hardware segment dominates the market and captured more than 61% of revenue share in 2024.

- By printer type, the industrial 3D printers segment generated the largest revenue share of around 71% in 2024.

- By technology, the stereolithography segment generated the highest revenue share in 2024.

- By software, the design software segment captured for the highest revenue share of around 31% in 2024.

- By application, the prototyping segment generated the highest revenue share of around 56% in 2024.

- By vertical, the automotive segment dominates the market.

- By material, the metal material segment captured for the largest revenue share of around 51% in 2024.

U.S. 3D Printers Market Size and Growth 2025 to 2034

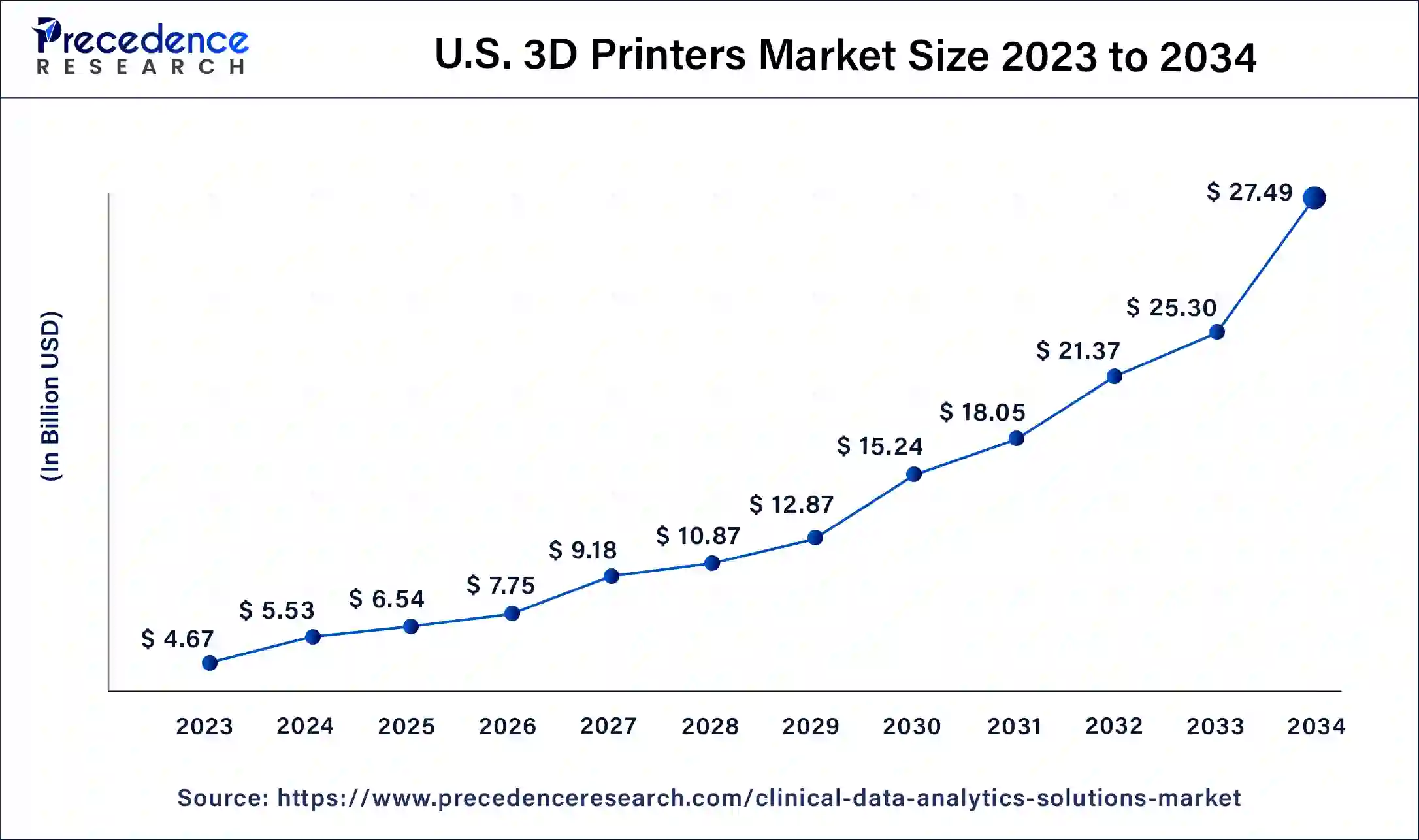

The U.S. 3D printers market size was estimated at USD 5.53 billion in 2024 and is predicted to be worth around USD 27.49 billion by 2034, at a CAGR of 17.4% from 2025 to 2034.

North America dominates the global 3D printers market with the highest revenue share of around 32.14% in 2024. The North America is predicted to maintain growth owing to rapid technological innovation. Increasing numbers of 3D printing technology start-ups in the region are seen as another driving factor for market growth. Europe is considered the fastest-growing region in the global market.

The presence of companies with expertise in additive technology is a contributing factor to the market's growth. Asia Pacific is projected to show a significant change in the 3D printers market during the forecast period of 2024-2034. Developing additive industries and increasing investment in R&D for invention in 3D technology printers are considered to drive the global 3D printers market in the Asia Pacific.

The emerging economy in the countries like Brazil and Chile is projected to grow the revenue share for the 3D printers market in Latin America. The deployment of 3D printers in automotive and architectural activities is expected to increase during the forecast period in Latin America. The rapidly developing IT industry and availability of low-cost raw materials are boosting the growth of the market in the Middle East & Africa. These regions are anticipated to show a significant increase during the forecast period.

Europe is expected to grow significantly in the 3D printers market during the forecast period. The use of 3D printers in the healthcare sector of Europe is increasing. It is being used in the development of dental models, prosthetics, and other implants. At the same time, its use for the development of aircraft parts in the aerospace sector is also increasing. Moreover, to enhance their applications and performance, various developments are being made with the help of advanced technologies, which in turn, are leading to new collaborations among the companies. They are also supported by the government funding. Thus, all these developments are promoting the market growth.

MarketOverview

In recent years, three-dimensional (3D) printing technology has replaced the traditional manufacturing process. 3D printing is the process of creating an object. This advanced technological process allows the designing or creating of complex parts for machines, tools, clothing, and even body parts. 3D printers have helped industries/enterprises mold and sculpt parts with reduced effort, time and cost. 3D printers create the blueprint of objects in the form of data. 3D printers, after receiving the data make a 3D object by adding layers to layers to form a full structure.

3D printers provide revolutionary advantages to enterprises/industries. The benefits offered by 3D printers include flexible design, printing on demand, rapid prototyping, lightweight yet strong part for machinery, and reduced waste. Moreover, 3D printers are considered environmentally friendly as they reduce material wastage. 3D printers are being used in many fields.

3D printing technology has revolutionized the healthcare, automotive, and aerospace industries. 3D printers are filled with unique 3d printing materials such as rubber, plastic, or even metal to create real-world models/objects. 3D printers have changed the manufacturing process's speed, functionality, and efficiency while promising production quality.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.68 Billion |

| Market Size in 2024 | USD 24.37 Billion |

| Market Size by 2034 | USD 119.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 17.30% |

| Dominated Region | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Component, Technology, Software, Application, Vertical, Material and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

The deployment of artificial intelligence in 3D printing technology is considered a major driving factor for the growth of the global 3D printers market. 3D printing technology has gained popularity in recent years as it offers rapid and flexible design with reduced efforts. Such factors that benefit large-scale industries are driving the growth of the market. The expansion of the application of 3D printing technology in the healthcare sector during complex replacement surgeries is considered a driver for the market's growth.

Rising government investment in the research and development of 3D printing technology is boosting the growth of the overall 3D printers market. The technological advancements in 3D printers with more ease and flexible application will fuel the development of the market during the forecast period.

However, the high cost associated with 3D printers that are not affordable for small and medium-sized enterprises is seen as a significant restraint for the growth of the 3D printers market. Along with this, several loopholes in the prototyping process in 3D printing, such as poor documentation and too many variations according to the client's requirements, are likely to hamper the market growth.

The lack of technical knowledge and skilled professionals required to manage 3D printers is considered a restraint for the global 3D printers market growth. Moreover, a lack of awareness about additive technology in underdeveloped countries is hindering market development.

Component Insights

The 3D printers market is segmented based on components: hardware, software, and services. The hardware segment dominates the market and generated more than 61% of the revenue share in 2024, owing to rapid industrialization and urbanization.

Advanced manufacturing processes and increased penetration in consumer electronics are other factors that boost the growth of the hardware segment in the 3D printers market.

Printer Type Insights

The industrial 3D printers segment holds the largest revenue share of around 71% in 2024. The rapid adoption of 3D printing technology by heavy industries such as automotive, aerospace and defense, electronics, and healthcare has boosted the demand for technologically advanced 3D printers, which makes industrial 3D printers the dominating segment.

Industrial 3D printers help design consumer, automotive and industrial tools and final parts. Industrial 3D printers have capabilities of mass production and offer high performance. Increasing demand from the healthcare, aerospace & defense, and automotive industries is boosting the growth of the industrial 3D printers segment.

On the other hand, the desktop 3d printers segment is showing steady growth. Desktop 3D printers are being deployed by educational centers such as institutions, schools, and universities for training purposes. Usually, desktop printers are used for limited purposes by small enterprises. Several small enterprises are adopting desktop 3D printers to manufacture/design projects.

The size of a desktop 3D printer is small and can be fitted near a computer or laptop, which is convenient for small-scale industries and educational institutions. Thus, the demand for desktop 3D printers is projected to grow during the forecast period.

Technology Insights

Based on technology, the stereolithography segment accounts for the highest revenue share in 2024. Stereolithography is a process used for industrial purposes to create concept models, and Stereolithography is considered the most conventional process of printing. The rapid adoption of Stereolithography is attributed to the easy operational methods for this printing process.

Moreover, the fuse deposition modeling segment is expected to account for the highest revenue share during the forecast period. Industries in prototyping and production applications use the fuse deposition modeling process. The fuse deposition modeling process in 3D printing boosts the prototyping speed. The rapid adoption of various 3D printing processes across the globe is considered a significant driver for the segment's growth.

Software Insights

Based on software, the design software segment accounted for the highest revenue share of around 31% in 2024 and the segment is projected to continue dominating the market during the forecast period. Design software is widely used to construct the designs of objects, and design software is mainly used in aerospace & defense, automotive, and engineering sectors.

Furthermore, the demand for scanning software has increased in recent years. The scanning software allows the storage of scanned images, which is predicted to boost the revenue share of the scanning software segment.

Application Insights

Based on application, the prototyping segment acquires the highest revenue share of around 56% in 2024. Prototyping offers flexible designing, allows easy detection of errors and easy functioning. These factors have led many industries and verticals to adopt the prototyping process in 3D printing.

Industries that require complex designing of components or parts, such as engineering, automotive, aerospace & defense, have started adopting prototyping to design parts. The functional parts segment is considered the fastest-growing segment in the market, with increasing demand for designing available parts with accuracy and precise sizes.

Vertical Insights

Based on vertical, the 3D printers market is segmented into automotive, aerospace & defense, healthcare, consumer electronics industrial, power & energy, education, fashion & jewelry, food, object, dental & others. The automotive segment dominates the global 3d printers market owing to the rapid adoption of additive technology for designing purposes in the industry. The Aerospace& defense sector has started deploying 3D printing technology to create complex designs.

The healthcare segment is seen as the fastest-growing segment in the global 3D printers market. The capabilities of the 3D printing process in replacement surgeries have forced the healthcare industry to adopt 3D printing technology. The food, education, fashion, and jewelry segments are anticipated to boost during the forecast period owing to the rapid adoption of desktop 3d printers.

Material Insights

The metal material segment accounts for the largest revenue share of around 51% in 2024. Metals allow suitable manufacturing processes due to high flexibility and strength. The segment is expected to maintain growth during the forecast period. The polymer segment accounted for the second-largest revenue share in the market. However, the ceramic material segment is new in the global 3d printers market.

3D Printers Market Companies

- HP Inc.

- 3D Systems Inc.

- Envision Tec Inc.

- Autodesk Inc.

- Canon Inc.

- Stratasys Ltd.

Recent Developments

- In July 2025, a new version of the Fortus 450mc 3D printer was launched by Stratasys Ltd. on its 10th anniversary. The Fortus 450mc consists of a mid-level, reliable FDM workhorse, along with 92% of installed systems still producing parts, which has enhanced its reputation over the past decade. Moreover, the Fortus 450mc printer was used across the automotive, aerospace, as well as other general industrial sectors, as it was designed for clients requiring precision, repeatability, and durability.

(Source: https://finance.yahoo.com)

- In July 2025, Snapmaker U1, a 3D printer, was revealed by the innovative outfit known for the modular machines, that is, Snapmaker. Moreover, this 3D printer can establish filament changes in just five seconds, as it consists of a four-head tool-changer. Additionally, this U1 can enable each toolhead with a travel speed of 500mm/s, 20,000mm/s² acceleration, and zoom at print speed of 300mm/s, as it features a CoreXY structure. Thus, this can enhance the printing speed, supporting the statement of Snapmaker that compared to the desktop printers, the U1 can print up to five times faster.

(Source: https://hothardware.com)

- In December 2022, INTAMSYS launched a Functional Material, FUNMAT PRO 310, an industrial-grade 3D printer. The new 3D printer was unveiled at Formnext 2022 event. Formnext is a leading European show for additive manufacturing. The FUNMAT PRO 310 3D printer is designed for high-temperature 3D printing capabilities.

- In December 2022, Photocentric, a UK-based 3D printer manufacturer, launched Liquid Crystal (LC) Titan 3D Printer. This 3D printer has the largest and most potent photo-centric unit to date.

- In November 2022, Switzerland-based 3D printer material provider, NematX launched its material extrusion platform Nex01 liquid crystal polymer 3D printer at Formnext 2022. It is designed to provide high performance for production with maximum process control with micron resolution 3D printing capabilities.

- In December 2022, a 3D printer start-up in Arizona, Mechanano, launched a new carbon nanotube-based electrostatic dissipative 3D printing resin in the market designed to yield vat polymerization 3D printed parts with enhanced impact resistance.

- In December 2022, a world-leading brand of resin 3D printers, Creality, launched laser modules to turn 3D printers into laser cutters.

- In December 2022, Horizon Microtechnologies, a microfabrication start-up, launched a new microscale 3D printing technology. This new technology will help bring greater manufacturing versatility to the production of electrodes.

- In December 2022, a US-based software company, Conflux, launched a new cartridge heat exchanger developed with 3D printing technology. The heat exchanger is configurable and provides high performance.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Printer Type

- Industrial 3D Printer

- Desktop 3D Printer

By Technology

- Stereolithography

- Inkjet Printing

- Direct Metal Laser Sintering

- Fuse Deposition Modeling

- Selective Laser Sintering

- Poly Jet Printing

- Electron Beam Melting

- Laser Metal Deposition

- Digital Light Processing

- Laminated Object Manufacturing & Others

By Software

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

By Application

- Prototyping

- Tooling

- Functional Parts

By Vertical

- Automotive

- Airospace& Defense

- Healthcare

- Consumer Electronics

- Industrial

- Power & Energy

- Education

- Fashion & Jewelry

- Food

- Object

- Dental

- Others

By Material

- Polymer

- Metal

- Ceramic

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting