What is the Smart Packaging Market Size?

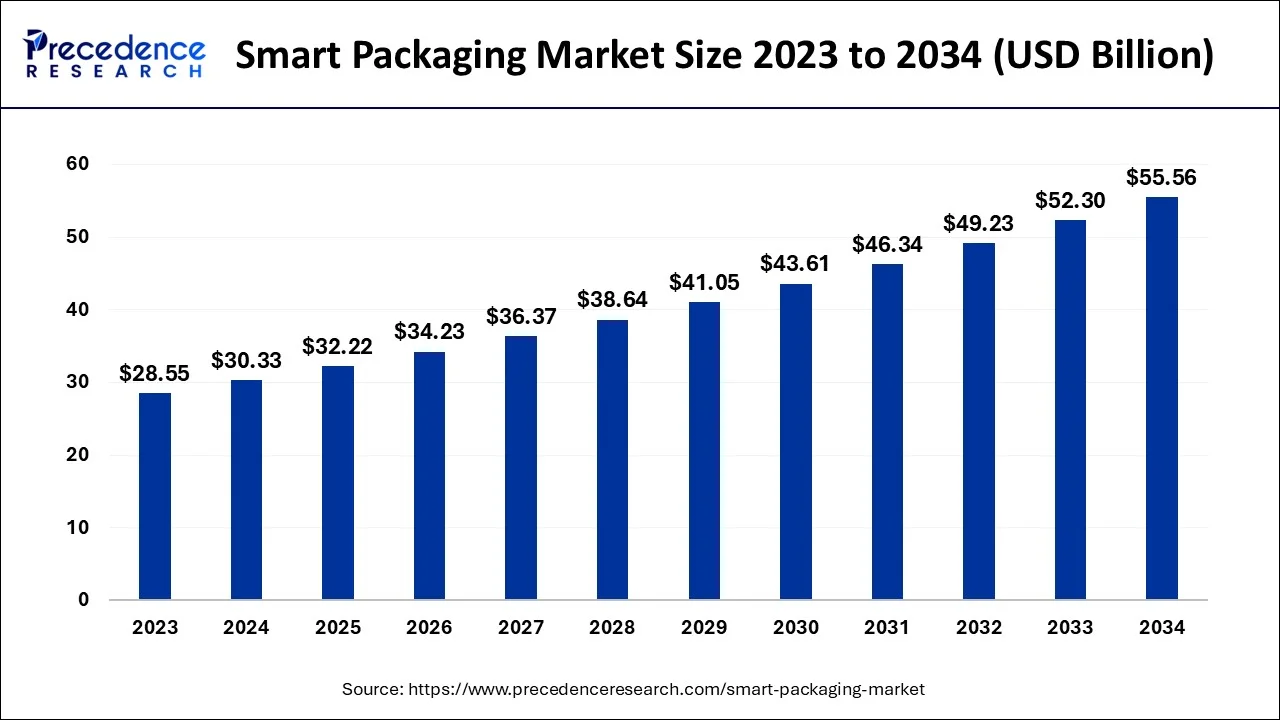

The global smart packaging market size is valued at USD 32.22 billion in 2025 and is predicted to increase from USD 34.23 billion in 2026 to approximately USD 55.56 billion by 2034, expanding at a CAGR of 6.24% from 2024 to 2034.

Smart Packaging Market Key Takeaways

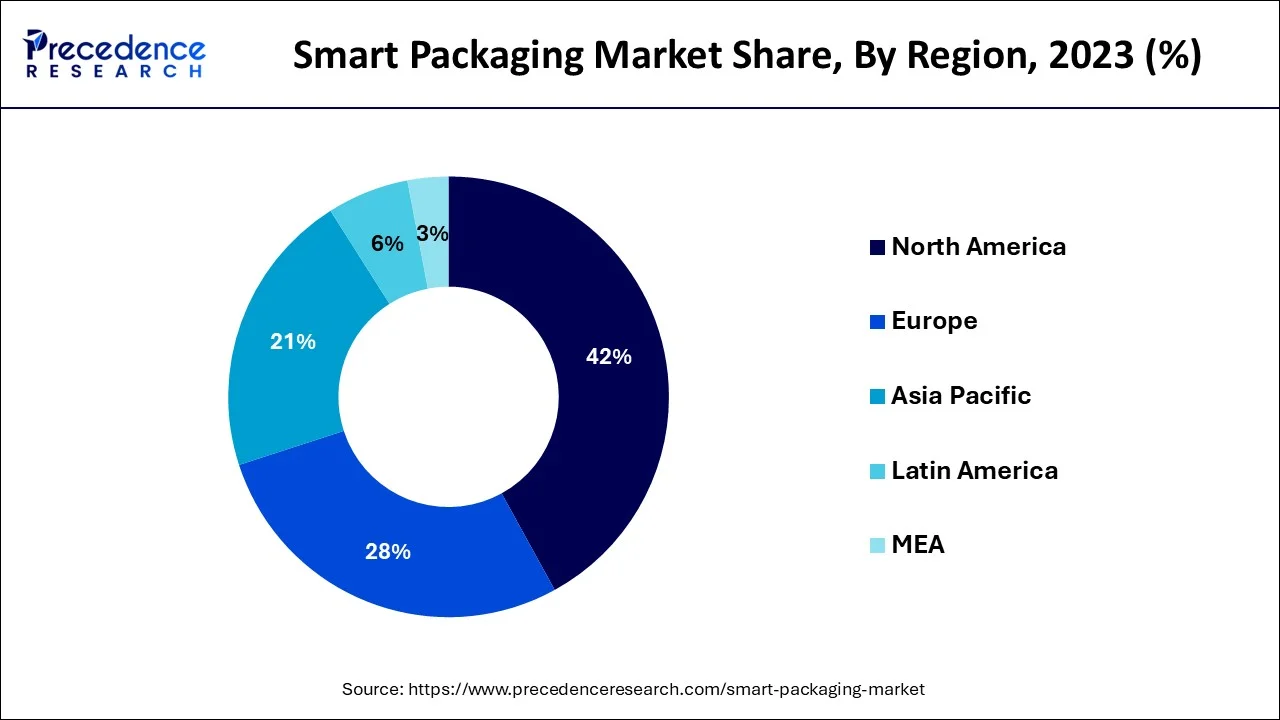

- North America dominated smart packaging market in 2024.

- By application, the food and drinks segment led the market in 2024.

- By type, the intelligent packaging segment dominated the market in 2024.

- By material, the solid segment led the market in 2024.

What is Behind the Fast Expansion of the Global Smart Packaging Market?

Smart packaging is a kind of device that boosts the engine's effectiveness and power. The term "smart packaging" refers to a particular kind of sensor-equipped packaging system used for a variety of goods, including food and pharmaceuticals. The smart packaging technology contributes to improving product quality, shelf life, freshness monitoring, and customer and product safety. These intelligent systems offer information on the product's quality and freshness when it is packaged with intelligent technology.

Due to restrictions on industrial operations during the COVID-19 epidemic, which also impeded the installation of new smart packaging systems, the market for smart packaging was hindered. Additionally, during the lockdown, the smart packaging solutions could not be efficiently sold through OEMs. The main drivers propelling the growth of this market are the increased need for sophisticated packaging solutions from the food processing and pharmaceutical industries, rising consumer concern for reducing food waste, and rising demand for smart & functional packaging. Additionally, the expanding E-commerce industry, increased industrialization, and high demand for excellent supply chain management are projected to provide up attractive potential for market participants.

The costs of the sensors and radio frequency identification (RFID) utilized for packaging applications, which are leading to the failures over the mass applications for packaging systems, make better packaging more expensive than traditional forms of packaging. Additionally, it results in the gathering of client data, which, in the manufacturers' opinion, might eventually create manipulative and tense situations that constrain the market.

The global smart packaging market is growing rapidly, as a result of the growing need for food safety, shelf-life extension, and tracking of products in real-time. Smart packaging technology, such as active, intelligent, and connected packaging, is transforming the logistics, healthcare, and food industries. The use of IoT, RFID, and QR codes is engaging consumers and improving traceability. The rise of e-commerce and sustainability initiatives also support the growth of the smart packaging market around the world.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 32.22 Billion |

| Market Size in 2026 | USD 34.23 Billion |

| Market Size by 2034 | USD 55.56 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Material, and Geography |

Market Dynamics

Key Market Drivers

- The changing lifestyle of customers - The rapid urbanization and increased consumer usage of single-use personal products with cutting-edge integrated innovation are driving the growth of the smart packaging market. Additionally, the global packaging market business depends on untapped geographic regions that provide enormous open doors for market competitors.

- Exploration of nanotechnology -The market is expanding as a result of research into various F&B uses for nanotechnology, the desire from retailers and manufacturers for shelf-stable and sustainable packaging options, and rising packaged food product consumption.

- The developments in the printing processes- Other market drivers include improvements in printing technologies across a range of sectors. In the processing and display of information on paper and other surfaces, printed technologies have demonstrated their usefulness. As a result, there has been a lot of recent scientific study on printed electronics and RFID technology, which establishes the foundation for future development of applications for smart packaging.

Key Market Challenges

- Cost of Capital -The market's expansion is hindered and challenged by factors such as the high cost of capital for installation, security concerns, new methods for manufacturing sensors and indications that are compliant with existing packaging regulations, and consumer awareness.

- The Lack of awareness- The lack of consumer awareness, which is causing a lack of desire for these smart solutions, is anticipated to further slow the market's development pace, creating difficulties for the market's expansion.

- ncorporating expensive technologies- The biggest difficulties facing businesses in the smart packaging sector are finding ways to incorporate pricey new technology into the packaging while maintaining or lowering customer pricing. The creation of innovative manufacturing processes for technologically sophisticated sensors that can adhere to current packaging regulations and teaching customers about the advantages of this kind of packaging are additional hurdles.

Key Market Opportunities

- Intelligent Packaging in Healthcare Industry - Smart packaging is essential in the healthcare sector. Special packing and temperature-controlled shipping are needed for some pieces of equipment and medications. This has caused the need for smart packaging to increase. Additionally, the prevalence of chronic illnesses and the growing senior population have boosted the need for over-the-counter medicines, which has resulted in an increase in the use of smart packaging services.

- Lucrative Market- The market's higher CAGR is encouraging for several businesses in the smart packaging sector. They are further lured in by the market's general profitability. In order to create a new generation of technologies that would enable them to create and commercialize smart packaging that is environmentally friendly, they are substantially investing in research and development. This is predicted to significantly increase future demand for this kind of packaging. Future packaging produced by these businesses will be more hygienic and safer thanks to improved printing technology.

- Demand for Temperature Controlled Packaging solutions- Due to their temperature-sensitive contents, the food, beverage, and pharmaceutical sectors are increasingly demanding temperature-controlled packaging solutions. This is fueling the market's expansion. Additionally, businesses in this industry today use labels for part identification and branding, which boosts demand for the market. The high initial costs of manufacture and execution, however, will impede the market's rate of expansion.

Application Insights

The sub-segment for food and drinks is probably going to have the highest market share for smart packaging. This is due to a few factors. The first is that more people desire to consume food that they are aware is healthy across the world. The second is that people like to consume food that is guaranteed to be fresh. Smart packaging makes this promise. Additionally, they prefer to purchase food that is constantly accessible, readily available, and has a lengthy shelf life. Once more, intelligent packing may ensure this. The majority of businesses in the food and beverage sub-segment are motivated to employ smart packaging since it makes it simpler for them to adhere to the most current and strict food safety regulations. Additionally, consumers want the information on their packaging to be as clear as possible. Smart packaging, according to businesses, enables them to do this while also safeguarding their brands. For reasons of sanitation and transparency, the world may already be trending toward preferring that food goods be wrapped in smart packaging. However, COVID-19 significantly sped up this process.

Type Insights

According to type, the intelligent packaging segment is anticipated to develop at the greatest CAGR throughout the forecast period, while the modified atmosphere packaging segment held the market's largest revenue share in 2023. According to end users, the food and beverage sector dominated the smart packaging market in 2023. However, the others category is anticipated to grow at the fastest rate over the next few years. In terms of revenue, the solid category dominated the market in 2023 and is predicted to experience the greatest CAGR throughout the projected period. North America generated the most revenue regionally in 2023, while LAMEA is predicted to have the best CAGR over the projection period.

Material Insights

Based on material, the solid category commanded more than two-thirds of the market in 2024, and it is anticipated that it would maintain its dominance during the projected period. Additionally, from 2024 to 2034, the liquid category is anticipated to have the greatest CAGR of 6%.

Regional Insights

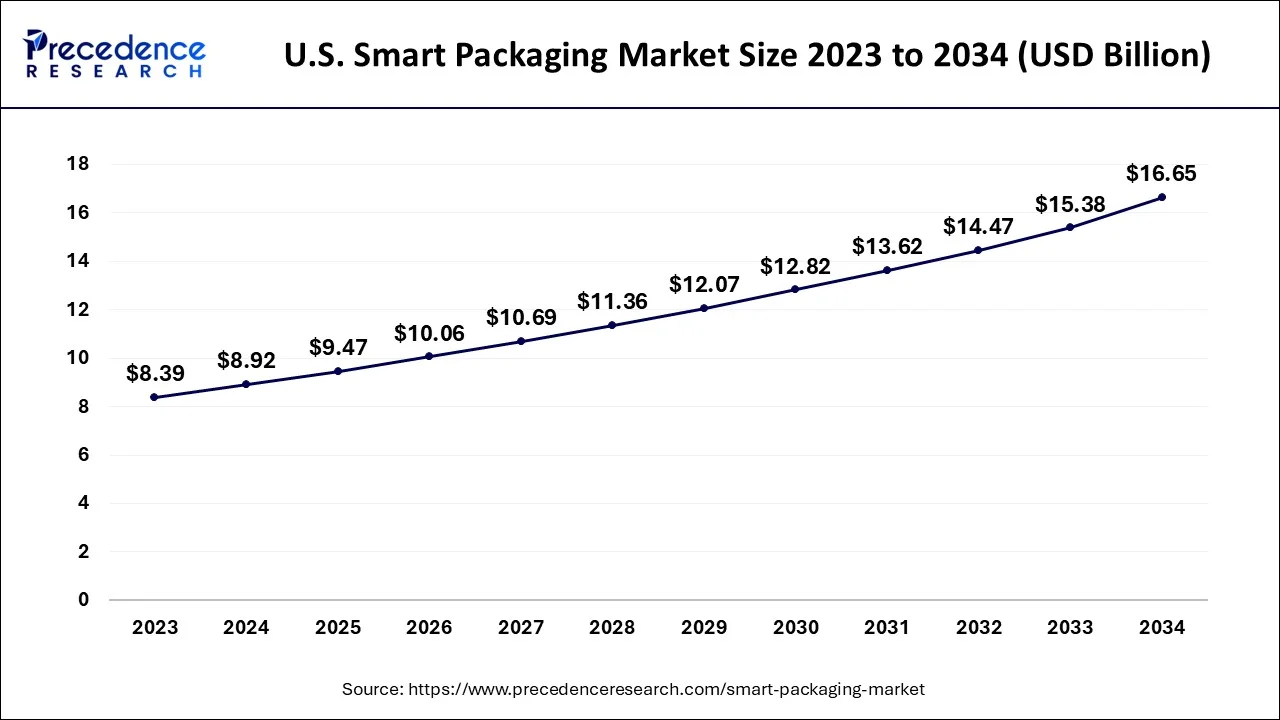

U.S. Smart Packaging Market Size and Growth 2025 to 2034

The U.S. smart packaging market size is evaluated at USD 9.47 billion in 2025 and is predicted to be worth around USD 16.65 billion by 2034, rising at a CAGR of 6.43% from 2024 to 2034.

For the period that this research covers, the smart packaging market is anticipated to develop at the greatest rate in the Asia-Pacific region. This is due to a few factors. The first is that Asians nowadays are, on the whole, significantly better educated than Asians in past generations. The second is that they are becoming lot more health-conscious as a result of the first reason. They are curious about the packaging of the meals they eat. Additionally, they inquire about the packaging these goods come in. The widespread consensus is that hygienic packaging results in safer food as well. In this area, people are likewise getting wealthy. As a result, people are able to afford to purchase products (food, pharmaceuticals) that are packed in clever packaging. Asians' growing desire for their food and medications to be wrapped in ecologically friendly packaging is another factor in this.

Asia Pacific: China Smart Packaging Market Trends

China's market is growing rapidly, driven by strong demand for food safety, traceability, and anti-counterfeiting, particularly in the food and pharmaceutical sectors. IoT technologies such as NFC, QR codes, and sensors are increasingly embedded to enable real-time tracking and consumer interaction. The market is also witnessing innovations in intelligent packaging that monitors freshness, temperature, and product quality.

For the time frame covered, the North American region is anticipated to have the largest market share for smart packaging. People's concern over food waste is one factor for this. Many Americans want to ensure that as little food is wasted as possible due to the fact that many Americans are hungry and that hunger is an increasing concern in America. If extra food is wrapped well to keep it fresh for as long as possible, this is achievable.

North America: U.S. Smart Packaging Market Trends

The U.S. smart packaging market is growing steadily, powered by rising use of IoT technologies, like sensors, QR codes, RFID, and NFC, to enable real time tracking and consumer engagement. Active packaging, such as time- and temperature-sensitive indicators, is widely used to extend shelf life and reduce food waste. Brands are increasingly embedding interactive elements into packaging to connect with consumers and drive loyalty through digital experiences.

Why is Smart Packaging Gaining Momentum in Latin America?

In Latin America, expansion is happening in the smart packaging sector as modernization continues across retail and logistics. Brazil and Mexico are leading in smart labelling systems and temperature monitoring to maintain product quality. The strong domestic agricultural and food export activity in the region increases the need for packaging to create conditions that preserve freshness. These consumer trends are ascending control, accountability, and waste reduction the leading to government policy with sustainable goals encourages awareness of consumer trends.

How is Europe Leading Innovation in the Smart Packaging Industry?

Europe leads the smart packaging market with the greatest development and adoption of sustainable and connected packaging solutions. Germany, France, and the UK are investing significantly in RFID and NFC-based packaging systems as a method to provide transparency in the supply chain and compliance with food safety standards.

The European Union has established policies, particularly circular economy policies, to encourage innovations and product development of biodegradable smart packaging. Brands in Europe highlight packaging has an important role and responsibility, as their participation permits smart packaging leaders to deliver fully traceable products while encouraging trust in insufficient information, sustainability, and carbon renaissance.

Which Elements are considered important in the Smart Packaging Value Chain?

The value chain of the smart packaging segment involves interlinking steps, which include material providers, smart technology enablers, smart manufacturing processes, distribution, and end-users, and other steps that move the product once packaged and ready for use. Within the value chain, companies leveraging smart packaging will look to convergence in terms of data, sustainable material usage, and transitioning packaging to an integrated approach to connectivity through smart packaging to digital platforms.

The overall value chain can add to technology-based efficiencies, helping brands manage inventory and improve the customer journey with enhanced engagement through smart recognition, tracking, authentication, and communications.

- Material Innovations and Sourcing: Using recyclable materials and advanced films enhances shelf life and sustainability while addressing consumer demand for eco-friendly packaging.

- Technology Integration: Sensors, QR codes, RFID, and NFC systems allow for real-time tracking, product authenticity, and visibility into the supply chain.

- Distribution and Engagement: The manufacturing process and supply chain can improve brand loyalty through direct, mobile engagement with the consumer.

How Does the Smart Packaging Market Perform in Terms of Future Growth Potential?

The outlook for the smart packaging market remains optimistic, driven by technology innovation, consumer-led sustainability, and the growing smart retail ecosystem in the retail sector. The introduction of artificial intelligence, cloud analytics, and blockchain will boost packaging intelligence levels by 2032.

- Industry Growth Overview: Smart packaging continues to present rapid growth, led by all things automation, digital transformation, and sustainability innovations for eco-friendly purposes. Continued adoption in the food, pharmaceuticals, and e-commerce segments will continually lead to market growth across all global markets.

- Sustainability Trends: The market is shifting towards recyclable, biodegradable, or reduced-waste materials to be in compliance with respective local and global environmental regulations. The brands are focused on all aspects of low-carbon, renewable-based packaging technology to lessen environmental footprints.

- Global Expansion: Manufacturers are mobilizing their market offerings across the increasingly expanding Asia-Pacific, Latin America, and emerging Eastern European markets by deploying locally based supply chains and technology partnership collaborations on key sales transactions. The formation of alliances of manufacturers and supply chain partners to improve reach and technology collaboration on projects to broaden smart packaging is apparent in both developed and emerging markets.

- Startup Ecosystem: There has been a recent explosion of startups creating smart packaging experiences in any and or all consumer-driven materials and interactions that are based on connected and not connected (e.g., data capture) are becoming a part of the supply chain material utilization strategies to improve functional performance measurables. These startups are allowing the consumer-driven smart packaging sectors of IoT, RFID, and AI packaging applications to become more cost-efficient, data-based, competitive, and sustainable outcomes.

Smart Packaging Market Companies

- 3M

- Avery Dennison Corporation

- Ball Corporation

- BASF SE,

- Crown

- International Paper

- R.R. Donnelley & Sons Company

- Stora Enso

- Sysco Corporation

- Zebra Technologies Corp. (Temptime Corporation).

Recent Developments

- Tetra Pak introduced a linked packaging platform in April 2019 that would turn milk and juice cartons into interactive information channels, substantial data carriers, and technological instruments. Greater supply chain visibility for retailers will make it possible for distributors to follow stock movements and gain real-time information.

- Why Sealed Air purchased MGM'sflexible packagingdivision in February 2019. MGM is a well-known packaging firm that offers flexible food packaging materials for consumer packaged goods markets in Southeast Asia. Increasing its foothold in Asia-Pacific and increasing its printing and laminating skills are the two main goals of the purchase.

Segments Cover in the Report

By Type

- Active Packaging

- Oxygen Scavengers

- Moisture Scavengers

- Self-Venting Films

- Ethylene Scavengers &Emitters

- Microwave Susceptors

- Antibacterial Films

- Temperature Control Packaging

- Carbon Dioxide Scavengers/Emitters

- Ethanol Emitters

- Flavour/Odour Absorbers

- Antioxidants

- Intelligent Packaging

- Indicators

- Sensors

- Bio Sensors

- Gas Sensors

- Data Carriers

- Barcodes

- 2D Matrix Codes

- Quick Response Codes

- Augmented Matrix Codes

- RFID Tags

- Modified Atmosphere Packaging

By Application

- Food & beverage

- Personal care

- Automotive

- Healthcare

- Others

By Material

- Solid

- Liquid

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting