What is the Flexible Packaging Market Size in 2026?

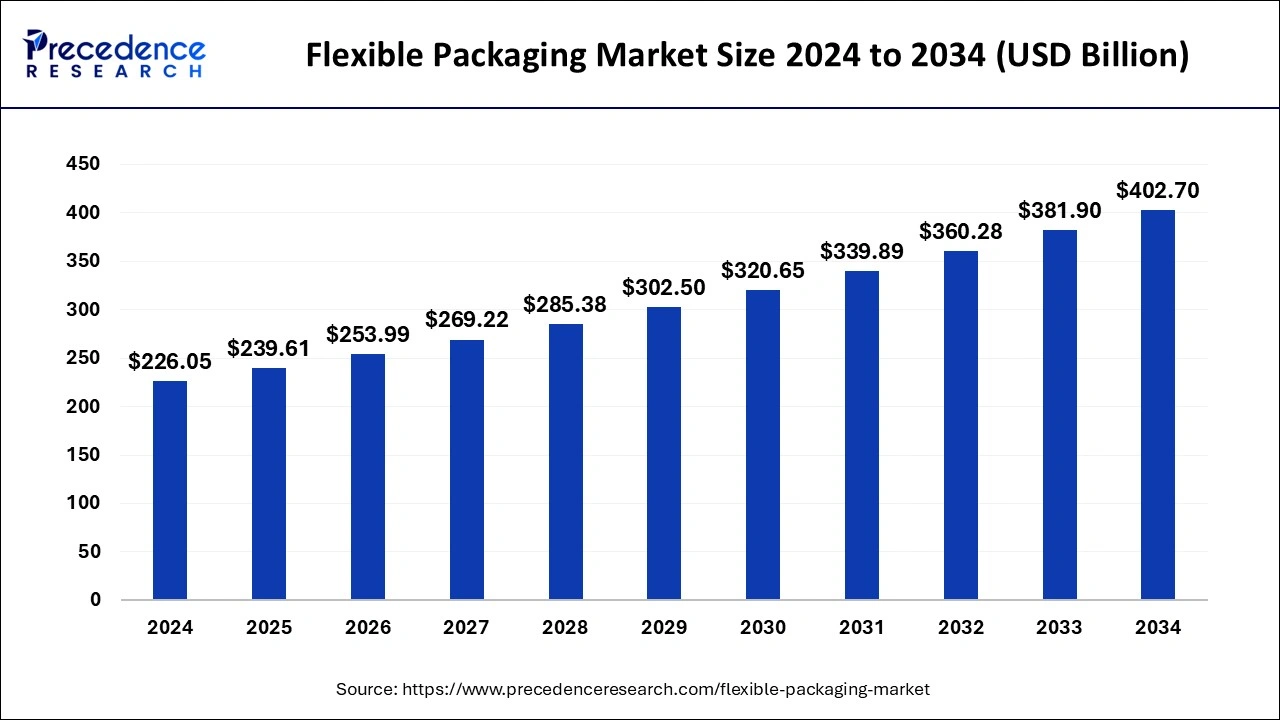

The global flexible packaging market size was valued at USD 239.61 billion in 2025 and is projected to grow from USD 253.99 billion in 2026 to approximately USD 424.05 billion by 2034, registering a compound annual growth rate (CAGR) of 5.87% during the forecast period from 2025 to 2034.

Flexible Packaging Market Key Takeaways

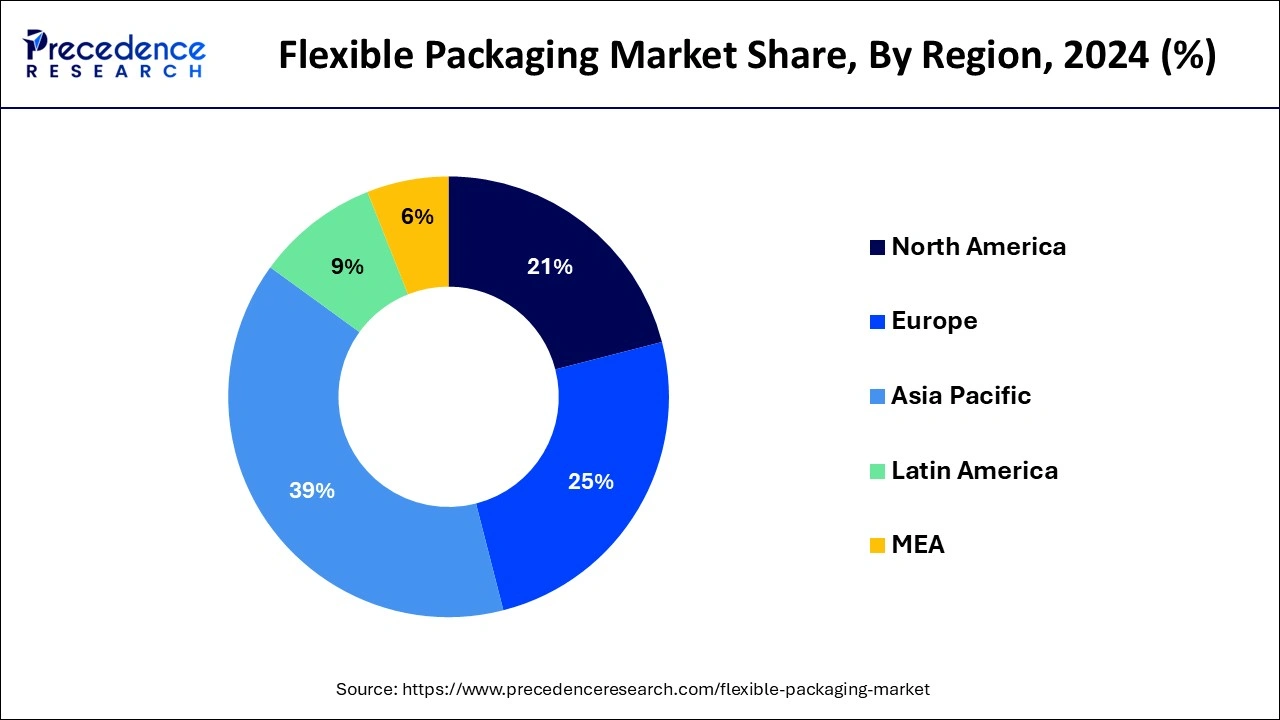

- Asia Pacific region has contributed the highest revenue share of 39% in 2025.

- By material, the plastic segment led the market share of 70.50% in 2025.

- By material, the paper segment is expected to grow at a significant CAGR of 5.90% over the projected period.

- By packaging type, the bags and pouches segment captured the largest market share of 38.20% in 2025.

- By packaging type, the laminates and coatings segment is anticipated to grow at a significant CAGR of 6.30% from 2026 to 2035.

- By end-use industry, the food and beverage industry segment held the biggest market share of 48.70% in 2025.

- By end-use industry, the pharmaceuticals segment is expanding at a significant CAGR of 6.80% from 2026 to 2035.

- By printing technology, the flexographic printing segment dominated the market with the largest share of 42.60% in 2025.

- By printing technology, the digital printing segment is expected to grow at a significant CAGR of 7.20% from 2026 to 2035.

- By barrier properties, the high-barrier packaging films segment dominated with a market share of 45.90% and is expected to maintain its fastest growth CAGR of 6.40%.

Market Overview

Flexible packaging makes use of materials that are not of the Richard form and they happen to be more economical and easily customized according to the need of the customers either as this method of packaging is cost effective and also provides better efficiency as compared to the different forms of packaging used in different industries the market for the flexible packaging is expected you grow well during the forecast period. Flexible packaging is usually used in the pharmaceutical market. This type of packaging is also used in the packaging of various personal care products. There is a good amount of growth in the usage of flexible packaging in various food and beverages items.

During the pandemic as the demand for various electronic products as well as the grooming and personal products went down the demand for flexible packaging has also declined. Due to the lockdown imposed across many countries in the globe during the COVID-19 pandemic the production of flexible packaging add also hampered to a great extent. The largest supplier of the raw material used in the manufacturing of flexible packaging is China as China was hit the worst during the pandemic the market activities had slowed down to a great extent. Even though many industries led to a decline in the consumption of these packages the demand for these products was still good during the pandemic as there was a growth in the consumption of different types of food products across the globe. As there was a demand for ready to cook food or ready to eat food and various ingredients used for cooking the market had grown well. Even though the pandemic had a negative impact on the market as many industries were shut down, but the food and beverages industry created a good amount of demand for the flexible packaging market.

How is AI Influencing the Flexible Packaging Market?

Artificial intelligence is transforming the flexible packaging market by enhancing sustainability and operational efficiency. AI-driven tools and machine learning algorithms optimize processes across the entire value chain, from package design and material selection to production and recycling. Additionally, AI-powered computer vision systems combined with deep learning enable high-speed, non-destructive inspection of packaging lines. These systems accurately detect defects such as misaligned labels or contaminants with greater consistency than human operators, reducing product recalls and material waste.

Flexible Packaging Market Growth Factors

The various manufacturing companies that produce flexible packaging for various products offer a large range of options. Due to the increased efficiency of this type of packaging used in various industry the market is expected to grow well during the forecast period. In order to manufacture the material which goes in the making of a flexible package the base used is less which helps in reducing the consumption of energy for the production of this packaging. As the packaging does not make use of any rigid material the production time of such packaging is also lowered. All of these factors provide an upper hand and increase efficiency.

The consumption of energy is less in the manufacturing of flexible packaging as compared to that of the rigid packaging and this happens should be and environment friendly option. Flexible packaging also happens to be offer reusable format. Flexible packaging can also be recycled for using it again. Unlike the rigid materials used packaging of various materials flexible packaging provides innovative designs depending upon the shape of the product.

The packaging material also comes in various designs and prints that provide customization. The quality of the products packed in a flexible package is intact. When it comes to the portability of this type of packaging it is far better than the rigid packaging options. Flexible packaging happens to be lighter as compared to the other options. This type of packaging is also not bulky so it is easier for the consumers to store various products in this type of packages. When it comes to the transportation of various goods that make use of flexible packaging it becomes simpler. The transport of such products is easy as they do not occupy a lot of space and they also happen to be light in terms of weight as compared to the other products that are packed in rigid packaging. There are many different types of flexible packages like the stock banks, printed pouches, sachets, sample pouches etc. When it comes to the use of pouches for the storage of different products the amount of material which is used in the manufacturing of these pouches is very less. This type of packaging also provides better profits to the organization.

Due to an increase in the revenue, there is a growing demand for flexible packaging in the market. Due to a hectic lifestyle and growing preference for ready to eat meals there is a great demand for flexible packaging in the developed as well as the developing economies. There is a maximum usage of this type of packaging due to the working-class people. There has been an increase in the use of flexible packaging in the food industry. As it has been and improvement in the techniques that are used for the processing of food along with the lifestyle changes the demand for flexible packaging is expected to grow during the forecast period.

Flexible packaging is also expected to have a great demand in the coming years as it consumes very less energy and it happens to be a sustainable way. Laws and adoption of strict regulations by the government that ensure maximum use of sustainable solutions even for the packaging of various products will ensure positive contribution to the growth of the market.

Market Outlook

- Market Growth Overview: The flexible packaging market is growing at a significant rate from 2026 to 2035, driven by the rising demand for lightweight, cost-effective, and sustainable packaging solutions across the food, beverage, and consumer goods industries. Increased urbanization, e-commerce expansion, and innovations in recyclable and high-barrier materials are further driving market growth.

- Major Investors: Major investors in the market include Amcor plc, Berry Global Inc., and Constantia Flexibles Group GmbH. They fund capacity expansion, R&D, and sustainable material innovations. Their investments help accelerate technological advancements, enhance production capabilities, and drive the adoption of eco-friendly and high-performance packaging solutions across industries.

- Startup Ecosystem: Emerging companies are primarily focused on driving sustainability while integrating advanced technologies to disrupt conventional plastic-dependent models. Startups leverage innovation to address environmental challenges, meet evolving consumer needs, and collaborate with larger corporations and investors to scale sustainable solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 239.61 Billion |

| Market Size in 2026 | USD 253.99 Billion |

| Market Size by 2035 | USD 424.05 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.87% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Raw Material, By Packaging Type, By Printing Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material Insights

The plastic segment led the flexible packaging market in 2025. This is mainly due to its versatility, cost-effectiveness, and ability to meet various packaging needs. Its superior barrier properties protect products from moisture, air, and contamination, thereby extending shelf life. Plastic can be molded into different shapes and sizes, making it suitable for a wide range of products and applications. It not only offers excellent protection against moisture and oxygen but also preserves product freshness, making it prevalent in the food and beverage, personal care, household goods, and pharmaceutical industries. This makes plastic a budget-friendly option for both manufacturers and consumers.

The paper segment is expected to experience rapid growth during the forecast period, driven by increasing environmental awareness and consumer demand for sustainable packaging solutions. This shift is fueled by concerns about plastic waste and the desire for eco-friendly alternatives, particularly in the food and beverage, personal care, and pharmaceutical sectors. Innovations in barrier coatings for paper are enhancing its protective properties, making it a viable alternative to plastic for a broader range of products. Additionally, paper-based packaging is generally more recyclable than many plastic alternatives, making it an attractive option for businesses looking to improve their sustainability profile.

Packaging Type Insights

The flexible packaging market dominated the global market in 2025. This growth is primarily attributed to their versatility, cost-effectiveness, and increasing popularity ine-commerce and food packaging. Bags and pouches can accommodate a variety of products, including food, beverages, pet food, personal care items, and even medical devices. They can be customized in different shapes, sizes, and closure types, such as zippers or spouts, to meet varying needs. Their popularity in food packaging, especially for high-liquid-content foods and beverages, is on the rise. Innovative designs featuring resealable closures and easy-to-open concepts enhance consumer convenience, further contributing to the popularity of pouches.

The laminates and coatings segment is currently experiencing the fastest growth in the market. This trend is driven by their superior barrier properties, extended shelf life, and enhanced protection for various products, particularly within the food and beverage industry. The demand for convenience foods, increased e-commerce activity, and a heightened focus on sustainability are further fueling this growth. Additionally, the rising popularity of ready-to-eat meals, snacks, and other convenience foods drives the need for flexible packaging that can withstand various storage and transportation conditions while maintaining product quality. This has led to the development of more versatile and high-performance flexible packaging options.

End-Use Industry

The food and beverage industry led market in 2025, largely because flexible packaging is versatile, cost-effective, and effective in extending shelf life, which helps reduce food waste. Flexible packaging, such as pouches and wraps, is lightweight, space-efficient, and generally offers better protection than rigid alternatives for many food products. Its ease of use and lightweight nature make it ideal for on-the-go consumers. Moreover, various food formats often utilize less material, reducing environmental impact and leading to lower manufacturing costs. The growth of e-commerce and online food ordering services further enhances the demand for convenient and portable packaging that protects food from moisture, air, and contaminants, minimizing spoilage and waste.

The pharmaceuticals segment is witnessing significant growth in the market, driven by increasing healthcare expenditure, expansion within the pharmaceutical industry, and the need for protective packaging for sensitive drugs. Flexible packaging provides key benefits, including portability, protection from environmental factors, and cost-effectiveness, all of which are crucial for pharmaceutical products. The industry is experiencing rapid growth due to an aging population, advancements in drug development, and the rise of biologics and biosimilars. Additionally, pharmaceutical packaging must adhere to strict regulations to ensure product safety and efficacy, which drives the demand for advanced and reliable packaging solutions.

Printing Technology Insights

The flexographic printing segment became the dominant method in the market in 2025, due to its versatility, cost-effectiveness, and ability to print on a wide range of materials. Its high-speed printing capabilities and advancements in automation have further contributed to its popularity in an industry characterized by high-volume production and quick turnaround times. The relatively low cost of printing plates, along with the ability to reuse them multiple times, makes flexographic printing a budget-friendly choice for high-volume packaging production. Additionally, flexographic presses are designed for high-speed printing, which is essential for meeting the demands of the fast-paced flexible packaging market.

On the other hand, the digital printing segment is experiencing the fastest growth in the market. This is primarily due to its capacity to offer on-demand, customized, and sustainable packaging solutions. The growth in this segment is driven by advancements in digital printing technologies that enable high-resolution printing with vibrant colors, faster turnaround times, and reduced waste compared to traditional printing methods. Digital printing minimizes waste by eliminating the need for printing plates and reducing ink consumption. Moreover, innovations such as enhanced ink formulations and high-speed print heads are improving efficiency and versatility, aligning with the increasing demand for eco-friendly packaging.

Barrier Properties Insights

The high-barrier packaging films segment has also dominated the market and is expected to maintain its growth during the forecast period. This success is largely due to their superior protection against external elements, which extends product shelf life and enables lightweight, cost-effective, and versatile packaging solutions. High-barrier films effectively protect contents from oxygen, moisture, light, and other factors that can degrade products, thus preserving freshness.

Additionally, advancements such as multilayer films and nanotechnology are further enhancing barrier properties and mechanical strength. As consumers increasingly favor convenient and eco-friendly packaging options, the demand for flexible high-barrier solutions is growing, offering greater design flexibility for innovative shapes, resealable closures, and easy-tear features, all of which enhance consumer convenience.

Regional Insights

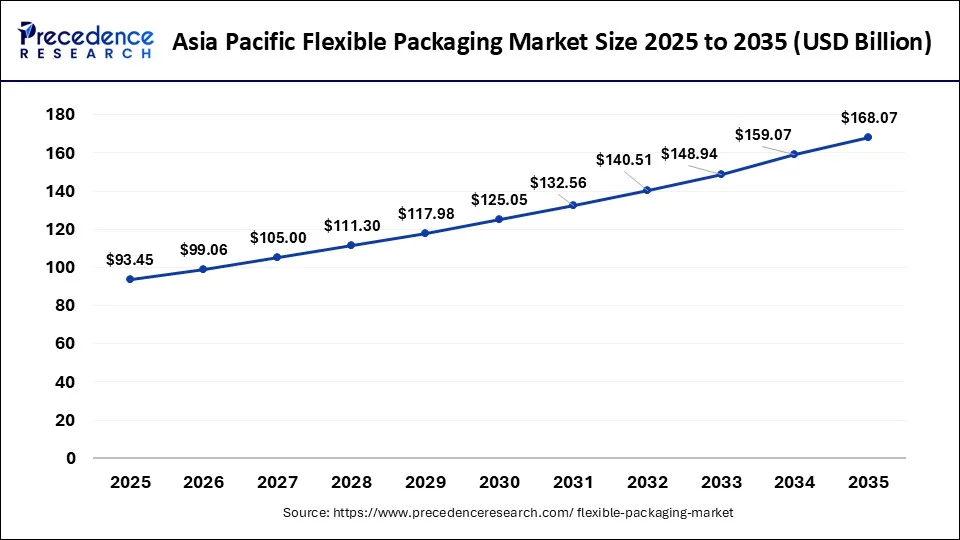

How big is the Asia Pacific flexible packaging market?

The Asia Pacific flexible packaging market size is estimated at USD 93.45 billion in 2025 and is predicted to be worth around USD 168.07 billion by 2035, at a CAGR of 6.05% from 2026 to 2035.

What Factors Contribute to Asia Pacific's Dominance in the Flexible Packaging Market?

The Asia Pacific region is expected to have the largest market share in the coming years. This region dominated the market in the past with about 39% of the market share in terms of revenue. As they show Pacific region provides great amount of opportunities for the growth of the market due to the growing population they shall be a good amount of growth in this region. The presence of the organized retail sector and the developing ecommerce sectors will provide better opportunities for the growth of the market. The availability of low cost labor and the easily available raw materials in this region will drive the market growth. Growing popularity of snacks and beverages in the developing nations of the Asia Pacific region will drive the market growth in the coming year period

India Flexible Packaging Market Analysis

India is a major contributor to the market in Asia Pacific. The plastic waste management rules in the country are strengthening traceability requirements and mandating the use of recycled content. To support innovation aligned with a net-zero future, the Council of Scientific and Industrial Research (CSIR) has launched a national initiative focused on sustainable packaging solutions. India's End Plastic Pollution campaign further reinforces market growth by promoting sustainability practices nationwide. Together, these efforts reflect India's progress toward a more sustainable and circular economy, with several initiatives encouraging the integration of recycled materials into new products.

What Makes North America a Significant Market for Flexible Packaging?

North America represents a significant market, driven by strong industrial collaborations and corporate initiatives aimed at improving flexible-packaging recycling infrastructure. Sustainability regulations, combined with innovations in materials and recycling technologies, are further propelling the region's flexible packaging industry. Consumers across North America increasingly prioritize sustainable, innovative, and convenient packaging solutions, prompting companies to invest heavily in mono-material designs, recyclable materials, and biodegradable alternatives. Major industry players and investors in the region include UFlex Ltd., Amcor, Sealed Air, Oroville Flexible Packaging, LLC, Prompac, Energizer, and American Packaging Corporation.

U.S. Flexible Packaging Market Analysis

The U.S. leads the North American market through several key initiatives. In November 2025, the U.S. Plastics Pact launched the second phase of its reuse and retail initiative, designed to help brands and retailers identify practical opportunities for implementing reuse systems in retail settings. Earlier, in August 2025, collaborations among leading companies led to the launch of the U.S. Flexible Film Initiative (USFFI), which aims to advance scalable recycling solutions for flexible packaging nationwide.

Why is Europe Considered a Notably Growing Area in the Flexible Packaging Market?

Europe is expected to grow at a notable rate in the market in the upcoming period due to strong regulatory support and rising consumer demand for sustainable solutions. Policies such as the Packaging and Packaging Waste Regulation (PPWR) and the European Green Deal encourage the use of recycled content, the reduction of packaging waste, and the adoption of circular-economy practices. Major companies in the region are responding by developing mono-material and eco-friendly packaging innovations. Together, these regulatory factors are driving significant growth in Europe's flexible packaging sector.

Germany Flexible Packaging Market Analysis

Germany is expected to maintain a strong market position. Government funding in Germany is allocated to support waste management and public-cleaning initiatives. The German market is primarily driven by mandates on recycled content and updated recyclability standards. The industry's growth is further fueled by the increased use of recycled materials, the adoption of more sustainable practices, and the development of mono-material packaging solutions, all of which strengthen the flexible packaging sector in the country.

What Potentiates the Flexible Packaging Market in Latin America?

In Latin America, the market is driven by the implementation and enforcement of regulations, including single-use plastic bans and extended producer responsibility (EPR) schemes. Key regulatory measures prohibit the production and commercialization of many single-use plastic products, aiming to transition toward recyclable, reusable, or compostable materials by 2030. Countries such as Chile have set specific recycling and recovery targets for various packaging materials, including plastics, which producers are required to meet, further supporting sustainable industry practices.

Brazil Flexible Packaging Market Analysis

Brazil is a major player in the Latin American market. Rising regulatory pressure and waste‑management initiatives are driving demand for more sustainable, recyclable packaging. In October 2025, Brazil announced the implementation of a reverse logistics system for plastic packaging to enhance recycling and waste management. The country's eco-investment platform seeks to attract foreign capital for green and sustainable projects. Leading companies are collaborating to drive innovation, promote sustainability, and capitalize on emerging trends in the packaging sector.

What Opportunities Exist for the Market in the Middle East & Africa?

The Middle East & Africa (MEA) region presents significant opportunities for the flexible packaging market, driven by targeted government programs and regulations, including Egypt's national anti-plastic campaign and Saudi Arabia's packaging regulations. Industrial initiatives supporting these goals include the launch of recycled packaging, investments in recycling infrastructure, and programs such as Amazon UAE's recycling initiative. Several countries have implemented key policies to reduce plastic waste, including Dubai's single-use plastic ban, Nigeria's Extended Producer Responsibility (EPR) regulations, Kenya's Sustainable Waste Management Act, and Ethiopia's single-use plastic ban.

Saudi Arabia Flexible Packaging Market Analysis

Saudi Arabia is a leading market in the region, driven by rapid e-commerce growth, Vision 2030 initiatives, and new regulations promoting smart, sustainable packaging. The adoption of RFID and IoT technologies in supply chain packaging, along with innovative packaging solutions, is transforming logistics and operational efficiency. Additionally, there is a clear shift toward recyclable mono-material films, such as all-PE or all-PP, to enhance recycling efficiency and support the country's sustainability goals.

Flexible Packaging Market Players

- Sealed Air Corporation (US)

- Coveris (Austria)

- Transcontinental Inc. (Canada)

- Amcor (Australia)

- Sonoco (US)

- Huhtamaki (Finland)

- Berry Global Inc. (US)

- Mondi (South Africa)

- Clondalkin Group.

Recent Developments

- A new product was launched by Amcor which would provide better packaging in the pharmaceutical segment of the organization. This organization introduced hi shield laminates of a sustainable nature. This product is recyclable and it shall also provide better performance by providing a great barrier.

- Propak was acquired by constantia flexibles in the year 2021. Propak is a packaging producer especially in the snacks market. This acquisition will be helpful in increasing the market for constantia flexibles.

Segments covered in the report

By Material

- Plastic

- Paper

- Aluminum

- Others

By Packaging Type

- Bags and Pouches

- Roll Stock

- Films

- Wraps

- Tetra Paks and Cartons

- Laminates and Coatings

By End-Use Industry

- Food and Beverage

- Pharmaceuticals

- Cosmetics and Personal Care

- Home Care and Cleaning Products

- Industrial Applications

- Retail Packaging

- Other (e.g., pet food, tobacco)

By Printing Technology

- Flexographic Printing

- Rotogravure Printing

- Digital Printing

- Offset Printing

- Others

By Barrier Properties

- High Barrier Packaging

- Medium Barrier Packaging

- Low Barrier Packaging

- Non-barrier Packaging

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting