What is the Sustainable Packaging Market Size?

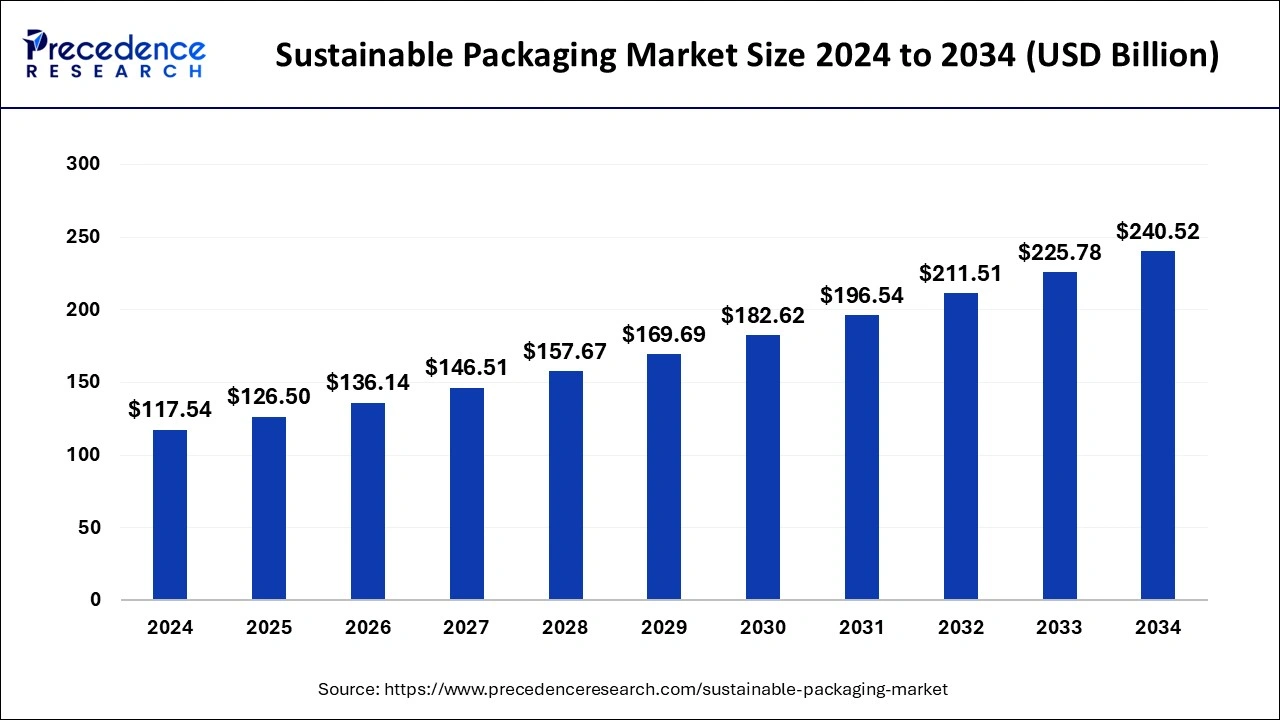

The global sustainable packaging market size was calculated at USD 126.50 billion in 2025 and is predicted to reach around USD 240.52 billion by 2034, expanding at a CAGR of 7.42% from 2025 to 2034.

Market Highlights

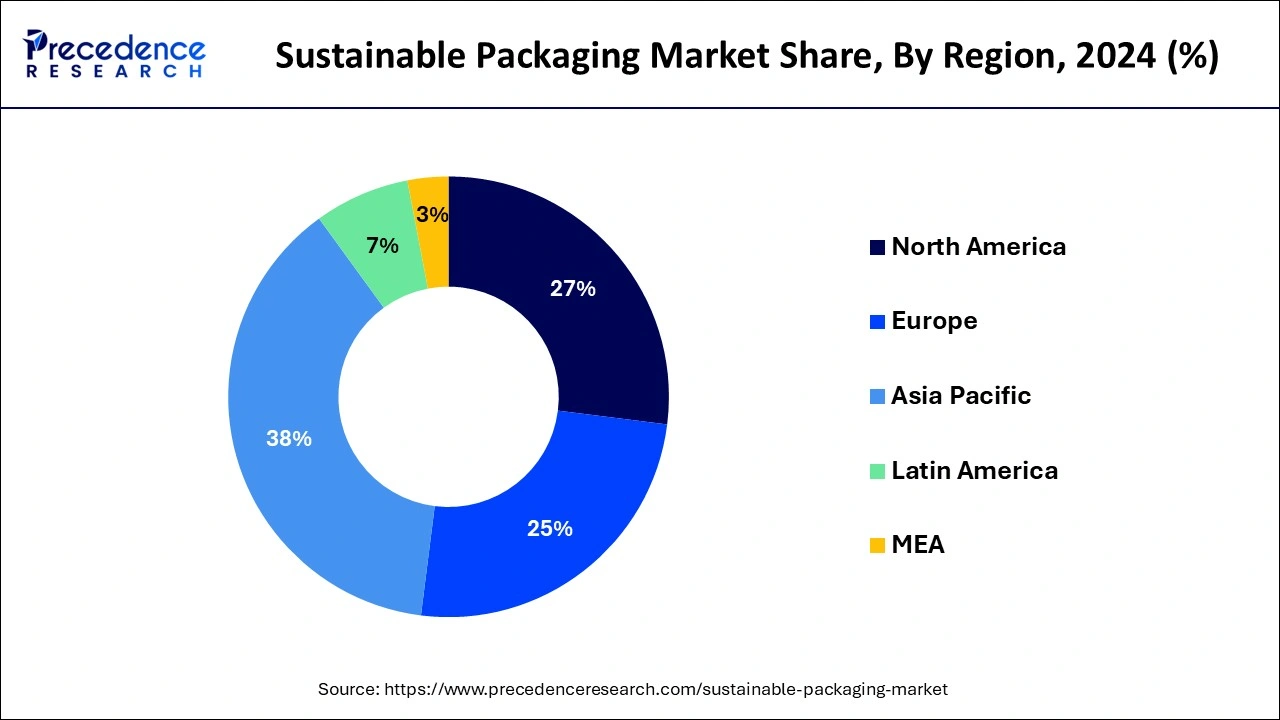

- Asia Pacific generated more than 38% of the revenue share in 2024.

- Tetra Laval has a market capitalization of USD 14.99 billion, the parent company has taken several measures during 2021 to enhance its sustainability initiatives via its subsidiaries.

- According to the Crown Holdings sustainability report for 2021 and the progress report for its Twentyby30 program, the company has achieved a 22% reduction in its scope 1 and scope 2 greenhouse gas emissions since 2019. Furthermore, the company is committed to achieving a 50% reduction in emissions by 2030. Additionally, Crown Holdings announced a 3.6% reduction in water usage, bringing the company closer to its target of a 20% reduction.

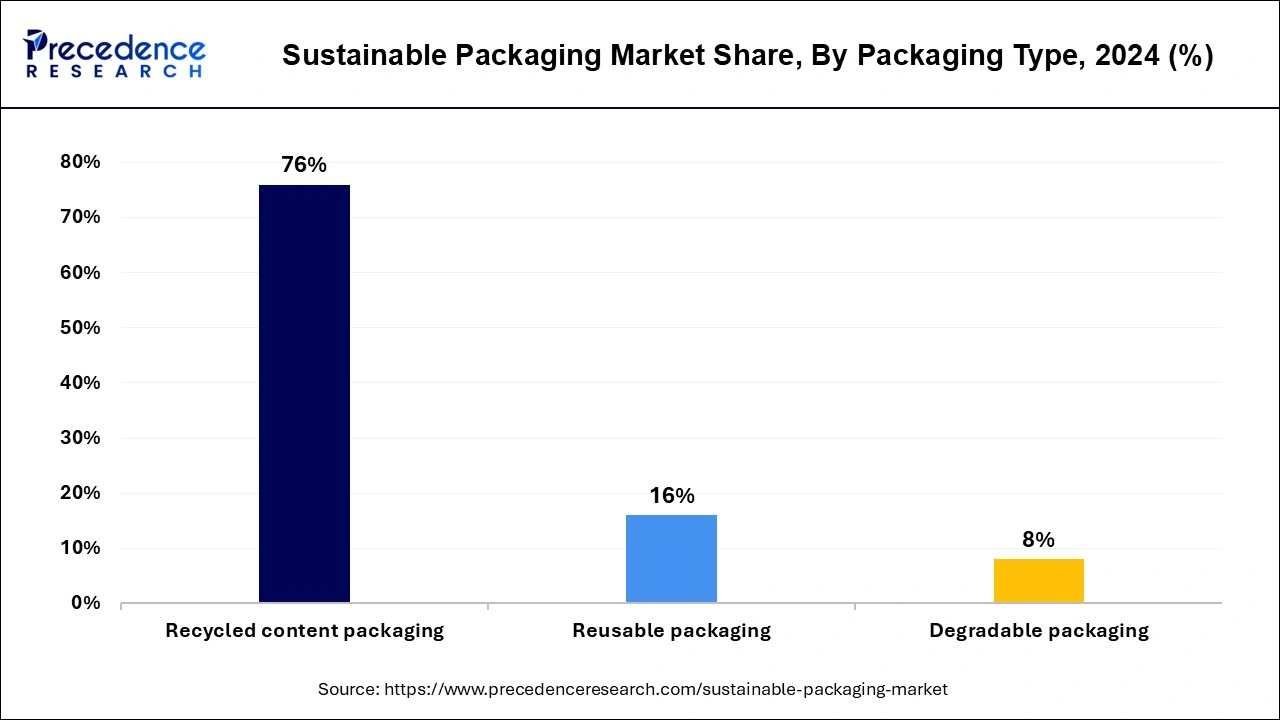

- By Packaging type, the recycled content packaging segment captured the largest share of 76% in 2024.

- By Packaging type, the reusable packaging segment is expected to expand at a noticeable growth between 2025 and 2034.

- By Material, the paper segment is predicted to lead the global market between 2025 and 2034.

- By Material, the plastic segment contributed a significant market share in 2024.

- By Application, the food and beverage segment generated the largest share of the market in 2024.

- By Application, the personal care segment is expected to record at the fastest CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 126.50 Billion

- Market Size in 2026: USD 136.14 Billion

- Forecasted Market Size by 2034: USD 240.52 Billion

- CAGR (2025-2034): 7.42%

- Largest Market in 2024: Asia Pacific

Market Overview

The sustainable packaging market refers to the market for packaging products and solutions that have the ability to reduce ecological impacts, preferably observed as an alternative to plastic packaging or other harmful metal packaging. The sustainable packaging market includes products and solutions that use renewable or recycled materials, reduce packaging waste, minimize harmful substances, and improve energy efficiency.

The growth of the sustainable packaging market is also being driven by government regulations aimed at reducing plastic waste. Governments around the world are implementing laws and regulations that require companies to use more sustainable packaging and reduce their use of plastics. By encouraging sustainable packaging practices, governments can help to reduce waste, conserve resources, and protect the environment and public health.

In January 2023, the Department of Consumer Affairs, India, announced that it would be setting up new standards for sustainable packaging. Industries will have to adhere to these norms before claiming sustainable packaging. The new standards will have specifications about the material, including plastic, paper, board, pulp, and glass. The new standards for sustainable packaging will help India in achieving its commitment to zero-emission ambition.

Highlighting the government's efforts towards promoting sustainable packaging, in June 2022, the government of Canada announced the winner of the Canadian Plastics Innovation Challenge on sustainable alternatives to plastic packaging. The challenge was a part of the innovative Canada program; magemi mining inc will receive up to $1 million for its proposed sustainable packaging solution.

Sustainable Packaging Market Growth Factors

The global sustainable packaging market is expected to grow at an exponential rate during the projected timeframe. Along with the ecological benefits, the economic benefits offered by sustainable packaging are projected to fuel the demand for sustainable packaging from various end-users.

Moreover, expanding end-users in the market is another factor observed as a driver for the growth of the sustainable packaging market. Along with the food and cosmetics, healthcare, pharmaceuticals, electronics, and chemical industries are expected to boost the utilization of sustainable packaging in upcoming years, this will create a plethora of opportunities for market players.

The growth of the sustainable packaging market is also attributed to the technological advancements in the market; these technological advancements in sustainable packaging are helping to reduce waste, conserve resources, and minimize the impact of packaging on the environment. Smart packaging technology, packaging reduction methods, and the use of renewable energy for sustainable packaging solutions are a few recent technological developments the global market has witnessed.

In addition, the growth of e-commerce and online shopping has led to an increase in demand for sustainable packaging solutions that can protect products during shipping and handling while also being environmentally friendly. Many e-commerce companies are shifting their focus on shipping products with sustainable packaging to address the rising environmental concerns along with building their brand image.

In September 2022, Southeast Asia's most significant end-to-end e-commerce enabler, aCommerce group, announced its partnership with Johnson & Johnson, Philippines, to offer sustainable packaging solutions and 100% recyclable packaging solutions in the Philippines. This wide-scale collaboration aims to reduce the waste caused by e-commerce businesses.

Additionally, sustainable packaging can often be more cost-effective in the long run, as it reduces waste and improves efficiency in the supply chain; this is another factor that highlights the future of the sustainable packaging market for upcoming years.

Several countries like the EU, China, the U.S., the UK, Japan, and India are widely adopting sustainable packaging solutions due to increased environmental awareness and stringent government regulations. The leading packaging companies in these countries are heavily investing in research and development activities to develop innovative packaging materials that minimize environmental impact.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 126.50 Billion |

| Market Size in 2025 | USD 136.14 Billion |

| Market Size by 2034 | USD 240.52 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.42% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging Type, Material, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising development of biodegradable packaging

Biodegradable packaging materials are designed to break down naturally, reducing the amount of waste that ends up in landfills and oceans. This leads to lower carbon emissions and less environmental pollution, making biodegradable packaging more sustainable.

The growing awareness of environmental issues among consumers and companies has increased the demand for sustainable packaging solutions. Biodegradable packaging materials, made from renewable resources and can be composted or recycled, are considered more environmentally friendly, leading to increased demand for these products.

Headquartered in the United Kingdom, Vegware is focused on developing reusable and biodegradable food packaging systems. The packaging options by Vegware are made from renewable, plant-based, recyclable, and low-carbon materials. The company recently launched an eco-embossed hot cup with two layers of plant-based materials.

Restraint

Limited availability of material

Limited availability of sustainable packaging materials can lead to supply shortages and inconsistency in the supply chain. This can make it difficult for companies to plan their production schedules and meet customers' demands, leading to delays and increased costs.

Limited availability also limits the choice of sustainable packaging materials and designs, which can restrict the flexibility and creativity of companies in designing their packaging solutions; this slowdown the adoption of sustainable packaging by companies and consumers. Thus, the limited availability of materials for sustainable packaging is observed to act as a major restrain for the market's growth.

Opportunity

Development of innovative materials

The development of innovative materials presents significant opportunities for the sustainable packaging market. As consumers and businesses are becoming more aware of environmental issues, there is a growing demand for packaging solutions that are more sustainable and have a lower environmental impact. Innovative materials can help to meet this demand by providing new solutions that are more environmentally friendly and meet the needs of consumers and businesses.

Innovative materials can include biodegradable plastics, compostable materials, and recycled materials. These materials are designed to break down naturally in the environment and have a lower impact on the environment than traditional packaging materials. Biodegradable plastics, for example, are made from renewable sources and can break down into natural materials that do not harm the environment.

Segments Insights

Packaging Type Insights

The recycled packaging type segment held the largest share of the market in 2024; the segment is expected to grow at a significant rate during the forecast period; the growth of the recycled packaging process can be attributed to a combination of environmental concerns, cost-effectiveness, improved technology, government regulations, and corporate responsibility. As consumers and businesses become increasingly focused on sustainability, the demand for recycled packaging will likely continue to grow. Rising government initiatives and plans to promote the development of recycling plants in countries have incentivized companies to adopt sustainable practices, including using recycled packaging.

The reusable packaging type segment is anticipated to witness noticeable growth during the projected period. The cost-effectiveness of the reusable packaging process is observed as a significant driver for the segment's growth. Reusable packaging can be more cost-effective in the long run compared to single-use packaging. Many companies are adopting sustainable business practices and committing to reducing their environmental impact, and using reusable packaging is one-way companies can demonstrate their commitment to sustainability. Overall, the growing demand for reusable packaging is driven by its environmental benefits, cost-effectiveness, improved supply chain efficiency, consumer demand, and corporate responsibility.

Material Insights

The paper segment is predicted to dominate the global sustainable packaging market during the projected timeframe owing to the rising consumer preferences towards paper bags, pouches, and other packaging forms. Many clothing brands, packaged food product companies, and other end-users are focused on promising sustainable packaging by considering the rising environmental concerns.

According to a report published by H&M Group, a leading clothing brand, during 2024, the company reduced plastic packaging by 44% against 2018; the brand has upgraded its plastic packaging of online purchases to completed FSC-certified paper packaging.

The plastic segment held a significant market share in 2024; the segment showed steady growth during the analyzed period. The rising production of recycled plastic material for multiple end-users, especially pharmaceutical purposes, is considered to drive the segment's growth during the forecast period. Additionally, plastic material is utilized as sustainable packaging due to its cost-effective and lightweight properties.

The glass segment remains the most promising segment in the sustainable packaging market during the forecast period. The growing popularity of sustainable glass packaging can be attributed to its environmental benefits, health, and safety advantages, durability, aesthetic appeal, and consumer demand for sustainable packaging options. The alcoholic and non-alcoholic beverage producers are expected to be the most significant contributors to the segment's growth.

Application Insights

The food and beverage segment held the largest share of the market in 2024; the segment will continue to grow with the rising awareness about environmental concerns. The presence of major key players focusing on the development of food packaging materials is expected to fuel the segment's growth.

Headquartered in Australia, Amcor company focuses on creating sustainable packaging materials for the food and beverage industry, including high-quality polyethylene that can act as a flexible material for food materials and beverages. The company has also set a target to reduce greenhouse gas emissions by 25% by 2025.

Multiple food chain companies are focusing on strengthening their brand image by using sustainable packaging; this is resulting in an increased consumer base and revenue share. The rising focus on green packaging for food and beverage delivery with rising environmental concerns will continue the development of the food and beverage segment.

The personal care segment is expected to register the fastest growth in the sustainable packaging market during the forecast period; as consumers become increasingly concerned about the environmental impact of the products they purchase, the demand for sustainable packaging in cosmetics and personal care products will continue to grow.

In March 2022, Uni, a dedicated personal care brand, launched a 100% recycled aluminum bottle and a sleek exterior designed by Marc Atlan. Along with this, Captain Blakenship, Codex Beauty Labs, Dove, Plus, Kate McLeod, and BlueLand are a few other leaders in the personal care products industry that offer sustainable packaging for multiple personal care/beauty products.

On the other hand, the healthcare segment is projected to be the most attractive segment of the market during the period analyzed; the rising concern about managing medical waste is forcing the healthcare sector to adopt sustainable packaging methods. Moreover, sustainable packaging can help to improve patient outcomes by reducing the risk of contamination and infection as they are designed to be sterile for a more extended period; this beneficial factor is expected to boost the growth of the healthcare segment.

Regional Insights

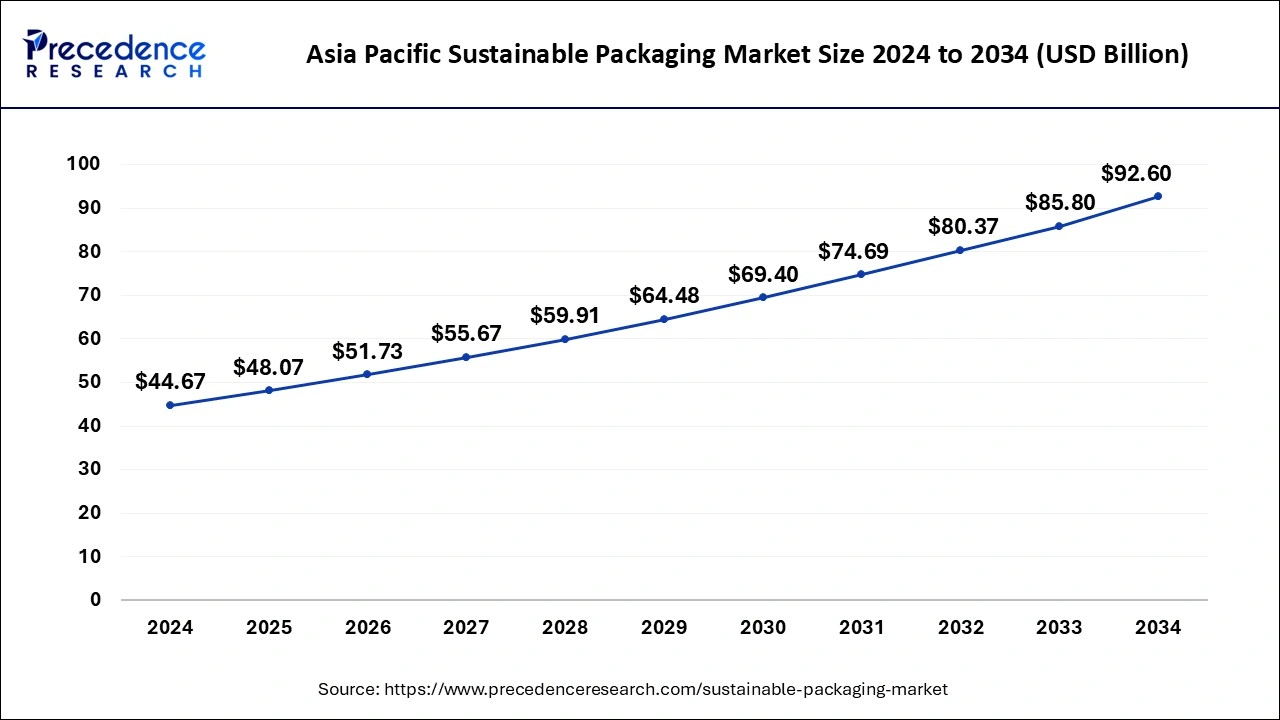

Asia PacificSustainable Packaging Market Size and Growth 2025 to 2034

The Asia Pacific sustainable packaging market size was exhibited at USD 48.07 billion in 2025 and is projected to be worth around USD 92.60 billion by 2034, growing at a CAGR of 7.56% from 2025 to 2034.

Asia Pacific is expected to hold the largest share of the market during the projected timeframe.China and India are the most lucrative markets for sustainable packaging solutions in Asia Pacific. The presence of a potential consumer base and increasing environmental concerns in these countries are observed to fuel the market's growth. Moreover, the rising penetration of recycling plants with innovative product development in the region propels the market's growth.

In addition, rising government support for utilizing sustainable packaging in multiple industries and rapid adoption of favorable government policies in Asian countries are observed as significant drivers for the market's growth in Asia Pacific.

In July 2022, the Indian government banned single-use plastic by defining it as a step to curb the pollution caused by unmanaged plastic waste. This step by the Indian government is predicted to shift businesses towards sustainable packaging solutions.

The expanding food chain industry is observed to adopt sustainable packaging solutions to address the rising environmental concerns; this makes India the most attractive marketplace for sustainable packaging in Asia Pacific.

In April 2022, India's largest food delivery partner, Zomato, announced that it would be using 100% plastic-neutral packaging onwards by setting up a target to deliver more than ten crore orders in sustainable packaging.

Other countries in the Asia Pacific region, such as Japan and South Korea, have also implemented policies and regulations to promote sustainable practices and reduce waste. Japan, in particular, strongly focuses on reducing plastic waste and has implemented policies to encourage using recycled materials in packaging.

North America is another significant marketplace for sustainable packaging; the United States and Canada have both made progress in promoting sustainability and reducing waste, which has driven demand for sustainable packaging solutions.

California has implemented a statewide ban on single-use plastic bags and requires certain products to be made from recycled materials. The government has implemented policies and regulations in Canada to reduce waste and promote sustainable practices, including a national strategy to reduce plastic waste. Such initiatives, along with the presence of major market players with massive potential for development, are observed to boost the growth of the North American sustainable packaging market.

During the forecast period, Europe is expected to hold the largest share of the market during the projected timeframe. European countries have been leaders in sustainability initiatives, and the demand for sustainable packaging has increased significantly in recent years.

The European Union has implemented policies and regulations to promote sustainable packaging practices. For example, the EU Single-Use Plastics Directive, which came into force in July 2021, bans single-use plastic products and requires member states to take measures to reduce the use of plastic packaging and promote sustainable alternatives.

Germany is one of Europe's leading countries in the sustainable packaging market. The country strongly focuses on sustainability and is home to many innovative companies developing sustainable packaging solutions. BASF, a chemical company based in Germany, has developed a compostable material ‘Ecovio' that can be used in a variety of applications, including packaging. The material is made from renewable resources and can be composted in industrial composting facilities.

Tetra Pak, a Swedish company with a significant presence in Germany, has developed sustainable packaging solutions for the food and beverage industry. The company has developed packaging from renewable materials, such as paperboard and plant-based plastics, and has implemented recycling programs to ensure its packaging is recycled and reused.

European countries such as the Netherlands, Spain, France, Germany, and the UK are leading with robust recycling measures and extended producer responsibilities (EPRs). Policies like the European Union's Circular Economy Action Plan significantly reduce plastic and encourage companies to invest more in sustainable packaging solutions. In addition, the rapid expansion of the e-commerce industry in the region is anticipated to propel the market's growth during the forecast period. For instance, according to the International Trade Administration, Europe is experiencing one of the largest retail e-commerce markets globally, with total revenues of USD 631.9 billion in 2023. An annual growth rate of 9.31% for revenues is anticipated to reach a total of USD 902.3 billion in European retail ecommerce sales by 2027.

Sustainable Packaging Market Companies

- Be Green Packaging

- Amcor

- Evergreen Packaging

- Mondi

- Tetra Laval

- Sonoco Products Company

- TetraPack International Company

- DS Smith

- Nampak

- Sealed Air Cor

Recent Developments

- In March 2025, ProAmpac, a pioneer in flexible packaging and material science, is advancing its ProActive Intelligence platform by launching innovative solutions in its Moisture Protect series. In collaboration with Aptar CSP Technologies, these solutions are designed to enhance product protection while supporting sustainability goals.

- In April 2024, Amcor, a global leader in developing and producing responsible packaging solutions, partnered with Kimberly-Clark, launched packaging for its Eco Protect diapers with 30% recycled materials in Peru. The bags contain post-consumer recycled content and provide a more sustainable packaging solution for the hypoallergenic diapers made with certified, plant-based fibers.

- In March 2024, Duni Group and Notpla, a British company, announced they had entered into a new collaboration to launch a new plastic-free food packaging with a unique algae coating that offers both functionality and improved environmental performance. The partnership marks Duni Group's focus on material development and ambition to become the leading player in sustainable packaging solutions within the HoReCa industry.

Europe (additional) - In March 2023, Spain-based Hinojosa Packaging Group launched a new food service line at an industrial level with 100% recyclable packaging solutions. With this launch, the company aims to focus on sustainable consumption patterns in the food industry.

- In February 2023, a leading producer of packaging solutions for the food and beverage industry, Pactiv Evergreen, announced its partnership with AmSty in order to offer innovative foam polystyrene products with advanced recyclable technologies.

- In February 2023, a global leader in eco-conscious packaging solutions for the beauty industry, WWP Beauty, announced the launch of its sustainable collection of packaging that includes high-end mono-material and refillable packaging solutions.

Segments Covered in the Report

By Packaging Type

- Recycled content packaging

- Reusable packaging

- Degradable packaging

By Material

- Glass

- Paper

- Metal

- Plastic

By Application

- Food & beverage

- Personal care

- Healthcare

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content