What is the Biodegradable Packaging Market Size?

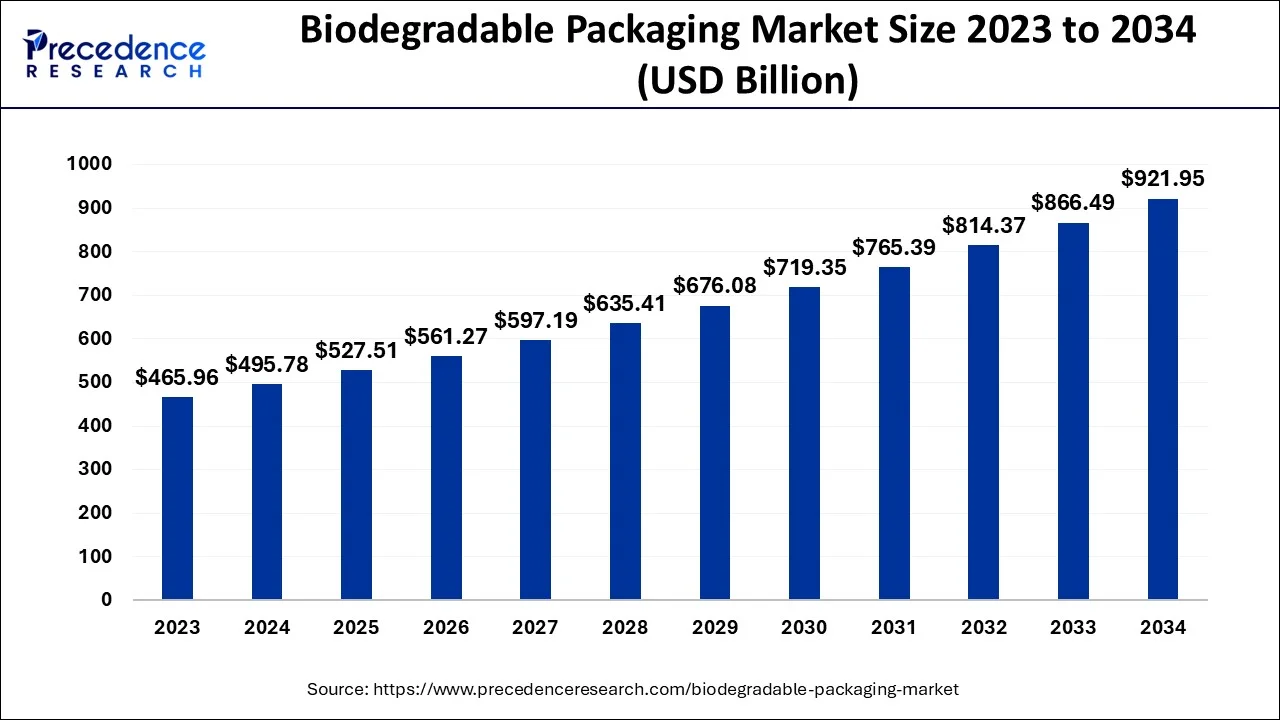

The global biodegradable packaging market size is valued at USD 527.51 billion in 2025 and is predicted to increase from USD 561.27 billion in 2026 to approximately USD 975.18 billion by 2035, expanding at a CAGR of 5.74% from 2026 to 2035.

Biodegradable Packaging Market Key Takeaways

- In terms of revenue, the biodegradable packaging market is valued at 527.51 billion in 2025.

- It is projected to reach $975.18 billion by 2035.

- The market is expected to grow at a CAGR of 5.74% from 2026 to 2035.

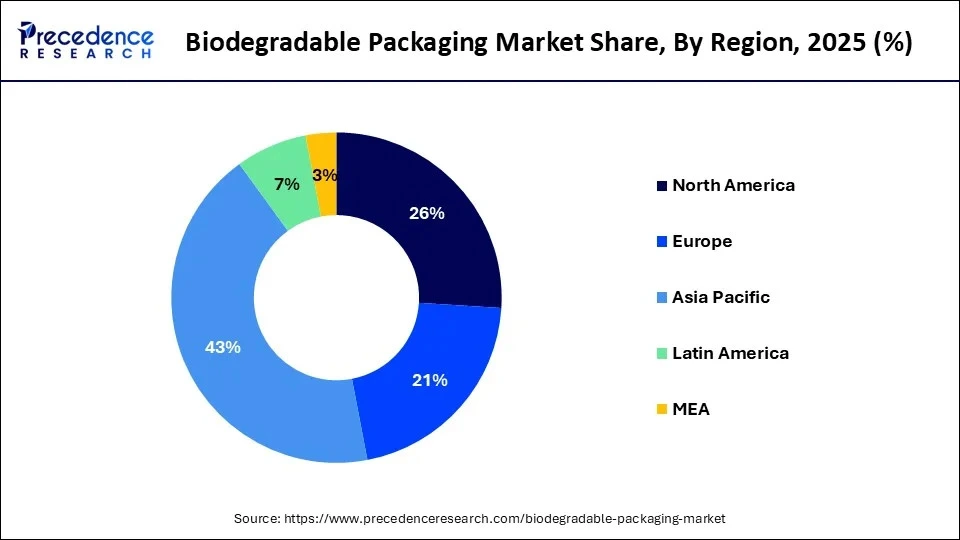

- The Asia Pacific region accounted for 43% of the revenue share in 2025.

- By end-use, the food segment has held 42% of the total revenue share in 2025.

- The German biodegradable packaging market is growing at a CAGR of 4.6% over the forecast period.

AI in the Market

Artificial Intelligence is transforming biodegradable packaging and granting improvements in sustainability, operational efficiency, and consumer marketing. AI-driven design tools perform package-size-design calculations and thus minimize waste and assure recyclability for package materials. The use of AI ensures the manufacturing processes are economical and consistent. In addition, automated quality assurance systems ensure fewer faults and reliability. AI-based supply chains help in predicting needs, the movement of goods, and tracking on demand, thus diminishing overproduction and wastage. Smart packaging can offer extended shelf life, monitor freshness, and improve food safety.

What is Biodegradable Packaging?

Demand for environmentally friendly food packaging surged in 2020, and it is predicted that it will decline in 2021. The global surge in demand for packaged foods during the coronavirus epidemic is largely to blame for the rise in demand. Furthermore, because food production and allied industries were seen as critical services, they kept running during the lockdown. Additionally, several businesses have implemented a variety of tactics to deal with the situation.

Governments all around the world are adjusting to other sources, such as biodegradable packaging, in response to the rising amount of packaging trash produced globally. Despite having only 4% of the world's population, the United States produces 12% of the world's municipal solid waste (MSW). According to another estimate, each American generates roughly 106.2 kg of plastic garbage annually.

The US Plastic Waste Reduction and Recycling Act states that the government wants to decrease plastic waste, promote research into and infrastructure for recycling technologies, and assure US leadership in the establishment of national and worldwide standards. Future restrictions governing the production of plastic may be more stringent for US-based packaging firms as a result of the act's ongoing research into microplastics.

Additionally, the use of renewable resources as opposed to limited ones and other environmental implications over the course of their whole life cycles make bio-based products potentially advantageous for greenhouse gas balances. The usage of biodegradable materials is meant to promote sustainability and lessen the environmental damage caused by the disposal of polymers made of oil.

Biodegradable Packaging Market Key Trends:

- Increasing usage of biodegradable materials in the packaging of food and personal care products.

- Major movement to compostable and bio-based solutions for packaging as a support to achieving the goals of the circular economy.

- Growing impact of sustainability promises and environmental regulations on the selection of packaging materials.

- More attention is being directed towards high-performance biopolymers that improve the strength and usability of the products.

- Biodegradable packaging is being used more and more in food delivery and takeaway applications.

- More and more focus on reducing plastic waste by replacing it with other materials.

- The acceptance of innovation in fiber-based and molded packaging formats in the market is gradually increasing.

Biodegradable Packaging Market Growth Factors

- The growing consumer preference toward healthier beverages and bottled waters is boosting demand for environmentally friendly solutions for packaging.

- Growing realization of pollution occurring in nature due to plastic waste is turning speedily in favor of its biodegradable alternatives.

- Being increasingly used in the food and beverage industry, these packages are gaining more generalized acceptance.

- Innovation in sustainable materials and collaboration of major consumer product companies are nurtured for product innovations.

- Supportive policies and regulations favoring sustainable packaging are working toward market augmentation.

Market Outlook

- Industry Growth Overview: The market grows steadily because consumers are searching the market in search of environmentally friendly, lightweight, and convenient packaging.

- Sustainability Trends: The industry is also focusing on the application of low-carbon materials and backing of investors who are interested in climate technology.

- Major Investors: Ball Corporation, Crown Holdings, Ardagh Group, CAN-PACK, Novelis, and Toyo Seikan Group are some of the major investors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 527.51 Billion |

| Market Size in 2026 | USD 561.27 Billion |

| Market Size by 2035 | USD 975.18 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.74% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Material Type, Packaging Format, Application, Distribution Channel, and Geography |

Market Dynamics

Key Market Drivers

Food on the go is in trend

- Food delivery and takeout have spread around the world as a result of people's busy lifestyles, which has increased demand for the biodegradable food packaging industry. Another trend that is driving the demand for biodegradable food packaging is food on the move.

- Customers are seeking more sanitary and clean packaging that they can reuse and recycle easily as a result of the global epidemic of COVID-19, which is causing the market for biodegradable food packaging to expand.

Environmental concerns

- People are being forced to give up non-biodegradable and throwaway packaging due to environmental concerns including pollution and global warming. The marine ecology is harmed by the waste of plastics and other toxic packing materials, and aquatic species die from ingesting or being entangled in the waste.

- Many packing materials include BPA and benzene, which are harmful to human health as well and can sometimes lead to cancer, blood pressure problems, and issues with the respiratory system. Consumers now choose biodegradable packaging materials over other unsustainable packaging materials since they are aware of all the negative consequences of packaging.

- The market for biodegradable food packaging is anticipated to grow even more due to changing customer tastes and an expanding global population. New packaging materials including cellulose, bamboo, corn starch, and seaweed have entered the market as a result of research and inventions in the biodegradable food packaging sector. The market's demand for biodegradable food packaging is expected to increase as a result of further research in this area.

Plastic pollution has become a global crisis, with the United Nations Environment Programme estimating between 19 and 23 million tons of plastic waste leaking into aquatic ecosystems each year.

- In January 2025, UConn Researchers partnered with a bioplastics company to examine biodegradable plastics. A recent study published in the Journal of Polymers and the Environment found that Mater-Bi, a starch-based polymer produced by Italian company Novamont, degraded by as much as nearly 50% over nine months in a marine environment, significantly more than traditional plastics, and showing promise for reducing marine pollution.

Key Market Challenges

- Environmental hazards and threats to health - Undoubtedly, the prohibition on plastics has encouraged customers to choose biodegradable packaging alternatives, but the market's potential development will be hampered by the high costs associated with making and recycling biodegradable packaging materials. Due to the lack of affordable biodegradable packaging options, market participants in end-use sectors face significant difficulties.

Key Market Opportunities

- The government's rising initiatives -The market for compostable packaging is anticipated to grow quickly as a result of the government's increasing measures for the production of biodegradable materials for packaging. The market for biodegradable packaging will expand profitably as a result of the rising investments in sustainable packaging options. Additionally, the rise of emerging new markets and strategic alliances would work as market drivers and expand beneficial chances for the industry's growth rate.

- The European Union (EU) is taking a remarkable step towards reducing plastic waste by banning single-use plastics by 2030. Single-use plastic packaging items for fresh fruit and vegetables, condiments in fast food restaurants, mini hotel toiletries, and thin plastic bags for groceries make the packaging of everyday items more sustainable. The region is taking several actions on waste management and the circular economy.

Value Cain Analysis

- Raw Material Sourcing

Sourcing raw materials for biodegradable packaging varies widely by the material and includes plastics, paper, and alternatives like glass.

Key Players: NatureWorks LLC, BASF SE, and TotalEnergies Corbion

- Material Processing and Conversion

The material processing and conversion for biodegradable packaging imply the industrial transformation of natural or bio-derived polymers into functional packaging articles by extrusion, molding, or other methods.

Key Players: NatureWorks and Mitsubishi Chemical

- Package Design and Prototyping

Packages for biodegradable packaging design and prototype are an iterative process for designing and testing an eco-friendly packaging using plant-based plastics or mycelium materials.

Key Players: Notpla and Ecovative Design

- Logistics and Distribution

Logistics and distribution for biodegradable packaging include designing, sourcing, storing, transporting, and handling packaging materials that break down naturally (e.g., cornstarch or mushroom packaging) to aid green logistics objectives and lessen environmental impact.

Key Players: UPS, FedEx, and DHL

- Recycling and Waste Management

Recycling and waste management of biodegradable packaging primarily consist of subjects engaged in processes like industrial composting and anaerobic digestion to decompose these organic materials from the packaging into useful components like compost, biogas, and humus

Key Players: Antony Waste Handling and Attero Recycling

Type Insights

Reusable packaging came in second on the market share list behind packaging with recycled content. Gains in recycled content packaging would be facilitated by expanding collection and processing capabilities as well as greater usage of recycled content packaging by businesses seeking to differentiate their goods and demonstrate environmental sustainability. The expansion of the market will be aided by initiatives by industry associations, brand owners, packaging businesses, and others to promote sustainability programs that will raise the recycling rates of different kinds of packaging materials.

The majority of reusable transport packaging is designed for business-to-business applications; however, the growth of e-commerce and home delivery applications creates opportunities for the effective use of reusable packaging for the domestic transport of products.

Application Insights

The market for green packaging worldwide is dominated by the food and beverage industry. Due to its mobility, extended shelf life, and simple manufacture, convenience food is primarily driving the market for food and beverage packaging. Frozen foods, snacks, finger foods, drinks, and other goods are included in convenience food categories. The meal items are often supplied in hot, ready-to-go containers and require less time to prepare.

Consumers prioritize nutritional content, package simplicity, product attractiveness, and product safety when choosing convenience foods. Innovative packaging and cutting-edge technologies have expanded the range of easily available food alternatives, including packaged food, frozen food, chilled food, etc. Product safety and sustainability are the primary concerns of the majority of package makers. Consumer packaged goods businesses are increasingly packaging food, which has changed people's preferences for convenience foods.

By minimizing the quantity of plastic used in packaging, several chemical suppliers are shifting toward more environmentally friendly choices. Customer understanding of the significance of sustainability is one of the factors behind the transition.

Fast-moving consumer goods (FMCG) companies and manufacturers are aggressive in making lofty pledges to increase package sustainability and reevaluate their packaging layouts. Regulators are taking action.

Regional Insights

Asia Pacific Biodegradable Packaging Market Size and Growth 2026 to 2035

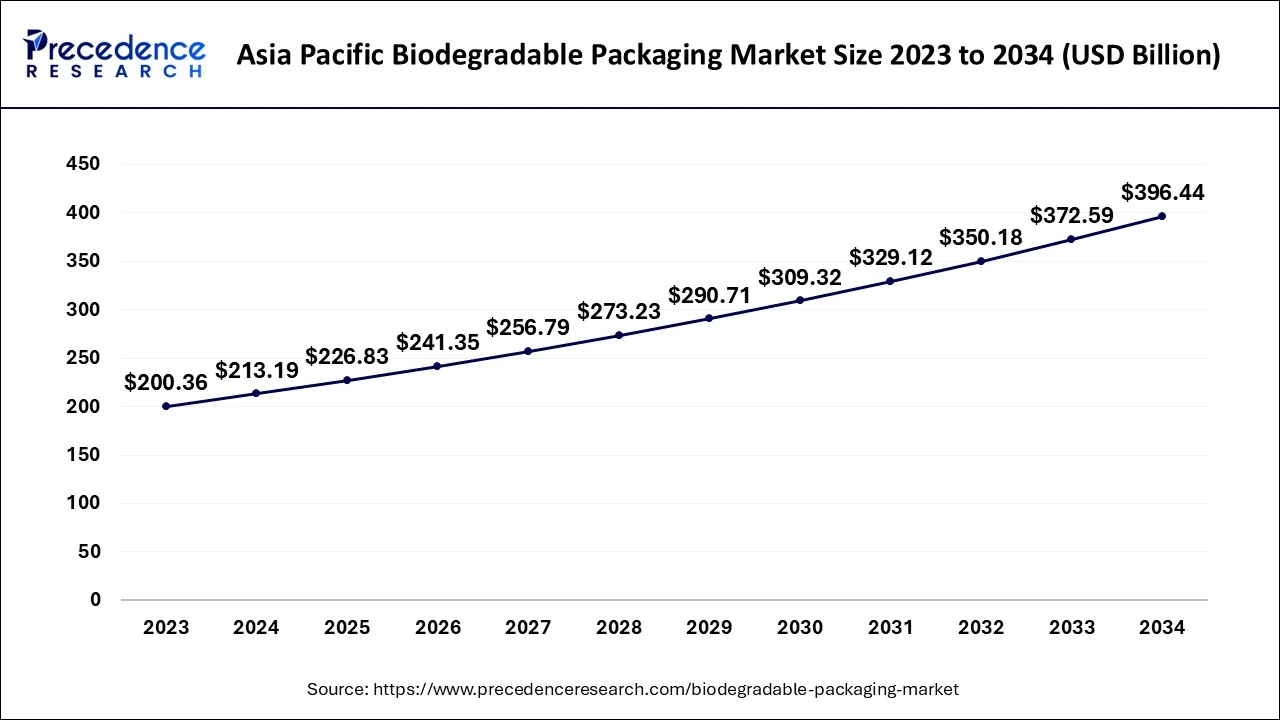

The Asia Pacific biodegradable packaging market size is evaluated at USD 226.83 billion in 2025 and is expected to expand to around USD 420.29 billion by 2035, rising at a CAGR of 5.77% from 2026 to 2035.

Throughout the forecast period, Asia Pacific is anticipated to maintain its leadership and occupy the top spot in the worldwide market for green packaging. Due to the increased population density, convenient meals and drinks are being consumed more often. Additionally, the regional market is projected to increase as a result of the green packaging producers in China, India, Japan, and South Korea placing a greater emphasis on environmentally friendly packaging options in response to rising consumer environmental concerns. In South-East Asia, it is simple to get the raw materials needed to make cartons, bags, boxes, and other packaging equipment. Positive market effects are also anticipated as a result of this.

Due to strict legislation promoting eco-friendly and sustainable packaging, North America is predicted to have considerable market growth. For instance, in order to adopt and put SMM policies and practices into effect, the Environmental Protection Agency (EPA) created a sustainable material management program in 2017.

One of the key geographical areas in the industry is Europe. The local market is being driven by the rising demand for eco-friendly and comparatively affordable sustainable packaging materials. Additionally, the regional market will be driven by the expanding R&D supporting the usage and development of bioplastic by ASIA PACIFIC USD 99.46 Billion the European-based firms like Tetrapak, Mondi Plc, and others. During the projection period, Latin America is anticipated to have significant growth. During the projection period, Latin America is anticipated to have significant growth. The market will develop as a result of rising food and beverage consumption per person in places like Brazil, Argentina, and the Caribbean.

- According to the European Parliament report in March 2024, Globally, researchers estimate that the production and incineration of plastic pumped more than 850 million tonnes of greenhouse gases into the atmosphere in 2019. By 2050, those emissions could rise to 2.8 billion tonnes, a part of which could be avoided through better recycling.

The European Commission has set very ambitious circularity objectives for plastics. Regulatory targets of the recently revised waste directives are 10% max landfilling of municipal waste by 2035, 50% recycling of plastic packaging by 2025, and 55% by 2030. Chemical recycling represents a positive step towards reducing disposed of waste and contributing to a circular economy for plastics. There is also a huge potential for new jobs as the sector develops.

The Middle East and Africa are anticipated to have moderate growth as a result of the evolving economic climate. The need for green packaging is soaring due to the rising popularity of canned goods due to their ease of use and longer shelf life. Additionally, it is anticipated that the local companies that provide a variety of canned goods would increase demand for packaging goods.

U.S. Biodegradable Packaging Market Trends:

The U.S. is taking advantage of the benefits of significant substance innovation and state-of-the-art research in packaging. Inventors guarantee the supply of biopolymers by working with NatureWorks. At the state level, as well as company sustainability goals, the shift towards biodegradable solutions in the foodservice and personal care packaging markets is underway.

Germany Biodegradable Packaging Market Trends:

Germany leads the market with biodegradable products through devotion to the environment. BASF SE and Novamont are the leading companies that bring the development of high-quality bioplastics to the arena; that is why they cannot be compared to the competition. The compliant sustainable packaging solutions are chosen by retailers and foodservice operators.

India & China Biodegradable Packaging Market Trends:

The packaging market in India is changing rapidly due to the government's stringent action on single-use plastic. First in the sector-wise are the biodegradable votes of the FMCG and foodservice sectors, while at the same time, the ever-growing food delivery sector in China has generated a massive capacity of biodegradable packaging materials across the country in terms of volume.

Top Companies in the Biodegradable Packaging Market & Their Offerings:

- Amcor: Amcor launches packaging that is made of bio-based materials, which is easy to recycle and compost, and therefore, contributes to the circular economy initiative.

- Be Green Packaging: Be Green Packaging produces compostable packaging using renewable natural resources that do not involve trees, using the process of molded fiber packaging.

- DuPont: DuPont offers biodegradable packaging as it offers biomaterials and performance polymers to improve the packaging, making it stronger, more functional, and more sustainable.

Biodegradable Packaging Market Companies

- Amcor

- Be Green Packaging

- DS Smith, DuPont

- Evergreen Packaging

- Mondi, Nampak

- Ball Corp.

- Sealed Air

- Tetra Laval

Recent Developments

- In May 2025, Futamura and GK Sondermaschinenbau collaborate on a compostable packaging laminate for liquid sachets, using NatureFlex technology and cellulose film for barrier and biofilm seals.

https://www.labelsandlabeling.com - In March 2025, Green Lab, a leading eco-packaging manufacturer in Southeast Asia, entered the U.S. market, offering FSC-certified, 100% recycled paper bags and eco-friendly food packaging.

https://www.prnewswire.com

Market Segmentation

By Type

- Recycled Content Packaging

- Reusable Packaging

- Degradable Packaging

By Material Type

- Plastic

- Starch-Based Plastics

- Cellulose-Based Plastics

- Polylactic Acid (PLA)

- Poly-3-Hydroxybutyrate (PHB)

- Polyhydroxyalkanoates (PHA)

- Other Plastics

- Paper & Paperboard

- Kraft Paper

- Flexible Paper

- Corrugated Fiberboard

- Boxboard

- Bagasse

By Packaging Format

- Bottles & Jars

- Boxes & Cartons

- Cans

- Trays & Clamshells

- Cups & Bowls

- Pouches & Bags

- Films & Wraps

- Labels & Tapes

- Others (Stick pack, Sachets, etc.)

By Application

- Food & Beverages

- Personal Care

- Healthcare

- Others

By Distribution Channel

- Wholesalers

- Retailers

- Distributors

- Resellers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting