What is the Food Packaging Market Size?

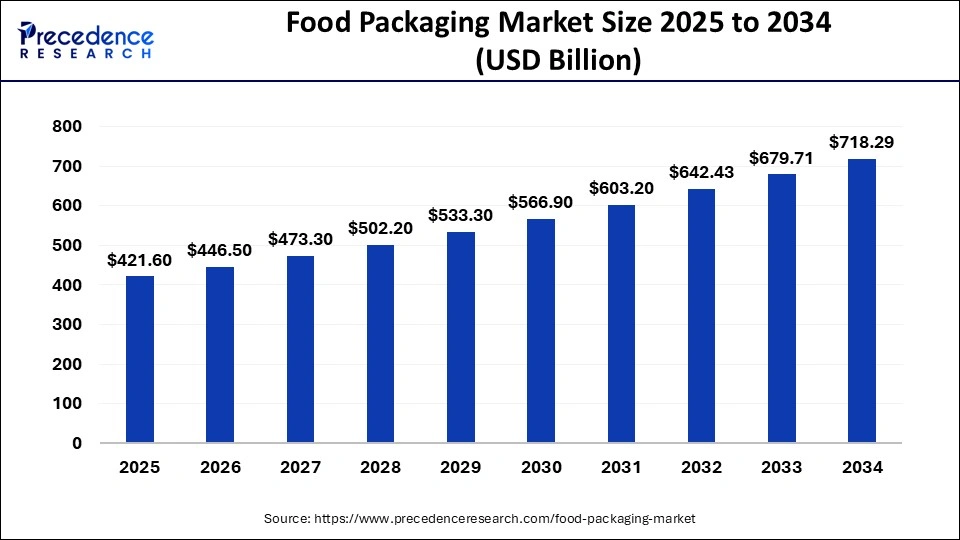

The global food packaging market size is calculated at USD 421.60 billion in 2025 and is predicted to increase from USD 446.50 billion in 2026 to approximately USD 756 billion by 2035, expanding at a CAGR of 6.01% from 2026 to 2035.

Food Packaging Market Key Takeaways

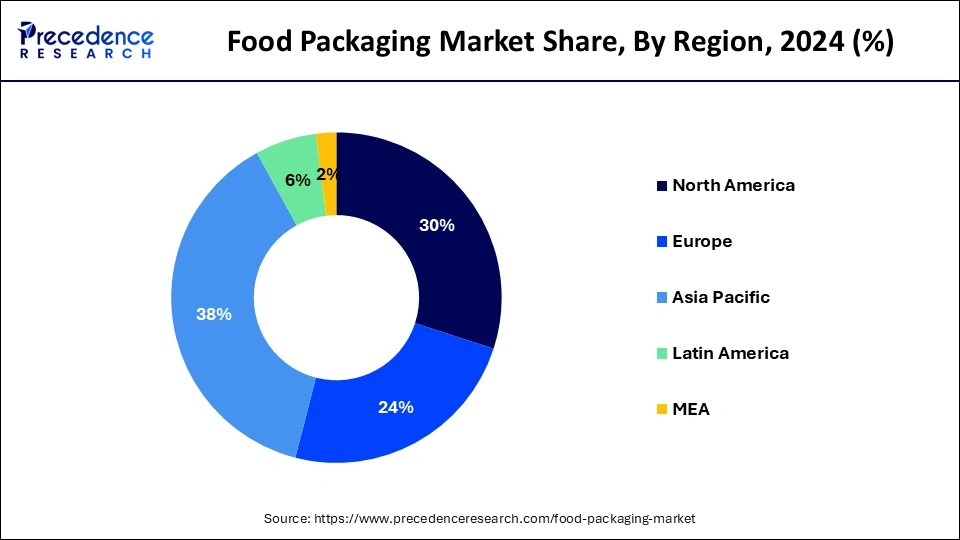

- Asia Pacific dominated food packaging market with the largest market share of 38% in 2025.

- By material, the paper and paper-based material segment is expected to generate the major market share in 2025.

- By application, the bakery and confectionery products segment held the largest market share in 2025.

Fresh Wraps, Smarter Packs: Market Overview

The food packaging market sits at the intersection of consumer convenience, food safety, supply-chain efficiency, and sustainability. It encompasses primary direct food contact and secondary packaging, across materials such as paper & cardboard, plastics flexibles, rigid containers, glass, metal cans, foil, and emerging bio-based or compostable substrates.

Demand is shaped by urbanization, on-the-go lifestyles, growth of e-commerce and food delivery, stricter food-safety and traceability requirements, and rising consumer preference for convenience formats and visible sustainability claims. Brand owners and retailers balance cost, shelf-life performance, marketing appeal, and regulatory compliance while packaging converters innovate to deliver barrier properties, lightweighting, and customization at scale.

Food Packaging Market Growth Factors

Rising demand for packaged food by consumers due to fast lifestyle along with changing eating habits expected to impact positively on the market. The product provides stable and extended shelf-life, safety, and high barrier properties, thereby propelling the market growth. Factors such as convenience along with use of high-performance material are further expected to aid towards the growth of the food packaging industry. Improved shelf-life along with increased efficiency in the prevention of content from contamination predicted to boost the growth of the market in the coming years. In addition, factors such as rising disposable income, increasing population, and shrinking households have also influenced positively on the market.

Moreover, the bargaining power of buyers projected to remain high during the analysis period. The industry is considered by the presence of large number of buyers that anticipated to fuel over the forecast period. Additionally, buyers seek for customized and innovative solutions for their products as well as exhibit high levels of price sensitivity together with frequent possibility for material substitution.

Besides this, the market analyzed to remain highly regulated with agencies such as the European Commission and the U.S. Food and Drug Administration (FDA) imposing strict regulations pertaining use of food contact materials and food packaging types. Furthermore, the market trend is inclined toward more sustainable packing solutions that include thermoplastics and bio-based plastics that further poised to spur the market growth.

Food Packaging Market Trends

- Increased emphasis on using biodegradable and recyclable packaging materials for meeting sustainability initiatives reducing packaging waste.

- Utilizing smart packaging solutions like QR codes and RFID tags for enhancing traceability and engagement of customers through digital interactions.

- Adding tamper-evident packaging features like indicators and seals for ensuring product safety and integrity, thereby preventing unauthorized access, contamination or alteration.

- Advanced technologies like Modified Atmosphere Packaging (MAP) for extending shelf life and preserving food product quality.

- Implementing transparent and concise labelling practices for effective communication of product information and ingredients.

Market Outlook

- Industry Overview: The food packaging industry includes material manufacturers, fibres, polymers, glass, metals, converters films, laminates, moulded trays, cartons, printing and labelling specialists, machinery suppliers, brand-owners F&B companies, retailers, and recycling/waste-management actors. Activity spans R&D for barrier coatings and mono-material solutions, process engineering for high-speed forming and filling, and logistics optimization for just-in-time supply.

- Key capabilities include barrier science for fresh/perishable foods, lightweight structural design, hygiene and sterilization compatibility, and packaging that supports extended cold-chain or ambient distribution. The industry is highly fragmented in converters and regionally concentrated in material supply, making partnerships and vertical integrations common strategies for securing performance and margins.

- Sustainability Trend: This trend covers reducing material use lightweighting, switching to recyclable mono-materials instead of complex laminates, increasing recycled content, and introducing certified compostable or bio-based options where appropriate. Equally important is addressing the whole system: improving collection and recycling infrastructure, designing for circularity easy-to-separate components, standardized formats, and using life-cycle assessments to ensure that a “green” material does not shift emissions upstream.

- Brands are also embracing refillable and reusable models for selected categories, and digital labels QR codes to educate consumers and enable traceability and recycling instructions.

- Major Investment Themes: Investors and strategic buyers are focusing on scalable, circular technologies and supply-chain enablers: recycled-content supply (chemical and mechanical recycling plants), mono-material barrier films, compostable polymers that meet food-contact standards, high-speed converting machinery that supports new substrates, and digital traceability/anti-counterfeit solutions.

- Sustainable Ecosystems and Startups: A sustainable food-packaging ecosystem blends material science startups, converters, municipal recycling pilots, brand partnerships, and academic research centres. Startups commonly focus on: novel bio-polymers and compostable coatings compatible with food contact; mono-material barrier films that enable easy recycling; refillable packaging platforms and dispensers; and recycling tech such as solvent-based chemical recycling for mixed plastics or separation technologies for multilayer films.

- Successful early-stage ventures often pair with large F&B brands for co-development pilots and with converters to ensure manufacturability. Public-private collaborations and accelerator programs help scale promising circular solutions from lab to production, while complementary investments in collection and sorting infrastructure determine ultimate impact.

Market Scope

| Report Highlights | Details |

| Market Size by 2035 | USD 756 Billion |

| Market Size in 2025 | USD 421.60 Billion |

| Market Size in 2026 | USD 446.50 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.01% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Material, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Material Insights

The paper and paper-based material segment led the global food packaging market and accounted for a value share in 2025. Growth of this segment is attributed to high adoption rate of the product in a bid to substitute non-biodegradable packing solutions. Ease of printability, innovations in design, and sustainability provide paper packaging a competitive advantage over other materials such as plastic and metal packaging solutions.

According to an article published by the IBEF in March 2024, the paper packaging industry significantly contributes to the growth of India's economy. India currently stands as the 15th largest paper manufacturer globally and comprises more than 600 paper mills, contributing significantly to the emerging economy. India's paper packaging industry is increasing its presence in export markets, particularly in the Middle East, Africa, and Southeast Asia. Export of paper, paperboard, and newsprint has increased almost 3 times from 532.7 thousand tonnes in 2010-11 to 1,560.2 thousand tonnes in 2023-24.

On the other side, plastic food packaging anticipated to witness considerable growth owing to increasing adoption by end users because of its low price. Further, increasing usage of plastic films in secondary food packaging expected to have a positive impact on the market. Superior properties provided by plastic packaging that include high moisture barrier and increased sealing capacity is presumed to boost the product demand over the coming years.

In January 2025, Cadbury launched 80% recycled plastic packaging. Mondel?z International is rolling out 80% certified recycled plastic packaging for Cadbury sharing bars sold in the British Isles. Mondel?z collaborated with Amcor and Jindal Films to develop the new packaging, which is recycle-ready and incorporates Amcor's AmFiniti recycled plastic. The 80% recycled packaging positions the brand well in a regulatory environment that's encouraging recycling and recycled content via rules like the European Union's Packaging and Packaging Waste Regulation (PPWR).

Application Insights

Bakery and confectionery products generally require high moisture barrier packaging so as to extend their shelf life. Flexible packaging is increasingly used for the bakery & confectionary application because of its advantages that include printability, lightweight, and cost-effectiveness over paper cartons and tins. Furthermore, attractive packing of confectionery products witnessed to boost the growth of the segment over the analysis period.

Increasing consumer inclination toward dairy products in smaller packs owing to shrinking households anticipated to augment the market growth. Further, adoption of attractive food packaging strategies by manufacturers is also intended to boost the growth of the segment. The rising demand for dairy products that include ice cream and yogurt considered to flourish the market growth for food packaging solutions in dairy products application.

Regional Insights

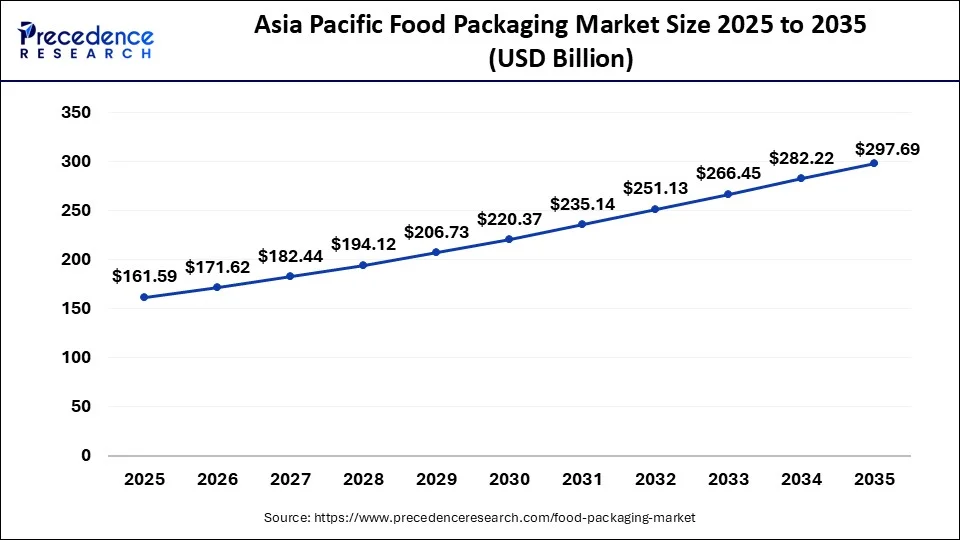

What is the Asia Pacific Food Packaging Market Size?

The Asia Pacific food packaging market size is valued at USD 161.59 billion in 2025 and is projected to be worth around USD 297.69 billion by 2035, growing at a CAGR of 6.30% from 2026 to 2035.

How did Asia Pacific dominate the Food Packaging Market in 2025?

The Asia Pacific estimated to be the dominant market, followed by North America and Europe, accounting for around 38% of the total value share in the year 2025. The market analyzed to be driven by rising per capital income, increasing population, and growing demand in emerging countries such as Japan, China, and India.

China, Japan, and India Food Packaging Market Analysis

China is the largest consumer of packaged food because of its growing economy and large population base. The market in China expected to flourish at a prominent rate due to its intensifying middle-class population along with their rising purchasing power. Among other Asian countries, India is the fastest growing market in consequence of increasing usage of the products in retail chains.

The strategic initiatives adopted by key players, such as acquisitions, partnerships, and new product launches, are expected to drive the growth of food packaging market during the forecast period. For instance, In July 2025, INEOS Styrolution launched bio-attributed polystyrene for food packaging. INEOS Styrolution has successfully commercialized its 100% bio-attributed polystyrene, Styrolution PS 158K BC100. The new material is produced from 100% bio-attributed renewable feedstock, achieving a 172% reduction in carbon emissions compared to conventional polystyrene. Food trays made with Styrolution PS 158K BC100 are available on the shelves at a leading Japanese retail chain.

- For instance, in May 2025, Pepcom India, a Kolkata-based startup, announced the replacement of more than six million single-use plastic containers used for packaging with eco-friendly, paper-based alternatives. The transformation resulted in prevention of 200 tonnes of plastic waste from reaching Indian landfills.

Why is North America the Fastest-Growing Region in the Food Packaging Market?

On the contrary, high rate of consumption of packaged food by consumers, thriving retail sector, as well as the presence of large number of manufacturers are the key factors projected to propel the demand for food packaging solutions in North America. Despite of high saturation level, Europe predicted to register a positive outlook over the analysis period. Single market policy within European countries allows free-trade that expected to encourage exports, consequently fuels the market growth.

- For instance, in April 2025, Elopak, a Norwegian packaging company specializing in production of cartons for liquid food products like milk and juice, opened its first carton production plant in U.S.

The North American market is growing steadily, driven by rising demand for convenience, ready-to-eat meals, and longer shelf-life products. Sustainability is a key trend, with brands increasingly adopting recyclable, biodegradable, and lightweight packaging materials to meet regulatory requirements and consumer preferences.

U.S. Food Packaging Market Analysis

The U.S. market for food packaging is expanding due to the growing demand for ready-to-eat food, the boom of online grocery, and e-commerce logistics. Flexible packaging, including pouches and resealable bags, is gaining popularity alongside traditional rigid packaging due to its cost-effectiveness and versatility. E-commerce and food delivery services are driving innovations in tamper-proof, insulated, and portion-controlled packaging solutions.

Can Latin America Repackage Its Future with Circular Solutions?"

Latin America's food packaging market is characterised by a mix of traditional pack formats and rapid growth in retail-ready and takeaway solutions. Brazil and Mexico lead in scale, with strong domestic converting industries serving both local consumption and exports. Affordability and cold-chain limitations steer many brands toward economical plastics and paperboard solutions, but rising environmental awareness and municipal recycling pilots are creating demand for recyclable mono-materials and increased recycled content.

Brazil Food Packaging Trends

Brazil's scale and domestic industrial base make it ripe for pilot programs in recycled-content packaging and larger investments in recycling infrastructure, while Mexico's integration with North American supply chains encourages adoption of specifications demanded by export markets, such as recyclable PET and paperboard standards. Argentina and Chile show niche opportunities.

Chile with export horticulture packaging requiring high-barrier formats, and Argentina with dairy and meat packaging needs that emphasize cold-chain-compatible trays and vacuum packs. In each market, success often depends on aligning packaging solutions with local logistics realities and incremental improvements that maintain affordability for consumers.

| Country | Company | Product | Aim/use |

| Switzerland | Amcor plc | Flexible and rigid food packaging solutions | Help food manufacturers improve shelf-life. |

| Finland | Huhtamaki Oyj | Fiber-based packaging, foodservice cups/trays, flexible food packaging. | Provide safe, high quality, recyclable or plant-based packaging for food and beverage. |

| U.S. | Viskase Companies | Film and casing packaging for processed meats and food services | Supply packaging materials for meat and food service segment. |

Value Chain Analysis

- Raw Material Sourcing: Raw material sourcing for food packaging must balance cost, consistency, regulatory compliance for food contact, and increasingly, recycled content or bio-based credentials. Suppliers procure base polymers PE, PET, PP, PS, EVOH, paper pulp virgin and recycle, glass cullet, and metal ingots, while specialized chemical suppliers provide barrier coatings, adhesives, inks, and laminating resins.

- Technological Advancements: Technological progress is driving faster, cheaper, and more sustainable packaging solutions: mono-material high-barrier films that allow easy recycling; chemical recycling processes that convert mixed plastics back into monomers; lightweighting via material and structural engineering; active and intelligent packaging that can absorb ethylene, release preservatives, or monitor freshness; and high-speed, flexible converting lines capable of short runs and customization for e-commerce.

- Raw Material Sourcing (Plastic, Paper, Glass, etc.):This stage leverages recycled polymers, bio-based materials, alternative fibers, recycled fiber, and closed-loop sourcing.

Key Players: Amcor Plc, Mondi Group, Smurfit Westrock, International Paper, Tetra Pak, Ball Corporation, Uflex Limited, EPL Limited - Logistics and Distribution: This stage defines smart distribution, real-time monitoring, sustainable and circular fulfilment, automation, warehouse logistics, and regulatory and safety compliance.

Key Players: Maersk, UPS Healthcare, Lineage Logistics, DHL Supply Chain, Americold Logistics, Kuehne + Nagel, Amcor Plc, Mondi Group, Smurfit Westrock. - Recycling and Waste Management:This stage includes recycling process innovations, digital traceability and sorting, circular economy systems, advanced materials for waste reduction, and regulatory compliance.

Key Players: Amcor Plc, Sealed Air, Huhtamaki, Berry Global, Tetra Pak, Mondi Group, Veolia, Waste Management, Inc., Republic Services, Indorama Ventures, Plastipak Holdings.

Food Packaging Market Companies

- Berry Plastics Groupis a global manufacturer of a wide range of plastic packaging products, including containers, bottles, films, and specialty items, serving markets from food and beverage to healthcare and industrial sectors. Its importance was centered on being a high-volume, low-cost producer and a leader in sustainable plastic solutions, including the use of post-consumer recycled content and developing a circular economy for polymers.

- Amcor Plc Its importance is defined by its massive global presence, serving food, beverage, pharmaceutical, and personal care industries. Amcor is a major innovator in sustainable packaging, committing to making all its packaging recyclable or reusable by 2025, and focusing on solutions that extend shelf life and reduce waste.

- Sigma Plastics Group The second-largest producer of plastic film and sheet in North America, manufacturing a wide variety of extruded polyethylene films and bags for industrial, institutional, agricultural, food, and medical markets.

- Sealed Air Corporation The company focuses on solutions that extend the shelf life of fresh food reducing waste and protective packaging that minimizes damage during shipping.

Recent Developments

- In May 2025, Kapag's innovative Changemaker concept uses Sappi's premium materials to create exceptional barrier packaging. This groundbreaking solution, developed by Kapag, combines Sappi's premium Algro Design paperboard or Fusion Topliner with AvantGuard functional barrier paper to deliver a 100% paper-based, mono-material, recyclable solution for food products that eliminates the need for plastic-based alternatives.

- In May 2025, Metsä Group and Amcor, a global leader in developing and producing responsible packaging solutions, announced a strategic collaboration to develop three-dimensional moulded fibre packaging solutions with lidding and liner for a variety of food applications. The collaboration aims to leverage both companies' expertise in innovative packaging technologies to create cycle-ready products that meet the growing demand for sustainable alternatives.

- In April 2025, Packaging film supplier SÜDPACK, food service company Werz, and BASF Gastronomie collaborated to utilize BASF's polyamide Ultramid Cycled material for meat and sausage packaging in the hotel, restaurant, and catering sector.

- In May 2025, Hotpack, the UAE-based food packaging company, expanded its presence in North America with an investment of $100 million by inaugurating a manufacturing and distribution hub in New Jersey.

- In April 2025, Amcor, a globally leading developer and producer of responsible packaging solutions, collaborated with Riverside Natural Foods, a major certified organic snack producer for launching MadeGood Trail Mix bars. The bars are packed Amcor's AmFiber, a paper-based packaging laminate manufactured with FSC-certified (C206475) fiber, offering curbside recyclability without compromising package performance.

- In October 2024, the Environmental Protection Agency (EPA) granted a research funding to a team of researchers from the Michigan State University's (MSU) School of Packaging for producing environmentally less-impacting packaging solutions as alternatives to non-biodegradable and single-use options. The grant was provided through EPA's People, Prosperity and the Planet (P3) Program.

Segments Covered in the Report

By Material

- Plastics

- Paper & Paper-based

- Glass

- Metal

- Others

By Type

- Semi-rigid

- Rigid

- Flexible

By Application

- Dairy Products

- Bakery & Confectionary

- Fruits & Vegetables

- Sauces & Dressings

- Meat, Poultry, & Seafood

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content