What is Beverage Packaging Market Size?

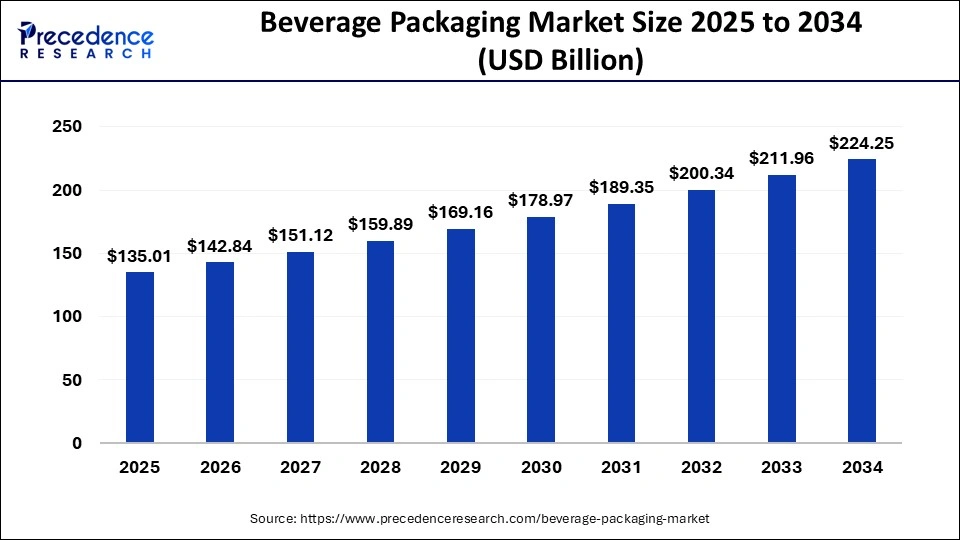

The global beverage packaging market size is estimated at USD 135.01 billion in 2025 and is predicted to increase from USD 142.84 billion in 2026 to approximately USD 236.09 billion by 2035, expanding at a CAGR of 5.80% from 2026 to 2035. The beverage packaging market is driven by the rise in need for sustainable products along with knowledge regarding the environment, combined with increasing requirement for convenient packaging.

Market Highlights

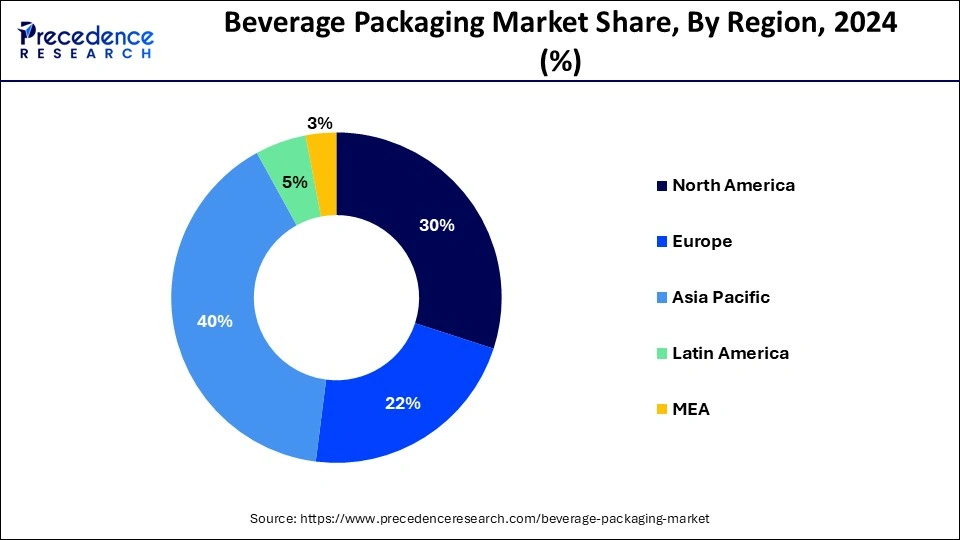

- Asia Pacific led the global market with the highest market share of 40% in 2025.

- North America is expected to expand at the fastest CAGR during the forecast period.

- By Material, the glass segment has held the largest revenue share in 2025.

- By Material, the plastic segment is anticipated to grow at the fastest CAGR during the projected period.

- By Product, the bottles segment dominated the global market in 2025.

- By Product, the home carton segment is expected to grow at a notable CAGR over the predicted period.

- By Application, the alcoholic beverage segment is estimated to hold the highest market share in 2025.

How is AI Enhancing the Beverage Packaging Industry?

The beverage packaging industry is undergoing a dramatic transformation, driven by the rise of artificial intelligence (AI). Among the many elements of packaging, bottle caps, small yet vital elements are part of this change. The beverage industry is utilizing AI to advance new products. With data-driven insights, AI systems can determine consumer trends more accurately from sources such as social media, sales, and reviews. This makes it easier to understand what users want in a brand's products, assisting R&D teams hone in on innovative goods while managing the data analysis.Sustainability is a priority for the beverage industry, and AI is leading by improving material usage and lowering waste. For example, AI can calculate the ideal thickness as well as weight of caps to minimize material use without compromising performance.

Market Overview

The beverage packaging market is significant because it's vital for preserving, protecting, and marketing beverages, while also accepting evolving consumer choices and sustainability trends. The market is adapting to trends such as on-the-go consumption with convenient packaging formats such as pouches along with single-serve bottles. There is an increasing need for sustainable and eco-friendly packaging alternatives, pushing innovation in materials along with designs.

- In February 2025, Tetra Pak declared its offering of packaging material with certified recycled polymers, becoming the first firm in the food and beverage packaging industry in India.

Market Trends

- Eco-friendliness, Sustainability Materials: Recyclable, biodegradable, and compostable materials are being embraced by brands to minimize the environmental effects. The traditional materials are being changed with environmentally friendly alternatives such as glass, paper-based cartons, and plastics produced on the basis of plants, as the industry is greatly shifting to eco-friendly manufacturing and the circular economy concept.

- Trend of Smart Packaging: The characteristics, such as QR, NFC tags, and augmented reality labels, provide transparency of products, tracking of their origin, and interactive information. Such technologies help to enhance brand engagement and enable manufacturers to track the inventory and maintain quality control.

- Demand for Lightweight and Convenient Packaging: Consumers are attracted to goods in forms such as cans, bottles, as well as pouches that are easily transported and discarded. Its package is also light, so it cuts down the costs of transportation and environmental effects, which makes it more attractive in the market.

Beverage Packaging Market Growth Factors

The global beverage packaging market is primarily driven by the growing demand for the various alcoholic and non-alcoholic beverages across the globe. The beverage packaging plays a crucial role in the overall growth of the beverages industry. There are numerous types of beverages each are packaged using varied materials and in different sizes. This is a key factor responsible for the growth of the beverage packaging market across the globe. The increased consumption of carbonated beverages, sports drinks, fruit juices, and other various beverages have played a significant role in the increased utilization of the beverage packaging materials across the globe. Packaging has also become a tool for the marketing of products. Innovative packaging solutions are also used to attract the customers to make a purchase.

The demand for the sustainable packaging solutions is rising across various industries. The growing popularity of compostable, recyclable, and bio-degradable packaging is expected to boost the market growth during the forecast period. The rising environmental concerns owing to the extensive use of conventional plastics in the past have led to a serious threat to the global environment as a huge amount of plastic wastes have already been generated that would take thousands of years to decompose. Hence, growing government initiatives to reduce the usage of plastic is expected to foster the adoption rate of biodegradable and recyclable plastics across the globe. Moreover, several nations have banned the use of petroleum based plastic to reduce the carbon footprint. Hence, the rising support from the government will drive the growth of the sustainable packaging solutions in the global beverage industry.

- The global beverage packaging market is primarily driven by the growing demand for various alcoholic and non-alcoholic beverages across the globe.

- The beverage packaging plays a crucial role in the overall growth of the beverage industry. There are numerous types of beverages, each of which is packaged using varied materials and in different sizes. This is a key factor responsible for the growth of the beverage packaging market across the globe.

- The increased consumption of carbonated beverages, sports drinks, fruit juices, and other beverages has played a significant role in the increased utilization of beverage packaging materials across the globe.

- Packaging has also become a tool for the marketing of products. Innovative packaging solutions are also used to attract customers to make a purchase.

- The demand for sustainable packaging solutions is rising across various industries. The growing popularity of compostable, recyclable, and biodegradable packaging is expected to boost the market growth during the forecast period.

- The rising environmental concerns owing to the extensive use of conventional plastics in the past have led to a serious threat to the global environment, as a huge amount of plastic waste has already been generated that would take thousands of years to decompose.

- Hence, growing government initiatives to reduce the usage of plastic are expected to foster the adoption rate of biodegradable and recyclable plastics across the globe.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 135.01 billion |

| Market Size in 2026 | USD 142.84 billion |

| Market Size by 2035 | USD 236.09 billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.75% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application Type, Material Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising consumption of packaged beverages

The increasing consumption of packaged beverages is a primary driver for the beverage packaging market, boosted by urbanization, changing lifestyles, and an increasing need for convenience and on-the-go options. Increased urbanization along with the prevalence of dual-income households with busy schedules have contributed to a greater reliance on packaged beverages for hydration as well as convenience. Consumers in urban areas are seeking portable, resealable packaging options, easy-to-consume, for beverages. The expansion of online retail and food delivery services has raised the need for packaging that can withstand transportation as well as maintain product integrity.

Restraint

Regulatory challenges

Regulatory challenges around waste management significantly restrain the beverage packaging market by increasing expenses, limiting material choices, and hampering innovation. Stringent regulations, such as those focused on extended producer responsibility (EPR), need companies to handle the end-of-life of their packaging, contributing to increased expenses for collection, recycling, and disposal.

Increased costs linked with more sustainable packaging can be passed on to users, making beverages more expensive. This can contribute to reduced demand, mainly in price-sensitive markets, impacting the overall expansion of the beverage packaging market.

Opportunity

Emergence of Innovative Packaging Solutions

Innovative beverage packaging solutions offer significant opportunities for market growth by addressing consumer need for sustainability, convenience, and improved product experience. The industry is shifting towards biodegradable as well as compostable materials such as seaweed-derived films, plant-based bioplastics, mushroom-based packaging. Emerging technologies such as AI-driven packaging solutions are redefining how beverages are transported, stored, and consumed.

Beverage Packaging Market Segment Insights

Material Insights

By material, the glass segment led the global beverage packaging market with a remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the increased production of soft drinks and increased usage of glass for packaging. Further the usage of glass materials for packaging of various products such as wine, oil, sauces, beers, and juices have significant contribution in the growth of the segment.

On the other hand, the plastic is estimated to be the most opportunistic segment during the forecast period. The low cost of plastic and higher demand for PET bottles among the consumers is expected to drive the segment growth in the foreseeable future. The growth in the demand for the eco-friendly packaging plastics is expected to boost the segment growth in the upcoming future.

Product Insights

By product, the bottles segment led the global beverage packaging market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. The extensive demand for the glass bottle from the alcoholic beverages industry has augmented the segment growth. The reusability is a major factor propelling the growth of this segment by providing sustainable packaging solutions to the global beverage industry.

On the other hand, the carton segment is estimated to be the fastest growing segment during the forecast period. Cartons are generally made up of paperboard that helps in the packaging of various beverages. It also facilitates transportation of numerous products such as milk, juices, and various other non-alcoholic beverages

Application Insights

By application, the alcoholic segment led the global beverage packaging market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. The growth of the beverage packaging segment has been extensively influenced by the growth of the alcoholic beverage industry. The alcohol beverages are mainly packaged to preserve it for a longer period of time. Therefore, the usage of glass bottles is extensive in the alcoholic beverage industry.

On the other hand, the non-alcoholic beverage segment is expected to be the most opportunistic segment during the forecast period. The increased consumption of various non-alcoholic drinks such as soft drinks, water, juices, seltzer, and sports and energy drinks are expected to augment the segment growth in the upcoming years.

Beverage Packaging Market Regional Insights

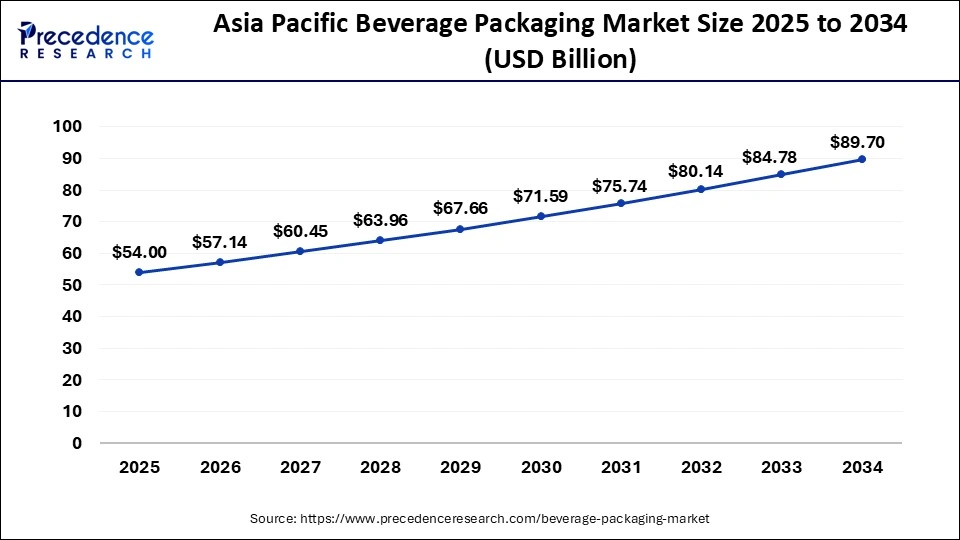

The Asia Pacific beverage packaging market size is estimated at USD 54.00 billion in 2025 and is predicted to be worth around USD 94.43 billion by 2035, at a CAGR of 5.75% from 2026 to 2035.

Based on the region, the Asia Pacific dominated the global beverage packaging market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributable to the higher volume of consumption of beverages due to the presence of large population in the region. Further, the PET bottles and cans are witnessing increased demand in the region owing to the various benefits it offers such as cheap price, safe packaging solution, lightweight, durability, and ease of transportation. Further, the growing penetration of fast-food chains that offer various beverages in their affordable meal packs are boosting the consumption of juices and soft drinks, thereby propelling the consumption of beverage packaging in the region.

China is leading the beverage packaging market in the Asia Pacific region owing to the factors such as huge population base, increased beverage consumption rates, rapid urbanization, ongoing technological advancements in developing advanced manufacturing solutions as well as growing emphasis on sustainable packaging.

India and Japan are emerging key market players significantly contributing to the growth of the beverage packaging market. Indian government's initiative for using recycled materials and banning plastic for beverage packaging, rise in middle class population and increased health consciousness are driving the market growth. Whereas, Japan's focus on innovation, well-established beverage industry and increased sustainability concerns are boosting the market expansion.

For instance, in February 2025, Tetra Pak, a globally leading food processing and packaging solutions company, announced the incorporation of certified recycle polymers in their packaging materials in India. The new carton packages with 5% certified recycled polymers will be implemented from 1 April 2025, aligning with the Indian Government's Plastic Waste Management (Amendment) Rules 2022 set by the Ministry of Environment, Forests & Climate Change.

On the other hand, North America is anticipated to be the most opportunistic market during the forecast period. North America is the home to the top beverages companies such as The Coca Cola Company, JBS, PepsiCo, Nestle, and Kraft Heinz Co. These companies consumes huge amount of packaging products in the region. Furthermore, the introduction of the eco-friendly packaging solutions such as bio-degradable plastic, compostable plastic, and water soluble grade plastic is attracting the consumers and various beverage industry players that is expected to boost the growth of the beverage packaging market in North America.

The European beverage packaging market is expected to witness significant growth over the forecast period, due to the changing consumer tastes, technological innovations, and rising focus on sustainability. These companies are continuously coming up with changes in the design of the packaging to match the trends in marketing strategy and the changing environmental laws. Also, the strict sustainability policies and regulating code of the European market are encouraging manufacturers to use recyclable, light, and biodegradable packaging materials.

The growing consumer preference for sustainable packaging solutions, or eco-friendly equivalents, as well as the intense R&D activities on innovative materials and packaging forms, further add to growth. The beverage packaging industry in the United Kingdom is experiencing dynamic development changes, most of which are a result of changing consumer lifestyles and rising health concerns. The youthful drinkers are opting more to a greater variety of alcoholic products, more frequently sold in intensive, designer, modern, and eco-friendly packages.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedsolutions. Moreover, they are also focusing on maintaining competitive pricing.

In July 2021, the parent company of Johnnie Walker and Smirnoff announced to develop 100% paper-based bottles for the spirits packaging. The source of this paper based packaging would be sourced from the sustainable wood.

The various development strategies adopted by the packaging industry players in today's time is majorly associated with the development of innovative sustainable packaging solutions that would create growth opportunities during the forecast period.

Beverage Packaging Market Companies

- Mondi Plc

- Amcor Plc

- RPC Group

- Tetra Laval International

- Crown Holdings, Inc.

- Saint-Gobain S.A.

- Sonoco Products Company

- Ball Corporation

- Ardagh Group S.A.

- Berry Global, Inc.

- Vidrala S.S

Recent Developments

- In May 2025, Ampol Food, a leading pioneer in the food and beverage manufacturing industry, selected the SIG DomeMini, SIG's on-the-go carton bottle option for launching their V-FIT premium rice-based nutritional drink range, further expanding the market for SIG DomeMini with its entry in Thailand. The carton bottle is designed for recycling using FSC-certified paperboard and is manufactured utilizing 100% renewable electricity.

- In April 2025, Sidel, a manufacturer and provider of equipment and services for liquid packaging, launched its EvoFill Can Compact filling solution which uses electropneumatic technology with magnetic flowmeters for accurate and efficient liquid measurement. The solution is tailored for filling up to 40,000 cans of beer, carbonated soft drinks and other premium beverages per hour for producers operating in the low-to-medium speed segment.

Beverage Packaging MarketSegments Covered in the Report

By Material

- Metal

- Plastic

- Glass

- Others

By Product

- Bottles

- Cans

- Pouch

- Carton

- Others

By Application

- Alcoholic Beverage

- Non-Alcoholic Beverage

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content