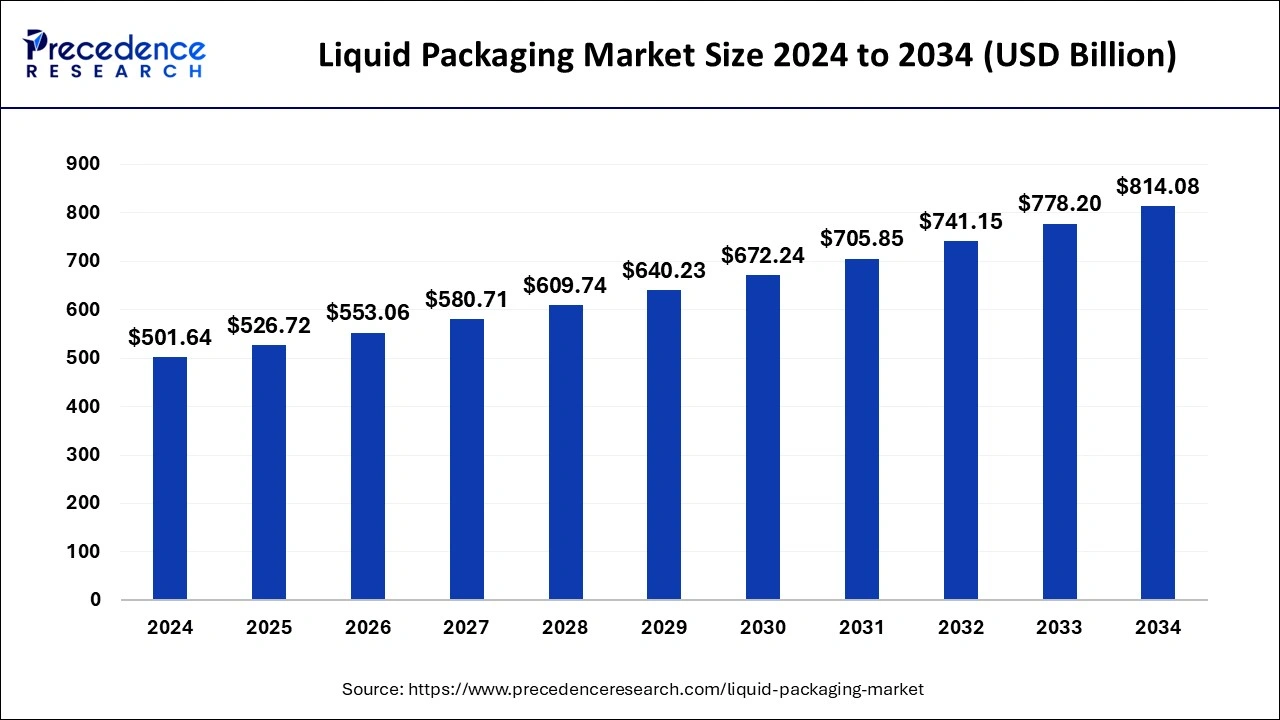

What is the Liquid Packaging Market Market Size?

The global liquid packaging market size is calculated at USD 526.72 billion in 2025 and is predicted to increase from USD 553.06 billion in 2026 to approximately USD 850.74 billion by 2035, expanding at a CAGR of 4.91% from 2026 to 2035.

Liquid Packaging Market Key Takeaways

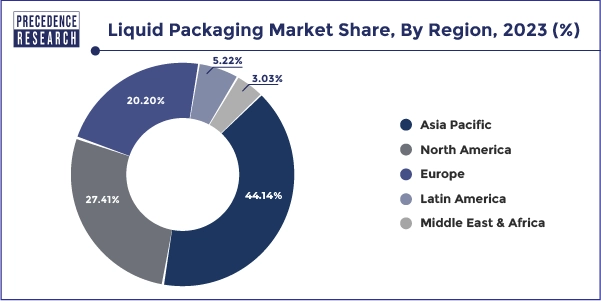

- Asia-Pacific region contributed 44% revenue share in 2025.

- North America market is expected to grow at a CAGR of 5.7% from 2026 to 2035.

- By materials, the plastics segment accounted for the largest revenue share of around 41% in 2025.

- By technology, the aseptic liquid packaging segment accounted for 76% revenue share in 2025.

- By packaging type, the rigid segment has garnered 85.5% market share in 2025.

Liquid Packaging Market Growth Factors

Glass, paper & paper boards, metals (tinplate, foils & laminates, aluminum, & tin-free steel), and plastics are the materials that have traditionally been uses in the food packaging. Further, emergence of aluminum films for packaging application expected to upend the food packaging industry and further propels the growth of liquid packaging market over the upcoming years. In addition, rising trend towards freshness and quality of the food in the duration of storage and distribution expected to impel the market growth for liquid packaging.

Furthermore, increasing application of plastics for beverage packaging because of its low cost compared to other materials such as glass and tin-plates likely to prosper the growth of the market. Plastics offer some functional advantages over other packaging materials that include microwavability, thermo-sealability, unlimited sizes & shapes, and optical properties is the other prime factors that boosts the growth of the liquid packaging. Use of plastic material separates the contact of product from environment that protects it from moisture and bacteria, thereby increasing its shelf life.

In addition, large number of people shifting towards urban areas expected to propel the growth of liquid packaging in for supporting transportation of liquid products over long distance along with increasing their shelf life. Attraction towards lifestyle coupled with greater opportunity for income in the urban areas draws large number of population towards cities.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 526.72 Billion |

| Market Size in 2026 | USD 553.06 Billion |

| Market Size by 2035 | USD 850.74 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.91% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Packaging Type, Raw Material, Technique, End-use, and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Packaging Type Insights

In terms of value, rigid packaging emerged as a dominant segment, accounting for the major market share of over 85.5% in 2025. Rigid packaging is extensively used to manufacture the packaging solutions for pharmaceutical drugs and beverages. This is mainly because of the exceptional properties of rigid packaging over other packaging type that includes excellent shelf-life and ease of transport & carrying.

On the other side, increasing application of flexible packaging materials owing to light weight, low transportation cost, and flexibility in the size & shape of the package anticipated to boost the growth of flexible packaging solutions over the upcoming years.

Raw Material Insights

In terms of raw material, plastics led the global liquid packaging market and accounted for more than half of the value share in the year 2025. Plastics are the most preferred material in the manufacturing of packaging solutions for different end-use verticals such as pharmaceutical, food & beverage, household care, and personal care.

However, paper segment likely to exhibit significant growth over the coming years owing to its excellent properties that include better environmental protection and high recyclability. A further, stringent government norm on restricting the usage of non-degradable plastics is the other major factors that impel the demand for paper materials. Suppliers of paper packaging solutions such as paperboard containers and boxes have increased their production capacities in response to meet the dynamic market conditions.

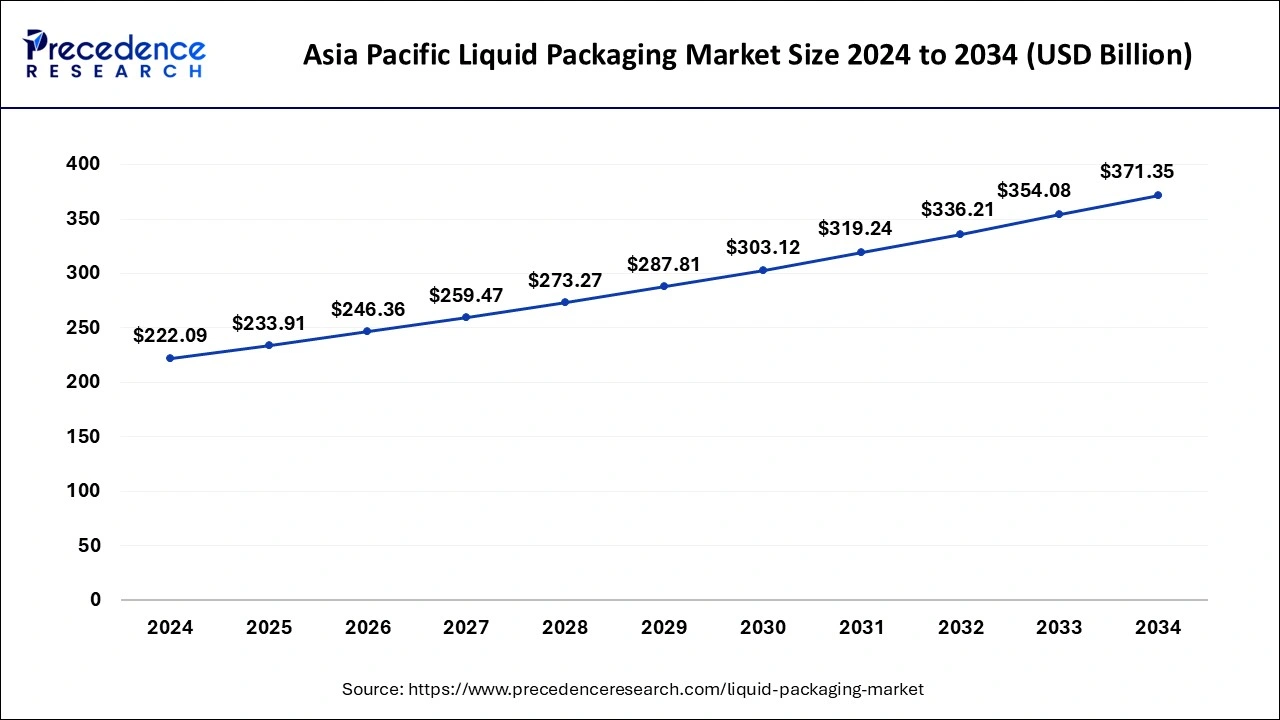

Asia Pacific Liquid Packaging Market Size and Growth 2026 to 2035

The Asia Pacific liquid packaging market size was estimated at USD 233.91 billion in 2025 and is predicted to be worth around USD 389.02 billion by 2035 with a CAGR of 5.22% from 2026 to 2035.

In terms of region, the Asia Pacific exhibits the highest demand for liquid packaging and accounted for around 44% value share in the year 2025. This is primarily because of the favorable government policies for manufacturers, expansion in pharmaceutical and food & beverage sectors, and the shifting of the production facilities in the region due to low operating and labor costs.

Besides this, North America expected to grow at a moderate rate over the forecast period. The U.S. is considered as the leading contributor towards the growth of the region because of prominent demand for liquid packaging along with rising implementation of paper products over other harmful materials in the region expected to propel the demand for liquid packaging in North America in the coming years.

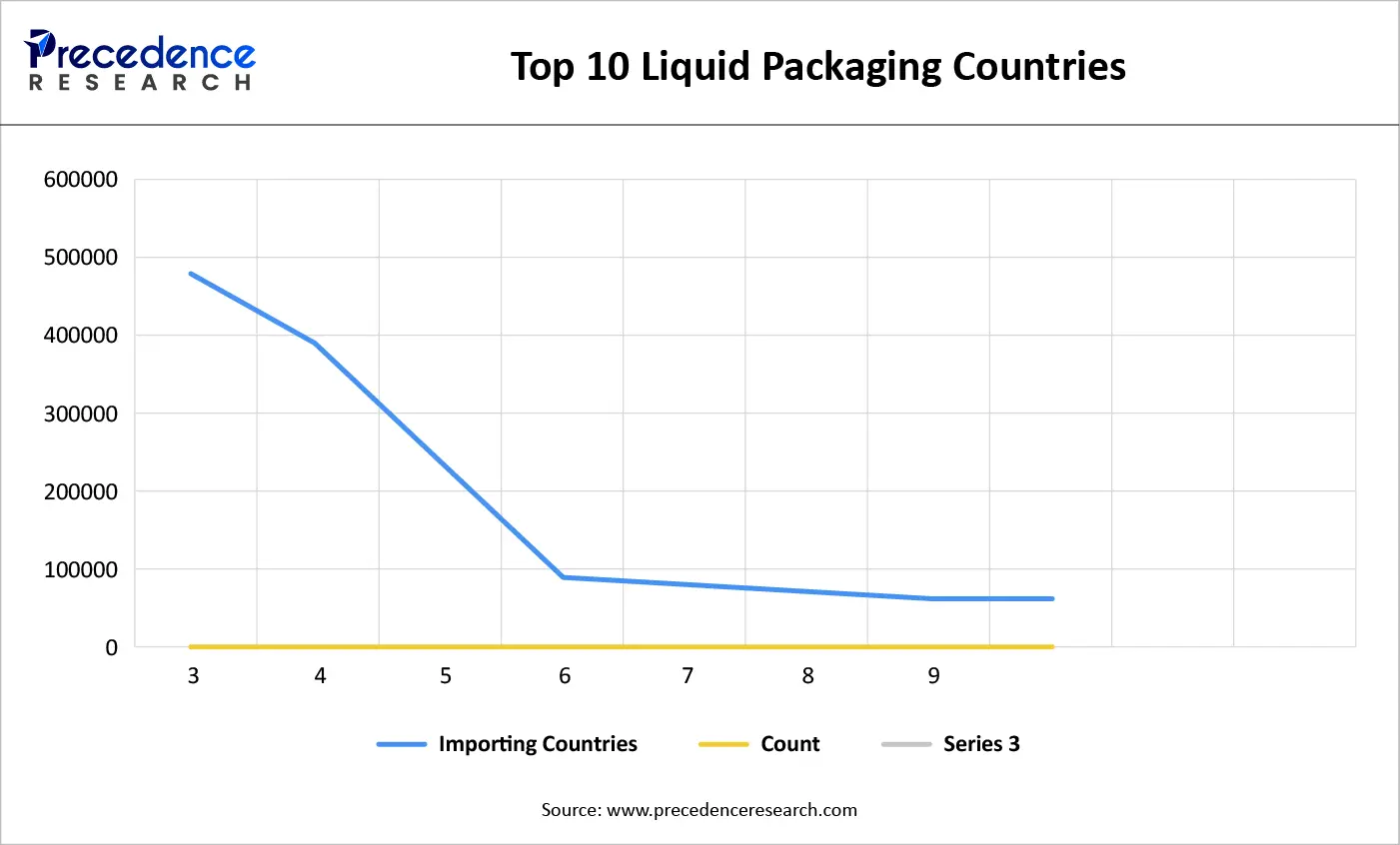

The diagram illustrates the top 10 liquid packaging importing countries, based on shipment volume data sourced from Volza Import Trade Data. Presented as a horizontal bar chart, it compares countries by the scale of their liquid packaging imports, offering a clear view of global demand concentration and market hierarchy.

Colombia emerges as the largest importer, with a significantly longer bar than the rest, indicating very high import volumes and strong domestic demand for liquid packaging solutions. Vietnam ranks second, reflecting rapid industrial growth, expanding food and beverage production, and rising consumption of packaged liquids. Russia and Ukraine follow, showing substantial but comparatively moderate import volumes, likely driven by demand from the beverage, chemical, and personal care industries.

Mid-tier importers such as Uzbekistan and Brazil demonstrate steady import activity, suggesting developing or regionally focused markets for liquid packaging materials. The United States appears further down the list, which may indicate a stronger reliance on domestic production rather than imports. Kazakhstan, Switzerland, and Japan occupy the lower ranks, reflecting smaller import volumes or highly specialized demand.

Overall, the diagram highlights a geographically diverse demand landscape, with emerging and developing economies playing a dominant role. It suggests that suppliers and exporters of liquid packaging solutions may find the greatest growth opportunities in Latin America, Southeast Asia, and parts of Eastern Europe, where import dependence and consumption growth are more pronounced.

Key Companies & Market Share Insights

The global liquid packaging market seeks intense competition among the market players because of rapid changes in the consumer preference that drive large number of innovation and product development. Further, the brand managers are largely focused towards grabbing maximum market share on the global scale on account of product differentiation and customization. For instance, in March 2020, Smurfit Kappa's new Top Clip solution was launched by a beer brewer Royal Grolsch as a paper-based material replacement for the plastic shrink wrap that are currently used on their can multi-packs.

Liquid Packaging MarketCompanies

- Comar LLC

- Tetra Laval International S.A.

- Liqui-Box Corporation

- Evergreen Packaging Inc.

- International Paper Company

- BillerudKorsnäs AB

- Nippon Paper Industries Co., Ltd.

- Klabin Paper

- The DOW Chemical Company

- Smurfit Kappa Group

- Mondi PLC.

Segments Covered in the Report

By Packaging Type

- Flexible

- Sachets

- Films

- Pouches

- Rigid

- Bottles

- Paperboard

- Drums

- Cans

- Containers

By Raw Material

- Paper

- Plastics

- PP

- PET

- PE

- Glass

- Metal

By Technique

- Modified Atmosphere Packaging

- Aseptic Packaging

- Intelligent Packaging

- Vacuum Packaging

By End-use

- Personal Care

- Food & Beverage

- Chemicals

- Pharmaceuticals

- Petrochemicals

- Household Care

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Get a Sample

Get a Sample

Table Of Content

Table Of Content