North America Liquid Packaging Market Size and Companies

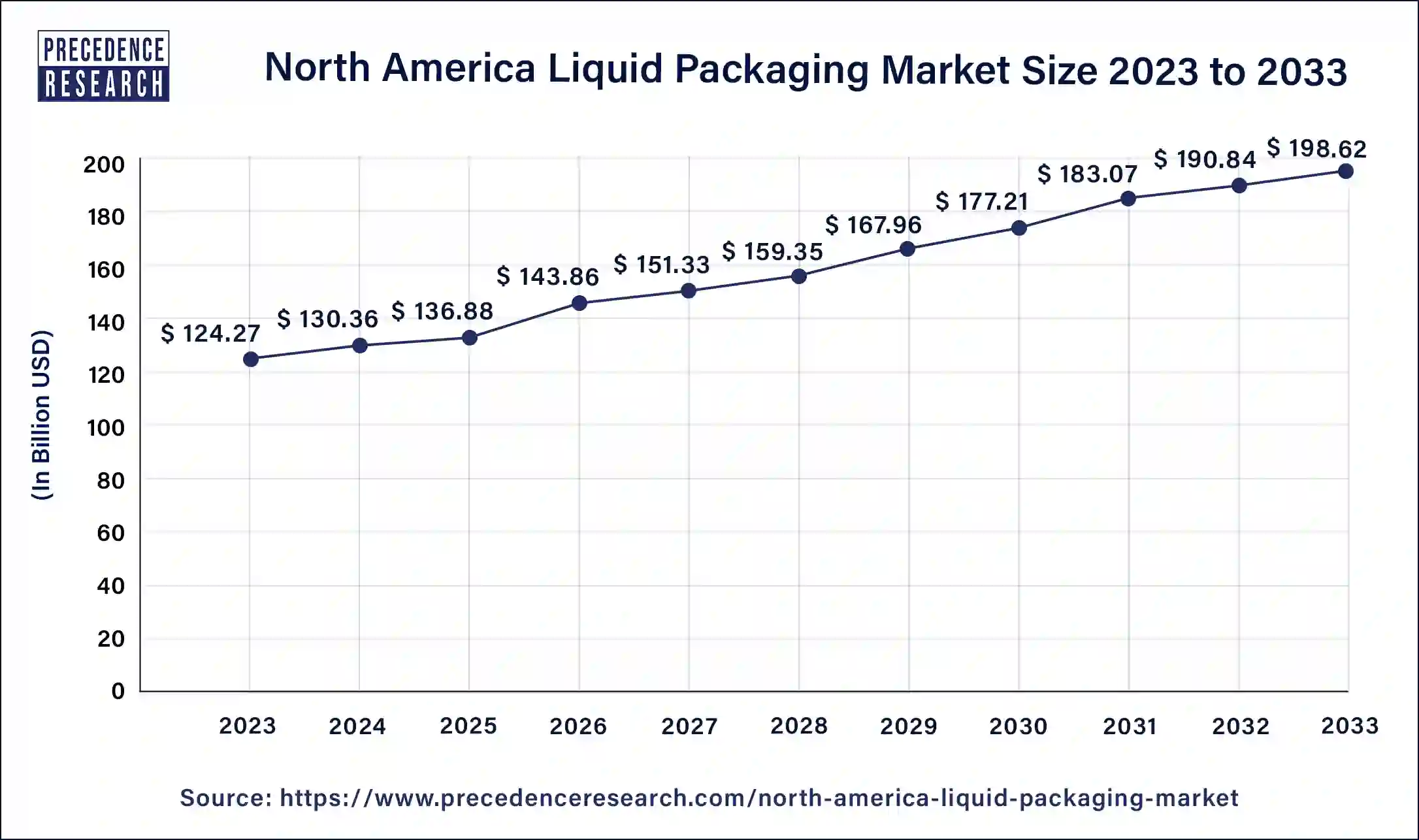

The North America liquid packaging market size was USD 124.27 billion in 2023, accounted for USD 130.36 billion in 2024, and is expected to reach around USD 198.62 billion by 2033, expanding at a CAGR of 4.80% from 2024 to 2033. The rising demand for efficient packaging solutions from the food and beverages industry is driving the growth of the market.

North America Liquid Packaging Market Key Takeaways

- The United States held the largest revenue share of 79% in 2024.

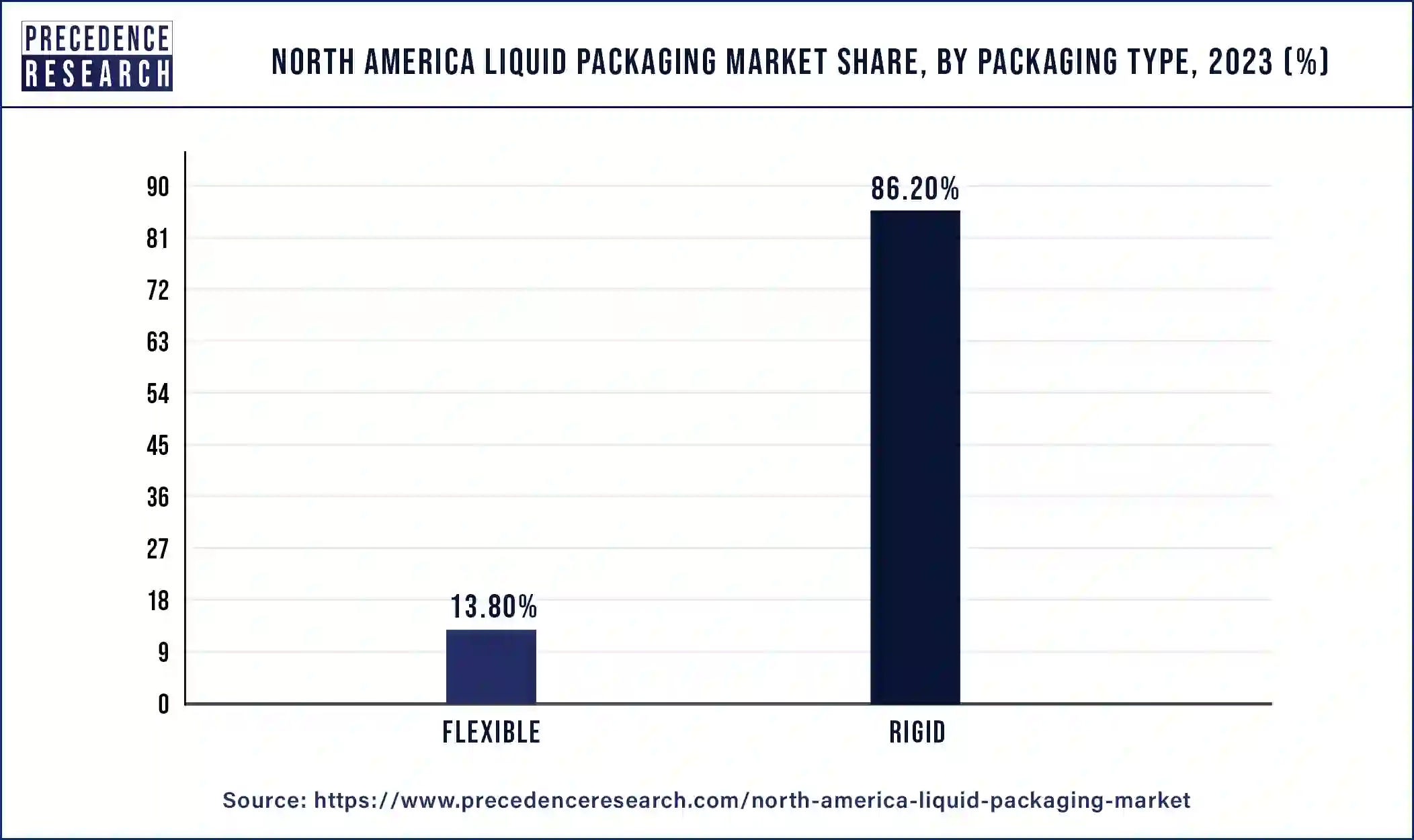

- By packaging Type, the rigid segment dominated the market with the largest revenue share of 86.20% in 2024.

- By packaging, the flexible segment is observed to grow a notable rate in the market during the forecast period.

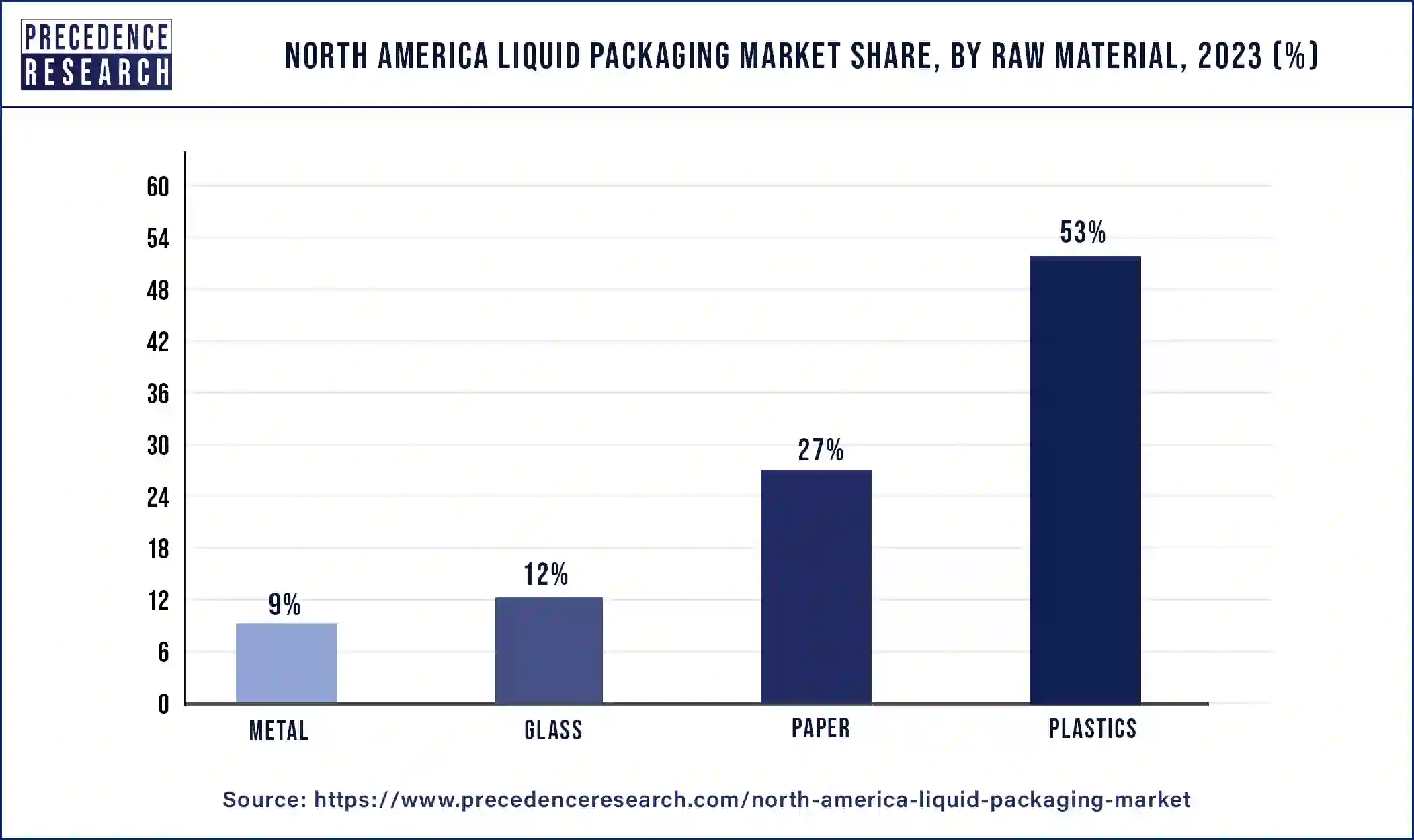

- By raw material, the plastic segment has contributed more than 53% of revenue share in 2024.

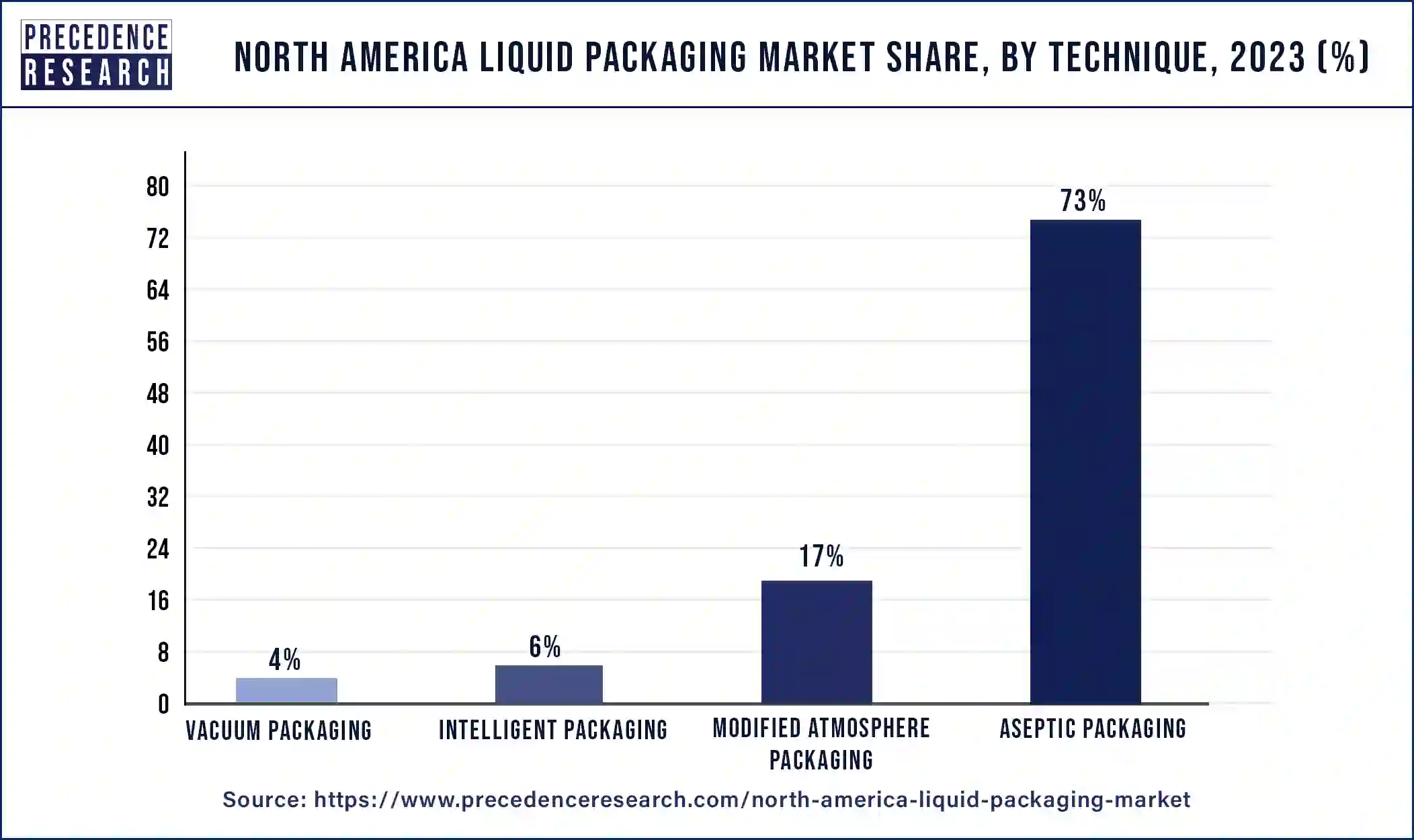

- By technique, the aseptic packaging segment has held a major revenue share of 73% in 2024.

- By end-user, the food and beverage segment has recorded the highest revenue share of 39.6% in 2024.

- By end-user, the pharmaceutical segment is expected to grow at a significant rate in the market during the forecast period.

- By raw material, the plastics segment is anticipated to show considerable growth in the market over the forecast period.

- By technique, the modified atmosphere packaging segment is anticipated to show considerable growth in the market over the forecast period.

How Is AI Integration Transforming the North American Liquid Packaging Market?

AI adoption is playing a significant role in changing the North American liquid packaging industry by improving the efficiency of production, quality control, and supply chain optimization. Manufacturers are also exploring machines powered by AI, which run the packaging process and notify about its defects in real-time, and maintain uniformity in the packaging standards. Quality assurance AI-based inspection tools can detect a leakage, adverse labeling, or variations in the packaging more precisely and faster compared to manual inspection methods.

AI is also helping in controlling supply chain management since it projects the trend in demand as well as judges the stocks and supplies against the demand. AI will be able to revolutionize the liquid packaging business by streamlining its operations, improving its precision, and helping in implementing pro-environmental programs, so that such businesses are in a position to meet their business and environmental needs.

U.S. Liquid Packaging Market Size and Growth 2024 to 2033

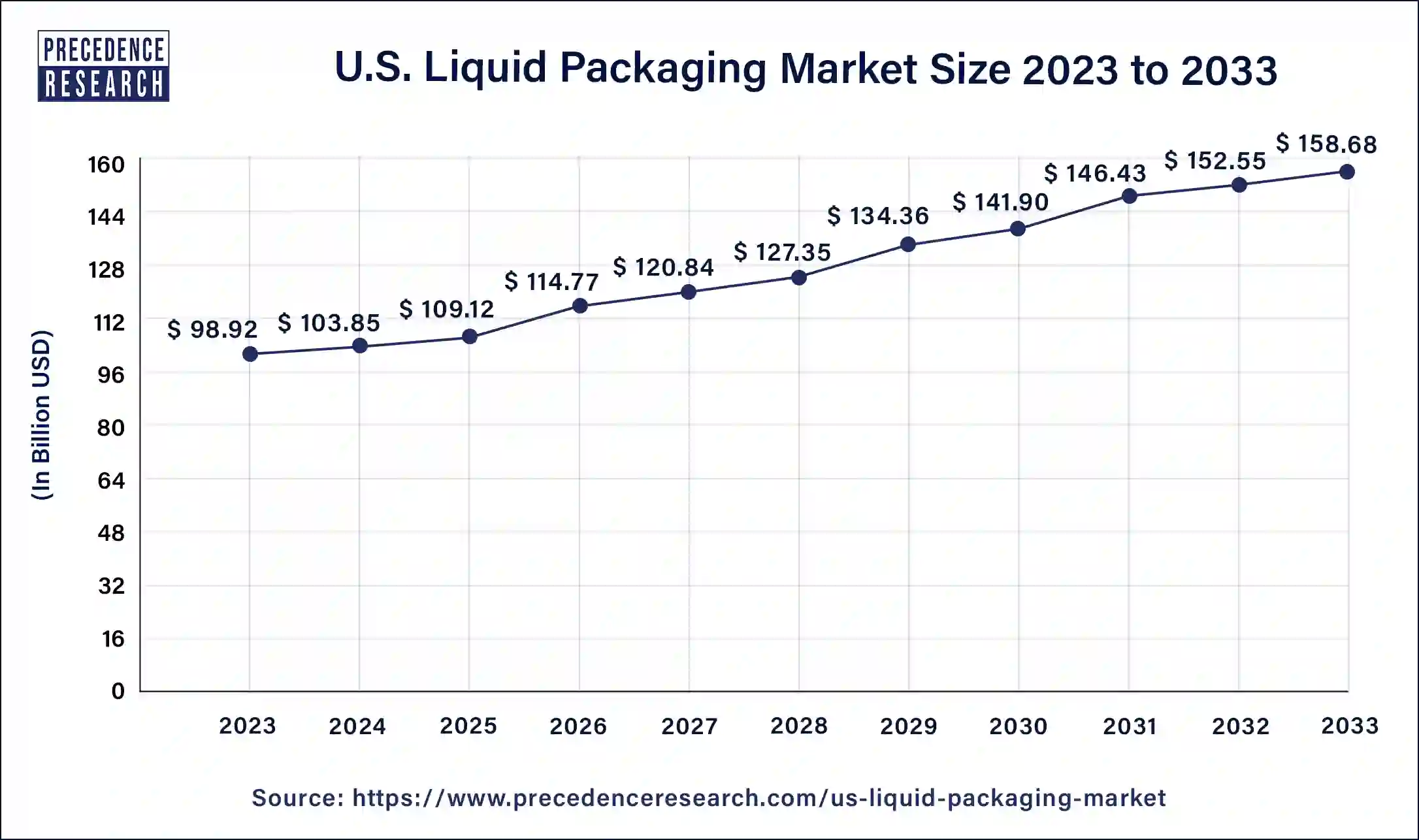

The U.S. liquid packaging market size surpassed USD 98.92 billion in 2023 and is projected to attain around USD 158.68 billion by 2033, poised to grow at a CAGR of 4.83% from 2024 to 2033.

The United States held the largest share in the North America liquid packaging market in 2023. The country is observed to sustain the position during the forecast period. The growth of the market is attributed to the rising demand for consumer goods in the population due to the increasing disposable income in the population and the rising industrialization is driving the demand for the packaging industry. The rising demand for the food and beverages industry pharmaceutical industry is driving the growth of the North America liquid packaging market.

North America held the dominating share of the liquid packaging market in 2024, driven by robust demand from the food and beverages, pharmaceutical, and personal care industries. The regional lifestyle has added to the huge popularity of ready-to-drink beverages, energy drinks, and convenience food products. The convenience of the liquid packaging systems with easy usability, long life, and portability is important. There is also the increased environmental concern that is driving the industry towards sustainable packaging formats, such as recyclable and biodegradable packaging materials.

The North American liquid packaging market is headed by the U.S., and this is attributed to the modern industrial base, steady progress in technology. Consumer demand for affordable and efficient, eco-friendly, and functional packaging is also influencing the U.S. market. Also, the very high e-commerce availability and increasing popularity of home delivery cause the further escalation of the necessity of effective and secure liquid packaging. With the mounting regulatory and consumer pressure concerning sustainability and product safety, the U.S. is likely to still occupy a leading role at the forefront of innovation and guiding light in the liquid packaging industry.

Market Overview

The materials and packaging styles used in the packing, transportation, and storage of liquids and semi-liquids are referred to as liquid packaging. It is crucial to choose the right liquid packing in order to permit safe transportation and long-term storage. It covers both flexible and rigid packaging formats, such as films, stand-up pouches, squeezable tubes, cartons, and bag-on-box. Rigid packaging formats include bottles and containers.

A single substrate can be used for liquid packaging, or it can be a multi-layered laminate, as in the case of liquid cartons. They are employed in the packaging of both food goods and non-food items like chemicals. The North America liquid packaging market is also growing rapidly due to the increased demand for lightweight packaging goods. To address cost-related concerns throughout the value chain, a number of manufacturers have started employing lightweight packaging goods.

North America Liquid Packaging Market Growth Factors

- Due to rising demand in the food and beverage and pharmaceutical industries, the size of the North America liquid packaging market is anticipated to expand rapidly over the forecast period.

- There is now more demand for packaged beverage products and other FMCG goods as a result of rising disposable income and changing lifestyles. Platforms for e-commerce offer services for all consumer goods that come in liquid packing, the factor is highly contributing in the expansion of the market.

- E-commerce co-packers also demand specialized packaging options with shorter lead times. Therefore, during the projection period, the expansion of the FMCG industry will increase demand for liquid packaging. Additionally, benefits of flexible liquid packaging like convenient and user-friendly packaging, the capacity to preserve freshness and lengthen the shelf life of food, reduced food product packaging costs, the elimination of material wastage, and the ability to customize packages all contribute to the market growth for liquid packaging.

- The most popular type of liquid packing is rigid liquid packaging. Packing materials for rigid liquids include PET bottles, paperboard, glass, cans, and cartons. The greatest subset of rigid liquid packaging is plastics and PET bottles. Liquid products like water, fizzy drinks, wine, beverages, dairy products, and others are frequently packaged using them.

- Long shelf life and durability, packaging has gained popularity across a variety of industries. The lack of a comparable level of cost-effective replacement in currently offered solutions is expected to drive future growth of the North America liquid packaging market.

Market Scope

| Report Coverage | Details |

| North America Market Size in 2025 | USD 124.27 Billion |

| North America Market Size in 2024 | USD 130.36 Billion |

| North America Market Size by 2034 | USD 198.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging Type, Raw Material, Technique, and End-Use |

North America Liquid Packaging Market Dynamics

Driver

The increasing demand for plastic packaging

Since consumers prefer packaging that is portable and easy to carry, the use of plastics in packaging has increased due to the material's strength and light weight, which has also increased demand in the packaging sector. Manufacturers are favoring plastic packaging across industries due to its affordability and ability to extend product shelf life. Flexible plastic packaging is considered to be the ideal choice because of package reduction efforts, rising end-user demand, and improvements in global production processes.

It is anticipated that improvements in the healthcare, pharmaceutical, and cosmetics industries will increase demand for plastic packaging products. More than 60% of American consumers, according to the Flexible Packaging Association, are willing to pay more for practical and tangible packaging benefits, such as product protection, transportation friendliness, and supply chain efficiency, among others. This increases the demand for plastic packaging and, consequently, the packaging industry is contributing to the expansion of the North America liquid packaging market.

Restraint

Fluctuation in raw material prices

The rising price of polypropylene results in the restriction in supply, slowing imports, and exports to Latin America. Additionally, the Mintec Global Packaging Index increased by four points to 96.3, suggesting that the average cost of plastic packaging materials is 55 cents per pound. Thus, the supply chain failure due to the spike in the price of raw materials is restraining the growth of the North America liquid packaging market.

Opportunity

Shifting toward renewable and innovative packaging solutions

Natural resources that are quick to replenish and are easy to grow are known as renewable raw materials. Innovative packaging solution providers have created effective, efficient, and environmentally friendly packaging solutions by fusing renewable raw materials with cutting-edge technology and creative design. Plastic and cardboard are common materials used in packaging today, and their value chains have been well-optimized.

Some renewable raw materials that can be utilized as sustainable packaging in place of traditional plastic are gaining popularity. Paper is sustainable, resource-saving, effective, and recyclable, thus cardboard and paper pulp have long been favorites. Thus, adoption of such material in the packaging industry is expected to set new opportunities over the upcoming years.

Packaging TypeInsights

The rigid segment dominated the market with the largest market share in 2023. Due to the widespread usage of glass and plastic bottles and containers, the rigid liquid packaging sector held the greatest market share. The greatest subset of rigid liquid packaging is plastics and PET bottles. Liquid products like water, fizzy drinks, wine, beverages, dairy products, and others are frequently packaged using them. The conventional packaging type for liquid items is rigid liquid packaging since it is chemically, impact, and moisture resistant as well as recyclable.

The flexible segment is observed to grow at a notable rate in the market during the forecast period. The rising adoption of flexible packaging as an alternative to rigid packaging in the wide range of consumer goods is contributing to the growth of the segment. The rising adoption of flexible packaging solutions by the personal care and cosmetics industry is expected to support the segment's expansion.

North America Liquid Packaging Market Revenue (USD Billion), By Packaging Type, 2022 - 2024

| Packaging Type | 2022 | 2023 | 2024 |

| Flexible | 16.24 | 17.13 | 18.09 |

| Rigid | 102.33 | 107.14 | 112.28 |

Raw Material Insights

The plastics segment is expected to grow at a significant CAGR over the forecast period, driven by its multiplicity, low cost, and application in various sectors. PET (polyethylene terephthalate), HDPE (high-density polyethylene), and LDPE (low-density polyethylene) are used as liquid packaging materials since they are lightweight, durable, and have leakproof qualities.

These materials provide barriers to moisture, air, and contaminants and thus would be excellent materials to package beverages, personal care products, household cleaners, and pharmaceutical liquids. The growing demand of the food and beverage market for single-use and mobile packs associated with the on-the-go consumption and its supporting burgeoning e-commerce and food delivery segments is also contributing to increased usage of plastic packaging.

Technique Insights

The modified atmosphere packaging (MAP) segment is expected to grow substantially in the North American liquid packaging market. MAP technology is the process of changing the atmosphere inside the package, which usually decreases oxygen and increases the amount of carbon dioxide or nitrogen to delay the growth of microbes and the oxidation process.

The method also proves to be very valuable in packing on liquid food items like dairy products, juices, soups, and sauces, whereby freshness and taste are of utmost importance. Such advances as high-barrier films and smart sensors that detect the gas composition inside a package are making the MAP systems even more effective. As the region is preoccupied with food safety, product quality, and sustainability, the modified atmosphere packaging niche will assume a significant role in changing the liquid packaging industry.

End-User Insights

The food and beverage segment dominated the North America liquid packaging market in 2023. Food & beverage is the largest end-use industry for liquid packaging. The food and beverage-associated businesses are expanding quickly, and its expansion is being aided by increased economic prosperity and population growth. Bag-in-box, stand-up pouch, plastic & PET bottles, cans, glass, films, paperboard, and cartons are some of the several packaging styles used for food & beverage packaging. These packaging options are used for liquid products like water, juices, dairy products, drinks, wine & spirits, detergents, and household cleaning supplies, among others.

The pharmaceutical segment is expected to grow at a significant rate in the market during the forecast period. The rising pharmaceutical and healthcare industry in the region, and the rising demand for the packaging material for pharmaceutical storage of drugs that fueling the growth of the segment in the market.

North America Liquid Packaging Market Companies

- Comar LLC

- Tetra Laval International S.A.

- Liqui-Box Corporation

- Evergreen Packaging Inc

- Nippon Paper Industries

Recent Developments

- In May 2024, North American paper & packaging industry, the 2 private equity deals in Q1 2024, with the total value of $230 million as per the data of GlobalData's Deals Database.

- In May 2024, ColorMatrix, a subordinate of PolyOne Corporation and a leading producer in liquid color and additives for plastics, launched the latest generation FlexCart™ proprietary liquid dosing system.

- In February 2024, Amcor plc cooperated with Stonyfield Organic and Cheer Pack North America to present the first all-polyethylene (PE) spouted packaging, which represented an important step toward sustainable packaging. The new approach will allow Stonyfield Organic to abandon using the multi-laminate package that had been utilised formerly by the company to pack its YoBaby refrigerated yogurt by instead using an environmentally friendly and recycle-ready mono-material PE design.

Segments Covered in the Report

By Packaging Type

- Flexible

- Pouches

- Films

- Sachets

- Others

- Rigid

- Bottles

- Cartons

- Paperboard

- Cans

- Containers

By Raw Material

- Plastics

- PET

- PP

- PE

- Paper

- Glass

- Metal

By Technique

- Aseptic Packaging

- Modified Atmosphere Packaging

- Intelligent Packaging

- Vaccum Packaging

By End-Use

- Food & Beverage

- Pharmaceuticals

- Chemicals

- Personal Care

- Petrochemicals

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting