North America Packaging Market Size and Forecast 2025 to 2034

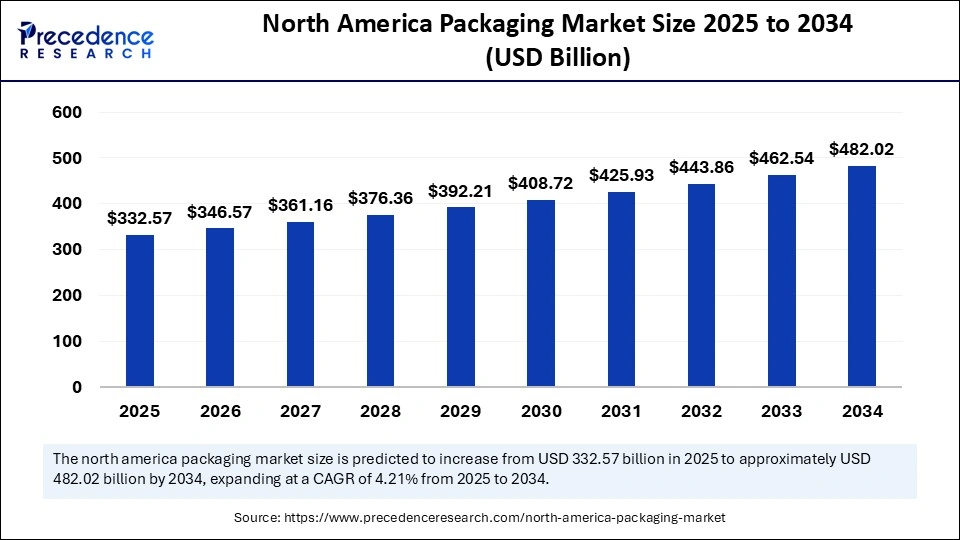

The North America packaging market size accounted for USD 319.13 billion in 2024 and is predicted to increase from USD 332.57 billion in 2025 to approximately USD 482.02 billion by 2034, expanding at a CAGR of 4.21% from 2025 to 2034.

North America Packaging Market Key Takeaways

- In terms of revenue, the North America packaging market was valued at USD 319.13 billion in 2024.

- It is projected to reach USD 482.02 billion by 2034.

- The market is expected to grow at a CAGR of 4.21% from 2025 to 2034.

- By material type, the plastic segment dominated the market in 2024.

- By material type, the paper and paperboard segment is expected to grow the fastest during the forecast period.

- By packaging type, the flexible packaging segment led the market in 2024.

- By packaging type, the rigid packaging segment is expected to grow the fastest during the forecast period.

- By product type, the boxes and cartons segment captured the biggest market share in 2024.

- By product type, the pouches segment is expected to grow at the fastest CAGR during the forecast period.

- By End-Use Industry, the food packaging segment contributed the highest market share in 2024.

- By End-Use Industry, the healthcare and pharmaceuticals segment is the fastest growing during the forecast period.

- By Functionality, conventional packaging segment generated the major market share in 2024.

- By Functionality, the eco-friendly packaging segment is the fastest-growing during the forecast period.

Impact of AI in this field

AI-driven tools are transforming the North America packaging market in various ways. In the designing sector, AI tools can help in faster designing with the help of algorithm-based iterations, generating numerous design options almost immediately. Designers can also use automated stress analytics to check the strength of packaging before developing them into physical prototypes. This leads to faster product launches, lower development costs and reduced wastage of resources. As a result, brands can enter the market more quickly while maintaining high standards of quality and innovation. The rising consumer expectations for personalized experiences also drive the expansion of artificial intelligence (AI). AI algorithms can now focus on aspects such as colors, visuals and messaging catered to specific regions or demographic groups, making packaging more relevant to target audiences. By analyzing customer data like buying behavior and preferences, brands are able to create unique packaging at scale which also strengthens brand loyalty and boosts product visibility.

Furthermore, AI's ability to support data-driven decisions and adapt smoothly to North America packaging market changes also proves to be beneficial. AI tools analyze consumer feedback, forecast trends, and deliver insights that guide packaging innovations. By using this intelligence, brands can quickly react to shifts in consumer preferences or competitor moves, adjusting their packaging strategies in real time and gaining a strategic advantage. Additionally, AI-powered virtualization tools enable rapid testing and iteration, thereby minimizing the risks and expenses associated with traditional trial-and-error methods. All these factors underscore how AI tools and systems are enabling companies to maintain a competitive edge in today's rapidly evolving consumer markets.

Market Overview

Packaging refers to the materials and processes used to protect, contain, transport, and present products from production to consumption. It plays a crucial role in ensuring product safety, extending shelf life, enabling branding, complying with regulations, and enhancing consumer convenience. Factors such as rising demand for cosmetics, growing sales of entertainment equipment, accelerating consumption of single-use packaging, rise in goods exports and rapid urbanization have driven the growth of the North America packaging market. The packaging market is experiencing robust growth driven by rising consumer demand for convenience, sustainability, technological advancements in packaging materials, and the expansion of e-commerce, with a shift towards eco-friendly solutions and innovative packaging designs across industries like food, beverages, pharmaceuticals, and personal care.

What are the Key Trends in the North America packaging market?

- One of the most important trends in the North America packaging market is the rise of sustainable packaging solutions. Consumers and brands are becoming increasingly environmentally conscious, driving a greater demand for recyclable, biodegradable, or renewable materials for packaging purposes. Both regulatory bodies and environmentally aware consumers are compelling companies to come up with alternatives to traditional plastic packaging. The Canadian government has introduced stringent policies to reduce single-use plastics, supporting the growth of recyclable, reusable, and compostable packaging.

- The integration of smart packaging technologies is another big trend that is influencing North America. Smart technologies include features such as QR codes, RFID tags and temperature indicators that change the way products are packaged, tracked and consumed. Smart packaging enables manufacturers to obtain real-time data about the condition of a product, including temperature, humidity, or even tampering. This feature proves vital for industries such as food and pharmaceuticals.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 482.02 Billion |

| Market Size in 2025 | USD 332.57 Billion |

| Market Size in 2024 | USD 319.13 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.21% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Packaging Type, Product Type, End-Use Industry, and Functionality |

Market Dynamics

Drivers

The North America packaging market is witnessing a strong demand for convenient, lightweight, and portable packaging, particularly in the food, beverage, and personal care sectors. Consumers now prefer single-serve, resealable, and easy-open formats that fit their busy lifestyles and urban living standards. Brands are responding quickly by developing innovative designs that extend shelf life and minimize waste. Retailers are also looking into packaging tactics that protect products and reduce damage during transport. Technological advancements are also reshaping the market as companies increasingly adopt digital printing, active packaging, and smart labeling solutions. Features like QR codes and temperature indicators enhance product traceability and reinforce brand trust. Furthermore, the region's large-scale investments in Industry 4.0 technologies are increasing efficiency and throughput, making advanced packaging more accessible and cost-effective.

Restraints

The market faces its fair share of challenges due to strict environmental regulations and shifting compliance requirements. Government mandates on single-use plastics, minimum recycled content, and waste management standards require significant operational modifications. Companies are compelled to invest in sustainable materials and update labeling to align with evolving environmental policies. This complex regulatory landscape needs proactive monitoring and strategic planning from industry participants, making it challenging for companies to keep up.

The North America packaging market faces another challenge of raw material costs, primarily paper and cardboard. Unforeseen fluctuations in these can significantly impact profitability and operational efficiency for manufacturers. External factors such as weather conditions can affect raw material cultivation and impact regional supply, further complicating the situation.

Opportunity

The North America packaging market presents strong opportunities through the expansion of sustainable packaging options. Increasing consumer and regulatory demand for recyclable, biodegradable, and compostable products has opened up new revenue streams for manufacturers. Investment in advanced materials and closed-loop recycling technologies has enabled companies to capture value from circular economy initiatives. The integration of post-consumer resin and bio-based plastics into mainstream packaging has also helped align the retailer with end-user expectations. This forces the market to focus more on eco-innovation and responsible production.

The surge in e-commerce activity and rising demand for customized, secure packaging solutions also offer significant opportunities for the market. Companies can capitalize on the need for tamper-evident, easy-to-handle, and lightweight designs tailored for direct-to-consumer shipments. Furthermore, the adoption of digital printing, automation, and smart packaging enhances operational agility and supply chain efficiency, thus enabling manufacturers to meet evolving logistics requirements and reduce lead times. This will allow the North America packaging market to differentiate its offerings and capture a broader customer base in the coming years.

Material Type Insights

Which material dominated the North America packaging market in 2024?

Plastic dominated the market in 2024. This dominance is due to its versatility, cost-effectiveness, and excellent barrier properties. Plastic offers lightweight and durable packaging solutions that are ideal for protecting a wide range of products, including food, beverages, pharmaceuticals, and various consumer goods. The advantage lies in the material's ability to be molded into various shapes and sizes, making it highly adaptable in both traditional as well as innovative packaging designs. Furthermore, a rise in biodegradable and recyclable plastics have also alleviated environmental concerns, encouraging its continued use.

Paper and paperboard are seen to be the fastest-growing segment throughout the forecast years. This growth is largely due to the shift in sustainability concerns and stringent regulations that restrict the use of single-use plastics across the U.S and Canada. Consumers now view paper as a greener or ecologically friendlier choice. Brands are also responding actively by switching to paper-based cartons, boxes and wraps wherever possible. Advances in coated and water-resistant paperboard are further fueling the growth of this segment.

Packaging Type Insights

Which Packaging Type Is Leading the North America Packaging Market Currently?

Flexible packaging currently dominates the market in 2024. This dominance is due to the lightweight and compact nature of this type of packaging, which in turn reduces material use, shipping costs, and carbon footprint, making it appealing to cost-conscious brands and e-commerce platforms. This segment also offers features like resealable zippers, spouts, and easy-tear strips, meeting consumer demands for on the go and user-friendly formats. Technological innovations such as multi-layer films, enhanced barrier coatings, high-quality digital printing, and smart packaging also drive this segment forward.

The rigid packaging type segment is seen to be the fastest-growing segment in the market due to its superior strength, durability, and protective qualities. Rigid packaging such as bottles, containers, cans, and boxes provide excellent structural integrity, making it an ideal choice for keeping products safe and protected during transportation and storage. Its widespread use in industries like food and beverages, pharmaceuticals, personal care, and household goods further strengthens its market position.

Product Type Insights

Which Product Type Has the Largest Market Share in 2024?

Boxes and cartons are expected to hold the largest market share in 2024. This is because consumers tend to perceive cartons and boxes as more eco-friendly than compared to plastics, thus making them a popular choice in the food and beverage industry. Packaging innovations such as lightweight corrugated solutions, water-resistant coatings, and improved printability are also helping this segment move forward and expand beyond its traditional uses.

Pouches are the fastest growing segment as of this year. Their rise is closely linked to the increase in e-commerce practices and sustainability demands. Their popularity stems from convenience, flexibility, and cost-effectiveness. They are a popular choice because they offer resealability, extended shelf life, and lightweight transport advantages compared to rigid packaging containers. Since they use less material and provide ease of storage, many brands and companies prefer to use them.

End User Insights

Which End User Led the North America Packaging Market This Year?

The food and beverage segment dominated the market this year. Their dominance is quite straightforward in nature, as almost every item in this segment requires some kind of packaging, whether for preservation purposes, branding,,transportation, or regulatory compliance. The food and beverage sector consumes a vast array of packaging formats, ranging from cereal boxes to frozen food pouches and snack bags. Furthermore, a rising demand for convenience-based foods like ready-to-eat microwaveable meals, ready-to-drink beverages, and on-the-go snacking options continues to boost this segment.

The healthcare and pharmaceutical segment is seen to be the fastest growing as of 2024. The growth is tied to multiple factors like the expanding pharmaceuticals industry, rising healthcare expenditure and the rapidly aging population all across the region. With the rise in prescriptions, e-commerce medicine providers, and health supplements being consumed, the rise of packaging also increases. The Covid-19 pandemic also accelerated the use of single use blister packs, vials and sterile pouches, pushing the demand for durable, safe and hygienic packaging options.

Functionality Insights

Why Is Conventional Packaging Dominating the North America Packaging Market?

Conventional packaging has dominated the North America packaging market in 2024. The reason behind this dominance is its scale of use, as plastics, foils and traditional solutions are deeply embedded in supply chains. They offer unmatched affordability, scalability and durability and they continue to support the vast majority of consumer as well as industrial packaging, all the way from PET bottles to corrugated boxes. Companies prefer to rely on pre-established packaging systems and logistical networks built around these conventional formats, further cementing their popularity.

The eco friendly packaging segment is the fastest growing segment as of this year. This surge is driven by regulatory practices, government initiatives, and changing consumer preferences. Governments across the U.S and Canada are tightening their restrictions around plastic use and large scale companies like Walmart and Amazon are shifting towards more recyclable packaging options, further accelerating the innovation in biodegradable films, molded fiber trays and paper based alternatives.

Value Chain Analysis

- Raw materials suppliers

This stage involves the procurement of raw materials which are required for packaging such as paper, plastics, metals, glass and biopolymers. North America has a strong focus on sustainable and recyclable materials due to regulatory pressures and consumers' views about eco-friendly packaging. Companies are increasingly using FSC-certified paper and bio-based plastics to meet environmental goals.

Key players: NOVA chemicals, Eastman, NatureWorks

- Material manufacturing and conversion

This stage converts the raw materials into usable packaging formats such as films, laminates, boxes, containers, folding cartons, and even flexible pouches. This stage is where technical differentiation happens and where capital intensity along with automation levels determine unit cost and lead time. The region has also been investing in high-speed automated lines to increase efficiency.

Key players: Berry Global, Sealed Air, Ball Corporation, WestRock

- Design, Branding and Smart packaging

At this stage, packaging and design choices not only protect the product's integrity but also influence its shelf appeal. It balances multiple aspects like packing structure, user convenience, smart features, and storytelling. The design team must align itself with the marketing aims. They must successfully translate retailer requirements into technical specs.

Key players: Avery Dennison, Esko, IDEO

North America Packaging Market Companies

- Bemis Company, Inc.

- Amcor

- Berry Global Group, Inc.

- Constantia Flexibles Group GmbH

- Sonoco Products Company

- Ball Corporation

- Crown Holdings Inc.

- Graphic Packaging Holding Company

- Huhtamaki Group

- Georgia-Pacific LLC

- Coveris Holdings S.A.

- Printpack, Inc.

- Reynolds Group Holdings

- Owens-Illinois Inc.

- AptarGroup Inc.

- Tetra Pak International S.A.

Recent Developments

- In August 2025, Metropolis Coffee Co. will team up with Compostable Solutions and Jura-Tech to produce compostable espresso capsules compatible with Nespresso Original Line machines. The Chicago-based coffee roaster, which supplies its goods to restaurants, hotels, and other institutions, is thought to be the first in the U.S. to use fully compostable pods and lidding.(Source: https://www.yahoo.com)

- In May 2025, KIND Snacks, a company well-known for its healthy snacks, launched its first curbside recyclable paper wrapper project. Made with pulpable paper, KIND's pilot will be leveraging a curbside recyclable, How2Recycle pre-qualified paper type. This innovative packaging material will encourage consumers to recycle, enabling them to make a kinder choice - both on the shelf and for the planet.(Source: https://www.mars.com)

Segments Covered in the Report

By Material

- Plastic Packaging

- Paper & Paperboard

- Glass Packaging

- Metal Packaging

- Biodegradable Packaging

By Packaging Type

- Flexible Packaging

- Rigid Packaging

By Product Type

- Bottles & Jars

- Pouches

- Cans

- Boxes & Cartons

- Trays

- Films & Wraps

By End-Use Industry

- Food & Beverages

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Household Products

- Industrial Packaging

- E-commerce & Retail

By Functionality

- Conventional Packaging

- Sustainable/Eco-Friendly Packaging

Get a Sample

Get a Sample

Table Of Content

Table Of Content