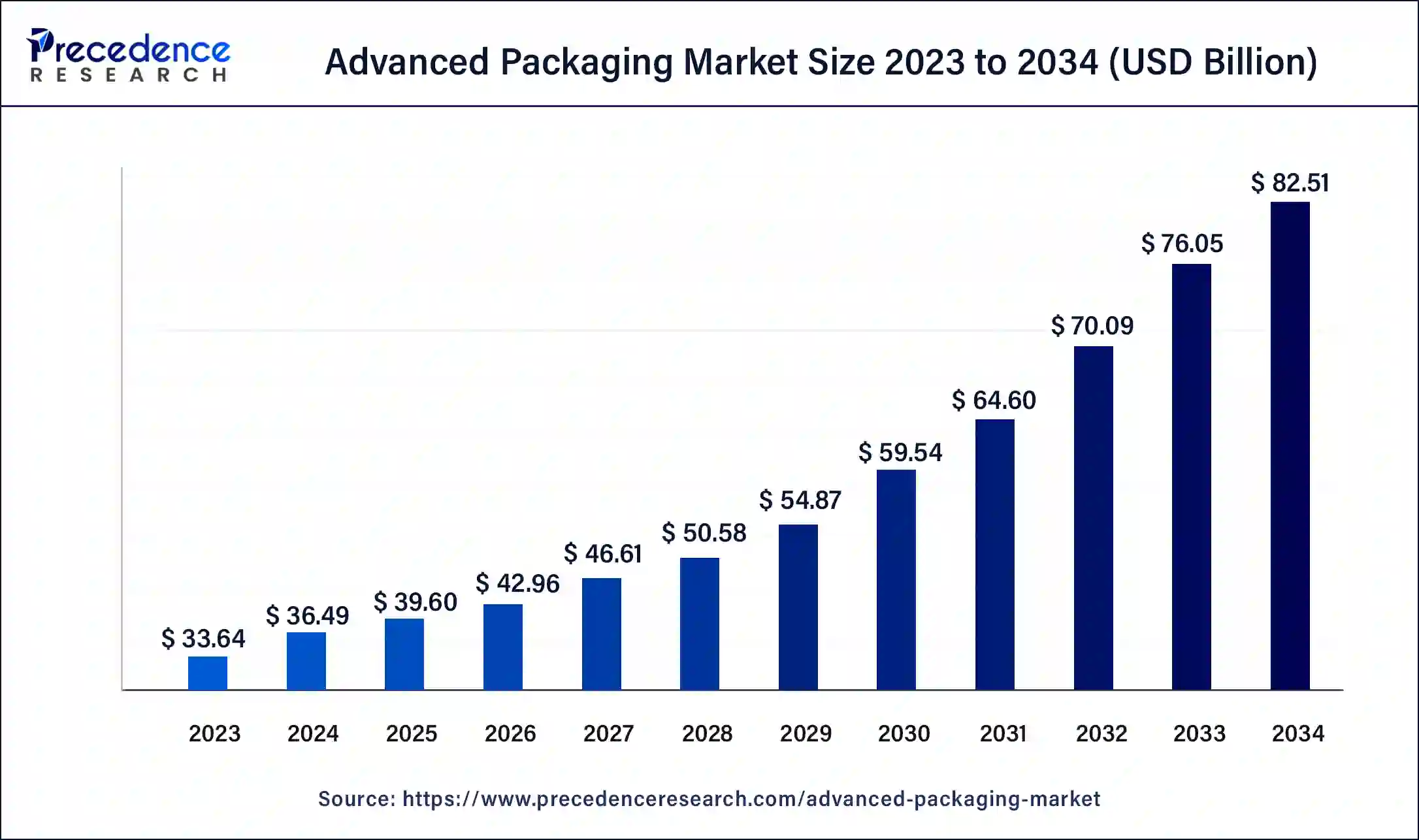

What is the Advanced Packaging Market Size?

The global advanced packaging market size is valued at USD 39.60 billion in 2025 and is predicted to increase from USD 42.96 billion in 2026 to approximately USD 88.63 billion by 2035, expanding at a CAGR of 8.39% from 2026 to 2035

Market Highlights

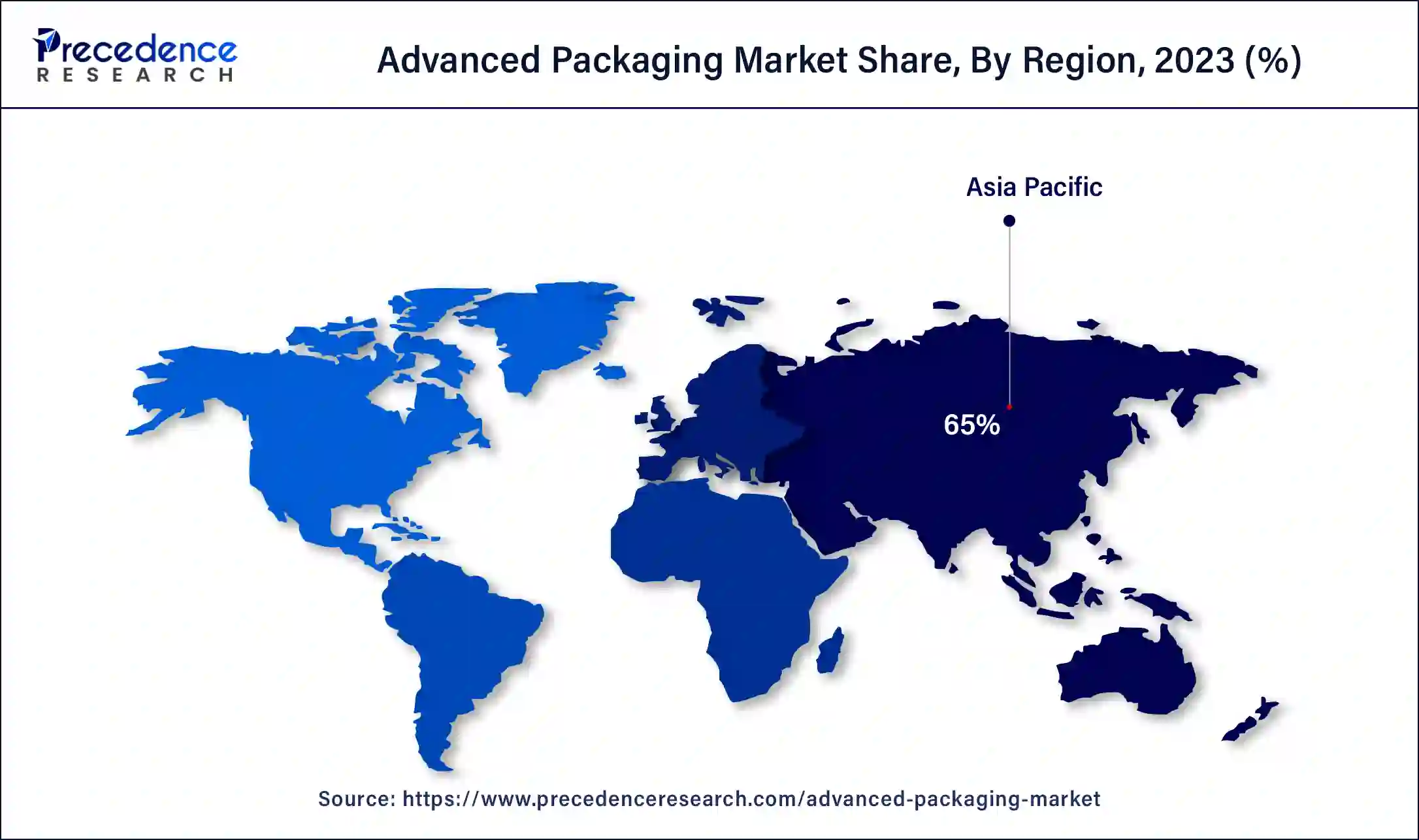

- Asia Pacific led the global market with the largest market share of 65% in 2025.

- North America is expected to expand at the fastest CAGR during the forecast period.

- By Type, the fan-out wafer-level packaging (FOWLP) segment has held the largest revenue share in 2025.

- By End-use, consumer electronics dominated the global market in 2025.

Market Outlook

- Industry Growth Overview: The advanced packaging market is growing, driven by rising demand for high-performance and contracted electronic devices. The increase of electric vehicles (EVs) and modern driver-assistance systems (ADAS) needs robust, high-performance semiconductor packages.

- Global Expansion: The advanced packaging market is experiencing global expansion due to the increasing requirement for high-performance, miniaturized electronics in various sectors such as consumer electronics, 5G, and AI. Asia-Pacific leads this growth, driven by growing manufacturing ecosystems in Taiwan, China, and South Korea.

- Major investors: Major investors are large integrated device manufacturers (IDMs) like Intel and Samsung, foundries such as TSMC, and outsourced semiconductor assembly and test (OSAT) companies such as ASE Group and Amkor Technology.

Advanced Packaging Market Growth Factors

The emergence in the advanced packaging technology has minimized the installation cost of ICs and enhances the output and efficiency of ICs and this factor is expected to drive the market growth. Also, with augmentation of IC in the automobiles, the demand for advanced packaging surged and this contributed positively towards the growth of the advanced packaging market. For instance, on 10th May 2021, Veeco Instruments Inc. announced that it has received an order for its AP300 Lithography System used in the production ramp of advanced packaging chips. This advanced packaging devices will be used to meet increasing demand for 5G system-on-a-chip, graphic processors (GPUs) and high performance computing applications. The AP300 systems were selected due to its industry-leading uptime and performance along with low ownership cost. This order indicates the fostering market demand for Veeco's lithography systems.

With the development in packaging technology, the functional density of large system-on-chip solutions has increased and this fosters the market growth. Moreover, the continuous research and developmental activities are performed in order to develop new and innovative packaging solutions and this will accelerate the growth of the advanced packaging market. Also, the rising demand for improving the performance of the electronic devices is estimated to fuel the growth of advanced packaging market. For instance, on 30th March 2021, YES (Yield Engineering Systems, Inc.), a leading manufacturer of process equipment for life sciences, semiconductor advanced packaging and AR/VR applications announced that it has received a large volume purchase order for the VertaCur XP from Taiwan-based OSAT Powertech Technology, Inc. The systems, which will be utilized for flip chip and wafer-level-packaging in high volume manufacturing, and it is expected to be delivered in the first half of 2021 to address growing production demands.

Furthermore, the surge in miniaturization of devices is assisting the embedded die packaging market gain renewed demand. Also, the heavy Government investment in developing semiconductor manufacturing plants specially in the developing nations are estimated to fuel the growth of market.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 42.96 Billion |

| Market Size in 2026 | USD 42.96 Billion |

| Market Size by 2035 | USD 88.63 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.39% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, End Use, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segment Insights

Type Insights

TheAdvanced Packaging Market is divided into Flip Chip CSP, Flip-Chip Ball Grid Array, Wafer Level CSP, 5D/3D, Fan Out WLP and Others. In this segment, the Fan-out wafer-level packaging (FOWLP) product type segment is accounted for contributing a significant market share amounting in 2024 and is expected to grow significantly during the forecast period. It is because of the significant benefits it provides such as lower thermal resistance, substrate-less package and higher performance. For instance, In 11th January 2021, Veeco Instruments Inc. announced that National Chiao Tung University (NCTU), based in Hsinchu, Taiwan, has been selected Veeco to be an important partnerin its initiative to boost the Taiwan's semiconductor production.

End-use Insights

TheAdvanced Packaging Market is divided into Consumer Electronics, Automotive, Industrial, Healthcare, Aerospace & Defense and Others. In this segment, the consumer electronics is accounted for contributing a significant market share in2024 and is expected to grow significantly during the forecast period owing to the increase in demand for consumer electronics products in the market such as mobile phones, laptops, air conditioners and many others. Also, the demand for miniaturization of the electronic devices will provide huge growth opportunities. All these factors positively impact the growth of the Advanced Packaging Market.

Regional Insights

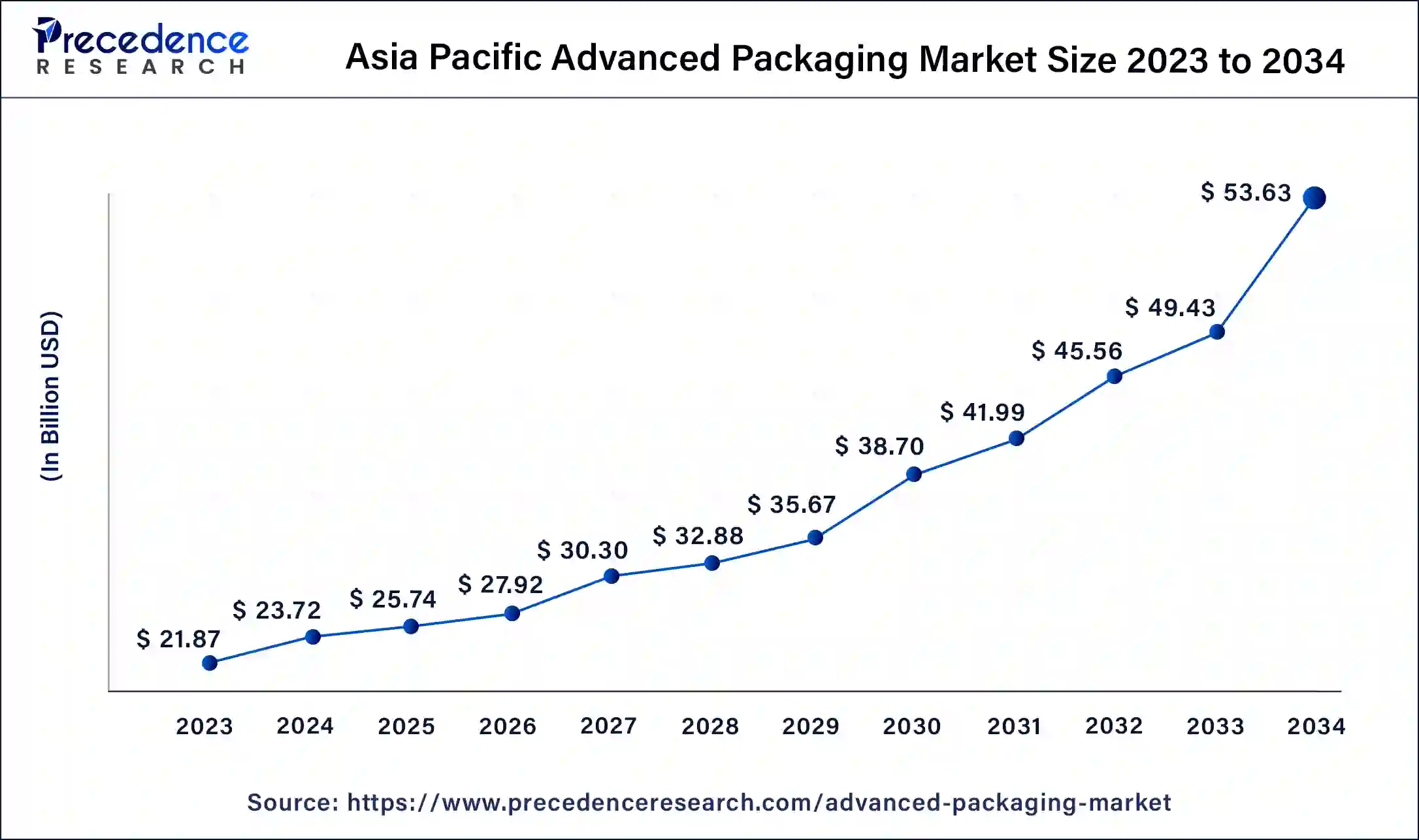

Asia Pacific Advanced Packaging Market Size and Growth 2026 to 2035

The Asia Pacific advanced packaging market size is exhibited at USD 25.74 billion in 2025 and is predicted to be worth around USD 57.73 billion by 2035, at a CAGR of 8.41% from 2026 to 2035

Asia Pacific dominates the advanced packaging market contributing a market share of more than 65% in 2024 and is expected to grow at a CAGR of 8.3% during the forecast period. It is because of the presence of major market players in this region and rapid growth in demand for semiconductors across various industry verticals such as automotive, consumer electronics, aerospace, defense and many others and the Government heavy investments in building semiconductor manufacturing plants specially in the developing countries such as India, China and South Korea. All these factors drive the growth of the Advanced Packaging Market. For instance, On 29th September 2021, Taiwan Semiconductor Manufacturing Co (TSMC) announced that it is developing new advanced packaging facilities in northern Taiwan. This advanced packaging fab in Chunan will be engaged in developing system on integrated chips (SoIC) technology.

Currently, Asia Pacific is dominating the advanced packaging market. Within the region, South Korea, Taiwan, and China hold the largest share of the market. The increased industries and excess demand for electronic gadgets require the largest rate of production of the packaging process. Another growth factor is that the production rate rises due to the several hubs of semiconductor manufacturing.

North America is also estimated to grow significantly over the forecast period owing to the development of several advanced packaging technologies such as copper hybrid bonding and wafer level packaging (WPL) and the increasing demand for IoT-connected devices, such as wearables are some of the attributes that is anticipated to drive the growth of the Advanced Packaging Market in this region. For instance,On 25th February 2021, Veeco Instruments Inc. announced plans to expand its manufacturing capabilities in San Jose, California in order to meet the increasing demand for the advanced laser annealing technology that benefits the world's leading semiconductor technology companies. This new, SEMI-compliant facility will serve the company's for the development and production of laser annealing and advanced packaging lithography systems for semiconductor applications.

U.S.: Presence of Major Key Players

In the U.S., growing R&D investment, the major presence of key technology organizations, strong government support such as the CHIPS Act, and growing demand from robust industries such as artificial intelligence (AI) and high-performance computing (HPC). The modern ecosystem of universities and research organizations, which offer a skilled workforce and drive collaborative R&D efforts, drives the growth of the market.

Europe: Driving High-Reliability Semiconductor Innovation and Leadership

Europe significantly drives the growth of the market as a focused strategy that leverages its strength in dedicated, high-reliability applications, its management in semiconductor manufacturing tools and materials, and strong, coordinated R&D programmes backed by increasing government funding. European organizations such as Infineon, STMicroelectronics, NXP, and Bosch are worldwide leaders in industrial and automotive electronics.

UK: Highly Skilled Talent Pool

The UK claims internationally renowned research institutions and a highly skilled talent pool specializing in modern materials and packaging enterprises. The UK government's National Semiconductor Strategy, a 20-year plan backed by significant spending, prioritizes the semiconductor subdivision, which drives the growth of the market.

Technological Advancement

Technological advancements in the advanced packaging market feature 3D packaging, chiplets, miniaturization, smart packaging, and system-in-package. The 3D packaging assembles multiple chips vertically, which proves an improvement in functionality even in a smaller space. The system-in-package merges multiple chips into a single substrate, supporting high-quality performance. The digital interface is a huge contribution to the advanced packaging market. The space for innovation in the market accelerates development on a large scale.

Miniaturization is an advanced packaging solution that allows the miniaturization of electronic appliances. The chiplets are small in size, specialized chips that can integrate intricate devices. The packaging industry is approaching advanced technologies to stimulate businesses. The advanced packaging system enables multiple devices to consist of semiconductor, electrical, and mechanical components. The system enables the packaging of a single electronic device. The combination of science and technology delivers several packaging solutions.

Advanced Packaging Market - Value Chain Analysis

- Raw Material Sourcing

It involves identifying and securing suppliers for specialized raw materials such as silicon interposers, photoresists, organic substrates, and epoxy molding compounds

Key Players: Veolia Environnement S.A. and Waste Management, Inc. - Material Processing and Conversion

It contributes a collection of manufacturing processes that integrate multiple semiconductor chips or components into compact, single, and high-performance electronic tools.

Key Players: SUEZ and Republic Services, Inc. - Recycling and Waste Management

It contributes processes such as developed mechanical and chemical recycling that break down plastics into their elementary components to create novel materials, including new fuels, plastics, and chemicals.

Key Players: Biffa Group Limited and MBA Polymers Inc.

Top Vendors in the Advanced Packaging Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Amkor Technology Inc. |

Tempe, Arizona |

Diverse global manufacturing footprint |

In October 2025, Amkor Technology Breaks Ground on New Semiconductor Advanced Packaging and Test Campus in Arizona; Expands Investment to $7 Billion. |

|

ASE Technology Holding Co., Ltd. |

Kaohsiung, Taiwan |

Strong focus on innovation and advanced packaging |

In February 2025, ASE officially launched its fifth plant in Penang, which will significantly build on the company's strong packaging and testing capabilities. |

|

China Wafer Level CSP Co., Ltd. |

China |

High-volume manufacturing capabilities and strong relationships |

China Wafer Level CSP Co., Ltd. is a global leading supplier of 3DIC and TSV wafer-level chip size packaging and testing services. |

|

ChipMOS Technologies, Inc. |

Hsinchu, Taiwan |

Integrated outsourced semiconductor assembly and test services (OSAT) |

ChipMOS TECHNOLOGIES INC. is one of the world's largest semiconductor services companies, providing a full range of back-end testing services for liquid crystal display (LCD) |

|

FlipChip International LLC |

United States |

High-volume wafer-level packaging (WLP) |

developed flip chip packaging technology that uses a wafer-level packaging process to seek higher efficiency and cost-effectiveness. |

Recent Developments

- In May 2025, Saudi Arabia and Sidel signed a memorandum of understanding (MoU) to localize advanced packaging capabilities and strengthen industrial cooperation. This agreement focuses on the development of innovations in the advanced packaging market.

- In May 2025, Veeco announced over USD 35 million in advanced packaging lithography system orders from IDM & OSAT customers. The company is expecting growth with the financial investment and development.

- In April 2025, Siemens and Intel foundry advanced their collaboration to enable cutting-edge integrated circuits and advanced packaging solutions for 2D and 3D ICs. The strategic collaboration is leveraging the market presence globally.

Segments Covered in the Report

By Type

- Flip Chip CSP

- Flip-Chip Ball Grid Array

- Wafer Level CSP

- 5D/3D

- Fan Out WLP

- Others

By End-use

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Aerospace & Defense

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content