What is the Graphic Processor Market Size?

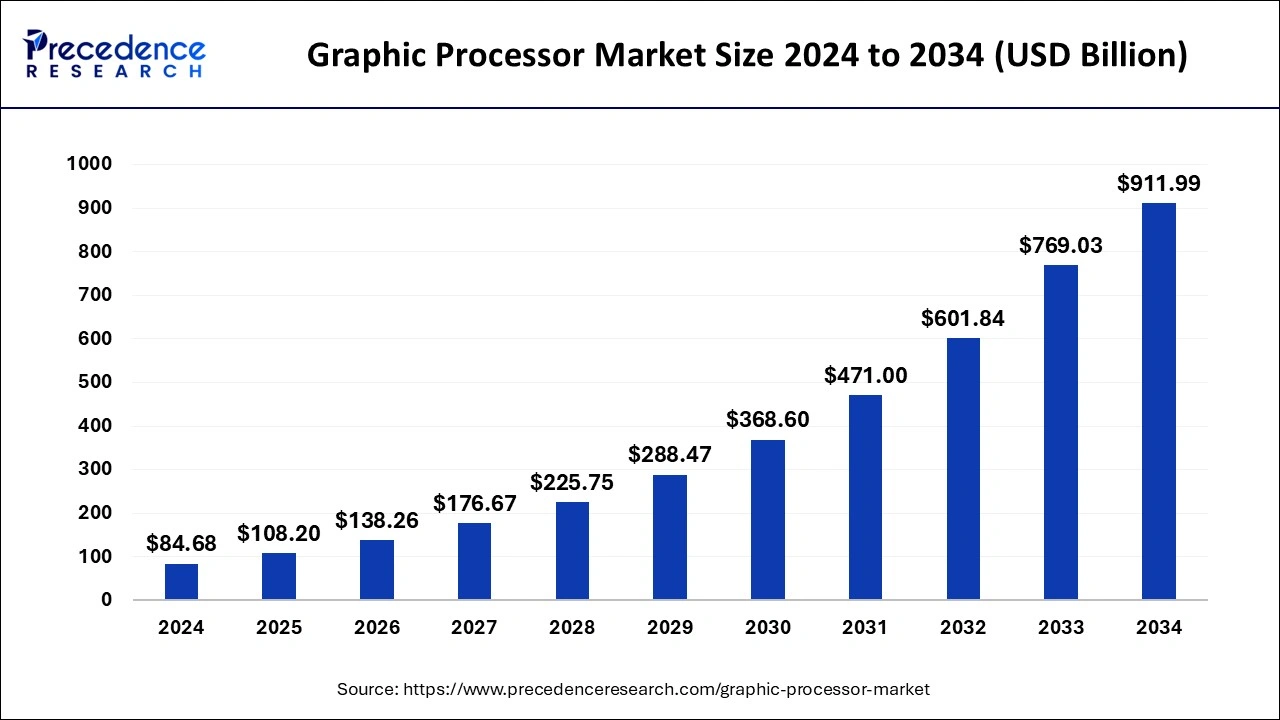

The global graphic processor market size was estimated at USD 108.20 billion in 2025 and is predicted to increase from USD 138.26 billion in 2026 to approximately USD 1071.10 billion by 2035, expanding at a CAGR of 25.77% from 2026 to 2035.

Graphic Processor MarketKey Takeaways

- In terms of revenue, the global graphic processor market was valued at USD 108.20billion in 2025.

- It is projected to reach USD 1071.10billion by 2035.

- The market is expected to grow at a CAGR of 25.77% from 2026 to 2035.

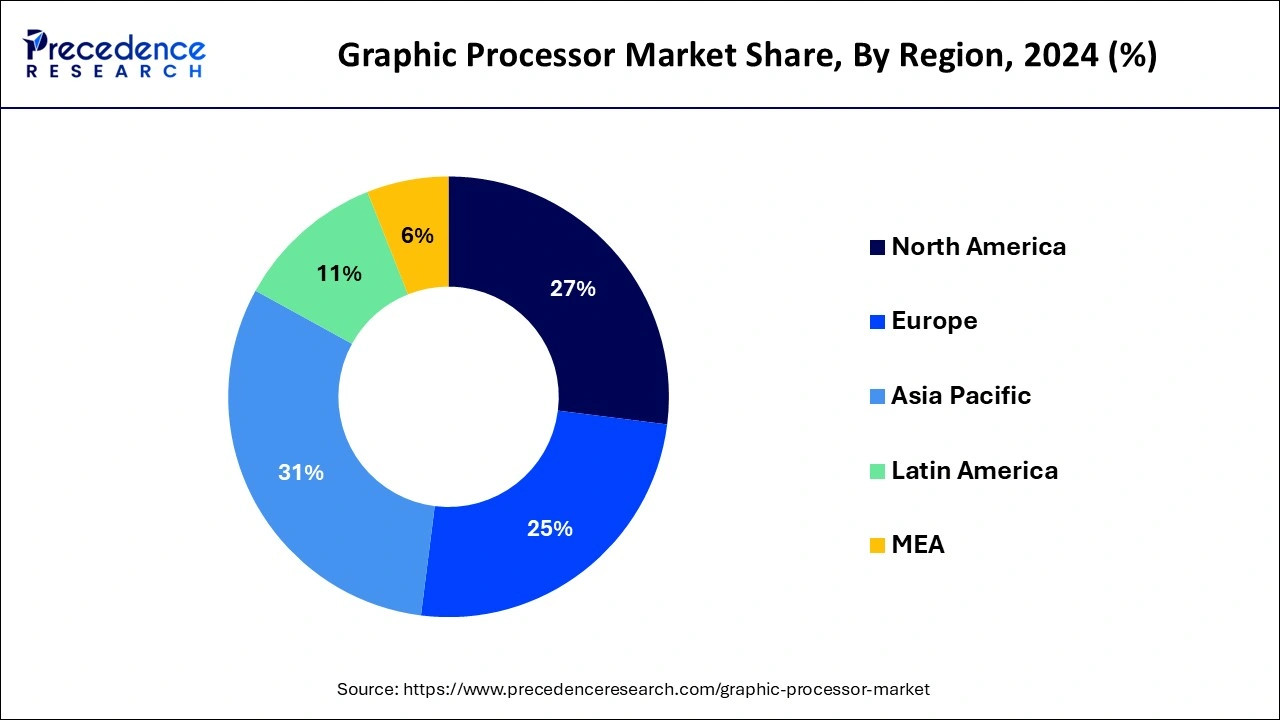

- Asia Pacific dominated the market with the largest share of 31% in 2025.

- North America is expected to expand at the fastest CAGR of 29.55% during the forecast period.

- By component, the hardware segment has contributed more than 56% of the market share in 2025.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 30% during the forecast period.

- By type, the integrated segment has accounted for the largest share of 45% in 2025.

- By type, the hybrid segment is expected to expand at the fastest CAGR of 29.75% over the projected period.

- By deployment, the cloud segment has held a major market share of 60% in 2025.

- By deployment, the on-premise segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

A graphic processor, commonly known as a graphics processing unit (GPU), is a specialized electronic circuit designed to accelerate and optimize the rendering of images and videos. It plays a critical role in handling visual data and is a key component in computers, gaming consoles, and mobile devices. Unlike a central processing unit (CPU), which is designed for general-purpose computing, a GPU is specifically tailored for parallel processing tasks essential for graphics rendering. In simpler terms, a graphic processor excels at rapidly performing complex mathematical computations needed to generate visuals on a screen.

This makes GPUs indispensable for graphics-intensive applications like gaming, video editing, and simulations, as they significantly enhance the speed and efficiency of image and video processing, leading to smoother and more immersive user experiences.

Artificial Intelligence: The Next Growth Catalyst in Graphic Processors

AI is profoundly impacting the graphics processor industry by dramatically increasing the demand for high-performance processors capable of handling the intensive computational requirements of training and running AI models. This surge in demand has shifted market focus, transforming GPUs from specialized components primarily used for rendering graphics into essential general-purpose processors for AI workloads.

Consequently, traditional market leaders like Nvidia have seen exponential growth, achieving multi-trillion-dollar valuations driven primarily by sales of their advanced AI accelerators rather than consumer graphics cards.

Graphic Processor MarketGrowth Factors

- The increasing need for high-performance computing, driven by applications like artificial intelligence, data analytics, and scientific simulations, fuels the demand for powerful graphic processors. GPUs play a crucial role in accelerating parallel processing tasks, making them essential for HPC applications.

- The surge in AI and ML applications relies heavily on parallel processing capabilities, making GPUs a preferred choice for these tasks. Industries adopting AI for tasks like image recognition, natural language processing, and deep learning contribute to the growth of the graphic processor market.

- The increasing adoption of VR and AR technologies in gaming, healthcare, education, and other sectors drives the demand for powerful graphic processors. These applications require real-time rendering and high-quality visuals, making GPUs integral to their success.

- The automotive industry's integration of advanced infotainment systems, including interactive displays and in-vehicle entertainment, contributes to the growth of the graphic processor market. GPUs are essential for rendering visually appealing and responsive interfaces in modern vehicles.

- The proliferation of high-resolution displays, including 4K and 8K monitors, demands graphic processors with increased capabilities. Consumers seeking enhanced visual experiences contribute to the market growth as they adopt higher resolution screens for gaming, multimedia consumption, and professional applications.

- The trend of parallel processing in data centers, driven by the need for faster data analytics and computations, is a growth factor for graphic processors. GPUs are increasingly used in data centers to accelerate tasks like image recognition, data mining, and scientific simulations, enhancing overall computational efficiency.

Graphic Processor Market Data and Statistics

- The NVidia GeForce RTX 3090, classified as a Titan-grade card, delivers exceptionally high-performance capabilities, meeting the demands of even the most resource-intensive applications.

- NVidia is making substantial investments in technology, providing gamers with customizable solutions. Recently, the company introduced the formidable GPU, named Titan RTX, utilizing NVidia's Turing architecture. This GPU boasts an impressive 130 teraflops of deep learning performance and 11 gigarays of ray-tracing performance, solidifying its position as a powerful component in the realm of graphics processing.

- The landscape of the latest graphics cards in the price range of USD 500 to USD 1500 has undergone a significant transformation. Both AMD and NVidia have revamped their product lineups to cater to the growing 1440p gaming market, reflecting the dynamic nature of the graphics card industry.

Market Outlook

- Market Growth Overview: The graphic processor market is expected to grow significantly between 2025 and 2034, driven by the integration of artificial intelligence and machine learning, data centers and cloud computing, and adoption in autonomous vehicles, robotics, and professional visualization.

- Sustainability Trends: Sustainability trends involve improved energy efficiency, sustainable manufacturing and supply chains, and modular design and the circular economy.

- -Major Investors: Major investors in the market include NVINDIA Corporation, Advanced Micro Devices, Intel Corporation, Qualcomm, and Hyperscalers.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 25.77% |

| Market Size in 2025 | USD 108.20 Billion |

| Market Size in 2026 | USD 138.26 Billion |

| Market Size by 2035 | USD 1071.10 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Type, Deployment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rise in gaming industry

- According to Newzoo, the global games market is projected to generate over $175 billion in revenues, with a significant portion attributed to high-end gaming hardware.

The surge in the gaming industry has a profound impact on the graphic processor market, driving substantial demand for advanced GPUs. As the gaming landscape evolves, there is a constant need for graphic processors that can deliver superior performance, rendering lifelike graphics, and enabling immersive gaming experiences. Gamers seek high-quality visuals, realistic simulations, and smooth gameplay, prompting a continuous demand for powerful graphic processors to meet these expectations.

The growth of online multiplayer gaming, virtual reality (VR), and augmented reality (AR) further intensifies the demand for GPUs, as these applications demand sophisticated graphical capabilities. With gaming becoming a mainstream entertainment activity worldwide, the graphic processor market witnesses a robust rise, as both casual and professional gamers invest in systems equipped with high-performance GPUs. This trend is expected to persist as the gaming industry continues to innovate and push the boundaries of graphical interfaces, ensuring a sustained and growing market for graphic processors.

Restraint

Global semiconductor shortages

The global semiconductor shortages significantly restrain the market demand for graphic processors. As an integral component of these processors, semiconductor chips play a crucial role in their production. The shortage of semiconductors has disrupted the supply chain, leading to delays and constraints in manufacturing graphic processors. This scarcity not only affects the production capacity of major GPU manufacturers but also limits the availability of these essential components for various electronic devices, including graphics cards.

The semiconductor shortages have resulted in increased lead times, reduced inventory levels, and a surge in demand backlog. Consumers face challenges in acquiring GPUs, leading to delayed upgrades and purchases. The overall impact is a bottleneck in the graphic processor market, with constrained supply adversely affecting manufacturers, distributors, and end-users alike. As the semiconductor industry addresses these shortages, the graphic processor market is poised to recover, but the current limitations underscore the vulnerability of the supply chain to global disruptions.

Opportunity

Global awareness campaigns

Automotive infotainment systems present significant opportunities for the graphic processor market. As vehicles become more technologically advanced, there is a growing demand for sophisticated graphics and multimedia experiences within the automotive industry. Graphic processors play a pivotal role in powering the visual elements of infotainment systems, providing drivers and passengers with visually appealing and interactive displays. These processors enable features such as high-resolution touchscreens, 3D mapping, and advanced entertainment options, enhancing the overall driving experience.

The integration of graphic processors in automotive infotainment systems extends beyond entertainment, encompassing navigation, connectivity, and real-time data visualization. With the advent of autonomous vehicles and connected car technologies, the role of graphic processors becomes even more crucial in delivering seamless and visually engaging interfaces. Manufacturers investing in innovative graphic processors tailored for automotive applications stand to benefit from the expanding market as consumers increasingly prioritize technology-rich infotainment solutions in their vehicles.

Segment Insights

Component Insights

The hardware segment held the highest market share based on the component. In the graphic processor market, the hardware segment refers to the physical components essential for the functioning of graphic processors. This includes the GPU chip, memory modules, cooling systems, and other tangible elements that collectively contribute to the processing and rendering of graphics. The hardware segment is witnessing trends such as the development of more powerful and energy-efficient GPUs, increased integration of advanced cooling solutions, and innovations in memory technologies, all aimed at enhancing the overall performance and capabilities of graphic processors.

The services segment is anticipated to witness rapid growth at a significant CAGR during the projected period. In the graphic processor market, the services component refers to the various support and maintenance offerings provided by manufacturers and third-party service providers. These services include software updates, troubleshooting, technical support, and training.

A significant trend in the services segment involves a shift towards comprehensive solutions, where manufacturers offer integrated services to optimize graphic processor performance, ensure compatibility with evolving technologies, and provide timely assistance to end-users. This trend reflects a growing emphasis on enhancing the overall user experience and addressing the evolving needs of graphic processor users in both consumer and enterprise environments.

Type Insights

The integrated segment has held the largest share in 2025. In the graphic processor market, the integrated type refers to processors integrated directly into a computer's central processing unit (CPU). Integrated graphic processors are commonly found in entry-level and mid-range computers, offering basic graphical capabilities without the need for a separate graphics card. The trend in integrated graphics involves continuous improvements in performance, with newer CPU models incorporating more powerful integrated GPUs. This is driven by the increasing demand for decent graphics performance in everyday computing tasks and the desire for energy-efficient solutions in laptops and compact desktop systems.

The hybrid segment is anticipated to witness rapid growth over the projected period. In the graphic processor market, the hybrid segment refers to a combination of different types of graphic processors within a single system. This hybrid approach often involves integrating both integrated graphics and discrete graphics processors to optimize performance and power efficiency. The trend in the hybrid segment reflects a growing demand for versatile systems that can balance the graphics processing power required for tasks like gaming and content creation while maintaining energy efficiency during less demanding applications, providing users with a dynamic and adaptive computing experience.

Deployment Insights

The cloud segment held the largest share of the market in 2025. In the graphic processor market, the cloud deployment segment refers to the utilization of graphic processing units (GPUs) within cloud computing environments. This involves accessing and utilizing GPU resources remotely through cloud services, enabling users to leverage high-performance graphics capabilities without the need for on-premises hardware. A notable trend in this segment is the increasing adoption of cloud-based GPU solutions for tasks like AI, machine learning, and graphics rendering, offering scalability, flexibility, and cost-effectiveness to businesses and developers seeking powerful graphic processing capabilities on demand.

The on-premise segment is anticipated to witness rapid growth over the projected period. The on-premise segment in the graphic processor market refers to the deployment of graphic processing units (GPUs) within the physical infrastructure of an organization. In this context, companies host and manage their graphic processors on-site, maintaining control over hardware resources. The on-premise deployment trend is witnessing sustained relevance as some industries, particularly those with data security and regulatory concerns, prefer in-house GPU setups. This ensures direct oversight, allowing organizations to tailor their graphic processing capabilities to specific requirements while maintaining data privacy and compliance with industry standards.

Regional Insight

What is the Asia Pacific Graphic Processor Market Size?

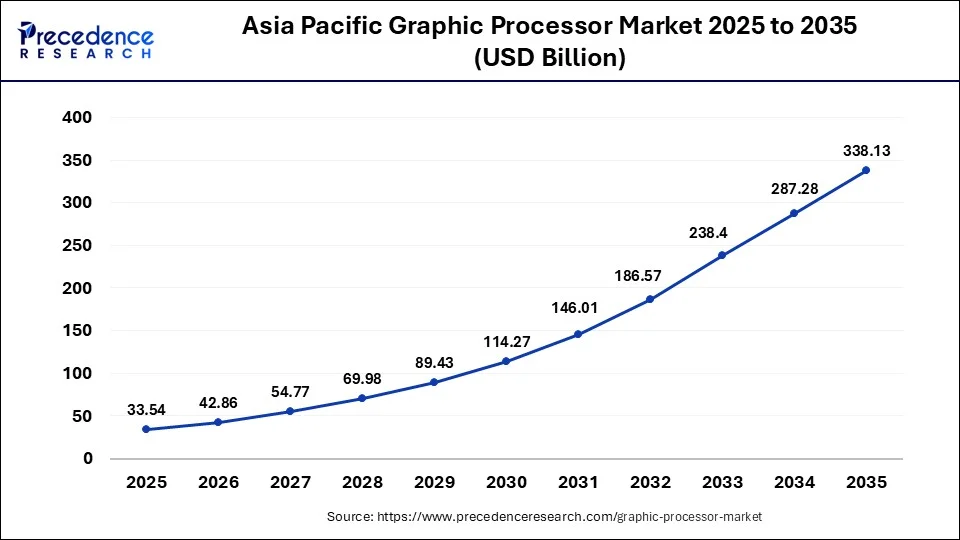

The Asia Pacific graphic processor market size was valued at USD 33.54 billion in 2025 and is anticipated to reach around USD 338.13 billion by 2035, poised to grow at a CAGR of 25.99% from 2026 to 2035.

Asia-Pacific held the largest share of the graphic processor market due to several factors. The region is a hub for electronics manufacturing, with key countries like China, Japan, and South Korea playing pivotal roles. Rapid technological advancements, a burgeoning gaming industry, and the increasing adoption of graphics-intensive applications in sectors like automotive and manufacturing contribute to the high demand for graphic processors. Additionally, the growing consumer base with a penchant for high-performance computing and mobile devices further propels Asia-Pacific's dominance in the graphic processor market.

China Graphic Processor Market Trends

China's rapid integration of AI across industries, such as finance, healthcare, and autonomous vehicles, rising adoption of liquid cooling in data centers, enabling higher density and better performance for AI training clusters, domestic GPU development and self-reliance, and integration of GPU-as-a-service fuel the market growth.

North America is poised for rapid growth in the graphic processor market due to several factors. The region is home to major players, fostering innovation and technological advancements in graphic processing units (GPUs). The increasing demand for high-performance computing, driven by sectors like gaming, AI, and data centers, contributes to market growth. Additionally, the rising adoption of advanced technologies such as artificial intelligence, virtual reality, and autonomous vehicles in North America further fuels the demand for powerful graphic processors, positioning the region as a key contributor to the market's expansion.

U.S. Graphic Processor Market Trends

The U.S.'s surge in AI and machine learning requirements necessitates high-performance architecture like NVIDIA's Blackwell and ADM's latest designs. Massive data center expansions and the rise of cloud-based GPU services and immersive, high-fidelity gaming drive the market growth.

Meanwhile, Europe is experiencing notable growth in the graphic processor market due to several factors. The region's increasing focus on high-performance computing, artificial intelligence, and automotive advancements contributes to the demand for powerful graphic processors. Additionally, the rise in gaming, augmented reality, and virtual reality applications fuels the need for advanced GPUs. European companies are actively investing in technology and innovation, fostering a competitive landscape. As the region continues to prioritize technological advancements across various industries, the graphic processor market in Europe sees substantial growth opportunities.

Germany Graphic Processor Market Trends

Germany's deep integration of AI and Machine Learning within its robust automotive and manufacturing sectors, where real-time processing is essential for autonomous driving and Industry 4.0 automation. This demand is further amplified by the expansion of cloud infrastructure and edge computing, providing the low-latency power required for both professional engineering simulations and a thriving high-fidelity gaming scene.

Value Chain Analysis of the Graphic Processor Market

- Raw Material Sourcing/Inbound Logistics: This stage involves the procurement, storing, and distribution of essential inputs, such as silicon wafers, rare earth metals, and specialty chemicals.

- Chip Design/Technology Development: In this critical phase, companies design the architecture and intellectual property (IP) for the GPUs, defining their performance and capabilities.

Key Players: ARM Limited and Imagination Technologies. - Manufacturing/Operations.: This stage involves the actual production of the physical chips, including wafer fabrication, assembly, testing, and packaging.

Graphic Processor Market Companies

- NVIDIA Corporation: NVIDIA pioneered the GPU and remains the market leader, heavily contributing with high-performance graphics cards for gaming (GeForce) and specialized GPUs for professional visualization and AI applications.

- Advanced Micro Devices, Inc. (AMD): AMD provides strong competition in the GPU market with its Radeon line of graphics cards, catering to both gaming enthusiasts and professional users, and is notable for supplying the integrated GPUs for current-generation game consoles.

- Intel Corporation: Historically focused on integrated graphics, Intel has recently entered the discrete GPU market with its Arc line, aiming to become a major third competitor and offer solutions across desktop, laptop, and data center segments.

- Qualcomm Technologies, Inc.: Qualcomm primarily contributes to the mobile graphics market, designing the Adreno GPUs integrated into its Snapdragon systems-on-a-chip (SoCs) that power many leading smartphones and tablets.

- ARM Limited: ARM licenses its Mali GPU designs to numerous semiconductor companies, enabling a wide variety of devices, from budget smartphones to smart TVs, to have essential graphics processing capabilities.

- Imagination Technologies Group plc: Imagination Technologies provides its PowerVR GPU intellectual property (IP) to various partners, who then integrate these designs into their own chips for mobile and embedded devices.

Other Major Key Players

- Matrox Electronic Systems Ltd.

- VIA Technologies, Inc.

- Silicon Integrated Systems Corp. (SiS)

- Broadcom Inc.

- Xilinx, Inc.

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Renesas Electronics Corporation

- PowerVR (a division of Imagination Technologies)

Recent Developments

- In January 2026, AMD previewed its next-generation Instinct MI400X series and launched the MI430X for high-end AI infrastructure, aiming for "yotta-scale" computing. It is designed for on-premises data centers and higher-end accelerators aimed at future large-scale AI systems. (Source: https://www.networkworld.com )

- In August 2023, Advanced Micro Devices, Inc. (AMD) made a significant announcement, revealing a fresh lineup of RX 7000 series GPUs during Gamescom 2023. These newly unveiled RX 7000 series GPUs focus on an advanced architecture, promising substantial improvements in both performance and power efficiency.

- In July 2022, Samsung Electronics introduced the industry's first 16-gigabit (Gb) Graphics Double Data Rate 6 (GDDR6) DRAM, featuring processing speeds of 24 gigabits per second (Gbps). Built with extreme ultraviolet (EUV) technology and Samsung's third-generation 10-nanometer-class (1z) process, this memory aims to significantly enhance graphics performance for next-gen graphics cards, laptops, game consoles, artificial intelligence applications, and high-performance computing (HPC) systems.

- In November 2022, Qualcomm Technologies, Inc. launched the Snapdragon 8 Gen 2 premium mobile platform. Strategically designed with groundbreaking AI on every level, the Snapdragon 8 Gen 2 sets a new benchmark for connected computing. It introduces new Snapdragon Elite Gaming capabilities, including real-time hardware-accelerated ray tracing, providing realistic lighting and reflections in mobile games. With the updated Qualcomm Adreno GPU offering up to 25% faster performance and the Qualcomm Kryo CPU delivering up to 40% greater power efficiency, users can enjoy champion-level gaming with extended battery life.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Type

- Integrated

- Discrete

- Hybrid

By Deployment

- On-premise

- Cloud

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content