What is the High Performance ComputingMarket Size?

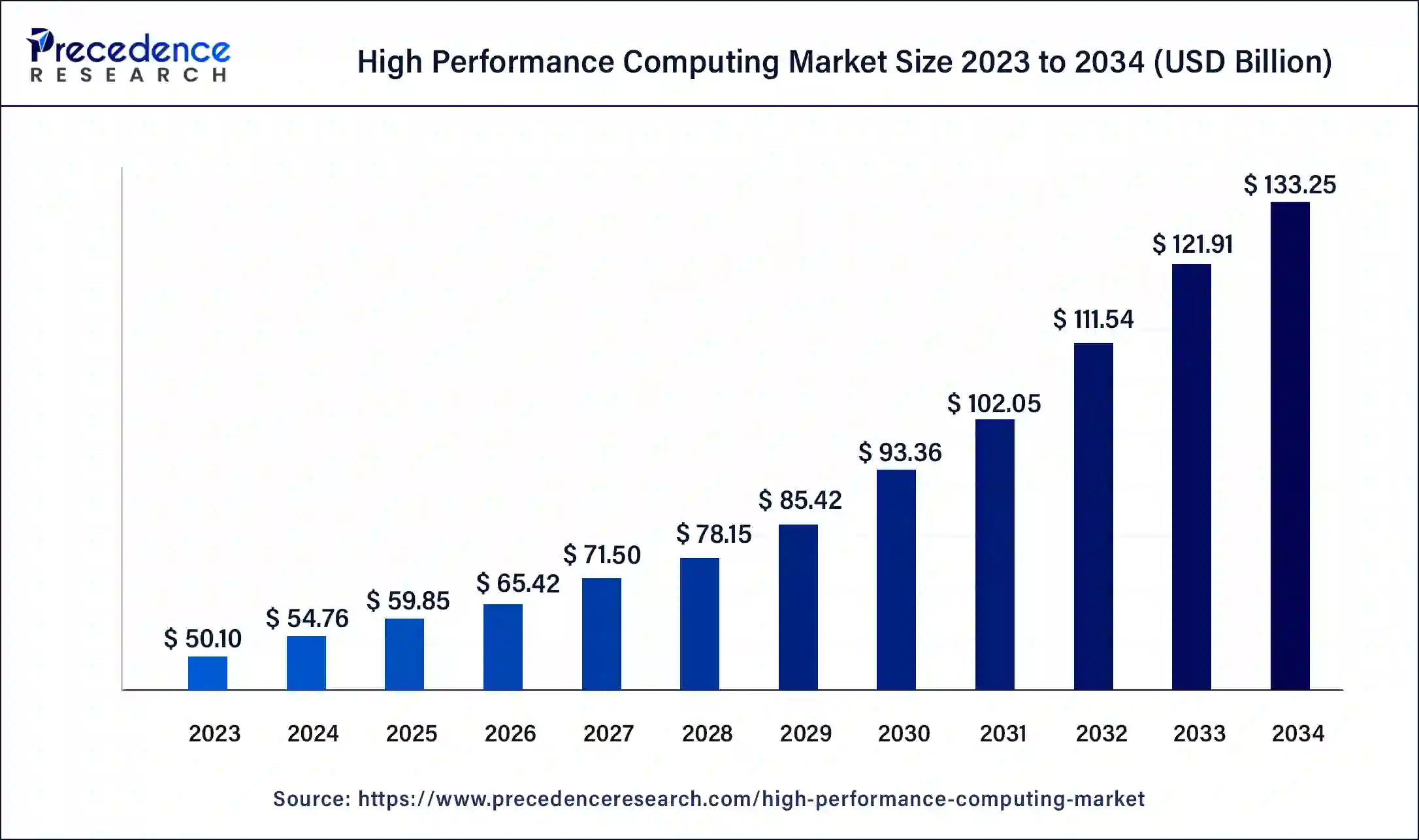

The global high-performance computing market size is accounted at USD 59.85 billion in 2025 and is predicted to increase from USD 65.42 billion in 2026 to approximately USD 141.62 billion by 2035, expanding at a CAGR of 9.8% from 2026 to 2035.

High Performance Computing Market Key Takeaway

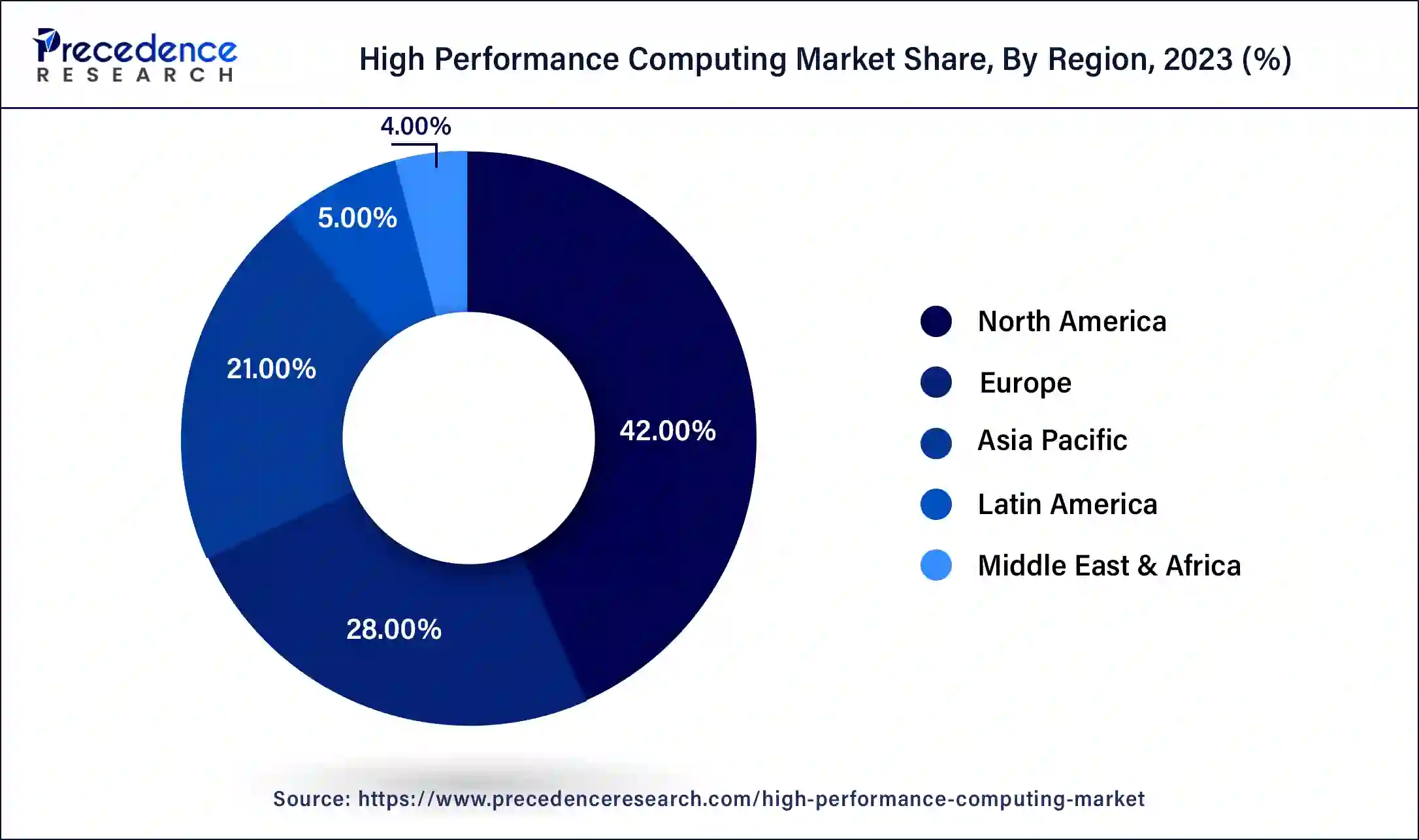

- The North America region has garnered the largest revenue share of 42% in 2025.

- By component, the servers segment has captured the highest revenue share of 34% in 2025.

- By deployment, the on-premise segment has accounted revenue share of 61% in 2025.

- By end-use, the government and defense segment held a revenue share of 26.2% in 2025.

High Performance Computing Market Growth Factors

The high performance computing is a practice of aggregating the powers of the computer which delivers high performance abilities while handling large number of problems in the fields of business, science, and engineering. Furthermore, high performance computing systems comprise of all the types of micro servers and servers which are being utilized for highly data intensive and computational tasks. At present, as high performance computinghas been decisively linked to the economic scientific advances and competitiveness it is becoming essential for all the nations. Also, the global study regarding HPC expresses, more than 3/4TH of the key players have opted the platforms of supercomputing and have expressed that their survival is impossible without it.

Micro server's capabilities of faster computing or high performance computing systems, enhanced the effectiveness of performance and operation & smarter deployment with high quality of service are some of the major key factors boosting the market growth of high performance computing all around the globe. Furthermore, some of the major challenges faced regarding these systems are cooling system operation, power, and data & storage management. The implication of data & storage management would endure to grow in the forthcoming time period. Moreover, the software hurdles will further continue to rise, which are hampering the market growth. The methodology is being majorly adopted among various diligence and academic institutions in order to make robust and dependable products which will enable to maintain an edge of competition in the business. Various sellers are further aiming to give technology solution based on high performance. Thus, this trend is likely to boost the market it will continue its growth in future.

However, the market is likely to pick gradually its pace from the year 2024 owing to rising demand for high performance computing systems owing to its benefits, like enhanced power and ability of the computation in order to calculate algorithms which are complex in nature. Also, the growing cloud computing popularity, mixed with the initiatives of digitization have been adopted by various governments, which would play a conclusive role in propelling the market growth in the forthcoming time period.

In addition, high performance computing, which is also known as supercomputing, foresees the use of parallel processing for the data processing at accuracies & higher speeds and thus also provide efficient output. This parallel processing is attained by allocating the program instructions amid various processors so that the time consumed to for running the algorithms is decreased majorly. The HPC systems also comprise of a group of computers, whose total or clubbed power further offer high capabilities of computation. Which means, HPC systems can simplify potentially business procedures which are complex in nature. In resultant, the demand for HPC systems is likely to grow in future.

There was a positive impact due to the outburst of Covid19 over the high performance computing market. Furthermore, The White House declared the launch of the COVID-19 consortium of high performance computing, which is a unique private & public consortium led by the IBM, White House Office of Technology and Science Policy, the National Science Foundation (NSF), and the U.S. Department of Energy. The high performance computing consortium allows the researchers to have access of the resources which are most powerful high-performance computing in order to accelerate the better understanding of the corona virus and to develop methods for combating it.

Market Trends

- The high-performance computing (HPC) sector is witnessing robust growth, fueled by the increasing demand for sophisticated data processing across various sectors. The surge in the adoption of artificial intelligence (AI) and machine learning (ML) is also driving the market.

- With sectors like healthcare, finance, and autonomous driving relying heavily on AI and ML, the demand for HPC systems is expected to boost.

- With the advent of cloud computing, providers are rolling out scalable HPC solutions, providing organizations with on-demand access to formidable computing resources. This allows small-scale enterprises and research bodies to harness top-tier computational power.

- The market is witnessing various breakthroughs in energy-efficient hardware and cloud-integrated HPC solutions. These are enabling scalable, cost-effective infrastructures that are aligned with sustainability goals.

Market Outlook

- Industry Growth Offerings- The market is growing due to rising demand for advanced data processing, AI, and analytics across sectors like research, finance, and healthcare. Innovations in supercomputers, energy-efficient HPC systems, and cloud-based solutions are driving widespread adoption.

- Global Expansion- The global market is expanding as countries invest in supercomputing infrastructure, AI, and big data initiatives. Cross-border collaborations, government funding, and rising adoption in research, healthcare, and industrial sectors are accelerating international growth.

- Startup ecosystem- The HPC startup ecosystem is thriving, with emerging companies developing AI-driven supercomputing solutions, cloud-based HPC platforms, and energy-efficient servers. Supportive incubators, venture funding, and government initiatives are fostering innovation and accelerating adoption across industries worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 59.85 billion |

| Market Size in 2026 | USD 65.42 Billion |

| Market Size by 2035 | USD 141.62 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.8% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Deployment Insights

Deployment was the leading market segment in the year 2024, however, cloud based technology segment is expected to grow due to its high adoption rate, while the usage on-premise deployment method would drop down slowly. The different types of deployment methods of high performance computing are cloud and on-premise based methods. Cloud deployment is gaining high traction in the industry, as cloud computing technologies are being majorly adopted by the players in different industries.

Application Insights

The dominating segment are high performance technical computing and high performance business computing. Technical computing of the HPC comprise of various sectors similar as bio-sciences, government, academic institutions, chemicals, consumer products, energy, electronics and many others. Furthermore, data analysis of high performance is being utilized in governmental sector for crime fighting & public security. In addition to this, high performance computing are used in fraud discovery and client accession/ retention across other sectors. High performance business computing includes media entertainment, online gaming, retail, fiscal service, ultra-scale internet, transportation and others.

Component Insights

How Servers Segment Dominated the High Performance Computing Market in 2025?

In 2025, the servers segment dominated the market due to its central role in delivering the raw processing power required for complex simulations, AI workloads, and large-scale data analytics. Advancements in multi-core processors, GPUs, and specialized accelerators enabled servers to handle increasingly demanding computational tasks more efficiently, attracting adoption across research, defense, energy, and financial sectors. Cloud-based HPC services further boost server deployment, allowing organizations to scale resources on-demand without investing in on-premises infrastructure.

Regional Insights

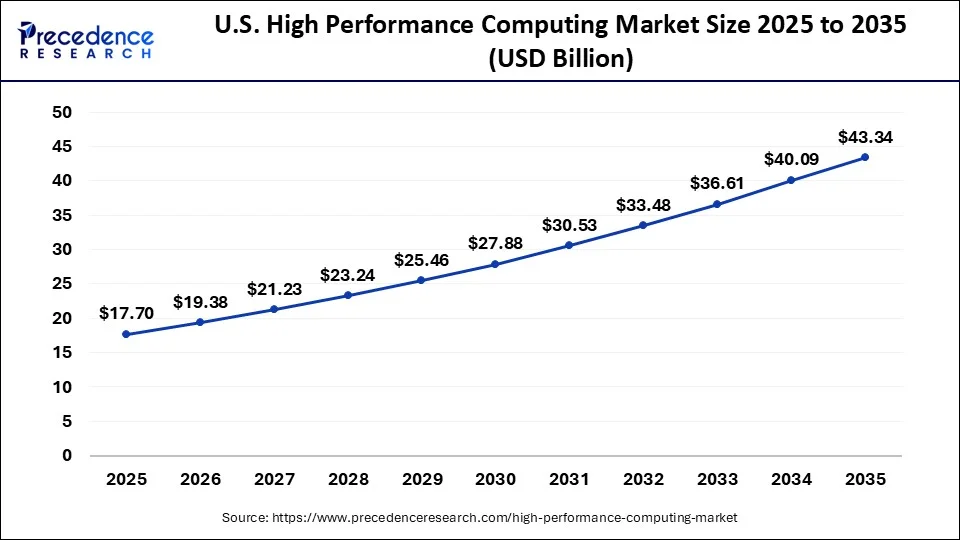

U.S. High Performance Computing Market Size and Growth 2026 to 2035

The U.S. high performance computing market size is exhibited at USD 17.70 billion in 2025 and is projected to be worth around USD 43.34 billion by 2035, at a CAGR of 6.57% from 2026 to 2035.

The HPC Revolution Driving North America's Tech Frontier

North America held the largest share of 42% in 2024. This is attributed to the region being the largest indigenous market for technology- grounded solution. Also, it's anticipated to be a strong player in the global economy, especially in the perpetration and development of new technologies. While the need to reuse large volumes of raw data is growing, having robust security measures in place is of consummate significance. This is driving the need to apply the rearmost technologies, which, in turn, is encouraging the adoption of HPC systems. Also, North America is the major area of functioning for some of the big enterprises, similar as General Motors and Boeing, which alongside with other SMEs, are aggressively opting for HPC systems to help them in easing the specialized conditions they're facing. As a result, the relinquishment of HPC systems is growing in North America.

Powering the Future of High-Performance Computing

The U.S. market is growing due to increasing demand for advanced data processing in sectors like scientific research, healthcare, finance, and defense. Rising adoption of AI, machine learning, and big data analytics requires powerful computational capabilities. Government investments, cloud-based HPC solutions, and ongoing innovations in processors and supercomputing infrastructure are further driving growth. Additionally, the need for faster simulations, modeling, and real-time analytics across industries is boosting market expansion.

Riding the Supercomputing Wave to Scientific Breakthroughs

Asia Pacific is projected to expand at the highest CAGR over the forecast period owing to the growing adoption of HPC systems for scientific exploration and weather forecasting. At the same time, China happens to be among the top 10 countries leading in the high performance calculating market. China is also home to supercomputers, similar as Tianhe-2 (Milkyway-2) and Sunway TaihuLight.

Rapid Expansion in High-Performance Computing Landscape in India

India's market is expanding due to growing demand from sectors like scientific research, defense, healthcare, and manufacturing for advanced simulations, modeling, and data analytics. Government initiatives promoting digital infrastructure and supercomputing adoption, coupled with rising investments in AI, machine learning, and big data technologies, are driving growth. Increasing collaboration with global HPC vendors and the development of indigenous supercomputing capabilities further support market expansion across both public and private sectors.

India's Supercomputing Initiative

Government of India's flagship initiative the National Supercomputing Mission (NSM) is empowering the country with high-performance computing abilities and is accessible through the National Knowledge Network (NKN).

- In September 2024, the Indian Government introduced three new supercomputers, PARAM Rudra, across three locations, including Delhi, Pune and Kolkata. Two High-Performance Computing Systems (HPC), named Arka and Arunika were also launched for strengthening India's capacity in technological development and scientific research.

- As of March 2025, a total of 34 supercomputers with a combined computing capacity of 35 Petaflops are positioned across several research organizations, academic institutions and R&D laboratories across India, under the NSM.

Europe: From research Lbs to Real-World HPC Application

Europe's market is increasing due to rising demand for advanced computing in scientific research, healthcare, finance, and automotive sectors. Investments in AI, machine learning, and big data analytics are driving the need for powerful supercomputing infrastructure. Government initiatives, such as the European High-Performance Computing Joint Undertaking (EuroHPC), support the development of next-generation HPC systems. Additionally, growing collaborations between academic institutions, research centers, and technology vendors are accelerating market growth across the region.

UK driving AI and Data-Intensive Innovation with HPC

The UK market is expanding due to increasing demand from sectors like scientific research, finance, healthcare, and defense for advanced simulations, modeling, and data analytics. Government initiatives and funding, including investments in supercomputing infrastructure and AI research, are driving adoption. Collaboration between universities, research institutions, and technology providers is enhancing HPC capabilities. Additionally, the growing need for faster computational power to support AI, machine learning, and big data applications is fueling market growth.

What Potentiates the High Performance Computing Market in Latin America?

The market in Latin America is being driven by ongoing advances in AI-driven workload optimization, which are helping companies gain competitive advantages and form strategic alliances. The region is also witnessing growing investments in 5G connectivity, edge computing, and sovereign cloud initiatives, creating new opportunities for market expansion. Rising demand for AI/ML model training, digital twins, and computational fluid dynamics (CFD) simulations is encouraging organizations to adopt scalable high-performance computing (HPC) infrastructures. Brazil and Mexico are leading the region due to their robust digital transformation efforts. Continuous advancements in cloud architecture and processor technologies are expected to further support market growth.

Brazil High Performance Computing Market Analysis

Brazil is a major contributor to the Latin American market. The market in Brazil is driven by the rising need for high-speed computation without capital-intensive infrastructure. Companies in the area are increasingly adopting high-performance computing services in order to help shorten development cycles and improve innovation speed, which also supports market growth.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) offers significant opportunities in the high performance computing market. These opportunities arise from the increasing demand for advanced computing solutions in sectors such as oil & gas, healthcare, and education. Governments in this region are recognizing the importance of HPC and are actively investing in infrastructure development, thereby contributing to the market. Countries like the UAE and South Africa are leading players in the region as they benefit from multiple initiatives that are aimed at enhancing research capabilities and boosting technological innovation. The region's focus on building a knowledge-based economy is expected to further drive the demand for HPC solutions in the near future.

Saudi Arabia Performance Computing Market Analysis

Rapid digital transformation initiatives driven by the government Vision 2030 are accelerating enterprise adoption of high-performance computing in the country, especially in sectors like energy, healthcare, and finance. Additionally, initiatives in cloud computing, smart cities, and national research programs are driving demand for scalable HPC infrastructure to support complex data processing and innovation.

Top Vendors and their Offerings

- Atos SE - Provides supercomputing solutions like the BullSequana series, high-performance servers, and AI-enabled HPC platforms for scientific research and enterprise applications.

- Fujitsu - Offers the Fugaku supercomputer, HPC servers, and integrated solutions for AI, data analytics, and large-scale simulations.

- Inspur - Delivers HPC servers, AI computing platforms, and cloud-based high-performance computing solutions for enterprises and research institutions.

- Lenovo - Supplies HPC clusters, servers, and integrated AI and analytics solutions, focusing on energy-efficient and scalable computing systems.

- Intel Corporation - Provides HPC processors, accelerators (like Xeon and Xe GPUs), interconnects, and software tools to support AI, analytics, and supercomputing workloads.

Other Major Key Players

- Advanced Micro Devices, Inc.

- Hewlett Packard Enterprise Development LP

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Intel Corporation

Recent Developments

- In August 2025, IBM (US) unveiled its latest quantum computing system, designed to integrate seamlessly with its existing HPC infrastructure. This development is pivotal as it positions IBM at the forefront of quantum technology, which is anticipated to revolutionize data processing capabilities. By aligning quantum computing with traditional HPC, IBM is likely to attract a diverse range of clients looking for cutting-edge solutions to complex computational problems.

(Source:bing.com ) - In March 2025, Axelera AI, a leading provider of purpose-built AI hardware acceleration technology for computer vision inference and generative AI, launched its high-performance, energy efficient and scalable AI inference chiplet, Titania with an innovative approach to Digital In-Memory Computing (D-IMC) architecture. The development of this chiplet was supported by funding of €61.6 million from the EuroHPC Joint Undertaking (JU) and member states as part of the Digital Autonomy with RISC-V for Europe (DARE) Project, following the successful closing of an oversubscribed Series B financing round of $68 million for Axelera AI.

- In November 2024, Eviden, a subsidiary of Atos SE, a European multinational information technology service company leading in advanced computing, announced the launch of Qaptiva HPC which is an innovative software designed specifically for high-performance computing (HPC) environments.

- In July 2024, the Centre for Development of Advanced Computing (C-DAC), India, collaborated with MosChip Technologies and Socionext Inc. for designing and developing a High-Performance-Computing (HPC) Processor SoC based on the Arm architecture and built on the TSMC (Taiwan Semiconductor Manufacturing Company Limited) 5nm technology node.

Segments Covered in the Report

By Deployment

- Cloud

- On-Premise

By Application

- High Performance Technical Computing

- Government

- Chemical

- Bio-Science

- University /Academic

- Large Product Manufacturing

- Consumer product Manufacturing

- Energy

- Electronics

- Others

- High Performance Business Computing

- Media Entertainment

- Online Game

- Retail

- Financial Service

- Ultra-scale Internet

- Transportation

- Others

By Components

- Solutions

- Servers

- Storage

- Networking Devices

- Software

- Services

- Design and Consulting

- Integration and Deployment

- Support and Maintenance, and Management

By Server Price Band

- USD 250,000 to 500,000 and Above

- USD 250,000 to 100,000 and Below

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting