What is the High Performance Computing as a Service Market Size?

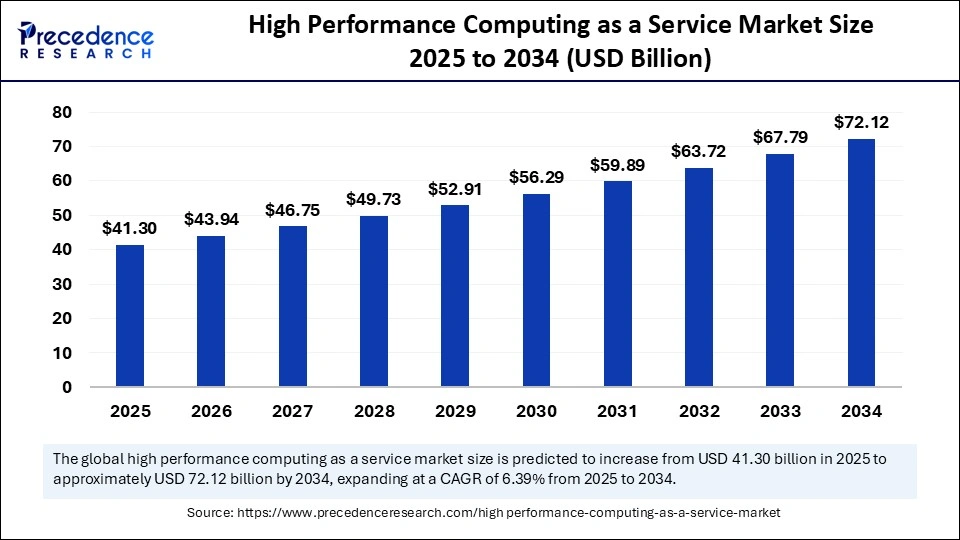

The global high performance computing as a service market size is valued at USD 41.30 billion in 2025 and is predicted to increase from USD 43.94 billion in 2026 to approximately USD 72.12 billion by 2034, expanding at a CAGR of 6.39% from 2025 to 2034. The increasing adoption of cloud-based solutions is expected to support market growth during the forecast period.

High Performance Computing as a Service Market Key Takeaways

- North America dominated the high performance computing as a service market in 2024.

- Asia Pacific is expected to witness the fastest growth in the upcoming period.

- By component, the solutions segment led the market in 2024.

- By component, the services segment is projected to show the quickest growth in the coming years.

- By deployment, the private cloud segment held the largest market share in 2024.

- By deployment, the hybrid cloud segment is expected to expand at a significant CAGR during the forecast period.

- By organization size, the SMEs segment led the market in 2024.

- By organization size, the large enterprises segment is anticipated to grow at the fastest CAGR in the coming years.

- By vertical, the BFSI segment captured the biggest market share in 2024.

- By vertical, the healthcare segment is expected to grow at a significant CAGR between 2025 and 2034.

AI and HPCaaS: A Revolution in Computing

The high performance computing as a service (HPCaaS) helps improve the performance and efficiency of AI solutions. With the growing adoption of AI across different sectors, the need for high performance computing is rising. HPCaaS offers the computing power that is necessary for the AI and machine learning (ML) models, ensuring the real-time analysis of data. Artificial Intelligence and HPCaaS are often utilized together for various functions. HPCaaS helps accelerate the training processes of AI because it needs computational resources to train complex AI models for analyzing huge amounts of data.

- In April 2025, a leading company, Compu Dynamics, launched a full lifecycle AI and high-performance computing data center infrastructure solutions.

Market Overview

The high performance computing as a service (HPCaaS) refers to the practice of utilizing parallel data processing in order to accelerate computation and carry out complex calculations through pooling of computing resources. HPCaaS enables advanced applications to work more effectively and better suited to the demands of the users. The growth of the high performance computing as a service market is driven by the rising data generation across the world. The rapid shift of organizations to cloud computing further boosts the growth of this market.

Governments are pushing for digital transformation, especially in emerging countries, which is aiding the expansion of this market. The ever-evolving technological landscape has created a necessity for computational systems that can solve complex problems or quickly sort the calculations. The rising proliferation and adoption of Internet of Things, AI, and ML technologies are expected to boost the growth of this market in the coming years.

High Performance Computing as a Service Market Growth Factors

- The increasing demand for high-performance and efficient computing services is driving the growth of the high-performance computing as a service market.

- The rapid digital transformation is expected to drive market growth in the coming years.

- With the rising data generation across various industries, the need for high-performance computing is rising for analysis and processing, supporting market growth.

- The increasing adoption of AI technologies further contributes to market growth.

High Performance Computing as a Service Market Outlook

- Industry Growth Overview: The market is set for strong growth from 2025 to 2034. This growth is driven by the explosive generation of data, the rising adoption of AI and machine learning, and the increasing usage of cloud computing for complex tasks. HPCaaS offers a cost-effective alternative to on-premise systems, broadening the customer base beyond traditional sectors.

- Democratization and Integration: This trend is making powerful, scalable computational resources accessible to a wider market without heavy capital investment and seamlessly combining them with AI and multi-cloud environments.

- Global Expansion: The market is growing globally as businesses and research institutions increasingly adopt cloud-based computing solutions to handle complex data processing, simulations, and artificial intelligence applications without heavy upfront capital investments. Emerging regions, particularly in Asia-Pacific, Latin America, and the Middle East, offer significant opportunities driven by rapid digitalization, growing demand for data analytics, and the need for cost-effective, scalable computing resources to drive innovation across industries such as healthcare, manufacturing, and finance.

- Major Investors: Large technology and cloud companies like Microsoft, AWS, Google, NVIDIA, and HPE are major investors. Investment is also being driven by government and academic projects in research and defense.

- Startup Ecosystem: A vibrant startup ecosystem focuses on innovation in AI-enabled control software, customized edge hardware, and cybersecurity. Startups are attracting funding for scalable, hybrid cloud, and specialized solutions across various industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 72.12 Billion |

| Market Size in 2025 | USD 41.30 Billion |

| Market Size in 2026 | USD 43.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.39% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Organisation Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Cloud Computing

The rising demand for cloud computing is a key factor driving the growth of the high performance computing as a service market. Cloud computing is being widely utilized because it offers delivery of computing services that consist of storage, servers, networking, software, analytics, and databases. Organizations are rapidly shifting toward cloud computing, as it provides them with a flexible and scalable platform for accessing high-performance computing resources.

For instance, as of 2025, more than 90% of organizations utilize cloud services. Cloud computing combined with high performance computing (HPC) as a service enables organizations to improve the performance of various processes and helps in innovation and cost savings. The integration of HPCaaS provides the benefits of calculating complex algorithms, managing resources, and powerful computing.

Restraint

High Costs and Integration Challenges

The high costs of HPCaaS solutions create barriers for SMEs, especially those with constrained budgets, limiting the adoption and hampering the growth of the market. The deployment of HPCaaS solutions requires robust infrastructure, adding to the infrastructure costs. High-performance computing services need sufficient hardware. In addition, implementing HPCaaS solutions in existing IT infrastructure creates complexities. This may deter potential users from adopting these solutions, limiting the growth of the market.

Opportunity

Technological Advancements

The evolving landscape of technology creates immense opportunities in the high performance computing as a service market. Technological like AI, ML, and Big Data are widely integrated across different industries. The utilization of advanced technologies opens new avenues for innovation as well as growth for this market. Technologies like edge computing and quantum computing further pave the way for innovations. Key players operating in the market must focus on innovations through technological advancements. Advanced technologies further improve the efficiency and performance of high-performance computing sources. Advanced technologies are expected to expand the scope of applications of HPCaaS.

Component Insights

The solutions segment dominated the high performance computing as a service market in 2024. This is mainly due to the increased need for software and tools for processing complicated procedures and calculations. Specialized software and tools enable users to effectively leverage high-performance computing resources. These solutions enhance performance, optimize management, and tailor workflows.

Meanwhile, the services segment is projected to show the quickest growth in the coming years. The growth of the segment can be attributed to the rising demand for high scalability and flexibility, along with enhanced performance and efficiency. Implementing HPCaaS solutions requires specialized knowledge, boosting the need for deployment and training services.

Deployment Insights

The private cloud segment led the high performance computing as a service market in 2024. This is mainly due to the increased concerns regarding data security and privacy. Private cloud platforms offer enhanced security and control over data and resources. This makes them indispensable for organizations dealing with sensitive information. The increased adoption of cloud services further bolstered the segmental growth. Private cloud platforms eliminate the need for new infrastructure development or resources, leading to cost-saving for organizations.

On the other hand, the hybrid cloud segment is expected to expand at a significant rate during the forecast period. The utilization of hybrid cloud is rising among organizations as it provides benefits of both private and public cloud. Hybrid clouds are preferred for their enhanced scalability and flexibility.

Organization Size Insights

The SMEs segment held a considerable share of the high performance computing as a service market in 2024. This is mainly due to the increased use of cloud computing among small and medium-sized organizations. HPCaaS eliminates the need for investments in hardware and infrastructure, making it ideal for SMEs as they often face budget constraints. The high-end applications in SMEs infrastructure create challenges in meeting the high performance needs. However, HPCaaS meets the requirements of high computational needs. On the other hand, the large enterprises segment is anticipated to grow at the fastest rate in the coming years. Large enterprises often deal with vast amounts of data, requiring high-performance computing. HPCaaS solutions enable these organizations to scale up or down their computing resources as per requirements, making them indispensable.

Vertical Insights

The BSFI segment led the high performance computing as a service market with the largest share in 2024. This is mainly due to the rapid expansion of IT infrastructure in the BFSI sector. Banks and financial institutions generate vast amounts of data, requiring reliable solutions to analyze and process this data. However, HPCaaS solutions enable these institutions to perform complex analytics on vast datasets without investing in infrastructure.

Meanwhile, the healthcare segment is expected to grow at a significant rate during the forecast period. The rapid pace of digital transformation and integration of advanced technologies are expected to drive the growth of this segment. HPCaaS solutions enable healthcare organizations to analyze massive data like electronic health records and imaging data. The growing concerns about data security further contribute to segmental growth.

Regional Insights

What Made North America the Dominant Region in the Market?

North America dominated the high performance computing as a service market with the largest share in 2024. This is mainly due to the heightened adoption of cloud computing among organizations, creating a foundation for the deployment of HPCaaS solutions. The region is also an early adopter of AI technologies, which require high-performance computing. The region is likely to sustain its position in the market in the upcoming period. The growing adoption of advanced technologies in various sectors supports the growth of the market in the region.

This region has a strong presence of major tech players like AWS and Microsoft, which are heavily investing in HPCaaS solutions. Organizations in this region are shifting to high-performance computing to optimize various business processes. The funding from the government and private sectors is boosting the research and development activities in scientific field, helping the market grow. The U.S. plays an important part in the regional market growth. The rising adoption of cloud computing services and increasing concerns regarding data security are expected to boost the growth of the market.

U.S. High Performance Computing as a Service Market Trends

The U.S. is a key player in the North American market. It drives the global market by advancing technology and investing heavily in research and development. Home to major tech giants like AWS, Microsoft, and Google, the U.S. leads in creating and implementing cloud-based HPC solutions. Strong demand from sectors such as finance, healthcare, and national security, along with the shift toward hybrid and cloud models, solidifies the country's leadership in the market.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is poised to witness the fastest growth during the forecast period. The growth of the high performance computing as a service market in the region can be attributed to the increasing adoption of advanced technologies like ML and AI among businesses across different industries. The rapid expansion of the IT and BFSI sectors further supports market growth. Governments around the region are promoting digital transformations and AI adoption across industries, which boosts the demand for high-performance computing. Countries like China, Japan, India, and South Korea play a crucial part in this market's growth. These countries are innovations, boosting the need for HPCaaS for scientific computing.

India High Performance Computing as a Service Market Trends

India is a key player in the Asia-Pacific market, with its growth driven by widespread digital transformation and expanding industrialization. Factors like increasing IoT adoption, the rollout of 5G, and government efforts to boost the digital economy drive demand for scalable and on-demand HPC resources. While India's market depends on global hardware providers, the focus is on expanding deployment and utilizing HPCaaS.

What Makes Europe a Notably Growing Area?

Europe is observed to witness notable growth during the forecast period. The rising investment in cloud computing by businesses is a key factor boosting the growth of the market in the region. Rising digitalization further contributes to market growth. An established environment for research and development activities further boosts the demand for high-performance computing for research. There is a rising adoption of AI and IoT, which drives regional market growth.

Germany High Performance Computing as a Service Market Trends

Germany is a major contributor to the market, fueled by its strong industrial base and focus on Industry 4.0. The manufacturing and automotive industries extensively use HPC for simulations, digital twin technologies, and supply chain management. Additionally, significant investments in energy research, especially for renewable energy sources and smart grids, are a key factor. The German market is also shaped by substantial government funding programs supporting technological innovation and digital transformation across various sectors.

How is the Opportunistic Rise of Latin America in the High Performance Computing as a Service Market?

Latin America is experiencing a strategic rise in the market. This growth is driven by increasing demand for scalable, on-demand computing resources to support complex simulations, big data analytics, and AI workloads. The expanding industrial sectors, government initiatives promoting innovation, and the growth of AI and machine learning are key drivers. The region is shifting towards hybrid cloud models to balance performance, cost, and scalability.

Brazil High Performance Computing as a Service Market Trends

Brazil leads the Latin American market, driven by investments in multi-access edge computing, cloud-based cluster services, and the growth of AI/ML workloads. This enables enterprises and research institutions to manage intensive workloads without large upfront infrastructure costs. Industries such as BFSI, healthcare, manufacturing, and telecom are fueling steady demand. Cloud services are lowering barriers to entry and offering flexible access to computing resources for organizations of all sizes.

What Potentiates the Growth of the Market in the Middle East and Africa?

The high performance computing as a service market in the Middle East and Africa is rapidly growing due to digital transformation across various industries and increasing investments in infrastructure. The rising demand for scalable, on-demand computing is evident in research, healthcare, finance, and engineering. Major drivers include significant investment in critical infrastructure, large-scale renewable energy projects, and the expansion of oil and gas operations. The adoption of cloud technologies and high-speed networks is facilitating the efficient deployment of HPC resources in the region.

UAE High Performance Computing as a Service Market Trends

The UAE is a leading player in the MEA region, driven by ambitious government initiatives that promote technological innovation, digitalization, and economic diversification. Key drivers include significant investments in large-scale infrastructure, smart city projects, and the rollout of 5G networks. This has driven strong demand for HPCaaS to enable IoT solutions, improve operational efficiency, and support advanced applications across industries.

Value Chain Analysis

- Infrastructure and Technology Development

This involves building core technology and infrastructure for HPCaaS, including servers, accelerators, high-speed networking, and data centers.

Key Players: AWS, Azure, NVIDIA, Intel, HPE, Rescale, and Penguin Computing. - Platform and Service Creation

This focuses on developing the software platform and management tools that make HPC resources accessible as a service.

Key Players: AWS, Azure, Rescale, Adaptive Computing, and ISVs. - Sales, Distribution, and Customer Acquisition

This involves acquiring customers through direct sales, marketing, and partnerships.

Key Players: Rescale, Sabalcore Computing, and Uber Cloud. - Deployment, Integration, and Utilization

This is the crucial stage where end users implement and use HPCaaS to solve complex computational problems.

Key Players: Pfizer, BioMarin, Intel, NVIDIA, Boeing, and GM. - Support, Maintenance, and Optimization

This ensures the long-term performance and efficiency of HPCaaS through technical support, maintenance, and cost optimization.

Key Players: AWS, Microsoft Azure, and Rescale.

Recent Developments

- In August 2024, Amazon Web Services (AWS) announced introduced AWS Parallel Computing Service (AWS PCS), a new managed service that enables scaling up high performance computing (HPC) workloads on AWS. The service enables businesses to build complete HPC clusters that integrate compute, storage, networking, and visualization resources, and seamlessly scale from zero to thousands of instances.

- In February 2023, CGG and 2CRSi announced a partnership to launch a state-of-the-art high performance computing as a service offering to meet the requirements of HPC clients globally.

Key Players

- IBM Corporation: IBM offers powerful cloud-based HPC solutions through its IBM Cloud platform, delivering scalable computing resources and advanced analytics capabilities for enterprises and research organizations.

- Hewlett Packard Enterprise Company: Hewlett Packard Enterprise (HPE) provides high-performance computing infrastructure, such as the HPE Apollo and Cray systems, supporting HPCaaS with flexible, on-demand computing power for industries requiring large-scale simulations and data processing.

- Dell Inc.: Dell offers a range of HPCaaS solutions through its cloud and edge computing platforms, providing scalable infrastructure and cloud-based supercomputing power for industries like healthcare, energy, and AI research.

- Microsoft Corporation: Microsoft contributes to the market with its Azure platform, which offers high-performance computing resources, AI, and machine learning tools, enabling enterprises to run complex simulations and data-intensive applications in the cloud.

- Intel Corporation: Intel plays a key role by providing the processors and hardware accelerators (like Intel Xeon CPUs and FPGAs) that power many of the HPCaaS platforms, enhancing performance and scalability for data-intensive tasks.

- Fujitsu Ltd.: Fujitsu offers advanced computing solutions such as its FUJITSU Supercomputer PRIMEHPC systems, enabling high-performance computing as a service for scientific research, AI, and enterprise applications.

- Cisco Systems Inc.: Cisco provides high-performance networking solutions and cloud infrastructure, facilitating seamless, high-speed data transfer and optimized network management for HPC applications.

- Oracle Corporation: Oracle delivers HPCaaS through its cloud-based solutions, offering customers access to powerful computing infrastructure for high-demand applications like big data analytics, scientific modeling, and enterprise simulations.

- Hitachi Ltd.: Hitachi offers HPCaaS with a focus on advanced data analytics, providing cloud-based computing power for industries like finance, manufacturing, and research, enhancing business intelligence and decision-making capabilities.

- Advanced Micro Devices Inc.: AMD contributes by developing high-performance processors and GPUs, like the EPYC and Radeon Instinct series, which power cloud-based HPC platforms, providing scalable and energy-efficient computing resources for AI and machine learning workloads.

High Performance Computing as a Service Market Companies

- IBM Corporation

- Hewlett Packard Enterprise Company Dell Inc.

- Microsoft Corporation

- Intel Corporation

- Fujitsu Ltd, Cisco Systems Inc.

- Oracle Corporation

- Hitachi Ltd

- Advanced Micro Devices Inc.

Segments Covered in the Report

By Component

- Services

- Solutions

By Deployment

- Public Cloud

- Private Cloud

- Hybrid

By Organization Size

- SMEs

- Large Enterprises

- By Vertical

- BFSI

- Healthcare

- Retail

- others

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content