What is the High Content Screening (HCS) Market Size?

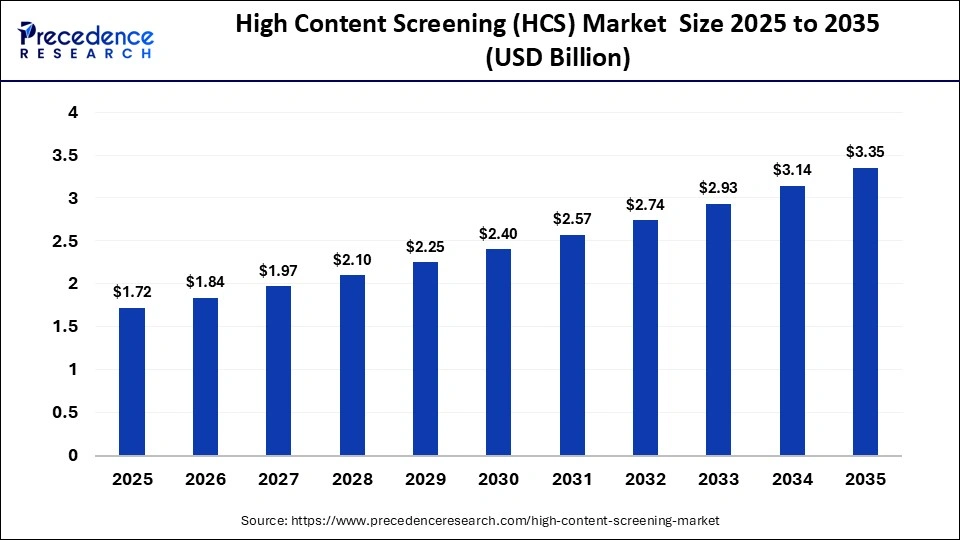

The global high content screening (HCS) market size was calculated at USD 1.72 billion in 2025 and is predicted to increase from USD 1.84 billion in 2026 to approximately USD 3.35 billion by 2035, expanding at a CAGR of 6.90% from 2026 to 2035.The market growth is attributed to increasing adoption of automated, AI-enabled high-content imaging platforms that streamline phenotypic screening and accelerate drug discovery workflows.

Market Highlights

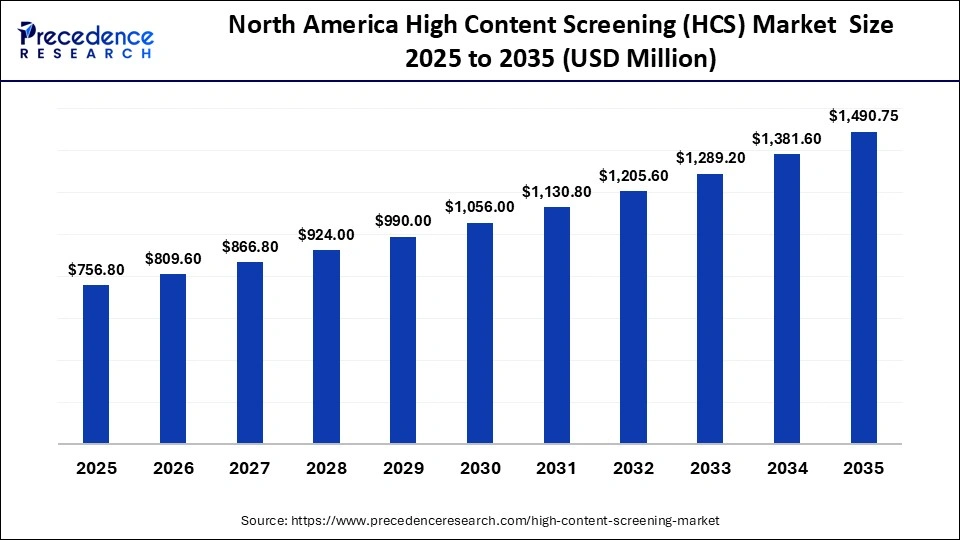

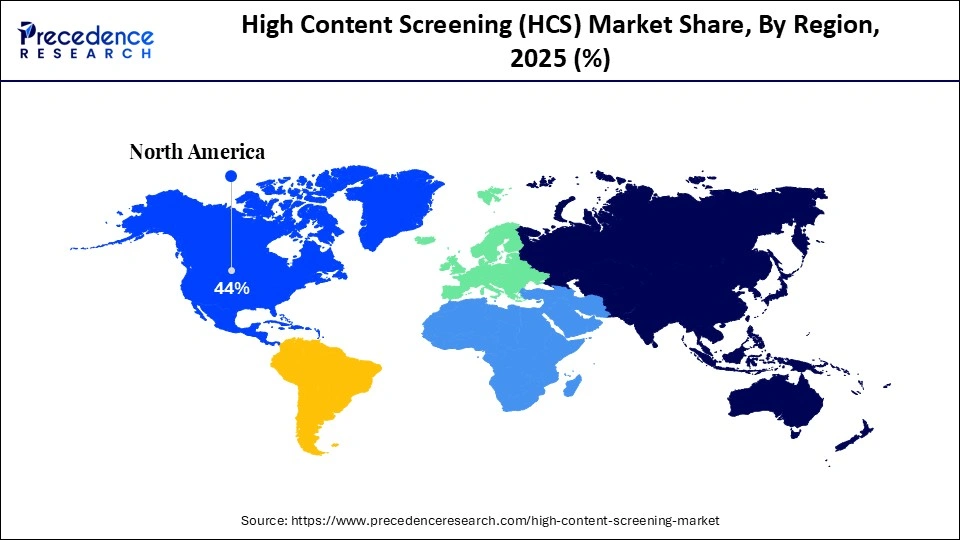

- North America dominated the market with a share of approximately 44% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of 8% between 2026 and 2035.

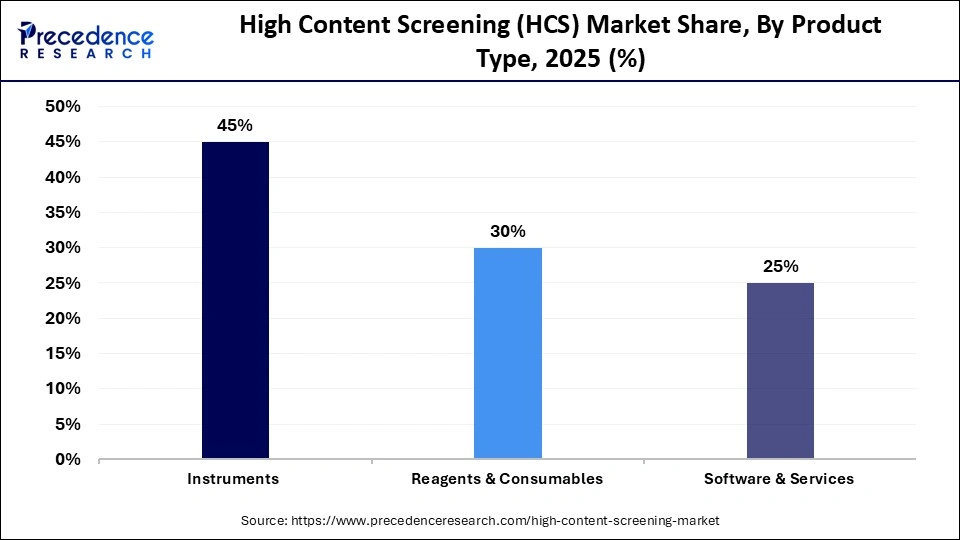

- By product type, the instruments segment contributed the highest revenue share of approximately 45% in the high content screening (HCS) market in 2025.

- By product type, the software & services segment is expected to grow at a strong CAGR of 6.7% between 2026 and 2035.

- By application, the drug discovery & development segment held a major market share of approximately 49% in 2025.

- By application, the toxicology testing segment is expected to expand at a notable CAGR of 6.8% from 2026 to 2035.

- By end user, the pharmaceutical & biotechnology companies segment captured the highest market share of approximately 50% in 2025.

- By end user, the contract research organizations (CROs) segment is poised to grow at a healthy CAGR of 7% between 2026 and 2035.

What is the High Content Screening (HCS) Market?

High Content Screening (HCS) is an advanced cell-based analysis technique combining automated microscopy, high-throughput screening, and image analysis to quantitatively assess cellular responses across multiple parameters. It is widely applied in drug discovery, toxicity testing, phenotypic screening, and cell biology research to identify effects of compounds on cell function and phenotype. HCS platforms integrate instruments, reagents, software, and data analytics to accelerate biological insights and improve decision-making in pharmaceutical, biotech, academic, and CRO settings.

The growing investment in public biomedical research funding propels the adoption of HCS technologies as governments and global health bodies push for more predictive and efficient drug discovery tools. Major public research agencies continue to allocate tens of billions of dollars annually to life sciences research. Furthermore, the increase in public funding for biomedical innovation in the Asia-Pacific region is increasing the global adoption.

High Content Screening (HCS) MarketGrowth Factors

- Expansion of Phenotypic Drug Discovery: The shift away from target-centric screening is driving broader adoption of HCS platforms capable of capturing complex cellular responses.

- Rising Use of AI in Life Sciences Labs: Rapid integration of machine learning in biology workflows is boosting demand for high-content image datasets generated by HCS systems.

- Growth of iPSC and 3D Cell Models: Increasing use of physiologically relevant cell models is propelling the need for multi-parametric imaging beyond conventional HTS readouts.

- Escalating Safety: Related Drug Attrition Costs: Pharmaceutical companies are fuelling HCS adoption to detect toxicity and safety signals earlier in preclinical pipelines.

Impact of AI on the High Content Screening (HCS) Market

Artificial intelligence (AI) revolutionizes the market through the improvement of the process of capturing, analyzing, and interpreting complex cellular data. Millions of high-resolution images are processed in seconds using AI algorithms. This allows the accurate recognition of cellular phenotypes that cannot be readily detected using traditional analytical methods. Furthermore, adaptive screening workflows refine experimental conditions in real time depending upon observed cellular responses and are also supported by the integration of AI.

High Content Screening (HCS) Market Trends

- Single Cell Multi-omics Integration Fuels Advanced Phenotypic Profiling:HCS instruments that tie high-resolution imaging to single-cell transcriptomics and proteomics attract investment from precision medicine labs. The phenotype of images in relation to molecular signatures has the potential to expand the scope of application beyond a conventional screen. This interdepartmental integration appeals to new end-users and increases high-value platform adoption.

- Cell Therapy & Immuno Oncology Screening Expands Market Footprint:High-content imaging in biotech companies has been used to measure engineered immune cell behavior on tumor models, leading to new screening uses. HCS allows the comprehensive study of cell-cell interaction processes and dynamic immune responses, which are not provided by standard assays. This trend opens dedicated markets in cell therapy R&D and strengthens long-term demand for instruments.

- Transforming the HCS Market: Key Innovations Powering Precision Phenotypic Screening: In FY2024–FY2025 filings, Danaher, Thermo Fisher Scientific, Revvity (formerly PerkinElmer), and Becton Dickinson collectively reported over USD 20 billion in annual life-science instrument revenue, with advanced imaging, cell analysis, and automation platforms representing a core product category manufactured primarily in the U.S.Agilent Technologies (U.S.) reported around USD 6.95 billion in annual revenue reported in 2025, supporting exported analytical and imaging software and tools that contribute to AI-enabled analysis in high-content workflows.

- In January 2025, Molecular Devices introduced the ImageXpress HCS.ai High-Content Screening System with proprietary AI-powered image analysis software, indicating mainstream adoption of deep-learning enabled analytics in commercial HCS platforms by leading OEMs.

- In 2024–2026, HCS adoption has grown for advanced biological models, including 3D cell cultures and organoids, enabling more physiologically relevant screening that better predicts clinical outcomes than traditional 2D assays.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.72 Billion |

| Market Size in 2026 | USD 1.84 Billion |

| Market Size by 2035 | USD 3.35 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, End User, and Region |

| Product Type,Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insight

Why Did the Instruments Segment Dominate the High Content Screening (HCS) Market?

The instruments segment dominated the market with a share of approximately 45% in 2025, due to its central role in enabling automated, high-resolution cellular imaging across drug discovery and toxicology workflows.

The pharmaceutical and biotechnology laboratories focused on capital investment in state-of-the-art confocal and widefield imaging to facilitate large-scale screening by phenotypics. Furthermore, government-funded screening programs and public research centers strengthened procurement volumes by upgrading legacy microscopy systems to fully automated high-content platforms.

The software & services segment is expected to grow at the fastest CAGR of 6.7% in the coming years, owing to the growing image complexities and volumes of data created by current screening campaigns. Image analysis using AI leads to high-dimensional datasets that are provided by advanced analytics platforms, which support machine learning, cloud computing, and scalable data management.

Moreover, research organizations now emphasize analytical flexibility and long-term data usability over one-time hardware acquisition, facilitating market growth.

Application Insights

Which Application Segment Dominated the High Content Screening (HCS) Market?

The drug discovery & development segment held the largest revenue share of approximately 50% in 2025, due to its strong dependence on phenotypic screening to sharpen early-stage decision-making and reduce downstream failure risk. Drug pipelines are becoming more dependent on multi-parametric cellular data to connect exposure of compounds to functional biological cellular outcomes. The increasing investments by government and private bodies also support the use of HCS in drug discovery.

High-content imaging facilitates the diagnosis of morphology, protein localization, cell-cycle effects, and pathway modulation in a single workflow. Massive pharma discovery centers and academic screening facilities extend the use of HCS in oncology, neuroscience, and rare disease discovery. The Microscopy Society of America (MSA) highlighted in 2025 that advances in automated fluorescence microscopy significantly improved reproducibility and throughput in drug screening laboratories. Additionally, these factors positioned drug discovery as the primary application anchor across screening workflows.

The toxicology testing segment is expected to expand significantly in the market with a CAGR of 6.8% in the coming years, owing to increasing regulations and scientific interests in early risk identification of safety. High-content imaging enables the measurement of cytotoxicity, mitochondrial dysfunction, oxidative stress, and organ-specific injury markers in human-relevant cell models simultaneously.

Toxicology screening programs supported by government and academic consortia are expected to screen thousands of chemicals per year through image-based in vitro platforms to enhance hazard prediction. Furthermore, the adoption is likely to rise across environmental toxicology, chemical safety, and combination drug testing programs. CROs continue to expand dedicated toxicity imaging capabilities to support sponsor-led safety evaluations.

End User Insights

Which End User Segment Led the High Content Screening (HCS) Market?

The pharmaceutical & biotechnology companies segment led the market with a share of approximately 50% in 2025, due to their direct control over early-stage research pipelines and internal screening infrastructure. Hundreds of parallel phenotypic experiments were routinely run every quarter by large biopharma organizations using automated HCS systems built into workflows of lead optimization. Moreover, continuous system upgrades toward higher-throughput confocal and spinning-disk architectures reinforced long-term dependency on internal HCS infrastructure among pharmaceutical & biotechnology companies.

The contract research organizations (CROs) segment is expected to witness the fastest growth in the market with a CAGR of 7.0% over the forecast period, as more phenotypic screening campaigns are being completely implemented by CROs serving early-stage biotech and virtual pharma sponsors.

CRO labs are now completing 24/7 automated pipelines of imaging services that allow turnover of assays in toxicology, CRISPR-based functional screens, and translational biomarker research. Furthermore, the vendors such as Molecular Devices, Nikon, and Zeiss highlighted increased CRO demand for systems optimized for high-content plus flow-imaging hybrid workflows, particularly in immuno-oncology and cell therapy screening.

Regional Insights

How Big is the North America High Content Screening (HCS) Market Size?

The North America high content screening (HCS) market size is estimated at USD 576.80 million in 2025 and is projected to reach approximately USD 1,490.75 million by 2035, with a 7.01% CAGR from 2026 to 2035.

Why North America Dominated the High Content Screening (HCS) Market?

North America held a major revenue share of approximately 40% in the market in 2025, due to the concentration of large-scale pharmaceutical R&D hubs, advanced imaging vendors, and mature automation ecosystems operating in tight coordination. North America conducts a large number of high-content imaging campaigns, with the majority of them in the areas of oncology, neuroscience, and immunology.

HCS workflows are incorporated into the academic medical centers' pipelines of genomics and proteomics, and the multi-parameter assays throughput was improved. Furthermore, the research funding by federal programs under NIH and NCI programs stimulates increased phenotypic screens, facilitating earlier target validation and mechanistic research.

What is the Size of the U.S. High Content Screening (HCS) Market?

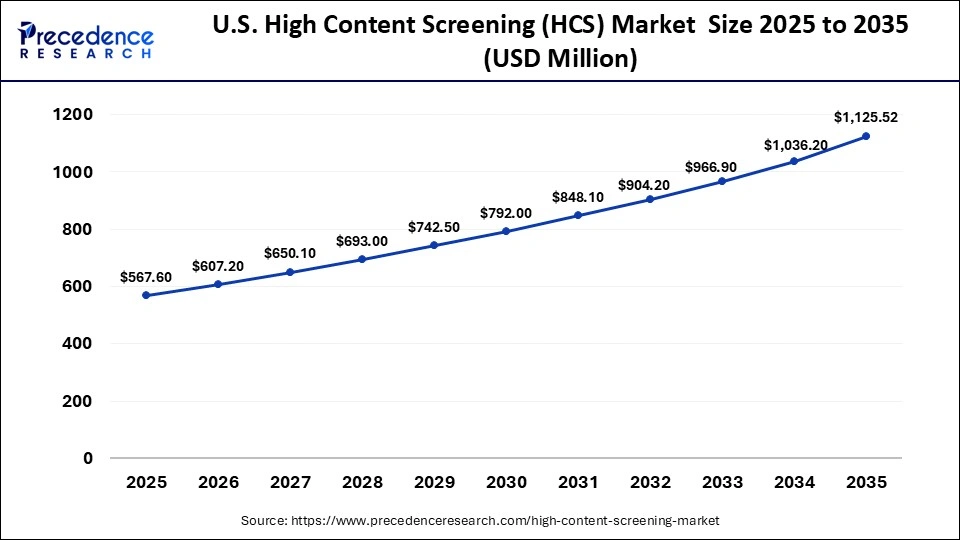

The U.S. high content screening (HCS) market size is calculated at USD 567.60 million in 2025 and is expected to reach nearly USD 1125.52 million in 2035, accelerating at a strong CAGR of 7.09% between 2026 and 2035.

U.S. – North America's High Content Screening Hub

U.S. leads the market in North America, owing to its intensive concentration of pharmaceutical discovery locations, excellent microscopy, and extensive research financing. In 2025, large U.S. research centers and biotech centers conducted significant expansions of automated high-content imaging initiatives. This is intended to facilitate large-scale phenotypic and mechanism-directed screens.

Several key players, such as Thermo Fisher Scientific, Genedata, and Danaher Life Sciences, are the major contributors of the market in the U.S. Furthermore, the cumulative momentum sustained the leadership role of the U.S. in deploying cutting-edge cellular analysis systems and reinforced its central position in North America's HCS market growth.

How is Asia-Pacific Growing in the High Content Screening (HCS) Market?

Asia-Pacific is expected to witness the fastest growth with a CAGR of 8.0% during the predicted timeframe, driven by the higher rates of pharmaceutical R&D, widening biologic pipelines, and government-supported infrastructure projects in China, India, South Korea, and Singapore. High-content imaging is incorporated in regional biotech companies to compete on the international scene in oncology, metabolic disorders, and immunology. Additionally, the university-CRO-pharma partnerships improved HCS assay development and interpretation of phenotypic data training, thus facilitating the market in this region.

China – Emerging Laboratory Innovation Hub in Asia Pacific

China is leading the charge in the Asia-Pacific region, owing to its specific investments in the infrastructure of life sciences, a growing biotech ecosystem, and the accelerated use of automated imaging methods. Moreover, the use of strategic alliances with the imaging providers and standardized AI analytics platforms enhanced scalability and made China the leading nation, promoting the next-generation HCS.

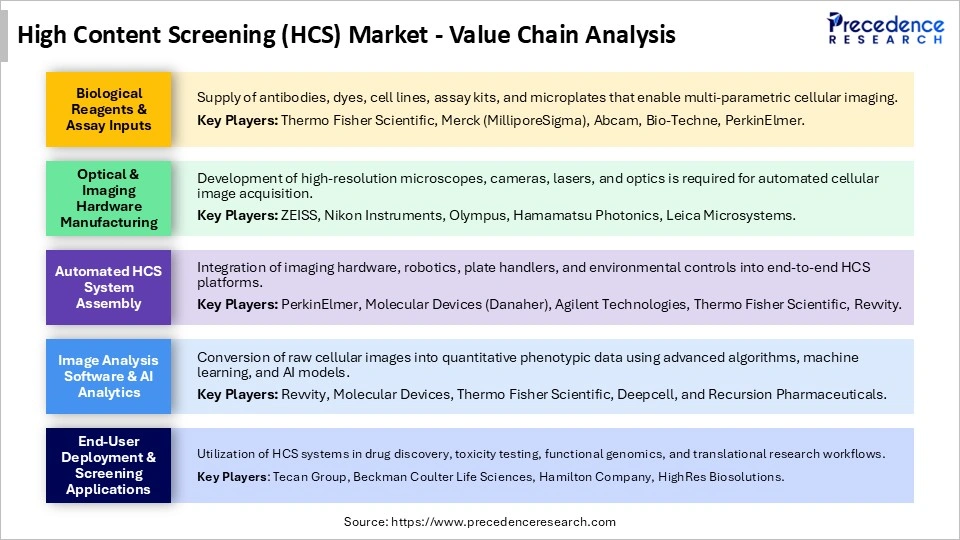

High Content Screening (HCS) Market Value Chain Analysis

Who are the Major Players in the Global High Content Screening (HCS) Market?

The major players in the high content screening (HCS) market include Thermo Fisher Scientific Inc., Danaher Corporation, Becton, Dickinson and Company (BD), PerkinElmer Inc., Agilent Technologies, Inc., Carl Zeiss AG, Merck KGaA, GE Healthcare, Bio-Rad Laboratories, Inc., Tecan Trading AG, Yokogawa Electric Corporation, Nikon Corporation, Sartorius AG, Corning Incorporated, Revvity, Inc.

Recent Developments

- In January 2026, Molecular Devices, LLC, a leading life science solutions provider and part of Danaher Corporation (NYSE: DHR), announced a strategic collaboration with London-based lab automation innovator Automata. The partnership aims to integrate Molecular Devices' imaging and detection systems with Automata's LINQ platform, creating fully connected, AI-ready research workflows.(Source: https://www.moleculardevices.com)

- In October 2025, the HCS-3DX platform introduced automated analysis for 3D cell cultures, or spheroids, leveraging AI-powered image processing and sample selection. The system enables high-precision, large-scale screening of complex cellular models in significantly reduced timeframes.(Source: https://www.news-medical.net)

Segments Covered in the Report

By Product Type

- Instruments

- Reagents & Consumables

- Software & Services

By Application

- Drug Discovery & Development

- Primary & Secondary Screening

- Target Identification & Validation

- Toxicology Testing

- Phenotypic/Stem Cell/Cancer Research & Others

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Other Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting