What is the North America Corrugated Packaging Market Size?

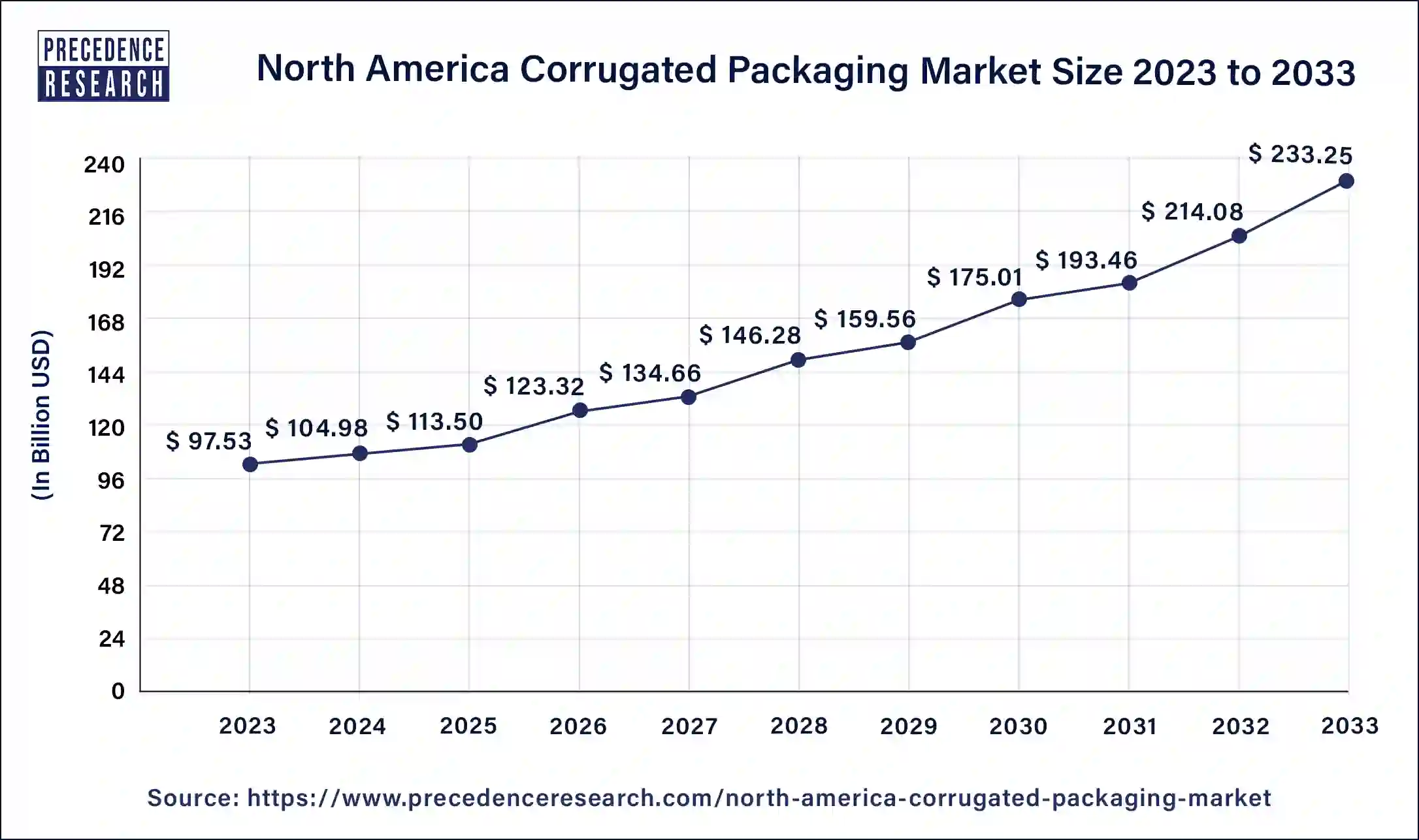

The North America corrugated packaging market size is calculated at USD 113.50 billion in 2025 and is predicted to increase from USD 123.32 billion in 2026 to approximately USD 252.42 billion by 2034. The market is expanding at a CAGR of 9.17% over the forecast period 2025 to 2034. The North America corrugated packaging market is driven by the increasing acceptance of online shopping.

North America Corrugated Packaging Market Key Takeaways

- The U.S. dominated the North America corrugated packaging market in 2024.

- Canada is observed to be the fastest growing in the market during the forecast period.

- By package type, the singe wall boards segment dominated the market with the largest revenue share of 38.46% in 2024.

- By package type, the double wall boards segment is observed to be the fastest growing market during the forecast period.

- By application, the food and beverages segment has contributed more than 34.36% of revenue share in 2024.

- By application, the e-commerce segment is the fastest growing in the North America corrugated packaging market during the forecast period.

What is the Role of AI in the North America Corrugated Packaging Market?

Automation handles the physical side of packaging production, and AI making waves in operational intelligence and decision making. Machine learning (ML) algorithms can analyze historical and real time data to predict maintenance needs, improve production schedules, and reduce waste. AI can improve supply chain management by tracking inventory levels in real-time, predicting supply chain disruptions, and recommending the most effective delivery routes. This leads to faster delivery times, cost savings, and a more sustainable approach to packaging production by minimizing wasted resources.

AI helps to improve packaging design to reduce material waste, ensure product freshness, and extend shelf life through smart and active packaging technologies. Machine learning and predictive analytics improve inventory management and supply chain efficiency, reducing spoilage and overpackaging.

Market Overview

The term "corrugated packaging" describes a kind of packaging composed of corrugated paperboard, a substance made up of two outer and an inner layer of paper known as "liners" and an interior layer known as "fluting." The liners offer a smooth surface for branding and printing, and the fluting provides strength and cushioning.

A wide range of goods, from food and drink to electronics and furniture, are shipped and stored in corrugated packaging. It is well-liked since it is recyclable, robust, and lightweight. Corrugated packaging can be used for displays, stands, and other marketing materials in addition to standard boxes. These goods are intended to serve as product displays and marketers in retail settings. As eco-friendly packaging solutions become increasingly important to consumers and businesses, sustainability is a significant trend in the corrugated packaging sector. As a result, many companies are converting to recycled and renewable resources like paper pulp, bagasse, and bamboo and introducing sustainable practices into every aspect of their business operations.

Growth Factors

- The need for robust and lightweight packing to ensure safe product delivery is growing as more people purchase online.

- Growing industries such as food & beverage, personal care, and healthcare drive demand for bespoke packaging solutions.

- Corrugated cardboard benefits from consumer and governmental focus on environmentally friendly solutions because it is recyclable and biodegradable.

- Strong and dependable packaging is essential for protecting products during transit, especially due to growing manufacturing activity and global trade.

- Corrugated boxes are more useful and aesthetically pleasing thanks to innovations in printing, design, and lightweight materials.

Market Trends

- Increasing demand from the food & beverage industry

- Technological innovation in packaging

- Expansion of e-commerce worldwide

- Deliver measurable value in different sectors

- Reduce operational complexities

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 113.50 Billion |

| Market Size in 2026 | USD 123.32 Billion |

| Market Size by 2034 | USD 252.42 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.17% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Package Type and Application |

Market Dynamics

Drivers

Rising demand in the agricultural and food and beverage sector

Popular packaging frequently used for storing and shipping various items is corrugated packing. It is constructed by laminating and fluting two or more sheets of paper to create a robust and long-lasting material. Food and drinks are kept safe despite being transported over large distances and handled by various personnel thanks to corrugated packaging. Additionally, corrugated boxes can be ordered in the precise size needed to fit the product. Customization usually impresses customers since it appears professional and denotes business, and it helps with brand recognition. Thus, creating a customized brand is the best approach to attract customers.

Due to the growing demand in the agriculture sector, there is a greater need for dependable and effective packaging solutions to move and store agricultural products. The agriculture business has favored corrugated packaging because of its affordability, durability, and adaptability. Because of its capacity to protect against moisture, pests, and other environmental conditions, it is specifically utilized for transporting and storing fruits, vegetables, and other agricultural items. Farmers and other producers will find it a helpful solution because it is lightweight and easy to handle.

Increasing demand due to restrictions on wooden packaging

Since corrugated crates are made of sophisticated materials, they weigh less and are as strong as wooden containers. This corrugated packing feature helps save freight and material costs by protecting the shipment. Furthermore, recyclable and reusable corrugated packaging lowers carbon dioxide emissions. Since corrugated packaging is one of the best choices for handling and long-distance transportation, it provides packaged goods with the highest stability and protection. Corrugated packaging takes up less room during transportation, another advantage over traditional hardwood shipping. As a result, more goods are transported in the available area, increasing demand.

Restraints

Flexible plastic container packaging poses significant competition

Retailers and manufacturers stand to gain the most from flexible plastic packaging since it reduces container weight, cuts transportation and storage costs, and requires significantly less space. Food tastes better in retort containers than traditional tin cans, and consumers appreciate features like single-serve amounts, easy-to-open, and easy-peel alternatives. Convenience, mobility, economy, sustainability, and health advantages are thus pushing product package manufacturers and packaging converters to move from rigid to flexible materials.

In contrast to corrugated packaging, these flexible plastic containers have superior moisture barrier qualities that shield the product from moisture and humidity while it is being stored and transported. When not in use, they occupy less space than corrugated packing, which lowers storage and shipping expenses. In addition, most of the packaging for flexible plastic containers is recyclable, which promotes sustainability initiatives and helps cut down on waste.

Inadequate weatherproofing

Extreme weather conditions negatively impact corrugated packaging. Corrugated container producers need to allow more time for the drying process when moisture and humidity levels rise. Because businesses want to expedite this process, the adhesive or ink could not evaporate entirely, giving the impression that the cardboard is flimsier, like how an absorbent substance retains moisture and water.

Conversely, suppose cardboard is stored in dry conditions for an extended period. In that case, the absence of moisture causes the packing to function as if it were a dehydrated sponge. It becomes very stiff and brittle, making it difficult to fold a box without ripping or breaking it. These elements might, in part, prevent market revenues from growing. Numerous companies are researching and developing projects to get around this restriction. Another choice is to erect a barrier between the product and the surroundings out of plastic or other waterproof materials. These methods might not work for all items or applications, and they might raise the cost of the packing.

Opportunity

Implementation of digitalization in the corrugated packaging industry by advancing novel paper range

Several businesses, including Smurfit Kappa, invented the incorporation of digitalization into corrugated packaged goods. It created a range of multipurpose paper suitable for flexographic and digital printers. Multipurpose paper facilitated cooperation between the printer and the packaging materials. This development expands the parameters of ideal digital printing and should optimize digital printing abilities.

One benefit of personalized graphic design is higher revenue, among other things. These advancements offer substantial market growth potential and have advanced the digitization of the paper-based packaging industry. The development of converters and printers is made possible by the capacity to personalize for brands, regions, stores, or individuals, in addition to the quality currently attainable through cutting-edge technologies.

Brand owners realize that these technological advancements present opportunities to engage their customer base more profoundly and increase declining brand loyalty. Industry leaders also find that packaging is critical in creating a memorable shopping experience that customers are likely to share on social media, which could enhance marketing, attract new customers, and encourage repeat business.

Package Type Insights

The single-wall boards segment underwent a notable growth in the North America corrugated packaging market during 2024.

- In June 2024, Marina, a smart reusable fish crate was launched by MUNICH-IFCO, a provider of reusable packaging containers (RPCs). It is designed in collaboration with the fishing industry. Marina aims to bring greater production, efficiency, and sustainability to the fresh fish and seafood supply chain.

https://www.qualityassurancemag.com/news/ifco-launches-digitally-enabled-reusable-fish-crate/

The double wall boards segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- In March 2024, the release of groundbreaking EAPP EcoReady All Plastic Airless Plastic was announced by APC Packaging, a leading provider of innovative packaging solutions.

APC Packaging Launches EAPP EcoReady All Plastic Airless Pump

North America Corrugated Packaging Market, by Package Type, 2022-2024 (Million Tonnes)

| Package Type | 2022 | 2023 | 2024 |

| Single Wall Boards | 18.79 | 19.59 | 20.56 |

| Double Wall Boards | 12.75 | 13.26 | 13.87 |

| Triple Wall Boards | 10.44 | 10.82 | 11.27 |

| Single Face Board | 7.01 | 7.26 | 7.54 |

Application Insights

The food & beverage segment enjoyed a prominent position in the North America corrugated packaging market during 2024.

- In January 2025, a unified platform dedicated to advancing beverage cartons as essential, renewable, and circular packaging solutions was announced by the Food and Beverage Carton Alliance (FBCA), an association formed from the two established organizations.

New Food and Beverage Carton Alliance Launches to Advance Sustainable Packaging | Packaging World

The e-commerce segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- In December 2024, a new origami packaging technology to create sustainable, lightweight, durable, and eye-catching alternatives to conventional protective packaging materials was launched by VTT Technical Research Center of Finland in collaboration with the Alto University and Finnish Industrial.

North America Corrugated Packaging Market, by Application, 2022-2024 (Million Tonnes)

| Application | 2022 | 2023 | 2024 |

| Electronics & Electricals | 4.99 | 5.16 | 5.38 |

| Food & Beverages | 16.79 | 17.5 | 18.33 |

| Transport & Logistics | 8.17 | 8.47 | 8.85 |

| E-Commerce | 11.86 | 12.36 | 13.01 |

| Others | 7.19 | 7.44 | 7.67 |

Regional Insights

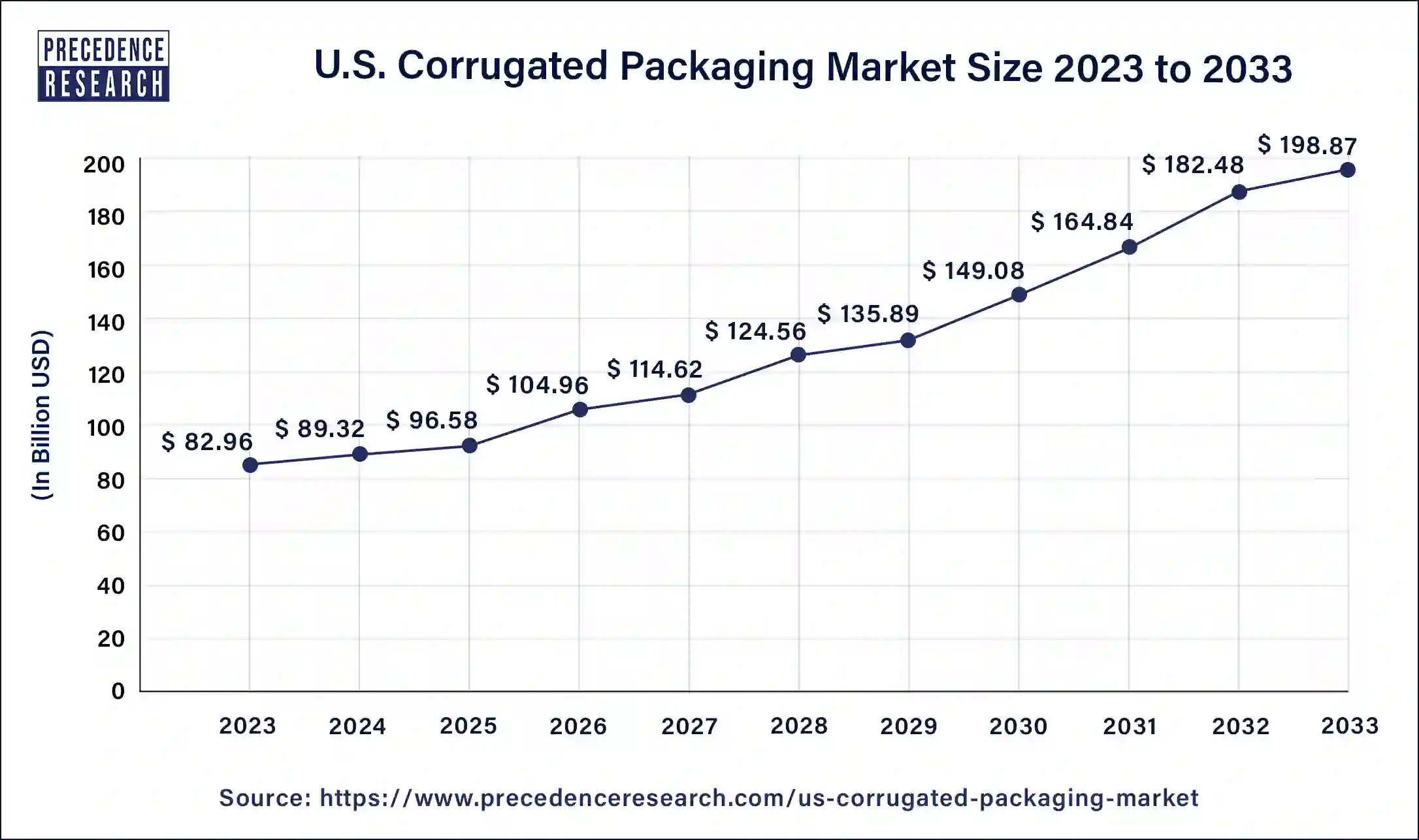

U.S. Corrugated Packaging Market Size and Growth 2025 to 2034

The U.S. corrugated packaging market size accounted for USD 89.32 billion in 2024 and is projected to attain around USD 215.26 billion by 2033, poised to grow at a CAGR of 9.19% from 2025 to 2034.

The U.S. had largest market share in 2024 in the North America corrugated packaging market. The US pharmaceutical business is growing. The increasing number of pharmaceutical companies venturing into e-commerce and offering home delivery services is expected to drive the regional market dynamics through 2032. Due to strict lockdown measures, consumer choices for online platforms for acquiring necessities like food, medications, and other items have changed. In addition, end-use industries were motivated to employ sustainable packaging solutions by the strict regulations governing single-use plastic packaging and the quickening of the green transition. These variables helped businesses grow during the recession and are expected to follow a similar trajectory going forward.

The market for corrugated packaging in the United States is anticipated to expand in the following years due to the growing demand from various sectors for economical, eco-friendly, and effective packaging solutions.

Canada is the fastest growing in the North America corrugated packaging market during the forecast period. Growing markets, new technologies, and sustainability are propelling corrugated packaging's expansion in Canada. Customers choose readily recyclable cardboard containers over tin or plastic packaging because of the growing emphasis on sustainability. Paper packaging will probably become a practical and affordable choice across the country as consumer demand for more consumer-friendly packaging and enhanced product protection increases. Demand for cardboard and paper products is rising in the nation due to the growing e-commerce sector, especially among logistics and transportation firms.

A variety of items can be transported, preserved, and protected at a reasonable price with the help of paper-based packaging. As environmental restrictions become more stringent, there will likely be a greater preference for environmentally benign and biodegradable packaging with reused materials.

North America Corrugated Packaging Market Companies

- Georgia-Pacific

- Oji Holdings Corporation

- Lee & Man Paper Manufacturing Ltd.

- Smurfit Kappa

- DS Smith

- WestRock Company

- International Paper

- Packaging Corporation of America

Recent Developments

- In January 2023, the launch of a new closed basket made of recycled and recyclable corrugated cardboard for the produce sector was announced by Cascades. An alternative to food packaging that is difficult to recycle, this new product is the latest addition to Cascades' line of eco-friendly packaging.

Cascades launches new eco-friendly packaging for fresh fruits and vegetables - In November 2023, to introduce Reusable Plastic Containers (RPCs) for bananas, Fresh Del Monte Produce, Inc., one of the world's leading vertically integrated producers, marketers, and distributors of high-quality fresh and fresh cut vegetables announced a strategic partnership with Arena Packaging.

Fresh Del Monte Pioneers Industry Shift with Launch of First-of-its-kind Reusable Plastic Banana Containers in Collaboration with Arena Packaging

Segments Covered in the Report

By Package Type

- Singe Wall Boards

- Double Wall Boards

- Triple Wall Boards

- Single Face Board

By Application

- Electronics and Electricals

- Food and Beverages

- Transport and Logistics

- E-commerce

- Others

By Country

- North America

- U.S.

- Canada

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting