Protective Packaging Market Size and Forecast 2025 to 2034

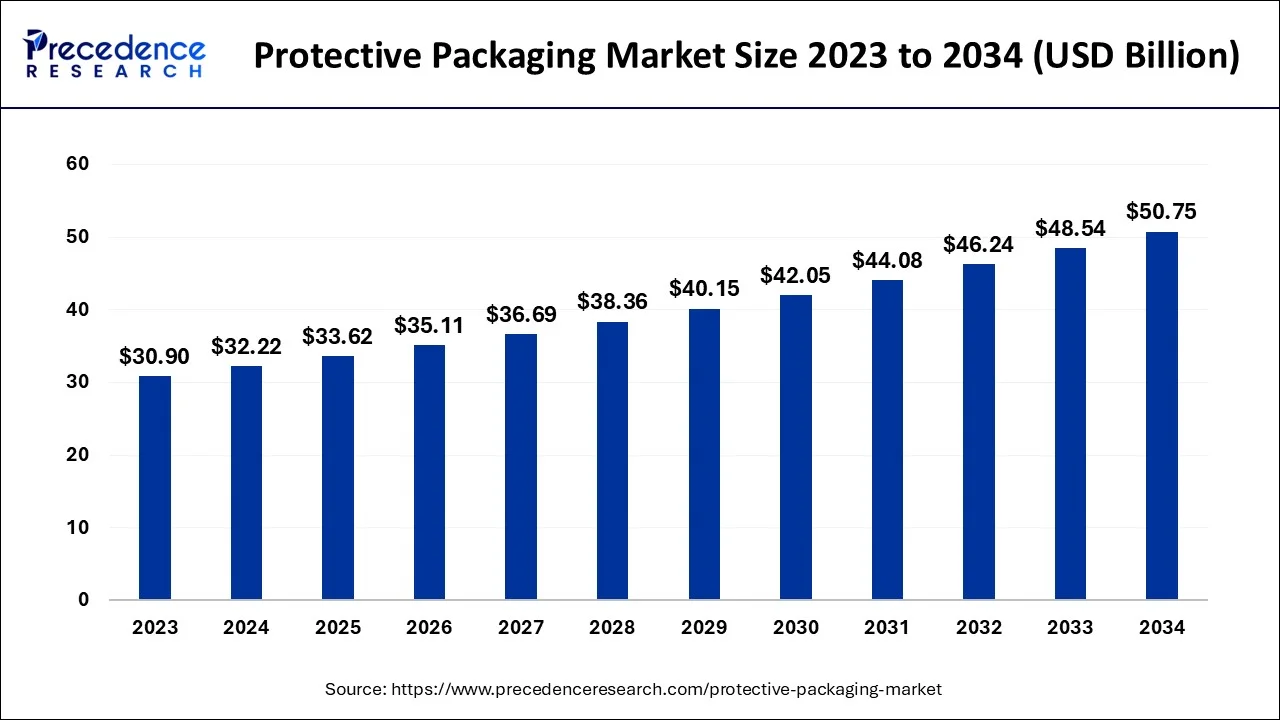

The global protective packaging market size is estimated at USD 32.22 billion in 2024 and is anticipated to reach around USD 50.75 billion by 2034, expanding at a CAGR of 4.70% between 2025 and 2034.

Protective Packaging Market Key Takeaways

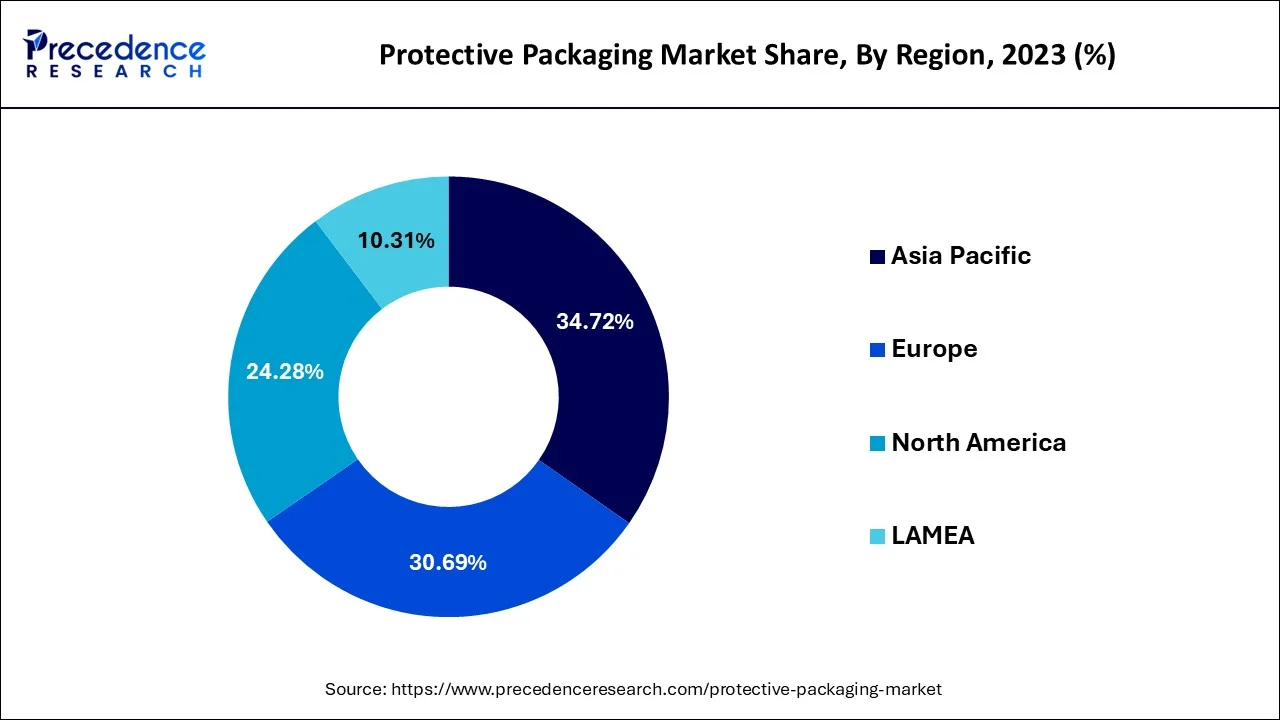

- Asia-Pacific dominated the protective packaging market with the share of 34.72% in 2024.

- By type, the intelligent packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By material, the biodegradable and sustainable materials segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- By function, the moisture control segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By application, the pharmaceuticals segment is set to experience the fastest rate of market growth from 2025 to 2034.

- By end use, the food and beverage segment dominated the market in 2024.

- By end use, the healthcare and pharmaceuticals segment is projected to expand rapidly in the market in the coming years.

How AI has been effecting Protective Packaging Market?

AI is beginning to have a powerful influence on the proactive packaging market, reshaping both how packaging is designed and how it functions throughout the supply chain. One of the most immediate impacts is in design and material optimization. Using AI driven simulations, manufacturers can model how different packaging materials respond to stress, temperature, or humidity, allowing them to develop packaging that is lighter, stronger, and more sustainable. This reduces the need for lengthy trial and error testing and accelerates the creation of eco-friendly packaging that still meets durability standards. AI is also helping brands experiment with smart labels, QR codes, and interaction data and refining packaging for maximum engagement. Another key area where AI is changing the market is in supply chain visibility and waste reduction. Proactive packaging often includes freshness indicators or condition monitors, and AI tools can process the data these generate at scale. By prediction when products are likely to spoil or degrade, AI enables companies to optimize distribution routes, reduce food and healthcare, where product safety and shield lied are critical. Additionally, AI supports real time quality monitoring on packaging plants, detecting defects before products reach shelves and thereby reducing recalls and brand damage. Together, these applications show that AI is not just an add on to proactive packaging but a driving force behind its evaluation. From creating smarter, more sustainable designs to powering real time decision making in logistics, AI is enabling proactive packaging to deliver on its promise of protecting products, reducing waste, and enhancing consumer trust.

Asia Pacific Protective Packaging Market Size and Growth 2025 to 2034

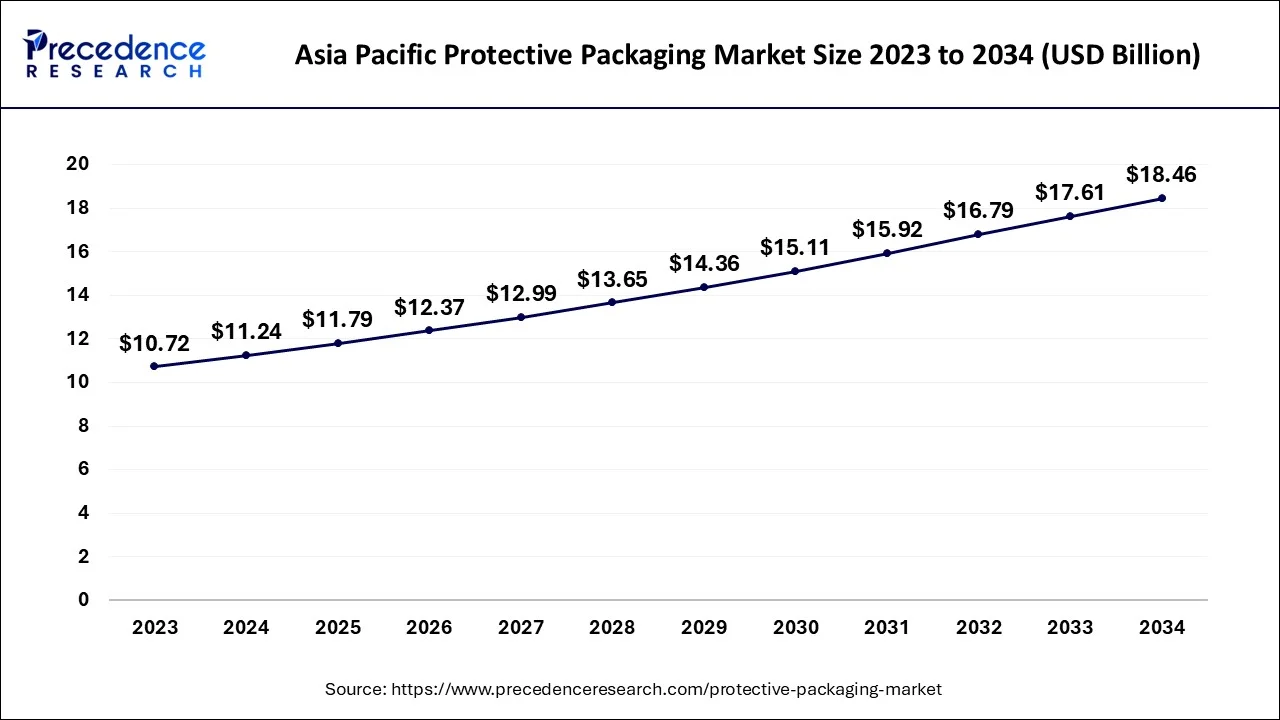

The Asia Pacific protective packaging market size accounted for USD 11.24 billion in 2024, and it is expected to be worth around USD 18.46 billion by 2034 with a CAGR of 5.1% from 2025 to 2034.

Asia- Pacific has its largest market share of 34.72% in the protective packaging market in 2024. The region's protective packaging market is at a CAGR of 5.12%. Growing consumer awareness of sustainability and product safety has forced companies to invest in premium packaging that protects their products and complies with environmental standards. Reusable packaging options, recyclable materials, and biodegradable polymers are examples of eco-friendly packaging materials that are becoming more popular. The nations in the area have embraced these developments with great speed.

Growing numbers of customers are choosing to purchase online, leading to increased package deliveries. Sturdy packaging solutions are needed to guarantee the goods are transported safely. The growth of the retail industry, which now includes convenience stores, supermarkets, and hypermarkets, has also increased the demand for protective packaging for various goods.

- In December 2024, Mars China's SNICKERS bar debut with dark chocolate cereal was announced. In addition to being low-GI and low-sugar, this novel new product has individual packaging composed of mono PP, which aligns with the idea of "Designed for Recycling" and is readily recyclable through approved methods.

- In May 2024, Huhtamaki unveiled a brand-new, environmentally friendly, flexible packaging innovation that offers the best possible protection, total recyclable content, and cost-effectiveness.

Europe was considered as the second largest share of 30.69% in protective packaging market in 2024. European businesses are focused on making R&D investments to launch cutting-edge protective packaging solutions. This entails utilizing cutting-edge packing technology to track the state of the items while they are in transit, such as materials that react to temperature, shock-absorbing designs, and monitoring systems. Numerous significant protective packaging participants, including local and international businesses, call it home. The competitive landscape further enhances the region's market share, which encourages innovation, product variety, and effective supply chain management.

North America is growing at the fastest rate in the protective packaging market, due to a strong e-commerce sector and demand for sustainable packaging. Amazon, for instance, is changing to using recycled paper filler in place of its plastic air pillows and is removing nearly 15 billion plastic air pillows per year, which is a huge change in consumer behavior toward sustainable materials. Companies like Winpak expect a 3% to 5% increase in sales volumes in 2024, and Canada's market is progressing alongside North America due to strict environmental regulations.

Market Overview

Protective packaging is designed to shield products from theft, loss, and damage while being transported, distributed, and stored. Using containers or wrapping to keep multiple goods together creates a sturdy platform for transportation. Protective packaging is used to endure varied static and dynamic stresses in a variety of supply chain locations, including the assembly line, transportation, warehouses, and order picking.

Moreover, it offers defence against environmental factors like precipitation, temperature, humidity, and sun radiation. Several applications, including those in the food, electronics, and pharmaceutical industries, embrace protective packaging. According to the type of goods, protective packaging can be divided into three basic categories: rigid, foam, and flexible.

protective packaging offers solutions that shield machinery, equipment, and industrial goods from harm while being stored and transported. Protective packaging also provides security through the void fill, wrapping, flexible cushioning, blocking and bracing, protective containment, and surface defense.

Protective Packaging Market Growth Factors

The market for protective packaging is expanding quickly due to a number of factors, including the rising demand from the food and beverage and healthcare industries as well as consumer preference for easy packaging. The production of manufactured goods on a global scale, ongoing technical advancements, and rising consumer demand for packaged goods are expected to drive the growth of the protective packaging market.

The e-commerce sector is expected to contribute significantly to cushioning the protective packaging market throughout the forecast period. Companies must make sure that they fully grasp their customers' needs and satisfy them. Major manufacturers are focusing on R&D efforts to enhance the creation of environmentally friendly and renewable packaging materials that can be recycled and regenerated.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 50.75 Billion |

| Market Size in 2025 | USD 33.62 Billion |

| Market Size in 2024 | USD 32.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.7% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Function, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

E-commerce industry to drive the usage of protective packaging

Electronic commerce, also known as e-commerce, is the exchange of products and services as well as the transmission of money and data via an electronic network, most commonly the internet. These commercial exchanges take place between businesses, consumers, other businesses, or between consumers and businesses.

The E-commerce sector's growing use of protective packaging is the main factor fueling the market's expansion worldwide. The demand for the worldwide protective packing business is projected to increase as online shopping becomes more widely accepted in both emerging and developed parts of the world. Additionally, global industrial production will accelerate, consumer spending on packaged products will increase globally, and demographic trends including an increase in the number of urban residents will further fuel this growth.

The potential for technological innovation to create packaging materials that are sustainable, reusable, and recyclable can be further investigated in the global market for protective packaging. The worldwide market for protective packaging is significantly constrained by the availability and high cost of raw materials. Therefore, the market for protective packages could expand with the excessive use of the E-commerce sector.

Restraint

Stringent regulation for packaging

Since many plastic packaging wastes are non-biodegradable, they pose a serious threat to the ecosystem. Governments all over the world have put strict laws and regulations in place that the packaging business must follow to address this problem. The European green deal, for instance, which was introduced in December 2019 and outlined a route to zero net greenhouse gas emissions by 2050 while putting an emphasis on economic growth unrelated to resource use, is one example.

The Commission announced that it would continue the plastics strategy by concentrating on enacting new legislation, such as legal requirements to boost the market for secondary raw materials with mandatory recycled content, targets and measures to combat excessive packaging, and waste generation regulations to ensure that all packaging is reusable or recyclable in the EU in an effort to reduce waste. Governments in developing countries are taking action to encourage sustainable packaging as they become more environmentally conscious.

The enacted laws forbid businesses from obtaining basic materials from suppliers who do not follow environmental laws. As a consequence, the price of raw materials is gradually rising, pushing up the cost of operations. As a result, protective packaging revenues as a whole experience a drop in profits.

Opportunity

Integration of Smart Technologies

One of the biggest opportunities in the proactive packaging market lies in the integration of smart and digital technologies such as RFID tags, QR codes, and embedded sensors. These innovations allow packaging to go beyond traditional protective functions and provide real time data about the product's condition, authenticity, and journey through the supply chain. For food and beverage companies, this means the ability to track freshness and reduce waste: for pharmaceutical firms, it provides an added layer of safety by monitoring temperature and preventing counterfeit drugs from entering the market. As consumers become more tech savvy and demand greater transparency, companies that adopt smart packaging solutions will be well positioned to build stronger brand trust and differentiate themselves in highly competitive industries.

Another significant opportunity comes from the growing emphasis on sustainability and circular economy practices. Consumers and regulators and increasingly pushing for packaging solutions that minimize environmental impact, reduce plastic waste, and utilize renewable or compostable materials. This opens the door for proactive packaging innovations that combine eco-friendly materials with advanced suctions such as antimicrobial coating, freshness indicators, or biodegradable oxygen absorbs. Companies that can successfully merge sustainability with functionality will not only meet consumer expectations but also gain early mover advantages in markets where stricter environmental regulations are being enforced. This convergence of sustainability and performance creates a powerful growth opportunity for packaging manufacturing and brands across food, healthcare, and consumer goods.

End Use Insights

The food and beverage segment dominated the market in 2024, capturing a significant portion due to the rising need to preserve freshness, prevent spoilage, and reduce food waste. Proactive packaging technologies such as freshness indicators, oxygen scavengers, and antimicrobial solutions are widely used to extend shelf life and improve quality assurance for perishable goods. This strong dependence on advanced packaging makes food and beverage the leading end use category.

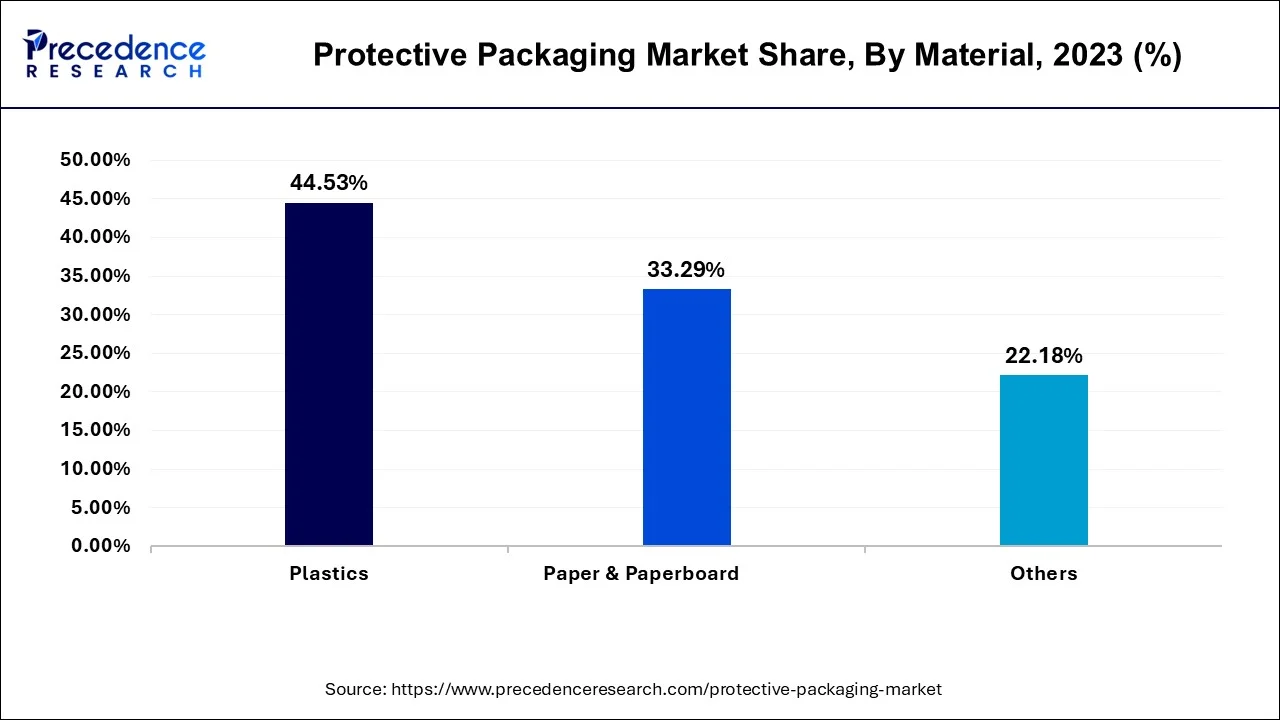

Material Insights

Biodegradable and sustainable are anticipated to be the fastest growing segment. With rising awareness around plastic pollution and the environmental impact of traditional materials, industries are turning toward eco-friendly alternatives such as bioplastics, compostable films, and recyclable substrates. Governments and regulators are also tightening packaging waste guidelines, further accelerating the shift. This trend us particularly prominent in sectors like food and pharmaceuticals, where companies seek to align product safety with sustainability goals, position biodegradable packaging as a vital growth driver in the proactive packaging market.

Protective Packaging Market Revenue, By Material, 2022 to 2024 (USD Million)

| Material | 2022 | 2023 | 2024 |

| Paper & Paperboard | 9,815.03 | 10,288.62 | 10,792.58 |

| Plastics | 13,271.88 | 13,760.15 | 14,276.32 |

| Others | 6,571.50 | 6,855.28 | 7,155.55 |

Type Insights

Intelligent packaging is projected to be the fastest growing segment in the coming years. This growth is largely driven by the increasing need for real time monitoring of product conditions such as temperature, freshness, and tempering. Intelligent packaging integrates features like smart labels, indicators, and sensors that prove valuable data to both manufacturers and consumers. This not only improves transparency and safety but also enhances brand trust. As industries prioritize supply chain visibility and customer assurance, intelligent packaging is expected to see rapid adoption across food, healthcare, and logistics.

Protective Packaging MarketRevenue, By Type, 2022 to 2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| Rigid Protective Packaging | 7,445.27 | 7,865.30 | 8,307.78 |

| Flexible Protective Packaging | 12,822.43 | 13,455.60 | 14,129.84 |

| Foam Protective Packaging | 9,390.70 | 9,583.15 | 9,786.82 |

Function Insights

Moisture control is emerging as the fastest growing segment. Moisture is one of the most common factors that compromise product integrity, particularly in food, pharmaceuticals, and electronics. Proactive packaging solutions that manage humidity, such as desiccants and moisture absorbing films, play a crucial role in extending shelf life and assuring safety. With consumer demanding longer lasting products and industries prioritizing reduced spoilage and waste, moisture control packaging is seeing expanding applications across a wide spectrum of goods, making it an essential functional area of growth.

Protective Packaging MarketRevenue, By Function, 2022 to 2024 (USD Million)

| Function | 2022 | 2023 | 2024 |

| Cushioning | 7,474.04 | 7,819.10 | 8,185.78 |

| Blocking & Bracing | 5,031.85 | 5,237.94 | 5,456.28 |

| Void Fill | 3,537.69 | 3,675.21 | 3,820.74 |

| Insulation | 8,337.60 | 8,705.16 | 9,095.24 |

| Wrapping | 5,277.23 | 5,466.64 | 5,666.40 |

Application Insights

The pharmaceutical segment is expected to be the fastest growing area in the market. The pharmaceutical industry requires packaging solutions that guarantee product stability, protect against environmental variables, and comply with stringent regulations. Proactive packaging with features such as oxygen scavenger, antimicrobial coatings, and time temperature indicators ensures the safe distribution and consumption of drugs. With biologics, vaccines, and personalized therapies becoming more prevalent, packaging that safeguard product integrity and enhances patient confidence is increasingly critical, driving rapid adoption in this sector.

Protective Packaging Market, By Application, 2022 to 2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Food & Beverage | 10,205.23 | 10,697.65 | 11,221.64 |

| Industrial Goods | 6,074.54 | 6,342.33 | 6,626.54 |

| Healthcare | 3,137.51 | 3,266.01 | 3,402.15 |

| Automotive | 2,412.57 | 2,503.84 | 2,600.38 |

| Household Appliances | 3,743.31 | 3,873.23 | 4,010.44 |

| Others | 4,085.24 | 4,220.99 | 4,363.30 |

Protective Packaging Market Companies

- Smurfit KAPPA Group

- Westrock Company

- Sealed Air Corporation

- Sonoco Products Company

- Huhtamaki OYJ

- DS Smith PLC

- Pregis LLC

- Pro-Pac Packaging Limited

- Storopack Hans Reichenecker Gmbh

- The DOW Chemical Company

- Cascades Corporation

Recent Developments

- Amazon recently reported a notable reduction in single use plastic packaging, achieved by transitioning to recyclable paper bags, deploying machines that efficiently wrap products in paper, and scaling back plastic air cushions. This shift has been met with praise from conversation groups, who interpret it as a market driven yet environmentally beneficial strategy. Amazon's VP of Mechatronics and Sustainable Packaging emphasized that stronger consumer demand for packaging that's easy to recycle and that protects products effectively drove the decision. The initiative aligns with broader sustainability trends and demonstrates how consumer preferences can influence packaging innovation.

(Source: Amazon wins green praise for brown-bag packaging: Ross Kerber | Reuters) - A recent survey conducted by sustainability consultancy Aura revealed that consumers in North America and Europe are increasingly opting out of purchases due to environmentally harmful packaging. A significant percentage of respondents across both regions reported refusing to buy products because they were packaged in non-eco-friendly materials. An overwhelming majority expressed concerns that brands are using excessive packaging. These findings send a clear signal to companies: failure to adopt more sustainable packaging could result in both reputational damage and sales losses.

(Source: https://www.wsj.com)

Segment Covered in the Report

By Type

- Rigid Protective Packaging

- Flexible Protective Packaging

- Foam Protective Packaging

By Material

- Foam Plastics

- Paper & Paperboard

- Plastics

- Others

By Function

- Cushioning

- Blocking & Bracing

- Void Fill

- Insulation

- Wrapping

By Application

- Food & Beverage

- Industrial Goods

- Healthcare

- Automotive

- Cushioning

- Household Appliances

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting