What is Polyethylene Market Size?

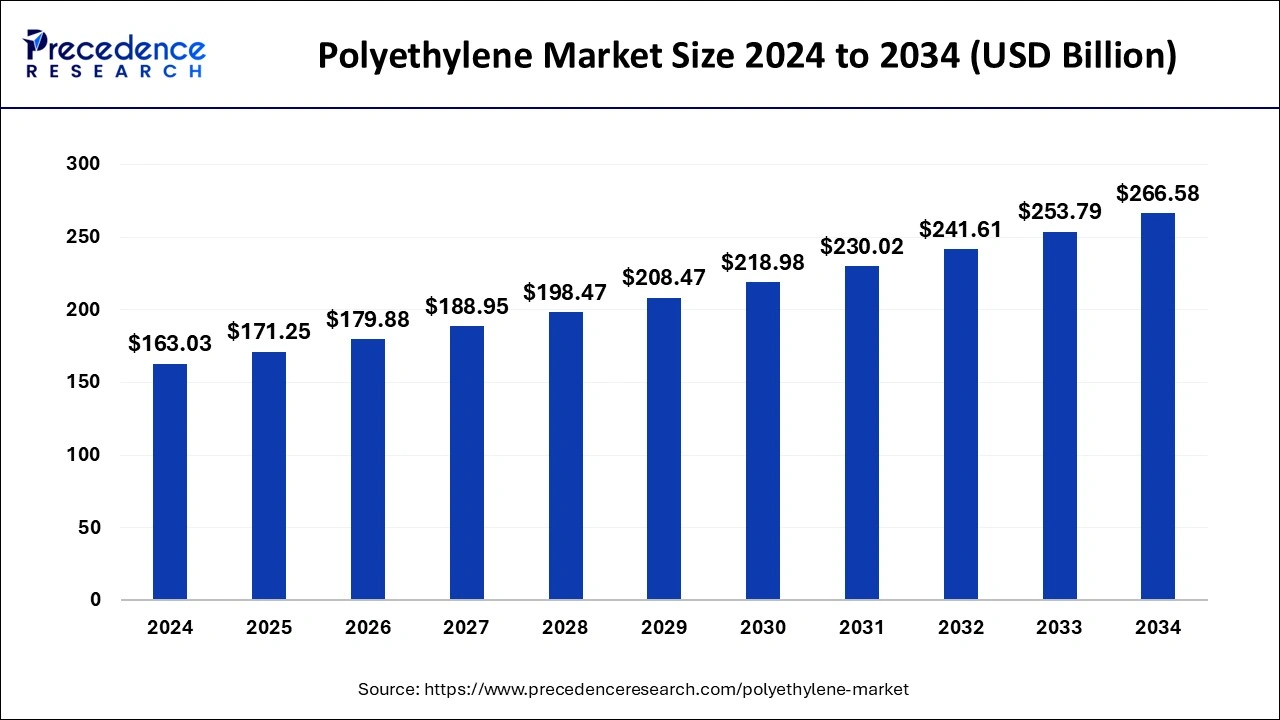

The global polyethylene market size is calculated at USD 171.25 billion in 2025 and is predicted to reach around USD 278.96 billion by 2035, expanding at a CAGR of 5.00% from 2026 to 2035. The growing demand for cost-effective and lightweight products boosts the development of the polyethyene market.

Market Highlights

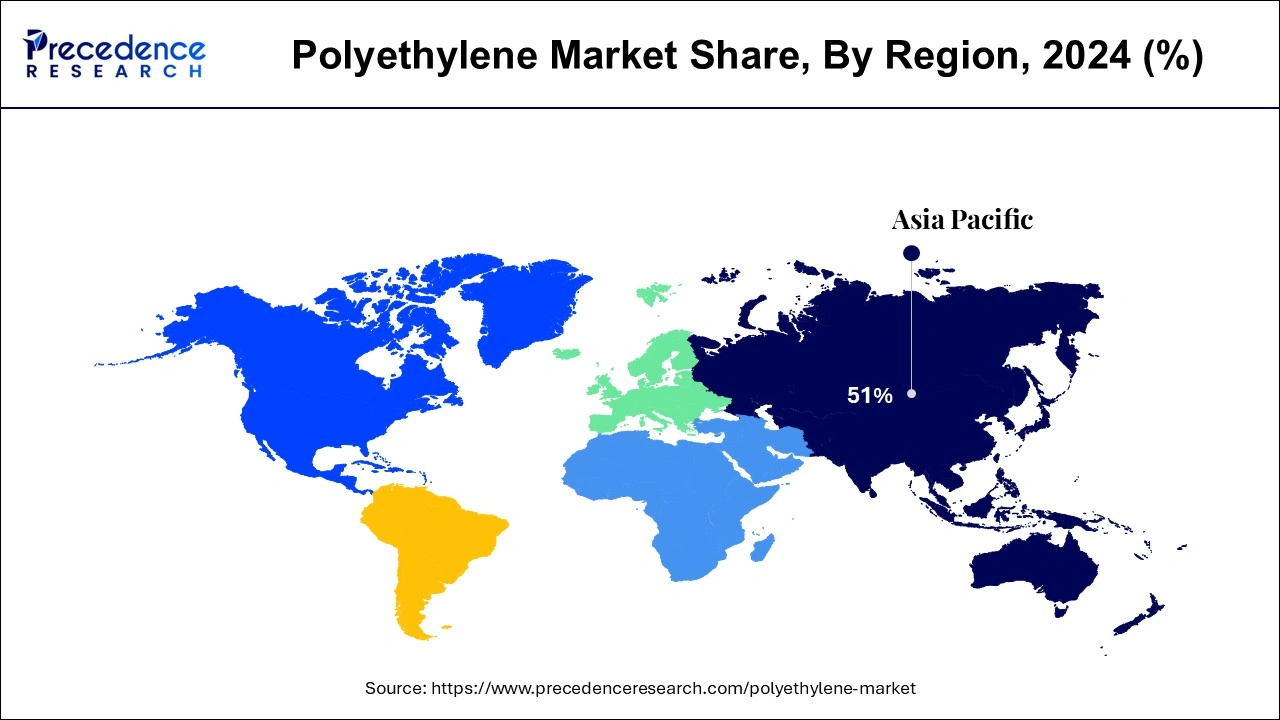

- Asia Pacific dominated the global market with the largest market share of 51% in 2025

- North America is projected to expand at the notable CAGR during the forecast period.

- By type, the HDPE segment has held the largest market share in 2025.

- By type, the LLDPE segments is predicted to be the fastest-growing segment during the forecast period.

- By application, the packaging segment captured the biggest market share in 2025

- By application, the construction segments is estimated to be the fastest-growing segment during the forecast period.

Role of AI in Polyethylene Industry

Artificial intelligence plays a significant role in the development of the polyethylene market as it supports the manufacturing of error-free products. With the incorporation of AI in this industry it becomes easy for market players to bring advancement in the manufacturing of a variety of products from various sectors such as healthcare, cosmetics, food & beverages, and many others. It comprises technologies such as machine learning which is useful in the production process. It tracks the real-time condition of the product and predicts its durability which attracts a huge number of customers towards this market.

Polyethylene Market Growth Factors

- The polyethylene market is primarily driven by its extensive usage in various industries such as packaging, construction, and consumer goods. The polyethyene is chemical resistant, has huge strength, and is easily available at a low cost. It is widely used in various forms such as food wraps, detergent bottles, fuel tanks, and shopping bags all over the globe.

- The durability and strength offered by polyethylene make it the most preferred material in the packaging industry, which fosters the demand for polyethylene across the globe.

- The affordability and easy availability are further expected to significantly drive the growth of the global polyethylene market.

- Recyclability, easy processing, and low cost are several factors that contribute significantly towards the growth of the polyethylene market.

- The rising demand for polyethylene across the automotive, electronics, and pharmaceutical industries is further expected to drive market growth during the forecast period.

- The versatility, strength, low cost, and lightweight characteristics of polyethylene serve as a popular packaging material, especially for food and beverage products.

- The rapid emergence of online food delivery platforms such as Zomato and Swiggy has significantly contributed n the demand for polyethylene packaging.

Polyethylene Market Trade Analysis

- Polyethylene exports globally are increasingly being dominated by producers in the Asia-Pacific and, in particular, China and India as those countries strive to increase market share as polyolefin providers for new and emerging economies.

- The existing anti-dumping duties and shifting tariff structures for polyethylene products in both the U.S. and EU have changed the way and price competitiveness of manufacturers of polyethylene for export.

- The disparity between natural gas and naphtha-based polyethylene producers exists primarily in the producer's area of the world. With producers in the Middle East or North America having price advantages in core export markets.

Market Outlook

- Industry Growth Overview: Strong urbanization around the world and increasing industrial activity continue to create demand for polyethylene products. This has led to the creation of lightweight, durable materials that will find their way into more and more markets.

- Sustainability Trends: With increasing environmental awareness, companies are being pressured to use recycled polyethylene and bio-based polyethylenes as a solution to the issues that face all of us in the Earth's circular economy.

- Global Expansion: With the emergence of the Asian, African, and Latin American economies, these countries are establishing new manufacturing facilities and supply chains to better serve the global polyethylene market.

- Startup Ecosystem: The increasing number of polymer recycling technology start-ups, bio-based feedstock start-ups, and digital manufacturing solution start-ups is making polyethylene manufacturers more competitive through increased technological capability and product differentiation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 171.25 Billion |

| Market Size in 2026 | USD 179.88 Billion |

| Market Size in 2035 | USD 278.96 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 5.00% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

The HDPE segment dominated the polyethylene market in 2025. The major factor behind its dominance is the low production cost of the HDPE. Moreover, along with the low cost, the high temperature resistance and higher strength and density of the HDPE has exponentially propelled the growth of the HDPE segment. The extensive usage of the HDPE in preparing bottles, caps, chemical resistant pipes, ballistic plates, and a variety of other products has boosted the growth of the HDPE segment in the past. The growing need for controlling cost and increasing profitability across various industry verticals is expected to boost the demand for the HDPE in the forthcoming years.

The LLDPE is estimated to be the most opportunistic segment during the forecast period. The growing popularity of the metallocene catalyst technology that significantly enhances the performance of resins is anticipated to drive the demand for the LLDPE segment during the forecast period. The LLDPE has higher tensile strength and higher puncture resistance properties as compared to that of the LDPE, which is a major growth driver of the LLDPE and the adoption of the LLDPE is expected to surpass the LDPE segment in the upcoming future.

Application Insights

Based on the application, the packaging was the most dominant segment in 2025. This is simply attributed to the increased adoption of the polyethylene in the packaging industry for packing a wider variety of goods across the globe. The PET derived from the polyethylene offers a moisture resistant and protectives structure to the products that makes it the highly demanded material in the packaging industry. The rising demand for the consumer electronics, food and beverages, automotive vehicles, and the growing penetration of the e-commerce platforms across the globe is expected to significantly drive the growth of the polyethylene market in the forthcoming future.

The construction is expected to be the fastest-growing segment in the foreseeable future. The increasing adoption of the polyethylene in the under-construction sites for protecting the various construction materials from moisture and water is expected to drive the market growth. Moreover, the HDPE is used to protect the ground water from getting toxic during the oil drilling process.

Key Developmental Strategies

- In July 2020, Dow Chemicals and Thong Guan collaborated to introduce new bio-based product series of polyethylene that targeted to serve the Asia Pacific region's rapidly growing demand for the polyethylene.

- In July 2019, the ExxonMobil Corporation started the production of the new high performance polyethylene products in its Texas facility. This expansion strategy aimed at increasing the production volume by 65%.

- In May 2020, UPM Raflatac introduced its new line of Forest Film products, which is produced from the post-consumer recycled plastics and it is used in the packaging of products. This strategy aimed at reducing the carbon footprint that will also provide a competitive advantage to the company.

The various developmental strategies adopted by the market players in the polyethylene market significantly contributes towards the market growth and helps the players to gain market share and competitive edge. The polyethylene market is fragmented owing to the presence of numerous market players across the globe and the various competitors are adopting various developmental strategies such as acquisitions, mergers, collaborations, new product launches, and partnerships in order to gain market share and exploit the prevailing market opportunities.

Regional Insights

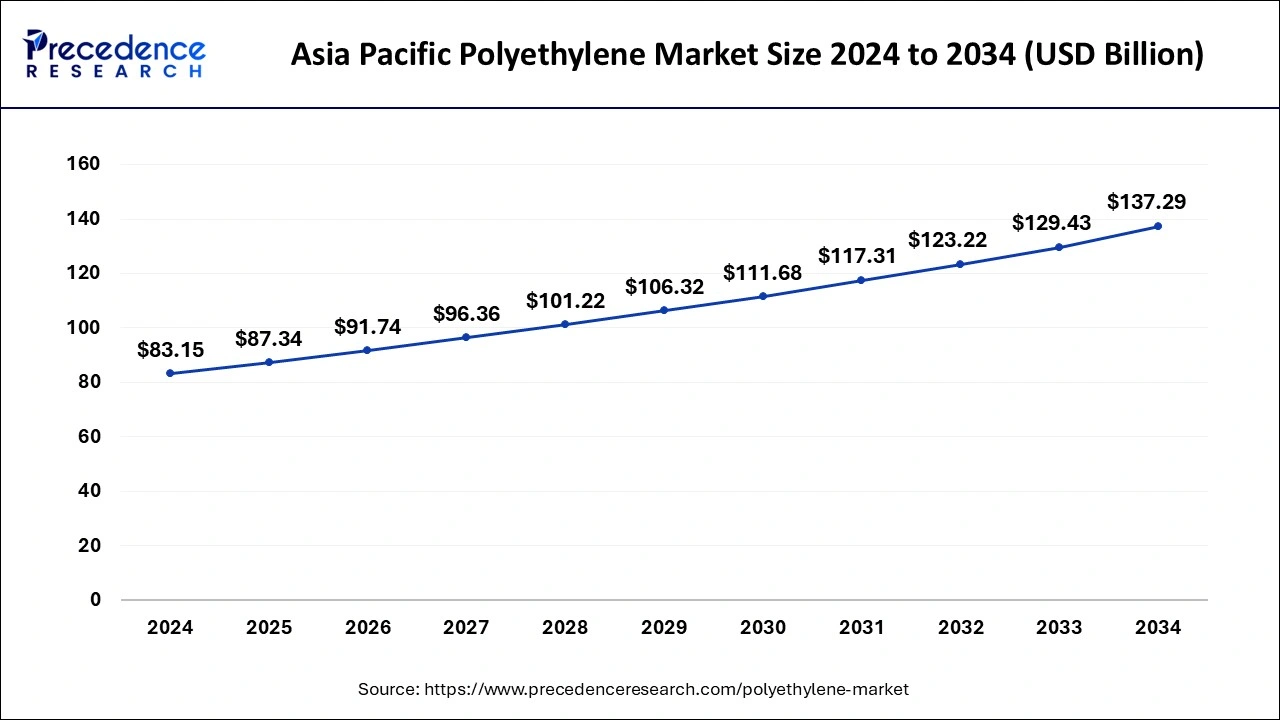

Asia Pacific Polyethylene Market Size and Growth 2026 to 2035

The Asia Pacific polyethylene marketsize is exhibited at USD 87.34 billion in 2025 and is projected to be worth around USD 144.05 billion by 2035, growing at a CAGR of 5.13% from 2026 to 2035.

Asia Pacific was the dominating segment in 2025and is expected to be the fastest-growing segment throughout the forecast period. This is attributable to the rapidly growing nature of various industries in the region such as pharmaceutical, healthcare, construction, automotive, consumer goods, and packaging owing to the presence of huge consumer base.

Moreover, the rapid industrialization and rapid urbanization of the Asia Pacific region is significantly propelling the demand for the polyethylene market. The rapidly growing penetration of the various e-commerce platforms such as Amazon, Flipkart, Zomato, and Wal-Mart is expected to drive the polyethylene market growth. The rising investments in expanding the manufacturing facilities of various consumer electronics in the region is further fueling the demand. The huge demand for the polyethylene in the construction industry in the developing nations like China, India, Indonesia, and Philippines is offering a lucrative growth opportunities to the market players operating in the Asia Pacific polyethylene market.

China Polyethylene Market Trends

China is a major contributor to the polyethylene market. The high manufacturing base for polyethylene and strong government support help in the market growth. The growing urbanization and increasing population increase demand for polyethylene. The growing demand for food & beverage packaging increases the adoption of polyethylene. The growing development of infrastructure projects through initiatives like the Belt and Road Initiative increases demand for polyethylene.

The growing shift towards sustainable packaging increases demand for bio-based polyethylene. The presence of abundant raw materials for the production of polyethylene helps in the market growth. The growing demand from various industries like automotive, packaging, and construction drives the overall growth of the market.

North America is expected to grow significantly in the polyethylene market during the forecast period. The increasing use of electronics as well as automotives is enhancing the use of polyethylene in North America. At the same time to various new approaches are also being developed to enhance the use of recycled plastics. This, in turn, also increases the use of various technologies to develop biodegradable materials as well as for the recycling of polyethylene. This is further supported by the government as well as various private companies. Thus, all these factors enhance the market growth.

United States Polyethylene Market Trends

The United States is growing in the polyethylene market. The strong presence of shale gas increases the production of polyethylene. The increasing expansion of the e-commerce industry increases demand for polyethylene. The strong government support for defense & homeland security and rising budget allocations increase demand for ballistic-grade HPPE. The growing demand from various industries like healthcare, automotive, construction, pharmaceuticals, packaging, and consumer goods drives the overall growth of the market.

- According to Volza's India Export data, the United States exported 66451 shipments of HDPE polyethylene. (Source: https://www.volza.com)

- According to Volza's China Export data, the United States exported 40009 shipments of polyethylene LLDPE.(Source:https://www.volza.com)

Europe is expected to show lucrative growth in the polyethylene market during the forecast period. The healthcare sector in Europe is advancing with the rising demands of drugs as well as with the utilization of various advance technologies. This in turn, increases the need for polyethylene packaging facilities for keeping the medications safe from various factors. Hence, its development is enhanced as well as research to make them more reliable, safe, and biodegradable. Thus, this promotes the market growth.

What are the Growth Factors for Polyethylene Market Growth in India?

India is significantly growing in the polyethylene market. The growing expansion of the packaging industry in various sectors like consumer goods, food & beverage, and healthcare increases demand for polyethylene. The growing middle-class population and rising demand for packaged goods help in the market growth. The increasing infrastructure and construction development fuel demand for high-density polyethylene.

The growing automotive industry increases demand for polyethylene for various components like bumpers, wiring insulation, fuel tanks, and interior panels. The rising adoption of electric vehicles is driving demand for polyethylene to enhance the performance of batteries. Additionally, growing domestic production and rising demand from the pharmaceutical & healthcare industries support the overall market growth.

According to Volza's India Export data, from November 2023 to October 2024, India exported 1734 shipments of HDPE polyethylene with a growth rate of 37% compared to the previous 12 months.

Italy Polyethylene Market Trends

The Italian market is driven by escalating needs from key end-use sectors like agriculture, packaging, and industrial applications. Italy's dependence on imported resins from other European countries and the Middle East influences pricing and supply, while local petrochemical clusters contribute to strategic production capacity. Sustainability trends are shaping the market, with increased emphasis on recyclable, bio-based, and recycled polyethylene grades to meet EU circular economy targets.

Polyethylene Market Analysis in the Asia Pacific

Asia Pacific's market shows significant growth during the forecast period. It is driven by rapid industrialization, high-volume manufacturing, and intense need from the packaging and construction sectors. Massive urbanization, along with infrastructure projects in China, India, and Southeast Asia are increasing the need for pipes, films, and also construction materials. Increasing use of polyethylene films for irrigation as well as greenhouse farming to boost crop yields is driving the need.

Strategic Insights into the Global Polyethylene Market in Latin America

Latin America's market shows notable growth during the forecast period. It is driven by escalating need across the packaging, automotive, and construction sectors, combined with regional economic growth and urbanization trends. Currently valued as a remarkable contributor to the regional petrochemical landscape, the market is undergoing a strategic shift toward higher-value, specialty PE grades, funded by technological advancements in production processes along with material innovation.

Brazil Polyethylene Market Trends

Brazil is a global leader in bio-driven polyethylene (derived from sugarcane), which is vital for meeting global ESG (Environmental, Social, and Governance) targets. The industry's shift toward greener materials is a huge growth area. The market is also increasingly embracing recycling and circular economy trends, with recycled PE and advanced bio-PE solutions gaining traction to meet environmental goals and brand ESG commitments.

MEA Polyethylene Industry Analysis

MEA's market shows fast growth during the forecast period. This is due to rising environmental pressure, and even the industry is shifting towards recycling along with sustainable solutions. There is a growing need for certified circular polyethylene. This market is greatly competitive and rapidly evolving, boosted by heavy investments in petrochemical infrastructure along with the increasing need for diverse applications.

Saudi Arabia Polyethylene Market Trends

As the world's largest oil exporter, Saudi Arabia offers a cost-effective, readily available supply of feedstocks, enabling local producers such as SABIC to maintain competitive pricing. The government's National Industrial Development as well as Logistics Program (NIDLP) drives investment in infrastructure, petrochemicals, and local manufacturing, decreasing reliance on imports.

Polyethylene Market-Value Chain Analysis

- Feedstock Procurement: Purchasing ethylene feedstock, such as naphtha and natural gas liquids, results in a benchmark as to both the cost of manufacturing and competitive pricing of resins.

- Naphtha Polymerization and Catalyst Technology:The method of polymerization and selection of catalysts will establish the quality and performance of the resin produced, thus defining how polyethylene resins will be differentiated.

- Warehousing and Transportation:Effective supply chain (Warehousing and Logistics) infrastructure will enable the timely delivery of PE resins to end-use manufacturers while maximizing supply chain responsiveness.

Top Companies in the Polyethylene Market & Their Offerings

- ExxonMobil - A variety of high-quality polyethylene resins for various applications, including packaging, consumer products, and specialised industrial uses.

- SABIC - Polyethylene resin solutions that include high-quality and certified circular polyethylene resins to support sustainability and recycling initiatives.

- LyondellBasell - A wide variety of polyethylene products designed to provide performance, sustainability, and new levels of recycling capability for customers worldwide.

Other Polyethylene Market Companies

- The Dow Chemical Company

- China Petrochemical Corporation

- Mitsubishi Chemical Corporation

- INEOS

- Borealis AG

- Chevron Phillips Chemical Co.

- SCG Chemical

Recent Developments

- In May 2025, a mulching scheme providing 50% subsidies along with training was proposed by the Bihar government to promote plastic, agro-textile, and jute mulches for enhancing the crop yield, supporting climate-resilient, conserving water, and eco-friendly farming across all districts.

- In April 2025, based on ISBM HDPE technology, an innovative range of lightweight bottles was launched by Incoplas, which is a bottle manufacturer. The symmetrical as well as asymmetrical bottles were combined in this innovative bottle range, which consisted of different sizes up to 5l. When compared to traditional HDPE EBM (Extrusion Blow Moulded) solutions, they showed reduced bottle weight.

- In June 2024, Univation Technologies, LLC announced the launch of its latest licensed technology platform – a tubular high-pressure PE process enabling the production of both low-density polyethylene (LDPE) and ethyl-vinyl acetate (EVA) copolymer resins which are offered under the brand name UNIGILITY™ Tubular High-Pressure PE Process Technology.

- In July 2024, Dow Chemical Co. announced its collaboration with RKW Group to develop two new grades of resins under Dow's Revoloop recycled plastic resin product offering, including a resin with up to 100% post-consumer recycled (PCR) plastic.

Segments Covered in the Report

By Type

- HDPE

- LDPE

- LLDPE

By Application

- Packaging

- Consumer Goods

- Automotive

- Healthcare/Pharmaceuticals

- Electronics/Electrical

- Construction

- Agriculture

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting