What is the Chlorinated Polyethylene Market Size?

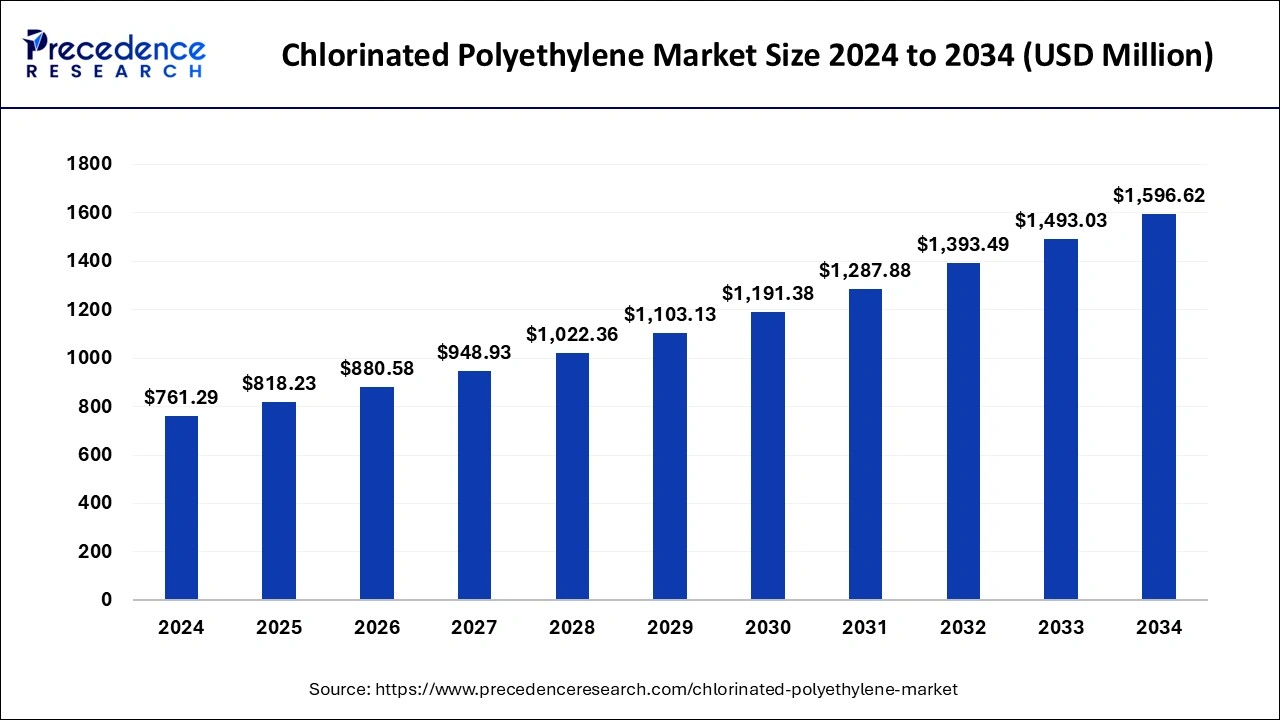

The global chlorinated polyethylene market size is calculated at USD 818.23 million in 2025 and is predicted to increase from USD 880.58 million in 2026 to approximately USD 1,596.62 million by 2034, expanding at a CAGR of 7.69% from 2025 to 2034.

Market Highlights

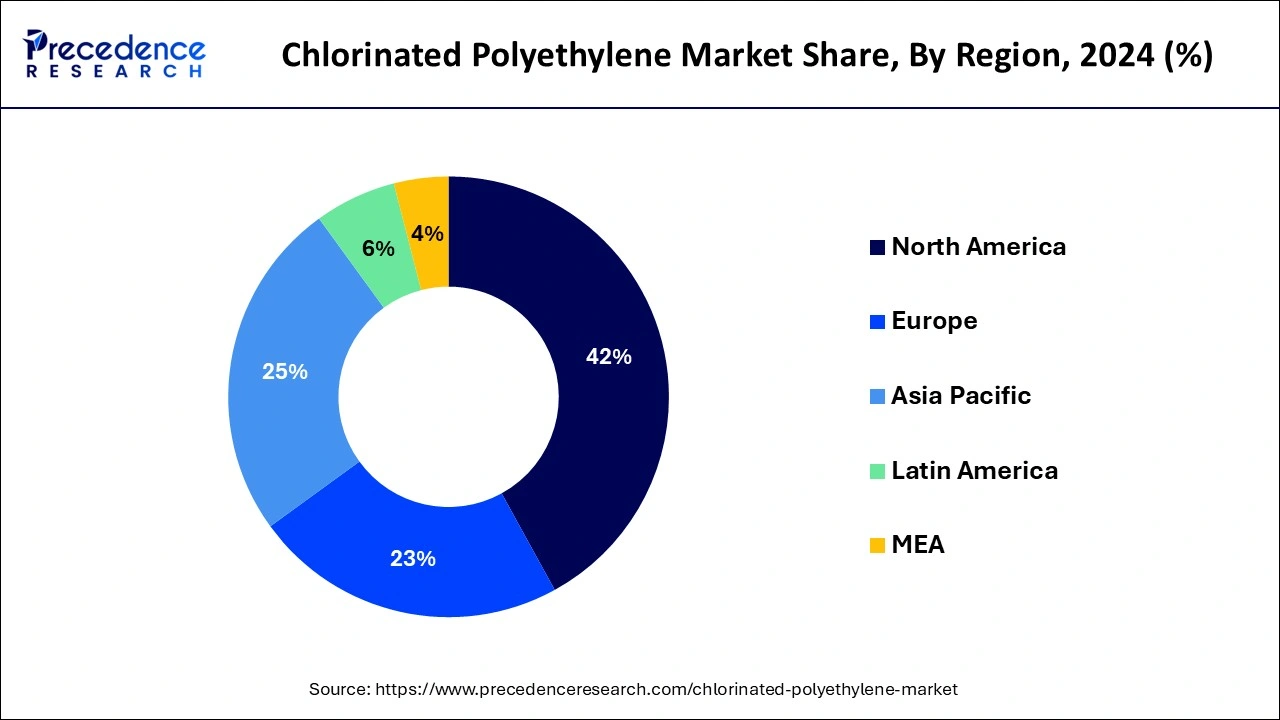

- North America contributed more than 42% of market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the CPE 135A segment has held the largest market share of 45% in 2024.

- By product, the CPE 135B segment is anticipated to grow at a remarkable CAGR of 8.1% between 2025 and 2034.

- By application, the wire and cable jacketing segment generated over 27% of the market share in 2024.

- By application, the adhesives segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Chlorinated polyethylene (CPE) stands out as a specialized thermoplastic derived from polyethylene through a chlorination process, elevating its resistance to chemicals, weather elements, and flames. Frequently utilized as an impact modifier in PVC (polyvinyl chloride) manufacturing, CPE significantly enhances the toughness and flexibility of the final product. This transformation involves introducing chlorine atoms into the polyethylene polymer chain, resulting in a shift in material properties.

CPE offers exceptional durability against heat, chemicals, and UV radiation, making it a preferred choice for various applications like cable insulation, automotive parts, roofing materials, and industrial hoses. Its compatibility with different polymers, especially PVC, makes it a valuable additive across industries. Moreover, the degree of chlorination can be adjusted to achieve specific performance characteristics, providing flexibility for diverse applications. In essence, chlorinated polyethylene combines the inherent qualities of polyethylene with improved attributes, contributing to its widespread use in creating robust and weather-resistant materials.

- The annual global production volume of fossil carbon-based plastic reached over 457 million metric tons (Mt) in 2019 and is anticipated to triple by 2060.

Chlorinated Polyethylene Market Growth Factors

- The growing demand for CPE in various end-use industries such as automotive, construction, and electrical is a significant growth factor. CPE's versatility and beneficial properties, such as chemical resistance and durability, contribute to its widespread use in these sectors.

- CPE is commonly employed as an impact modifier in the production of polyvinyl chloride (PVC) to enhance its toughness and flexibility. As the demand for modified PVC continues to rise in applications such as pipes, cables, and profiles, the CPE market experiences parallel growth.

- With increased construction and infrastructure development globally, there is a rising demand for durable and weather-resistant materials. CPE, known for its weatherability and resistance to environmental factors, is favored in construction applications, contributing to market growth.

- Ongoing advancements in polymer technology, including the development of innovative CPE formulations with tailored properties, are driving market growth. Manufacturers are investing in research and development to create CPE variants that meet specific industry requirements.

- The market growth is also influenced by a growing emphasis on sustainable and eco-friendly materials. CPE, with its potential for recyclability and ability to enhance the performance of existing materials, aligns with the sustainability goals of various industries.

- The geographical expansion of industries and infrastructure projects, particularly in emerging economies, contributes to the growth of the CPE market. Increased industrialization and urbanization in these regions drive the demand for CPE-based products.

Chlorinated Polyethylene Market Trends

- Surging demand in wire & cable insulation due to CPE's superior flame resistance, flexibility, and outdoor durability.

- Growing use in polymer blends (especially with PVC and ABS) as manufacturers seek stronger, more heat-resistant, and cost-effective material combinations.

- Increased adoption in roofing and construction membranes because CPE delivers strong UV, chemical, and weather resistance ideal for long-lasting structures.

- Shift toward eco-friendly grades as companies develop low-emission and sustainable CPE to meet global environmental regulations.

- Rising usage in automotive weatherstrips and sealing parts, supported by growth in EV manufacturing where heat stability and lightweight materials are prioritized.

- Higher demand for industrial hoses and tubing as industries and agriculture prefer CPE for its excellent abrasion and chemical resistance.

- Technological advancements in production, enabling more consistent, high-purity, and application-specific CPE grades.

Market Outlook

- Industry Growth Overview: The market is growing due to industries use chlorinated polyethylene for flexible hose cables roofing membranes and impact modified plastics the market for CPE is expanding. Is is widely used in automotive and construction applications due to its strong weather resistane and durability. Demand is growing as producers search for affordable elastomers that function well in challenging conditions

- Sustainability Trends:Producers are improving formulations to reduce emissions during production and enhance recyclability. There is also a shift toward cleaner processes that use fewer harmful chemicals. Energy-efficient manufacturing systems are being adopted to lower the overall environmental footprint.

- Major Investors: Key investors include major chemical companies like Dow, Weifang Hongxin, Showa Denko, and Novista, who continue expanding capacity and improving product grades. Investments also come from plastic compounders and construction material suppliers. These players focus on developing high-performance CPE variants tailored for cables, pipes, and roofing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 818.23 Million |

| Market Size in 2026 | USD 880.58 Million |

| Market Size by 2034 | USD 1,596.62 Million |

| Growth Rate from 2025 to 2034 | CAGR of 7.77% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

PVC modification demand

- PVC is the third most-produced synthetic polymer in the world, after polyethylene and polypropylene.

The surge in demand for chlorinated polyethylene (CPE) is intricately tied to the increasing need for PVC modification. PVC, a widely used thermoplastic, benefits significantly from CPE's role as an impact modifier. The incorporation of CPE enhances PVC's toughness, flexibility, and overall performance, making it an ideal choice for various applications. As the demand for modified PVC continues to rise, particularly in sectors such as construction, automotive, and consumer goods, the market for chlorinated polyethylene experiences a proportional upswing. CPE's ability to impart desirable properties to PVC, including improved weatherability and resistance to impact, positions it as a crucial component in the production of durable and versatile materials. The symbiotic relationship between CPE and PVC underscores the material's pivotal role in addressing the evolving needs of industries reliant on modified PVC, thus propelling the demand for chlorinated polyethylene in the broader market.

Restraint

End-of-life disposal challenges

End-of-life disposal challenges pose a significant restraint on the market demand for chlorinated polyethylene (CPE). The chlorine content in CPE raises environmental concerns during disposal, as it can release harmful by-products. Proper disposal methods and recycling processes become imperative to mitigate environmental impact. The challenges associated with the end-of-life phase can affect consumer perception and industry acceptance, especially in regions with stringent environmental regulations and a growing emphasis on sustainable practices.

As environmental awareness increases, stakeholders in the CPE market need to proactively address these disposal challenges. Developing eco-friendly disposal methods and promoting recycling initiatives for CPE-containing products can not only mitigate environmental impact but also enhance the market's reputation. Failure to navigate these disposal challenges may lead to reduced demand for CPE as industries and consumers increasingly prioritize materials with more sustainable end-of-life solutions.

Opportunity

Renewable energy targets

Advancements in chlorinated polyethylene (CPE) formulations are creating significant opportunities within the market by expanding the material's applicability and performance characteristics. Ongoing research and development efforts focus on tailoring CPE properties to meet specific industry requirements, such as improved heat resistance, flexibility, and environmental sustainability. These innovations allow CPE to address diverse market needs, contributing to its versatility and competitiveness in various sectors. Innovative formulations enable CPE to meet evolving industry standards and regulations, positioning it as a preferred choice in applications ranging from construction and automotive to consumer goods. The ability to customize CPE properties not only broadens its scope but also enhances its compatibility with emerging technologies, ensuring a dynamic and responsive presence in the ever-evolving landscape of materials and polymer technologies.

Segments Insights

Product Insights

In 2024, the CPE 135A segment had the highest market share of 45% on the basis of the product. CPE 135A is a specific grade within the chlorinated polyethylene (CPE) market. It represents a type of CPE characterized by a high chlorine content, typically around 35%, making it well-suited for applications requiring enhanced chemical resistance and impact strength.

- According to the recent chlorinated polyethylene market survey report, the total volume of CPE 135A production and sales is estimated to be swelling at a rate of 7%.

In the market, the CPE 135A segment is witnessing a growing demand, particularly in PVC modification for products such as pipes, cables, and profiles. The trend is driven by its ability to impart excellent weatherability and toughness to PVC, aligning with the increasing requirements for durable and versatile materials in various industries.

The CPE 135B segment is anticipated to expand at a significant CAGR of 8.1% during the projected period. CPE 135B is a specific grade within the chlorinated polyethylene (CPE) market, characterized by its high chlorine content, typically around 35%. This grade offers enhanced heat resistance, chemical stability, and impact strength, making it suitable for various applications. In recent trends, CPE 135B has seen increased demand in industries such as wire and cable insulation, automotive components, and industrial hoses due to its superior performance characteristics. The market is witnessing a shift towards CPE 135B as industries seek high-quality materials to meet stringent requirements in diverse applications.

Regional Insights

Application Insights

According to the application, the wire and cable jacketing segment held a 27% market share in 2024. The wire and cable jacketing segment in the chlorinated polyethylene (CPE) market involves the use of CPE as a protective outer layer for wires and cables. This application benefits from CPE's excellent weather resistance, chemical stability, and flame-retardant properties, ensuring durability and safety in diverse environments. A notable trend in this segment is the increasing demand for CPE jacketing in response to growing infrastructure projects, particularly in telecommunications and power distribution, where reliable and robust wire and cable insulation is crucial for long-term performance.

The adhesives segment is anticipated to expand fastest over the projected period. In the chlorinated polyethylene (CPE) market, the adhesives segment refers to the utilization of CPE in adhesive formulations. CPE enhances adhesives by imparting improved flexibility, durability, and resistance to environmental factors. As a trend, the adhesives sector within the CPE market is witnessing increased demand due to the growing emphasis on high-performance adhesives in construction, automotive, and industrial applications. CPE's ability to enhance adhesive properties makes it a sought-after component, contributing to the expansion of the adhesives segment in the broader CPE market.

Regional Insights

U.S.Chlorinated Polyethylene Market Size and Growth 2025 to 2034

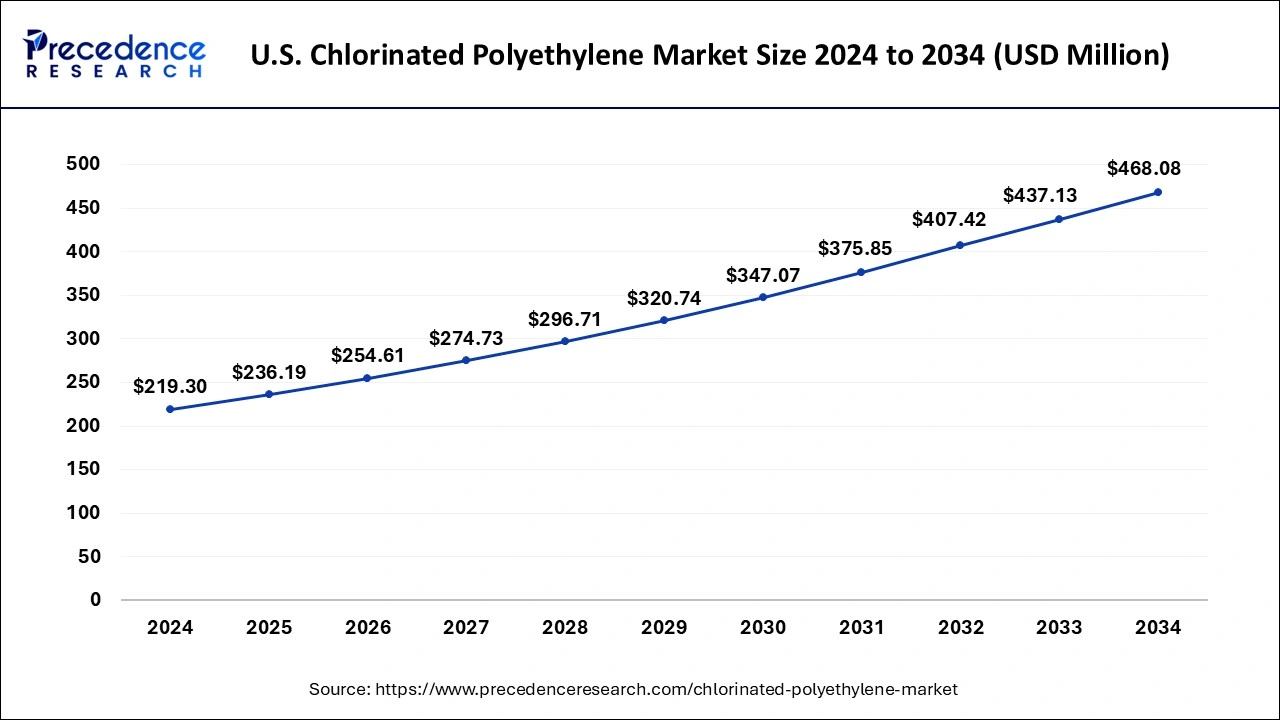

The U.S. chlorinated polyethylene market size is exhibited at USD 236.19 million in 2025 and is projected to be worth around USD 468.08 million by 2034, growing at a CAGR of 7.88% from 2025 to 2034.

North America holds a share of 41% in the chlorinated polyethylene market due to robust demand across diverse industries. The region benefits from a well-established construction sector, where CPE is extensively used in applications like pipes and roofing materials. Additionally, the automotive industry's reliance on CPE for impact modification contributes to market dominance. Stricter environmental regulations also drive the adoption of CPE, which offers a balance between performance and sustainability. The mature industrial landscape, technological advancements, and a focus on high-quality materials further solidify North America's prominence in the CPE market.

On the other hand, Asia-Pacific is projected to witness rapid growth in the chlorinated polyethylene market due to escalating industrialization, infrastructure development, and increasing demand for PVC-based products. The region's robust manufacturing sector, particularly in China and India, drives the consumption of CPE in applications such as wires, cables, and construction materials. Additionally, rising automotive production and the expanding electronics industry contribute to the growing demand for CPE. Favorable economic conditions, coupled with the region's status as a key manufacturing hub, position Asia-Pacific as a significant player in the accelerating growth of the chlorinated polyethylene market.

The cables and wires (C&W) sector in India continues to grow, fuelled by strong domestic demand from multiple industries and a surge in exports. Prominent companies such as Polycab and KEI Industries are experiencing significant growth with major expansions. The exports are significantly gaining traction, growing 25% YoY in October 2024 and 8% YoY during April-October 2024. Markets like Saudi Arabia and Oman have reported strong growth, with India benefiting from competitive pricing, international compliance, and diversified offerings.

- India's position as a net exporter of cables and wires (C&W) underscores its capability to meet the evolving global demand. The major growing factors in international markets include the increasing adoption of electric vehicles, the rising push for renewable energy, and the modernization of power grids.

Meanwhile, Europe's notable growth in the chlorinated polyethylene (CPE) market can be attributed to increasing demand across diverse industries, including construction, automotive, and consumer goods. The region's emphasis on sustainability and stringent quality standards drives the adoption of CPE for applications requiring durability and weather resistance. Moreover, ongoing research and development initiatives in European countries contribute to innovative CPE formulations, expanding its applications. The robust infrastructure projects and automotive manufacturing in Europe further fuel the demand for CPE, positioning the region as a significant contributor to the market's growth.

- According to data from Eurostat, in February 2025, compared with February 2024, the production in construction increased by 0.2% in the euro area and by 0.3% in the EU.

- According to the European Automobile Manufacturers' Association (ACEA), in the European markets:

New registrations increased 24% in Spain and 19% in the Czech Republic in March 2025 compared with March 2024.- The largest year-over-year increase in PHEV registrations was in Czechia (+90% over March 2024), and HEV registrations increased the most in Spain (+34%). Shares of MHEVs were highest in Italy (32%) and Poland (30%) in March 2025, and they are gaining popularity in France and Spain, where registrations increased 59% (France) and 52% (Spain) in March 2025 compared with March 2024.

- The highest increase in BEV registrations occurred in Czechia, Spain, and Italy, where registrations increased 261%, 94%, and 78%, respectively, in March 2025 compared with March 2024.

Value Chain Analysis

- Feedstock procurement: The production of CPE is primarily dependent on polyethylene and chlorine so obtaining premium raw materials is essential production costs may be impacted by changes in the price and interruptions in the supply of basic polymers orr chlorine. To guarantee consistent output manufacturers are looking into more dependable suppliers and different feedstock approaches.

- Waste Management and Recycling: In the CPE market waste management is primarily concerned with post consumer CPE products production scrap and off spec material. Chorine content makes recycling difficult but some mechanical and chemical recycling methods are being developed. To increase sustainability businesses are also looking into ways to reduce waste during manufacturing.

- Regulatory Compliance and Safety Monitoring: Due to the safety and environmental concers related to chlorine production and use of CPE are strictly regulated. Workplace safety standards emissions limits and chemical handling laws must all be followed by businesses. Risks are decreased and sustainable operations are ensured through routine monitoring and adherence to safety and environmental regulations.

Chlorinated Polyethylene Market Companies

- Showa Denko K.K.

- Weifang Yaxing Chemical Co., Ltd.

- Novista Group Co., Ltd.

- Hangzhou Keli Chemical Co., Ltd.

- S&E Specialty Polymers

- Nippon Paper Crecia Co., Ltd.

- Sundow Polymers Co., Ltd.

- Jiangsu Tianteng Chemical Industry Co., Ltd.

- Jiangsu Changqing Agrochemical Co., Ltd.

- Shandong Gaoxin Chemical Co., Ltd.

- Xuyi Xinyuan Technology Co., Ltd.

- Dow Inc.

- Xiamen Xingyan Chemicals Co., Ltd.

- Xianju Furuixiang Special Chemical Co., Ltd.

- Hangzhou Electrochemical Group Co., Ltd.

Recent Developments

- In November 2024, at a seminar on the development of Vietnam's modern and sustainable construction material sector on Le Trung Thanh, Director of the Department of Building Materials at the Ministry of Construction, revealed that the industry generated around 47 billion USD annually, contributing 11% to the national GDP.

- In December 2024, Arkema announced the acquisition of Dow's flexible packaging laminating adhesives business, one of the leading global producers of adhesives for the flexible packaging market. The acquisition will enable the Group to significantly expand its portfolio of solutions for flexible packaging and become a key player in this attractive market.

- In March 2024, Aurora Material Solutions, LLC. (Aurora), a leading manufacturer of polymer compounds, announced the acquisition of EnCom Polymers, Inc. EnCom products are utilized in a host of applications in the electrical, automotive, medical, building and construction, consumer goods, business equipment, and transportation industries.

- In August 2022, Continental announced its collaboration with INOVYN to incorporate BIOVYN, a bio-attributed PVC, into its automotive surface materials. This strategic partnership aims to diminish the carbon footprint of Continental's products while meeting the increasing market demand for sustainable, bio-based solutions.

- In January 2021, Shintech disclosed a significant capital investment of USD 1.25 billion to fortify its integrated PVC business under Shin-Etsu Chemical Co. Ltd. This investment is expected to substantially augment Shintech Inc.'s PVC production capacity in the United States, reaching an impressive 3.62 million metric tons annually.

- In January 2021, Orbia announced plans to divest its PVC Unit due to demand constraints. However, the final decision on this divestment is pending an official announcement.

Segments Covered in the Report

By Product

- CPE 135A

- CPE 135B

- Others

By Application

- Impact Modifier

- Wire and Cable Jacketing

- Hose and Tubing

- Adhesives

- Infrared Absorption

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting