What is the Ultra-high Molecular Weight Polyethylene Market Size?

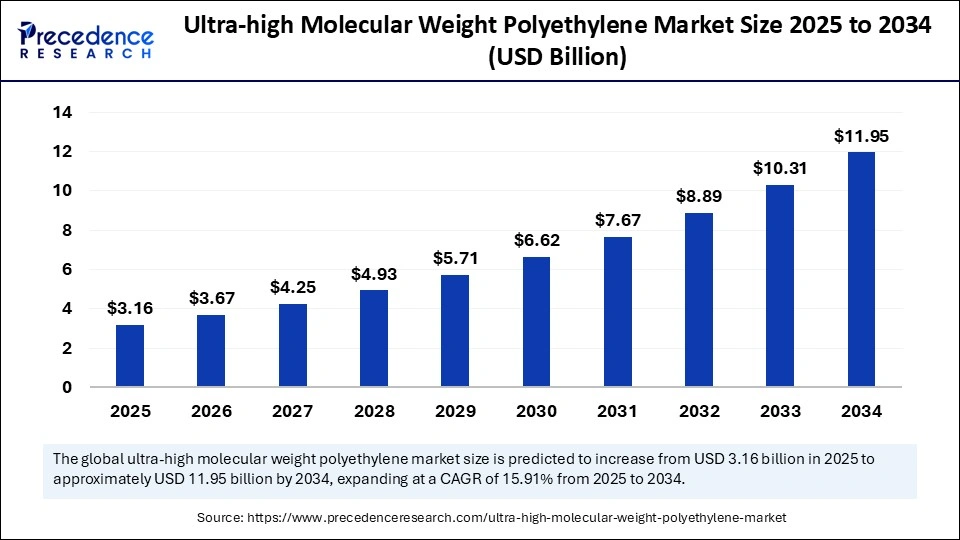

The global ultra-high molecular weight polyethylene market size is valued at USD 3.16 billion in 2025 and is predicted to increase from USD 3.67 billion in 2026 to approximately USD 11.95 billion by 2034, expanding at a CAGR of 15.91% from 2025 to 2034. The rising use of ultra-high molecular weight polyethylene in high-performance applications across medical, aerospace, and industrial sectors for its exceptional strength and wear resistance is driving the growth of the market.

Ultra-high Molecular Weight Polyethylene Market Key Takeaways

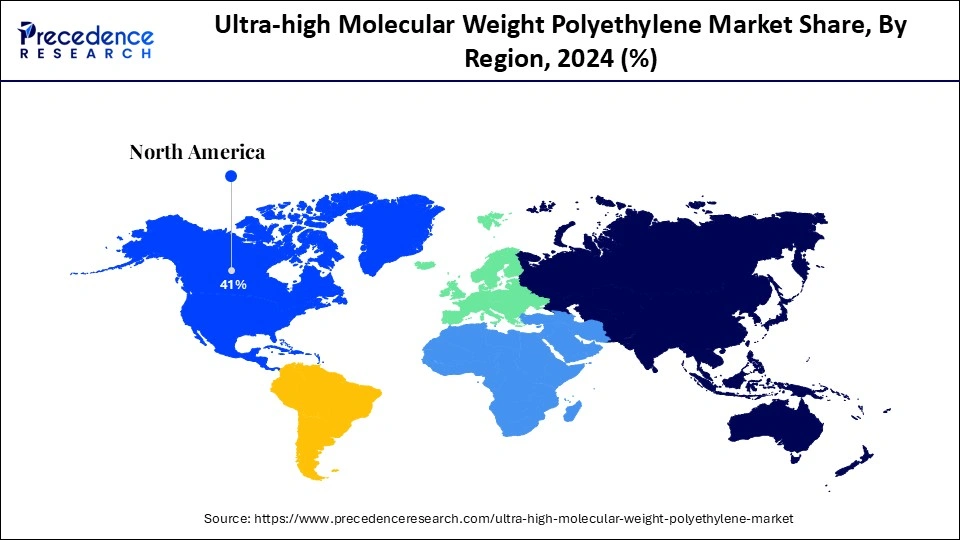

- North America accounted for the largest revenue share of 41% in 2024.

- Asia Pacific is expected to grow at the fastest rate in the upcoming period.

- By form, the sheets & films segment dominated the market with the largest share in 2024.

- By form, the fiber segment is expected to grow at a significant rate in the coming years.

- By end-user, the medical segment dominated the market with the largest share in 2024.

- By end-user, the automotive segment is expected to grow at the fastest CAGR during the forecast period.

Artificial Intelligence: The Next Growth Catalyst in Ultra-high Molecular Weight Polyethylene

Artificial intelligenceis revolutionizing the ultra-high molecular weight polyethylene (UHMWPE) industry by enhancing material design, optimizing manufacturing processes, and accelerating research and development cycles. By predicting material behaviors and identifying ideal formulations, manufacturers can eliminate the need for extensive physical prototyping through the use of AI-driven simulations and machine learning algorithms. Ai also improves quality control by guaranteeing consistent product performance through real-time process adjustments and sophisticated defect detection. Businesses may boost productivity, cut waste, and launch cutting-edge UHMWPE products more quickly by incorporating AI into supply chain management and production processes. This will ultimately boost competition and create new uses for these technologies in a variety of sectors.

Strategic Overview of the Global Ultra-high Molecular Weight Polyethylene Industry

The ultra-high molecular weight polyethylene market is witnessing rapid growth, driven by its outstanding mechanical qualities, superior impact strength, low friction, and high abrasion resistance. UHMWPE find applications in various sectors such as heavy-duty industrial operations, automotive defense, and medicine. Its biocompatibility in medical applications and its lightweight and high strength profile for ballistic protection further contribute to the materials' appeal. Its use is growing due to developments in manufacturing technologies and sustainable UHMWPE, which makes it a material of choice for both established and emerging industries.

Ultra-high Molecular Weight Polyethylene MarketGrowth Factors

- Rising demand for medical implants boosts the growth of the market. UHMWPE is widely used in orthopedic applications like joint replacements due to its biocompatibility and low friction.

- Increasing use in the defense and aerospace sectors further boosts market growth. UHMWPE finds applications in the aerospace sector for its lightweight and high strength.

- Growing industrial applications contribute to market growth. It is widely used in conveyor systems, liners, and wear strips due to its superior abrasion resistance.

- The rising use of sports and recreation equipment, including high-performance gears, helmets, and protective padding, drives market growth.

- Growing preference for UHMWPE over metals and conventional plastics due to its superior impact resistance, chemical inertness, and long service life boosts market growth.

- Advancements in fiber and textile technology expand the scope of applications of UHMWPE in ropes, nets, and fabrics, driving market growth.

Market Outlook

- Market Growth Overview: The Ultra-high Molecular Weight Polyethylene market is expected to grow significantly between 2025 and 2034, driven by the high demand from the medical, defense, and automotive sectors. This expansion is fueled by technological advancements, such as vitamin E-influenced materials and high-performance fibers for ballistics, and the increasing use in EV battery separators.

- Sustainability Trends: Sustainability trends involve eco-friendly production methods, the use of bio-based feedstocks, and enhancing recycling technologies.

- Major Investors: Major investors in the market include Celanese Corporation, DSM-Firmenich/Avient Corporation, Honeywell International Inc., Braskem, and Mitsui Chemicals, Inc.

- Startup Economy: The startup economy is focused on sustainable production methods, enhanced recycling technologies, and niche product development.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.95 Billion |

| Market Size in 2025 | USD 3.16 Billion |

| Market Size in 2026 | USD 3.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.91% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Why are Manufacturers Increasingly Turning to UHMWPE for High-performance Solutions?

Manufacturers are increasingly choosing ultra-high molecular weight polyethylene (UHMWPE) for high-performance solutions because it is perfect for demanding industrial applications due to its combination of high impact strength, low coefficient of friction, and exceptional wear resistance. Its lightweight design and chemical resistance make it suitable for use in demanding environments and weight-sensitive industries like sports and aerospace. UHMWPE's durability lowers maintenance expenses and downtime, and its biocompatibility supports medical applications as well. UHMWPE is a flexible, effective, and affordable material that can be used in a variety of industries due to its recyclability, which also supports sustainability objectives.

Growth in Defense and Ballistic Protection

UHMWPE is essential in making personal protective equipment such as helmets and ballistic vests. It provides lightweight armor solutions without sacrificing safety because it is 15 times stronger in weight than steel. Demand from the military and law enforcement sectors has increased due to modern warfare requirements and homeland security concerns. Applications requiring blast and ballistic resistance benefit greatly from its high energy absorption capacity. UHMWPE-based body armor designs that are flexible and ergonomic are the focus of new product innovations. Advanced personal protective technology is receiving more and more funding from international defense budgets.

Sustainability and Environmental Resistance

The extended service life of UHMWPE lowers overall material waste and the frequency of part replacements. Because of its resistance to UV deterioration, corrosion, and chemicals, it can be used in harsh environmental conditions. It works better in outdoor and damp environments than conventional polymers in the marine and agricultural sectors. These days, producers use renewable energy and bio-based feedstocks to create UHMWPE grades. Its non-toxicity and recyclable nature also conform to international environmental and regulatory standards. Green procurement initiatives and eco certifications are being used more and more to promote sustainable innovations in UHMWPE.

Restraints

Limited Heat Resistance

Insufficient heat resistance of UHMWPE limits its adoption in some applications, hampering the growth of the ultra-high molecular weight polyethylene market. It has a relatively low melting point (below 130°C and 136°C). It cannot be used in high-temperature settings. It may deform or deteriorate in applications that expose it to high temperatures for an extended period of time, like industrial machinery or automobile engines. This restricts its ability to be used in place of materials like PTFE or specific thermoplastics. Additionally, its performance may be impacted in applications that call for high-heat autoclaving for sterilization. Temperature sensitivity still prevents it from being widely used in the electronics and aerospace industries. The material's adaptability in high-heat industries is limited by this drawback.

Environmental Concerns and Disposal Issues

Despite the durability and chemical inertness of UHMWPEs, their high use raises environmental concerns due to their non-biodegradable nature. Microplastic pollution can be caused by improper disposal, particularly in soil and marine environments. Technically, UHMWPE can be recycled, but because of the high processing costs, it is not economically feasible. Most regions have a small number of recycling facilities that accept UHMWPE. Green procurement guidelines and regulatory pressures are driving the need for more environmentally friendly substitutes. To avoid losing market share, manufacturers are under pressure to develop eco-friendly grades.

Opportunities

Rising Infrastructure Development and Construction Activities

The rising infrastructure development and construction activities, especially in emerging countries, create immense opportunities in the ultra-high molecular weight polyethylene market. UHMWPE is used in construction and infrastructure projects for its high strength, resistance to abrasion, and low friction. It is ideal for construction pads, pipelines, protective barriers, and dock fenders. Materials that are durable and require little maintenance are becoming more and more in demand as smart cities and infrastructure development projects grow. UHMWPE prolongs the life of assets in abrasive environments like tunnels, railroads, and ports. In civil engineering, its application in wearing plates and sliding bridge bearings is growing in popularity. Growing investments in both public and private infrastructure present a promising path for expansion. Tests are also being conducted on reinforced UHMWPE grades for structural use.

Marin and Offshore Applications

Steel is being replaced by UHMWPE ropes, nets, and liners in marine transportation, fishing gear, and offshore platforms. Its excellent corrosion resistance and high strength-to-weight ratio make it perfect for exposure to saltwater. The main factors driving this market are aquaculture farms' cargo handling and offshore drilling. Because it is lightweight and flexible, it improves safety from steel and nylon to UHMWPE in oceans is being driven by sustainability concerns. Additionally, the product has a longer lifespan and is more durable in abrasive water conditions.

Form Insights

The sheets & films segment held the largest share of the ultra-high molecular weight polyethylene market in 2024. UHMWPE sheets and films are widely used in industrial applications such as chute, silos, and truck liners. For wear-intensive tasks, their low coefficient of friction, superior abrasion resistance, and resilience to harsh chemical environments make them perfect. Heavy-duty applications benefit from increased operational efficiency due to the material's durability and lightweight nature. These sheets and films are preferred by industries because they are simple to fabricate and have a long lifespan.

The fiber segment is expected to grow at the fastest rate in the coming years due to its increased adoption in high-performance applications like advanced composite, defense equipment, and ballistic protection. In terms of weight, these fibers are stronger than steel because of their remarkable strength-to-weight ratio. They are increasingly being used in body armor, fishing lines, and medical sutures. The growing demand for materials that are strong, long-lasting, and lightweight and suit a range of industrial applications significantly contributes to segmental growth.

End-User Insights

The medical segment dominated the ultra-high molecular weight polyethylene market with the largest share in 2024. This is mainly due to the increased use of UHMWPE in surgical instruments, joint replacements, and orthopedic implants. The material is perfect for long-term medical use because of its low friction, wear resistance, and biocompatibility. Medical devices are predicted to continue to rely heavily on UHMWPE due to aging populations and rising demand for cutting-edge healthcare. Its durability and patient safety make it particularly valuable in knee and hip replacements.

The automotive segment is expected to grow at the fastest rate during the forecast period due to the increasing need for high-performance and lightweight materials. UHMWPE is ideal for vehicle parts like chain guides, bushings, gears, and underbody protection systems. By using it, the weight of a vehicle can be decreased, fuel efficiency can be increased, and component life can be prolonged under severe stress. The rising focus on improving vehicle efficiency is likely to boost the demand for UHMWPE in the automotive industry.

Regional Insights

U.S. Ultra-high Molecular Weight Polyethylene Market Size and Growth 2025 to 2034

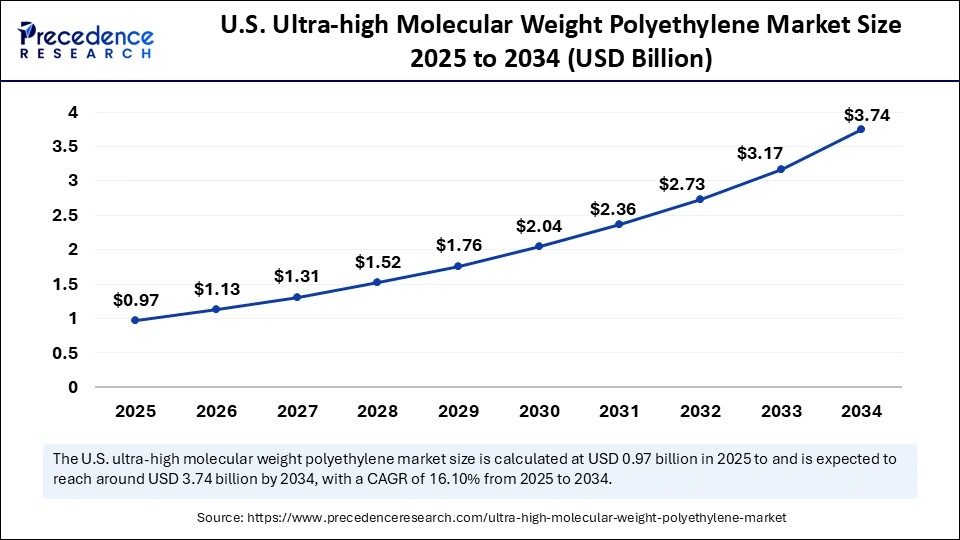

The U.S. ultra-high molecular weight polyethylene market size is exhibited at USD 0.97 billion in 2025 and is projected to be worth around USD 3.74 billion by 2034, growing at a CAGR of 16.10% from 2025 to 2034.

North America dominated the market by holding more than 41% of revenue share in 2024 as a result of its robust defense industry and sophisticated healthcare system. The region boasts a robust industrial base, boosting the applications of UHMWPE in various industries. The region's leadership is further strengthened by the presence of major manufacturers of medical devices and significant R&D investments. The early use of high-performance polymers in ballistic filtration and prosthetic applications further bolstered the growth of the market in the region. Its dominant position is also maintained by strategic partnerships with international players and expanding manufacturing capabilities.

U.S. Ultra-high Molecular Weight Polyethylene Market Trends

The U.S. ultra-high molecular weight polyethylene market is experiencing increasing adoption in the healthcare sector for orthopedic implants and in the defense industry for ballistic protection. The integration of technological advancements to enhance performance and the expansion of applications into the automotive and electric vehicle battery markets.

Asia Pacific is expected to grow at the fastest rate in the upcoming years. This is mainly due to rapid industrialization, along with the increasing demand for strong yet lightweight materials in various industries. Growing defense budgets and infrastructure development are also major factors creating the need for UHMWPE. To satisfy both domestic and foreign demands, local manufacturers are increasing production and funding research. The market is growing as a result of the growing need for cutting-edge medical devices.

Europe is considered to be a significantly growing area. The growth of the ultra-high molecular weight polyethylene market within Europe is attributed to its strong emphasis on innovation, sustainability, and superior engineering standards. UHMWPE is actively used in the region in renewable energy, water treatment, and medical device applications. Manufacturers are being encouraged to use advanced materials, including UHMWPE, due to regulatory frameworks. European businesses are making efforts to develop next-generation UHMWPE-based solutions for precision medicine and clean energy, supporting regional market growth.

China Ultra-high Molecular Weight Polyethylene Market Trends

China's market is characterized by robust growth and strategic expansion, transitioning towards high-performance applications like fibers for defense and separators for EV batteries. The rapid industrialization, supportive government policies classifying UHMWPE as a strategic material, and increasing domestic demand.

Germany Ultra-high Molecular Weight Polyethylene Market Trends

Germany's ultra-high molecular weight polyethylene market includes a strong demand from the advanced automotive, healthcare, and packaging sectors. A significant focus on sustainability and the production of lightweight, durable, and high-performance materials. Continuous technological innovation and a strong medical device sector further solidify Germany's position.

Value Chain Analysis of the Ultra-high Molecular Weight Polyethylene Market

- Raw Material Production (Ethylene & Polyethylene Feedstock)

This initial stage involves the production of ethylene, a fundamental petrochemical, and its polymerization into high-density polyethylene (HDPE) feedstock, which is then processed into UHMWPE powder.

Key Players: Sinopec, Yulong Petrochemical - UHMWPE Powder Manufacturing

This critical stage involves the specialized polymerization process to create the ultra-high molecular weight polyethylene powder, a technically challenging and crucial step that determines the material's properties.

Key Players: Celanese Corporation, Royal DSM, and Braskem. - Compounding & Semi-Finished Product Processing

At this stage, the UHMWPE powder is processed into semi-finished forms like rods, sheets, tubes, and fibers through methods such as compression molding and advanced extrusion.

Key Players: Poly Hi Solidur (part of Menasha Corporation) - End-Product Manufacturing & Application

This final stage involves using the semi-finished products to manufacture final goods for various applications, including medical implants, ballistic protection, battery separators, and industrial components.

Key Players: Stryker Corporation and Zimmer Biomet Holdings, Inc. - Distribution & Sales

This stage focuses on getting the final products to the end-users through various distribution channels and sales networks.

Top Companies in the Ultra-high Molecular Weight Polyethylene Market & Their Offerings:

- Honeywell International Inc. contributes by manufacturing high-strength Spectra UHMWPE fibers through a gel-spinning process, which are widely used in ballistic protection, defense applications, and ropes.

- Beijing Tongyizhong Specialty Technology & Development Co., Ltd. (BJTYZ) is a key Chinese manufacturer specializing in the research, development, and sale of UHMWPE fibers and composites, operating as a National High-tech Enterprise.

- Dongyang MFG Co., Ltd. is a major South Korean manufacturer of synthetic fiber ropes, producing high-performance ropes from UHMWPE yarns for marine and industrial applications. Their products, such as the TERAMAX™ series, are known for their exceptional strength, lightweight properties, and resistance to UV and chemicals.

- Sixty Sci-Tech Co., Ltd. offers technology for continuously producing UHMWPE through a low-pressure, low-temperature polymerization process to create different grades of UHMWPE powder.

- DuPont does not directly produce UHMWPE, but they are a major chemical company, and its Mobility & Materials business was acquired by Celanese Corporation in 2022, impacting the specialty materials market landscape. The search results show their coverall products, not the UHMWPE material itself.

- Apex Polymers is an Indian company that contributes to the market by supplying UHMWPE sheets for industrial applications.

- Avient Corporation acquired DSM's Protective Materials business, including the Dyneema brand, in 2022, becoming a major player in the UHMWPE market, particularly for high-performance fibers.

- Celanese Corporation is a leading manufacturer of GUR UHMWPE powder and offers bio-based GUR ECO-B grades as sustainable alternatives for applications like medical implants, lithium-ion battery components, and industrial wear surfaces.

- JP Fibres, based in India, supplies UHMWPE fibers for various applications, including ropes and anti-ballistic fabrics. They contribute to the market by providing high-tenacity UHMWPE yarn.

Ultra-high Molecular Weight Polyethylene MarketCompanies

- DSM-Firmenich

- Honeywell International Inc.

- Beijing Tongyizhong Specialty Technology & Development Co., Ltd.

- Dongyang MFG Co., Ltd.

- Sixty Sci-Tech Co., Ltd.

- DuPont

- Apex Polymers

- Avient Corporation

- Celanese Corporation

- JP FIBRES

Recent Development

- In June 2022, Repsol invested €105 million to build the new ultra-high molecular weight polyethylene (UHMWPE) plant at its Industrial Site in Puertollano. The plant, scheduled to start up at the end of 2024, will have an annual manufacturing capacity of up to 15 kt.

(Source: https://www.repsol.com)

Segments Covered in the Report

By Form

- Sheets & Films

- Rods & Tubes

- Fibers

- Tapes

- Others

By End User

- Automotive

- Aerospace & Defense

- Medical

- Chemicals

- Electronics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Get a Sample

Get a Sample

Table Of Content

Table Of Content