Electric Vehicle Battery Market Size and Forecast 2025 to 2034

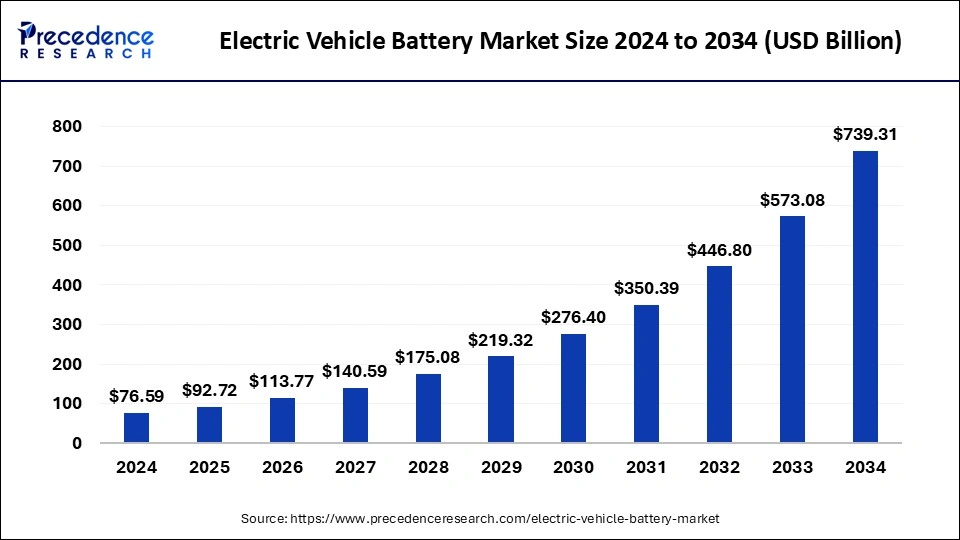

The global electric vehicle battery market size accounted for USD 76.59 billion in 2024 and is predicted to increase from USD 92.72 billion in 2025 to approximately USD 739.31 billion by 2034, expanding at a CAGR of 25.95% from 2025 to 2034. The electric vehicle battery market is driven by rising fuel prices, increasing environmental awareness, a global push for sustainable transportation, government incentives and policies, and advancements in battery technology.

Electric Vehicle Battery Market Key Takeaways

- In terms of revenue, the global electric vehicle battery market was valued at USD 76.59billion in 2024.

- It is projected to reach USD 739.31billion by 2034.

- The market is expected to grow at a CAGR of 25.95% from 2025 to 2034.

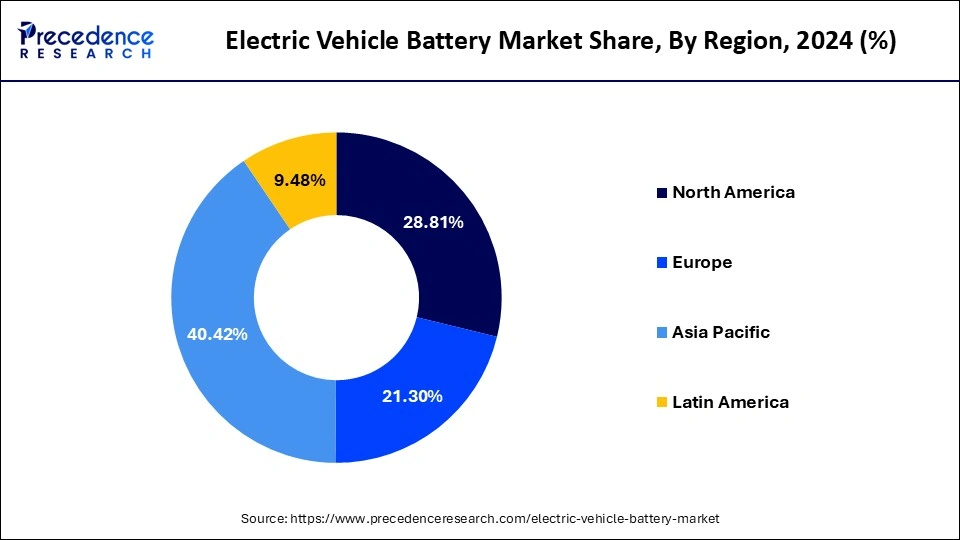

- Asia Pacific dominated the global market with the largest market share of 40.42% in 2024.

- By battery type, the lithium-ion battery segment captured the biggest market share of 65.24% in 2024.

- By lithium-ion battery, the component, the separator segment contributed the highest market share of 32.62% in 2024.

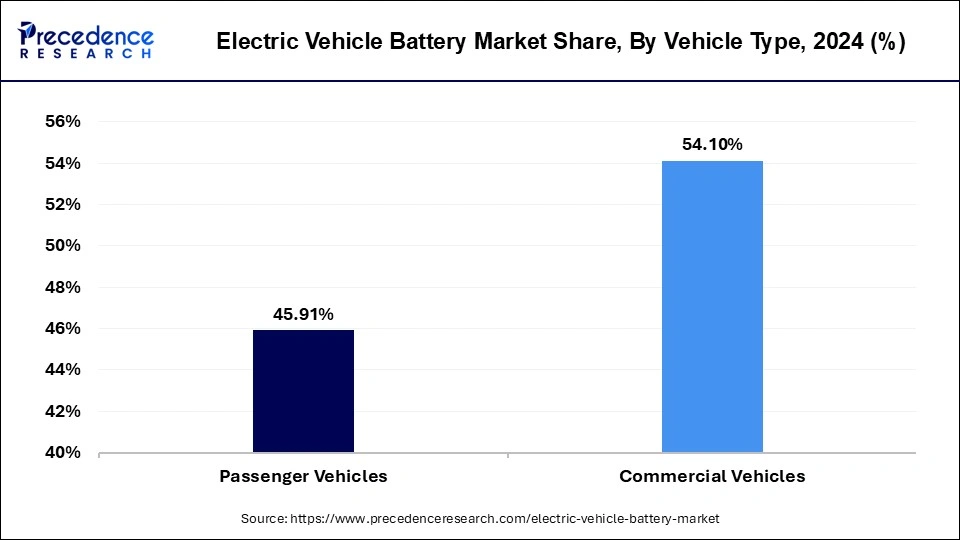

- By vehicle type, the commercial vehicles held the maximum market share of 54.10% in 2024.

- By vehicle type, the passenger vehicles segment is expected to grow at the fastest CAGR of 28.5% during the forecast period.

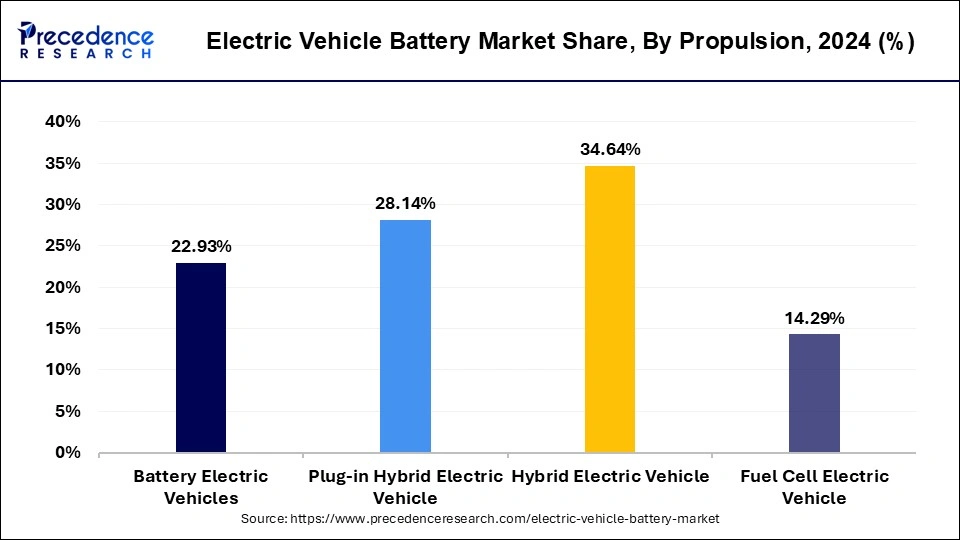

- By propulsion, hybrid electric vehicles generated the major market share of 34.64% in 2024.

- By propulsion, the battery electric vehicles segment is projected to expand rapidly with a CAGR of 26.7% in the coming years

- By capacity, the 50-110 kWh segment contributed the largest market share of 32.25% in 2024.

- By capacity, the 201-300kWh segment is expected to grow at the quickest CAGR of 26.9% during the forecast period.

- By material, the lithium segment held the largest market share of 34.81% in 2024.

- By battery form, the pouch segment has generated the highest market share of 43.14% in 2024.

Asia Pacific Electric Vehicle Battery Market Size and Growth 2025 to 2034

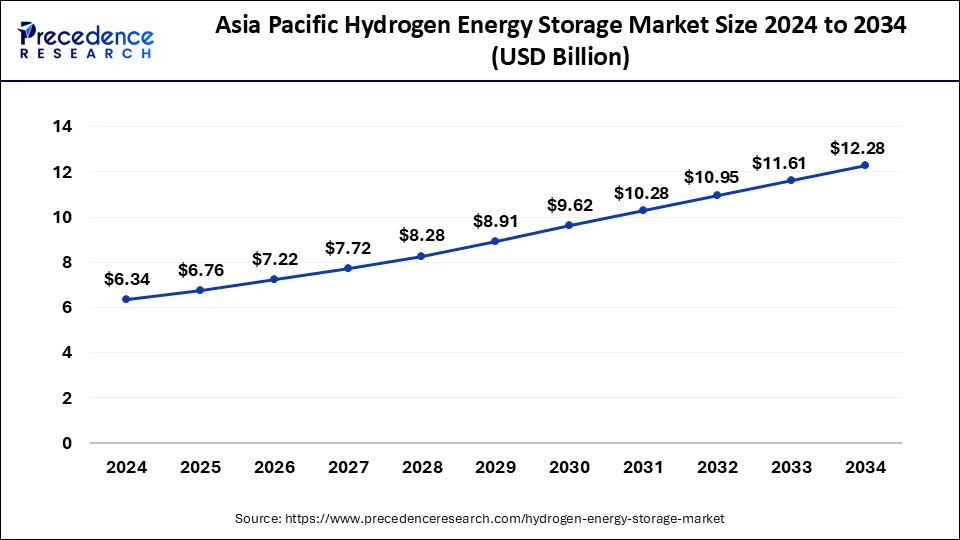

The Asia Pacific electric vehicle battery market size was exhibited at USD 22.06 billion in 2024 and is projected to be worth around USD 271.33 billion by 2034, growing at a CAGR of 26.20% from 2025 to 2034.

Asia Pacific dominated the EV battery market in 2024. The presence of top manufacturers in the region has facilitated the huge volume production of electric vehiclesand EV batteries. The countries like China and India offers cheap labor and other factors of production and the pro-industrial government policies attracts huge investments from the top MNCs. The presence of huge consumer base in the region, growing demand for the electric passenger and commercial vehicles, rising investments in development of charging infrastructure, and growing government initiatives to promote the adoption of the electric vehicles are the prominent drivers of the Asia Pacific EV battery market.

China EV Battery Industry Trends:

China, in particular, has emerged as a dominant force in both electric vehicle and battery production. This region, with rapidly developing economies such as China and India, is witnessing a sharp increase in the demand for innovative transportation solutions and energy systems, including electric vehicles. To facilitate this transition, numerous countries in the Asia-Pacific have implemented comprehensive government policies aimed at promoting both EV adoption and battery production, thus ensuring sustainable growth in this sector.

- China electric vehicle battery market was valued at USD 8.81 billion in 2024 and it is expected to reach at CAGR of 26.91% from 2025 to 2034.

- Japan electric vehicle battery market was valued at USD 6.18 billion in 2024 and it is projected to grow at a CAGR of 26.39% from 2025 to 2034.

- South Korea electric vehicle battery market was valued at USD 7.09 billion in 2024 and it is expanding at a CAGR of 26.14% from 2025 to 2034.

The North America is expected to witness significant growth during the forecast period. The strict government regulations regarding the emissions and adoption of electric vehicles, high disposable income, and increased consumer awareness regarding the benefits of electric vehicles, high environment consciousness, and presence of top auto manufacturers in the region are the major factors that are expected to have a significant impact on the growth of the EV battery market in the foreseeable future. The increased demand for the sustainable products among the consumers and increased adoption of the advanced technologies is supporting the growth of the market in these regions.

U.S. EV Battery Trends:

North America, and specifically the United States, is also experiencing a vigorous expansion in the electric vehicle battery market. This growth can be attributed to a notable surge in electric vehicle sales, underpinned by the availability of critical raw materials such as cobalt and lithium. Increasing governmental support through incentives like tax credits and rebates is further propelling this market forward. The U.S. is characterized by a substantial increase in consumer interest in electric vehicles, driven by advances in battery technology, the enhancement of charging infrastructure, and a growing preference for zero-emission transportation options.

- U.S. electric vehicle battery market was valued at USD 9.95 billion in 2024 and will reach at CAGR of 26.70% from 2025 to 2034.

- Canada electric vehicle battery market was valued at USD 7.20 billion in 2024 and will grow at a CAGR of 26.37% from 2025 to 2034.

Market Overview

A rechargeable battery powers the electric motors in an electric vehicle or hybrid electric vehicle. Many nations are starting to employ them more frequently. The battery is the key element in electric vehicle technology. Due to their significantly higher energy density as compared to weight, lithium-ion and lithium polymer batteries are typically seen in modern electric vehicles. Lithium, cobalt, manganese, steel, graphite and nickel are the main chemical components needed in lithium-ion batteries. Each of these parts performs a unique function in the conventional electric vehicle battery that enhances efficiency.

The global adoption of EVs is anticipated to be fueled by increased technological developments and falling battery prices. Additionally, the government has been obliged to enact severe rules regarding the reduction of carbon footprint and preservation of the environment due to the rising pollution levels and deteriorating environmental conditions. Therefore, the increased efforts to reduce car emissions are anticipated to increase demand for electric vehicles, which will therefore increase demand for EV batteries.

Electric Vehicle Battery Market Growth Factors

The global leading automotive manufacturers such as General Motors, BMW, Volkswagen, and Fords Motors are increasing their emphasis on rolling out various types of electric vehicles in the market. The rising awareness regarding the benefits of electric vehicles, surging popularity of the advanced electric vehicles, and the growing production volumes by the top automakers are the prominent factors that are driving the growth of the global EV battery market. The growing government initiatives to promote the adoption of EVs by incentivizing the manufacturers and by offering subsidies to the customers are positively driving the sales of the EVs.

The government policies to promote the establishment of charging stations through public-private partnerships are expected to boost the growth of the market in the forthcoming years. The rising investments in the urbanization and the growing government investments in the infrastructural development is expected to support the growth of the EV battery market in the foreseeable future. The rising advancements in the technologies and the declining battery prices is projected to fuel the adoption of the EVs across the globe.

Moreover, the rising pollution levels and deteriorating environmental conditions has forced the government to adopt strict policies regarding the reduction of carbon footprint and conservation of the environment. Therefore, the rising efforts to control the emission from vehicles are expected to spur the demand for the electric vehicles and subsequently the demand for the EV batteries is expected to grow.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 76.59 Billion |

| Market Size in 2025 | USD 92.72 Billion |

| Market Size by 2034 | USD 739.31 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 25.95% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery Type, Vehicle Type, Propulsion, Li-ion Battery Component, Method, Capacity, Battery Form, Material Type, End User, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

INCREASING DEMAND FOR ELECTRIC VEHICLES

Due to the growing need to reduce reliance on imported oil and the quickly diminishing fossil resources, there is an increase in demand for electric vehicles. Oil production costs are increasing, which makes it more expensive to import oil. As a result, countries that rely heavily on oil imports are forced to make substantial investments, placing economic strain on their economies. Because fuel cells, electricity, and batteries power EVs (Electric Vehicles), there is less reliance on foreign oil. Over the next few years, it is anticipated that this factor will accelerate the adoption of EVs. EV adoption is being fueled by their low emission levels, and this trend is anticipated to increase market revenue growth during the projection period.

In urban regions, where daily driving distances are shorter on average, smaller, more fuel-efficient cars are more common. By 2033, it's anticipated that more than 50% of the world's population will reside in urban areas, increasing demand for electric vehicles. The range of electric vehicles expands as battery technology advances. For people who commute a longer distance, EVs with longer range are more feasible. High-speed charging will also become a reality due to charger performance and battery advancements, minimizing downtime while driving. Thus, increasing demand for EVs will drive EV battery market.

FALLING PRICE OF LITHIUM-ION BATTERIES

Lithium-ion batteries are the primary power source for electric vehicles at the moment. Over 70% of the market for rechargeable batteries is made up of Li-ion batteries, according to 2018 research by the US International Trade Commission. Additionally, the cost of batteries per kilowatt-hour (kWh) has decreased to under $200. Battery prices are also predicted to fall below 100 USD/kWh in the upcoming years due to improvements in cell chemistry and battery pack production methods. Therefore, it is projected that a decline in the price of battery packs, which account for between 35% and 45% of the costs associated with making electric vehicles, will fuel the market's expansion.

The rise of Asia Pacific as a major center for global industry has increased the use of tools powered by lithium-ion batteries. In the next ten years, improved battery technology and lower costs will be achieved through continued R&D spending and supply chain capacity increase novel cathode materials and cell production techniques, silicon and lithium metal anodes, solid-state electrolytes, and others, to play a significant part in making these price cuts possible. In 2020, the percentage of electric vehicles (EVs) sold worldwide was only about 3.2%; however, this percentage is expected to rise during the next ten years, partly as a result of declining EV battery prices. Batteries are getting cheaper to build because of increased production and technological advancements, which puts EVs on a par with gas-powered vehicles.

Restraint

Raw material supply constraints

One of the most critical restraints in the electric vehicle battery market stems from the limited availability and concentration of key raw materials such as lithium, cobalt, nickel, and manganese. These resources are not evenly distributed across the globe, with mining is largely dependent on politically unstable regions, which increases the risk of supply disruption. Additionally, the extraction and processing of these materials are environmentally intensive, often facing oppositions. Together, these factors create uncertainty in pricing, availability, and ethical sourcing, acting as a major barrier for manufacturers seeking to scale production sustainably.

Battery recycling and end-of-life management:

Another major restraint lies in the challenge of recycling and managing the end of life stage of electric vehicle batteries. Lithium-ion batteries are complex devices that contain multiple metals, electrolytes, and chemical compounds, making safe and efficient recycling technologically difficulty and expensive. Current recycling infrastructure is limited, with most regions lacking the capacity to handle the anticipated surge in retired EV batteries over the coming decade. Without effective recycling systems, the industry faces risks of resource wastage, environmental hazards from improper disposable, and higher long term costs for sourcing raw materials. Developing scalable recycling solutions is further complicated by the rapid pace of innovation, as new chemistries and formats may require entirely different recycling techniques. Until these issues are resolved, battery end of life management will remain a critical bottleneck in the growth of the EV battery ecosystem.

Opportunity

INTRODUCTION OF THE BATTERY-AS- A-SERVICE MODEL

Businesses are developing business models that enable consumers to switch out EV batteries after they are drained, such as battery swapping and battery-as-a-service (Baas). In contrast to a stationary charging station, where charging batteries takes time and requires expensive infrastructure, a battery-as-a-service model (BaaS) enables customers to swap out batteries quickly. BaaS is an asset-light, inexpensive, and quick-on-its-feet model. The upfront costs of EVs may decrease dramatically as a result of the BaaS model; for example, the expenses for two-wheelers may easily decrease by up to 20%. This reduces the amount of time users must spend charging their batteries, increasing customer happiness and resolving one of the primary barriers to EV adoption. Battery swapping at EV charging stations has increased since it saves EV customers' time from having to charge their batteries.

Despite the fact that the market for EV cars outside of China is still growing, it has demonstrated its potential. For instance, NIO expects to deploy about 4,000 more battery switching stations in China by 2025 after installing over 300 by July 2021. By July 2021, its battery swapping stations would have been used 2.9 million times worldwide, with about 1,000 more units slated for locations outside of China. In November 2021, Shell and NIO entered a contract to work together to build these battery-swapping EV charging stations. As a result, the battery now has a new chance to provide EV charging services.

Battery Type Insights

The lithium-ion battery segment held the largest share of 65.24% in the 2024 electric vehicle battery market. The lithium-ion batteries are the ruling power supply for electric vehicles (EVs). Its long-term, fast charging, and high energy density capabilities secure its position among the vast EV battery companies. The materials used in the making of lithium-ion batteries are lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminium oxide (NCA), lithium iron phosphate (LFP), and lithium manganese oxide (LMO). These materials support the consistency and accelerate the performance of the lithium-ion battery. The current research is primarily focusing on enhancing their safety, costing, and performance.

The lithium-ion battery segment is set to experience the fastest growth in the electric vehicle battery market. Its dominance comes from a combination of high energy density, longer lifecycle, and superior charging efficiency compared to other battery type. Automakers across the globe are increasingly adopting lithium-ion technology for both passenger and commercial electric vehicles, as it supports extended driving ranges and rapid chagrining infrastructure. Continuous advancements in lithium-ion chemistry, along with falling production costs, are expected to further accelerate its adoption, making the most rapidly expanding category in the industry

Global Electric Vehicle Battery Market Revenue, By Battery Type, 2022-2024 (USD Billion)

| By Battery Type | 2022 | 2023 | 2024 |

| Lead-Acid Battery | 7.57 | 9.08 | 10.99 |

| Lithium-ion Battery | 34.33 | 41.25 | 49.97 |

| Sodium-ion Battery | 5.02 | 5.98 | 7.18 |

| Nickel-Metal Hydride Battery | 3.25 | 3.87 | 4.64 |

| Others | 2.91 | 3.32 | 3.82 |

| Total | 53.08 | 63.51 | 76.59 |

Vehicle Type Insights

The passenger vehicles segment held the largest share of 54.10% in the 2024 electric vehicle battery market. The passenger vehicle is booming due to the strict emission regulations and rapid EV adoption. The growth is proven by the increase in battery demand, mainly for lithium-ion batteries. It has also transformed plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs). While the current advancement in charging solutions, policies, and battery technology is enough to win over challenges such as charging infrastructure and range issues. These advancements are expanding the EV market globally.

Global Electric Vehicle Battery Market Revenue, By Vehicle Type, 2022-2024 (USD Billion)

| By Vehicle Type | 2022 | 2023 | 2024 |

| Passenger Vehicles | 23.26 | 28.49 | 35.16 |

| Commercial Vehicles | 29.82 | 35.02 | 41.43 |

| Total | 53.08 | 63.51 | 76.59 |

Battery Capacity Insights

The 61-90 kWh segment held the largest share of 34.70% in the 2024 electric vehicle battery market. The 61-90 kWh battery pack in an EV delivers driving capacity of 250 to 400 miles covered on a single charge. It is the best and convenient choice for numerous EV models. The battery of 61-90 kWh is mostly used in larger and mid-size EVs. This provides equal balance across vehicle size, range, and cost. The recent research is concentrating on enhancing energy density, improving battery safety, and cutting costs.

The 90+kWh segment is expected to accelerate at a CAGR of 15.60% during the forecast period. The 90+kWh batteries are compatible for long drive purposes, supporting huge vehicles such as trucks and SUVs. The recent EV models run on 50 kWh, the 90+kwh high high-capacity batteries are steadily acquiring larger space in EVs with their consumer demand for extensive range and robust vehicles for developing reliability. To initiate 90+kwh, the EV industry needs to build a powerful model to bear the capacity.

Form Insights

The prismatic segment held the largest share of 42.80% in the 2024 electric vehicle battery market. The prismatic cells, with a rectangular shape and a powerful casing, are speeding force in the EV battery industries globally. The prismatic form provides pros such as greater thermal management, efficient packaging, and high energy density. This is a popular choice among manufacturers. It's best suitable to leading current battery investments. The compatibility in all ways makes the manufacturer approach the prismatic form in the EVs innovation that will offer satisfying results and do justice to the innovation. The convenient and compact design of the packaging doubles the quality check at first interaction with the consumers, to stay in demand in the long run.

The pouch segment is expected to grow at a CAGR of 14.80% during the forecast period. The pouch-style cells have a foldable design, are foldable, and contain high energy density. The making involves stacking electrode layers in a laminated pouch, providing benefits in weight elimination and space utilization. The pouch cells need more powerful packaging within their battery module to provide safety against certain damage and manage heat control. As these may reduce and mismatch the density benefits. Though the pouch cells are introduced to elevate the amount of active material according to the volume, a thorough development will help the pouch segment grow in the future.

Propulsion Insights

Hybrid electric vehicles are expected to witness the most significant growth within propulsion categories. They offer a practical balance between traditional combustion engines and full electric powertrains, making them highly attractive in markets where chagrining infrastructure is still developing. Hybrids provide consumers with better fuel efficiency and reduced emissions without the range anxiety often associated with battery electric vehicles. Automakers continue to expand their hybrid portfolios as a bridge toward full electrification, assuring strong demand for the batteries that power them.

Global Electric Vehicle Battery Market Revenue, ByPropulsion, 2022-2024 (USD Billion)

| By Propulsion | 2022 | 2023 | 2024 |

| Battery Electric Vehicles | 12.01 | 14.46 | 17.56 |

| Plug-in Hybrid Electric Vehicle | 15.01 | 17.91 | 21.55 |

| Hybrid Electric Vehicle | 18.34 | 21.97 | 26.53 |

| Fuel Cell Electric Vehicle | 7.72 | 9.16 | 10.95 |

| Total | 53.08 | 63.51 | 76.59 |

Battery Capacity Insights

The 50-110 kWh segment held the largest share of 32.25% in the 2024 electric vehicle battery market. The 61-90 kWh battery pack in an EV delivers driving capacity of 250 to 400 miles covered on a single charge. It is the best and convenient choice for numerous EV models. The battery of 61-90 kWh is mostly used in larger and mid-size EVs. This provides equal balance across vehicle size, range, and cost. The recent research is concentrating on enhancing energy density, improving battery safety, and cutting costs.

In terms of battery capacity, the mid-range category is anticipated to grow the fastest. These batteries are widely adopted in mainstream electric vehicles, as they provide a balance between affordability and performance. Mid capacity packs are sufficient to support the driving ranges demanded by most consumers, making them a popular choice among automakers seeking to deliver practical solutions for everyday commuting. As demand for mass market EVs increases, the increases, the mid capacity segment s poised for strong growth, reflecting its alignment with consumer expectations and industry trends

Sales Channel Insights

The OEM segment held the largest share of 94.10% in the 2024 electric vehicle battery market. The original equipment manufacturers (OEMs) are emerging with safe and developing battery technology. The supply chain via OEM becomes trustworthy as they are constantly investing in research and development to meet battery potency, such as silicon anodes and solid-state batteries. Also concentrating on battery integration techniques to enhance vehicle performance. Most of the OEMs are involved in effective collaborations and joint ventures to manage raw material supply and battery production capacity. The OEM segment is putting efforts into promising a reliable and sustainable EV ecosystem.

The aftermarket segment is expected to accelerate at a CAGR of 11.20% during the forecast period. The aftermarket is rapidly growing and is fueled by its skyrocketing adoption of EVs, and its required upgrades, services, and maintenance are more than the original manufacturer's offers. The aftermarket segment refers to a vast range of services and components consisting of battery upgrades, battery health monitoring, performance tuning, and charging solutions. The aftermarket sale is experiencing demand for sustainable solutions like battery recycling processes.

Component Insights

The battery cells segment peaked at the largest share of 52.60% in the 2024 electric vehicle battery market. The battery cells are primary components of EV batteries, and advancement is pivotal to meet certain expectations of the global EV market. The lithium-ion batteries have occupied a large space in the EV battery industry. Whereas, researchers are aiming to improve survival capacity, cost, safety, and discover new chemistries such as sodium-ion, lithium-sulfur, and solid-state batteries. The elevated demand rate and government policies are boosting the extension of battery manufacturing capacity, mainly in EV markets such as the US, Europe, and China.

The battery management systems (BMS) segment is expected to grow at a CAGR of 14.70% during the forecast period. The BMS is important for the efficient and protective operations of EV batteries. It resembles the brain of the battery pack that controls and inspects several parameters to stimulate performance and expand battery durability. The major functions, consisting of monitoring voltage, temperature, and current, with their discharging and charging management, thermal management, and cell balancing, helped BMS to consistently deliver quality in the EV models.

Charging Type Insights

The fast-charging segment peaked with the largest share of 63.90% in the 2024 electric vehicle battery market. The fast-charging technology is playing a vital role in the adoption and advancement of EVs worldwide, with its potential to diminish charging times. This advancement was required to emerge by overcoming range anxiety and empowering broad EV adoption. The current research and development are concentrating on improving battery longevity and charging speeds. The fastest charging time in EVs presents a viable option to gasoline vehicles.

The slow charging segment is expected to grow at a CAGR of 12.50% during the forecast period. The slow charging is popular due to its grid stability and impressive battery life, while enabling cost-effective charging solutions. With its lowest power level, it provides fair distribution of ions in the battery, reducing heat generation and minimizing stress on the battery cell. The slow charging is suitable for workplace and residential charging patterns within a calculated timely manner. The slow charging works a miracle in merging with smart charging technologies.

Form Insights

The prismatic segment held the largest share of 42.80% in the 2024 electric vehicle battery market. The prismatic cells, with a rectangular shape and a powerful casing, are speeding force in the EV battery industries globally. The prismatic form provides pros such as greater thermal management, efficient packaging, and high energy density. This is a popular choice among manufacturers. It's best suitable to leading current battery investments. The compatibility in all ways makes the manufacturer approach the prismatic form in the EVs innovation that will offer satisfying results and do justice to the innovation. The convenient and compact design of the packaging doubles the quality check at first interaction with the consumers, to stay in demand in the long run.

The pouch segment is expected to grow at a CAGR of 14.80% during the forecast period. The pouch-style cells have a foldable design, are foldable, and contain high energy density. The making involves stacking electrode layers in a laminated pouch, providing benefits in weight elimination and space utilization. The pouch cells need more powerful packaging within their battery module to provide safety against certain damage and manage heat control. As these may reduce and mismatch the density benefits. Though the pouch cells are introduced to elevate the amount of active material according to the volume, a thorough development will help the pouch segment grow in the future.

Li-ion Battery Component Insights

The separator segment dominated the electric vehicle battery market by capturing the largest share in 2024 and is expected to grow at the fastest rate in the coming years. The separator is an essential component in Li-ion batteries, as it improves battery performance by separating the anode and cathode and preventing short circuits. As the production of EVs increases, the demand for Li-ion batteries also increases, and so does the need for essential components like separators. Moreover, the increasing focus on improving vehicle performance contributes to segmental growth.

Within lithium-ion chemistries, structural battery composites represent the most dynamic area of growth. These batteries integrate the function of energy storage directly into the structure of the vehicle, reducing overall weight and improving efficiency. This innovation addresses two of the biggest challenges in electric vehicles: increasing range while composites are likely to gain strong momentum, positioning them as one of the most transformative and fast growing technologies in the EV battery space

Global Electric Vehicle Battery Market Revenue, ByLi-ion Battery Component, 2022-2024 (USD Billion)

| By Li-ion Battery | 2022 | 2023 | 2024 |

| Positive Electrode |

6.28 | 7.50 | 9.04 |

| Negative Electrode |

7.23 | 8.67 | 10.49 |

| Electrolyte |

9.69 | 11.66 | 14.14 |

| Seperator |

11.13 | 13.42 | 16.30 |

| Total | 53.08 | 63.51 | 76.59 |

Capacity Insights

The 201-300 kWh segment held the dominant share of the market in 2024 due to the increased demand for high-energy-density batteries to improve vehicle performance. The segment is further likely to expand at the fastest rate throughout the forecast period. This is mainly due to the increasing popularity of large vehicles, such as SUVs and XUVs. Higher energy density batteries stand out as unavoidable in addressing range and performance issues. These batteries are ideal for long haul. The growing concerns about frequent recharge during long haul is a major factor boosting the demand for larger capacity batteries, supporting the segment's growth.

Global Electric Vehicle Battery Market Revenue, By Capacity, 2022-2024 (USD Billion)

| By Capacity | 2022 | 2023 | 2024 |

| <50kWh |

8.69 | 10.37 | 12.47 |

| 50-110 kWh |

17.10 | 20.47 | 24.70 |

| 111-200kWh |

10.66 | 12.73 | 15.32 |

| 201-300kWh |

9.17 | 11.06 | 13.44 |

| >300kWh | 7.46 | 8.88 | 10.66 |

| Total | 53.08 | 63.51 | 76.59 |

Battery Form Insights

The pouch segment led the electric vehicle battery market in 2024 by holding the largest share. The segment is projected to continue its dominance over the studied period. With the increasing demand for lightweight vehicles, the acceptance of pouch cells is increasing, which is expected to boost the segment growth. Pouch cells are increasingly preferred due to their design flexibility, lightweight, and portability compared to prismatic and cylindrical cells. They have better thermal performance due to their flat and thin design, dissipating heat during charging and discharging cycles.

The pouch cell design is positioned as the fastest growing form factor in the EV battery market. Its flexible and lightweight structure allows for efficient space utilization within market. Its flexible and lightweight structure allows for efficient space utilization within electric vehicles, enabling higher energy density in compact areas. Pouch cells also offer cells are increasingly being adopted, giving this segment a prominent role in the industry's future growth.

Global Electric Vehicle Battery Market Revenue, By Battery Form, 2022-2024 (USD Billion)

| By Battery Form | 2022 | 2023 | 2024 |

| Prismatic | 17.14 | 20.53 | 24.80 |

| Pouch |

22.78 | 27.32 | 33.04 |

| Cylindrical |

13.17 | 15.65 | 18.75 |

| Total | 53.08 | 63.51 | 76.59 |

Material Type Insights

The lithium segment accounted for the largest market share in 2024 and is likely to grow at the fastest rate in the foreseeable future. The segmental growth is primarily attributed to the increasing demand for Li-ion batteries. Lithium is widely preferred due to its low atomic weight, leading to the overall weight reduction of battery packs and improving vehicle performance. Lithium-ion batteries withstand many charge-discharge cycles, reducing frequent battery replacement.

Among materials used in EV batteries, manganese is projected to experience the fastest growth. Manganese based chemistries are increasingly being incorporated due to their stability, safety profile, and ability to enhance the performance of lithium-0ion cells. They are also considered more cost effective and sustainable compared to some other materials, making them a preferred choice for large scale production. As automakers seek to diversify supply chains and reduce dependence no more expensive inputs, the role of manganese in battery production is expected to strengthen significantly.

Global Electric Vehicle Battery Market Revenue, By Material, 2022-2024 (USD Billion)

| By Material | 2022 | 2023 | 2024 |

| Lithium |

18.32 | 22.02 | 26.66 |

| Cobalt |

12.88 | 15.45 | 18.68 |

| Manganese |

13.80 | 16.48 | 19.84 |

| Natural Graphite |

8.07 | 9.56 | 11.41 |

| Total | 53.08 | 63.51 | 76.59 |

Recent Developments

- In September 2023, Samsung SDI, a battery producer, announced intentions to invested $1.98 billion in its second battery factory in partnership with Stellantis, a top global automaker, marking a substantial entry into the U.S. EV battery industry. The South Korean corporation disclosed this strategic change in a regulatory filing on September 27. In Starplus Energy, a joint venture with Stellantis devoted to producing batteries for electric vehicles, Samsung SDI holds a 51% ownership position.

- In August 2023, with only a 10-minute charge, a Chinese manufacturer claimed to have introduced a "superfast charging" battery that can give a 400 km driving range. The new battery is the world's first 4C quick-charging LFP battery, according to Contemporary Amperex Technology Co. Limited (CATL). It can deliver 400 km of range in 10 minutes and over 700 km of overall range on a single full charge.

- In August 2020, CATL revealed the plan of building new EV batteries without the use of nickel and cobalt owing to the high costs associated with the cobalt.

- In November 2020, Samsung SDI decided to commercialize its li-ion battery to replace liquid electrolyte in batteries and improve the battery performance.

- In December 2019, Samsung SDI acquired additional stake of15% in the Samsung SDI-ARN Power Battery Co. Ltd. and became the major stakeholder with 65% of the company's stake.

Electric Vehicle Battery Market Companies

- Hitachi, LTD.

- Sony Group Corporation

- ATLASBX Co. Ltd.

- Zhejiang Narada Power Sour

- BB Battery Co.

- Panasonic Energy Co., Ltd.

- Narada Power Source Co., Ltd.

- Robert Bosch LLC

- Crown Battery

- EnerSys, Inc.

- GS Yuasa Corporation

- TCL Corporation

- Huanyu New Energy Technology

- C&D Technologies, Inc.

- Duracell

- NEC Corporation

- North Star

- GS Yuasa Corp.

Recent Developments

Toyota

Partnership- In October 2023, Toyota, a prominent leader in the electric vehicle (EV) market, made headlines by entering into a strategic partnership with Idemitsu Kosan, a key player in the energy and materials sector. This collaboration aims to leverage Idemitsu's expertise in battery technology to enhance the performance and efficiency of EVs.

Stellantis

Innovation- In November 2024, Stellantis is set to introduce a demonstration fleet of electric Dodge Charger Daytona vehicles by the year 2026. This initiative aims to conduct extensive testing of solid-state batteries developed in partnership with Factorial, a company recognized for its innovative approaches to automotive battery technology.

South 8 Technologies

Innovation- In November 2024, South 8 Technologies will pioneer a safer and more efficient battery alternative designed to mitigate the common issues associated with traditional lithium-ion batteries. The company's CEO, Tom Stepien, recently revealed that they have developed an innovative technology known as LiGas.

Segments Covered in the Report

By Battery Type

- Lead-Acid Battery

- Lithium-ion Battery

- Sodium-ion Battery

- Nickel-Metal Hydride Battery

- Others

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Propulsion

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

By Li-ion Battery Component

- Positive Electrode

- Negative Electrode

- Electrolyte

- Separator

By Capacity

- <50 kWh

- 50-110 kWh

- 111-200 kWh

- 201-300 kWh

- >300 kWh

By Battery Form

- Prismatic

- Cyindrical

- Pouch

By Material Type

- Lithium

- Cobalt

- Manganese

- Natural Graphite

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting