What is the Off-highway Electric Vehicle Market Size?

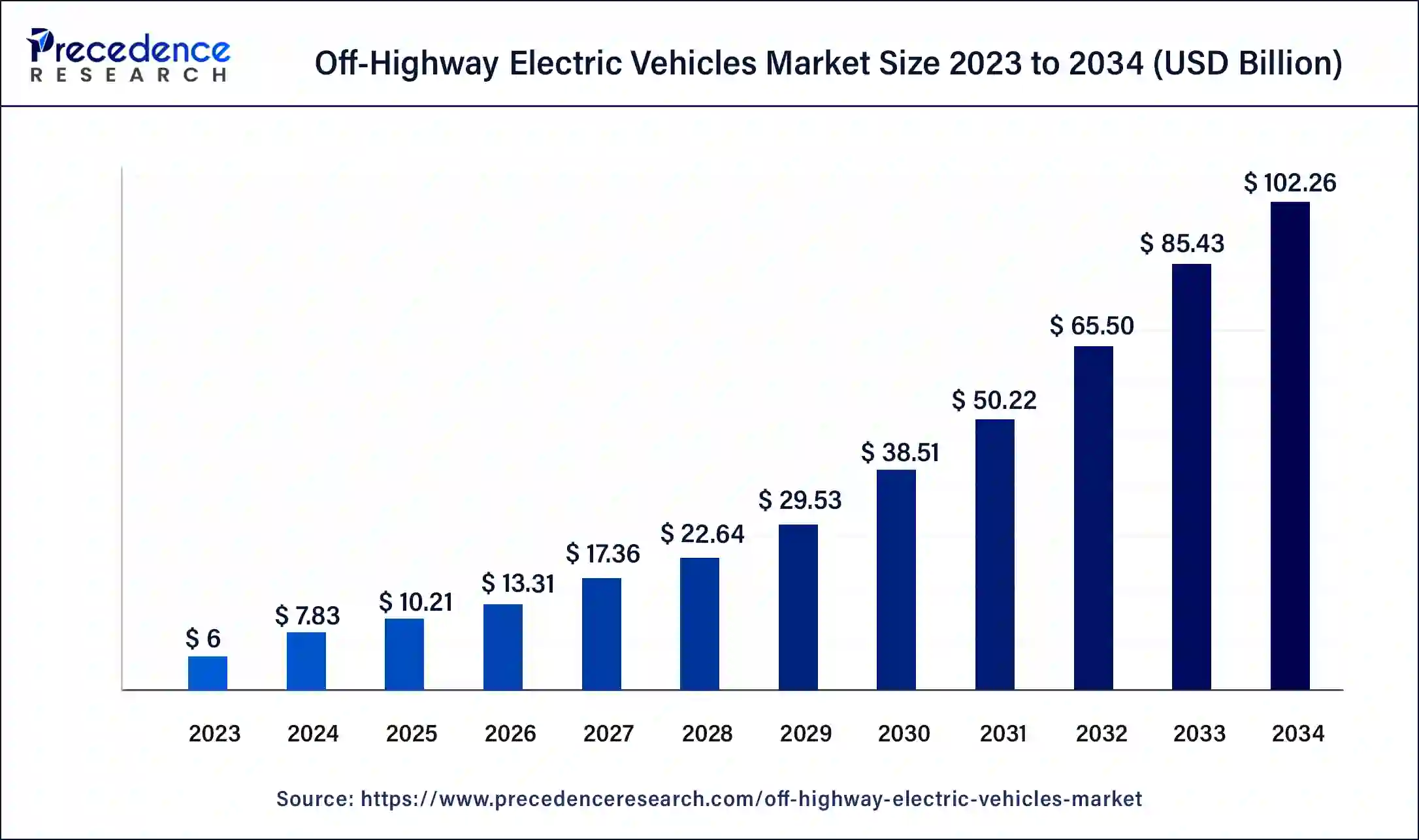

The global Off-highway electric vehicle market size is calculated at USD 10.21 billion in 2025 and is predicted to increase from USD 13.31 billion in 2026 to approximately USD 121.16 billion by 2035, expanding at a CAGR of 28.07% from 2026 to 2035.

Off-highway Electric Vehicle Market Key Takeaways

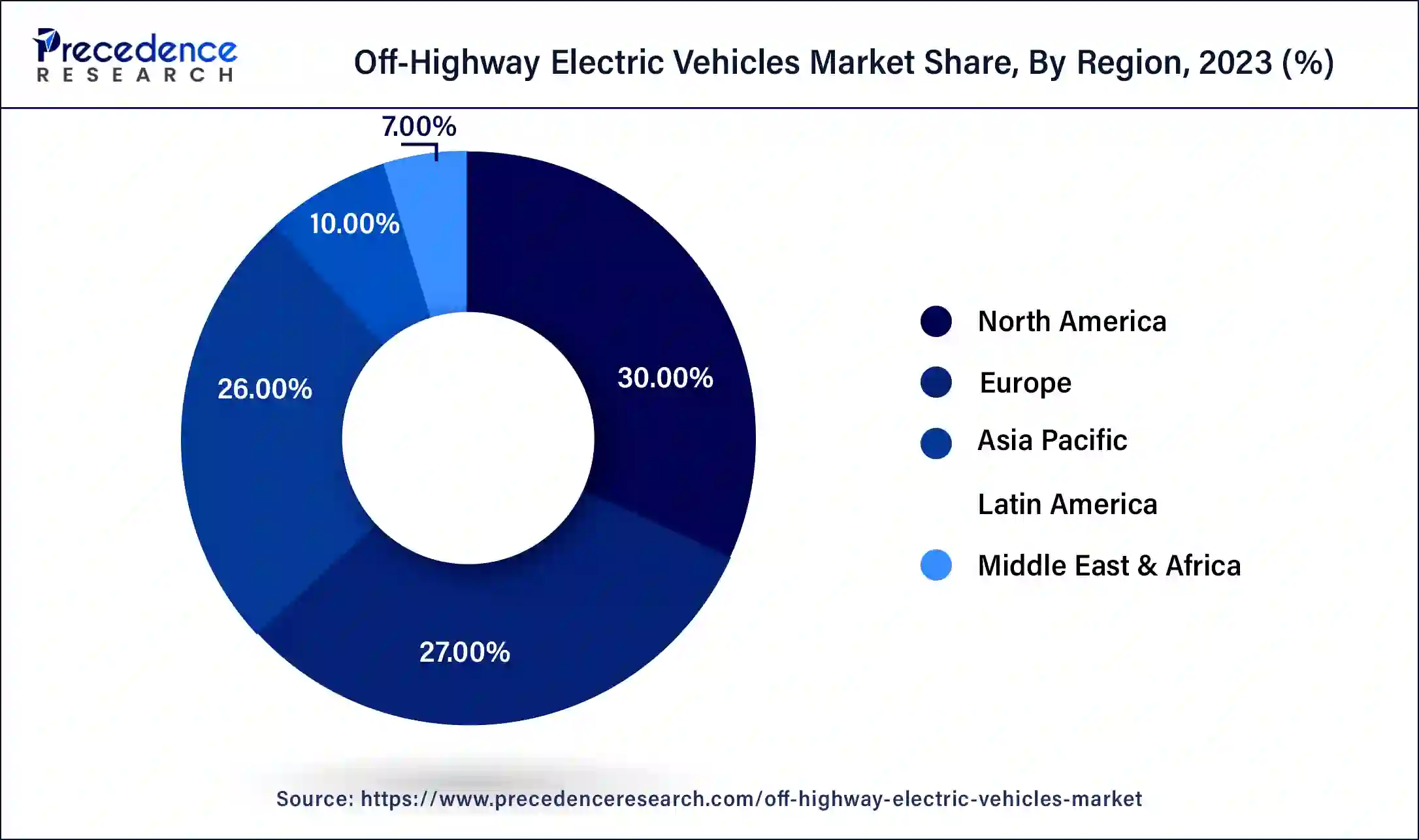

- North America dominated the market with the largest market share of 30% in 2025.

- By application, the construction segment contributed more than 38.2% of market share in 2025.

- By application, the agriculture segment is anticipated to grow significantly in the market during the forecast period.

- By electric vehicle, the HEV segment generated the highest market share of 66.2 % in 2025.

What is the Off-Highway Electric Vehicle Market?

The growing growth of infrastructure in developing markets and the introduction of redevelopment projects in developed countries are boosting sales of electric highway vehicles. Strict emission standards by government agencies, such as emission standards for greenhouse gas ( GHG ) emissions by the U.S. The Environmental Protection Agency ( EPA) and the European Commission are both main factors influencing the global market for off-road electric vehicles ( EVs). In addition, the market for off-highway electric vehicles is also leveraged by factors such as improved electrical machinery performance, lower noise and vibration levels, lower overhaul costs, and others.

Government authorities have introduced increasing stringency in emission standards for off-highway vehicles, such as emission standards for greenhouse gas (GHG) emissions by the U.S. India, and China VI Environmental Protection Agency (EPA), BS-VI. The increasing strictness of emission standards has shifted the attention of OEMs toward alternative powertrain sources such as hybrid electric and full electric off-highway vehicles that exploit global demand. Electrification of heavy-duty off-highway vehicles is on the rise, and businesses are highly interested in exploring how this emerging development will complement their current business models. There are many advantages to the electrical system of heavy-duty vehicles. However, in conducting research and implementing the electrical solution, factors such as battery technology, infrastructure, and overall cost of production play a vital role.

How is AI contributing to the Off-highway Electric Vehicle Market?

Artificial Intelligence offers the potential of off-highway electric vehicles by battery performance optimization, autonomous navigation enhancement, and smart energy management facilitation. It increases design productivity through scooping and predictive maintenance support, reducing breakdown and real-time sensor analytics, and improving component reliability. AI-powered automation improves the precision of manufacturing, and smart routing increases operational productivity. In summary, AI facilitates the adoption in tough industrial environments by enhancing safety, efficiency, and lifecycle management.

Market Outlook

- Industry Growth Overview: Electrification needs and technological advancements leading to better heavy equipment performances are the two major drivers of industry growth.

- Sustainability Trends: Sustainability gets faster as operations more and more depend on clean power solutions that reduce the environmental footprint and improve the working conditions.

- Global Expansion: Global expansion continues as the use of electric machinery in various regions to modernize industrial operations, and the ability to produce goods in an environmentally friendly way are the main reasons for this.

- Major investors: Investors like Caterpillar Inc., Volvo Construction Equipment AB, Komatsu Ltd., and Deere & Company are the driving force of the market because they keep coming up with powerful electric platforms that push the performance, efficiency, and reliability of industrial equipment markets.

- Startup Ecosystem: Startups are behind the new technologies in batteries, charging systems, and design that make it easier for industries to adapt to changing needs.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 10.21 Billion |

| Market Size in 2026 | USD 13.31 Billion |

| Market Size by 2035 | USD 121.16 Billion |

| Growth Ratefrom 2026 to 2035 | CAGR of 28.07% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Electric Vehicle, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Application Insights

The construction segment accounted for the highest share of around 38.2% in 2023, The segment includes electric construction equipment, such as electric loaders, electric excavators, and more. One of the key factors driving the market demand for this equipment has been growing investments by governments worldwide to build public infrastructure. In order to comply with the tougher emission requirements, OEMs are introducing electric off-highway equipment. In the future, legislation could mandate zero emissions on heavy-duty construction equipment to pave the way for OEMs to drop diesel-powered engine output and go all-electric.

The agriculture off-highway electric vehicle segment is expected to grow at a CAGR of 22.1% from 2024-2034. The segment covers electric agricultural equipment such as electric tractors, electric harvesters, etc. Consumers have begun embracing new farm machinery and advanced agricultural processes to achieve higher yields in regions such as North America and Europe. Thus, the demand for electric and hybrid tractors and other farm equipment is expected to rise in the forecasted timeline.

Electric Vehicle Insights

The HEV segment accounted for the biggest revenue share of 66.2% and is predicted to retain its dominance over the forecast period. These vehicle types are intended to increase the use of the internal combustion engine in combination with the electric powertrain. The stringent emission regulations by different government agencies such as the European Commission and the United States The demand for hybrid off-highway propulsion equipment from the EPA is rising and pushing manufacturers to build more environmentally friendly off-highway vehicles. A hybrid engine, a variation of the diesel-electric propulsion system, has been adopted by off-highway vehicle manufacturers since 2017.

The BEV Off-highway electric vehicle segment is likely to expand at the maximum CAGR of 29.5% over the forecast period. Growth can be likely to downturn in the adoption of internal combustion engine vehicles and CO2 aim restrictions. The power needed for the majority of off-highway vehicles to operate is, however, too high; the use of fully electric BEVs is therefore still limited. The reduction in lithium-ion battery prices and advancements in battery technology would leverage the demand for BEVs in the forecast period.

Key Companies & Market Share Insights

The global Off-highway Electric Vehicle market seeks intense competition among the market players owing to rapidly changing consumer preferences. Further, the industry participants are prominently adopting inorganic as well as organic growth strategies that include partnership, collaboration, merger & acquisition, and many others to maintain their competitive edge in the global market. Apart from this, they invest prominently in R&D activity for new product development & advancements.

Regional Insights

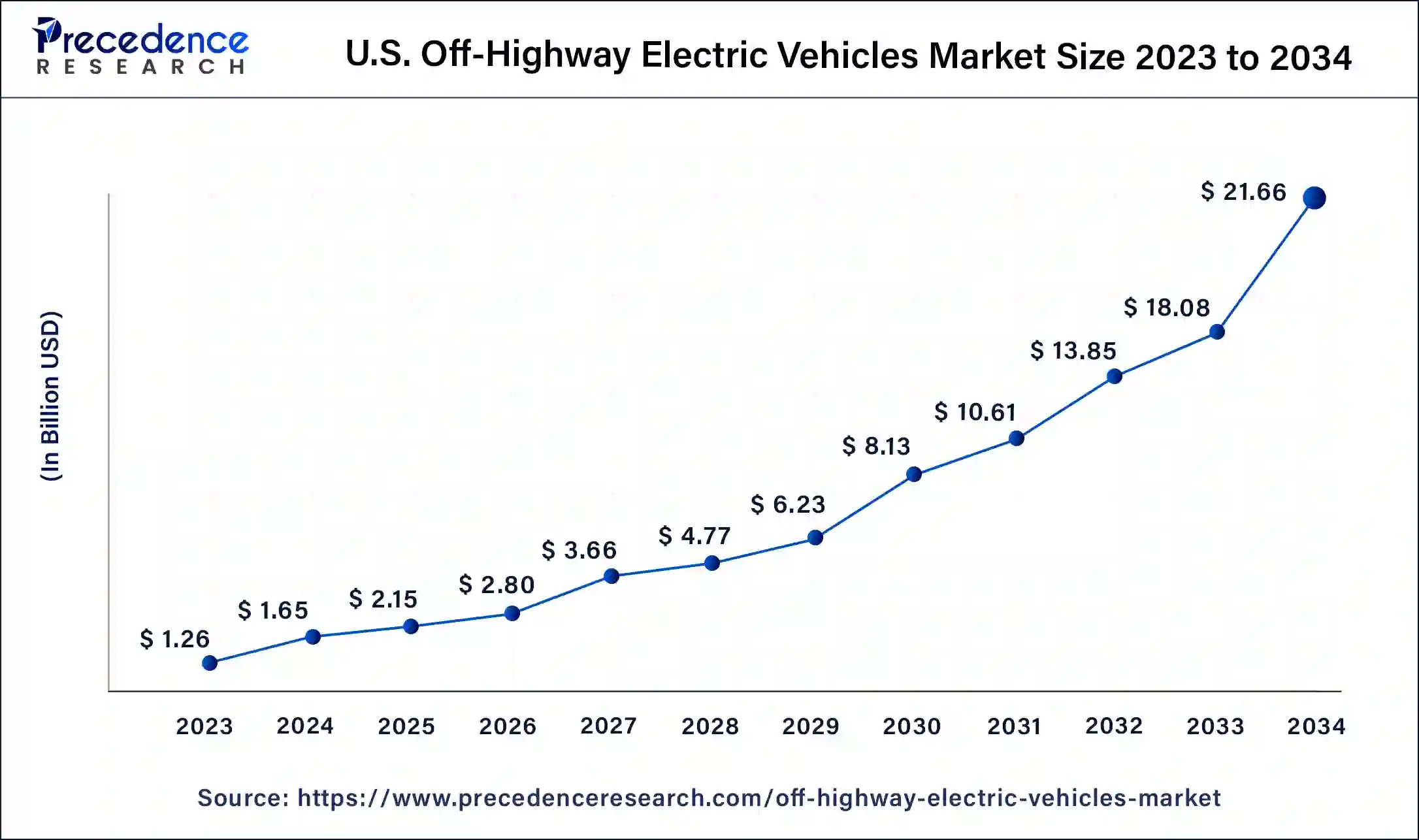

What is the U.S. Off-highway Electric Vehicle Market Size?

The global Off-highway electric vehicle market size is valued at USD 2.15 billion in 2025 and is expected to be worth around USD 25.67 billion by 2035, at a CAGR of 28.14% from 2026 to 2035.

North America showed prominent growth in the global Off-highway electric vehicle market accounting for a significant market share in 2023. Due to the presence of key companies such as Caterpillar, Deere & Company, and CNH Industrial N.V., the area holds a dominant share in the forecast era. In the North American region, the construction industry is increasing, affecting the region's demand for off-highway electric equipment. According to the United States Environment Protection Agency (EPA), the U.S. adopted rigorous emission requirements in 2018; off-highway equipment accounted for almost 30 percent of overall emissions of greenhouse gases. The increased emissions of greenhouse gases have pushed companies to introduce new electric models for off-highway vehicles. In the Asia Pacific region, the off-highway EV market is projected to grow from 2024 to 2034 at the highest CAGR of 34.4 percent. Asia Pacific countries, such as China and India, reported a strong performance in 2023 due to the increase in investment in infrastructure. Due to the existence of numerous OEMs, low production prices, low labor costs, and the availability of excellent facilities, China is one of the major contributors to the production of construction machinery.

How is Asia-Pacific performing in the Off-highway Electric Vehicle Market?

The consumption of Asia-Pacific is made possible by the growing demand from industry, strong manufacturing ecosystems, and policies that support electric mobility. The region is able to take advantage of its established production capability, technology adoption, and sustainability equipment demand for construction, mining, and agriculture growth.

China Off-Highway Electric Vehicle Market Trends:

China has been the first to embrace electric vehicles as a main player, thanks to the country's strong production capacity, well-developed electric mobility policies, and large charging stations. An increase in industrial demand, investments in sustainability by the government, and the quick conversion of the construction and agriculture sectors to electric power are the factors that continue to create new opportunities for the development of off-road electric vehicles.

What are the driving factors of the Off-highway Electric Vehicle Market in Europe?

Europe progresses by setting high sustainability boundaries, slowly but steadily accepting electric machinery, and pushing clean technologies through strong regulations. The support given to researchers, the governments, and technology innovators indeed makes electric dealings in construction, agriculture, and industrial applications throughout the region.

Germany Off-Highway Electric Vehicle Market Trends:

Germany benefits from its strong engineering skills, commitment to the environment, and deliberate production of electric tools for tough applications. Initiatives of encouragement and high manufacturing standards are the ones that make sales of electrified building, mining, and industrial machinery go up.

How is North America leading in the Off-highway Electric Vehicle Market?

North America is expanding due to the growing importance of environmental factors, more money being put into electrification, and the use of electric machines in industries. The region's top-notch manufacturing capabilities and continuous technological advancements are the ones that will eventually lead to the adoption of off-highway electric vehicles.

United States Off-Highway Electric Vehicle Market Trends:

The United States is one of the countries that provides support to the market growth with the help of the increasing demand for efficient equipment for construction, agriculture, and industry. The implementation of advanced technology, the focus on the environment, and the state-of-the-art infrastructure all play a role in the adoption of high-quality electric off-highway equipment that is used in greater volumes.

Value Chain Analysis

- Raw Material Sourcing (Steel, Plastics, Electronics): Selecting the necessary materials for manufacturing with maximum quality, cost savings, and uninterrupted supply.

Key Players: Henkel AG & Co., TSMC - Component Manufacturing (Engines, Transmissions, etc.): Supplying or manufacturing the main intricate parts needed for the construction of the vehicle.

Key Players: Bosch, Continental AG, Denso, ZF Friedrichshafen AG, Dana TM4 - Vehicle Assembly and Integration: The process of combining systems and parts to manufacture fully functional off-highway electric vehicles.

Key Players: Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, John Deere - Testing and Quality Control: Checking that the vehicles comply with required performance, dependability, and safety standards before they are dispatched.

Key Players: SGS, TÜV SÜD, DEKRA - Distribution to Dealers and OEMs of Off-highway Electric Vehicle: Sending the completed cars to the respective partners for the final market placement and customer access.

Key Players: Caterpillar and Volvo

Recent Developments

- In December 2025, BC Hydro will open its first high-powered EV charging hub in Hope, featuring eight ports to support light and medium-duty EVs along Highways 1, 3, and 5.

- In May 2025, Germany's Schaeffler Group produces diverse motion technology products, including EV components, recently unveiling new products for electric construction machinery, responding to bans on legacy ICE vehicles in urban areas.

https://chargedevs.com

Off-Highway Electric Vehicle Market Companies

- Caterpillar: Creates highly productive electric mining trucks and heavy equipment that's easy and cheap to operate, and the performance is strong enough even for the toughest industrial applications.

- Komatsu Ltd: Manufactures electric and hybrid excavators, responsible for increasing efficiency, cutting down on polluting emissions, and aiding the growing demand of mining and construction with their operations.

- Volvo Construction Equipment AB: Distributes electric excavators, wheel loaders, and material handlers, which are all part of the company's eco-friendly vision, featuring no emissions at all, quieter working areas, and better performance of equipment in factories.

Other Major Key Players

- Deere & Company

- Sandvik AB

- Hitachi Construction Machinery Co., Ltd

- Epiroc AB

- Doosan Corporation

- CNH Industrial N.V

- J C Bamford Excavators Ltd.

Segments Covered in the Report

By Application

- Construction

- Agriculture

- Mining

By Electric Vehicle

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting