Electric Vehicle Charging Station Market Size and Forecast 2026 to 2035

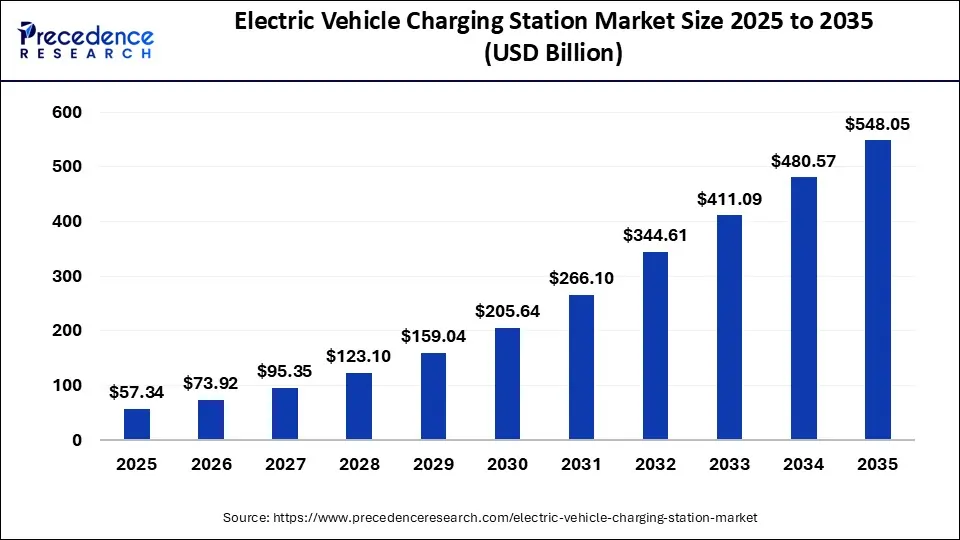

The global electric vehicle charging station market size was estimated at USD 57.34 billion in 2025 and is anticipated to reach around USD 548.05 billion by 2035, expanding at a CAGR of 25.32% from 2026 to 2035.

The EV charging station market is highly attractive and opportunistic market. The growth trend of EV charging stations is directly proportional to the electric vehicle (EV) adoption rate across the globe. As per the stats, Norway leads the world in percentage of EVs sold per year out of total vehicles sale with 49.1% followed by Iceland with 19.1%, Sweden with 8%, Netherlands with 6.7%, Finland with 4.7%, and China with 4.4%. Furthermore, according to stats revealed for U.S., total EVs registered across U.S. in the year 2020 were 1,019,260 with California, Florida, and Texas leading in the number of EV registrations. This was mainly attributed to the attractive government policies for reducing the rate of emission from vehicles.

Electric Vehicle Charging Station MarketKey Takeaway

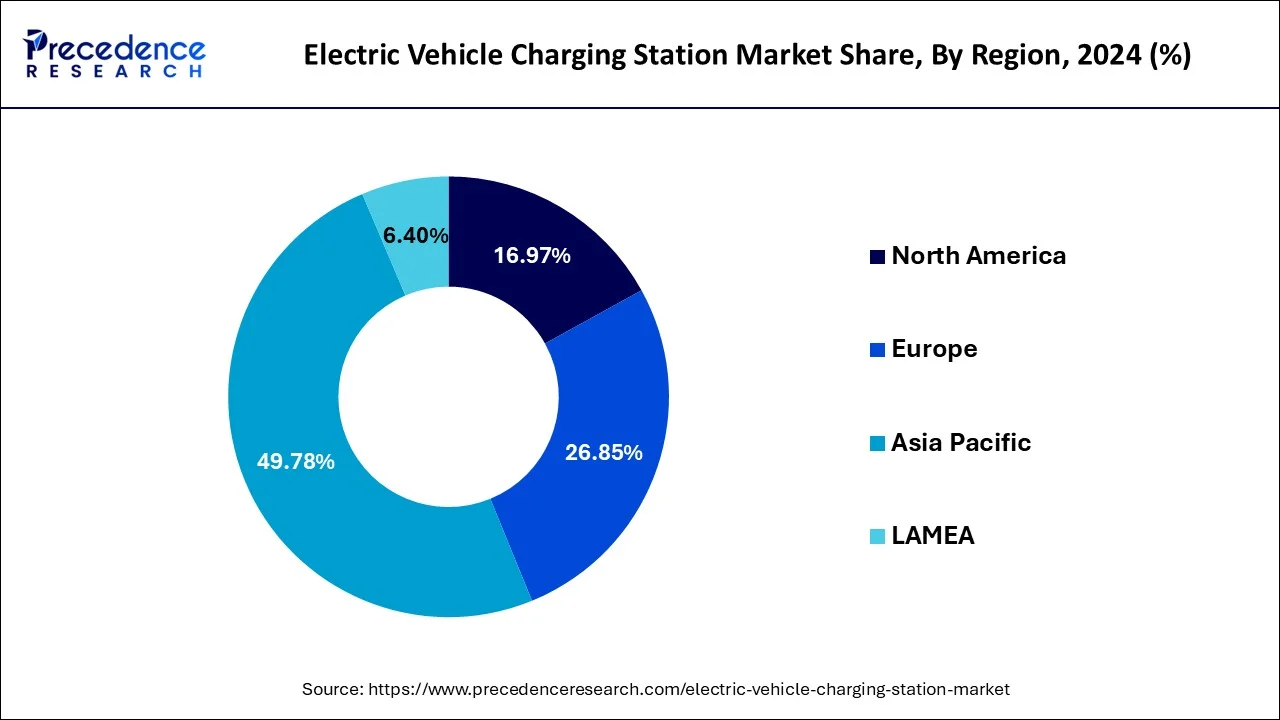

- Asia Pacific dominated the EV charging station market with the largest market share of 49.78% in 2025.

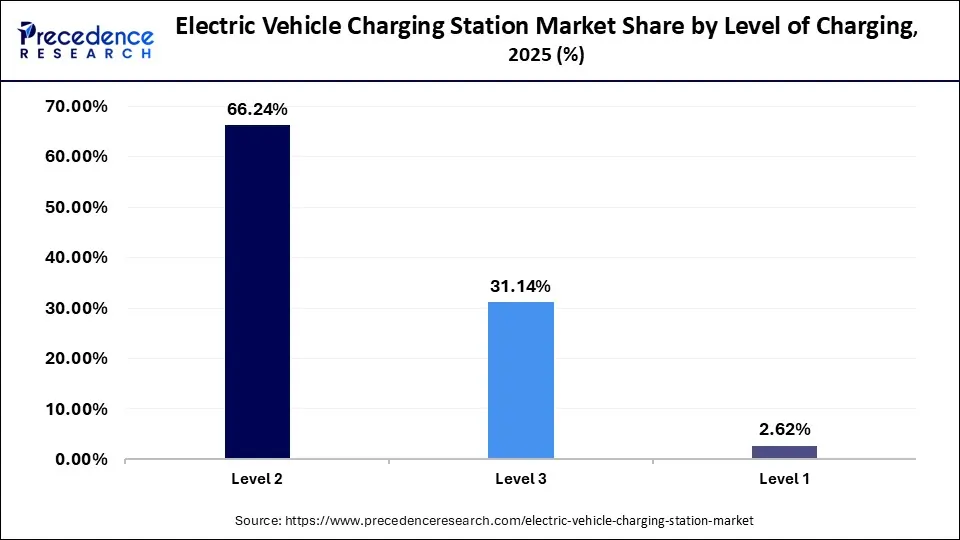

- By level of charging, the level 2 segment has held the biggest market share of 66.24% in 2025.

- By level of charging, the level 3 charging station segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2035.

- By charging station type, the wireless charging segment is set to experience the fastest rate of market growth from 2026 to 2035.

- By mode of charging, the plug-in charging segment accounted the highest market share of 86% in 2025.

- By end user, the residential segment caprued the maximum market share of 65% in 2025.

- By application, the public chargers segment recorded more than 85% of market share in 2025.

How is AI enhancing the electric vehicle charging station industry?

Artificial Intelligence (AI) is transforming electric vehicle (EV) charging stations. By analyzing traffic, weather, and user behaviors, AI can determine the best locations to build new EV charging stations. AI will also help cut the power usage in order to charge many EVs at the same time without overloading the power grid. It will tell drivers where to charge, how to find chargers that are close to them, the estimated wait time to charge, and minimize charge times by using less expensive time periods to charge. It can monitor for failures in the system, notifying operators in advance before charge stations finish perfecting a breakthrough. These systems can provide cost-effective, time-effective, and energy-effective options for EV drivers, enhancing the overall user experience.

- For instance, Tesla utilizes AI in its supercharger network to funnel drivers to supercharging stations at less popular times to minimize the time spent waiting for the station. Tesla also preconditioned the vehicle battery even before arriving at a supercharging station. This enables it to charge more rapidly and therefore save time, enhance user experience, and make the overall charging process seamless.

Asia Pacific Electric Vehicle Charging Station Market Size and Growth 2026 to 2035

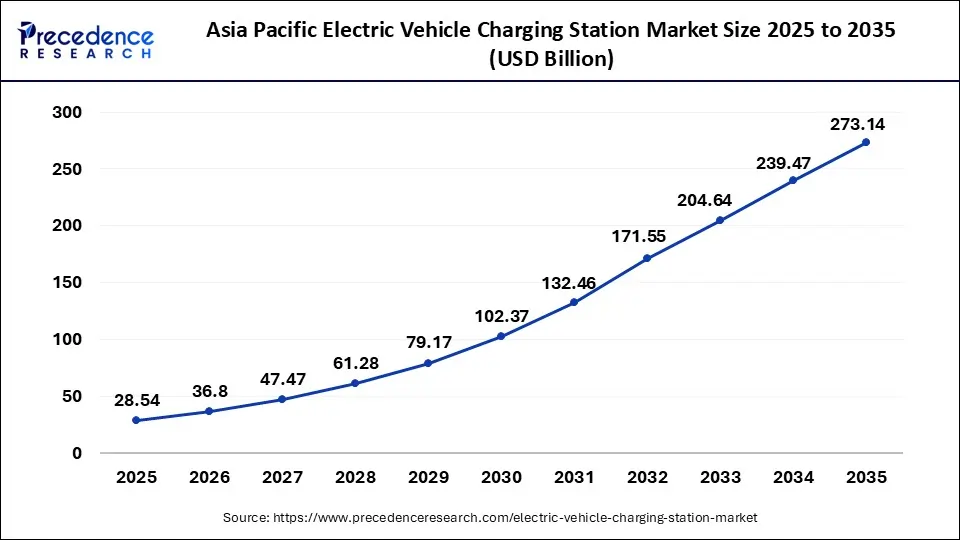

The Asia Pacific electric vehicle charging station market size was evaluated at USD 28.54 billion in 2025 and is predicted to be worth around USD 273.14 billion by 2035, rising at a CAGR of 25.34% from 2026 to 2035.

Asia Pacific dominated the EV charging station market with the largest market share of 49.78% in 2025, and is expected to be the most lucrative region during the forecast period. This is majorly attributed to the increasing investments by the government of China, South Korea, Japan, and other Asian countries for installation of charging infrastructures. For instance, in April 2020, China announced its plan to invest USD 1.43 billion in 2020 to maintain its leadership in EV adoption race. Similarly, Singapore, India, Korea, and Japan are also investing in the electric vehicle charging infrastructure to promote its adoption in their region.

The market for EV charging station in Asia-Pacific region is being driven by growing government initiatives. As of the end of July, members of the Alliance claimed that around 566,000 public charging stations had been erected and were operational across the country, according to figures released by the China electric charging infrastructure promotion in August 2020. Furthermore, by 2050, the Japanese government plans to convert all new cars sold in the country to electric or hybrid vehicles. By 2050, the government wants to reduce carbon dioxide emissions and other greenhouse gas emissions by around 80% per car. Thus, market growth in region is expected in the near future.

Key contributor countries in this region:

China: With significant global influence, China has heavily invested in developing one of the world's most extensive charging infrastructures, strongly supported by government backing and its status as the largest EV market.

India: Striving towards a greener transport future, India is pushing forward with electric mobility by offering subsidies and establishing a growing network of public and private charging points.

Japan: Japan is integrating its EV expansion with sustainability goals by deploying advanced charging technologies and working towards a carbon-neutral future.

South Korea: Emphasizing innovation, South Korea is leading with smart and renewable-powered charging stations and expanding its EV-ready urban infrastructure.

What are the Trends for the Electric Vehicle Charging Station Market in China?

China is a major contributor to the electric vehicle charging station market. The strong government support for the adoption of electric vehicles increases demand for EV charging stations. The government's focus on the development of charging infrastructure helps market growth. The growing consumer demand for electric vehicles increases the demand for electric vehicle charging stations. The strong presence of private and public charging stations drives the overall growth of the market.

India's Electric Vehicle Charging Station Market Trends

India is growing in the electric vehicle charging station market. The increasing consumer demand for electric vehicles fuels demand for EV charging stations. The growing electrification of commercial fleets like buses, taxis, and delivery vans increases demand for charging stations, helping the overall growth of the market. The strong support of the Indian government through the FAME scheme for electric vehicles fuels demand for charging stations. The growing investment of companies like Tata Power in charging infrastructure supports the overall growth of the market.

The total number of electric vehicles' public charging stations is 25202 in India.

(Source:https://www.pib.gov.in)

Europe and North America witness moderate growth in the global electric vehicle charging station market. This is mainly due to the government's ambition in Europe & North America to curb the carbon emission and increase the adoption rate of electric vehicles. Nearly, 76% of total charging stations in Europe are just concentrated in four countries that are Germany, France, UK, and the Netherlands. In June 2019, Volkswagen Group announced its plan to install 36,000 electric vehicle charging points in various parts of Europe by 2025. Similarly in June 2018, three major states of U.S. that include New York, New Jersey, and California announced to spend USD 1.3 billion in the deployment of EV charging infrastructure to boost their EV adoption.

Germany Electric Vehicle Charging Station Market Trends

The focus on reducing carbon emissions increases the adoption of electric vehicles, which fuels demand for charging stations. The strong government support for installing private & public charging stations helps the market growth. The growing number of electric vehicles on the roads increases demand for charging infrastructure. The growing expansion of EV charging infrastructure by companies like Shell Recharge, Tesla, and Allego GmbH drives the market growth.

The U.S. is dominating the electric vehicle charging station market in the North America region. Electric vehicle use is fast expanding throughout North America. The U.S. is the third-largest market for electric vehicles, according to the International Council on Clean Transportation, with around 320,000 new electric vehicle sales in 2019. According to the International Energy Agency, about 1.8 million electric automobiles were recorded in the U.S. as of 2020, which is more than three times the number registered in 2016. The total number of electric vehicles registered in the U.S. increased from under 300,000 in 2016 to over 1.1 million in 2020. California began establishing charging station networks to help with the broad adoption of electric vehicles. As of 2021, there are more than 42,000 publicly accessible charging stations in the U.S.

For instance, electric car owners in the UK can take advantage of the EVHS (Electric Vehicle Homecharge Scheme) OLEV (Office for Low Emission Vehicles) subsidy, which, starting on April 1, 2020, pays up to USD 384.9 off the price of buying and inaugurating a residence charging point. Government incentives are also available to companies in the UK. The WCS (Workplace Charging Scheme), a voucher-based program created to assist with the up-front costs of purchasing and installing wall chargers, allows you to declare up to USD 10,999.5 for 40 chargers.

Additionally, according to bp pulse, the first charging station for medium- and heavy-duty electric trucks would open in Europe. There are now six public charging stations with ultra-fast 300kw charge ports over a 600km section of the Rhine-Alpine route in Germany. The freight roads, one of the busy roads in Europe, the corridor links the Mediterranean port of Genoa in Italy with the Netherlands and the North Sea ports in Belgium via a 1,300 km long network of motorways.

Additionally, the assistance in France takes the form of a tax credit: up to a deduction of 300 euros, equal to 75% of the cost incurred and detailed on the invoice, including installation charges. This assistance is a component of the ADVENIR project, which aims to install EV charging stations across France.

Top EV Charging Products- 2025

| Country | Company | Product | Description |

| USA | Tesla | Supercharger V3 | Tesla's proprietary fast-charging network offers up to 250 kW charging speeds, enabling rapid charging for Tesla vehicles. The supercharger network is a cornerstone of Tesla's strategy to alleviate. |

| Germany | Siemens | Versicharge | Siemens offers the Versicharge line, providing both AC and DC charging solutions suitable for residential, commercial, and public applications, emphasizing smart connectivity and energy efficiency. |

| Netherlands | EvBox | Elvi residential charger | EVBox specializes in scalable charging solutions, with the EM designed for home use and the toniq modular catering to high-traffic commercial locations. supporting fast charging capabilities. |

| U.K. | BP Pluse | Rapid Ultra-fast charges | BP Pulse operates a network of rapid and ultra-fast charges across the UK, aiming to provide convenient charging options and support the country's transition to electric mobility |

| France | TotalEnergies | High-power changing | Total Energy is expanding its EV charging infrastructure with high-power stations across Europe, focusing on integrating renewable energy sources and enhancing user experience. |

Market Overview

The rise in carbon emissions and other hazardous pollutants from transportation has necessitated the adoption of electric vehicles. As a result, there is a growing demand for electric vehicle charging infrastructure in business and residential settings. Increased cooperation among automobile manufacturers for charging infrastructure, as well as a subscription model, are also projected to boost market expansion.When opposed to residential areas, commercial spaces have a far higher market penetration of electric vehicle charging equipment. With the increased usage of electric vehicles, the number of commercial charging stations is expected to rise. Efforts to improve charging infrastructure in commercial areas would be critical in increasing the use of electric vehicles, as overnight charging at residential complexes or individual residences would not be adequate for long-distance travel.

The major factors driving the market's growth are government initiatives to encourage the adoption of electric vehicles and associated infrastructure, rising demand for electric vehicles fast charging infrastructure, and increased deployment of electric vehicles by shared mobility operators. The market players can benefit from increased research and development in vehicle-to-grid technology and rising acceptance of electric mobility in emerging nations.

Rising demand for electric vehicles is one of the prime factors for the aggressive growth of EV charging station market. The growth is further propelled by the government funding to the Original Equipment Manufacturers (OEM) for the deployment of charging stations. For instance, in December 2016, ChargePoint Inc. was awarded USD 4 million by California Energy Commission (CEC) for completing the West Coast Electric Highway that connects Baja California to British Columbia with electric vehicle charging stations.

Additionally, increasing popularity of Mobility as a Service (MaaS) also expected to flourish the market growth. Further, the growth of the EV charging station is fuelled by the significant emphasis on the subscription-based charging models. As per the model, many utilities such as Vattenfall AB, Duke Energy Corporation, and New York Power Authority have signed a partnership agreement with the OEMs to provide the subscription-based services to their customers. For instance, in April 2019, Duke Energy Corp. signed a partnership agreement with ChargePoint Inc. for offering subscription-based services to its EV drivers in the U.S. state of North Carolina.However, various costs associated to the EV charging infrastructure that includes maintenance cost, installation cost, and operational cost are impacting negatively on the market growth.

The governments all around the globe have shifted their focus from other activities to medical and health care facilities due to COVID-19 pandemic. During the outbreak, strict lockdown rules were imposed in all countries. These restrictions hampered the work process of every industry. People were forced to stay at home and maintain social distancing norms and prevent the coronavirus from spreading, affecting the availability of the labor. However, as all countries lifted the lockdown restrictions, the ongoing projects resume, and the electric vehicle charging stations market is likely to rise significantly.

Electric Vehicle Charging Stations Market Data and Statistics

- In July 2023, the Confederation of Indian Industry stated that India requires approximately 1.32 million electric vehicle charging stations by 2030. The nation is aiming to set up at least one charging station for 40 electric vehicles.

- By 2025, Beijing, China alone will have 7,00,000 electric vehicle chargers. The policy, Urban Management Development Plan for Beijing is expected to promote the installation of electric vehicle charging stations in the city.

- ABB, one of the largest manufacturers of EV chargers expanded its manufacturing capacity in 2022 with a $30 million production facility in Italy. The new production facility aims to produce 10,000 EV chargers annually.

- In February 2023, the United States government invested $7.5 billion for electric vehicle charging infrastructure while aiming net-zero emissions by 2050.

- The United States installed 6,300 fast chargers in 2022, about three-quarters of these fast chargers were of Tesla Superchargers.

- The Tokyo Metropolitan Government exceeded the subsidy for apartment EV charging station installation up to $12,600. Tokyo plans to offer EV charging stations at every construction of building with 20% of parking space.

- EVgo, a leading manufacturer of EV charging stations in the United States stated that its revenue increased to $25.3 million in the first quarter of 2023, which showed a 229% year on year growth.

- The Federal government, Canada partnered with the United States in May 2023, in order to establish a binational charging station corridor connecting Michigan to the Quebec City.

- In March 2023, the Government of India announced a grant of Rs.800 crore to Hindustan Petroleum, Bharat Petroleum and Indian Oil in order to establish 7,432 public fast EV charging stations in the country.

- The United Kingdom government introduced a grant in 2023 under which, people can receive up to 75% cost of purchase and installation of electric vehicle charging station at home. Along with this, 18 companies in the UK aim to invest $7.5 billion in EV infrastructure by 2030.

- The Motor Fuel Group in the United Kingdom announced a plan to invest $50 million in EV hubs in 2023, the hubs will offer 360 ultra-rapid chargers.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 57.34 Billion |

| Market Size in 2026 | USD 73.92 Billion |

| Market Size by 2035 | USD 548.05 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 25.32% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Charging Station Type, Power Output, Supplier Type, End User, Geography |

Market Dynamics

Drivers

Growing adoption of vehicle-to-grid electric vehicle charging station

- Vehicle-to-Grid electric vehicle charging is a system in which plug-in electric vehicles and the power grid exchange electrical energy in both directions. Electric vehicles may store and discharge unused energy to the grid usingVehicle-to-grid technology. This can improve the performance of the electrical component and increase the value of electric vehicles.

Increasing Sustainability

- By installing charging stations, we can show clients and potential employers that you are doing your share to promote sustainability and cut emissions. The most straightforward action the company may take to advance its sustainability plan is probably to provide EV charging stations. It is simple to choose a smart EV charging infrastructure if you wish to incorporate EV charging into your company's sustainability strategy. Dashboards are widely used in smart EV charging.

Development in the EV Infrastructure

- In order to make it convenient for EV users to locate nearby charging stations, the manufacturer of EV charging stations also offers cloud-based app connectivity. Additionally, it benefits the businesses that run the charging stations by increasing foot traffic from nearby EV vehicles. Additionally, it moves the construction of a sizable EV charging infrastructure forward, which raises the incentive and profitability of EV charging businesses. Last but not least, EV charging manufacturers like Griden provide ongoing assistance for setting up and maintaining charging stations so you may continue to leverage business revenues without any problems.

Restraints

Stringent government regulations

- Various governments have enacted strict regulations governing the placement of charging stations. When installing charging stations, service providers must adhere to a set of guidelines. When the installation is on private property, they need permission from plot owners, local governments for regulatory mandates, and utility companies for energy transfer.

Lack of Vehicle-grid Interoperability

- There must be more agreements, logistics, and communication channels between the grid, utilities, and charging manufacturers. The inability to reach a consensus on a broad-scale deployment of an inexpensive, dependable, and secure electric vehicle charging network for drivers has limited the situation. All these partners are essential for the necessary procedures and technologies that the vehicle-to-grid infrastructure has made possible. This frequently occurs due to information being withheld by the government or utility companies that are otherwise not provided to the charging network providers. This frequently slows down development time and reduces the project's profitability.

Opportunities

Surge in sales of electric vehicles

- The increased acceptance and use of electric vehicles has highlighted the need for charging infrastructure development. Leading electric vehicle markets are spending heavily in electric vehicle charging infrastructure as well as R&D to develop faster and effective charging methods. Auto manufacturer are anticipated to make noteworthy outflows to meet the growing demand for electric vehicles and to play a key role in the market's evolution.

Increasing demand for clean transportation

- One aspect of a more general mobility trend is electric autos. Along with becoming more electric, our cars will also be autonomous, linked, and shared. When all of these advances are used, transportation planners believe that emissions, traffic, and accidents will greatly decrease. No longer is it believed that every adult would operate a combustion vehicle alone. Carpooling is an option for us. Electric mopeds, electric scooters, and electric cycles can all be used as last-mile transportation. Additionally, connected electric vehicles produce data planners can utilize to reorganize parking and roadways. Smart EV charging stations represent the start of a significant transformation. Giving greater space on the road to pedestrians, cyclists, and green areas can come after that.

Challenges

Limited grid infrastructure

One large hurdle the EV charging station market faces is the state of the power grid in many places. Most grids were built a long time ago and are not built to support the high energy needs of fast charging stations. There have been a few times when several EVs charge at the same time, which puts stress on the grid, and they are legally obligated not to deliver power to one or more of the charging stations. Many rural places may not have the electric line to these stations, ensuring they only work with the grid when it is sufficient enough to supply the energy load. Either way, these electrical experts need to put more money into building new grids or fixing the existing grids that were in place long before any of us were born.

- For instance, a study in 2024, at California State University, discovered that EV charging could pose an onerous overload potential risk on campus distribution contractors and transformers, and display the limits of its infrastructure.

Lack of universal charging standards

Another significant problem for electric vehicles is that different electric vehicle providers are using different plugs and connectors. For instance, some electric vehicles use CCS; some use CHAdeMO; and Tesla uses the Tesla plug. This creates confusion for every EV driver, considering they may pull up to a station and only find they cannot charge there. The charging station companies also have to spend the extra money to add various types of systems to accommodate multiple plug types. Not only does this slow down the setup of a station charging vehicle, but it also increases the price of charging. The more plugs you have, the greater the likelihood that the model of an EV won't fit one. This confusion and lack of trust are keeping some drivers from considering an electric vehicle, which is prohibiting the development of the charging market at a more flexible CCS pace.

- Prior to 2023 and the announcement that companies like Ford and GM planned to adopt Tesla's connector (NACS), many Americans discovered that Tesla's own charging plug (NACS) was incompatible with public charging, which used CCS or CHAdeMO. Effectively, Tesla owners had limited options for charging anything but their Tesla.

Level of Charging Insights

Level 3 charging station is the fastest growing segment in the electric vehicle charging station market, as Level 3 charging stations can charge an electric vehicle rapidly, and they are able to fully charge a vehicle within an hour. Level 3 charging will reduce the wait time, as opposed to Level 1 or Level 2 charging stations. This type of charging is commonly used in public areas, such as highways or city charging stations. The speed and convenience of Level 3 charging have both made it popular for electric vehicle drivers.

- In March 2024, Francis Energy, one of the big developers of electric vehicle charging networks in the U.S., established a joint venture with Wallbox to deploy Level 3 DC fast chargers for underserved areas throughout the U.S., with a specific focus on complying with National Electric Vehicle Infrastructure (NEVI) guidelines to allow for the ability to fast charge for longer-distance travel.

Charging Station Type Insights

Wireless charging is expected to show robust growth in the market in the forecasted period as it allows drivers to recharge their electric vehicles without a connected cable. Wireless charging is easier to use, cleaner, and can be installed in places like homes and parking lots. Wireless charging can save time, but more importantly, it eliminates complications involving wires. More auto manufacturers are bringing cars with wireless charging as an option to the market, and this is an increasingly important growth area.

Vehicle Type Insights

Governments all around the globe are encouraging the production of automobiles in response to increasing concerns about the environmental impact of conventional cars. zero-emission cars, or electric vehicles, are becoming more well-liked as a more eco-friendly mode of public transit across the globe. To encourage the use of EVs, numerous national authorities provide financial incentives, such as refunds and tax exemptions, lower parking/toll charges for EVs, free charging, and subsidies. Thus, the battery-electric vehicle industry is rapidly growing. Electric cars require much less maintenance than internal combustion engines since they have fewer moving parts.

Electric cars require less upkeep than regular gasoline or diesel vehicles. As a result, the annual cost of operating an electric car is relatively low. Road tax and registration for electric vehicles are less expensive than those for gasoline or diesel vehicles. These elements are fueling battery-electric vehicle growth on a global scale.

Connector Type Insights

The AC charging specification created by renowned connection maker Mennekes was highly received by EV users and is widely utilized in Taiwan, Europe, Australia, Southeast Asia, and Australia. The lack of a pin on the object distinguishes Type 2 from other types. Customers can choose SINBON's 20A, 32A, and so on.

Due to the increasing demand for electric vehicles, there is a greater need for charging stations. As a result, new products are being created, and there is a wider variety of EV charger specifications available.

AC charging chargers need to arrive faster. An electric vehicle may be fully charged in roughly 3 minutes at its 22 kW maximum rating. The majority of European electric vehicles use the Type 2 connector, which is what the chargers often have.

Application Insights

The public chargers segment recorded more than 85% of market share in 2025. as they are more cost-effective to the manufacturers. In addition, they have sufficient parking space and are accessible to all public.

On the other hand, private type charging stations are basically workplace based or residential based station that are only accessible to the owners or limited public. As a result OEMs and different utilities are also focused towards building public charging station. Thus significant benefits offered by public type over private type fuels the market growth.

The future of the EV industry is mainly in public EV charging, which must be reliable and easily available for the EV sector to experience sustainable growth. Public EV charging is any station that enables members of the public to refuel their cars, whether it is used at specialized charging stations (like those found at current gas stations) or at establishments that provide public access, such as stores and apartment buildings. No limits apply to which drivers can use the public charging station.

The advantages of public EV charging are numerous. Tax subsidies and other financial incentives at the federal, state, and local levels support a large portion of the public charging infrastructure. Widespread use also entails public charging. While station utilization increases income, it is net-positive for sustainability. As a result of the higher utilization and revenue, owners may have more opportunities.

Mounting Type Insights

A dedicated circuit that can handle a heavier load than a typical home circuit connects the wall-mounted box to the electrical grid. A Mobilize power solution is accessible to everyone who wants to charge their car at home or to business owners who want to add electric vehicles to their fleet. Additionally, each owner of an electric vehicle residing in a shared apartment building has the right to have a charging station installed in their parking space in an increasing number of nations, including Spain, France, India, and Japan.

By using this cutting-edge technology, one may, for instance, charge an electric vehicle at night when there is less demand for electricity and then use that electricity to power their homes during the day (V2H) or help balance local or even national energy supply and demand (V2G). A more balanced power supply translates to cheaper costs and more dependable electricity for everyone.

End User Insights

The residential segment caprued the maximum market share of 65% in 2025. A dependable and sophisticated commercial EV charging station is essential for your company or local government because many companies aim to convert their fleets to electric vehicles while also offering EV charging options for clients and tourists. Consider the software and service provider EV Connect for electric vehicle charging. The platform provides possibilities for charging electric vehicles at public, private, academic, and hospitality facilities. The platform develops and maintains the industry's most dependable and flexible cloud-based platform for controlling charging stations and the drivers who utilize them. The service provides charge station agnostic command and manages enterprise, driver communications and support, demand-response capability across several charging networks, energy systems integration via an open API, and more.

Electric Vehicle Charging Station Market Companies

- EVgo Services LLC.

- Allego

- Scheinder Electric

- Blink Charging Co.

- Wi Tricity Corporation

- Toshiba Corporation

- AeroViroment, Inc.

- Mojo Mobility, Inc.

- General Electric

- Robert Bosch GmbH

- Chargemaster plc.

- Evatran Group

- HellaKGaAHueck& Co.

- Siemens AG

- Leviton Manufacturing Co., Inc.

- Efacec

- Alfen N.V.

- Denso Corporation

- Elix Wireless

- Tesla Inc.

- ClipperCreek

- Engie

- Infineon Technologies AG

- Qualcomm Technologies, Inc.

Latest Announcements by Industry Leaders

- In October 2024, Governor Pritzker joined the Illinois Department of Natural Resources and local leadership to declare a donation of multiple electronic vehicle chargers to the state from the electric mobility firm EVBox.

- In July 2024, ChargePoint, a leading provider of networked charging solutions for electric vehicles (EVs), declared continued leadership in allowing DC fast charging at National Electric Vehicle Infrastructure program-funded locations. Two newly stretched-out ChargePoint sites alongside Interstate 95 in Rhode Island make it the initial state to complete Phase 1 of the NEVI program.

Recent Developments

- In July 2025, Ballenoil launched its own EV charging network. The company plans to install 42 charging points and charging infrastructure, focusing on delivering over 150kW of power. The focus is on charging vehicles in just 10-20 minutes.

(Source: https://www.mobilityplaza.org)

- In September 2024, Amazon and Global Optimism co-founded The Climate Pledge. They launched a network of shared charging stations for faster acquisition of electric mobility, with the Pledge signatories and partners looking to collectively invest over $2.65 million into the project by 2030.

- In August 2024, 3V Infrastructure declared its formation with a mission to accelerate widespread access to EV charging; staffed with top-tier talent, 3V Infrastructure builds and functions Level 2 EV chargers in long-dwell properties like multifamily hotels and housing, eliminating upfront and ongoing costs for real estate portfolio owners and managers.

Segments Covered in the Report

This research report estimates revenue growth at global, regional, and country levels and offers an analysis of present industry trends in every sub-segment from 2020 to 2032. This research study analyzes market thoroughly by classifying global electric vehicle charging station market report on the basis of different parameters including charging station type, power output, supplier type, end user, and region:

By Level of Charging

- Level 1

- Level 2

- Level 3

By Charging Station Type

- AC Charging

- DC Charging

- Wireless Charging

By Power Output

- <11KW

- 11KW-50KW

- >50KW

By Supplier Type

- OE Charging Station

- Private Charging Station

By Vehicle Type

- Passenger Cars

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Vehicle(PHEV)

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Two-wheelers & Scooters

By Installation Type

- Fixed

- Portable

- Residential

- Commercial

By Connector Type

- Normal Charging

- Type 2

- CCS

- CHAdeMO

- Tesla SC

- GB/T

By Application

- Private

- Public

By Mounting Type

- Wall Mount

- Pedestal Mount

- Ceiling Mount

By Charging Service

- EV Charging Service

- Battery Swapping Service

By End User

- Commercial EV Charging Stations

- Commercial Public EV Charging Stations

- On-Road Charging

- Parking Spaces

- Destination Chargers

- Commercial Private EV Charging Stations

- Fleet Charging

- Captive Charging

- Commercial Public EV Charging Stations

- Residential EV Charging Stations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting