Wireless Charging Market Size and Forecast 2025 to 2034

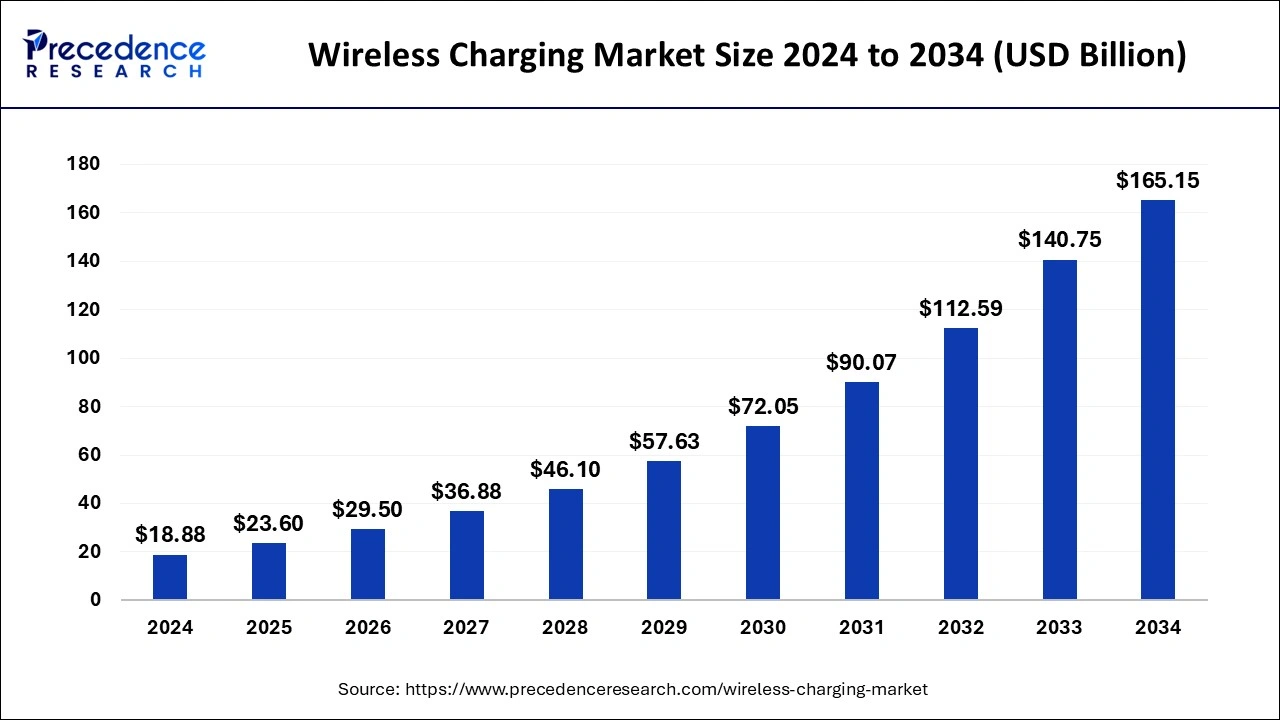

The global wireless charging market was valued at USD 18.88 billion in 2024 and is anticipated to reach around USD 165.15 billion by 2034, registering a CAGR of 24.22% from 2025 to 2034. Technological advancements and rising usage of consumer electronics is driving the wireless charging market.

Wireless Charging Market Key Takeaways

- The global wireless charging market was valued at USD 18.88 billion in 2024.

- It is projected to reach USD 165.15 billion by 2034.

- The market is expected to grow at a CAGR of 24.22% from 2025 to 2034.

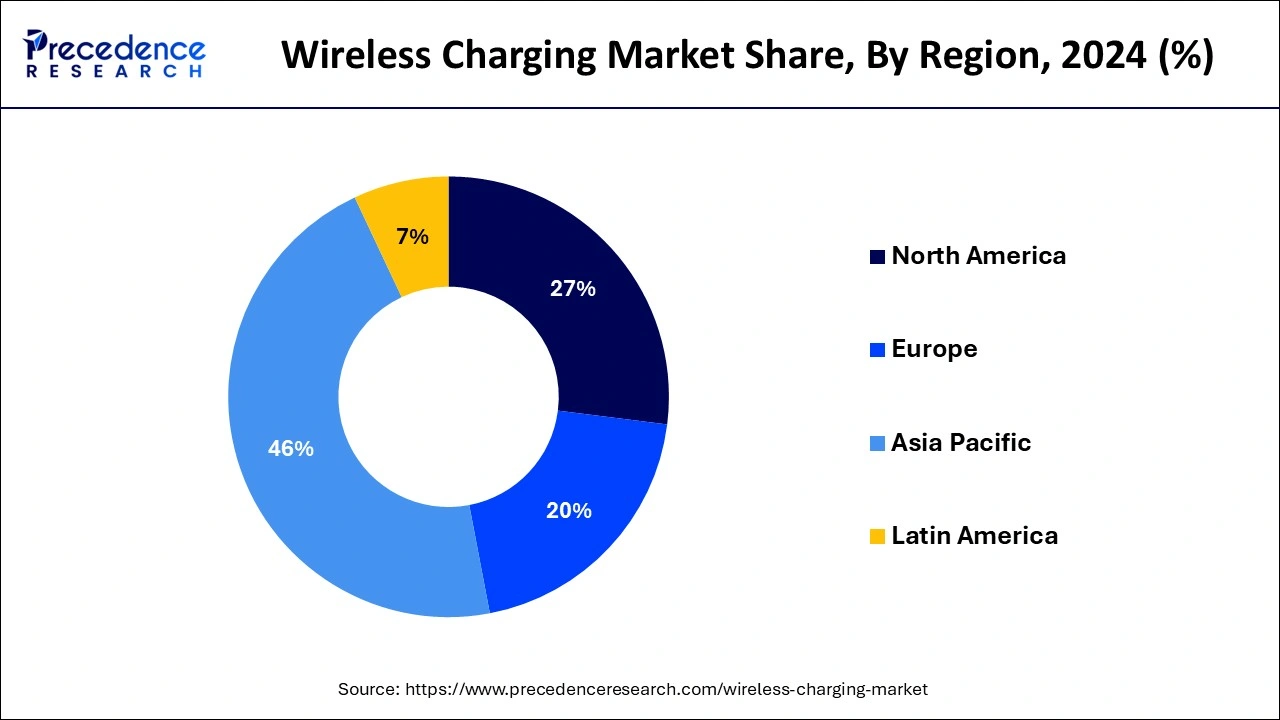

- Asia Pacific held a significant share of the wireless charging market in 2024.

- By technology, the inductive segment held the largest segment of the market in 2024.

- By technology, the radio frequency segment is expected to grow significantly during the forecast period.

- By application, the consumer segment dominated the market in 2023 and is expected to maintain its position in the market over the forecast period.

- By application, the healthcare segment is expected to grow at a significant rate in the market during the forecast period.

How is AI Impacting the Wireless Charging Market?

One of the main factors changing the wireless charging device industry is the combination of automation and artificial intelligence (AI). Predictive maintenance and intelligent energy management are two ways AI is being used to improve charging process efficiency. Manufacturing and quality control procedures are becoming more efficient thanks to automation technologies, which also lower costs and increase output. The performance and dependability of wireless charging systems are enhanced by these technical developments, which also promote innovation and increase the devices' variety of uses, which boosts market expansion overall.

Asia Pacific Wireless Charging Market Size and Growth 2025 to 2034

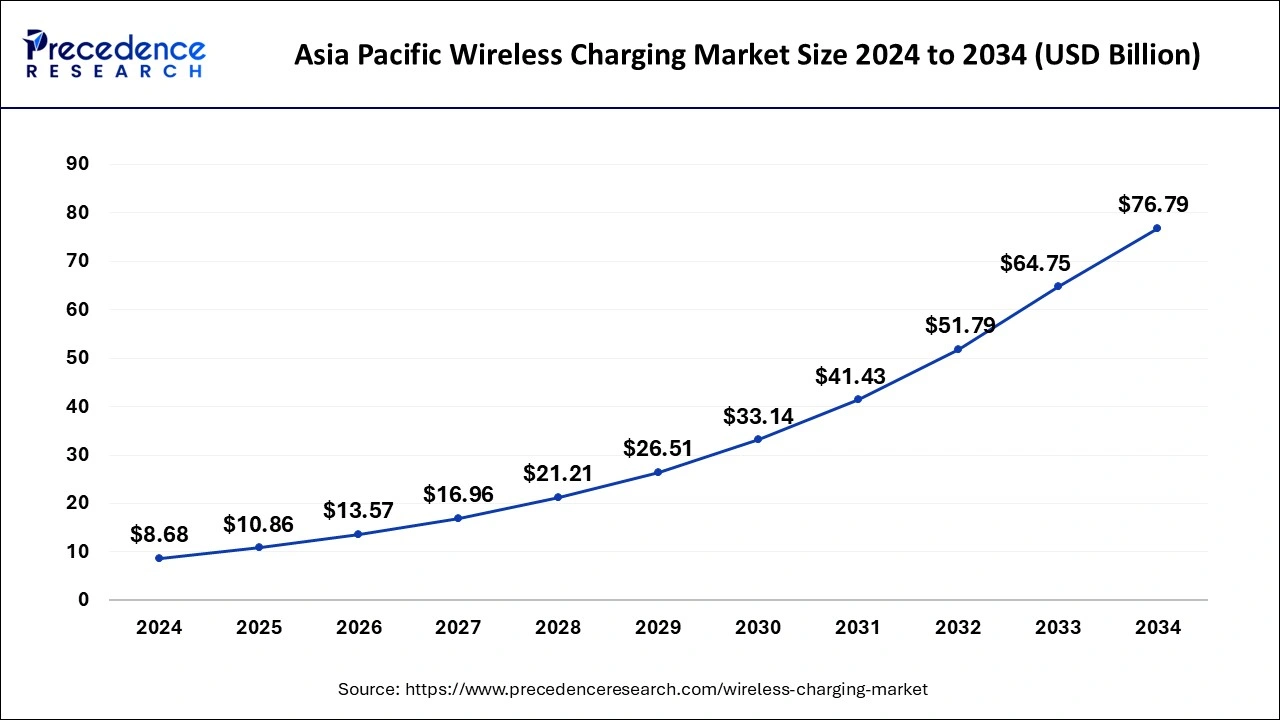

The Asia Pacific wireless charging market size surpassed USD 8.68 billion in 2024 and is projected to hit around USD 76.79 billion by 2034, with a remarkable CAGR of 24.36% from 2025 to 2034.

Asia Pacific dominated the wireless charging market in 2024. Rapid economic growth and urbanization in the Asia-Pacific region have led to increased disposable incomes and a higher standard of living, which translates to greater consumer spending on advanced technologies, including wireless charging. The automotive industry in the Asia-Pacific region is increasingly integrating wireless charging solutions, especially for electric vehicles (EVs). Additionally, the healthcare sector is adopting wireless charging for medical devices, further driving market growth.

Europe is expected to witness a notable rate of growth in the wireless charging market in the coming years owing to the increasing investment in wireless charging infrastructure for EVs, rising awareness regarding the benefits associated with wireless charging in technology, favorable government policy, and increasing penetration of internet of things (IoT). The European countries have experienced robust demand for tablets, smartphones, wearables, electric vehicles, and other wireless charging-enabled devices. Moreover, rapid technological advancement and growing innovations in the automotive and consumer electronics sectors are projected to propel the expansion of the region's wireless charging market.

- In March 2024, Starship Technologies, the world's leading provider of autonomous delivery services, announced the installation of the first wireless charging station for its robots in Europe. In collaboration with Cambourne Town Council, a fleet of Starship robots will recharge autonomously when making grocery deliveries across Cambourne in Cambridgeshire.

- In March 2023, ABT e-Line and WiTricity announced their plan to deliver aftermarket wireless EV charging across Europe. With extensive experience working with the Volkswagen Group (VW), ABT e-Line will initially upgrade the VW ID.4 to support wireless charging from WiTricity, with availability targeted for early 2024. The company plans to expand to additional EV models thereafter.

- According to the Global EV Outlook 2024 of the International Energy Agency (IEA), In Europe, new electric car registrations reached nearly 3.2 million in 2023, increasing by almost 20% relative to 2022. In the European Union, sales amounted to 2.4 million.

Market Overview

In the era of digitalization, wireless charging is rapidly gaining momentum in portable devices as it does not require a wired connection. Wireless charging is the process of electrically charging battery-powered devices, including smartphones, laptops, wearable tech, digital cameras, and electric vehicles, eliminating the need for cables to charge a device. In wireless charging, the battery-powered device can be charged by placing the device close to a wireless power transmitter or at a designated charging station. The use of wireless charging technology offers both convenience and reliability.

Wireless Charging Market Growth Factors

- Integration in consumer electronics: The majority of portable devices, wearable technology, computers, and smartphones use wireless power transfer. The spike in the usage of efficient charging solutions for wearable and portable devices is expected to drive significant growth in wireless charging for the electronics market.

- Increased efficiency: Due to the quick development of quicker and more effective wireless charging, the market for wireless charging is seeing a notable increase in popularity. Since wireless charging eliminates the need for cords, it is a better alternative than standard charging, which is why businesses and consumers alike are adopting it. The primary demands of customers are met by wireless charging solutions' faster speed and, consequently, increased efficiency.

- Rising EV demand: While a global network of electric car charging stations is still being developed, several manufacturers are testing wireless EV charging, which may be the next big thing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.60 Billion |

| Market Size by 2034 | USD 165.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 24.22% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for consumer electronics

The growing demand for consumer electronics around the world is expected to drive the growth of the wireless charging market during the forecast period. Wireless charging has gained considerable attention as a safe technology for powering and charging electrical devices. The increasing use of electronic devices such as laptops, tablets, smartphones, wearable gadgets, and other portable electronic devices that require regular charging has led to the development of wireless charging technologies.

Wireless power technology allows users to charge consumer electronic devices quickly and conveniently, and it eliminates the need for a cable. Wireless charging technology is considered safer than conventional cable charging as it significantly reduces the possibility of electrical shock or fire threats as well as contributes to lower energy costs. Thus, the rising use of consumer electronics globally is expected to supplement the wireless charging market growth during the forecast period.

- In March 2024, Infinix announced the latest addition to its product lineup: the NOTE 40 Series. This remarkable series comprises the NOTE 40, NOTE 40 Pro, NOTE 40 Pro 5G, and the most advanced model, the NOTE 40 Pro+ 5G. The NOTE 40 Series represents a significant advancement in Infinix's All-Round FastCharge 2.0 technology.

- In January 2024, U&I announced the launch of a new wireless neckband and power bank in India. U&I expands its product portfolio with two mobile accessories: Dynamic Series Wireless Neckband and Turbo Series Power Bank.

Restraint

High cost of installing wireless charging systems for EVs

The high cost required for wireless charging systems for electric vehicles (EVs) is anticipated to hamper the market's growth. A high initial cost is needed for installing wireless power transfer technology as it is to be installed beneath the surface of a vehicle parking area to enable vehicle charging. In addition, middle- and lower-income countries are reluctant to opt for these technologies due to budget constraints, which are likely to limit the expansion of the global wireless charging market.

Opportunity

Rising adoption of wireless charging for EVs

The increasing popularity of wireless charging for electric vehicles across the globe is projected to offer immense growth opportunities to the wireless charging market during the forecast period. The rising production and sales of EVs led to a surging demand for wireless charging technology. Gradually, EV charging technology is poised for a transformative shift from wired charging solutions in which drivers plug in a cable to recharge the car's battery to wireless charging. Wireless EV charging has no wires, charges EVs quickly and safely, eliminates range anxiety, and provides more convenience.

Technology companies, original equipment manufacturers (OEM), automakers, and charging infrastructure providers are recognizing their immense potential, which is likely to boost the market expansion for wireless EV charging. Some of the Major Players in the EV Wireless Charging Industry are Continental AG, Daihen Corporation, Delachaux Group, Electreon, Inc., ELIX Wireless, HEVO, Inc., and WAVE, Inc. The market has also witnessed heavy investment by several market players to advance the wireless charging ecosystem. This will accelerate the wireless charging market growth during the forecast period.

- According to the Global EV Outlook 2024, Electric car sales were nearly 14 million in 2023, 95 percent of which were in China, Europe, and the United States. Almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. Electric car sales in 2023 were 3.5 million higher than in 2022, a 35 percent year-on-year increase. This is more than six times higher than in 2018. Electric cars accounted for around 18% of all vehicles sold in 2023, up from 14% in 2022 and only 2% five years earlier, in 2018.

- In March 2024, Scientists at the U.S.'s Oak Ridge National Laboratory (ORNL) successfully demonstrated wireless charging of a passenger electric vehicle (EV) with a 100-kW wireless charger in 20 minutes. The charging was completed with a five-inch gap between the charger and the car, similar to what is achieved in small consumer devices with this ability.

- In December 2023, Electreon unveiled the world's first commercial wireless charging terminal for buses in Israel. Electron completed the construction of a groundbreaking wireless charging terminal for parked urban electric buses (e-buses), marking a world first in this innovative charging technology.

Technology Insights

The inductive segment held the largest segment of the wireless charging market in 2024. In inductive charging, the electromagnetic field is generated by two coils (transmitter and receiver) that transmit the energy. This technology offers ease of positioning devices onto charging pads and eliminates the need for wired connections. The wireless smartphone charging pads often make use of inductive charging. Thereby driving the growth of the segment.

- In May 2024, In the field of wireless charging technology, the 703S model introduced by the Swanscout brand is undoubtedly a highly anticipated product. Wireless chargers are a technology that utilizes electromagnetic induction to transfer energy through electromagnetic fields, enabling devices to charge wirelessly.

In the wireless charging market, the radio frequency segment is expected to grow significantly during the forecast period. Radio frequency technology is capable of charging several devices simultaneously within its coverage area without the need for any cable by putting the receiver at the same frequency as the transmitter.

Application Insights

The consumer segment dominated the wireless charging market in 2024 and is expected to maintain its position in the market over the forecast period. The growth of the segment is majorly driven by the rising use of consumer electronics devices such as smartwatches, smartphones, and others globally. Wireless charging technology is user-friendly and offers convenience to the gadget users. Moreover, rapid technological innovation and increasing investment are likely to fuel the market's growth.

The healthcare segment is expected to grow at a significant rate in the wireless charging market during the forecast period owing to the increasing adoption of IoT devices in the healthcare sector. The market has witnessed the growing demand for wireless charging technology in the healthcare industry to boost efficiency and improve the performance of medical equipment and devices.

Wireless Charging Market Companies

- Samsung Electronics

- Sony Corporation

- Fulton Innovation LLC

- Qualcomm Incorporated

- Texas Instruments

- Plugless Power LLC

- Powercast Corporation

- ConvenientPower HK Ltd.

- Texas Instruments, Inc.

- Semtech Corporation

- Renesas Electronics Corporation

- Belkin International, Inc.

- Energous Corporation

- Witricity Corporation

- Ossia Inc.

- ZenS B.V.

Recent Developments

- In November 2023, Electreon, a pioneer in wireless charging of Electric Vehicle (EV), announced a partnership to deliver a groundbreaking wireless charging initiative to BDX Företagen AB, a prominent road and freight distribution company operating in Sweden for Ahlsell AB.

- In May 2024, Purdue University engineers and the Indiana Department of Transportation (INDOT) are working to make it possible for electric vehicles ranging from tractor-trailers to passenger cars to charge while driving on highways wirelessly. Construction is in progress on a quarter-mile test bed on U.S. Highway 231/U.S.

- In May 2024, WiTricity, the leader in wireless electric vehicle charging, and International Transportation Service LLC (ITS) announced the launch of a first-of-its-kind pilot program at the Port of Long Beach. The six-month program will test the effectiveness and efficiency of WiTricity's patented wireless charging technology in real-world conditions.

Segments Covered in the Report

By Technology

- Inductive

- Resonant

- Radiofrequency

- Others

By Application

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Aerospace & Defense

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting