What is the Headset Market Size?

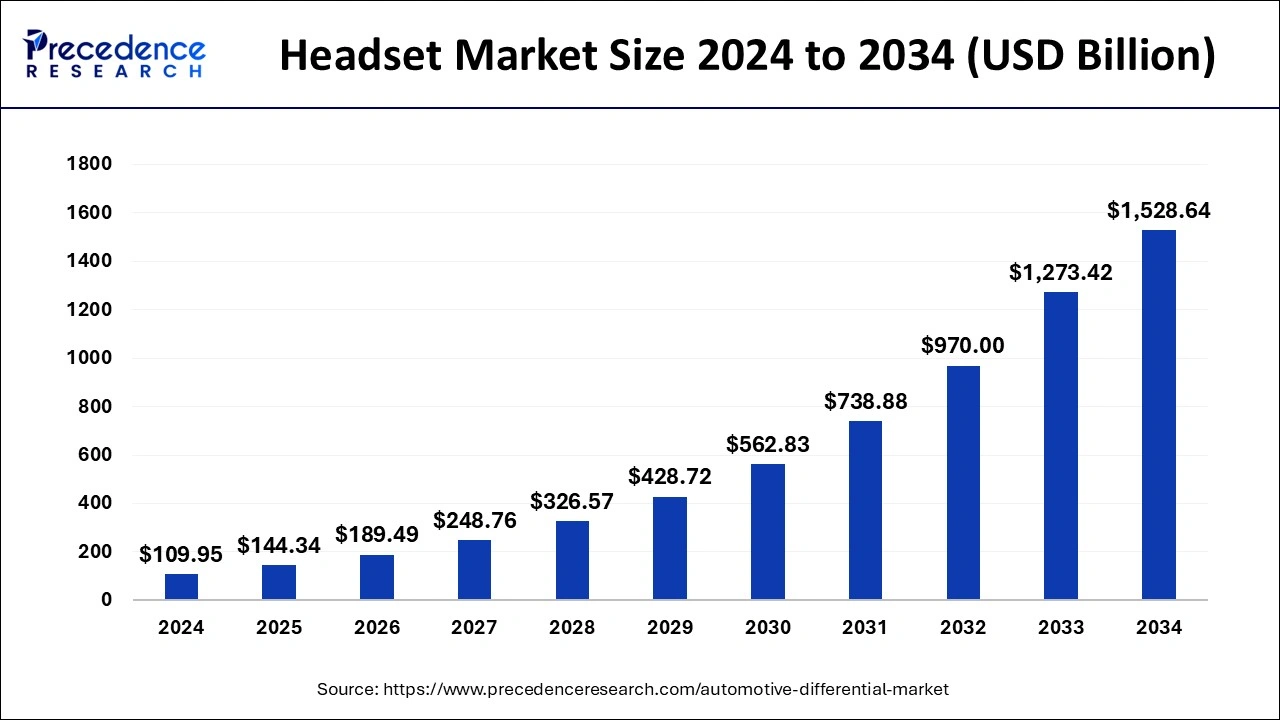

The global headset market size was estimated at USD 144.34 billion in 2025 and is predicted to increase from USD 189.49 billion in 2026 to approximately USD 1,815.99 billion by 2035, expanding at a CAGR of 28.82% from 2026 to 2035.

Headset Market Key Takeaways

- In terms of revenue, the global headset market was valued at USD 109.95 billion in 2025.

- It is projected to reach USD 1,528.64 billion by 2035.

- The market is expected to grow at a CAGR of 30.11% from 2026 to 2035.

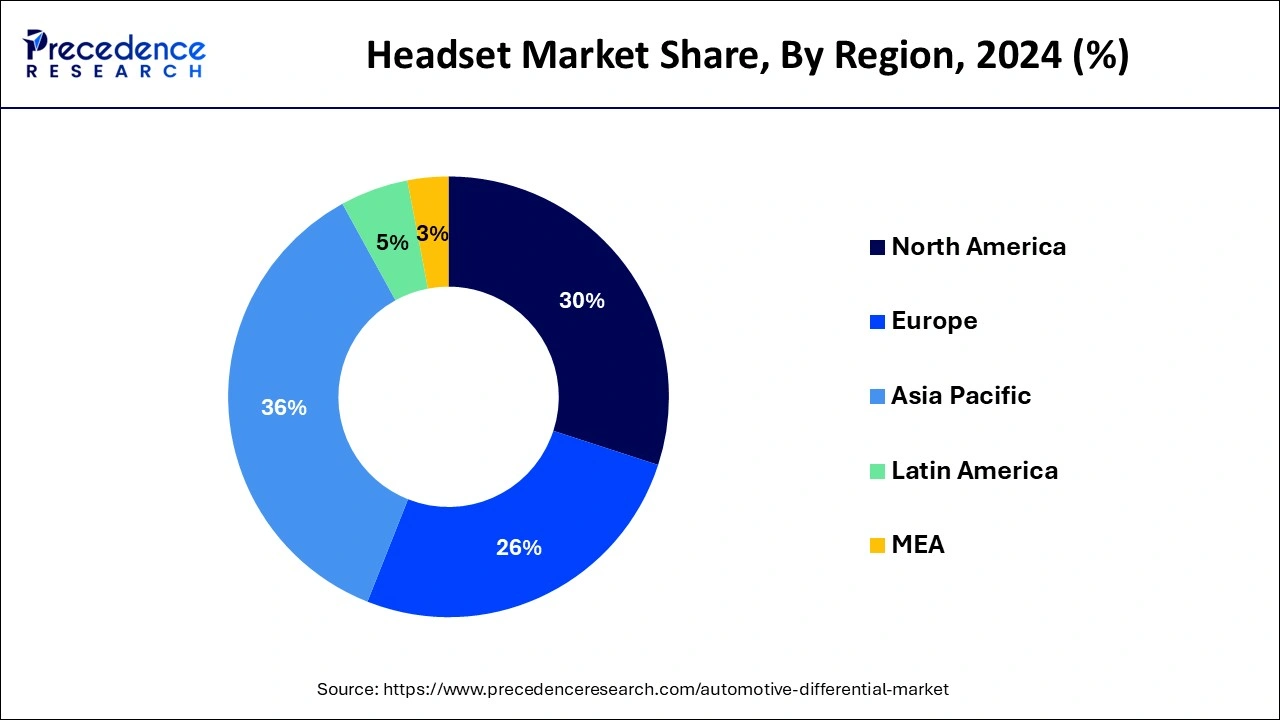

- Asia Pacific held the largest market share of 36% in 2025.

- North America is expected to expand at a rapid pace during the forecast period.

- By type, the over-ear segment accounted for the dominating share in 2025.

- By type, the in-ear segment is observed to witness a significant share during the forecast period.

- By connectivity, the wireless segment held the largest share of the headset market in 2025.

- By connectivity, the wired segment is expected to grow at a substantial rate during the forecast period of 2026 to 2035.

- By application, the personal segment held the dominating share of the market in 2025.

- By application, the commercial segment is observed to witness a significant rate of growth during the forecast period.

Strategic Overview of the Global Headset Industry

A headset is a device that is worn on the head that enables someone to hear sound when using a phone, laptop, or desktop system. Headsets are widely used by people for multiple activities, including gaming, listening to music, watching movies on a computer, making phone calls, or participating in video conferences. A headset offers better call quality and hands-free convenience as well as assisting in enhancing the audio quality and reducing disturbances for the surroundings. The headset market offers production, innovation and distribution of types of headsets along with their components.

The basic components of headsets are built-in audio speakers that go inside the ears and deliver sound and a second pair of speakers referred to as a mic for speech input. The global industry facilitates innovative device designs along with the integration of advanced technologies such as advanced microphones and noise cancellation systems. The growth of the

Artificial Intelligence: The Next Growth Catalyst in Headsets

AI is transforming the headset industry by shifting devices from simple output tools to intelligent, context-aware companions that offer highly personalized user experiences. Advanced machine learning algorithms power features like adaptive noise cancellation, which intelligently adjusts to real-time ambient sounds, and personalized sound profiles that tailor audio output based on individual hearing preferences.

Beyond audio optimization, AI integration enables practical innovations such as high-accuracy voice assistant interactions, real-time language translation for seamless communication across languages, and the incorporation of health and fitness tracking through integrated biometric sensors.

Headset Market Growth Factors

- The growing focus on gaming, along with advanced features like in-game communication to support and improve the gaming experience, is likely to promote the growth of the headset market in the upcoming years.

- The introduction of active noise cancellation technologies to improve consumer listening and safeguard against low-frequency droning sound and increasing levels of external noise, which creates demand for headsets and helps the industry flourish during the forecast period.

- The increasing use of headsets while exercising. Athlete people and gym goers prefer hassle-free wireless gadgets to concentrate on training without any surrounding disruptions.

- The rise in disposable income levels among developed and several developing countries boost consumer spending power, and it is expected to fuel the growth of the headset market.

Market Outlook

- Market Growth Overview: The headset market is expected to grow significantly between 2025 and 2034, driven by the shift towards wireless and TWS devices, the growing expansion of gaming and entertainment, and the rising fitness and sports industry.

- Sustainability Trends: Sustainability trends involve energy efficiency and renewable energy, circular economy and repairability, and eco-friendly materials.

- Major Investors: Major investors in the market include Apple Inc., Sony Corporation, Bose Corporation, Samsung Electronics Co., Ltd., and Sennheiser electronics GmbH & Co. KG.

- Startup Economy: The startup economy is focused on augmented reality and virtual reality, immersive and high-quality audio, and enterprise solutions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 28.82% |

| Market Size in 2025 | USD 144.34 Billion |

| Market Size in 2026 | USD 189.49 Billion |

| Market Size by 2035 | USD 1,815.99Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Connectivity, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing engagement toward online gaming

The rising engagement towards online gaming is expected to boost the growth of the global headset market. Gamers often use headsets for immersive audio experiences and to communicate with fellow players while playing. With the use of headset devices, gaming has experienced many improvements. The entertainment industry has also been revolutionized with the advent of computer games. Gamers use headsets to increase both concentration and mental function. The willingness to use online games has increased with the launch of advanced headsets in the market. Therefore, the demand for headsets has substantially increased due to the increasing acceptance of sophisticated gadgets in modern society.

- In September 2022, JBL launched the JBL Quantum 350 wireless headphones, a gaming headset designed to support the gaming experience. With a long-lasting 22-hour replenishable battery, users can enjoy extended gaming sessions without any disruption in their playtime.

Restraint

Rising availability of counterfeit products

The rising availability of counterfeit products is anticipated to hamper the growth of the headset market. Consumers often get trapped and buy counterfeit items offering similar features at a considerably low price. The demand for branded products is adversely affected due to the low-cost counterfeit products. The lack of understanding between original and low-cost counterfeit products in underdeveloped and emerging economies is likely to limit the adoption and restrict the expansion of the global headset market.

Opportunity

Robust growth of the fitness industry

The robust growth of the fitness industry is projected to offer a lucrative opportunity for the growth of the headset market during the forecast period. The increasing number of gym goers is positively affecting the growth of the market. People that are interested in sports and gym goers prefer hassle-free wireless headsets while exercising to concentrate more and without getting any disturbance from external noise. Companies around the world offer cutting-edge features like fitness tracking and monitoring health to fitness freak clients. The introduction of active noise cancellation technologies improves listening. Such noise-canceling headphones provide superior hearing protection against high levels of external noise. Thereby driving the market's growth.

- In March 2023, Sony India launched WH-CH720N headphones, designed for listeners to enjoy music the way the artist intended with high-quality audio in a compact form factor. The over-ear WH-CH720N wireless headphones incorporate dual noise sensor technology and Sony's integrated processor V1 chip to provide noise cancellation. It offers a long-lasting battery life of up to 50 hours to enjoy music for longer without background interruptions.

Segment Insights

Type Insights

The over-ear segment accounted for a dominating share of the headset market in 2024. The over-ear headset wraps around the ear and has big ear cushions and thick neckbands that surround the ear. These headphones are often large and bulky but offer the most comfortable design. They are well-padded and are easy to wear when required. The over-ear headsets are portable and offer long-lasting battery life for the extended audio experience for users. Over-ear headsets are usually used on the desk, and they make for a great stereo pair for your computer system.

The in-ear segment is observed to witness a significant share during the forecast period. In-ear headsets have miniaturized headphones that fit into the ear canal and create a noise-blocking seal. These headsets are ideal for travel, good for noisy listening environments, and listening to music while in bed.

Connectivity Insights

By connectivity, the wireless segment held the dominant share of the headset market in 2024. The growth of the segment is attributed to the advancement in technology such as augmented reality, AI, and others.

- The rising utilization of wireless headsets in the sports and fitness industry is observed to supplement the growth of the segment. For instance, the acceptance of bone conduction technology allows the swimmer to hear audio seamlessly underwater.

In recent years, wireless headsets have become increasingly popular due to their ease of use. Wireless headsets are generally used with Bluetooth technology to connect to devices such as tablets, smartphones, laptops, and others.

The wired segment is expected to grow at a substantial rate during the forecast period. The wired headsets are connected to another device through cables and segmented into advanced technologies, including active noise canceling, which is ideal for gaming while experiencing better audio sound. The wired headsets offer superior audio quality, have less latency, and have a longer life. T the sustainability of wired headphones as compared to wireless headsets promotes the growth of the segment.

Application Insights

The personal segment held the dominating share of the market in 2024 owing to the increasing use of headsets for casual, sports, fitness, and gaming for personal utilization of the people. Consumer inclination towards sophisticated devices with features such as noise cancellation and voice control facilities promote the growth of the segment. The personal segment of application in the headset market witnessed a growth with the trend of work from home culture since the arrival of Covid-19 pandemic. The easy availability of headsets with advanced technologies at e-commerce platforms supplements the segment's growth.

The commercial segment is observed to have a significant rate of growth during the forecast period. Headsets are essential accessories for gamers, providing immersive audio experiences and enabling clear communication with teammates during multiplayer games. They are also used for listening to music, watching movies, and consuming other forms of digital entertainment.

Regional Insights

What is the Asia Pacific Headset Market Size?

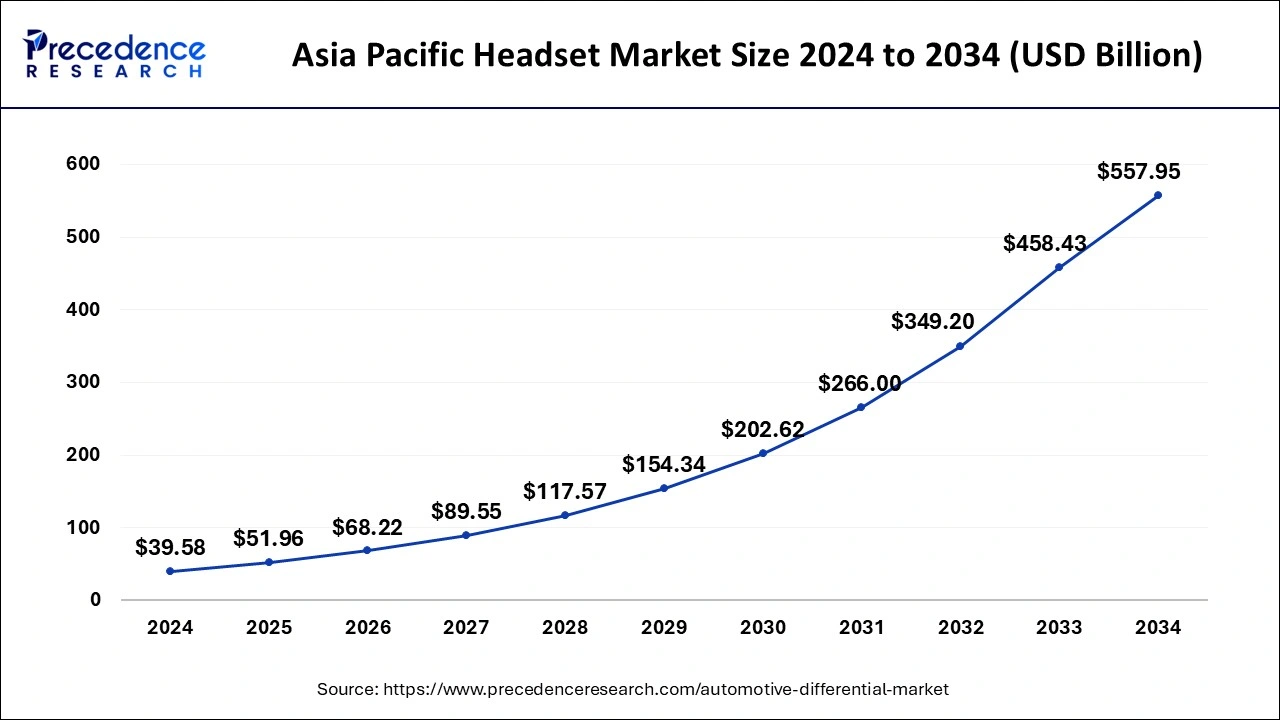

The Asia Pacific headset market size was estimated at USD 51.96 billion in 2025 and is anticipated to reach around USD 663.94 billion by 2035, poised to grow at a CAGR of 29.02% from 2026 to 2035.

Asia Pacific dominated the headset market with the largest share of 36% in 2024. The dominance of the region is attributed to the wide adoption of wearable technology, robust growth of the fitness industry, rising availability of sophisticated gadgets and rapid adoption of noise cancelation technologies in various sectors. The market in the region is observed to expand in the upcoming years with the growing usage of gaming applications, rising disposable income, and increasing internet penetration along with smartphones.

- In 2023, China had the largest number of internet users, with 1.05 billion, followed by India with 729 million. The rising penetration of internet services in such countries is observed to boost the number of headset users while supplementing the growth of the market.

In Asia Pacific, developing economies such as India, Japan, and China are the major contributors to the market due to the presence of prominent key players, increasing availability of wireless devices at affordable pricing, increasing participation in virtual meetings, and rising investment in the development of innovative technologies.

- According to 2023 gaming statistics, there were more online gamers in the Asia-Pacific region than any other area of the world, with 1.7 billion people from the region being active users of gaming devices.

- In February 2024, Bollywood actor Ranveer Singh announced an investment in the consumer electronics brand boAT. The actor has invested an undisclosed amount in the world's second-largest audio wearable brand boAT. According to the company statement, the actor has an entrepreneurial spirit and a deep understanding of Gen Z and millennial audio preferences, making him a strategic asset for boAt.

China Headset Market Trends

China's industry is witnessing a clear bifurcation between high-performance gaming peripherals and comfortable open-ear (OWS) designs tailored for hybrid work. Leading manufacturers are leveraging 5G and AI-driven personalization to integrate these devices into seamless hardware ecosystems.

North America is expected to expand at a rapid pace during the forecast period. The growth of the region is driven by several factors, such as increasing penetration of smartphones & laptops, increasing presence of tech-driven companies, increasing consumer disposable income, increasing consumer inclination towards gaming applications, rising investment in the technological-based industries, and growing acceptance of headset devices in the region. Thus, this is expected to propel the growth of the headset market in the area during the forecast period.

U.S. Headset Market Trends

U.S. consumers favor wireless devices for convenience, with Bluetooth headphones seeing rapid adoption and innovation, rising hybrid work fueling the demand for high-quality, comfortable headsets, and growing and immersive experiences fuel the market growth.

How Did Europe Notably Grow in the Headset Market?

Europe's massive popularity of esports, console gaming, and the proliferation of smartphones and streaming services. Key technological innovations such as virtual surround sound, active noise cancellation, and low-latency wireless connectivity are now standard features demanded by consumers and professionals alike.

Germany Headset Market Trends

Germany's growth in hybrid work and gaming is projected to increase demand for specialized enterprise and surround-sound headsets, with a growing expectation for devices to integrate seamlessly with digital assistants and IoT ecosystems. Manufacturers are focusing on combining high performance with multi-platform compatibility to meet the demands of this tech-savvy consumer base.

Value Chain Analysis of the Headset Market

- Inbound Logistics (Raw Material Sourcing & Handling)

This stage involves sourcing, receiving, and storing raw materials like plastics, metals, electronic components, and packaging materials.

Key Players: Apple, Sony, and Samsung. - Operations (Manufacturing & Assembly)

Operations focus on the manufacturing and assembly processes that convert raw materials and components into the final headset product.

Key Players: Sony, Apple, Samsung, Bose, and Sennheiser - Outbound Logistics (Distribution & Warehousing)

This activity ensures that finished headsets are stored, managed, and distributed to various sales channels, including retailers and direct-to-consumer outlets.

Key Players: Apple, Samsung, and Sony

Headset Market Companies

- Zebronics India Pvt. Ltd.: Zebronics is a dominant force in the budget-to-mid-range Indian audio market, providing high volumes of affordable TWS earbuds and headphones designed for the mass consumer.

- ULTIMATE EARS: Specializing in professional audio and premium consumer products, Ultimate Ears is known for high-fidelity custom in-ear monitors (CIEMs) used by musicians and audiophiles.

- Audio-Technica: As a legacy audio brand, Audio-Technica is a key player in both the professional studio equipment and consumer markets, renowned for durable, high-fidelity wired and wireless headphones.

- Apple, Inc.: Apple dominates the premium TWS segment with its AirPods and Beats lines, leveraging its closed ecosystem to offer seamless pairing, spatial audio, and H1/H2 chip integration.

- Alclair / Matrics Inc.: Alclair is a U.S.-based company that manufactures custom in-ear monitors (CIEMs) for performers, sound engineers, and musicians.

- Sony Corporation: A global electronics behemoth, Sony is a leader in consumer audio innovation, particularly in the premium over-ear ANC headphone segment.

Other Major Key Players

- Skullcandy

- Motorola

- Logitech.

- LG

- Koninklijke Philips N.V.

- JVCKENWOOD Corporation

- HARMAN International.

- Grado Labs.

- GN

- EDIFIER

- Dell

- Bose Corporation

- Shure Incorporated.

- SHENZHEN CANNICE TECHNOLOGY CO.,LTD.

- Sennheiser electronic GmbH & Co. KG

- Sennheiser

- Samsung

- Poly

- Plantronics, Inc.

- Pioneer Corporation.

- Panasonic Holdings Corporation

Recent Developments

- In January 2026, JBL launched a JBL Quantum 950X (Flagship), a wireless gaming headset featuring 50mm carbon dynamic drivers, 3D head tracking. The JBL Quantum 950X (Flagship), has a hot-swappable dual battery system for 50 hours of play. (Source: https://news.harman.com/ )

- In February 2024, Apple announced the launch of the Vision Pro Mixed-Reality Headset in 2024. Vision Pro is a revolutionary spatial computer that transforms how people work, collaborate, connect, relive memories, and enjoy entertainment. Vision Pro seamlessly blends digital content with the physical world and unlocks powerful spatial experiences in visionOS.

- In September 2022, Sennheiser announced the launch of Momentum 4, a cutting-edge wireless headphone that redefines audio performance. The Momentum 4 incorporates adaptive noise cancellation (ANC) technology, ensuring a serene listening environment and enhanced audio clarity.

- In September 2023, Meta announced the launch of the Quest 3 VR (virtual reality) headset at $499 (Rs 41,517). It costs $200 more than the previous Quest series but promises significant upgrades.

- In February 2022, Niantic and Sony announced the collaboration in Audio AR. The partnership focuses on combining Niantic's real-world AR technology with Sony's audio technology to provide people with an unprecedented AR experience.

Segments Covered in the Report

By Type

- In-ear

- Over-ear

By Connectivity

- Wired

- Wireless

By Application

- Commercial

- Personal

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting