What is the Online Gaming Market Size?

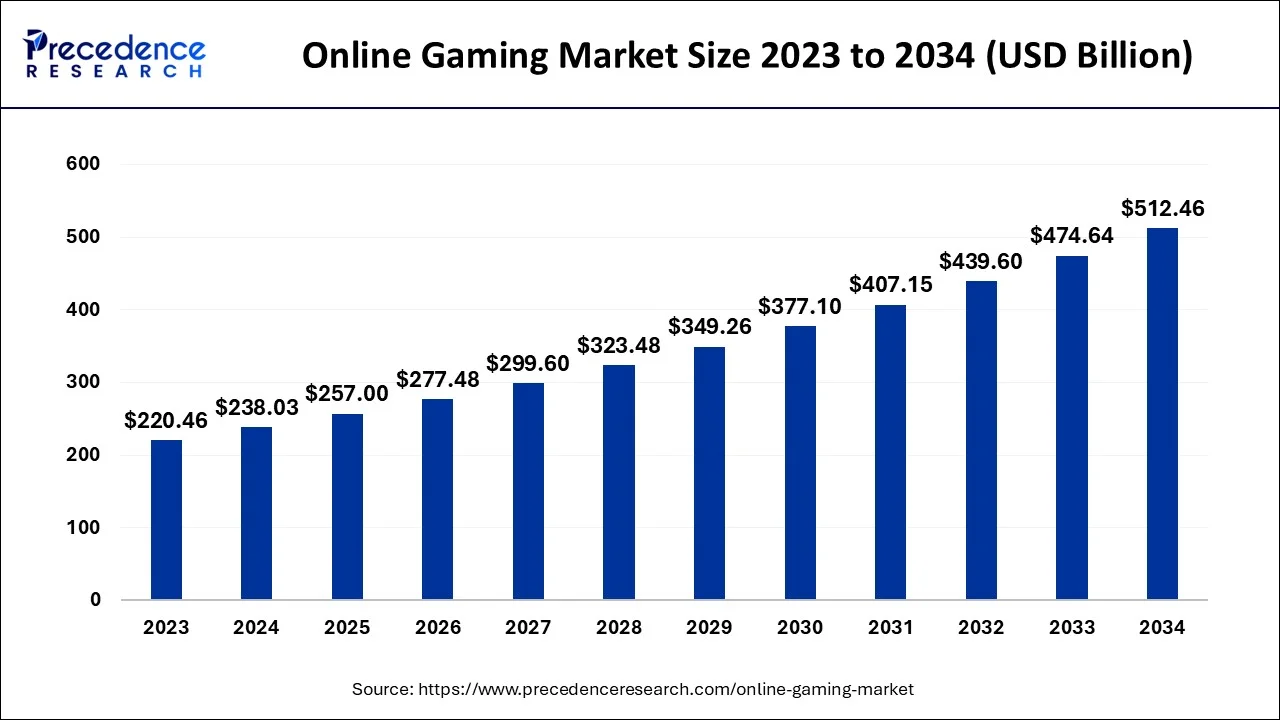

The global online gaming market size is estimated at USD 257.00 billion in 2025, and is projected to hit USD 277.48 billion by 2026, and is anticipated to reach around USD 512.46 billion by 2034, expanding at a CAGR of 7.97% between 2025 and 2034.

Market Highlights

- North America held the largest revenue share in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR from 2025 to 2034.

- By Game Type, the action & adventure games segment held the maximum revenue share in 2024.

- By Platform, the mobile segment is expected to expand at a significant CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 257.00 Billion

- Market Size in 2026: USD 277.48 Billion

- Forecasted Market Size by 2034: USD 512.46 Billion

- CAGR (2025-2034): 7.97%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Playing a video game online simply means doing it while connected to the internet, typically with companions. Online games can be played on a wide range of gadgets, including PCs, laptops, mobile phones, and specialized gaming consoles like Xboxes, PlayStations, and Nintendo Switches. Current cloud gaming scenarios have undergone a considerable transformation thanks to recent advances in cloud technology.

A server maintains the games and does tasks including video encoding and streaming, game logic processing, and game rendering when playing games in the cloud. Users, especially those with little smartphone storage devices, gain from this. Market growth is anticipated to be fueled by regulatory changes and the development of smart gadgets.

The internet gaming sector, however, may be threatened by a few government rules that forbid online gambling. However, it is anticipated that new organizations that regulate player protection, fair gaming, and responsible operator behavior, like e-Commerce Online Gambling Regulation and Assurance (eCOGRA), will open up new opportunities for market growth in the years to come.

Market Trends

- In July 2025, a cross-over collaboration between WePlay, which is an online social gaming platform well known among young players, and Taiwan's renowned IP, that is Bugcat Capoo, was launched. The outstanding leadership and strength in the casual social gaming sector of WePlay is being presented, as this collaboration was successful in featured placements in Google Play as well as the App Store in Taiwan. (Source: https://finance.yahoo.com)

- In July 2025, to launch a time-limited event in the PC MMORPG Ragnarok Online, a collaboration between Gravity, which is a Global gaming company, and Universal Products & Experiences was announced. The release of How to Train Your Dragon, which is a live-action reimagining of Universal Pictures and DreamWorks Animation, overlaps with the launch of this event. It will be available to the players with Base Level 90 and above till 5th August. The Vikings and dragons from Berk will visit the Abyss Lake in Ragnarok Online in this collaboration event. Thus, Hiccup the young Viking, Toothless, his Night Fury dragon, and his friends will be helped by the players to complete the story-driven quest and return them to Berk. (Source: https://cerebral-overload.com)

Online Gaming Market Growth Factors

The year saw a rapid increase in e-sports participants and wide adoption of e-sports, which is likely to support the growth of the online gaming market during the forecast period. E-sports have enormous market demand and are propelling industry expansion in India and around the world. Video game competitions are known as esports. E-sport competitions use popular multiplayer online games like Counter-Strike, Halo, and Call of Duty, and the winners receive cash or hardware.

The graphics and plot of many companies' games are being developed to appeal to players and be compatible with a variety of devices. The widespread adoption of smartphones has increased online gaming sales to their highest level. Consoles are being created by businesses so that players can have a better experience. Gamers may now find games from many publishers, including Arcade and Stadia, due to the cloud gaming service that online gaming businesses have launched.

One of the main reasons for the enormous increase in online gaming is the availability of cheap, unlimited 4G data plans from telecommunications. Future growth in the sector will be fueled by increasing investments in online services and the impending 5G infrastructure. With preexisting headsets and smartphones becoming increasingly capable of meeting the quality of consoles and PCs, augmented reality virtual reality gaming is anticipated to gain a big boost. Additionally, developers will eventually be able to swiftly and economically produce game materials, spanning from story to animation, with the help of artificial intelligence (AI). By providing them with a variety of options, will empower users.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 257.00 Billion |

| Market Size in 2026 | USD 277.48 Billion |

| Market Size by 2034 | USD 512.46 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.97% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Gaming Type, Platform, Business Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption of mobile devices

The increase in adoption of mobile devices is expected to fuel the growth of the online gaming market during the forecast period and this trend is likely to continue in the future. According to the Mobile Economy 2022 report by GSMA Intelligence, by 2025, there will be close to 7.5 billion smartphone connections, or more than four out of five mobile connections.

Over the next six years, mobile data usage is likely to triple in the majority of regions due to rising smartphone penetration and video consumption. As of July 2022, there were 3 billion new gamers, an increase of +5.3% over the previous year. The Asia-Pacific area is home to more than 50% of these new gamers. The rise can be ascribed to a number of variables, including an increase in the proportion of amateur and professional players, a boost in viewership as a result of the popularity of esports, and a rise in the number of viewers tuning in to live streams of various genres.

Further, almost US $41.2 billion was spent on mobile gaming in the first half of 2022. The two games with the biggest revenue during that time were Honour of Kings from Tencent and PUBG Mobile, which each brought in over US $1 billion from customer spending. Google Play also achieved US $15.6 billion during that time. This is due to the development of 5G technology, which gives players access to faster and more dependable mobile internet rates. In the future, more competitions and events including mobile online gaming are anticipated to offer opportunities for market growth.

Restraints

The threat of malicious activity

Malicious actions is becoming more and more of a danger, especially in online gaming wherein forged transactions can result in losses of millions of dollars. According to threat statistics compiled by Kaspersky Security Network, 303,827 users encountered gaming-related malware and unwanted programs between July 1, 2020, and June 30, 2021, with 69,244 of those files being distributed under a false identity of the twenty-four most popular PC games. Grand Theft Auto V, Fortnite, PUBG, the Sims 4, and Minecraft are the top five PC games used as bait in assaults that target the most users.

The stakes have never been higher because of an increase in players, wagers, and financial activities. This is likely to limit the growth of the market in the years to come. Thus, game makers must always incorporate more complex fraud detection rules and algorithms into their games to keep ahead of online fraudsters.

Opportunities

Introduction of crypto and NFT in gaming

For modern investors, cryptocurrency is starting to become a worldwide phenomenon. It is one of the most profitable investment opportunities with high risks that have provided quick cash for many young investors. Online gaming is one such industry that is adopting cutting-edge technologies into its core products as crypto currency's global popularity rises.

It has turned into huge ground for game producers looking to take advantage of digital currencies and enter the NFT gaming market. The emphasis of game producers is on two methods of game monetization: exchanging NFTs and earning in-game currency or prizes. They invest in NFT characters rather than making a purchase that does not ensure any financial gain for the players.

The popularity of crypto gaming has risen as players can collect and trade virtual assets that are transferrable and tradable globally. It has become a secure and straightforward way for the gaming industry to generate income. A report by Worldwide Asset Exchange revealed that more than 75% of online gamers wish to exchange their virtual assets for a currency that can be utilized on various platforms. Non-fungible tokens (NFTs) have also transformed the concept of purchasing and possessing digital assets by transforming them into unique units of data stored on the Blockchain.

Segments Insights

Game type insights

On the basis of game type, the action & adventure games segment held a considerable revenue share in 2024. This is owing to the presence of strong and dedicated fan base that has been built over several years. Additionally, action and adventure games typically offer high engagement and replay value due to their immersive gameplay and storyline, which can keep players engaged for hours. Further, the development of more advanced gaming technology, such as virtual reality (VR) and augmented reality (AR), has allowed for more realistic and engaging action and adventure games which is also likely to augment the segmental growth of online gaming market during the forecast period.

The battle royale games segment held the largest share of 22.00% in the 2024 global online gaming market. The segment has promoted free-to-play models and availed the accessibility via cross-platform development and has been generating uniqueness and competitive occurrence encompassing esports and streaming. Fortnite is the best example of a free-to-play model. The battle royale games are emerging with the demand for connecting players with the most convenient source, like mobile devices. The development depends on the increasing number of users and the diverse genres emerging from community-made game mods.

The hyper-casual games segment is expected to grow at a CAGR of 13.00% during the forecast period. The segment plays a major role in the global online gaming market. It acts as an exploratory pathway for new players, a connection to quickly develop content and a key driver of advertising revenue. The simple mechanics and design, and short duration play session, are a seamless approach for the market. This simplification leads to high and quick access to the hyper casual games. The segment has largely helped to extend advertising ecosystems and user acquisitions.

Platform Insights

Based on the platform, the mobile segment is expected to grow at a significant CAGR during the forecast period. This is attributable to the increasing adoption of smartphones globally. Mobile gaming apps are easily accessible through app stores, and there is a wide range of games available, catering to different audiences and preferences. Mobile games often incorporate social connectivity features such as multiplayer options, leaderboards, and social media integration, which have further increased their popularity.

The mobile games (smartphone and tablet) segment held the largest share of 49.00% in the 2024 global online gaming market. The mobile games have been gaining traction in the market. It's been a convenient and affordable platform since Android has explored impressive clarity and sound to vibe with the gamers' craze. The smartphone and tablet brands are running in high demand due to their integrated features and supportive functions that also harness other game modes. The segment has been accelerating with the growing user population and their requirement for online gaming options.

The cloud-based streaming games segment is expected to grow at a CAGR of 12.50% during the forecast period. The segment is bringing major positive changes in the global online gaming sector by eliminating the expensive gaming channel (platform). Its high-end hardware enables players to browse and have access to the games on any device with a better internet connection. The fluctuating game development and accessibility is gaining traction by allowing developers to create robust, high-fidelity games for a massive audience without being less by PC hardware constraints and consoles.

Regional Insights

North America held a considerable revenue share in 2023. The US dominated the North America region in 2024. This is owing to the advancements in technology, such as virtual reality and cloud gaming, which have created new opportunities for game developers to create immersive and innovative gaming experiences. in the region. The increasing popularity of mobile gaming with millions of people using their smartphones and tablets to play games on-the-go is also likely to support the growth of the market in the region. Additionally, the region has strong gaming culture, with a large and dedicated community of gamers who are passionate about their hobby which is also likely to create immense growth opportunities for the market in the region.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This is attributable to the increasing population and a rapidly growing middle class with increasing access to high-speed internet and smartphones in the region. Additionally, esports has become increasingly popular in the region, with large-scale tournaments and professional leagues attracting millions of viewers and generating significant revenue. This has created new opportunities for game developers, publishers, and esports organizations and is expected to support the regional growth of the market in the years to come.

In 2021, the total revenue from online gaming in Europe reached an impressive €36.4 billion, which accounted for 41.7% of overall gambling. This amount is projected to grow annually, hitting €52 billion by 2026. The increasing advancements in hardware and software for online gambling, ongoing smartphone adoption, improved internet services, and swift digital transformation are driving market expansion. Additionally, numerous European nations have established or are contemplating legal structures to oversee online gambling, creating a transparent legal landscape for both operators and players, which in turn enhances the size of the European online gaming market. The extensive uptake of mobile gambling, live dealer games, esports betting, and similar trends is anticipated to drive market expansion. Moreover, certain online gambling providers are looking into incorporating cryptocurrencies as methods of payment. Cryptocurrencies provide advantages like improved security, privacy, and reduced transaction fees, thus boosting the demand for online gambling in Europe. These elements are enhancing the online gambling market income, consequently contributing to the Europe online gambling market share.

The Middle East and Africa are expected to grow significantly in the online gaming market during the forecast period. The growing interest in online games is increasing in the Middle East and Africa. At the same time, the growing digitalization is also enhancing the development of the gaming platforms. Moreover, the growing internet access is also driving their use. Additionally, to support them, gaming hubs are being developed, as well as tournaments are also being conducted. Thus, all these developments, along with the government support, are promoting the market growth.

Business Model Insights

The free-to-play (F2P) segment held the largest share of 58.00% in the 2024 global online gaming market. The F2P model has attracted a huge group of audience. The segment emerging from an unpopular market in the 2000s to now has been the primary revenue generator for many developers who have built a strong perspective in the market. The F2P business eliminates the upfront cost barrier, though the live service models, and the critical monetisation plan meet a few ethical challenges. The development will fix these challenges and continue to build the safe online gaming ecosystem globally.

The ad-supported games segment is expected to grow at a CAGR of 11.80% during the forecast period. The segment is a pivotal component of the global online gaming market. It initially offers a major revenue stream for developers who promote and provide their games on a F2P basis. This ad-supported games business model enables games to collectively attract a huge audience and gain prominent income from the players who don't pay for IAP. The segment is further fueled by technological advancement and the emerging demand for mobile gaming.

Revenue Stream Insights

The in-game purchases segment held the largest share of 47.00% in the 2024 global online gaming market. The microtransactions or in-game purchases (IAP) have transformed the market. The revenue shift from one-time product sales to games as a games-as-a-service model has redefined the IAP. The IAP has become a major revenue source that bolsters market growth, trimming games modification based on monetisation and design. This revenue stream brings ethical consideration and critical psychological issues regarding the players' behaviour. This strongly emphasises the analysis of the mode of the game and the kind of person playing it.

The advertising revenue segment is expected to grow at a CAGR of 12.20% during the forecast period. The advertising revenue has rapidly gained attention and profit in the global online gaming market. With the growth of the F2P mobile games, this segment is also accelerating in the market. The ad format expands the number of players, develops strong long-term engagements and generates significant revenue with suitable implementation. This is the best platform for brands to promote and gain audiences for the instant growth of their upcoming or launched endeavours.

Device type Insights

The smartphones segment held the largest share of 50.00% in the 2024 global online gaming market. The smartphone is a handy, convenient and affordable device, influencing big smartphone brands to integrate with the developers and their gaming system. The smartphone device has largely promoted technological innovation, and further extended the market into the entertainment one with its fascinating features and impressive permissions to enjoy gaming in the comfort of the place from anywhere, anytime.

The AR/VR headsets (wearables) segment is expected to grow at a CAGR of 14.00% during the forecast period. The segment has been a secondary one, but holds the quality advanced value in the online gaming sector. Most of the gamers on YouTube or any other gaming platform, including the local audience, prefer AR/VR headsets for an interactive and real kind of experience, correlating to the physical and digital world simultaneously with one device. The AR/VR headset market is growing with the key tech companies like Apple, Sony and Meta and more. Following this, it involves and contributes to the global online gaming market as a whole.

Online Gaming Market Companies

- Tencent Holding Limited

- Activision Blizzard, Inc.

- Nintendo of America Inc.

- Microsoft Corporation

- Valve Corporation

- Electronic Arts Inc.

- Sony Corporation

- Take-Two Interactive Software, Inc.

- Square Enix Holdings Co., Ltd.

- Amazon.com, Inc.

- Gameloft SE

- King Digital Entertainment Ltd.

Recent Developments

- In June 2025, Octoplay debuted its online casino games in the United States, marked its first launch with BetMGM in New Jersey. The collaboration with BetMGM marks Octoplay's initial active partnership in the US and comes after the supplier's recently secured provisional license in Michigan.

- In May 2025, India -Business Wire India the Real11 Fantasy Sports team has announced an exciting development,they've just introduced Real Rummy, an online gaming platform allowing users to play rummy anytime and from any location.

- In February 2025, ODDSworks revealed that it has debuted its premium iGaming content with Caesars Entertainment across four U.S. jurisdictions: New Jersey, Pennsylvania, Michigan, and West Virginia. ODDSworks' online casino games are now launched and accessible for users at Horseshoe Online Casino, Caesars Palace Online Casino, and Caesars Sportsbook & Casino.

- In April 2023, an agreement has been made by Sony Interactive Entertainment LLC ("SIE") to secure Firewalk Studios. The acquisition is part of SIE's efforts to introduce a new era of live gaming service experiences for PlayStation gamers, in collaboration with other top-tier development teams such as Haven Interactive Studios and Bungie.

- In March 2023,in order to bring Xbox PC titles to Boosteroid's cloud gaming platform, Microsoft Corp. and Boosteroid signed a 10-year deal. Boosteroid, a cloud gaming provider with its software development team located in Ukraine, has become the largest independent provider of cloud gaming, with over 4 million users worldwide. Following Microsoft's acquisition of Activision Blizzard, customers of Boosteroid will now have the ability to stream PC games from Activision Blizzard as well.

- In February 2023,an agreement was announced by NCSOFT and Amazon Games to launch the much-awaited THRONE AND LIBERTY, a massively multiplayer online role-playing game, in South America, North America, Europe, and Japan. The game will be published by Amazon Games and will be available on PlayStation 5, PC, and Xbox Series X|S. It will also have provision for cross-platform play.

Segments Covered in the Report

By Game Type

- Massively Multiplayer Online Role-Playing Games (MMORPG)

- First-Person Shooter (FPS)

- Real-Time Strategy (RTS)

- Multiplayer Online Battle Arena (MOBA)

- Battle Royale Games

- Casino & Card Games

- Sports & Racing Games

- Simulation Games

- Puzzle & Arcade Games

- Adventure Games

- Hyper-Casual Games

- Trivia & Word Games

By Platform

- PC Games

- Console Games

- Mobile Games (Smartphone & Tablet)

- Browser-Based Games

- Cloud-Based Streaming Games

- Smart TV/Connected Devices

By Business Model

- Free-to-Play (F2P)

- Pay-to-Play (P2P)

- Freemium (In-App Purchases)

- Subscription-Based

- Ad-Supported Games

- One-Time Purchase

By Revenue Stream

- Game Purchases

- In-Game Purchases

- Advertising Revenue

- Subscription Revenue

- Tournament & Sponsorship Revenue

- Merchandising & Licensing

By Device Type

- Smartphones

- Tablets

- Desktops/Laptops

- Consoles (PlayStation, Xbox, Nintendo)

- Smart TVs

- Wearables & AR/VR Headsets

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting