What is the Online Food Delivery Market Size?

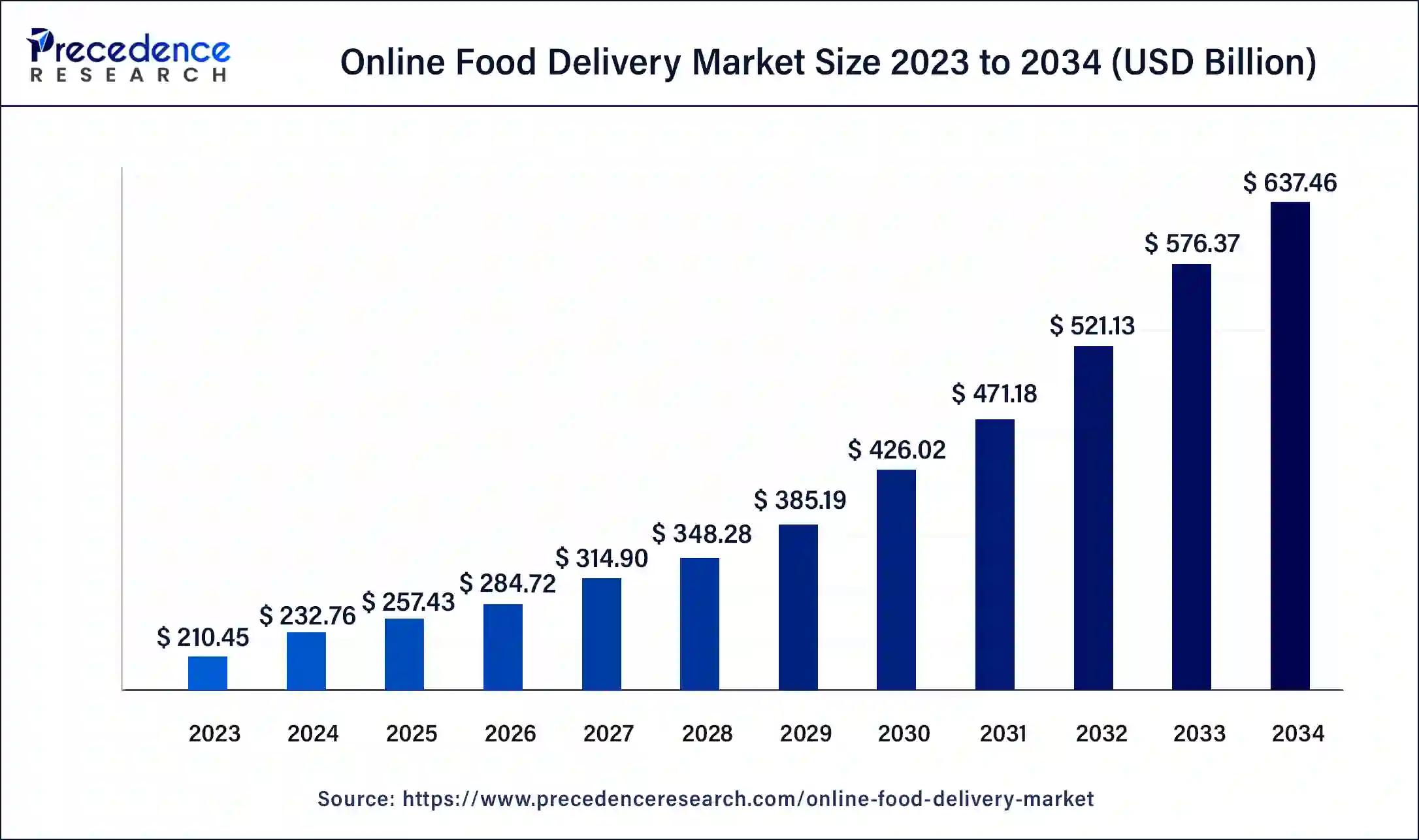

The global online food delivery market size accounted for USD 257.43 billion in 2025 and is expected to be worth around USD 694.65 billion by 2035, at a CAGR of 10.44% from 2026 to 2035.

Market Highlights

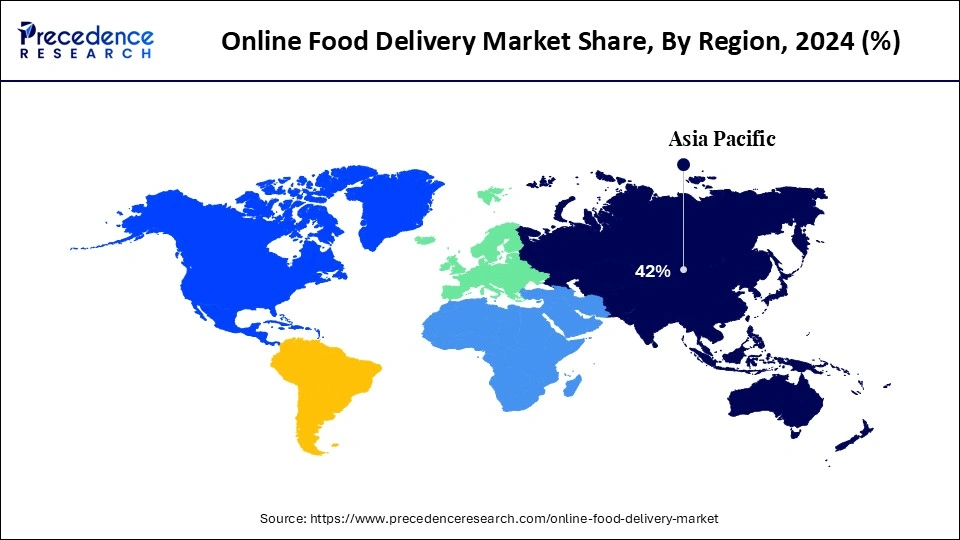

- Asia Pacific contributed more than 42% of revenue share in 2025.

- By Platform, the mobile application segment held the largest share in 2025.

- By payment Mode, the online payment segment dominated the market in 2025.

Market Size and Forecast

- Market Size in 2025: USD 257.43 Billion

- Market Size in 2026: USD 284.72 Billion

- Forecasted Market Size by 2035: USD 694.65Billion

- CAGR (2026 to 2035): 10.6%

- Largest Market in 2025: Asia Pacific

Online Food Delivery Market Growth Factors

The widespread availability and adoption of smartphones is anticipated to augment the growth of the online food delivery market during the forecast period. Mobile applications provided by food delivery platforms make it extremely easy for users to browse menus, place orders, track deliveries, and make payments, all from the convenience of their smartphones. Furthermore, online food delivery platforms have made significant investments in expanding their delivery infrastructure. This includes partnering with restaurants, hiring delivery drivers, and implementing efficient logistics systems to ensure timely and reliable deliveries. The expanded delivery networks have contributed to the growth of the market by reaching more customers and reducing delivery times.

The remarkable expansion of the online food delivery industry has not gone unnoticed, as evidenced by tech giants like Amazon and Google entering the market with their own delivery services on a global scale. This presents an opportunity for food business owners to establish early partnerships with these well-funded services and reap the benefits of the expected growth in the coming years. Additionally, while having a dedicated delivery team has been crucial to the success of online food ordering and delivery; many brands consider it a potentially unreliable dependency in the long term. There is ample room for optimizing the delivery process in terms of both speed and cost-effectiveness, and we are witnessing notable efforts being invested in developing new delivery channels, such as robots, parachutes, and drones.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 257.43 Billion |

| Market Size in 2026 | USD 284.72 Billion |

| Market Size by 2035 | USD 694.65Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.6% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Platform Type, Payment Method, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing third-party delivery options

The food delivery landscape has undergone a complete transformation with the emergence of third-party delivery companies. In the past, food delivery options were limited to either large companies with the infrastructure to offer delivery (usually focused on pizza) or small local businesses providing localized delivery services. However, the advent of platforms like DoorDash, Uber Eats, and GrubHub has revolutionized the delivery space, making it significantly easier for businesses of all sizes to sell food online and have it delivered directly to customers.

Moreover, third-party delivery services are no longer restricted solely to restaurant food delivery. While delivery apps remain popular for restaurant orders, other food and beverage businesses, including alcohol delivery and convenience stores, are also utilizing third-party delivery services. There is a wide array of third-party delivery services available for businesses to choose from, making it challenging to determine the best app(s) based on the specific business type. Some of these apps are already integrated with leading point-of-sale (POS) systems, while others operate independently.

Increased competition in the sector has the potential to drive down delivery commissions, which are often substantial, thereby helping food businesses increase their profits and attract more customers. Thus, the online food delivery market has experienced significant growth and diversification, with the utilization of third-party delivery companies.

Restraint

Unstable market prices

The pricing strategy for food delivery services faces a significant challenge due to the volatility of food prices. Multiple factors influence prices in the food industry, including supply and demand, weather conditions, disease outbreaks, conflicts, and natural disasters. One of the primary factors affecting food prices is the high cost of oil. As food often travels long distances, increased oil prices result in higher shipping costs. Furthermore, climate change contributes to price fluctuations. Changes in climate patterns lead to more extreme weather events caused by greenhouse gas emissions. Rising temperatures result in increased evaporation, reduced rainfall, water runoff, and potential crop damage due to floods.

Opportunity

Introduction of delivery management software

The rollout of delivery management software is likely to offer growth opportunities for the online food delivery market in the years to come. Delivery management software is utilized by various businesses to effectively track deliveries at every stage. This software can be widely employed by renowned delivery companies like FedEx and UPS to streamline the entire delivery process. Moreover, food businesses and third-party delivery companies are increasingly adopting advanced delivery management software to facilitate efficient management of their own deliveries. Integrating specific delivery management software can help analyze delivery data and optimize processes, reducing waiting times and minimizing costs. Remarkably, some restaurant website builders now offer built-in management software specifically designed for this purpose.

Online ordering management software is suitable for restaurant chains, independent and small restaurants, quick-service restaurants, coffee shops, and fast-casual eateries, essentially catering to all types of food businesses that provide delivery services. Additionally, dark kitchens, also known as cloud kitchens, ghost kitchens, or virtual restaurants, can greatly benefit from this type of delivery middleware. These kitchens exclusively prepare food for delivery (and sometimes takeaways), with third-party platforms like Deliveroo, Just Eat, Glovo, Foodora, SkipTheDishes, and others providing last-mile delivery services. Furthermore, larger enterprises engaged in delivery, such as FMCG companies, supermarkets, groceries, and other retail businesses, can also find online food delivery software beneficial to their operations.

Segments Insights

Platform Type Insights

On the basis of platform type, the mobile applications segment held a considerable revenue share in 2025. Mobile applications provide a convenient and user-friendly platform for customers to browse menus, place orders, and track deliveries. The ease of use and accessibility of these apps have attracted a large user base, contributing to the segment market growth. Mobile apps offer features that enhance the overall user experience, such as personalized recommendations, easy navigation, real-time order tracking, and secure payment options. These features improve customer satisfaction and loyalty, driving the growth of the mobile applications segment. These factors are likely to create opportunities for the segment growth of the online food delivery market during the forecast period.

Payment Method Insights

Based on the payment method, the online payment segment held the largest market share in 2025. Online payment methods provide a convenient and secure way for customers to pay for their food orders. The ability to make payments directly through the app or website eliminates the need for cash transactions and offers a seamless checkout experience. Additionally, as digitization continues to expand globally, more people are adopting online payment methods. This trend creates an opportunity for the online payment segment within the food delivery market to grow and cater to the increasing number of users who preferdigital payment options.

Regional Insights

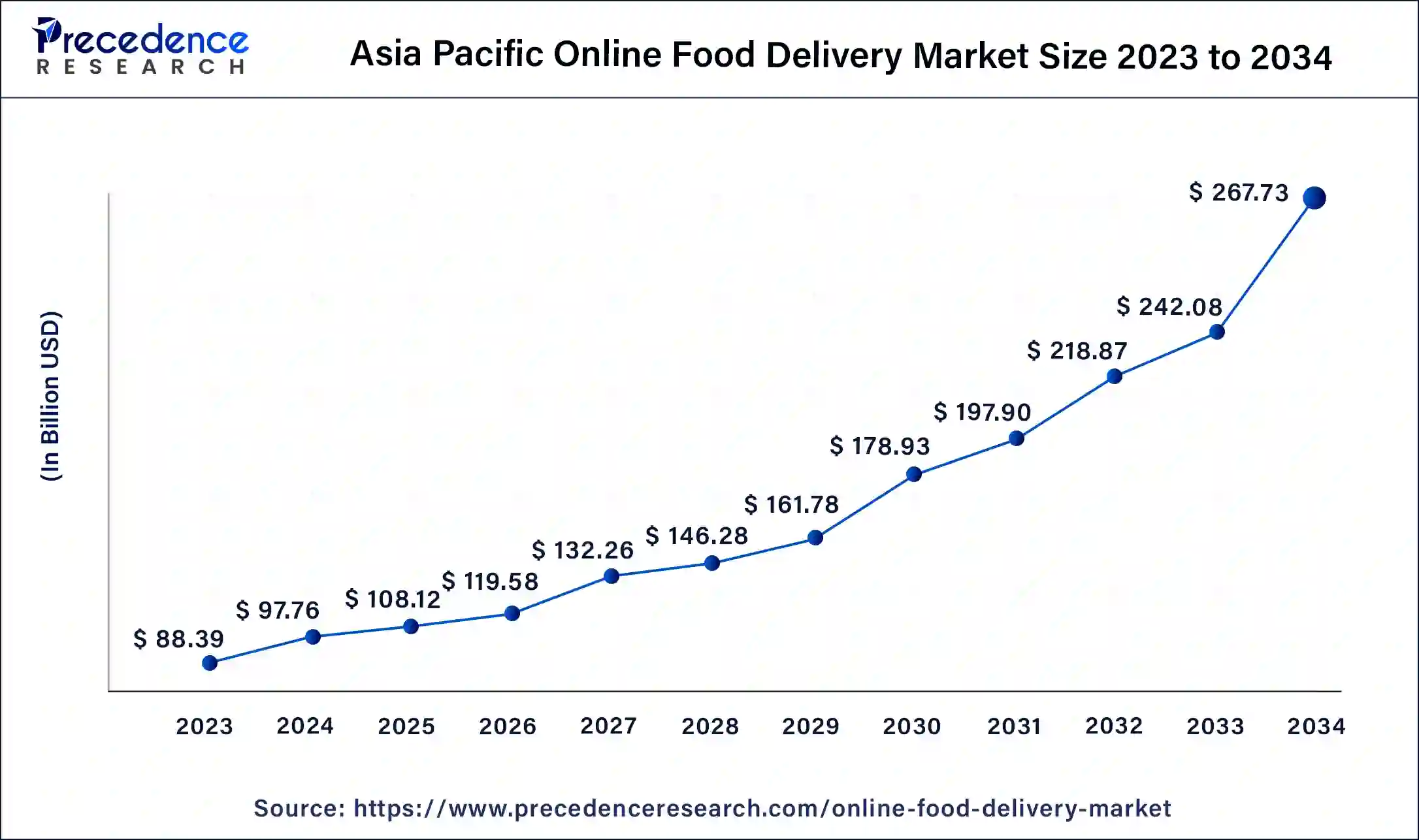

What is the Asia Pacific Online Food Delivery Market Size?

The Asia Pacific online food delivery market size was estimated at USD 108.12 billion in 2025 and is predicted to be worth around USD 291.75 billion by 2035, at a CAGR of 10.44% from 2026 to 2035.

The process of ordering food online involves customers selecting their preferred restaurant or food cooperative/franchise through the restaurant's website or mobile application. Typically, individuals search for their favorite restaurant based on cuisine type, choose from the available menu items, and opt for either delivery or pickup. The delivered items can include beverages, food dishes, desserts, and more. Payment can be made using credit cards or cash, and the restaurant shares a portion of the payment with the online food company.

Online food delivery offers unparalleled convenience to consumers. With just a few clicks or taps on their mobile devices, customers can order food from their favorite restaurants and have it delivered to their doorstep. This convenience factor has attracted a large customer base, including busy professionals, families, and individuals who prefer the ease of ordering from home.

Europe: Mature Market with Sustainability Focus

The European delivery sector's growth is driven by urban development, digital transformation, eco-friendly packaging, and carbon-neutral delivery options. Online food delivery platforms must adapt their operational practices for compliance with both local regulations and legislation governing employee relations. Furthermore, they must continue to innovate by developing new operating methods.

Among the countries experiencing the greatest growth, Spain is in the lead because more people are using apps for convenience, traveling frequently for work or leisure, and more restaurants are digitalizing their menus.

Latin America: Rapid Urban Adoption & Mobile-First Growth

The growth of the Latin American delivery sector is accelerating due to the increasing prevalence of smartphones, increasing numbers of middle-class people, and changing consumer lifestyles. Aggregator platforms are using subscription-based models and local payment solutions to achieve customer retention within urban areas. Brazil is leading in terms of food delivery frequency, number of cloud kitchens, and interest from investors, making it the fastest-growing country in the region.

Middle East & Africa: Emerging Opportunities with Untapped Potential

The Middle East and North Africa (MEA) region's rapid growth is being driven by a large, young population, increasing available discretionary income, and increased reliance on convenience-based services. Aggregator delivery platforms are expanding into new markets through cloud kitchens and partnerships with local restaurants in major metropolitan markets. Among the fastest-growing MEA countries, the United Arab Emirates (UAE) is leading in terms of high-quality delivery options, technology adoption, and overall order volume.

Value Chain Analysis of the Online Food Delivery Market

- Platform & Technology Infrastructure Management: Robust digital platforms used to manage app development and cloud hosting, AI-driven recommendations, and secure payments are the backbone of the online food delivery market.

Key Players: Zomato, Uber Eats, DoorDash. - Restaurant Onboarding & Menu Optimization: Restaurants provide one of the key links in the value chain. Digital onboarding and menu digitization, dynamic pricing tools, and demand forecasting support are all critical for onboarding new restaurants into a restaurant delivery service.

Key Players: Swiggy, Deliveroo, Just Eat Takeaway. - Last Mile Delivery & Delivery Operations: Last-mile delivery represents the highest cost in the food delivery value chain, including fleet management, route optimization, rider allocation, and accuracy of time of delivery.

Key Players: Meituan, GrabFood, Postmates.

Online Food Delivery Market Companies

- Uber Eats

- DoorDash

- Grubhub

- Just Eat Takeaway

- Zomato

- Deliveroo

- Grab Holdings Inc.

- Delivery Hero SE

- Ele.me

- Rappi

- Foodhub

- GoPuff

Recent Developments

- In June 2023, GrubHub, a food ordering and delivery platform, announced the expansion of its collaboration with Amazon. As part of this extended partnership, Grubhub will offer a one-year complimentary Grubhub+ membership to Amazon Prime members in the United States. This initiative is designed to provide added value to Amazon Prime members who have previously enrolled in Grubhub+ since its introduction in July 2022. These members will now receive an extra 12 months of free Grubhub+ membership.

- In February 2023, Zomato, a prominent online food delivery service provider, unveiled its latest offering called Zomato Everyday, replacing its previously introduced 10-minute delivery feature from last year.

- In May 2020, Foodhub, an online food ordering platform based in the UK, made an announcement regarding its expansion into the United States, with Louisiana being chosen as its starting point. The decision to commence operations in Louisiana was driven by similarities in population densities, city sizes, and the number of independent restaurants compared to the UK.

Segments Covered in the Report

By Platform Type

- Mobile Applications

- Website

By Payment Method

- Online Payment

- Cash on Delivery

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting