What is the Online Grocery Market Size?

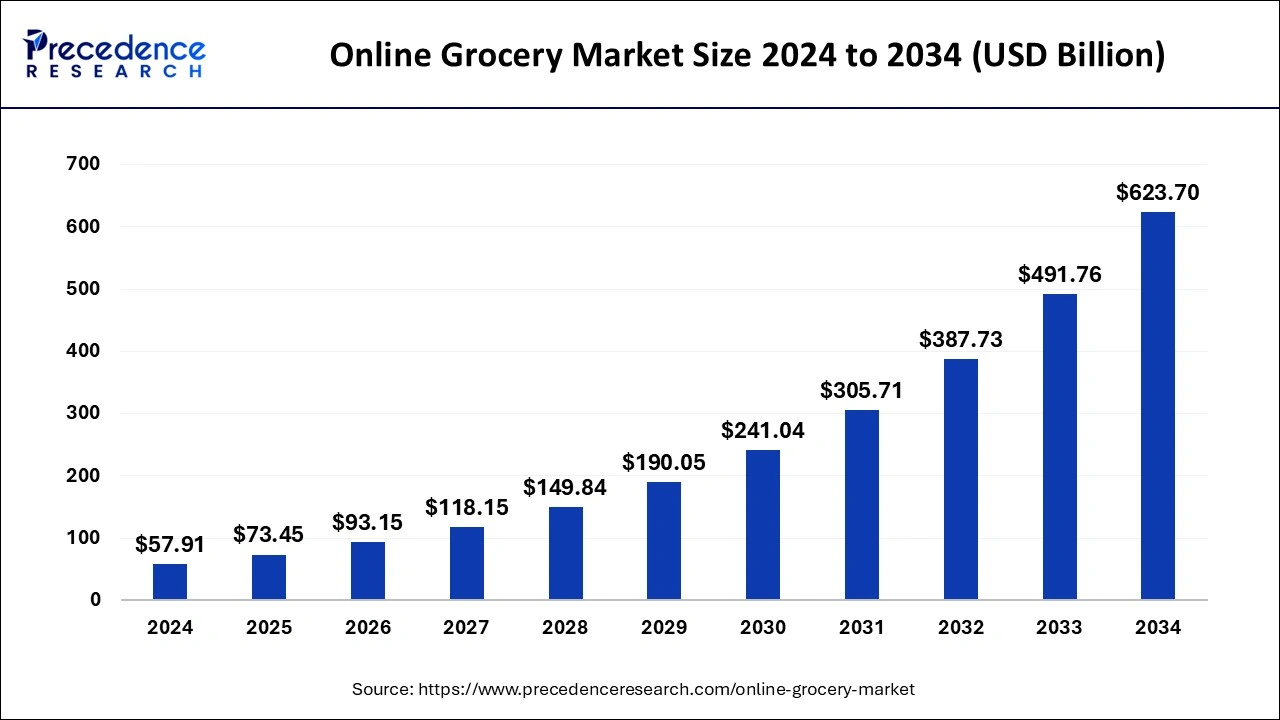

The global online grocery market size is estimated at USD 73.45 billion in 2025 and is anticipated to reach around USD 737.03 billion by 2035, expanding at a CAGR of 25.94% from 2026 to 2035

Market Highlights

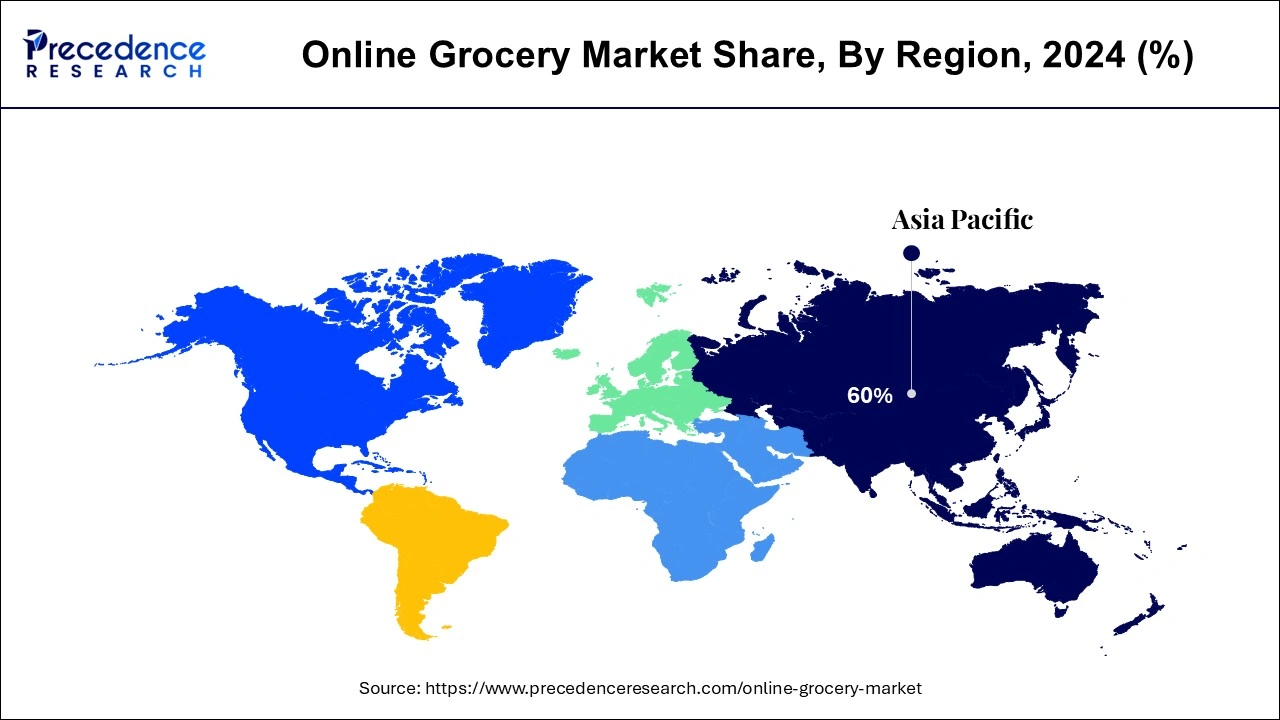

- Asia Pacific dominated the global online grocery market with the largest market share of 60% in 2025.

- By product, the staples and the cooking essentials segment accounted for the highest market share of 34% in the year 2025.

- By product, the breakfast and dairy segment is expected to grow at a notable CAGR over the forecast period.

Market Overview

The online grocery market is growing rapidly as the preferences of the consumers are changing due to the pandemic and the growth of the e-commerce industry. The global pandemic has brought this platform to the center stage. Previously, high e-commerce fees or not-so-user-friendly website designs had stunted the growth of this market. Apart from the pandemic, other factors have led customers to adopt this platform.

Previously, when all the grocery was bought from shops, now there is a shift to online grocery stores. Items of personal care, snacks, packaged foods, dairy, fresh meat, and frozen food have all seen a significant rise.

The United Nations Environment Programme (UNEP) reported in 2025 that major grocers are integrating sustainability into online operations, including low-emission packaging and optimized last-mile delivery.

Major online stores are providing services that help in placing the order and collecting it on the same day. This helps in the rapid growth of the services market. The click-and-collect concept is adopted to enable a contactless shopping experience.

- Walmart's 2024 Q1 initiative included expanding same-day grocery pickup to over 1,500 new locations across North America.

Role of AI in Online Grocery Sector

Artificial intelligence is bringing much-needed change in the industry by bringing in more aspects of personalization, operational efficiency, and good customer experience. Behavior analysis, browsing history, and past purchases are what AI is working on to recommend products, offer discounts, and display shopping interfaces accordingly. AI keeps inventory management at uptight levels, performing automations of some of their annoying tasks while offering dynamic price-setting functionalities based on real-time market situations. Additionally, AI smoothens the interaction using chatbots, visual search, and voice shopping while optimizing logistics from the time delivery happens to fuel consumption. It finally leads to less overstock and food waste, saving costs and augmenting efficiency to provide top-class, highly personalized, and economical shopping experiences for online grocery outlets.

Online Grocery Market Growth Factors

Shopping online helps in saving the time required in traveling up and down to the store, collecting the things and prevents wastage of fuel or gas. Customers have an advantage of a fully stocked store even if you try to place an order at midnight. Online grocery shopping will help in reduction of the carbon dioxide emissions compared to the individual household trips for such shopping. The tendency of impulse buying within is turned down during online shopping.

The feature of price comparison provided by these platforms makes the life of the housewives easy and helps save their money. Searching the products online is also easy as compared to the shops. Many groceries store sites help you with your shopping list that you last ordered, so this also helps in reordering the items. It is also less stressful as compared to dealing with the busy grocery store, when everyone else is there during the peak hours.

There is a change in the preference for grocery shopping through online channels due to changes in technology due to urbanization and shift in consumer shopping habits. The growing disposable income and attractive discounts that are offered by the online grocery stores is driving the market. Low service fees and easy availability of time slots is also helping the market grow. The options offered by online grocery stores are more than the conventional stores. A hectic lifestyle has also led to an increase in the market share.

The availability of smartphones or smart devices at home, along with Internet connectivity, have also led to a growth in the online sales. Increased liking for hassle free shopping and a growing inclination towards the ecommerce platforms is also expected to help the market grow. The online grocery stores also provide some attractive offers like cash back, discounted offers and express delivery options.

- In 2024, Amazon Fresh and BigBasket introduced AI-powered recommendations, which increased basket sizes and improved user retention according to internal pilot studies shared during tech summits.

- Convenience and time saving: Pre-peak occasions are the perfect time for consumers to order before crowds arrive to create the peak experience and make it uncomfortable.

- Cost efficiency: Price comparisons, discounts, and cashbacks, and reasonable delivery are some of the cost-saving methods in place for consumers.

- More product variation and unrestricted access: The online platform, along with nighttime access, offers a larger catalog for an extensive product list, aside from ease in repurchasing.

- Penetration of technology: Online grocery sales are supported in their development because of high smartphone penetration levels, availability of internet connection facilities, and higher knowledge of e-commerce.

- Lifestyle and urbanization trends: Fast-track lifestyles, greater disposable incomes, and increased preferences for less work in shopping are some of the major drivers for online grocery uptake.

- Convenience and Time Savings: No driving around and no waiting at the checkout.

- Shift in Consumer Preferences: Urbanization and acceptance of digital platforms have been pursued by consumers to the online grocery shopping.

- Technological Advancements: Improved smartphone use, internet connectivity, and payment security are contributing to the high accessibility of online grocery shopping.

- Discounts and Offers: Attractive promotions, cashback, and loyalty points are some incentives that lure consumers to do their grocery shopping online.

- Increasing Disposable Income: Rising income and offline delivery options make online shopping practically feasible as well as attractive.

Market Outlook

- The online grocery industry is expected to have consistent growth as all generations of consumers grow accustomed to using digital channels for their shopping activities. Factors such as increasing urbanisation, faster delivery times and subscription-based services are driving continued demand on a worldwide basis.

- Global Expansion: Online grocery companies are obtaining growth into future developing markets using approach towards pricing, product range and partnership arrangements to accelerate entry and growth into these markets.

- Startup Ecosystem: The start-up ecosystem for the grocery industry appears to be one of the hottest, with increasing investment by venture capital groups into companies and platforms developing quick delivery services (quick-commerce) or grocery items in close proximity to customer homes (hyperlocal).

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 73.45 Billion |

| Market Size in 2026 | USD 93.15 Billion |

| Market Size by 2035 | USD 737.03 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 25.94% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Delivery, Purchasers, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Convenience and Time Savings

Online grocery stores offer a high level of convenience for their clients; groceries can be ordered everywhere from anywhere, at any time. The need to drive to a physically existing grocery store, standing in long queues, keeping track of whatever they had to buy, and making multiple errands are all eliminated from the equation, thus saving an enormous amount of time and effort Saving repeated inputs into shopping lists, setting up recurring orders, and express delivery are some other attributes that add more weight to ease of use of such platform systems so that online grocery finds fewer traditional ways of grocery purchase.

Restraint

High Operational and Logistics Costs

Public grocery club necessarily encountered considerably from higher operational and logistics cost. Building robust supply chains with specialized cold storage for perishables and last-mile delivery at a timeliness requires a lot of investment. Hence, such expenses inflict upon profits, especially on smaller or newer platforms. In addition, returns handling and all the difficulties in ensuring product standards while trying to vary demand make operations quite complex, causing such financial and logistical weight to keep the platform tied back in its growth capacity, thereby delaying expansion into newer markets and making long-term sustainability a challenge.

Opportunity

Using Technology and Personalization

Growing big has been an opportunity for the online grocery trade through the aid of technology and personalized services. AI and ML give platforms the ability to analyze customer behavior and recommend products to them, enhancing user satisfaction while doing so. Websites and mobile applications that provide smooth user experiences, accepting voice search along with numerous payment options, will increase the engagement and retention of users. They could also be integrated with smart kitchen appliances that register orders for goods for users based on actual consumption behavior and expiry tracking. All combined, these innovations create convenience in the life of the customer, thereby engendering loyalty and eventually creating avenues for selling, hence establishing technology as one of the growth levers.

Segment Insights

Product Insights

All the staples and the staples and the cooking essentials segment accounted for the highest market share of 34% in the year 2025. Staples include the demand for grains, oil, which are necessities in any household. Especially across Asia Pacific apart from the staples the dairy market is expected to grow at par with the staple segment. Due to doorstep delivery available for the milk and milk products this market is growing. That is expected to be a 24% growth in the fresh produce segment. Due to availability of meat and seafood online this market is also expected to rise in the forecast period. The breakfast and dairy segment is expected to grow at a notable CAGR over the forecast period. Online grocery stores cover a wide range of products, like the cereals, vegetables, fruits, bakery,breakfast products, Poultry and meat.

Delivery Insights

Based on the delivery type the segment can be further classified into click and collect or home delivery. The home delivery option is expected to have a larger market share during the forecast period. The click and collect process allows the customer to place an order through the online website for the products and while selecting the option for pick up. The benefit of click and collect order is that the delivery is within on the same day or the next day. So it helps in saving time and the shipping costs.

- In 2024, Walmart announced a 30% expansion in its same-day pickup locations in suburban U.S. areas, citing increased customer preference for click-and-collect over home delivery in specific zones

Purchaser Insights

The segment can be further classified as one-time customers or subscribed customers. The subscription services are rapidly growing and it's playing a niche role in driving the market. It helps in allowing the customers to have free delivery, cash back offers and priority of having the earlier slots for delivery. It helps in building trust among the customers and also encouraging customers to opt for subscriptions that are annual. In the recent years, there has been a rise of online shopping subscriptions. In order to retain the customers, subscription services are provided which provide rewards or savings.

- In 2024, Instacart expanded its 'Instacart+ Membership' across 12 new countries, offering healthcare-linked benefits such as free wellness products.

Regional Insights

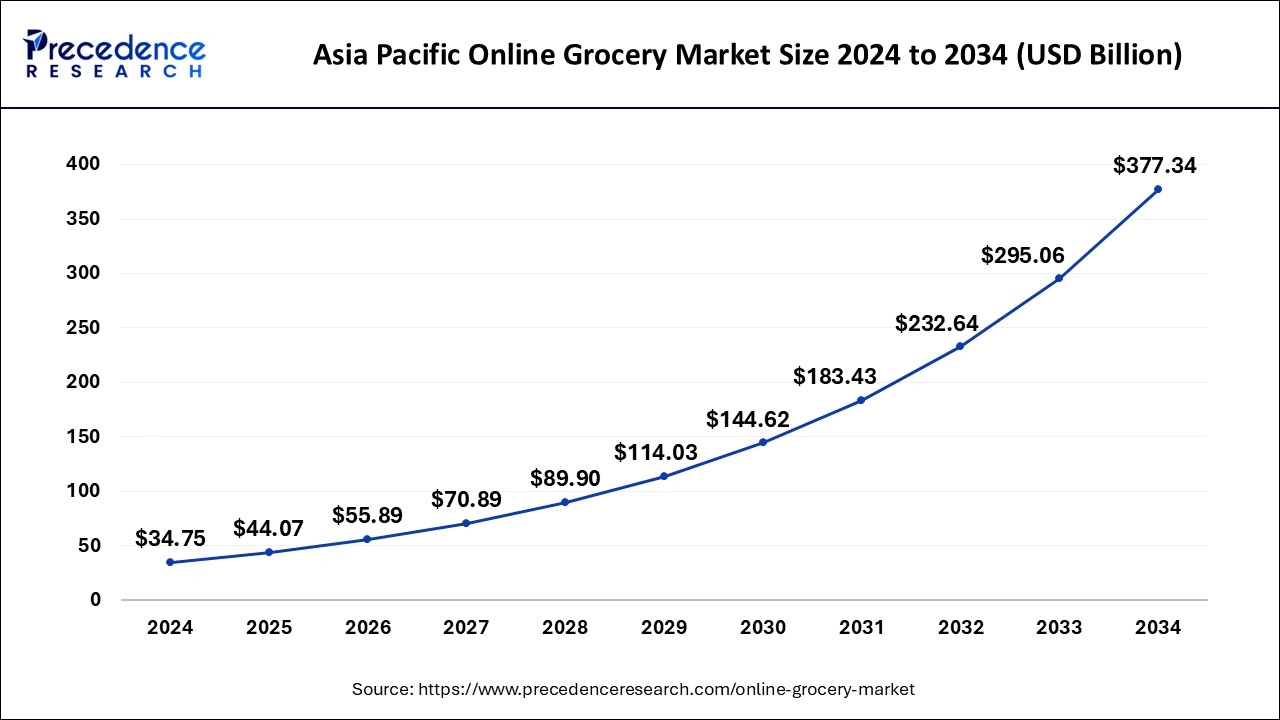

Asia Pacific Online Grocery Market Size and Growth 2026 to 2035

The Asia Pacific online grocery market size is evaluated at USD 44.07 billion in2025 and is predicted to be worth around USD 446.38 billion by 2035, rising at a CAGR of 26.05% from 2026 to 2035

Asia Pacific dominated the global online grocery market with the largest market share of 60% in 2025.North America is forecasted to rise during the forecast period. Apart from these nations, India and China are considered to be very high potential markets for the platform. Due to digitization in India and China, which are Asia Pacific markets are expected to have a growth. The coronavirus lockdown had helped in a significant rise in online grocery sales in these regions.

The various government initiatives that are aimed at digitally empowering these nations, this market is expected to grow during the forecast. US is witnessing a steady growth in this platform. Several key players, Walmart Amazon.com Inc, Instacart etc. are all from North America.

- In 2024, Instacart announced a strategic partnership with Kroger to expand their AI-powered fulfillment centers across the U.S., aimed at reducing delivery times and improving inventory management in online grocery logistics.

Latin America Online Grocery Market Trends:

The online grocery sector in Latin America is experiencing growth due to several factors, such as the increasing availability of the Internet (broadband services), increases in the number of the middle class, and growing consumer confidence in the Internet for making payments. The demand for app-based grocery delivery is growing in cities in Brazil, Mexico, and Chile.

Europe Online Grocery Market Trends:

Europe has an established and rapidly changing online grocery market. The demand for sustainable food and highly efficient supply chains continues to shape the online grocery market in Europe. The United Kingdom, Germany, and France are the leading adopters of the "click-and-collect" and rapid-delivery service models. Many consumers in these countries prefer buying premium quality products, private label products, and environmentally friendly packaging for their grocery orders.

The presence of efficiently operating cold chain supply chain companies with large-scale inventory management systems also increases efficiency. The increase in government regulations regarding food safety, product quality and competition among digital businesses are also contributing to innovation and increasing the position of Europe in the global online grocery industry.

Value Chain Analysis

- Research, Design, Product Development: Development of digital platforms, sourcing strategies, and product assortment that together meet consumer demand efficiently.

Key Players: Instacart, My Cloud Grocer, and Shopify - Inbound Logistics: Procurement and management of goods from farms, wholesalers, and manufacturers for the timely supply of quality.

Key Players: BigBasket and Walmart - Operations: Inventory control, order processing, warehouse management, and order fulfillment with the smooth implementation.

Key Players: Amazon Fresh, Instacart, and BigBasket - Outbound Logistics: Order dispatch with route optimization for last-mile delivery and faster service.

Key Players: Amazon and Walmart, Delhivery, Blue Dart - Marketing and Sales: Promotion to increase brand visibility with discount offers and analytics that attract online shoppers and retain them.

Key Players: Amazon, Flipkart, JioMart, and Zepto - Service and Support: After-sales support, including handling product returns and keeping customers satisfied through responsive communication.

Key Players: Instacart and Walmart

Online Grocery Market Companies

- Amazon.com, Inc.

- Walmart Inc.

- FreshDirect LLC.

- Target Corporation

- Instacart

- Safeway Inc.

- Edeka group

- Tesco PLC.

- Alibaba Group

- Grofers India Private limited

- Avenue Supermarkets limited

Recent Developments

- In August 2025, Amazon.com now offers customers in over 1,000 cities and towns the option to order fresh groceries with Same-Day Delivery, with plans to expand to over 2,300 by year-end. This marks a significant grocery expansion for Amazon, introducing thousands of perishable food items.

- In May 2025, Pingo Doce, a Portuguese supermarket chain, launched its own online grocery platform, Pingo Doce Online, in Lisbon and Porto, following a seven-year partnership with Glovo's Mercadão. · https://www.esmmagazine.com/technology/pingo-doce-launches-its-own-online-grocery-platform-288648

- In April 2025, South Korean retailer Lotte introduced Lotte-Mart Zetta, its latest online grocery app powered by the Ocado Smart Platform (OSP). This launch reflects continued collaboration between Ocado Group and Lotte, initiated in November 2022. Ocado's OSP provides a comprehensive e-commerce, fulfilment, and logistics solution tailored for online grocery operations. According to Lotte Mart and Super CEO Kang Sung-hyun: “By merging Lotte Mart's strength in groceries with Ocado's advanced technology, we aim to become a leading brand in the local online food market and dominate both online and offline grocery sectors.”

- In May 2025, Coop Alleanza 3.0, a major Italian retail cooperative, introduced a new, sophisticated e-commerce platform designed to elevate customers' digital shopping journey. Found at [www.easycoop.com](http://www.easycoop.com), this portal offers greater flexibility, especially at checkout, allowing shoppers to choose a specific delivery day and time slot. As a value-add, customers receive a text alert shortly before delivery with the driver's name and ID code. Developed and financed by Digitail, a Coop Alleanza 3.0 subsidiary, the service is currently active in Greater Rome but is set to expand across Italy.

- In November 2024, Jiva Technologies, a pioneer in wellness-focused digital ecosystems and physical spaces, announced the debut of wegotgroceries.com through a joint venture with We Got Groceries. Now live, the site features a curated selection of health and wellness food products. It is integrated with U.S.-based distribution centers to enable fast delivery of shelf-stable, chilled, and frozen items. Net profits are evenly divided between the partners. Targeting a segment of the USD 554.04 billion global health and wellness food market\*, JIVA plans to use its tech capabilities and SEO-driven approach to scale reach and conversions.

Segments Covered in the Report

By Product

- Fresh produce

- Breakfast and dairy

- Snacks and beverages

- Staples and cooking essentials

- Poultry and meat

- Others

By Delivery

- Home delivery

- Click and collect

By Purchasers

- One time customers

- Subscribers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting