What is the Mobility as a Service Market Size?

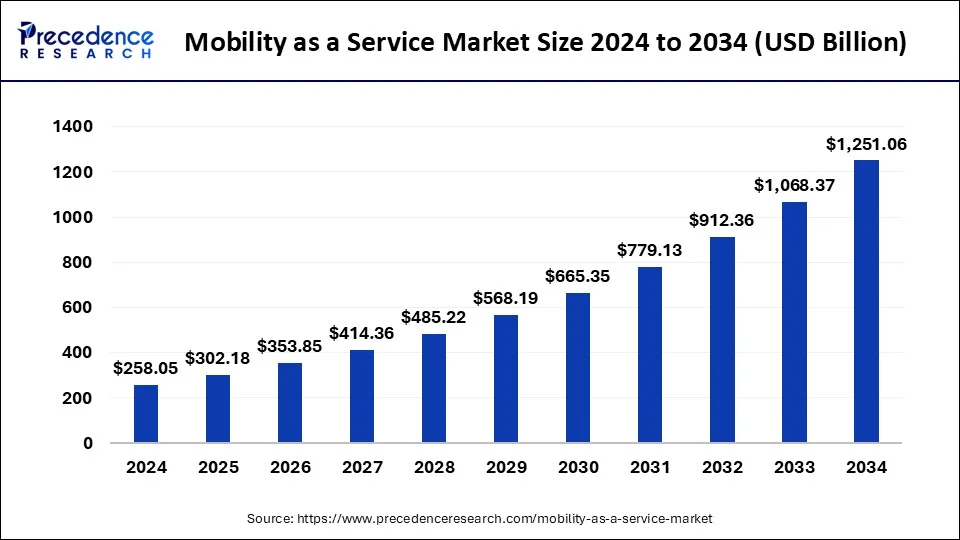

The global mobility as a service market size is estimated at USD 302.18 billion in 2025 and is predicted to increase from USD 353.85 billion in 2026 to approximately USD 1415.96 billion by 2035, expanding at a CAGR of 16.70% from 2026 to 2035.

Market Highlights

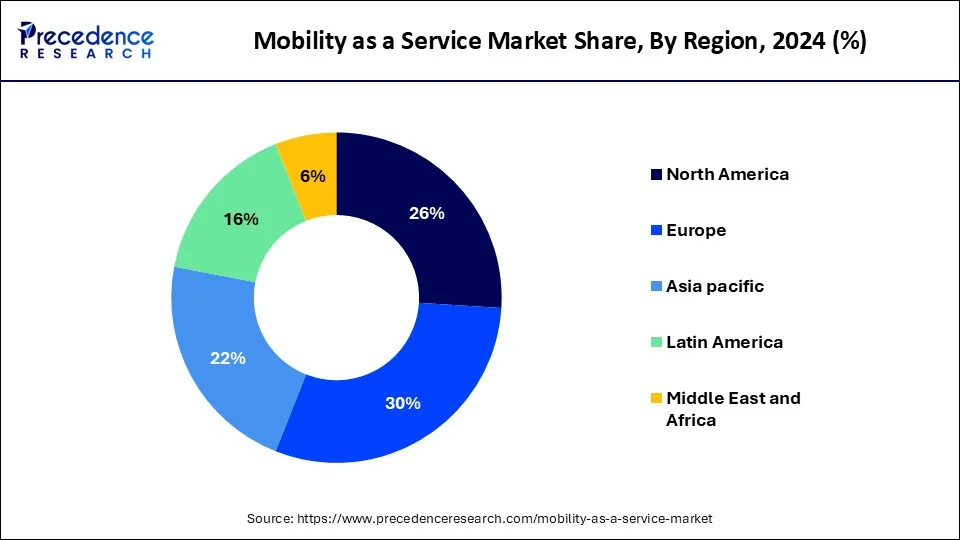

- Asia Pacific mobility as a service market size was valued at USD 302.78 billion in 2025.

- Europe accounted highest revenue share of over 30% in 2025.

- By vehicle type, the passenger car segment accounted revenue share of over 34.5% in 2025.

Market Size and Forecast

- Market Size in 2025: USD 302.18 Billion

- Market Size in 2026: USD 353.85 Billion

- Forecasted Market Size by 2035: USD 1415.96 Billion

- CAGR (2026-2035): 16.70%

- Largest Market in 2025: Asia Pacific

- Fastest Growing Market: Europe

Market Overview

Mobility the word itself defines movement it includes various modes of transportation and improving the mobility services with the adapting technology with emerging developed countries across various regions. Due to increasing population increased demands for the mobility services which includes ride sharing, car sharing, bike commuting, public transport, trains are in demand. There is a wide growth of the mobility as a service during the forecast period. Focusing on development of the smart cities with low emission of carbon dioxide and decreased pollution in the region. Mobility such as Ola, uber, zip car and many more helped the mobility service to boost the market.

Developed manufacturing and technologies with the increased demands from the consumer have enhanced the mobility service market. Service mobility has gained the trust of customers over developed technology which provide effective and safe journey securely with in the time. Mobility service market with various developments of transport ride sharing, bike sharing, car sharing is estimated to grow and boost the market during the forecast period. The continues demand of the mobility service from the consumer in the emerging developed region have derived the market high.

Mobility as a Service Market Growth Factors

- Rising penetration of smartphones and smooth internet connectivity make booking, navigation, and payment processes seamless, thus promoting the adoption of MaaS.

- Urbanization and traffic congestion are driving demand for integrated mobility solutions that reduce travel delays and increase convenience.

- Environmental awareness motivates users to go for shared eco-friendly transport modes that help cut down on emissions and pollution.

- The expected extension of MaaS ecosystems is backed by the governments and private players investing in infrastructure, smart traffic management, and partnerships.

- Continuous provider innovations in areas such as bundled travel packages, subscriptions, and user experience are responsible for increased consumer trust and expansion of the market.

Market Outlook

- Industry Growth Overview: The mobility as a service market is poised for rapid growth between 2025 and 2034. This is mainly due to the integration of multiple transportation modes into unified, app-based platforms, enhancing convenience, efficiency, and sustainability for urban commuters. Providers of mobility are shifting from asset ownership to service-based models, driving market growth. Moreover, collaboration among transport operators, technology firms, and governments contributes to market expansion.

- Major Investors: Major investors in the MaaS space include technology companies, automotive manufacturers, mobility startups, and venture capital firms. Their investments are largely focused on digital platforms, shared mobility services, and data-driven transport solutions. In addition, the public sector is providing funding for MaaS pilots and smart mobility projects. Strategic investments are directed toward scaling integrated mobility ecosystems.

- Global Expansion: The market is expanding worldwide, driven by urbanization, smart city development, and digital connectivity. To enter a new region, companies typically partner with local transportation authorities. Standardization and open mobility platforms are the main enablers of cross-border scalability. The need for congestion relief and accessibility solutions has led to rapid adoption of MaaS in emerging economies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 302.18 Billion |

| Market Size in 2026 | USD 353.85 Billion |

| Market Size by 2035 | USD 1415.96 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 17.10% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Solution Type, Transportation Type, Vehicle Type, Application, Operating System, Business Model, Propulsion Type, Mode, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Government Support -Support from the various governments across the regions with developing and introducing passenger vehicles and electric passenger vehicles for example buses have improved the transportation modes and developing infrastructure of charging station forelectric vehiclesand investing providence. Which help to boost the market growth high.

- Increased Transportation-Increased modes of transportation for example bike sharing, car sharing, ride sharing, bike commuting, trains, and passenger vehicles. Such as Ola, uber, zip car and many more wireless connections with improved technology of internet connectivity 5G and 4G LTE connection with high internet speed and wireless communication with the driver over telecom with the usage of smart phones have increased market of mobility as a service.

- Increased solution-Increased modes of transportation with improved solution such as traffic management, parking management, mobility management, less emission which led to green city and developed smart city, reduced costing, decreased accidents have increased the market rate.

Key Market Challenges

- Wireless connections- Mobility service involves connecting through wireless connection to the driver with the internet connectivity of 5G and 4G LTE connection with high speed internet over the smart phones. But the lack of connectivity may led to problem to connect for the mobility may led to decrease the market growth. Wi-Fi can led to improve the mobility as a service market growth.

- Providence- Mobility as a service market need the support from the government for developing infrastructure, telecom facilities to improve the growth in the market with developed technologies.

- Lack of knowledge- Lack of awareness among the people in the underdeveloped regions of the available mobility as as a service management in the region with the lack of knowledge of smart phones among the people may affect the market due to decreased demand can hamper the growth of mobility as a service market.

Key Market Opportunities

- Mobility as a service management with increased opportunities with developed technologies of the mobility services across the regions with improved urbanization and improved revenue share boosted the mobility service market to grow high

- Increased cyber security connecting through customers over Internet of thing involves performance over clouding with improved safety and measurements to perform various functions without interruption of connectivity. Transmitting data from one user to another user with the clouding system and improved technology for transmitting information through the smart devices to connect the people.

Segments Insights

Application Insights

B2C dominates MaaS, as consumers consider convenience above car ownership. Via MaaS platforms, any kind of transport service can be called by the individual, without having to worry about parking or maintenance. This urbanization and smartphone-driven lifestyle grind increases demand; hence, B2C solutions serve to supply unimpeded, accessible, cost-effective mobility solutions right from the street to the end-user across cities.

B2B is the fastest-growing application segment as corporates seek streamlined mobility solutions for workforce productivity. MaaS platforms enable employees to commute efficiently amid multi-modal transport while traveling for business. As B2B MaaS reduces administrative overhead and cost optimization, it facilitates the smooth functioning of organizations and increases employee satisfaction and hence will gain momentum in the corporate and institutional sectors worldwide.

End User Insights

This sector is the dominating force in the MaaS market, with automobile manufacturers adapting to the shifting demands of consumers toward sharing rather than ownership. Automation offers integrated mobility services, including ride-share, rental, and micro-mobility, giving it a double advantage: expansion with the service delivery and diversification of the undertaking to secure its standing in the long term and to capture new streams of revenue within the evolution of the mobility ecosystem.

The government is the fastest-growing segment among the end users that use MaaS to enhance urban transport infrastructure and citizen mobility. Governments partner with MaaS providers to establish integrated platforms that make public transit easier to use while also being inclusive and sustainable. Customized solutions such as those supporting citizens with disabilities make MaaS a strategic instrument of improving the quality of life in urban spaces.

Solution Insights

Application technology solutions dominate the MaaS market as they form the backbone of integration between transport modes. By building on the principles of APIs, cloud platforms, and secure data management, these solutions allow for a seamless user experience. The solutions allow real-time navigation, booking, and communication between providers, thereby strengthening the capabilities of and scaling MaaS ecosystems.

The fastest-growing segment of payment solutions has been made possible by in-app, multi-currency, and bundle payment options. Users experience transactions that neither require switching of apps nor distract them in any sense for service on demand, alike for subscription-based services, thereby amping up customer satisfaction, assisting international travelers, and further supporting the rise of MaaS through conducive travel packages, which translate into systems that are deemed worthy and satisfying.

Transportation Type Insights

It is public transport that first makes its entry into the MaaS market, as it is the backbone of urban mobility. Hence, MaaS platforms improve the public transport experience by facilitating access, schedule integration, and multi-modal connectivity; hence, route optimization based on demand and ticketing help enhance ridership, while cost-effectiveness ensures it remains an affordable choice for the masses and thereby bestows the public transport with the most integral component of MaaS solutions.

On the other side, private transport is the fastest-growing segment as the MaaS platforms continue to push the personalized on-demand booking options. Private mobility is preferred for convenience, flexibility, and also for servicing routes that public transit does not adequately cover. The segment is particularly attractive to younger demographics seeking a premium experience and travelers with specific requirements, thereby consolidating the rising share of private transport in the MaaS ecosystem.

Propulsion Type Insights

Transportation by ICE-type vehicles dominates the MaaS market due to their sheer availability at cheap rates, and their super-flexible to demand. They are the glue in regions where infrastructure limitations and the high cost of EVs make electric vehicles a deserted group. By maintaining mixed fleets, MaaS providers guarantee the reliability and accessibility needed, the ICE vehicle would then be a vital link in mobility solutions across the globe.

Electric vehicles constitute the fastest-growing propulsion type for MaaS due to the great global thrust toward sustainability. The incorporation of EVs in the fleets has become increasingly attractive, as such users bristle at polluting transport and look to lessen operational costs down the line with cheaper fuel and maintenance expenses. A MaaS platform that features EVs, therefore bumps itself to one that is responsible and cutting-edge, and, importantly, supports the regulatory objectives along with consumer preference for green transport.

Payment Type Insights

By definition, demand payment is the esteemed one within the MaaS environment, for it aligns well with user expectations of flexibility and convenience. The on-demand method caters efficiently to a fast-paced urban lifestyle by allowing an immediate response to their ride-hailing, bike-sharing, and micro-mobility needs. Smartphone integration allows the easy use of applications for transacting factor that has contributed immensely to user loyalty and, consequently, validating on-demand payments as the prime commercial option in the MaaS ecosystem.

The subscription mode of payments enjoys tremendous pace in growth as users prefer predictability in costs while streamlining access to various modes of transport. With this, there are monthly packs that include a myriad of services-from transit passes to ride-share and rentals-that go a step down in the pricing and simplification for end-users. This way, it retains its customer base and keeps a steady income stream for providers, justifying subscription's further endeavor for growth in the MaaS world.

Operating System Insights

Android dominates the Maas operating system landscape due to its extensive adoption and affordability, especially in emerging economies. Programs underlying the MaaS for Android offer a highly user-oriented experience in smooth integration with high accessibility. The broad reach of Android enables scalability and widespread acceptance that characterize it as the platform preferred by all mobility service providers throughout the world.

The fastest-growing operating system segment for MaaS, iOS is driven by its premium end-user base and the character of seamless integration across Apple devices. Intuitive design of the MaaS apps for iOS enhances travel planning, booking, and payment, making it appealing to users who highly value convenience and quality. Growing acceptance strengthens iOS' role in forging the future of urban mobility.

Regional Insights

Europe Mobility as a Service Market Size and Growth 2026 to 2035

The Europe mobility as a service market size is evaluated at USD 90.65 billion in 2025 and is predicted to be worth around USD 433.12 billion by 2035, rising at a CAGR of 16.93% from 2026 to 2035.

What Made Europe the Dominant Region in the Mobility as a Service Market?

Europe dominated the market with the largest revenue share in 2024. This is mainly due to its strong emphasis on sustainability and the integration of public transportation. To reduce carbon emissions, cities are actively promoting multimodal travel. Regulatory frameworks are in place to support data sharing and interoperability among mobility providers. More MaaS platforms are integrated with smart city initiatives. High public transportation usage provides a strong foundation for MaaS implementation. Europe remains at the forefront of integrated mobility planning and setting standards for the rest of the world.

At the country level, Finland is a leader in implementing MaaS with well-grounded multimodal platforms. Germany integrates rail, shared mobility, and urban transport networks. France supports MaaS development through urban sustainability and emission-reduction policies. The UK guides the expansion of MaaS through digital transport initiatives. Growth at the country level is largely driven by policy alignment and advanced urban planning.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is the fastest-growing region in the mobility as a service market due to rapid urbanization and increasing traffic congestion, which create strong demand for efficient and integrated transportation solutions. The widespread adoption of smartphones and digital payment systems facilitates seamless access to multi-modal mobility platforms. Additionally, supportive government initiatives and investments in smart city infrastructure are accelerating the deployment of MaaS solutions across the region.

China, Japan, and India are key major players in the market in Asia Pacific, each leveraging technology and infrastructure to enhance urban transportation. China is expanding smart mobility platforms and integrating ride-hailing, public transit, and bike-sharing services to manage growing urban traffic. Japan focuses on advanced digital transport solutions and efficient public transit integration, while India is rapidly adopting app-based multi-modal mobility services to improve last-mile connectivity and reduce congestion in its major cities.

What Potentiates the Market in the Middle East & Africa?

The mobility as a service market in the Middle East & Africa is growing as cities upgrade their transportation infrastructure. Investments in smart cities are enabling the development of integrated mobility platforms. There is a rapid expansion of ride-hailing and shared mobility services. Governments are introducing digital mobility solutions to ease traffic and make the city more efficient. The growth of public transportation is opening the door to MaaS integration. The region shows strong potential for long-term growth.

At the country level, the UAE is at the forefront of adopting MaaS through smart mobility initiatives in major cities. Saudi Arabia is creating a digitally driven transportation ecosystem that aligns fully with urban transformation goals. South Africa is researching the best way to implement MaaS to increase urban accessibility. Developing African cities are shifting toward mobile-based shared mobility models. Progress at the country level reflects infrastructure development and digital readiness.

Mobility as a Service Market Companies

- Lyft, Inc.

- Moovit, Inc.

- Uber Technologies, Inc

- Communauto, Inc

- Citymapper, Ltd

- MaaS Gobal Oy

- uBIgO Innovation AB

- SkedGo Pty, Ltd.

- Moovel Group GmbH

Recent Developments

- In July 2025, Bengaluru launched its first-ever Mobility-as-a-Service (MaaS) applications, Tummoc and Namma Yatri, as part of the Enroute Open Data Startup Challenge, led by Mercedes-Benz Research and Development India.

- In June 2025, Tesla's robotaxi launch in Austin, Texas, represents a significant shift in the mobility-as-a-service (MaaS) market, showcasing its unique approach to cost efficiency and AI strategy.

Segments covered in the Report

By Service Type

- Ride Hailing

- Car Sharing

- Micromobility

- Bus Sharing

- Train Services

By Solution Type

- Technology Platforms

- Payment Engines

- Navigation Solutions

- Telecom Connectivity Providers

- Ticketing Solutions

- Insurance Services

By Transportation Type

- Public

- Private

By Vehicle Type

- Micromobility

- Four-wheelers

- Buses

- Trains

By Application

- Personalized Application Services

- Journey Management

- Journey Planning

- Flexible Payments & Transactions

By Operating System

- Android

- iOS

- Others (Linux, Symbian OS, Blackberry OS, Windows, and KaiOS)

By Business Model

- Business-to-Business

- Business-to-Consumer

- Peer-to-Peer

By Propulsion Type

- ICE Vehicle

- Electric Vehicle

- Hybrid Electric Vehicle

- CNG/LPG Vehicle

By Mode

- Public

- Private

By End User

- Business Developments

- Transport Services

- Academics

- Civil Work

- Hospital Transport Facility

- Municipal Sector

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content