What is the Ride Sharing Market Size?

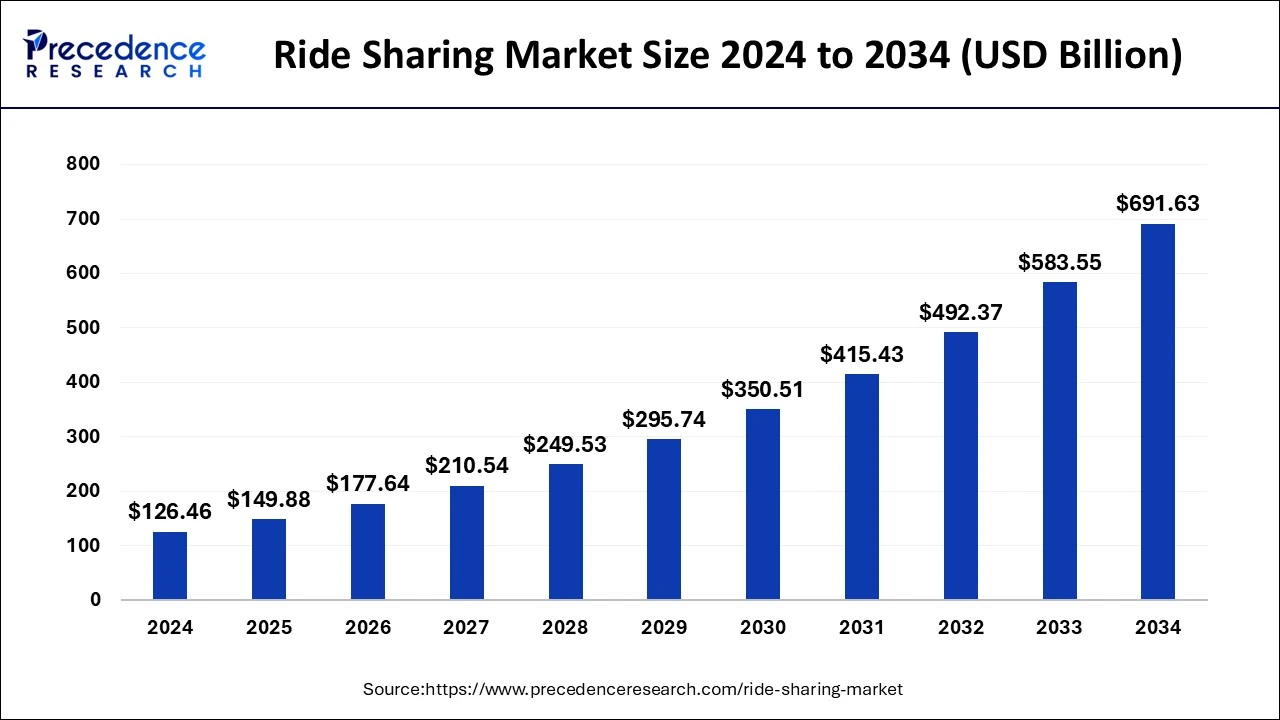

The global ride sharing market size is accounted at USD 149.88 billion in 2025 and predicted to increase from USD 177.64 billion in 2026 to approximately USD 788.44 billion by 2035, representing a CAGR of 18.06% from 2026 to 2035.

Market Highlights

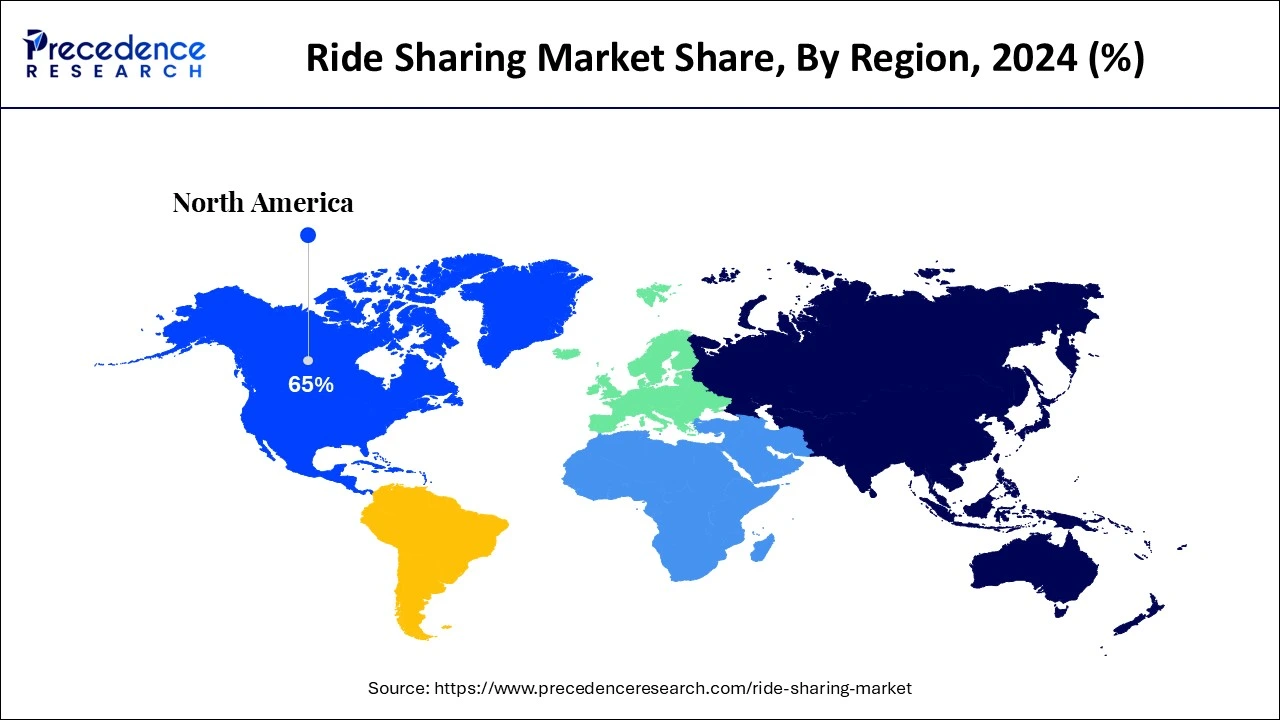

- North America led the global market with the highest market share of 65% in 2025.

- By service type, the e-hailing segment dominated the market in 2025.

- By membership type, the corporate ride sharing segment is anticipated to grow at a remarkable CAGR between 2026 to 2035.

Ride Sharing Market Growth Factors

Rising demand for time-saving and cost-saving trend in the mobility drives the market growth for ride sharing in the coming years. Further, the increasing cost of vehicle ownership along with rising concern for environmental protection is the other major factors that proliferates the market pace. In support to the environmental protection, governments of various regions have mandated the adoption of ride sharing in the country.

Meanwhile, startups in the ride sharing market believe that smartphones along with digital networks are likely to further prosper the market growth of ride sharing in the coming years. Increasing popularity of smartphones and digital networks favors the development of application for booking carpools and other ride sharing services and thus promotes the market growth.

Other than this, increasing commutation time owing to high traffic congestion is the other significant factor that favors the adoption of ride sharing mobility trend across various regions. For instance, average commutation time in Los Angeles is 53.68 minutes. The ride sharing trend is being most popular in highly populated regions such as North America, Europe, and Asia Pacific. French startup, BlaBlaCar has already reached to 40 million members across the globe. In United Kingdom, people more than 500,000 uses Liftshare.

Ride Sharing Market Outlook

- Industry Growth Overview: The ride-sharing market is growing, driven by the increasing adoption of smartphones, urbanization, rising fuel prices, and the need for convenient, cost-effective, and sustainable transportation. The rise in demand for short-distance travel using small vehicles like scooters and bikes

- Global Expansion:The ride-sharing market is experiencing global expansion, as the widespread use of smartphones and mobile internet allows for the easy use of ride-sharing apps for booking, tracking, and cashless payments. North America is dominated in the market by the presence of major companies such as Lyft and Uber.

- Major investors:Major institutional investors in ride-sharing organizations include Vanguard Group, BlackRock, and Capital Research Global Investors, with individual investors like Turqi Alnowaiser also driving significant shares in companies such as Uber

Ride Sharing Market Trends

- E-hailing services offered through digital platforms like mobile applications are becoming a popular opinion among customers.

- Advancements in technologies such as advanced driver assistance systems (ADAS), electric vehicles and GPS trackers are enhancing the efficiency and transparency in ride sharing services.

- Reduced traffic congestion, vehicle trips and carbon emissions with the use of ride-hailing services is contributing in reducing the environmental impact.

- Growing use of peer-to-peer ride-sharing platforms is offering a convenient and cost-effective option for individuals seeking alternatives to owning and maintaining vehicles.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 149.88 Billion |

| Market Size in 2026 | USD 177.64 Billion |

| Market Size by 2035 | USD 788.44 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.06% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Vehicle Type, Membership Type and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Segmental Insights

Service Type Insights

e-hailing anticipated to grow as the largest revenue contributor during the analysis timeframe owing to increasing demand for e-hailing services because of increasing traffic congestion, ease of booking, and higher level of comfort to the passengers. In addition, increasing government initiatives to create awareness among public regarding the rapid rise in the air pollution propels the demand for e-hailing market. Further, several e-hailing providers are entering in the established ride sharing market in order to expand their offerings. For instance, DIDI, a China-based ride-hailing service provider has relaunched its carpool service to stay competitive in the global market.

Membership Type Insights

The market is segmented into fixed ridesharing, corporate ridesharing and dynamic ridesharing.

The corporate ride sharing segment is expected to be the fastest growing segment during the forthcoming years because of rising subscription from multinational companies to avail the ride sharing services for the commutation of their employees. Increasing industrialization and shifting of information technology company's bases to the Asia Pacific region likely to accelerate the market pace for the adoption of ride sharing services in the region. In addition, the corporate ride sharing services offer lucrative opportunity for the market vendor to proliferate in the coming years.

Regional Insights

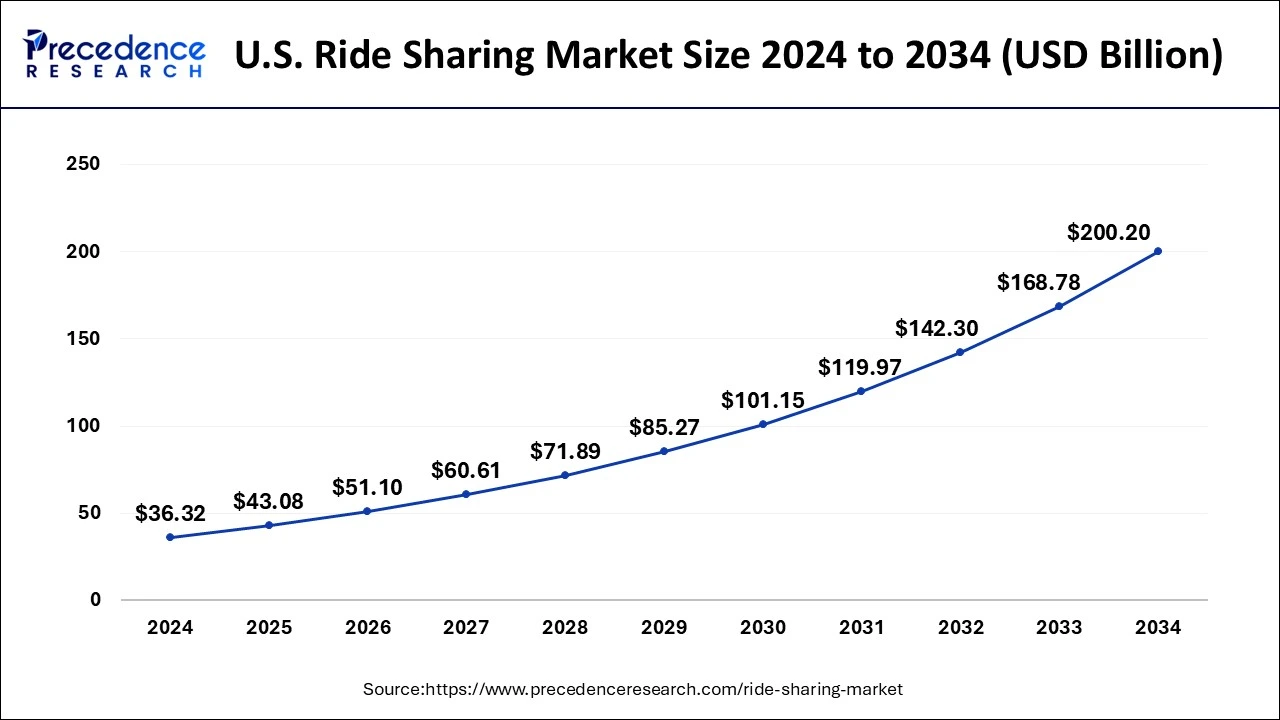

The U.S. ride sharing market size is exhibited at USD 43.08 billion in 2025 and is projected to be worth around USD 228.32 billion by 2035, growing at a CAGR of 18.15% from 2026 to 2035

Increasing urbanisation

The U.S. boasts a sophisticated technological infrastructure, characterized by extensive smartphone and internet access, which is vital for app-based ride-sharing operations. As more people move to urban areas, traffic congestion rises, increasing the demand for efficient, on-demand transportation solutions needs that ride-sharing services are well-equipped to address.

North America is the major revenue share holder in the global ride sharing market because of technology advancement in the region as well as a leading innovator across the world. Further, the region being an early adopter to new technologies promotes the entrance of new market players, this in turn triggers the competition in the region. In addition, the government of United States favors ride sharing in order to reduce the traffic congestion as well as to control the rapidly rising air pollution in the country. Based on the data released by the Environmental Assessment Agency, the United States is the second highest CO2 emitting country after China. Hence, the risk for increasing pollution is much higher in the country, thus government supports the ride sharing mobility trend in order to reduce the traffic on road and in turn the rate of CO2 emissions from the passenger vehicles.

As a result of promoting ride sharing, New York government has replaced 13,000 taxis to 3,000 ride sharing cars. This concludes, that the United States is significantly supporting ride sharing trend in the modern mobility except few cities such as Florida, Texas, Pennsylvania, and a few other cities where bill to legalize ride sharing failed to pass. The demand for ride sharing expected to rise in the region owing to initiatives taken by the both the government as well as the market vendors in order to strengthen their presence in the booming market.

Asia Pacific is a lucrative region anticipated to show strong growth in the ride sharing market. Increased urbanization activities and population density is creating the need for easily accessible, affordable and efficient transportation services which drives the demand for ride-hailing services. Furthermore, growing emergence of local players in the booming market, expansion of ride-hailing services, rising rate of corporate companies, constantly changing customer preferences and favourable government policies are fuelling the market expansion.

- For instance, in May 2025, the Maharashtra government rolled out a new mandate making it compulsory for well-known ride-hailing services such as Uber, Ola and Rapido for compensating customers for driver cancellations under the State Aggregator Cabs Policy 2025.

Supportive government policies

In China, the government has supported the sector with policies promoting ride-sharing as a sustainable transportation option, especially benefiting companies like Didi. Favorable economic conditions and rising costs of private car ownership have also encouraged more people to use ride-sharing alternatives.

Europe is experiencing substantial growth in the market due to major European cities are progressively implementing stringent environmental regulations, like low-emission zones and congestion charges, which inspire the use of shared and electric mobility options. Increasing smartphone penetration, extensive internet connectivity, and the development of advanced mobile applications have made ride-hailing services easily acceptable to a large customer base.

Industry Collaboration and R&D

The UK ride-sharing sector is dominated by factors such as growing urbanization, rising costs of car ownership, and the increasing acceptance of smartphones and digital payments. High expenses related to owning a car, like as insurance, maintenance, fuel, and parking, make ride-sharing a more cost-effective and practical choice for many consumers. The government's commitment to reducing carbon emissions is encouraging the adoption of electric vehicles in ride-sharing armadas.

Value Chain Analysis

- Raw Material

The primary raw materials in the ride-sharing market are those used in the manufacture of the vehicles and the technology infrastructure. These materials include various metals, plastics, minerals, and rubber. - Key Players: BlaBlaCar and Grab

- Chemical Synthesis and Processing

Chemical synthesis and processing are fundamental to the ride-sharing sector, particularly through their application in the manufacture of vehicles, components, and maintenance products. - Key Players:Bolt and Cabify

- Compound Formulation and Blending:

The advancement and use of specialized material compounds and blends, particularly for vehicle components such as tires and plastics, to enhance performance, safety, and sustainability. - Key Players:Uber and Lyft

Top Vendors in the Ride Sharing Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

DIDI Chuxing |

Beijing, China |

Diversified service ecosystem |

DiDi provides solutions including taxi hailing, private car hailing, Hitch, DiDi Chauffeur, DiDi Bus, and Enterprise Solution. |

|

UBER Technologies Inc. |

California |

Powerful network effects and platform strategy |

Expanded to 50 countries, providing monitored accounts for teen drivers. |

|

GETT |

London, United Kingdom |

Time Management/Organization |

Gett is expanding its reach in the US and Canada through the launch of a new, strategic partnership with Lyft. |

|

GRAB |

Germany |

Strong innovation |

In October 2025, Grab Invests in May Mobility to Expand Ride-Hailing Services in Southeast Asia. |

|

ANI Technologies Pvt. Ltd. |

Singapore |

Strong Brand Recognition |

ANI Technologies operates the mobility platform Ola, offering various ride-hailing and ride-sharing services |

Ride Sharing Market Comapnies

- INTEL

- BLABLACAR

- TOMTOM International BV

- Denso Corporation

- APTIV

- WAYMO

- General Motors

- Ford Motor Company

- IBM International

- CABIFY

- CAR2GO

- DAIMLER,

- EASY Taxi

Recent Developments

- In May 2025, Uber Technologies (UBER) signed a deal with Poni AI, the Chinese autonomous vehicle maker, for bringing Pony AI's robotaxis to Uber's platform. The companies aim at launching their collaborative initiative in the Middle East later in 2025 with plans for expansion into other markets in the future.

- In February 2025, Uber Technologies, Inc., an American multinational transportation company, signed a memorandum of understanding with the Assam government for launching a private car rideshare service called Saarthi in Assam at the state's investment summit, Advantage Assam.

- In January 2025, BluSmart, the largest provider of all-electric ride-hailing service in South Asia, launched an eco-friendly travel service in Mumbai with its all-electric fleet covering key routes which include airport rides and rental options, from Goregaon to Bandra with plans to expand its services to other areas of Mumbai later. The initiative offers several features to travellers such as on-time arrivals, no ride cancellations and a CO2 tracker in the app for highlighting the environmental benefits.

Ride Sharing Market Segments Covered in the Report

By Service Type

- E-hailing

- Car Rental

- Car Sharing

- Station-based Mobility

By Membership Type

- Fixed Ridesharing

- Corporate Ridesharing

- Dynamic Ridesharing

By Vehicle Type

- Electric Vehicle Mobility

- CNG/LPG Vehicle

- ICE Vehicle Mobility

- Micro-mobility

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content