Passenger Vehicles Market Size and Forecast 2025 to 2034

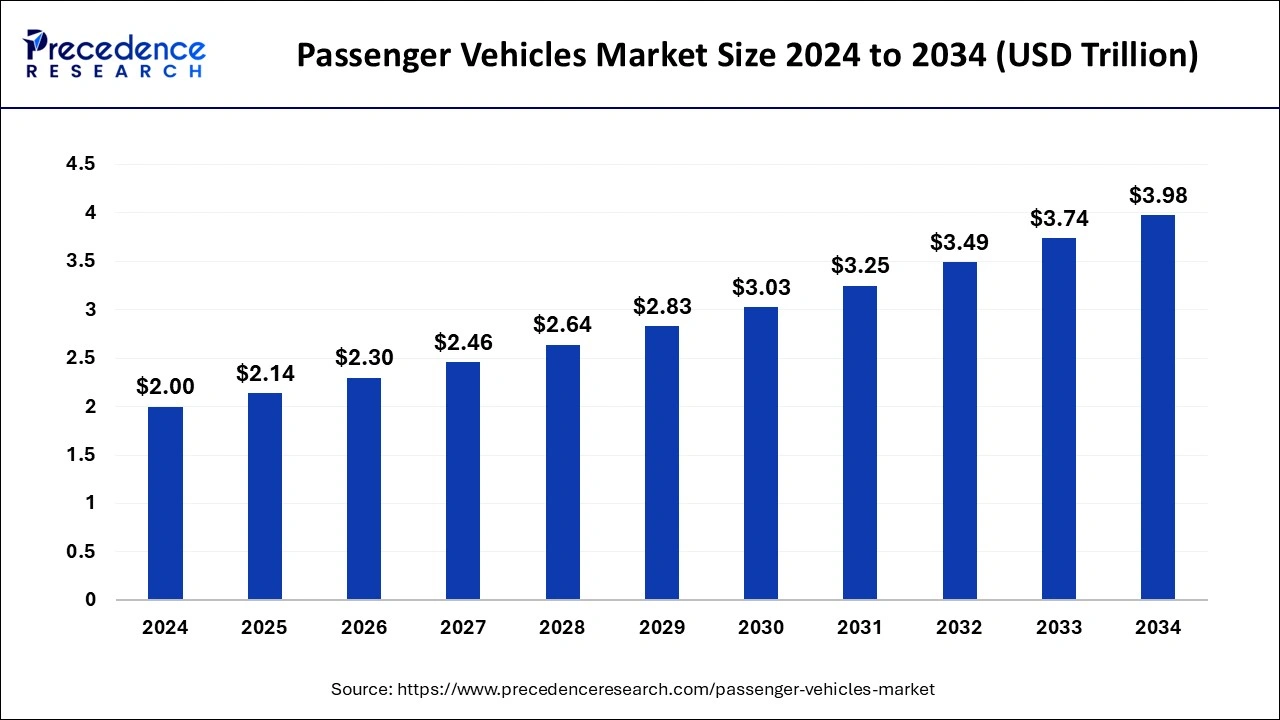

The global passenger vehicles market size was accounted for USD 2 trillion in 2024, and is expected to reach around USD 3.98 trillion by 2034, expanding at a CAGR of 7.12% from 2025 to 2034.

Passenger Vehicles Market Key Takeaways

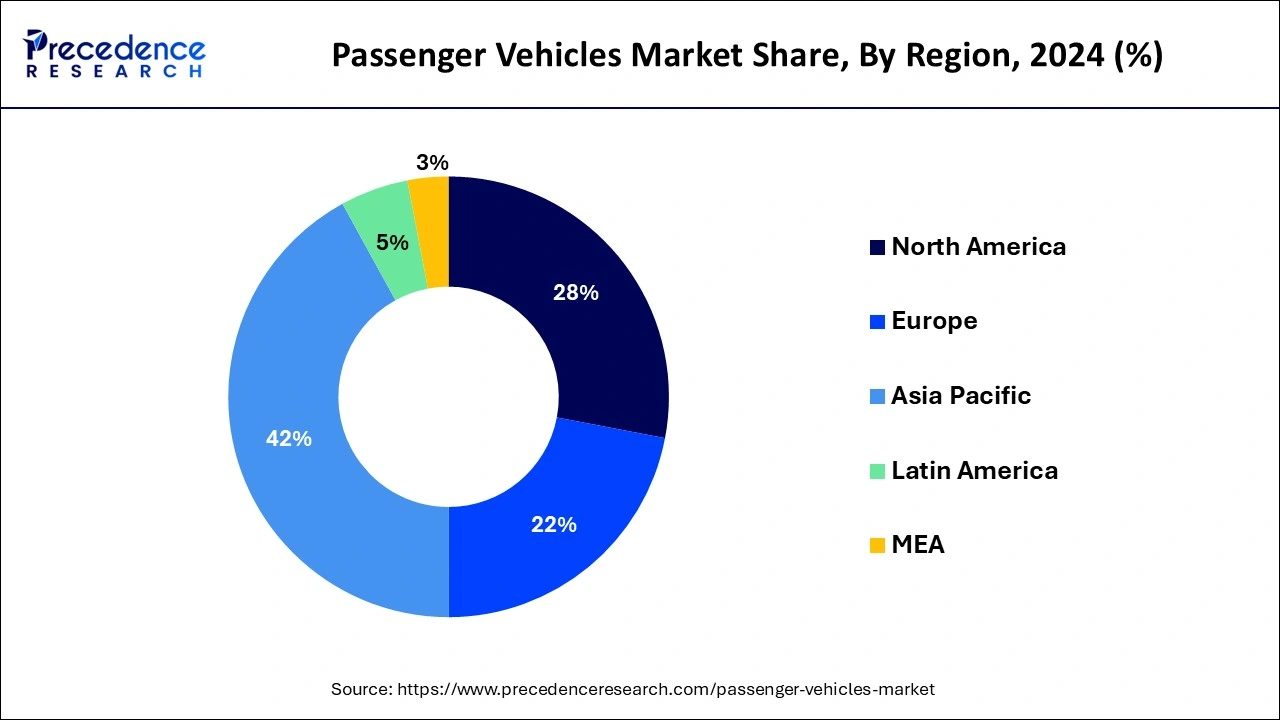

- Asia Pacific led the global market with the highest market share of 42% in 2024.

- Asia-Pacific (APAC) is expected to expand at the fastest CAGR between 2025 and 2034.

- By Application, the electric segment is predicted to dominate the market between 2025 and 2034.

- By Body, the SUV segment is expected to dominate the market between 2025 and 2034.

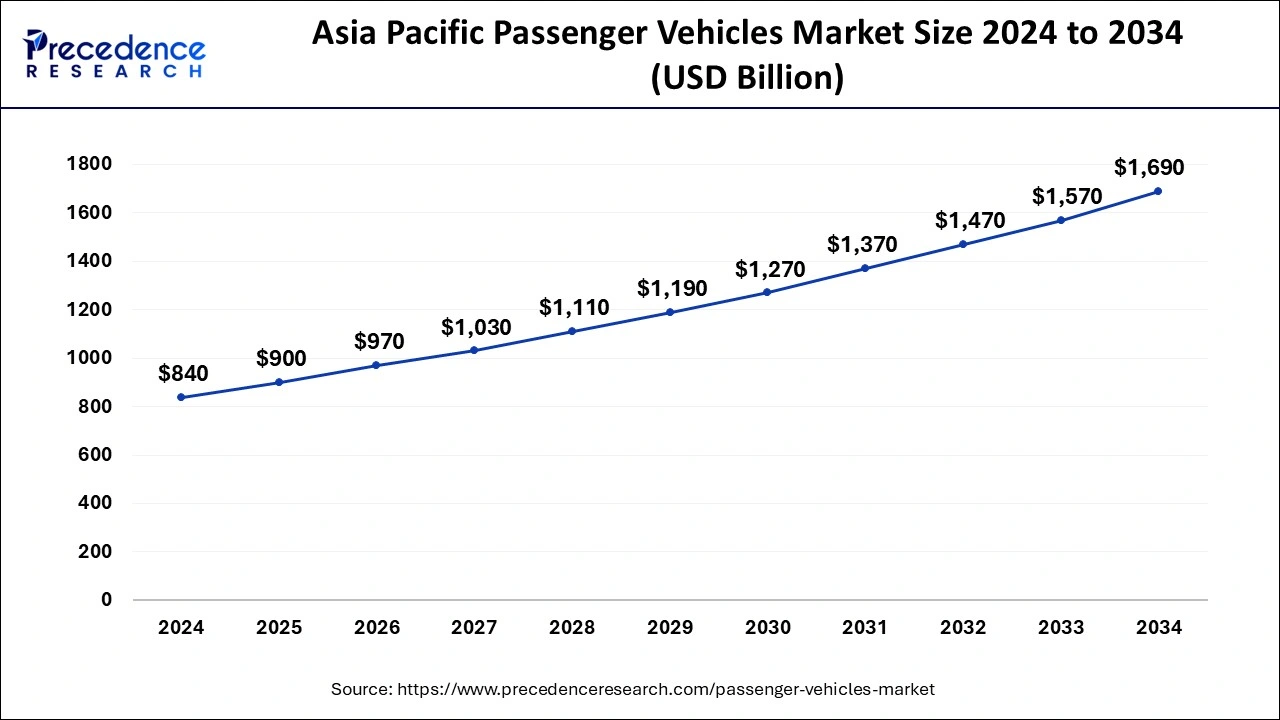

Asia Pacific Passenger Vehicles Market Size and Growth 2025 to 2034

The Asia Pacific passenger vehicles market size was estimated at USD 840 billion in 2024 and is predicted to be worth around USD 1690 billion by 2034, at a CAGR of 7.24% from 2025 to 2034.

The passenger vehicle industry is divided into four geographic segments: North America, Europe, Asia Pacific, and the rest of the globe. The region with the largest market share worldwide is anticipated to grow further as a result of the automotive industry's quick adoption of cutting-edge technologies.

Asia Pacific held the largest market share of 42% in 2024. The major contributors to the global automobile market are both developing and developed nations including India, China, Japan, and South Korea. Additionally, the demand for and sales of passenger automobiles have been rising as a result of the rapid urbanisation of cities in nations like India, China, and the ASEAN nations. Demand for passenger automobiles is rising as consumers' disposable income rises. The second-largest share was registered by the European region. The expansion ofelectric vehicle charging infrastructureis assisting in maintaining the second-largest market share. The passenger automobile market in this region is growing as a result of the presence of significant key players there and the increasing use of cutting-edge technologies. The passenger automobile market is expected to develop moderately in North America.

North America is expected to grow significantly in the passenger vehicles market during the forecast period. The growing demand for the use of comfortable vehicles is increasing the use of passenger vehicles in North America. At the same time, the industries are developing new models, which are attracting the population, increasing their demand. Thus, this promotes the market growth.

U.S.

The industries in the U.S. are developing new passenger vehicles to meet the rising demand of the population. Additionally, the increasing use of electric vehicles is also driving their demand to launch new affordable models. These developments are further supported by various policies by the regulatory bodies as well.

Canada

Due to the growing demand for comfortable, safe passenger vehicles with internet connectivity features in Canada is increasing their development by various companies. At the same time, their development is also supported by the investment provided by different companies, enhancing their manufacturing and production.

Market Overview

In developed nations, passenger vehicles are the most used mode of transportation. A lot of cutting-edge technologies, such as the advanced driver assistance system (ADAS), have been adopted recently. The demand for passenger cars is being fueled by the adoption of electric vehicles. The number of passenger cars is rising in developing nations in tandem with the rise in per capita income. Because a nation's passenger automobile market heavily depends on its present economic situation, the sector suffered during the recession in the US and Europe. In order to keep up production in a weak economy, many passenger car manufacturers, notably General Motors, Ford, and Chrysler have had to apply for sizable loans. One of the major worries in the passenger automobile sector is the increase in raw material prices. Recently, the cost of steel and plastic has increased significantly, which has raised the price of passenger automobiles for consumers. The passenger automobile market heavily relies on R&D, and in order for it to compete, its goods must satisfy real-time consumer demands.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.14 Trillion |

| Market Size by 2034 | USD 3.98 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 7.12% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Body, Application, Fuel Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

High demand for passenger vehicles

The primary factors propelling the market's expansion are the rise in demand for passenger vehicles brought on by the surge in the population of middle-income groups and the rising quality of living in emerging nations. The availability of affordable alternatives in these vehicles is another factor influencing consumer preference for them. The market's demand for passenger vehicles is anticipated to increase as a result of the growing logistics and passenger transportation sectors.

The development of the passenger car sector is significantly influenced by government policies and regulations. In the future years, it is anticipated that these initiatives and norms will both expand and stay the same. Market expansion would be aided by the availability of better prices and more options, as well as by the booming urban population. Additionally, it is projected that increasing disposable income and an increase in population growth will benefit the passenger vehicle industry in the next years. Due to the expanding global popularity of leisure and travel-related activities, there has been a surge in the demand for Special Utility Vehicles (SUVs).

Restraints

Insufficient EV charging station

Over the past ten years, scientific improvements and the mass manufacture of electric vehicle batteries have led to a decrease in the price of EV batteries. As EV batteries are one of the most expensive parts of the car, this has resulted in a fall in the price of EVs. A typical EV battery cost about USD 1,100 per kWh in 2010. However, by 2020, the cost had decreased to around USD 137 per kWh, and by 2021, it had fallen all the way to USD 120. In China's electric vehicle business, these batteries can be purchased for as little as $100 per kWh. This is brought on by the declining costs of making these batteries, the lower cost of cathode materials, increased production, etc. By 2030, the cost of EV batteries is anticipated to drop to around USD 60 per kWh, which would result in a huge decrease in the cost of EVs, making them more affordable than traditional ICE vehicles.

Opportunities

Technological advancements

Market expansion is accelerated by the rise in technological developments, such as the incorporation of all-EV charging station systems with Internet of Things (IoT) and real-time information solutions. The technologies find nearby charging stations and offer real-time data on the number of open places. The market's expansion is accelerated by the rise in demand for heavy and upscale vehicles as well as an increase in cars powered by diesel engines. Additionally, a rise in passenger car sales brought on by consumer desire for affordable vehicles aids in market expansion. Moreover, the market for passenger automobiles benefits from the expansion of the automotive industry, a rise in investments, and rising disposable income.

Fuel Type Insights

the global passenger car market is segmented into petrol, diesel, hybrid, and electric. The electric segment is estimated to dominate the market during the study period. In integration with the private sector and in cooperation with related government agencies, Saudi Arabia's Ministry of Energy disclosed the regulations for the rollout of electric vehicle charging stations in the country in August 2022. The development of charging infrastructure in numerous countries is fuelling the demand for passenger electric vehicles. As of July 2022, 40% of all new passenger vehicles registered in the European Union (EU) were running on petrol, while diesel accounted for 19.6% of total registrations. By July 2022, 18% of new passenger vehicles in the European Union were electrically-chargeable (9.1% battery electric and 8.9% plug-in hybrids), while hybrids accounted for 19.6% of total vehicle sales. Petrol and diesel-powered vehicles are anticipated to be replaced with hybrid and electric vehicles in the coming years.

Type Insights

The passenger market is segmented into hatchbacks, sedan, compact SUV, and SUVs. The compact-SUV segment is anticipated to dominate the market during the forecast period. Powerful engines and high ground clearance are the crucial factors that are supporting the compact-SUV segment over the forecast period. According to International Energy Agency (IEA), global SUV sales grew considerably by over 10% between 2020 and 2021, accounting for over 45% of all new vehicle sales globally. The demand for electric SUVs is growing significantly in Canada. The Hyundai Kona electric, Canada's first subcompact electric SUV was launched in 2021. Owing to an outstanding all-electric range of up to 415 km, this compact SUV is proposed to be a preferred choice for both longer adventures as well as daily commutes.

Passenger Vehicles Market Companies

- Ford Motor Company (US)

- General Motors (US)

- AUDI AG (Germany)

- Kia Motors Corporation (South Korea)

- Groupe Renault (France)

- Groupe PSA (France)

- SAIC Motor Corporation Limited (China)

- Tesla (US)

- Daimler AG (Germany)

- BMW AG (Germany)

- Hyundai Motor Company (South Korea)

- BYD Company Ltd. (China)

- Continental AG (Germany)

- TOYOTA MOTOR CORPORATION (Japan)

- Nissan Motor Co., LTD. (Japan)

- Volkswagen AG (Germany)

- AB Volvo (Sweden)

- Honda Motor Co., Ltd. (Japan)

Recent Developments

- In June 2025, an application portal was launched for the Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI) by the Ministry of Heavy Industries (MHI). To increase the proposals from various renowned companies and enhance the electric vehicle (EV) manufacturing ecosystem of India by increasing the investments will be the aim of this scheme.

(Source:https://www.msn.com)

- In June 2025, an agreement was signed by Francisco Motors (FMC), which is a 100% Filipino-owned company, to export its electric passenger vehicles, including hydrogen-powered tricycles and e-jeepneys, to Nigeria, which in turn was a milestone achievement in the green technology export ambitions of the country. Moreover, to introduce affordable, clean, and efficient electric vehicles that can overcome the Nigerian environmental challenges, along with urban mobility, will be the main goal of this collaboration between the Honorary Philippine Consul in Lagos and Nigerian entrepreneur, Emmanuel Akpakwu, MFR.

(Source: https://www.msn.com)

- In December 2022, the Honourable Steven Guilbeault, Minister of Environment and Climate Change announced that the Canadian Government has proposed regulations that lay down zero-emission vehicle (ZEV) sales targets for importers and manufacturers of new SUVs, passenger cars, and pickup trucks. As per these regulations, at least 20% of new vehicles sold in Canada will be zero emission by 2026, at least 60% by 2030, and 100% by 2035.

- In October 2022, BYD Auto Co., Ltd. announced its debut in the Indian passenger vehicle segment by launching Atto 3, an electric sport-utility vehicle (SUV). BYD Auto Co., Ltd. reported that they delivered 340 units of Atto 3 electric sport-utility vehicles in January 2023. With existing 24 dealership showrooms with partners across India, the world's top electric vehicle producer has set an aim of selling 15,000 electric SUVs in India and further targets to capture 40% of India's EV market by 2030.

- In January 2023, Mercedes-Benz reported that it sold 2.05 million passenger cars in 2022. As per Mercedes, the sale of battery-electric vehicles (BEVs) was more than doubled, to 117,800 units in 2022. The highest rise in passenger cars sales for Mercedes-Benz over the year was registered in the U.S. at 4%, while Europe experienced an increase of 1%.

- In February 2023, as per the data published by the China Passenger Car Association, Tesla sold 66,051 China-made electric vehicles (EVs) in January 2023. This was an 18% rise as compared to December 2022, when the US electric vehicle manufacturer sold 55,796 China-made vehicles.

Segments Covered in the Report

By Type

- Compact

- Midsize

- Premium

- Luxury

- Others

By Body

- MPV

- SUV

- Hatchback

- Sedan

- Others

By Application

- Personal

- Commercial

- Electric

By Fuel Type

- Petrol

- Diesel

- CNG

- EV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting