What is the Passenger Vehicle ADAS Market Size?

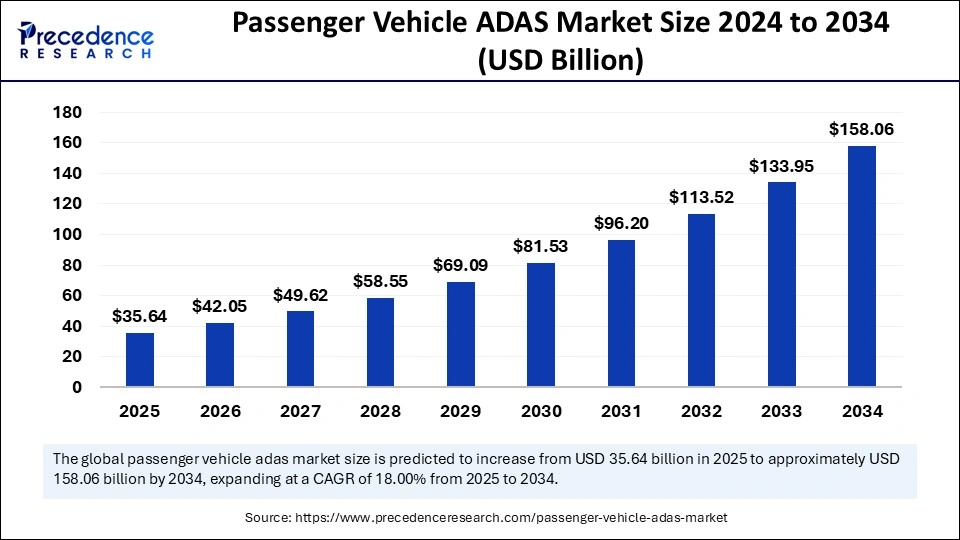

The global passenger vehicle ADAS market size is calculated at USD 35.64 billion in 2025 and is predicted to increase from USD 42.05 billion in 2026 to approximately USD 179.72 billion by 2035, expanding at a CAGR of 17.56% from 2026 to 2035.

Passenger Vehicle ADAS Market Key Takeaways

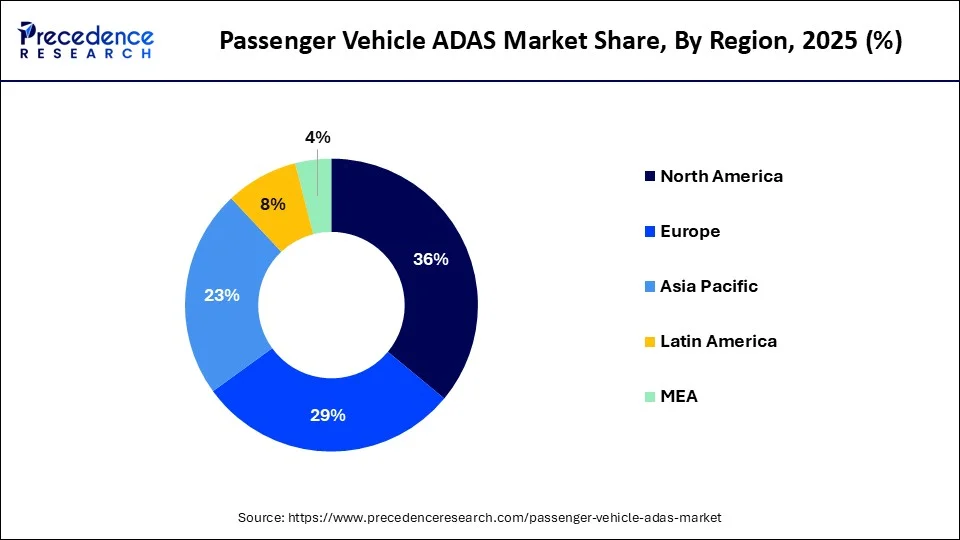

- North America led the global market with the highest share 36% of in 2025.

- The Asia Pacific market is estimated to expand at the fastest CAGR between 2026 and 2035.

- Europe has been expanding at a significant pace in the global market.

- By system, the lane departure warning system segment held the largest market share of 16% in 2025.

- By system, the adaptive cruise control segment is anticipated to grow remarkably between 2025 and 2035.

- By sensor, the radar segment captured the biggest market share in 2025.

- By sensor, the LiDAR segment will expand at a notable CAGR over the projected period.

- By vehicle, the SUV segment captured the biggest market share in 2025.

- By vehicle, the hatchback segment is expected to grow at a notable CAGR over the projected period.

- By distribution channel, the OEM segment captured the biggest market share in 2025.

- By distribution channel, the after-market segment is expected to grow rapidly over the projected period.

Market Overview

The advanced driver assistance systems (ADAS) in passenger cars are technologies that are designed to ensure security for vehicle occupants and improve the driving experience by aiding in a wide range of tasks. ADAS systems rely on arrays of sensors, cameras, radar, and artificial intelligence to assist such features as lane-keeping, adaptive cruise control, automatic emergency brakes, and parking aid, and are intended to lessen human error, reduce crashes, and optimize the driving experience. Increasing complexity is driving the automotive industry towards a future development of connected and autonomous driving solutions and multi-task driving systems.

While automakers develop more advanced ADAS systems, consumer demands for advanced safety features, regulatory impacts, and impetus from standards organizations for the implementation of systems such as forwarding collision avoidance, pedestrian detection are driving ADAS growth. The demand for ADAS systems has increased collaboration between technology providers and car makers, hardwiring integrations for quick improvements in developing more intelligent and responsive driving systems. The emphasis on the development of semi-autonomous and fully autonomous vehicles is expected to dramatically fuel the development and demand for ADAS systems.

AI Driving Innovation in Passenger Car ADAS Systems

Artificial intelligence (AI) is playing an important role in transforming the passenger vehicle ADAS market with state-of-the-art technologies that improve safety and the driving experience. Vehicles can now employ AI-powered systems that analyze information from a variety of cameras, radar, sensors, and LiDAR, providing advanced features such as lane-keeping assist, adaptive cruise control, and automatic emergency braking. These technologies help optimize a vehicle's performance while reducing human errors to improve safety on the road.

Moreover, AI-powered systems can provide predictive maintenance to give a vehicle reliability and efficiency over the long term. As the automotive ecosystem progresses toward automation, AI is facilitating real-time decision-making and working toward fully automated vehicles for the future, while at the same time enabling a connected transportation ecosystem that allows vehicles to communicate with each other and everything else that can improve safety and traffic flow on the roads. As the industry continues to develop, it is clear that in the future, vehicles will be smarter and more intuitive to reshaping how we drive and interaction in the near future.

Passenger Vehicle ADAS Market Growth Factors

- Development of autonomous vehicles: The growing shift toward autonomous vehicles is driving demand for ADAS technologies, which are key building blocks for autonomous vehicle systems.

- Government regulation: Stringent safety regulations from governments around the world. For passenger vehicles, there are concerns about the adoption of ADAS technologies.

- Competitive landscape: As automakers compete for differentiation against an increasingly crowded market, by offering innovative ADAS features, they are in essence growing the market as they want to provide more advanced and attractive safety technologies to consumers.

- Technological advancement: The continued innovation of artificial intelligence, machine learning, and sensors has improved ADAS capabilities by increasing their affordability, effectiveness, and reliability, thus promoting widespread growth of this market.

Market Outlook of the Passenger Vehicle ADAS Market

- Industry Growth Overview: The strong growth of the passenger vehicle ADAS market is driven by safety mandates from government regulations, growth awareness of the consumer, and innovation of driver assistance technologies utilizing sensor fusing and artificial intelligence.

- Sustainability Trends: The adoption of ADAS can also be seen as a positive initiative in support of sustainability, as by creating a more efficient process and reduces the impact on congestion caused by accidents, through the use of eco-driving assistance technology, and conducting research on all aspects of a vehicle contributes to the use of less fuel in urban driving APIs.

- Global Expansion: Automakers are increasing their ADAS vehicle portfolio in emerging countries by developing manufacturing locally to provide cost effectiveness due to driverless sensor modules, along with government-driven programs to enhance road safety.

- Startup Ecosystem: Startups are developing Innovative technologies for AI-based vision processing, low-cost LiDAR, and driver monitoring systems by partnering with original equipment manufacturers (OEMs) to bring products to market faster and to lower the overall cost of ADAS systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 179.72 Billion |

| Market Size in 2025 | USD35.64 Billion |

| Market Size in 2026 | USD 42.05 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 17.56% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System, Sensors, Vehicle, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Driving the Future: Rising Demand for Safety Accelerating the Market

The passenger vehicle ADAS market is rapidly expanding, mainly driven by the rising demand for safety, convenience, and technology. In 2024, total worldwide car sales reached 74.6 million units, a 2.5% increase from 2023, signifying consumer confidence in the automotive market. This growth is correlated with the increasing consumer preference for cars with ADAS capabilities, including lane-keeping assistance, adaptive cruise control, automatic emergency braking, and other collision avoidance systems.

Research conducted by the Insurance Institute for Highway Safety (IIHS) indicates that consumer familiarity and adoption of ADAS have grown significantly; nearly 60% of new vehicles sold in the United States now incorporate these technologies. Regulatory pressures, such as standardizing safety regulations and NCAP rating changes in Europe, have prompted automakers to offer ADAS in more trim and packages; they stand out as unique selling propositions to consumers.

According to the International Organization of Motor Vehicle Manufacturers, global passenger vehicle sales have steadily increased from 2021 to 2023.

Restraint

High Maintenance Costs: A Barrier to ADAS Adoption in Passenger Cars

The expensive price of ADAS technologies is a key inhibiting metric in the passenger vehicle ADAS space. More advanced systems, like Automatic Emergency Braking System (AEBS), Blind Spot Detection (BSD), and Adaptive Cruise Control (ACC), use radar sensors, which are both expensive to install and repair. An example of the cost is radar sensors, AEBS sensors, and ACC sensors, which cost over USD 900, for BSD and rear cross-traffic warning, which cost more than USD 2,000.

The American Automobile Association study reported that even for minor damage to front radar or distance sensors, repair costs can sometimes exceed USD 1,540. Due to these often high costs of repair and maintenance, combined with difficulty in repair, may limit consumer interest in these technologies, especially in a price-sensitive market, which limits some of the widespread ADAS applications in passenger vehicles.

Opportunity

Connectivity Advancements: Unlocking New Potential for ADAS

The rapid advancement of connectivity, especially with applications of Vehicle-to-Everything (V2X) communications and 5G networks, will have a notable impact on opportunities in the passenger vehicle ADAS market. V2X allows vehicles to communicate with one another, with infrastructure, and with cloud-based services in real-time, enabling additional safety and convenience features such as cooperative adaptive cruise control, traffic signal priority, and hazard alerts.

The rollout of 5G networks will enhance the performance of ADAS systems through low-latency and high-bandwidth communications, enabling real-time traffic delivery and even OTA software updates. By early 2024, 5G is expected to see substantial adoption, as there are projected to be over 2 billion 5G connections globally by 2025. This convergence of connectivity will enable new ADAS features to be implemented that will offer increased safety, convenience, and driver experience, furthering demand and growth in the passenger vehicle ADAS market.

Segment Insights

System Insights

The lane departure warning system segment held the largest passenger vehicle ADAS market share in 2025 due to its safety enhancement in avoiding lane departure, a major cause of accidents. These systems, which are part of a broader category of ADAS applications, monitor the positions of lanes and warn the driver or intervene by steering to reposition the vehicle, which lessens the likelihood of a crash. The upsurge in ADAS adoption in the passenger segment stems from growing customer preferences for safety features as well as advancements in camera and sensor technologies.

The adaptive cruise control segment is anticipated to grow remarkably between 2026 and 2035 due to improvements and innovations in sensor, radar, and artificial intelligence technologies. Greater government pressure and safety regulatory requirements are also increasing the outputs of vehicle manufacturers in terms of safety systems in commercial vehicles. The growth of the electric vehicle and hybrid vehicle segments of the market is driving ACC adoption in light-duty passenger vehicle manufacturing. The increased attention on automated driving solutions is key for this segment of ADAS applications in the marketplace.

Sensor Insights

The radar segment captured the biggest passenger vehicle ADAS market share in 2025 due to its versatility across a multitude of environmental settings. Radar sensor-based systems enable accurate object detection in low visibility obstacles that are safety critical for adaptive cruise control and collision avoidance in inclement weather conditions, such as rain, fog, or snow. Radar sensors are the low-cost, proven, reliable, and most test vehicle agnostic ADAS sensor, making them a popular choice for automakers to utilize inside mainstream ADAS systems.

The LiDAR segment will expand at a notable CAGR over the projected period. Major benefits of Lidar technology include precision in 3D imaging, making it a critical sensor in developing autonomous driving systems. Additionally, Lidar technology offers accurate range and object detection validations while being high-resolution capable. Due to the wide use case applications in autonomous driving, Lidar technology will increase very quickly as car manufacturers and technology companies push for more autonomous vehicle solutions, which will create a need for multiple Lidar sensors or more sophisticated Lidar sensors, and in high volume.

Vehicle Insights

The SUV segment captured the biggest passenger vehicle ADAS market share in 2025, as many consumers are enthusiastic about advanced safety capabilities. SUVs usually come with multiple advanced driver technologies, such as automated emergency braking, lane departure warnings, and adaptive cruise control etc. As awareness and demand continue to grow for vehicles offering a higher driving position and advanced safety capabilities, automotive manufacturers are likely to make ADAS technologies more widely available in the SUV segment.

The hatchback segment is expected to grow at a notable CAGR over the projected period, particularly due to increasing urbanization and demand for smaller and more affordable vehicles. As population density in urban regions continues to grow, the demand for smaller vehicles that allow for ease of maneuverability and cost efficiency will result in greater appeal for hatchbacks. Hatchback consumers have also become increasingly aware of the added benefits ADAS technologies offer, and therefore, manufacturers have started to introduce safety-focused ADAS technologies in entry-level hatchbacks. As awareness of ADAS in budget-conscious vehicles increases, so does the popularity of hatchback vehicles in the ADAS market.

Distribution Channel Insights

The OEM segment captured the biggest passenger vehicle ADAS market share in 2025 because automakers are fitting ADAS technologies as part of the manufacturing process in the automotive vehicle. OEM integration means that ADAS systems are built into the vehicle during the manufacturing process, allowing for better performance, compatibility, and reliability. Additionally, manufacturers can benefit from economies of scale and maintain quality control by providing ADAS as part of a standard or optional vehicle configuration.

The after-market segment is expected to grow rapidly over the projected period, driven by an increased demand to retrofit legacy vehicles installed with the safety technology of modern vehicles. As the public becomes increasingly aware of road safety, more vehicle owners are opting to add aftermarket ADAS features, such as parking sensors, lane-keeping assist, and collision warning systems, to their older vehicles. Supporting this growth trend is the advent of affordable and user-friendly aftermarket products that can easily be retrofitted to previously manufactured vehicles; thus, the aftermarket distribution channel will continue to accelerate as more consumers look to modify their vehicle technology and incorporate advanced driver assist systems instead of purchasing new vehicles.

Regional Insights

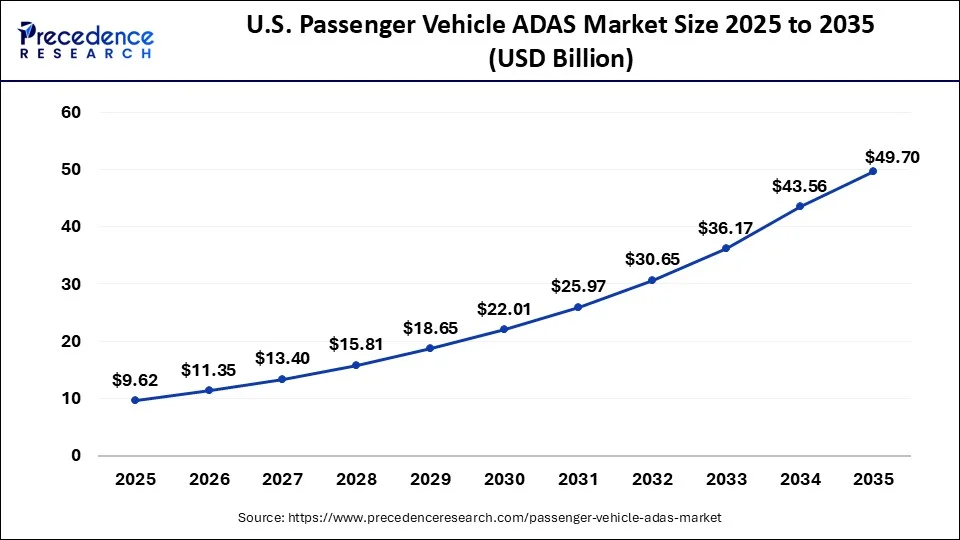

What is the U.S. Passenger Vehicle ADAS Market Size?

The U.S. passenger vehicle ADAS market size was exhibited at USD 9.62 billion in 2025 and is projected to be worth around USD 49.70 billion by 2035, growing at a CAGR of 17.85% from 2026 to 2035.

North America Dominates Market with Strong Demand and Regulations

North America led the global passenger vehicle ADAS market with the highest share in 2025 because of strong consumer interest and regulatory developments from the U.S. and Canadian governments. U.S. automakers continued emphasizing advanced driver assistance systems in 2024, as leading manufacturers such as General Motors, Ford, and Tesla introduced ADAS features in mid-tier vehicles. Additionally, in 2024, the National Highway Traffic Safety Administration (NHTSA) initiated regulations that would mandate that ADAS systems, like automatic emergency braking systems, be included in every new vehicle sold in the region.

- In 2024, Tesla rolled out a major update to its Full Self-Driving (FSD) software that gave thousands of additional vehicle users access to more advanced ADAS systems. This demonstrates the industry's continued interest and push toward fully autonomous driving.

The United States saw a major increase in the adoption of ADAS technologies in 2025, partly as a result of rising demand for SUVs that often feature such systems. There was also a meaningful increase in consumer adoption of advanced driver assistance technologies across mainstream models like the Ford Mustang Mach-E, which features technology like adaptive cruise control and lane keeping assist, in 2025.

Moreover, the NHTSA called for more advanced safety standards and announced new vehicle safety standards in early 2025, which also spurred greater adoption of advanced safety systems among automakers. This regulatory advancement is expected to advance the adoption of ADAS systems, particularly as there is a continued focus on autonomous driving.

- In December 2024, aiMotive and Safran Electronics & Defense announced a collaboration to enhance the safety of ADAS and automated driving (AD) development through advanced testing and validation using AI and simulation technologies.

Asia Pacific Growth Promoted with Technological Advancements

The Asia Pacific passenger vehicle ADAS market is estimated to expand at the fastest CAGR between 2026 and 2035 due in large part to advancements in technology and strong government support. The integration of advanced safety features into vehicles, such as lane-keeping assistance and automated emergency braking, has become more prominent throughout the region in 2024. To increase the adoption of ADAS features, local and international manufacturers now have incentives, such as subsidies, to invest in ADAS or urban autonomous driving technologies. This will allow Asia Pacific to become a major market for the development and deployment of advanced safety systems, and in turn, create a sustainable way to transition the future of mobility in the region.

ADAS adoption in Asia Pacific is being led by China. The automotive manufacturers in China, such as BYD and NIO, have also released expanded EV product lines, including features such as lane-keeping assistance and automated emergency braking. According to the report of the International Energy Agency, 10.1 million passenger electric cars were sold in China in 2024, owing to the rising ADAS integration. Additionally, support from the Chinese government, including subsidies for purchasing ADAS vehicles, has contributed to the increase in consumer demand. Both domestic and foreign markets are further supported by additional self-driving trials in cities such as Shanghai.

- In 2024, the China Passenger Car Association (CPCA) reported an increase in passenger car export volumes by 20%, which now total nearly 5 million vehicles, while also reporting an increase of 13.6% in domestic sales in December 2024.

European Market Soars with Stricter Safety Rules and Consumer Demand

Europe is considered to be a notably growing region in the upcoming period due to stricter vehicle safety rules and increased consumer demand for more advanced technologies. In 2025, European Union regulations tightened again, with new legislation establishing the requirement that all new passenger vehicles manufactured from 2026 be equipped with emergency lane-keeping and advanced braking systems, as well as a driver-monitoring system. Manufacturers such as BMW and Mercedes-Benz have continued their track record of ADAS innovation by further enhancing features related to higher levels of semi-autonomous driving for use in ADAS vehicles.

Germany remains a leader in the European passenger vehicle ADAS market and is focused on combining conventional and ADAS capabilities in production. For Instance, in 2025, the Volkswagen Group of Germany announced the introduction of the new ID.4 with updated driver-assistance systems and capabilities for semi-autonomous driving. The regulatory environment in Germany has also evolved significantly to promote the adoption of ADAS in vehicles, with the Federal Motor Transport Authority (KBA) focusing on safer road transportation in 2025.

Latin America: Gradual Proliferation of ADAS with High Potential

Gradually, the market in Latin America continues to embrace the use of ADAS technology as safety awareness continues to grow and there is an increase in the importation of vehicles into this region. Also, cost-effective ADAS configurations are seeing a rise in popularity among mid-range automotive manufacturers. Brazil is rapidly becoming one of the fastest-growing countries for ADAS technology, in large part due to the expanding automotive manufacturing in Brazil and improving road safety standards.

Middle East and Africa (MEA): Infrastructure-Led Opportunity for ADAS

Over the past several years, there has been an increasing demand for premium vehicles, and as such, the Middle East and Africa region has emerged as a strong market for ADAS technology. ADAS adoption is being led by developing nations in the GCC area, which have a high reliance on imports for their automotive needs and a limited capacity for local manufacturing.

Saudi Arabia is currently experiencing significant growth in ADAS technology, driven by increasing passenger vehicle sales and investment in smart mobility.

Analysis of Value Chain in the Passenger Vehicle ADAS Market:

- System Manufacturing of Components: Involves numerous types of devices, including sensors (LiDAR, radar, cameras), semiconductors, and ECUs, all requiring precision and safety regulations.

Key Players: Bosch, Continental, and Denso. - System Integration & Software Development: This is where the hardware and AI algorithms/perception software/decision-making logic are used together in the same product.

Key Players: Aptiv, ZF Friedrichshafen, and Mobileye. - Rear View Mirror Manufacturer: Original equipment manufacturer (oem) deployment and aftermarket support for vehicle manufacturers who install adas into their assembly line and provide upgrades and recalibration services after installation.

Key Players: Toyota, Volkswagen Group, and Hyundai Motor Group.

Passenger Vehicle ADAS Market Companies

Leaders Announcements

- In January 2025, Tata Technologies and Telechips announced a partnership to develop innovative solutions for next-gen software-defined vehicles (SDVs). Their collaboration will focus on ADAS platforms, automotive cockpit controllers, and gateway systems, helping OEMs tackle software-hardware integration challenges and speed up time-to-market.

- In September 2024, Valeo announced a new production facility in Pune for power electronics, boosting its presence in India's growing passenger vehicle ADAS market. The facility will supply key components for advanced safety and electric vehicle technologies.

Recent Developments

- In March 2025, Elitek Vehicle Services launched ADAS MAP, a tool to help shops diagnose, calibrate, and repair ADAS systems, supporting the growing passenger vehicle ADAS market and enhancing vehicle safety and performance.

- In January 2025, Garmin unveiled its latest innovation, Unified Cabin 2025, at the Consumer Electronics Show in Las Vegas. The solution includes features like Ultra-Wide Band (UWB) technology for Child Presence Detection (CPD), enhanced blind spot detection, improved computer vision, and augmented reality capabilities.

- In August 2024, Mercedes-Benz announced that it had received a Level 4 autonomous driving test license. The automaker plans to upgrade its current Level 3 autonomous driving system to Level 4 for the Chinese market, with the upgrade scheduled for September.

Segments Covered in the Report

By System

- Adaptive cruise control

- Blind spot detection

- Lane departure warning system

- Automatic emergency braking (AEB)

- Forward collision warning

- Night vision system

- Driver monitoring

- Tire pressure monitoring system

- Head-up display

- Park assist system

- Others

By Sensor

- Radar

- Lidar

- Camera

- Others

By Vehicle

- Sedan

- SUV

- Hatchback

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting