What is the Hybrid Vehicle Market Size?

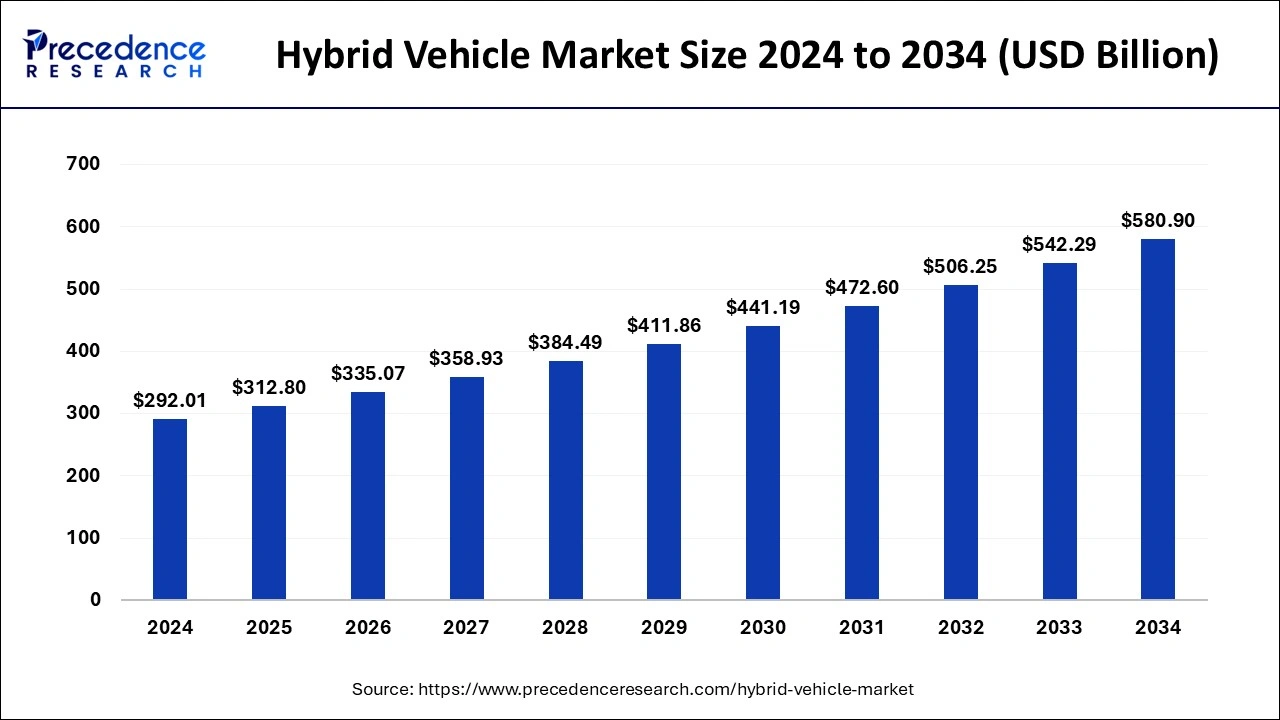

The global hybrid vehicle market size is estimated at USD 312.80 billion in 2025 and is predicted to increase from USD 335.07 billion in 2026 to approximately USD 617.80 billion by 2035, growing at a CAGR of 7.04% from 2026 to 2035. A growing focus on sustainability is driving the growth of the hybrid vehicle market.

Market Highlights

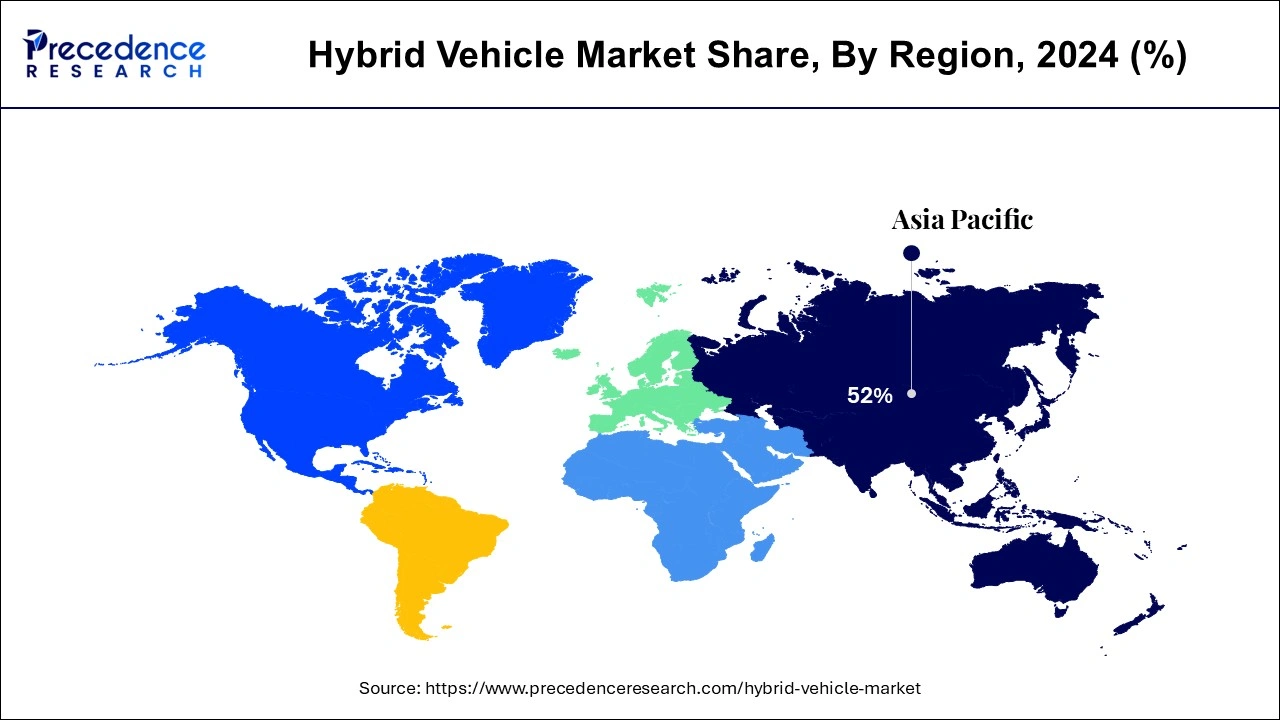

- North America dominated the global hybrid vehicle market with the largest market share of 52% in 2025.

- Asia Pacific is expected to expand at a solid CAGR during the forecast period.

- By hybridization, the fully hybrid segment contributed the highest market share of 50% in 2025.

Market Size and Forecast

- Market Size in 2025: USD 312.80 Billion

- Market Size in 2026: USD 335.07 Billion

- Forecasted Market Size by 2035: USD 617.80 Billion

- CAGR (2026-2035): 7.04%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

What is a hybrid vehicle?

Hybrid vehicles are powered by both an internal combustion engine and an electric motor, and they can achieve significantly better fuel mileage than traditional vehicles while producing fewer carbon emissions and costing less to run on fuel. A combination of rising fuel prices, stricter emission regulations from governments worldwide, growing environmental awareness, and improvements in battery technology and the efficiency of hybrid vehicle powertrains are all contributing to the rapid growth of the market. The technologies that support hybrid vehicles are also becoming increasingly available to both passenger and commercial vehicles.

How is AI Impacting the Hybrid Vehicle Market?

Designing and modifying algorithms and datasets to enable advancements in automotive technology that would have been unachievable for humans is the primary focus of artificial intelligence's use in hybrid and electric cars. Using information from past and present circumstances, machine learning, an AI system, can accurately forecast future driving and environmental situations.

These projections for the future may result in more precise RE, which would enhance the optimization of the EV range. The best location for electric vehicle charging stations (EVCs) is made possible by the ongoing advancement of AI technology. To precisely forecast charging demand estimation, artificial intelligence (AI) systems, such as machine learning, monitor important characteristics from journey history, car recharging data, and other environmental (including geographic) aspects.

Market Outlook

- Industry Growth Overview: The hybrid vehicle industry will continue to grow because more and more companies have created fuel-efficient products that can bridge the gap between traditional gas-powered vehicles and full electric vehicles. Consumers see hybrids as a logical transition to electrification.

- Sustainability Trends: Automotive companies have begun to use recyclable materials, lightweight products and energy-efficiency processes in their production and design of vehicles. Hybrid vehicles will continue to align themselves with global sustainability goals and carbon neutral mobility initiatives.

- Global Expansion: Due to a lack of infrastructure for electric vehicle adoption in emerging countries, those markets will be major focuses for hybrid vehicle development. Hybrid vehicles will allow a wider range of consumers worldwide to adopt hybrid vehicles.

- Startup Ecosystem: Startups are innovating in battery management systems, hybrid drive systems and energy optimisation systems. They work with the original equipment manufacturers (OEMs) to improve the efficiency of the vehicle's production processes and reduce production costs.

Hybrid Vehicle Market Growth Factors

- Popularity among consumers: In the automobile industry, hybrid cars have quickly gained popularity as a solution for buyers looking to strike a compromise between performance and fuel economy.

- Rising fuel prices: Economic concerns, especially the volatility of gasoline costs, are contributing to the growing popularity of hybrid vehicles. Rising gas prices are causing consumers to search for methods to reduce their expenses, and hybrid vehicles provide substantial long-term savings due to their increased fuel economy.

- Government incentives: Since many governments are providing incentives for the purchase of environmentally friendly automobiles, hybrids are growing in popularity.

Trends Encouraging Growth in the Hybrid Vehicle Market

- Increasing Global Demand: Due to escalating fuel prices and consumer interest in environmentally friendly vehicles, demand for hybrids is increasing at an accelerated pace - thus, hybrids are becoming a priority for the large automotive manufacturers in some sub-segments of the automotive market (e.g., sedan, SUV, etc.)

- Technological Development: Technological advancements in the battery management systems, the regenerative braking systems, the development of lightweight materials, and the use of intelligent control systems have all contributed to the enhancement of a vehicle's hybrid performance and to a reduced total cost of ownership.

- Administration Regulation: The recent increase in regulatory pressure for cleaner air, as well as the variations in the electric vehicle (EV) incentive or restriction policies in different states, has been an influencing factor in the increased hybrid vehicle deployment in areas where full-scale EV infrastructure has yet to be developed.

- Expansion of Emerging Markets: An increasing trend between the various Asian and African countries is a growing interest in the importation and sale of hybrids in those markets, as consumers are looking for lower-cost alternatives to traditional gasoline engine vehicles.

Import and Export Data of the Hybrid Vehicle Market

- Worldwide, hybrids were shipped more frequently than they were imported, almost 93k in total, with the top three countries exporting hybrids (China - 39k, Japan - 27k, Turkey - 7.5k fibers) representing over 80 percent of the global export volume.

- The majority of hybrids have been imported by emerging economies such as Uzbekistan, Bangladesh, and Russia. As of September 2023, the total import volume accounted for an estimated 69 percent of the global hybrid volume, indicating strong demand for hybrids in the emerging economies

- The hybrid buying network has grown in size dramatically this year. A total of 29070 active buyers of hybrids have been identified in 156 different nations, and hybrids are currently being sourced from more than 10,000 suppliers globally. Some of the key importers include the SP OOO BYD Uzbekistan Factory and the Suzuki Motor Vehicles Marketing Company, which are indicators of substantial hybrid activity throughout the world.

(Source: https://www.volza.com )

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 312.80 Billion |

| Market Size in 2026 | USD 335.07 Billion |

| Market Size by 2035 | USD 617.80 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.04% |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Hybrid, Vehicle, Type of Propulsion Insights, Type of Drivetrain Insights, Type of Drivetrain Insights, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Environmental sustainability

The need for more environmentally friendly modes of transportation has increased as worries about climate change and environmental sustainability grow on a worldwide scale. For drivers who wish to lessen their carbon footprint without compromising the comfort and familiarity of gasoline-powered automobiles, hybrid vehicles which combine the finest features of internal combustion engines with electric power offer an alluring alternative.

Restraint

Initial and maintenance cost

Hybrid cars are costlier than their internal combustion engine (ICE) counterparts because of their increased complexity. In addition to raising the total cost of purchase, more technology in a hybrid vehicle may have an impact on maintenance expenses. In particular, if the components of the hybrid system are damaged, the upkeep might out to be very expensive.

Opportunity

Better vehicle ranges and charging capabilities

Longer electric-only ranges are expected to be a feature of plug-in hybrid car development. Future plug-in hybrids are expected to have longer electric-only driving ranges due to developments in battery technology, enabling drivers to use electric power for longer periods of time before switching to an internal combustion engine. In addition, plug-in hybrids will soon have improved fast-charging capabilities. Users will find these cars more convenient with faster charging times, which will also provide drivers more control over how they manage their hybrid power sources and fit in with the rising trend of expanded charging infrastructure.

Segments Insights

Hybrid Insights

Depending upon the extent of the hybrid, vehicles can be classified as micro hybrid, Fully hybrid or Mild hybrid. The fully hybrid segment of the vehicles shall hold the largest market share during the forecast. It provides better fuel efficiency and reduced emissions. Also, there are continuous technological changes in this domain. The mild hybrid segment is also expected to grow during the forecasted. Followed by the fully hybrid segment.

Vehicle Insights

Hybrid vehicles can be passenger cars of commercial vehicles. Since the government of various nations is making more stringent laws, the commercial hybrid vehicles are expected to grow during the forecast. Growing awareness about the environment and since the Hybrid vehicles provide fuel efficiency people are purchasing more and more cars for their personal use.

Type of Propulsion Insights

It includes the hybrid electric vehicles, plug in hybrid electric vehicles and natural gas vehicles out of the three, the market size of EV is increasing continuously due to the high volume sales in China, Japan and US. Data developing nations are also. Improving the emission standards there is a growth in the market of the hybrid vehicles. Compared to the natural gas vehicle and the PHEV, the has a better share in the market.

Type of Drivetrain Insights

The functioning of the engine and the motor together to power the car determines the type of drivetrain. The Electric Motor Acts as a generator in the parallel hybrid and in the series hybrid cars, a separate generator is attached to the engine. In both the parallel and series hybrid regenerative breaking system is used. For the city drive, the series, hybrid cars are more efficient. And when it comes to driving on a highway at constant speeds, the parallel hybrids are more efficient. The parallel hybrid segment is estimated to increase during the forecast.

Regional Insights

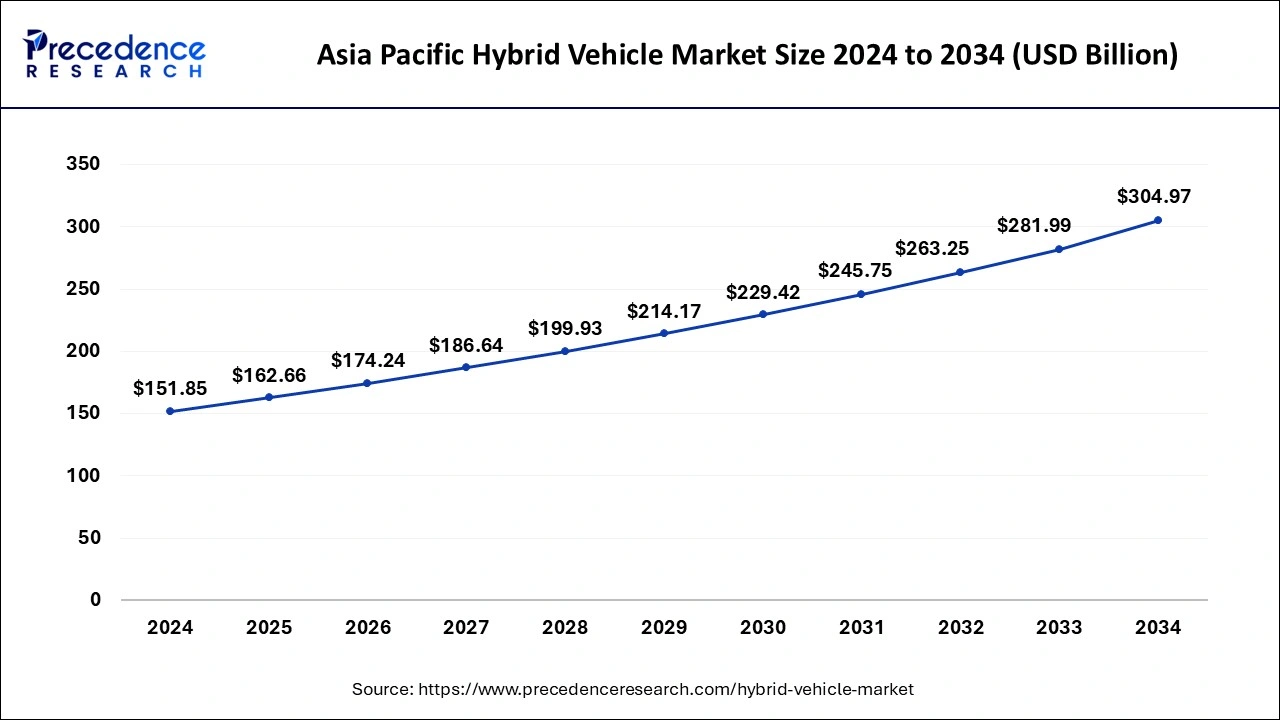

What is the Asia Pacific Hybrid Vehicle Market Size?

The Asia Pacific hybrid vehicle market size is estimated at USD 312.80 billion in 2025 and is anticipated to be surpass around USD 325.12 billion by 2035, rising at a CAGR of 7.17% from 2026 to 2035.

Hyundai, Nissan, Toyota Fuel Asia's Hybrid Surge

Asia Pacific is going to be the fastest growing market for Hybrid vehicles. In regions like Japan, South Korea. China there has been an increase in the sales of hybrid cars. Many key market players like the Hyundai, Nissan, Honda, Toyota are all from Asia Pacific. The countries like Japan and China have given a major boost to the market as there is a mass adoption of the hybrid cars.

Hybrids Overtake EVs in China's Booming Auto Market

As customers in China move away from gas-only automobiles, hybrids are becoming more and more popular than battery-only vehicles. In 2024, the market leader, BYD, reported selling around 4.3 million passenger cars. Of those, over 2.5 million were hybrids, which is a flip from 2023, when BYD sold somewhat fewer hybrid cars than battery-only models. The automobile industry in China is still changing quickly. By July 2024, electric or hybrid cars accounted for over half of all sales. 945,000 hybrid vehicles were sold, up 27.6% from the year before, according to the China Federation of Individual Car Manufacturers (CPCA).

Strict Laws Fuel North American Hybrid Adoption

North America is expected to host a significantly growing hybrid vehicle market during the forecast period. Hybrid car adoption has accelerated throughout the continent due to strict pollution laws and rising customer awareness of environmental issues. The U.S. Department of Energy reports that sales of hybrid cars in North America hit a record 1.2 million units in 2023, a 17% increase over the previous year. The region's strong charging infrastructure and the presence of large automakers making significant investments in hybrid technology serve to further solidify this supremacy. The market attractiveness has increased due to the growing variety of hybrid vehicles that buyers can now choose from, ranging from SUVs to small automobiles.

U.S. Hybrid Market Leadership: Incentives and Dema

The United States continues to lead the North American hybrid vehicle space with strong consumer demand, an awareness of fuel economy and favorable government incentives. Toyota, Ford, and Honda hybrid models continue to lead the American roads today. Adoption has been supported by federal tax credits, legislation advocating for stricter emissions regulations and green mobility investments by automakers. Here in California, for instance, consumers are rewarded with incentives like access to carpool lanes and rebates on hybrid vehicles, accelerating penetration in the hybrid vehicle space. As infrastructure investments improve, and sustainability becomes more of a priority, the United States will continue to lead.

South America: Increasing environmental awareness

South America is significantly increasing in the market due to growing environmental awareness in consumers and governments, promising government guidelines, and the vehicles' ability to offer a balance of fuel effectiveness and reliability, particularly in regions with advancing charging infrastructure. Hybrids are attractive as they offer the reliability of a traditional engine and a backup power source.

Europe Embraces Hybrids: A Cleaner Drive

Europe is witnessing the accelerated growth of hybrid vehicles, fueled by EU level carbon emission targets, rising fuel prices and increased awareness of employee impact on global warming. Policy changes and purchase subsiding across the Member States, is driving the adoption of hybrid vehicles as cleaner alternatives.

Europe Hybrid Vehicle Market Trends

The increase in the number of cars powered by or operating with a hybrid of gasoline and electric energy is expected to continue as more countries and states implement supportive policies towards hybrids. In addition, the availability of low carbon fuel blends is also expected to increase throughout the world. Many different countries will enhance their hybrid market by making changes in the policy toward the use of hybrid vehicles. The European Union (EU) has established its climate change policy and is now mandating stricter emission standards than any other region in the world. Countries such as Germany, France, and the United Kingdom are moving quickly to reduce emissions. In turn, EU countries are moving towards a greater amount of supply of these fuels to the general public.

Brazil: Technological advancements

Brazil's strong base in biofuels such as ethanol offers a unique opportunity for hybrid vehicles. This lets for a more expanded and self-sufficient energy approach for transportation. The Brazilian regulations are encouraging the acceptance of electric and hybrid vehicles through different policies, including tax incentives and subsidies.

Germany's Green Charge: Hybrids Meet Policy Goals

Germany is leading the charge on hybrids with its strong automotive industry and climate change policies. Major German manufacturers like BMW, Audi and Mercedes-Benz have made significant launches of the hybrid variants to satisfy EU standards. Also, the German government has rapidly developed incentives like green tax addressing lower income households and similar low emissions zones for navigating the cars.

MEA: Government initiatives and visionary policies approach

South America is experiencing substantial growth in the market due to MEA governments, specifically in the GCC (Gulf Cooperation Council) countries, which are vigorously encouraging green transportation to spread their economies away from fossil fuels and meet environmental targets. Major oil producers, some countries in the MEA region have experienced increasing domestic fuel costs, which drives the growth of the hybrid vehicle market.

South Africa: Growing manufacturer and industry strategy

In Brazil, rising regulatory incentives and guidelines, theed re to accept international regulations, automaker spending in hybrid production, and the inherent advantages of hybrids for the local context, like fuel effectiveness and compatibility with solar power. Producers are progressively focusing on manufacturing hybrids as a stepping stone to a full EV transition.

Value Chain Analysis – Hybrid Vehicle Market

Raw Material:

The raw materials for the hybrid vehicle market involve battery components such as lithium, nickel, cobalt, manganese, and graphite; electronics and motor materials like rare earth elements (such as neodymium, praseodymium, and dysprosium), silicon, and copper.

- Key Players: Toyota and Honda

Chemical Synthesis and Processing:

Chemical synthesis and processing in the hybrid vehicle (HV) market significantly focus on evolving advanced materials for batteries, fuel cells, lightweight composites, and specialty coatings.

- Key Players: Ford and Hyundai

Compound Formulation and Blending:

In the hybrid vehicle industry, compound formulation and blending are significant in the advancement of particular lubricants, coolants, and battery mechanisms.

- Key Players: Kia and BMW

Top Vendors in the Hybrid Vehicle Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Japan |

Strong brand reputation for quality and reliability |

In September 2025, Toyota had sold 15M+ hybrids and now offers 15+ models in 2025, with hybrids making up 40% of sales as it prepares 30 EVs by 2030. |

|

|

Japan |

Strong Brand Reputation and Equity |

Variants of the two-motor hybrid system are also available in the Honda Accord and CR-V and represent more than 50% of Accord and CR-V sales. |

|

|

BYD Company Ltd |

China |

Advanced battery technology |

In October 2025, BYD introduced another global breakthrough in powertrain technology: the first Super Hybrid vehicle with biofuel compatibility. |

|

Lexus |

Japan |

Strong reputation |

Lexus India introduced the highly anticipated new Lexus LM 350h, a masterpiece meticulously crafted to redefine the ultra-luxury mobility segment. |

|

Ford Motor Company |

Dearborn, Michigan |

Strong financial position and cash flow |

Ford Motor Company is significantly expanding its hybrid vehicle lineup and strategy. |

Other major key players

- Kia Motors Company

- Nissan Motor Company

- Volkswagen AG

- AB Volvo

Latest Announcements by Industry Leaders

- In December 2024, we have a bold plan in place to accommodate Indian customers' changing tastes. Our goal is to electrify powertrains, such as hybrids and BEVs, even as we remain in the mainstream ICE (internal combustion engine) market in the upcoming years, stated Takuya Tsumura, president and CEO of Honda Cars India.

Recent Developments

- In January 2025, Chinese automaker BYD is planning to introduce its first plug-in hybrid vehicle in Japan within the year. This move is part of BYD's strategy to enhance its product offerings and dealer network in Japan. Plug-in hybrids, which combine a battery with a traditional fuel engine, are designed to run on either power source.

(Source: https://www.techinasia.com) - In October 2024, in the near future, Hyundai Motor India Limited (HMIL) intends to launch hybrid automobiles in the Indian market. The nation's second-largest automaker is certain that its selection of engine alternatives will satisfy consumer preferences, even if the precise timetable has not yet been announced.

- In September 2024, according to the CEO of Skoda Auto in New Delhi, Volkswagen's Skoda sees a chance to introduce hybrid vehicles in India in order to increase customer fuel options and reduce emissions.

Segments Covered in the Report

By Hybridization

- Fully hybrid

- Micro hybrid

- Mild hybrid

By Drivetrain

- Parallel drivetrain

- Series drivetrain

By Vehicle

- Passenger car

- Commercial vehicles

By Propulsion

- HEV

- PHEV

- NGV

By Component Type

- Battery

- Electric Motor

- Transmission

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting