Plug-in Hybrid Electric Vehicles (PHEV) Market Size and Forecast 2025 to 2034

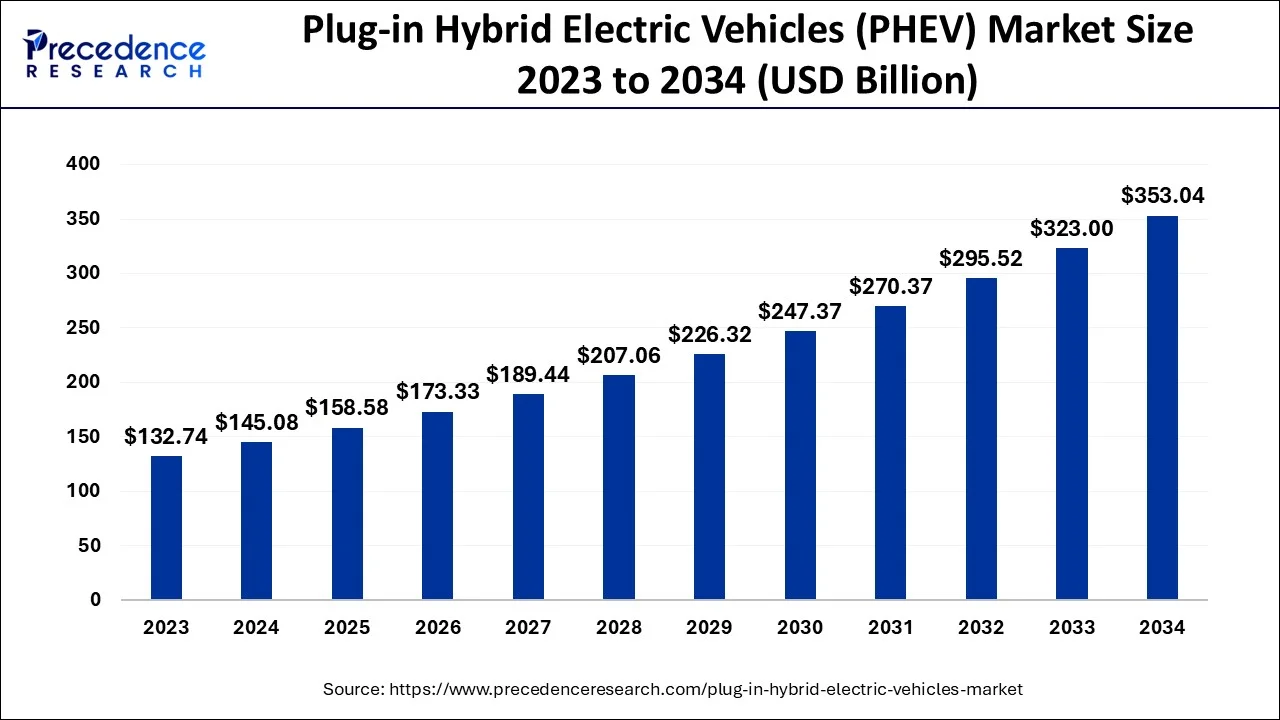

The global plug-in hybrid electric vehicles (PHEV) market size is estimated at USD 145.08 billion in 2024 and is anticipated to reach around USD 353.04 billion by 2034, expanding at a CAGR of 9.30% from 2025 to 2034.

Plug-in Hybrid Electric Vehicles (PHEV) Market Key Takeaways

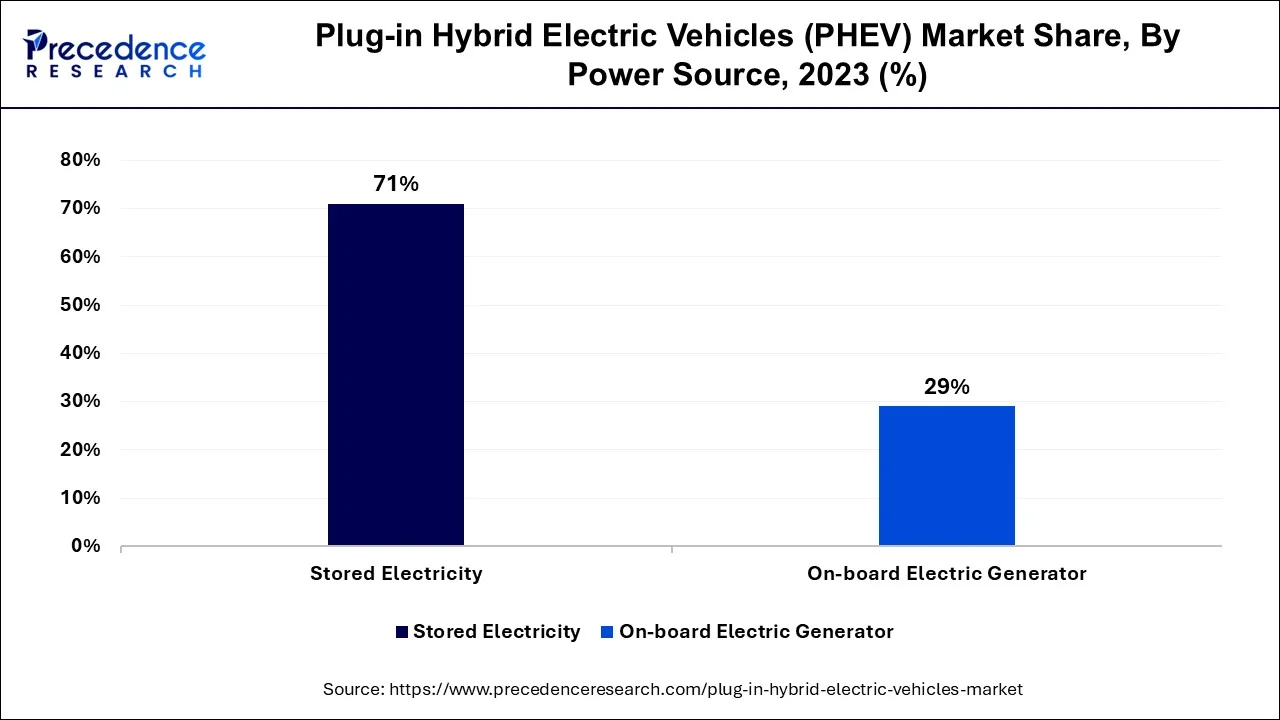

- By power source, the stored electricity segment accounted highest revenue share of over 71% in 2024.

- By vehicle type, the passenger vehicle segment held 84% of the total revenue share in 2024.

- The India plug-in hybrid electric vehicles market is registering growth at a CAGR of 7.4% from 2025 to 2034.

- The U.S. has hold 74 to 76% of the North America market share in 2024.

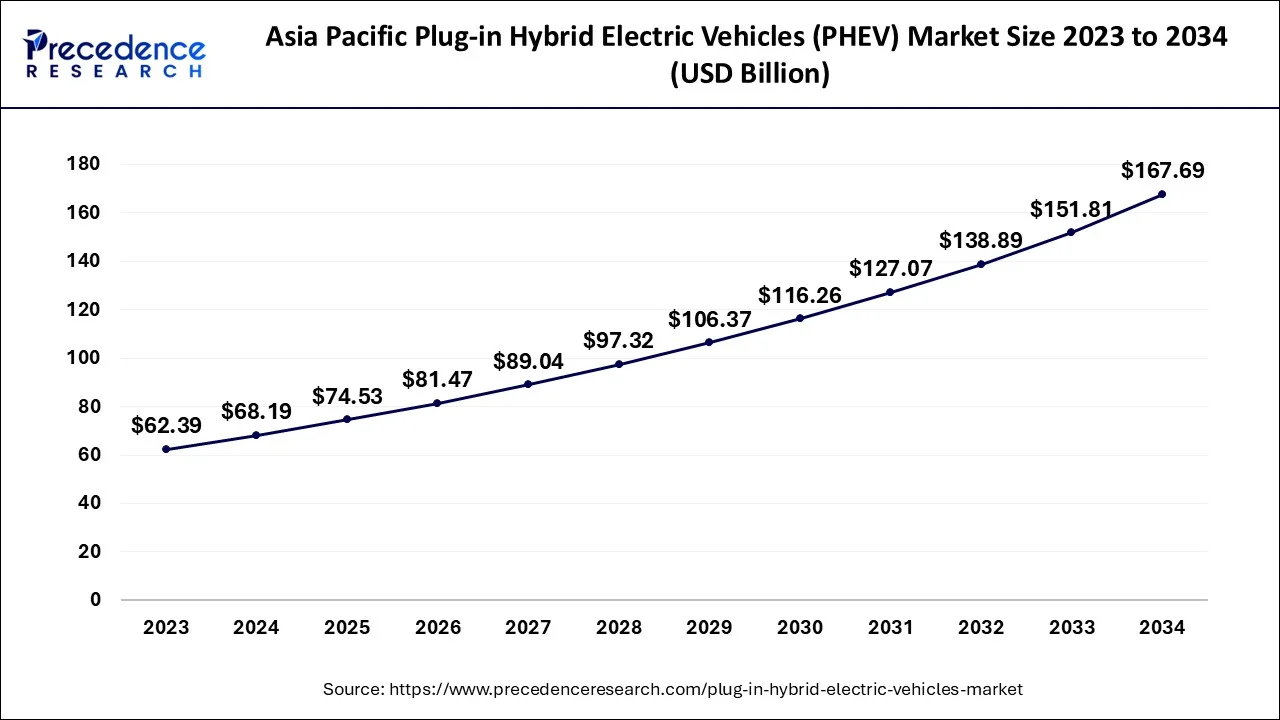

Asia Pacific Plug-in Hybrid Electric Vehicles (PHEV) Market Size and Growth 2025 to 2034

The Asia Pacific plug-in hybrid electric vehicles (PHEV) market size is evaluated at USD 68.19 billion in 2024 and is predicted to be worth around USD 167.69 billion by 2034, rising at a CAGR of 9.40% from 2025 to 2034.

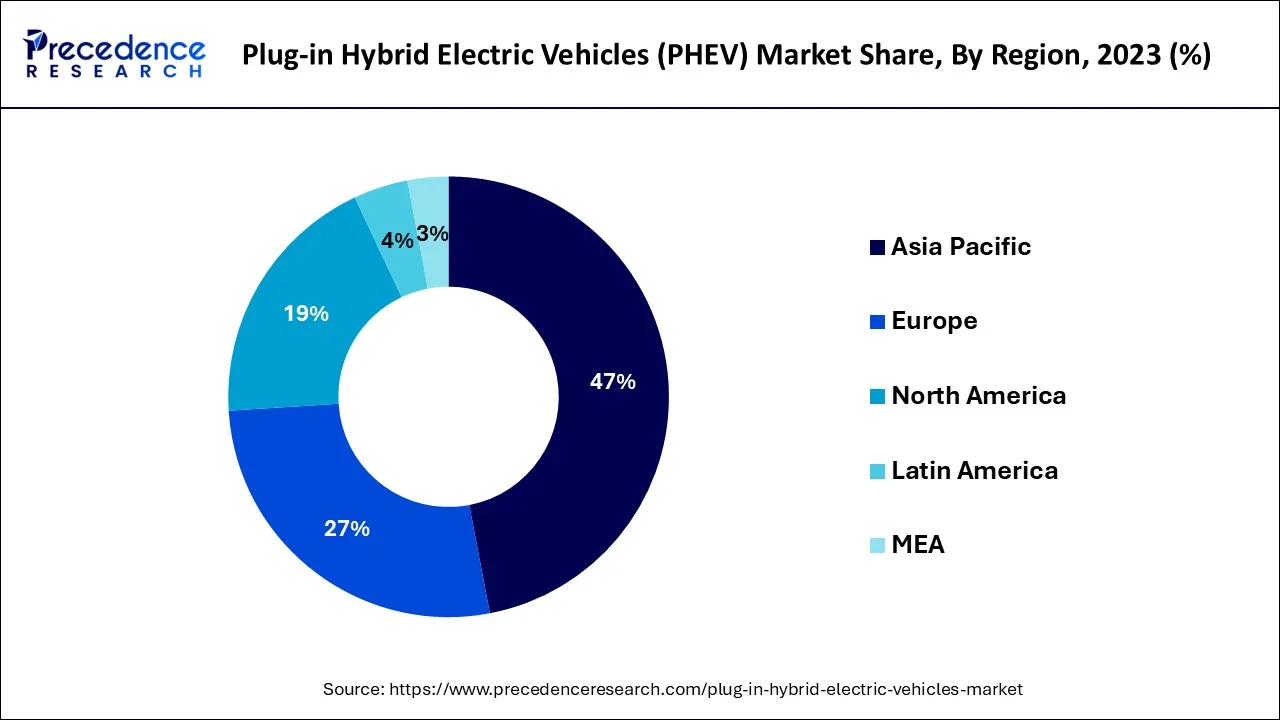

Asia-Pacific dominated the plug-in hybrid electric vehicle market in 2024. The Asia-Pacific region is heavily populated, with the bulk of residents falling into the middle class. They are the largest purchasers of plug-in hybrid electric vehicles. As a result, the volume of plug-in hybrid electric vehicle sales in this region is likely to continue to climb. Customers are being pushed to choose plug-in hybrid electric vehicles due to rising gasoline prices. In the coming years, the potential market for plug-in hybrid electric vehicles is expected to be India, Brazil, South Africa, Russia, and Mexico.

North America is expected to develop at the fastest rate during the forecast period. The North American plug-in hybrid electric vehicle markets are partnering on a variety of fronts to raise hybrid electric vehicle awareness and, as a result, increase global demand.

A significant trend in the plug-in hybrid electric vehicles market in the United States is the growing accessibility of charging infrastructure. With the increasing installation of charging stations nationwide, consumers feel more assured about the feasibility of owning a plug-in hybrid electric vehicle. The United States features a vast and varied automotive market, with differing preferences and requirements in various areas. In certain states, like California, there are more stringent rules regarding emissions and an increased emphasis on environmental sustainability. This has resulted in a greater demand for plug-in hybrid electric vehicles in these areas than in others.

- By December 2023, total sales in the U.S. reached 4.7 million plug-in electric vehicles since 2010, primarily comprising all-electric vehicles. In 2023, sales amounted to 1,402,371 units, capturing a market share of 9.1%. This marked the first occasion that the American market exceeded 1 million sales.

China holds the title of the largest market globally for plug-in hybrid electric vehicles (PHEVs), experiencing a swiftly increasing demand for them.

Consumer choices, market trends, regional unique situations, and fundamental macroeconomic influences all play a role in shaping the plug-in hybrid electric vehicles market in China. The Chinese market has seen substantial expansion in recent years. This can be ascribed to various factors. To begin with, the Chinese government has enacted measures to encourage the use of new energy vehicles, such as PHEVs.

Chinese automakers like BYD and Chery are increasing their sales of plug-in hybrids in the European Union to circumvent import tariffs on electric vehicles manufactured in China, based on data revealed. Furthermore, increasing consumer awareness of environmental concerns and the rising adoption of electric vehicle technology are additional elements driving the growth of the PHEV industry.

- In March 2025, the two brands sold 3,269 and 757 plug-in hybrid electric vehicles (PHEVs) in the bloc, an increase from almost no sales in July 2024 when initial tariffs were implemented, according to a report by research firm Rho Motion.

Market Overview

A plug-in hybrid electric vehicle is a hybrid vehicle with a battery pack that can be recharged both internally and externally by plugging a charging cable into an external electric power source, as well as by its onboard internal combustion engine-powered generator. The majority of plug-in hybrid electric vehicles are passenger cars, but they also come in commercial and van versions, buses, motorbikes, utility trucks, trains, and even military vehicles.

The commercially available plug-in hybrid electric vehicles include many light-duty models, with medium-duty vehicles entering the global plug-in hybrid electric vehicle market. Although plug-in hybrid electric vehicles are more expensive than comparable conventional and hybrid vehicles, some of the costs can be offset by federal tax credits, fuel savings, and financial incentives and subsidies.

An external electric power source, the internal combustion engine, or regenerative braking can all be used to charge plug-in hybrid electric vehicle batteries. The electric motor functions as a generator during braking, utilizing the energy to charge the battery and recapturing energy that would otherwise be lost.

The distance traveled between battery charges determines the plug-in hybrid electric vehicle fuel consumption. If the vehicle is never plugged in to charge, for example, its fuel efficiency will be comparable to that of a similarly sized hybrid electric vehicle. It may be possible to use only electric power if the vehicle is driven a shorter distance than its all-electric range and is plugged in to charge between trips. As a result, the best method to optimize the electric benefits is to charge the vehicle on a regular basis.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 145.08 Billion |

| Market Size in 2025 | USD 158.58 Billion |

| Market Size by 2034 | USD 353.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Power Source, Powertrain, Vehicle Type and Regions |

Market Dynamics

The rising environmental concerns, government subsidies, tax incentives, and stringent emission requirements are driving the growth of the global plug-in hybrid electric vehicle market. The market for plug-in hybrid electric vehicles is constrained by factors such as a lack of infrastructure like plug-in charging stations, high vehicle costs, and expensive battery costs. To overcome these obstacles, the private sector and government organizations should collaborate to reduce the cost of plug-in hybrid electric vehicles and build suitable infrastructure. In addition, public awareness campaigns should be conducted to educate the public about the advantages of plug-in hybrid electric vehicles over traditional vehicles. The plug-in hybrid electric vehicle helps in the reduction of greenhouse gas emissions which contributes to market growth on a large scale.

The plug-in hybrid electric vehicle business is made up of vehicles that get their power from two or more different sources. The electric generator and the internal combustion engine are the two most important. The usage of gasoline and diesel in similar generators aids in the smooth operation of electric connectors that connect to the generators. The electric motor is also powered by a generator. The main idea of the plug-in hybrid electric vehicle is that the engine can function with a variety of power sources while maintaining efficiency while changing speeds. The change in the estimated frequency contributes to the automotive engine's increased efficiency. Furthermore, a significant amount of money is saved on the cost of fuel utilized. All these factors contribute to the growth of the global plug-in hybrid electric vehicle market during the forecast period.

The technology has found the answer to another current problem in the automotive sector, namely the high emissions of greenhouse gasses from automobiles, which contribute to global warming and climate change. With rapid technological advances, battery-powered vehicles are now a reality. Through the introduction of electric vehicles, new possibilities for charging stations have opened up. Automotive innovations with the increasing availability of high-performance electric vehicles (EVs) are emerging as one of the key growth drivers in the global EV charging market. Additionally, government policies to encourage purchases of electric vehicles, pressure from global organizations to reduce carbon footprint, and collective efforts to identify alternative fuel sources are driving the global market. Increasing government incentives and tax benefits for consumers around the world to purchase electric vehicles, and increased investment by government and private organizations in developing electric vehicle charging infrastructure is expected to drive the growth of the electric vehicle charging station market. For example, the Indian government has announced the installation of around 69,000 electric vehicle charging stations and points across India. The announcement is seen as part of the government's first phase for the growth of electric vehicle infrastructure in the country.

The high cost of hybrid vehicles is a barrier for the market. The battery is the most important component of a hybrid vehicle, such as a plug-in hybrid car. The battery raises the vehicle's cost, making it more expensive than diesel and gasoline-powered automobiles. The price difference is related to the cost of elements like the battery and the regenerative braking. However, the cost of batteries has dropped significantly in recent years. In addition, battery producers are taking the necessary steps and doing R&D to reduce the cost of batteries.

Hybrid vehicles offer significant growth opportunities in developing markets due to government initiatives and support (eg. incentives for sales and production, tax credits, and a greater focus on the deployment of hybrid commercial vehicles). The Indian government is offering a premium of about $ 446 for purchases of hybrid and electric vehicles in India. The Brazilian government encourages the purchase of hybrid vehicles, such as hybrids, electric hybrid vehicles, and CNG hybrids, to be added by lowering the tax rate. The Mumbai Metropolitan Area Development Authority (MMRDA) has signed a contract with Tata Motors of India to supply 25 hybrid electric buses from the Tata Starbus diesel series.

Power Source Insights

The stored electricity segment dominated the plug-in hybrid electric vehicle market in 2024. The low voltage auxiliary battery of a plug-in hybrid electric vehicle provides electricity to start the vehicle before the traction battery is engaged, as well as powering plug-in hybrid electric vehicle accessories.

The on-board electric generator segment is the fastest growing segment of the plug-in hybrid electric vehicle market in 2024. During the working of an onboard electric generator, the moving wheels of the generator generate electricity, which is then transferred to the traction battery pack. Some plug-in hybrid electric vehicles have motor generators that do both the driving and the regeneration.

Power Train Insights

The parallel hybrid segment dominated the plug-in hybrid electric vehicle market in 2024. Both the engine and the electric motor are linked to the wheels to propel the plug-in hybrid electric vehicle in parallel hybrid mode. The engine mechanically drives the wheels, and if necessary, the engine is aided by an electric motor. The parallel mode of operation has several benefits, including the removal of efficiency losses in various power conversion procedures between the electric machines and the battery, reduced traction motor size, and no need for a generator.

The series hybrid segment, on the other hand, is predicted to develop at a rapid rate over the projection period. In stop-and-go traffic, where gasoline and diesel engines are inefficient, series hybrids succeed. The plug-in hybrid electric vehicle's computer can choose to only use the battery pack to power the motor, saving the engine for instances where it is more efficient.

Vehicle Type Insights

Based on vehicle type, the passenger cars segment dominates the plug-in-vehicle market. Due to increasing government initiatives and alternatives for energy sources. Also, the growing awareness regarding environmental pollution and less CO2 emission is driving the market. Moreover, increasing petroleum prices dominate commercial vehicles and two-wheelers segments in the market.

Key Market Players

In order to meet the growing demand for plug-in hybrid electric vehicles, the major market players are focusing on research and development and new product development. Several market players are introducing new plug-in hybrid electric vehicles to the market. BMW, for instance, debuted the BMW X5 plug-in hybrid electric vehicle in 2016. Toyota Prius, Ford Fusion, BMWi8, Porsche 918 Spyder, Volkswagen Golf, and other plug-in hybrid electric vehicles are available on the market. The income generated by the leading plug-in hybrid electric vehicle market players is likely to be used to estimate the market value of plug-in hybrid electric vehicles. The key market players are effective on both a regional and a global level. It also aids in the creation of a competitive landscape.

Plug-in Hybrid Electric Vehicles (PHEV) Market Companies

- Nissan Motor Co., Ltd

- Mercedes-Benz Group AG

- General Motors

- Volkswagen AG

- Renault Group

- Ford Motor Company

- BMW Group

- Honda Motor Co., Ltd

- MITSUBISHI HEAVY INDUSTRIES, LTD

- TOYOTA MOTOR CORPORATION

Recent Developments

- In June 2022, Honda Motor (China) Investment Co., Ltd., a completely-owned Honda subsidiary in China, announced that GAC Honda Automobile Co., Ltd. (GAC Honda), a Honda automobile production and sales joint venture in China, began construction of its new EV plant.

- In March 2022, Honda Motor (China) Investment Co., Ltd., a completely-owned Honda subsidiary in China, announced that GAC Honda Automobile Co., Ltd. (GAC Honda), a Honda automobile production and sales joint venture in China, began construction of its new EV plant.

- In May 2022, Nissan announced its partnership with British adventurer, Chris Ramsey, to undertake the world's-first all-electric driving adventure from the magnetic North Pole to the South Pole.

- In 2021, FedEx Corp. announced that it has received its first 150 electric delivery vehicles from BrightDrop, the technology startup from General Motors decarbonizing last-mile delivery. This marks a critical milestone for FedEx as the company plans to transform its entire parcel pickup and delivery (PUD) fleet to all-electric, zero tailpipe emissions by 2040 and comes just months after BrightDrop's commercialization of the Zevo 600 as the fastest vehicle to market in GM's history.

- In May 2020, the e-NV200 is cementing its reputation as the ideal vehicle for urban deliveries where operators and residents appreciate its near-silent and zero-emission operation.

- In March 2020, Nissan concluded 31 agreements with local governments and companies on EV use during and after natural disasters. The agreements make electric cars available for local communities and citizens to use as power sources at evacuation centers and welfare facilities in the event of outages caused by natural disasters. This includes vehicles owned by local governments as well as ones used for car-sharing services and test drives at Nissan dealerships.

- In March 2019, Tesla announced its fully electric Model Y, which holds the capability of carrying seven passengers along with their cargo.

- In May 2019, Volkswagen launched pre-booking in Europe for the first model of its new full-electric ID.3. The first special edition was kept highly limited to just 30,000 vehicles.

Segments Covered in The Report

By Power Source

- Stored Electricity

- On-board Electric Generator

By Powertrain

- Series Hybrid

- Parallel Hybrid

- Combined Hybrid

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting