What is the Electric Motor Market Size?

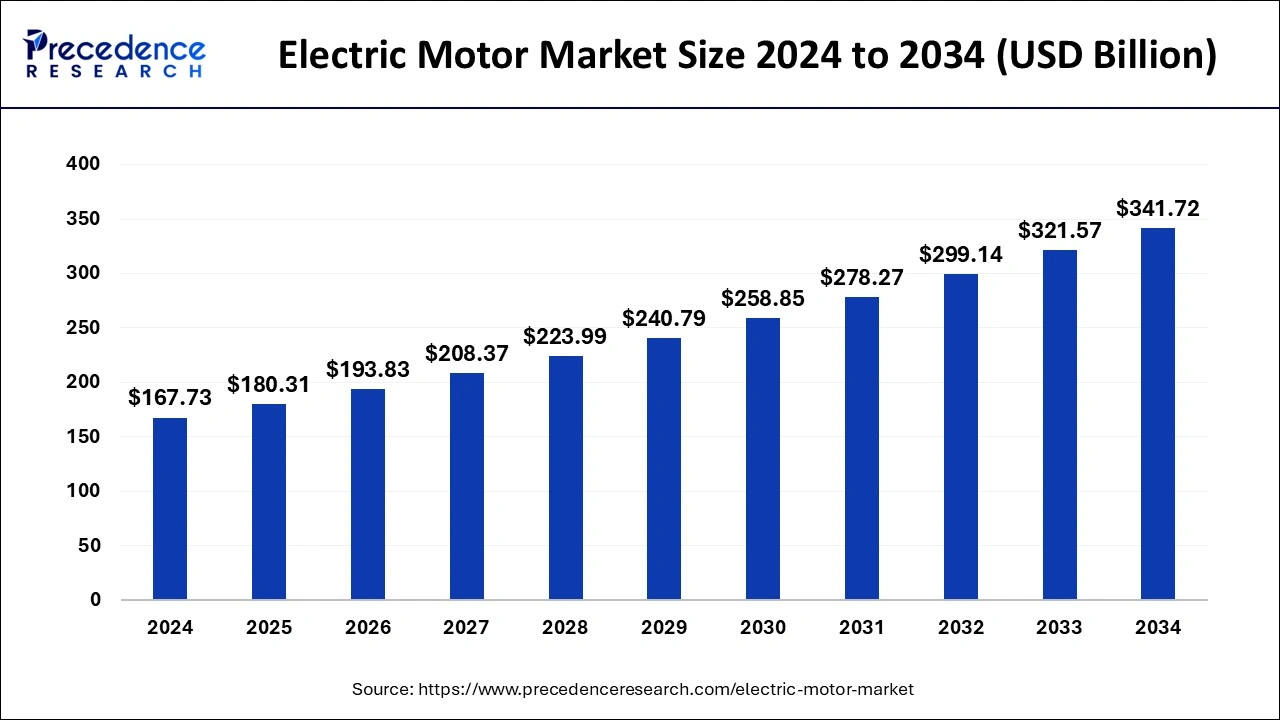

The global electric motor market size is calculated at USD 180.31 billion in 2025 and is predicted to increase from USD 193.83 billion in 2026 to approximately USD 363.39 billion by 2035, expanding at a CAGR of 7.26% from 2026 to 2035. Electric Motor Market. The electric motor market is driven by the rising need for energy efficiency, heavily impacted by stringent government regulations and even the global transition to sustainable energy.

Electric Motor Market Key Takeaways

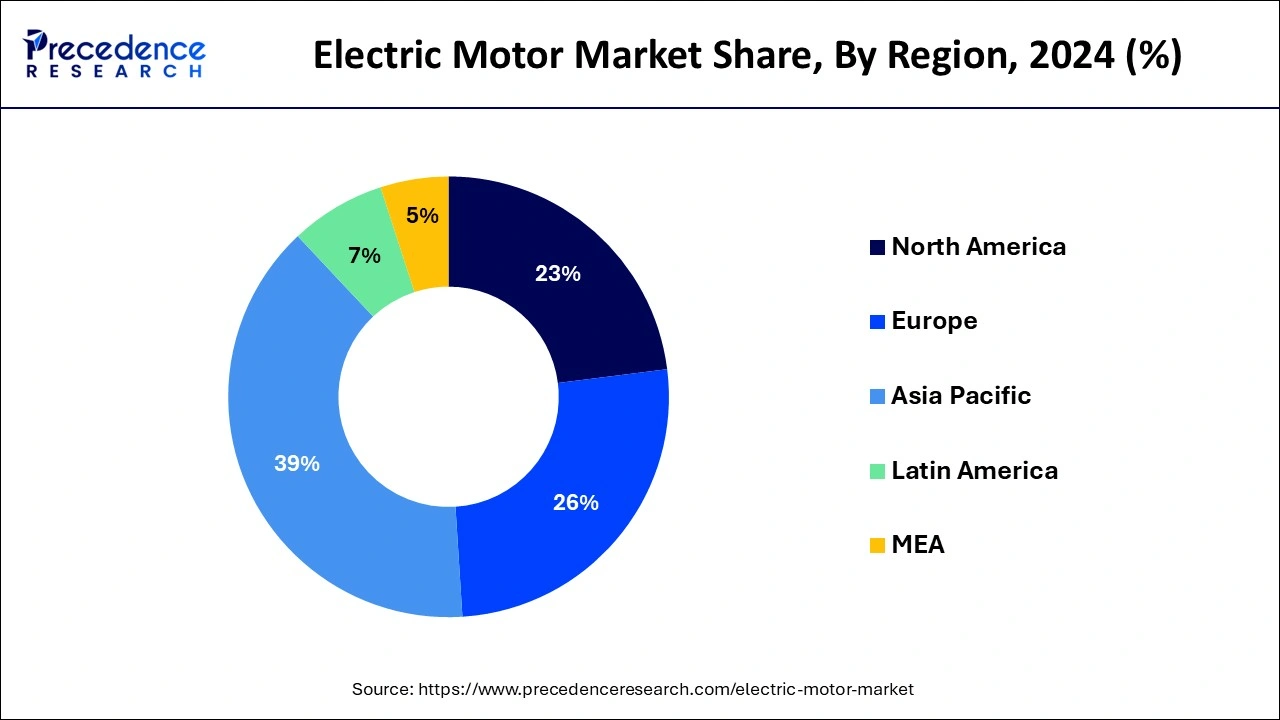

- Asia Pacific led the global market with the highest market share of 38.14% in 2025.

- By Type, the AC electric motors segment has held the largest market share in 2025.

- By Output Power, the above 1 hp motors segment captured the biggest revenue share in 2025.

- By Rotor Type, the inner rotor segment is expected to grow at a remarkable CAGR during the forecast period.

- By End-User, the industrial segment is expected to expand at the fastest CAGR over the projected period.

What is an electric motor?

Heating, ventilation, and air conditioning systems give thermal comfort and assure air quality in indoor spaces. They are one of the main building blocks of modern infrastructures, particularly for massive office buildings or shopping malls. The demand for HVAC systems is constantly growing in the Asia Pacific region, primarily in China and India, due to continuous expansion in their industrial and commercial sectors. In addition, HVAC systems are connected with construction industry owing to fuel the global market in the coming decade.

The expanding number of partnerships or collaborations among the numerous entities participating in this industry reflects the growing interest in vector manufacturing. The goals of these collaborations varied depending on the purpose. Collaborations have been formed for a variety of reasons, including the manufacture of vector promoters, the establishment or acquisition of manufacturing facilities, and the out / in licensing of vector manufacturing technology.

Key AI Integration in the Electric Motor Industry

Artificial Intelligence (AI) is transforming the electric motor industry over the entire product lifecycle, from design along with manufacturing to operation and maintenance. Key impacts include significant improvements in efficiency, reliability, and even the development of new, high-performance motor systems, mainly in electric vehicles (EVs) and even industrial automation. AI-powered automation and robotics improve production lines, enhancing quality control and reducing defect rates.

Market Outlook

- Industry Growth Overview:

The electric motor market is growing, driven by the growing demand for energy-efficient motors in sectors such as automotive, appliances, and manufacturing, as well as regulatory support for electric mobility and renewable energy. - Global Expansion:

The electric motor market is experiencing global expansion, as the push for energy effectiveness, stricter guidelines, and increasing demand in significant sectors such as electric vehicles (EVs), automation, and customer electronics. Asia Pacific is dominated in the market due to quick urbanization, industrialization, and government initiatives. - Major investors:

Major investors in the electric motor industry include large industrial conglomerates, recognized automotive manufacturers, particularly EV producers, and specialized component suppliers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 180.31 Billion |

| Market Size in 2026 | USD 193.83 Billion |

| Market Size By 2035 | USD 363.39 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 7.26% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segment Covered | Type, Output Power, Rotor Type, and End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

The AC electric motors segment is estimated to carry for the most prominent share due to its advantages over DC motors because it requires less maintenance and has longer life cycle than DC motors.

Also, AC motors are typically thought to be more powerful than DC motors because they will create more torque with a better current which is increasing its demand for various applications.

Output Power Insights

The above 1 hp motors segment is predicted to dominate the electric motor market from 2024 to 2033. Electric motors are utilized in various user applications due to their compactness, lightweight, and low maintenance requirements. Electrical motor installation in industrial and transportation user applications is expected to rise rapidly.

Rotor Type Insights

From 2025 to 2034, the inner rotor segment is expected to grow at a higher pace. Inner rotor motors have rotors in the middle that are encircled by stator winding. These motors are used in robotics, CNC machines, automatic door openers, and metal cutting and forming machine applications in the manufacturing, automotive, and consumer electronics industries. These applications require motors that will perform fast acceleration and deceleration of speed, offer high starting torque, have reversible action capability, and are compact. Consistent with the IEA, EV Outlook 2020, the worldwide sales of electrical cars reached 2 million in 2019, 40% above in 2018. This means the increased demand for electric vehicles and their accelerated manufacturing in coming years, which successively, is predicted to fuel the demand for inner rotor electric motors.

End-User Insights

The industrial segment is predicted to steer the electrical motor market from 2025 to 2034. This sector provides good scope for motor manufacturers, as most industries depend upon motorized automation. Electric motors are used in pumps, boilers, compressors, and other applications in the utilities, oil & gas, cement & manufacturing, metal and mining, oil & gas, renewables, petrochemicals & chemicals, water & wastewater, and paper & pulp industries, among others.

Regional Insights

Asia Pacific Electric Motor Market Size and Growth 2026 to 2035

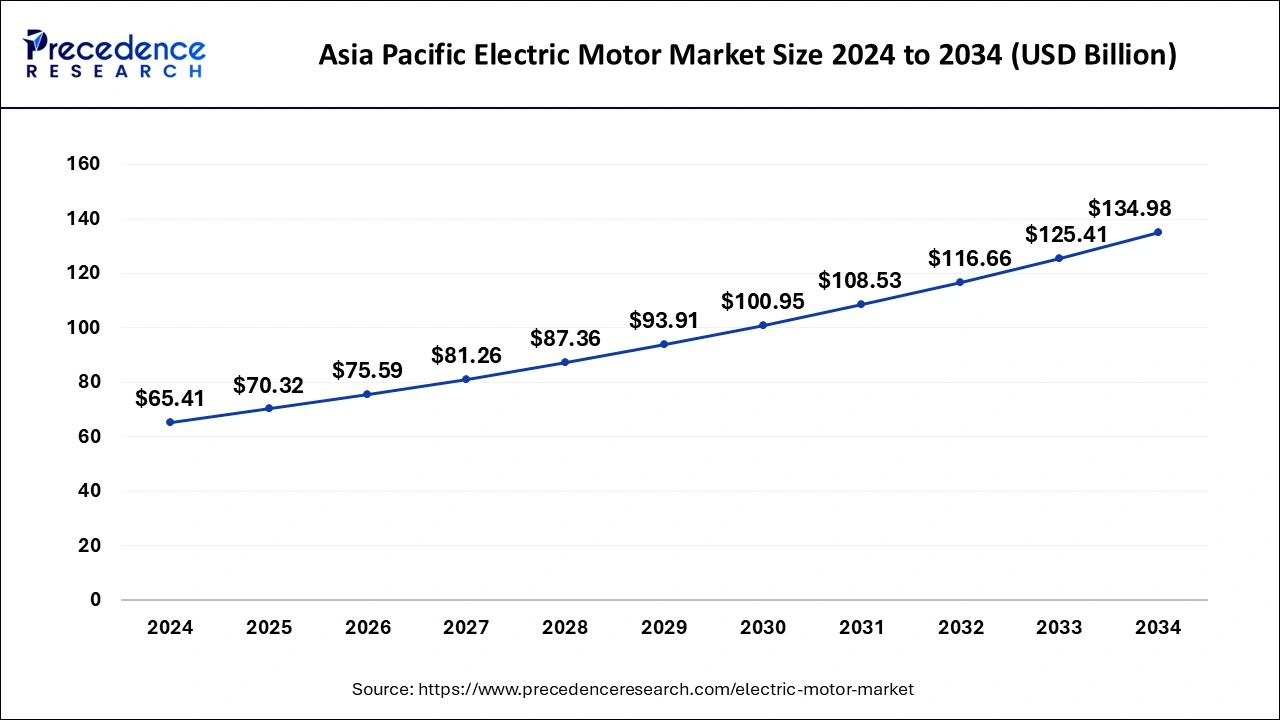

The Asia Pacific electric motor market size is valued at USD 70.32 billion in 2025 and is projected to be worth around USD 144.00 billion by 2035, growing at a CAGR of 7.51% from 2026 to 2035.

Asia Pacific: Rapid industrialization

The Asia Pacific is predicted to be the biggest electric motor market during the forecast period. The Asia Pacific encompasses China, India, Japan, South Korea, and the Rest of Asia Pacific. With the rapid industrialization, the countries in the Asia Pacific are progressing toward internet-based industrial operations in each sector. According to the GSM Association, the developed countries in the Asia Pacific, such as South Korea, and Japan are rapidly discovering the potential of innovative services and connected devices. The automotive sector in the region is also flourishing. The Asia Pacific is the largest manufacturer of automobiles in the world. These factors are expected to contribute to the market's expansion in the Asia Pacific region.

China: Massive manufacturing and industrial base

In China, massive manufacturing base, strong regulatory support for EVs and renewable energy, and increasing demand from industrial automation and infrastructure developments. There is an increasing demand for motors from manufacturing activities, driven by rapid industrialization, infrastructure advancement, and automation.

Europe: Enlarged focus on renewable energy

On the other hand, Europe is anticipated to grow exponentially in the coming years due to an enlarged focus on renewable energy and green energy targets. Furthermore, the region's principal focus has shifted to the deployment of electric motors for agricultural and industrial operations, which would aid the market's demand growth in the region.

UK: Supportive government policies

The UK government's support for electric vehicles (EVs) by its policies on energy efficiency, renewable power acceptance, and phasing out internal combustion engine vehicles. The UK has a well-recognized manufacturing capability and plays a significant role in the worldwide automotive supply chain, helping as a production and export base for EVs and mechanisms.

North America: Growing demand for electric vehicles

North America is experiencing substantial growth in the market due to it has a well-established, highly developed industrial and manufacturing base, particularly in the United States and Canada. The region is also a main center for automotive manufacturing, with significant investments in electric and hybrid vehicle technology. The high adoption rate of electric vehicles (EVs) in major countries drives the growth of the market.

U.S.: Industry Collaboration and R&D

In the U.S., significant spending in industrial automation and the growing shift towards energy-efficient systems also drives the demand for electric motors in the different sectors. The U.S. has a large domestic market that drives demand, from household appliances and HVAC systems to manufacturing machinery, which drives the growth of the market.

Latin America Powers Up: Emerging Growth Accelerates the Electric Motor Industry

Latin America's market is experiencing emerging growth driven by industrial expansion, rising automation, and increasing investments in energy-efficient technologies. Growing demand from manufacturing, mining, water and wastewater treatment, and HVAC applications is boosting adoption of advanced motor systems. Additionally, stricter energy-efficiency standards, electrification of transport, and integration of motors with variable frequency drives are creating new opportunities and supporting long-term market development across the region.

Brazil Electric Motor Market Trends

Brazil's market is showing steady growth, supported by expanding industrial activity, rising automation in manufacturing, and ongoing investments in infrastructure. Increasing demand for energy-efficient and high-performance motors across sectors such as mining, oil & gas, water and wastewater treatment, and HVAC is driving technology upgrades.

Value Chain Analysis – Drive by Wire Market

- Raw Material

The main raw materials for electric motors contribute electrical steel for the stator and rotor core, copper wire for the windings, and insulating materials such as resin or polymer composites.

Key Players:BlaBlaCar and Grab - Chemical Synthesis and Processing

The electric motor market uses chemical synthesis and processing widely in the creation of specialized insulation materials, magnetic alloys, and mechanical components, and for different cleaning and finishing processes.

Key Players: Bolt and Cabify - Compound Formulation and Blending:

Compound formulation and blending are significantly used to create specialized polymer composite materials for electrical insulation, temperature management, and structural components.

Key Players: Uber and Lyft

Key Companies & Market Share Insights

ABB Group and General Electric have had strong presence in the market with their wide range of products available for different end-user segments. These companies are well geared up with required products for various applications, having an advanced stator rotor, and copper rotor technology, which enhances motor performance, efficiency, and reliability. In addition, they are presiding in various sectors such as battery manufacturing and renewable energy among others, those benefits in grabbing investment opportunities from several customers.

The other companies in the market contain Nidec Motor Corporation, WEG, Toshiba Corporation and Hitachi among others. These companies target on developing their product portfolio and customer reach by getting contracts and investments in research and development (R&D).

Electric Motor Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Zurich, Switzerland |

Diversified product portfolio |

ABB Motion is showcasing its latest high-efficiency, safety-focused skills for the public transport sector |

|

|

Cambridge, Massachusetts |

Strong research and development (R&D) capabilities |

General Motors Co. announced it will increase its EV and AV investments from 2020 through 2025 to $35 billion, representing a 75% increase from its initial commitment announced before the pandemic. |

|

|

ARC Systems, Inc. |

United States |

Industry reliability |

ARC Systems, Inc. specializes in custom, high-performance electric motors and related components, focusing on niche, demanding applications rather than the mass-market EV sector. |

|

Nidec Motor Corporation |

Louis, Missouri |

Technological integration |

In September 2025, Nidec U.S. MOTORS is proud to introduce PrecisionFlow, its newest high-efficiency electronically commutated technology. |

|

DENSO |

Japan |

World-leading R&D and innovation |

In October 2025, DENSO CORPORATION announced that it had developed new electrification products that contribute to improved energy efficiency, driving performance, and reduced charging time for electric vehicles. |

Other Major Key Players

- WEG

- Emerson Electric

- Toshiba Corporation

- Hitachi

- Bosch

- Maxon Motors AG

- Regal Beloit Corporation

- Rockwell Automation, Inc.

- Siemens AG

- AMETEK.Inc.

- Johnson Electric Holdings Limited

Recent Developments in the Electric Motor Industry

- In August 2023, WEG stretched its operations to the markets of Eastern Europe and even Southwest Asia by starting a new office in Dilovas, Kocaeli, Turkey. The 7,000 m2 area is used to offer technical support to customers and even assemble products. The move provides a shorter time to market, not only for the local area but even for the surrounding countries.

(Source:watermagazine.co.uk)

Segments Covered in the Report

By Type

- Alternate Current (AC)

- Direct Current (DC)

By Output Power

- <1 HP

- >1 HP

By Rotor Type

- Outer Rotor

- Inner Rotor

By End-User

- Industrial

- Residential

- Commercial

- Agriculture

- Transportation

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting