What is the Electric Construction Equipment Market Size?

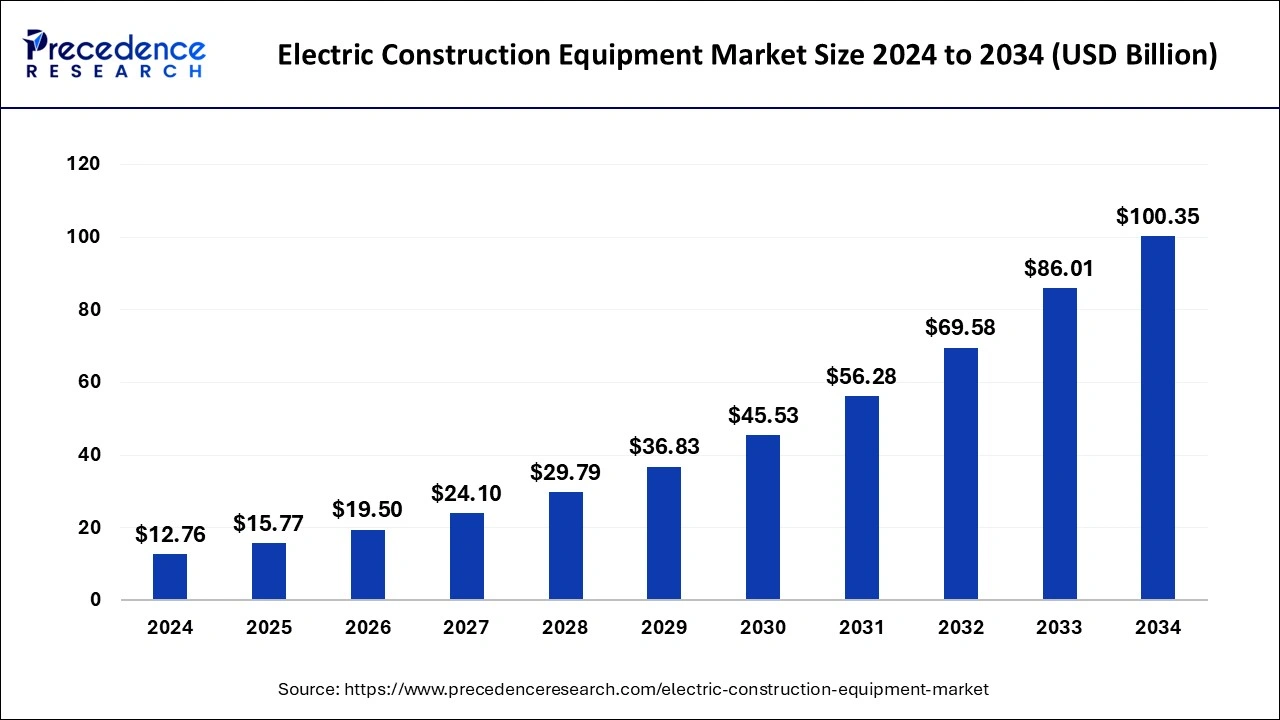

The global electric construction equipment market size was estimated at USD 15.77 billion in 2025 and is predicted to increase from USD 19.50 billion in 2026 to approximately USD 116.08 billion by 2035, expanding at a CAGR of 22.09% from 2026 to 2035.

Electric Construction Equipment MarketKey Takeaways

- The global electric construction equipment market was valued at USD 15.77billion in 2025.

- It is projected to reach USD 116.08billion by 2035.

- The electric construction equipment market is expected to grow at a CAGR of 22.09% from 2026 to 2035.

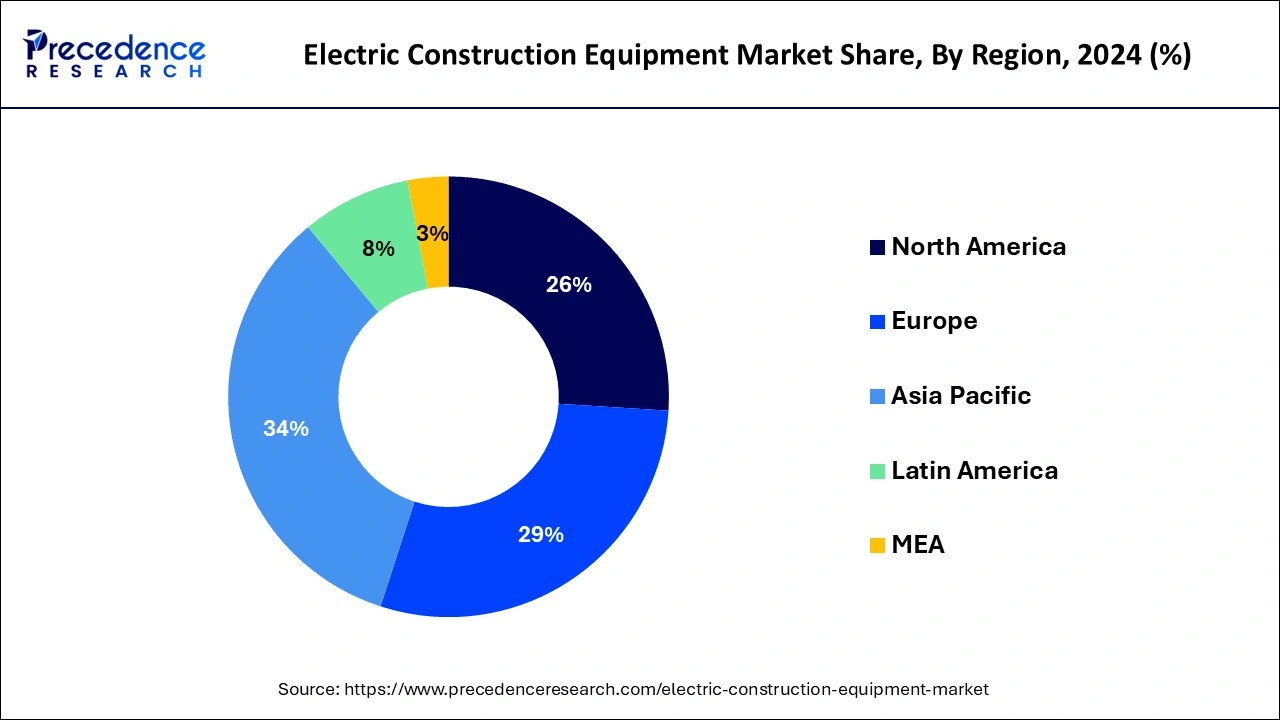

- Asia Pacific contributed 34% of market share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 to 2035.

- By vehicles, the excavators segment held the largest market share of 30% in 2025.

- By vehicles, the cranes segment is anticipated to grow at a remarkable CAGR of 25.2% between 2026 to 2035.

- By source, the lithium-ion segment generated over 44% of market share in 2025.

- By source, the lead acid segment is expected to expand at the fastest CAGR over the projected period.

- By end use, the construction segment generated over 32% of market share in 2025.

- By end use, the industrial segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The electric construction equipment market offers solutions in the form of machinery used in construction and excavation projects that operate using electricity rather than traditional fuel sources like diesel or gasoline. These machines utilize electric motors powered by rechargeable batteries to perform various tasks such as digging, lifting, and moving materials on construction sites. By employing electric power, this equipment produces zero emissions during operation, making them environmentally friendly alternatives to conventional diesel-powered machinery.

Additionally, electric construction equipment often produces less noise pollution compared to their fuel-powered counterparts, contributing to quieter and more pleasant working environments. The adoption of electric construction equipment is steadily increasing due to growing concerns about environmental impact and the desire for more sustainable construction practices. As technology continues to advance, electric machinery is becoming more efficient, cost-effective, and widely available, offering construction companies a greener and more sustainable option for their projects.

Electric Construction Equipment Market Data and Statistics

- The European Union has pledged to decrease its net greenhouse gas emissions by a minimum of 55 percent by 2030, compared to levels in 1990. Additionally, as part of the European Climate Law, the EU has set the ambitious target of achieving net zero greenhouse gas emissions by 2050.

- Volvo CE, in June 2023, introduced its inaugural mid-size electric excavator, the EC230 Electric, exclusively within the European market. This initiative aims to provide end-users with solutions that are both low-noise and emissions-free.

- In July 2023, the Brazilian government disclosed plans for a series of road auctions valued at USD 13 billion for the year, aimed at enhancing the maintenance and expansion of the transportation network. This effort seeks to facilitate cross-border trade activities and enhance mobility for consumers.

- A new metro development project, with an estimated investment of Euro 36.1 billion (USD 47.7 billion), has been outlined. The French Government, through Societe du Grand Paris (SGP), is contributing 30% of the funding, with the remaining 70% coming from local authorities through various sources such as taxes, subsidies, and loans.

- Caterpillar announced in November 2023 the initiation of a three-year program aimed at demonstrating an advanced hydrogen-hybrid power solution based on its new Cat C13D engine platform. This endeavor focuses on developing a system capable of meeting transient needs for off-highway applications.

- Volvo Construction Equipment unveiled a 38-tonne class EC380E hybrid excavator model in September 2022, marking one of the largest offerings in the company's hybrid product line. This launch not only expands Volvo's hybrid range but also boosts fuel efficiency by 17%.

- India's government announced its ambition to achieve net zero emissions by 2070 while targeting a reduction of one billion metric tons in projected carbon emissions by 2030. Similarly, China aims to peak CO2 emissions before 2030 and attain carbon neutrality before 2060.

- In June 2023, XCMG, a Chinese heavy machinery manufacturer, launched the XES35, a next-generation super 35m³ electric shovel excavator designed for loading approximately 65 tons of ore per cycle. This excavator is intended for deployment alongside mining dump trucks ranging from 220 to 330 tons.

- The National Highways Authority of India (NHAI) revealed plans in September 2023 to construct 27 new roads in Kerala, with a total project cost of INR 70,114 Crore (USD 8.4 million). These projects will cover a distance of 960.27 km, including the development of greenfield highways and the ongoing construction of National Highway 66.

Electric Construction Equipment MarketGrowth Factors

- Increasingly stringent environmental regulations and sustainability initiatives drive the adoption of electric construction equipment due to their lower carbon emissions and reduced environmental impact compared to traditional fuel-powered machinery.

- Electric construction equipment offers potential cost savings over time through reduced fuel expenses, lower maintenance costs, and longer equipment lifespan. This financial benefit attracts construction companies looking to optimize operational efficiency and reduce long-term operating expenses.

- Ongoing advancements in battery technology, electric motors, and charging infrastructure improve the performance, efficiency, and reliability of electric construction equipment. These technological developments enhance the appeal and competitiveness of electric machinery in the construction industry.

- Growing awareness of environmental issues and increasing demand for sustainable construction practices stimulate the electric construction equipment market. Customers, including construction companies, contractors, and governments, seek greener alternatives to meet sustainability goals and reduce their carbon footprint.

- Various government incentives, subsidies, and grants encourage the adoption of electric construction equipment by offering financial support or tax benefits to businesses investing in environmentally friendly machinery. These incentives help offset the initial higher purchase costs of electric equipment and accelerate market growth.

- Expansion of charging infrastructure and support networks for electric vehicles and machinery facilitates the widespread adoption of electric construction equipment. Investments in charging stations, grid capacity, and renewable energy sources enable seamless integration and operation of electric machinery on construction sites, driving market growth.

Electric Construction Equipment Trends

- The increasing adoption of silent machinery is spearheading the industry growth in the current period. The typical traditional construction machinery produces high-volume sound that can feel very noisy sometimes. Therefore, the manufacturers have been increasingly investing in R&D programmers for the development of these comfortable and silent machines in the past few years.

- The sudden surge in the improvement in battery technologies is driving the market growth in recent years. Moreover, these improvements are seen in solving the problems of builders and developers while cutting off limited time hours. Also, this can reduce the cost of construction developments. Also, technological advancement can play a major role in better battery development. Also, the producers are increasingly seeing the installation of automation in their plants nowadays, which is expected to increase production supply while cutting extra costs.

- The increasing favorable government initiatives for clean construction activities have contributed to industry growth in recent years. Several government agencies are seen in providing benefits and subsidies to developers for the adoption of machinery, which can reduce carbon emissions during construction programs.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 22.09% |

| Market Size in 2025 | USD 15.77 Billion |

| Market Size by 2035 | USD 116.08Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Vehicles, By Source, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Government incentives and subsidies

Government incentives and subsidies play a crucial role in boosting the market demand for electric construction equipment. These incentives typically come in the form of financial assistance, tax breaks, or rebates offered by governments to businesses and individuals investing in environmentally friendly machinery. By providing financial support, governments aim to encourage the adoption of electric construction equipment, which helps to reduce carbon emissions and mitigate environmental impact. These incentives make electric construction equipment more affordable and economically attractive for businesses, as they offset some of the initial higher costs associated with purchasing electric machinery compared to traditional fuel-powered alternatives. As a result, construction companies and contractors are more inclined to invest in electric equipment, leading to increased market demand.

Additionally, government subsidies create a favorable business environment for manufacturers and suppliers of electric construction equipment, stimulating innovation and technological advancements in the industry. Overall, government incentives and subsidies act as powerful drivers in accelerating the transition towards sustainable construction practices and promoting the widespread adoption of electric construction equipment.

Restraint

Concerns about equipment durability and longevity

Concerns about equipment durability and longevity act as significant restraints on the market demand for electric construction equipment. Some potential buyers hesitate to invest in electric machinery due to uncertainties surrounding the durability and lifespan of these newer technologies. Construction companies rely heavily on their equipment to withstand harsh working conditions and maintain high levels of productivity over extended periods. If there are doubts about the durability of electric construction equipment or concerns about its ability to endure heavy usage, businesses may opt to stick with traditional fuel-powered machinery that has a proven track record.

Additionally, the perception that electric construction equipment may require more frequent repairs or replacements compared to their diesel counterparts can deter potential buyers. Businesses are wary of potential downtime and maintenance costs associated with less durable electric equipment, which could impact project timelines and overall profitability. Until electric construction equipment can demonstrate comparable durability and longevity to traditional machinery, concerns in this area will continue to restrain the market demand for electric alternatives.

Opportunity

Growth of rental and leasing services for electric equipment

The growth of rental and leasing services for electric equipment presents significant opportunities in the electric construction equipment market. Rental and leasing options allow businesses to access electric machinery without the need for a substantial upfront investment, making it more accessible to a wider range of construction companies. This lowers the barrier to entry for adopting electric equipment, particularly for smaller firms or those hesitant to make a long-term commitment to purchasing new machinery.

Furthermore, rental and leasing services offer flexibility and scalability to construction businesses, enabling them to adjust their equipment fleet according to project requirements and demand fluctuations. As more rental companies add electric construction equipment to their offerings, it increases exposure and familiarity with these technologies among contractors and encourages trial usage. This, in turn, can drive broader acceptance and adoption of electric machinery within the construction industry, fostering growth and expansion opportunities for manufacturers and rental service providers alike.

Segment Insights

Vehicles Insights

The excavators segment held the highest market share of 30% based on the vehicles. In the electric construction equipment market, the excavators segment refers to machinery used for digging, lifting, and moving materials on construction sites. Trends in this segment include a shift towards electric-powered excavators, driven by increasing environmental concerns and regulatory pressure to reduce emissions. Electric excavators offer zero-emission operation, lower operating costs, and quieter performance compared to traditional diesel models. As technology improves and charging infrastructure expands, the adoption of electric excavators is expected to continue growing in the construction industry.

The cranes segment is anticipated to witness rapid growth at a significant CAGR of 25.2% during the projected period. In the electric construction equipment market, cranes refer to heavy machinery used for lifting and moving materials on construction sites. A notable trend in this segment is the increasing adoption of electric-powered cranes due to their lower emissions and operational costs compared to traditional diesel-powered counterparts. Electric cranes leverage advanced battery technology and electric motors to provide efficient and environmentally friendly lifting solutions. This trend aligns with the broader industry shift towards sustainability and green construction practices.

Battery Insights

The lithium-ion segment held a 44% market share in 2025. The lithium-ion battery segment in the electric construction equipment market refers to machinery powered by rechargeable lithium-ion batteries. These batteries offer higher energy density, longer lifespan, and faster charging capabilities compared to traditional lead-acid batteries. As technology advances, lithium-ion batteries are becoming more cost-effective and efficient, driving their widespread adoption in electric construction equipment. Additionally, advancements in battery management systems and safety features contribute to the growing popularity of lithium-ion batteries, making them a key trend in the market.

The lead-acid segment is anticipated to witness rapid growth over the projected period. The lead-acid battery segment in the electric construction equipment market refers to batteries that utilize lead plates immersed in an acidic electrolyte solution to store and discharge electrical energy. Despite being one of the oldest battery technologies, lead-acid batteries continue to find applications in electric construction equipment due to their affordability and reliability. However, there is a growing trend towards the adoption of more advanced lithium-ion batteries in the industry, driven by their higher energy density, longer lifespan, and superior performance.

End Use Insights

The construction segment has held a 32% market share in 2025. The construction segment in the electric construction equipment market refers to the industry sector that utilizes machinery and equipment for various construction activities such as building, infrastructure development, and earthmoving projects. Trends in this segment include a growing preference for electric machinery due to environmental concerns, tightening regulations, and cost-saving opportunities. Construction companies are increasingly adopting electric excavators, loaders, and other equipment to reduce emissions, lower operating costs, and align with sustainability goals.

The industrial segment is anticipated to witness rapid growth over the projected period. The industrial segment in the Electric Construction Equipment market refers to the use of electric machinery in various industrial applications such as manufacturing, warehousing, and logistics. A notable trend in this segment is the increasing adoption of electric forklifts, pallet jacks, and other material handling equipment to enhance efficiency and reduce carbon emissions within industrial facilities. Companies are increasingly prioritizing sustainability and seeking electric alternatives to traditional fuel-powered machinery to align with environmental goals and regulations.

Regional Insights

What is the Asia Pacific Electric Construction Equipment Market Size?

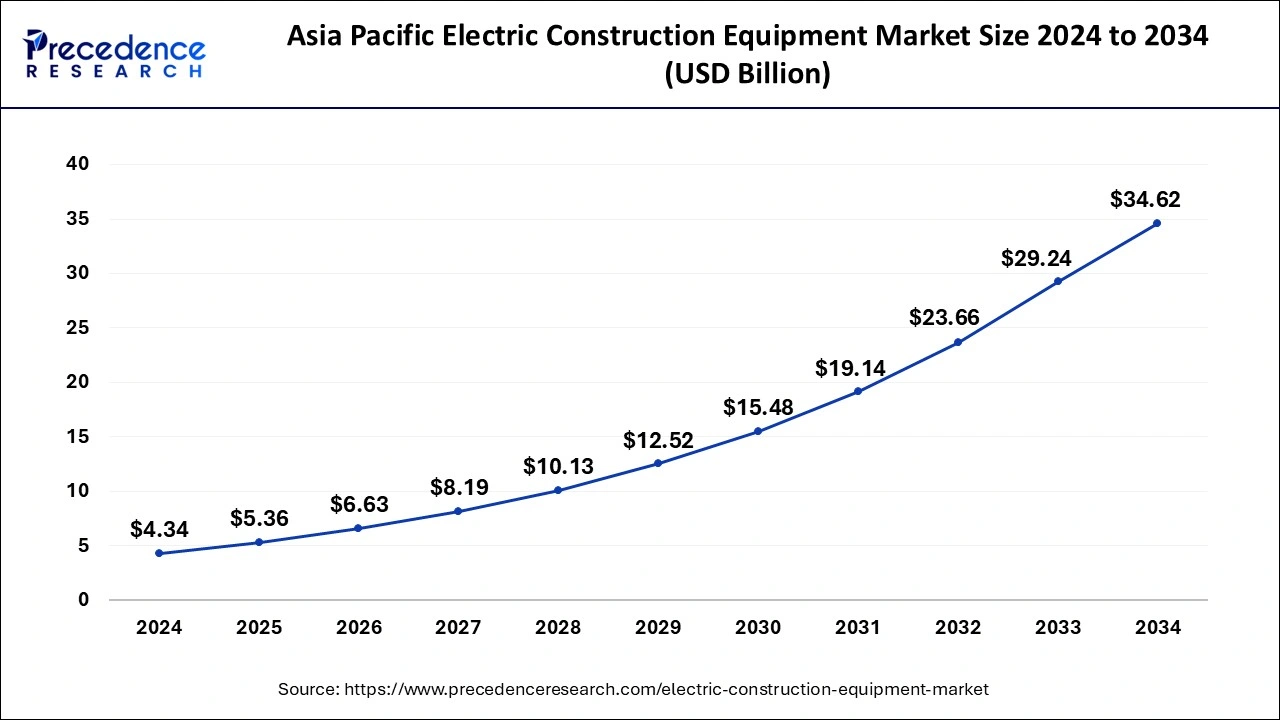

The Asia Pacific electric construction equipment market size was estimated at USD 5.36 billion in 2025 and is projected to surpass around USD 40.13 billion by 2035 at a CAGR of 22.30% from 2026 to 2035.

Asia-Pacific held a share of 34% in the electric construction equipment market in 2025 due to several factors. The region experiences rapid urbanization, leading to increased construction activities and infrastructure development. Additionally, governments in countries like China, India, and Japan are implementing stringent regulations to curb pollution, driving the adoption of electric construction equipment. Moreover, Asia-Pacific has a robust manufacturing sector, facilitating the production and distribution of electric machinery. The region's large population and rising disposable income further contribute to the demand for sustainable and efficient construction equipment, cementing its significant market share.

North America is experiencing rapid growth in the electric construction equipment market due to several factors. Firstly, stringent environmental regulations are driving the demand for cleaner, emissions-free construction equipment. Additionally, the region's advanced technological infrastructure supports the development and adoption of electric machinery. Moreover, increasing awareness of sustainability and the benefits of electric equipment among construction companies and government initiatives promoting renewable energy contribute to the market's growth. Finally, incentives and subsidies offered by governments further incentivize the transition towards electric construction equipment, fueling its rapid expansion in North America.

Meanwhile, Europe is experiencing notable growth in the electric construction equipment market due to several factors. Stringent environmental regulations, coupled with increasing sustainability initiatives, are driving the adoption of electric machinery. Additionally, advancements in battery technology and government incentives further promote the shift towards electric construction equipment. Rising fuel costs and growing public awareness of environmental impact also contribute to the market's expansion. As a result, construction companies in Europe are increasingly embracing electric alternatives to traditional fuel-powered machinery to meet sustainability goals and reduce carbon emissions.

Germany Electric Construction Equipment Market Trends

The adoption of electric construction equipment rates in Germany is among the highest in the world, as it is heavily influenced by environmental building codes, established industrial automation capabilities, and continued infrastructure upgrade projects taking place in smart cities throughout Germany. Construction firms are adopting these technologies to reduce operating costs, lower carbon footprints, and improve compliance with EU and national emissions standards.

Latin America: Urban Renewal Driving Demand

Urban redevelopment (to meet government directives) and sustainable mining operations are driving steady growth rates for the acceptance and usage of electricity-generated equipment in Latin America. As infrastructure upgrades to metropolitan areas are constructed using electrified equipment, more developing countries plan to continue to make equipment purchases based on anticipated fuel cost savings, due to the fluctuation of diesel fuel prices.

Brazil Electric Construction Equipment Market Trends

Brazil is gaining ground in the electricity generation market and throughout Latin America due to investment in renewable energy, urban/municipality mobility projects, and continued purchase and use of electricity-driven compact construction machinery, allowing construction contractors to perform work more cost-effectively. Additionally, partnerships between equipment manufacturers and local distributors are accelerating product availability and after-sales support across key Brazilian regions.

Middle East and Africa: Demand for Sustainable Construction Projects

Countries in the MEA are expressing more interest in electric construction equipment to support large-scale smart city projects and tourism infrastructure, where sustainability is a consideration. Coupled with the need for climate-resilient behavior, the availability of advanced charging solutions will also be an increasingly important factor when purchasing equipment for construction projects in desert locations.

Saudi Arabia Electric Construction Equipment Market Trends

The economy of Saudi Arabia continues to grow due to large amounts of money spent on diversifying its infrastructure and creating urban centers that focus on sustainability. As developers work towards creating energy-efficient and low-carbon development, the use of electric and alternative-fuel-powered construction equipment will continue to rise.

Value Chain Analysis of the Electric Construction Equipment Market

- Raw Material Sourcing: Electric construction equipment manufacturers use raw materials which include: high-strength steels, aluminum alloys, copper wire, lithium-ion batteries, semiconductors, power electronics, etc.

Key Players: BYD Co., Ltd., CATL, LG Energy Solutions, and Hitachi Metals. - Component Fabrication and Machining: Manufacturing of components for electric construction equipment requires the precision fabrication of electric drivetrains, battery enclosures, hydraulic systems, power control units, and structural frames through the use of advanced computer numerical control (CNC) machine tools.

Key Players: Komatsu Ltd., Volvo Construction Equipment, Caterpillar Inc., and Hitachi Construction Machinery. - Maintenance & After Sales: Creating effective after-market services for electric construction equipment manufacturers requires predictive diagnostics, battery monitoring, remote fleet management programs, and technician training programs; these services help to reduce equipment downtime and maximize long-term value for the contractor and developer of infrastructure.

Key Players: JCB, Hyundai Construction Equipment, Liebherr Group, and Doosan Bobcat.

Electric Construction Equipment Market Companies

- Volvo Construction Equipment

- Komatsu

- Caterpillar

- John Deere

- Honda

- Cummins

- Wacker Neuson

- XCMG

- Hitachi Construction Machinery

- Liebherr

- JCB

- Doosan Infracore

- Hyundai Construction Equipment

- Kobelco Construction Machinery

- Sany Group

Recent Developments

Case Construction

- Launch: In 2025, the construction company introduced their latest five construction machines recently. Moreover, this machine line includes two compact wheel loaders, an articulated loader, with two new motor graders as per the company's claim.

Greaves Retail

- Launch – In 2024, Greaves Retail unveiled the latest electric construction equipment recently. Also, this equipment includes the heavy-duty mini excavator, electric scissor lift , and others. Moreover, the launch of this equipment was held at CONEXPO India 2024.

Volvo CE

- Launch: Volvo CE introduced its latest construction equipment recently. This construction equipment is named L120 electric. This is a totally electric wheel loader that can offer the same performance compared to its diesel variant, as per the company report. Moreover, this equipment has benefits such as zero emissions with a silent operation feature.

Segments Covered in the Report

By Vehicles

- Excavators

- Loaders

- Cranes

- Others

By Source

- Lithium-Ion

- Lead Acid

- Others

By End-use

- Residential

- Construction

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting