What is the Construction Equipment Rental Market Size?

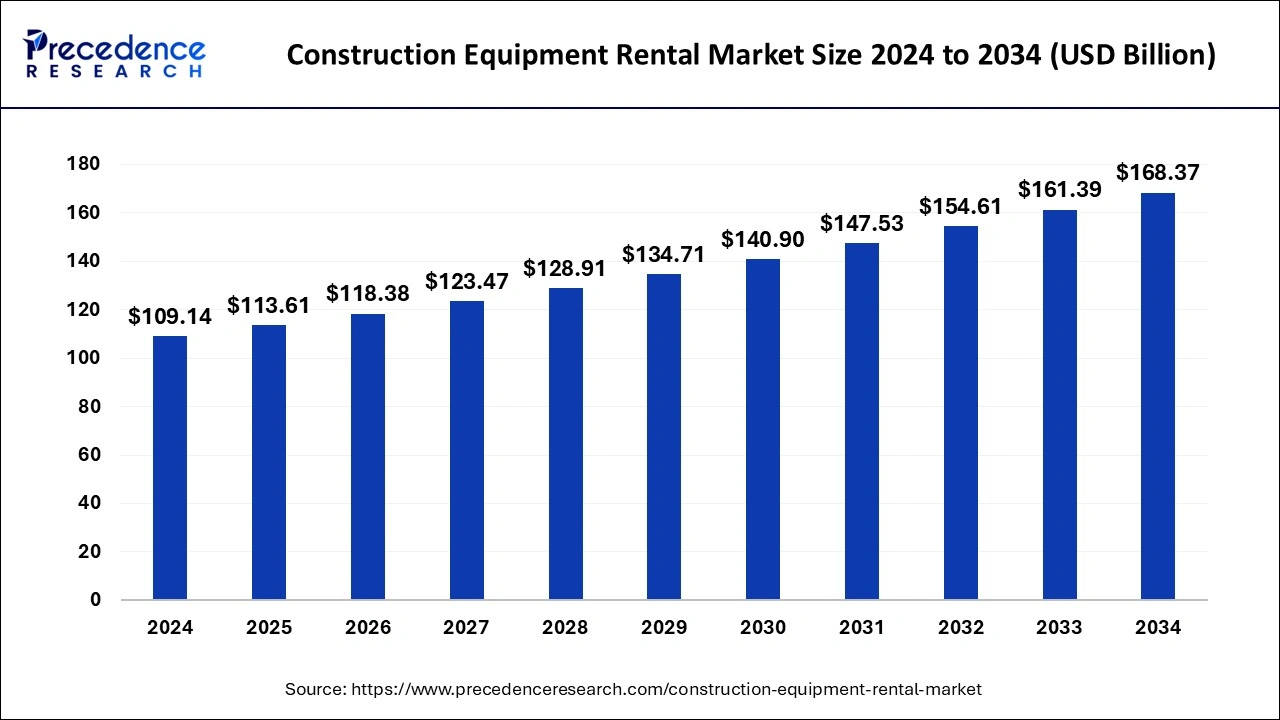

The global construction equipment rental market size is calculated at USD 113.61 billion in 2025 and is predicted to increase from USD 118.38 billion in 2026 to approximately USD 175.21 billion by 2035, groeing at a CAGR of around 4.43% from 2026 and 2035.

Market Highlights

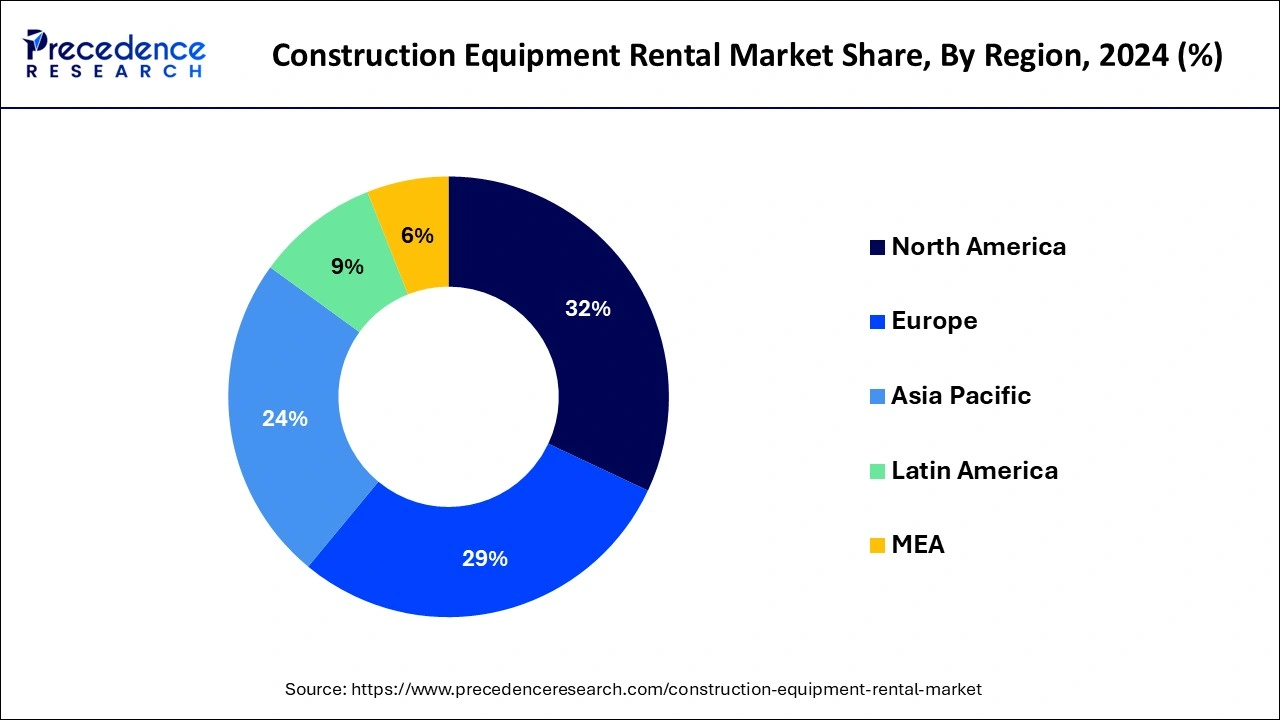

- North America dominated the market with the highest market share of 31.64% in 2025.

- North America is expected to expand at the largest CAGR between 2026 and 2035.

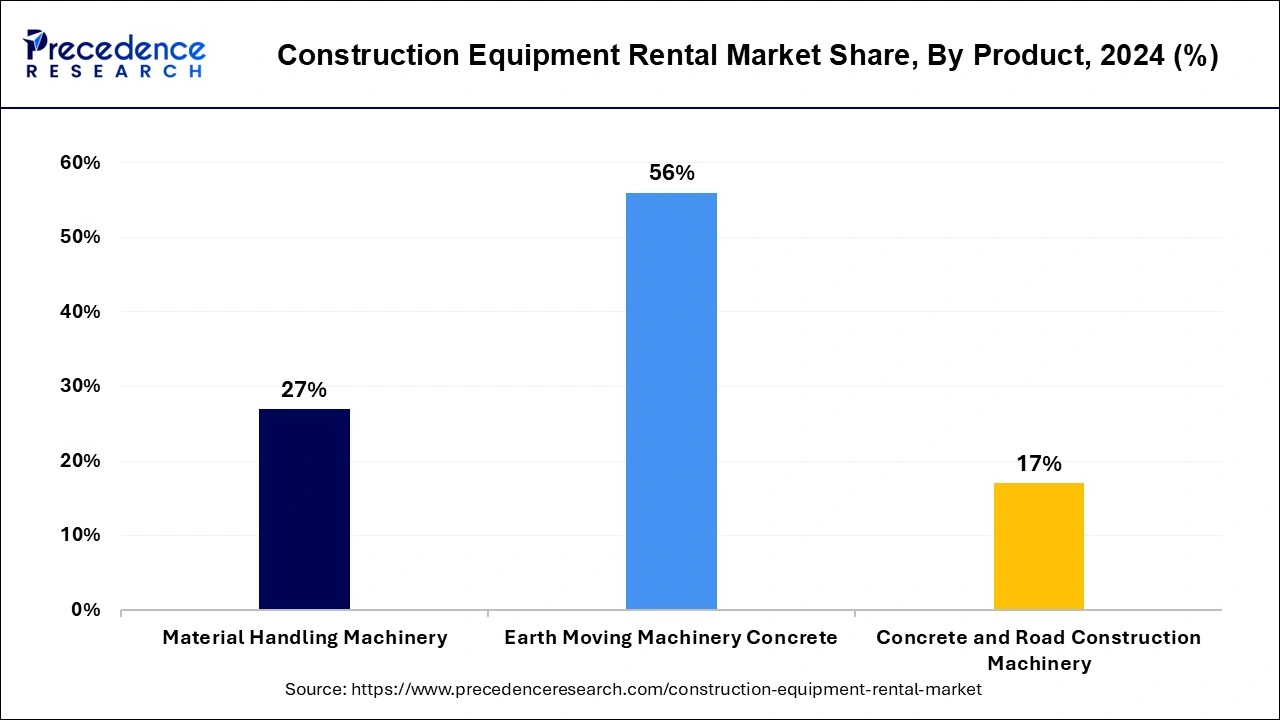

- By Product, the earthmoving machinery segment dominated the market in 2025.

How is AI Influencing the Construction Equipment Rental Industry?

AI is transforming the construction equipment rental industry by changing from reactive to proactive operations, leveraging information for predictive maintenance, improved logistics, and dynamic pricing. AI determines sensor data from machinery to forecast failures before they occur, significantly decreasing unplanned downtime and repair expenses. AI models adjust rental rates in real-time, driven by market need, availability, and competitor activity.

Construction Equipment Rental Market Growth Factors

Constant improvements in the infrastructure industry along with a diverse range of cutting-edge construction equipment in rental fleets are anticipated to spur the demand for the construction equipment rentals services across the globe. Corporations in the construction equipment rental market are skillful in identifying consumers and accordingly reposition construction equipment to diverse locations to control swelling requirement from real estate sector in residential and commercial areas. Furthermore, stringent guidelines, cumulative ownership price and financial restraints are some of the important motives stimulating the growth of global construction equipment rental market. On the other hand, unstable fuel prices and spending of delivering and picking up machinery, specifically if the contractor is working in inaccessible areas may impede demand in the construction equipment rental market during years to come.

Technological progressions in heavy machinery and automotive industry have carried out numerous new-fangled features in the construction equipment rental market. Construction equipment manufacturers are strongly concentrating on integrating cutting-edge safety features including 360-degree camera visual, lift assist, and supplementary work lights and also striving to offer systems that increase operational productivity and need minor maintenance. Nevertheless, these features come at a great cost, which is not reasonable to numerous small contractors and builders. Due to these factors, professionals are more inclined towards rental construction machinery.

Construction Equipment Rental MarketMarket Outlook

The construction equipment rental market is experiencing strong growth driven by rising infrastructure development, cost-efficient access to advanced machinery, and an increasing preference for flexible, short-term equipment use over ownership across commercial and residential construction projects.

The market is expanding worldwide, driven by rapid infrastructure development, increasing urbanization, and the shift toward renting rather than purchasing heavy equipment. Growing construction activities across emerging economies further strengthen international market penetration.

Major investors in the market include global and regional rental service providers, equipment manufacturers, and private equity firms. Key players like United Rentals, Ashtead Group, and Herc Holdings invest in fleet expansion, advanced machinery, and technology-driven rental solutions.

The startup ecosystem in the market is emerging, with tech-driven platforms offering on-demand rentals, fleet management solutions, and digital marketplaces. These startups focus on efficiency, cost optimization, and connecting contractors with rental providers for streamlined access to machinery.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 113.61 Billion |

| Market Size in 2026 | USD 118.38 Billion |

| Market Size by 2035 | USD 175.21 Billion |

| Market Growth Rate from 2026 and 2035 | CAGR of 4.43% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 and 2035 |

| Segments Covered | Product Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Access to latest technology

Telematics systems, which enable remote monitoring of usage, fuel consumption, maintenance schedules, and even location tracking, are being integrated by numerous rental firms into their equipment. Construction projects are using automation technology like drones, self-driving cars, and GPS-guided machinery more and more. These elements are being offered by rental firms as equipment to increase productivity, safety, and accuracy on construction sites. Manufacturers of equipment are producing lighter, more robust, and energy-efficient machinery by utilizing improved materials and production procedures. Rental equipment is being equipped with predictive maintenance algorithms to foresee and stop malfunctions before they happen. Rental companies can reduce downtime and repair costs by scheduling maintenance proactively and monitoring equipment health in real-time.

- In April 2025, Bobcat introduced a new generation of mini excavators. Bobcat showed its new R2 Series 1-2 tonne mini excavators for the first time at Bauma 2025, as well as its advancements in electrification and automation. The new 1-2 tonne mini excavators include four models with a new look and features aimed at improving customer productivity.

Restraint

Maintenance and Downtime

In the market for renting construction equipment, maintenance and downtime are vital factors. Reducing downtime is crucial for rental companies to increase revenue and satisfy clients. Preventive maintenance procedures are generally used by rental firms to ensure that their equipment remains in optimal condition. In order to spot such problems early on and resolve them before they become more serious and result in downtime, routine inspections, service, and repairs are planned. Breakdowns can still happen even with precautions taken. For rental companies to react swiftly to equipment issues, they must have effective mechanisms in place. This entails having knowledgeable personnel on hand for on-site repairs or quickly delivering replacement equipment to reduce interference with the client's project.

Opportunity

Service Offerings and Value-added Solutions

In order to guarantee that the equipment is in top operating condition throughout the duration of the rental, rental companies frequently provide maintenance services. This can involve routine examinations, fixes, and replacements as necessary. To guarantee the equipment operates safely and effectively, several construction equipment rental businesses offer their clients training courses. Online resources, user manuals, and on-site instruction are a few examples of this. Remote monitoring of usage, performance, and maintenance requirements is made possible by the integration of telematics and other technologies into rental equipment. Since sustainability is becoming more and more important, rental companies might provide eco-friendly equipment or adopt eco-friendly procedures like fuel efficiency optimization and emissions monitoring.

Construction Equipment Rental Market Segment Insights

Product Insights

Global construction equipment rental market can be classified on the basis of product into material handling machinery, earthmoving machinery, and concrete and road construction machinery. Out of these different products contributing in market growth, earthmoving machinery led the global construction equipment rental market in 2024. Nevertheless, the concrete and road construction machinery segment is also projected to display the utmost growth rate during the assessment period. The earthmoving machinery including excavators experiences huge demand across the globe due to its widespread application scope in mining, agriculture and construction industries. Other equipment in this category includes mini excavators, backhoe loaders, crawler excavators, and skid-steer loaders that also possess eye-catching market potential. These provide high load capability and engine power, which allow them to operate competently in harsh circumstances.

Construction Equipment Rental MarketRegional Insights

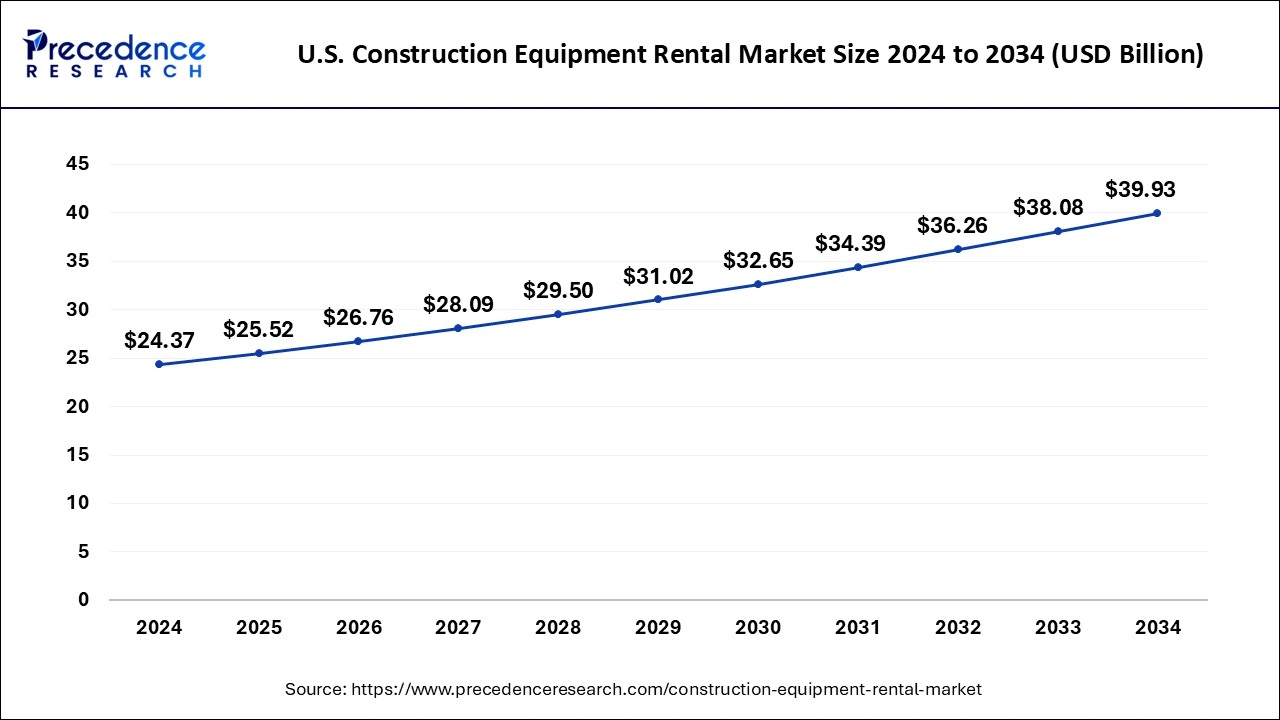

The U.S. construction equipment rental market size is estimated at USD 25.52 billion in 2025 and is predicted to be worth around USD 41.76 billion by 2035, at a CAGR of 5.05% from 2026 and 2035

North America holds the largest share in Construction Equipment Rental Market. For many construction enterprises, renting construction equipment can be more economical than buying new machinery outright. They can now access a large variety of equipment without having to worry about upkeep, storage, or depreciation. Renting offers flexibility, making it simple for businesses to scale their equipment requirements in accordance with project specifications. This is especially helpful for smaller businesses or those with varying workloads. Typically, rental businesses provide support and maintenance services to keep equipment in working order and reduce downtime for building projects. North America has a competitive rental market with several providers providing a variety of equipment alternatives. Competitive pricing and better client services are frequently the results of this competition.

In April 2025, Surplus.net introduced a dedicated service offering to assist construction firms, contractors, and equipment rental companies in managing surplus assets across North America. As infrastructure projects evolve and equipment needs shift, businesses are frequently left with idle machinery, unused parts, and obsolete materials. Surplus.net provides a process-driven platform to help organizations assess, list, and sell surplus inventory in a secure and structured manner.

U.S. Construction Equipment Rental Market Trends

The U.S. market is driven by digitalization, infrastructure investment, and a shift toward rental over ownership to avoid high capital expenses. Rental firms are heavily utilizing telematics and IoT to track equipment usage, enhance maintenance, and decrease downtime for clients. Rental firms are investing in newer, more efficient, and thus, electric equipment to meet sustainability goals and offer modern, low-emission options to contractors.

Europe is expected to expand rapidly during the forecast period, owing to the robust presence of construction equipment rental companies, rising construction activities, rapid economic growth, and surging government investments in the development of public infrastructure and smart cities.

- In March 2024, Kiloutou rolled out a new system in France that will allow contractors to share machines on a single site. The Konnect system works with an RFID-enabled card that gives the holder access to the machine through its telematics box. Contractors can configure each machine for a USD 150 charge and then issue multiple RFID cards, each costing USD 20, to cover an entire site.

The market is experiencing significant growth in the European region, as several construction businesses and contractors are shifting towards construction equipment leasing due to the high initial purchase cost of modern construction equipment.

Numerous prominent market players are widely adopting various business strategies, such as acquisitions, collaborations, partnerships, and innovating existing products, to expand and strengthen their position in the industry. For instance, in May 2025, French telematics and Hiboo, a data management specialist, signed two new partnerships in the UK and France, expanding its customer base in the construction equipment rental market.

- In October 2024, eGate Smart Building Innovation Oy (eGate), a leading provider of cloud-connected condition monitoring solutions, announced a strategic partnership with Cramo Group, one of the leading construction equipment rental companies in Europe. The agreement includes mutual exclusivity, with Boels holding exclusive distribution rights for eGate in Europe and eGate becoming a strong partner for condition monitoring solutions.

UK Construction Equipment Rental Market Trends

The UK market is driven by the rising environmental regulations, which are pushing the need for eco-friendly, electric, and hybrid construction equipment. There is a growing need for specialized, technically developed machinery tailored to specific construction demands, rather than just general-purpose machines.

Italy Construction Equipment Rental Market Trends

There is significant funding from the National Recovery and Resilience Plan (PNRR), and investments in rail, road, and water infrastructure are boosting the need for heavy machinery. Increased focus on eco-responsible, electric, and Stage V-compliant machinery is rising, with electric models anticipated to grow at a high rate.

Brazil Construction Equipment Rental Market Trends

Brazil's market is driven by the increasing need for earthmoving machinery, rapid acceptance of telematics for efficiency, and even a shift towards sustainable, electric, or hybrid equipment. High need for specialized equipment, mainly in mining, alongside a growth in short-term rentals for flexible project timelines.

Latin America offers significant opportunities in the market due to rising infrastructure development, urbanization, and industrial expansion. Increasing demand for cost-effective machinery solutions, limited contractor capital investment capacity, and the growing presence of rental service providers are driving the market. Government initiatives to improve roads, transportation, and energy projects further support market growth across the region.

What Potentiates the Market in the Middle East & Africa?

The construction equipment rental market in the Middle East & Africa is driven by rapid urbanization, large-scale infrastructure projects, and industrial expansion. Rising investments in energy, transportation, and commercial construction, combined with contractors' preference for cost-efficient rental solutions over ownership, are driving the market. Additionally, the increasing adoption of technologically advanced machinery and fleet management solutions offers rental providers opportunities to expand services across the region.

The UAE leads the Middle East & Africa construction equipment rental market because of its strong infrastructure development, large-scale construction projects, and heavy investment in commercial and industrial sectors. Advanced logistics, established rental service networks, government backing for sustainable construction, and the widespread use of technologically advanced machinery further reinforce the UAE's dominance in the regional market.

On the other hand, the Asia Pacific region is expected to grow at a notable rate. The growth of the region is attributed to the rising construction activities of the commercial, industrial & residential sectors, the rising trend toward automation in the construction industry, and increasing government spending on construction activities. Additionally, strategic initiatives adopted by the key market players to expand their presence in the region, such as partnerships or collaborations, are expected to drive the region's major share in the construction equipment rental market.

- For instance, In June 2025, Multi Ways Holdings Limited, a leading supplier of a wide range of heavy construction equipment for sales and rental in Singapore and the surrounding region, announced that it has agreed to enter in a agreement with Shandong Shantui Construction Machinery Import & Export Co., Ltd., a global leader in bulldozer manufacturing. In this agreement, Multi Ways will serve as the exclusive dealer for all Shantui earthmover equipment in Singapore from June 1, 2025, to May 31, 2026.

China Construction Equipment Rental Market Trends

China's market is driven by a high need for earthmoving and even concrete machinery, rising infrastructure investment, and a shift toward rental over ownership to handle capital costs. The adoption of digital platforms for booking, equipment management, and telematics is increasing operational efficiency.

Construction Equipment Rental MarketValue Chain

This stage involves procuring high-grade steel, aluminum, and specialized alloys for heavy machinery frames and components. Sourcing hydraulic components, engines, and electronic parts from certified suppliers for reliable equipment performance.

This stage involves manufacturing and assembling engines, hydraulic systems, and control units for heavy equipment to meet safety and performance standards. Machining structural frames, booms, and chassis using precision engineering technologies for strength and reliability. Integrating electrical, telematics, and safety systems into construction equipment for operational monitoring and compliance.

Maintaining equipment through regular servicing, repairs, and replacement of worn-out parts to extend operational life. Deploying rental fleets strategically across regions to optimize utilization, availability, and customer satisfaction. Retiring or reselling outdated machinery while recycling components to maximize asset value and sustainability.

Construction Equipment Rental Market Companies

Global construction equipment manufacturer providing a wide range of excavators, loaders, backhoe loaders, and telehandlers. Their rental services offer flexible leasing options and support for infrastructure, industrial, and residential projects.

Prominent Middle East-based equipment rental and distribution company offering earthmoving machinery, cranes, and industrial equipment, along with maintenance services and operational support for construction and mining projects.

North American rental provider offering heavy machinery, aerial work platforms, cranes, and earthmoving equipment with flexible rental terms, fleet management, and on-site technical support.

Global brand offering high-quality earthmoving, forestry, and agricultural construction machinery; their rental services provide contractors access to advanced, durable equipment for infrastructure and commercial construction projects.

Focused on providing construction and industrial machinery for civil, commercial, and infrastructure projects; offers fleet management, technical support, and customized rental solutions.

Specializes in crane rentals and related lifting equipment for large-scale construction, industrial, and infrastructure projects. They offer project-specific solutions with certified operators and technical guidance.

Provides construction machinery and equipment rentals, including loaders, excavators, and aerial lifts, with flexible rental contracts, preventive maintenance, and on-site support to optimize operations.

Other Major Playes

- Industrial Supplies Development Co. Ltd

- Caterpillar Inc.

- Komatsu Equipment

Recent Development

- In April 2025, CASE Construction Equipment is launching a range of new machines and technology upgrades with a focus on providing rental businesses with equipment that's simple to use, painless to maintain, and easy to keep moving off the lot. The new launch includes a rugged and reliable compact wheel loader, an in-demand electric compact wheel loader, and a highly versatile small articulated loader with a telescopic boom. With the rising need for cost-effective, crowd-pleasing equipment in an increasingly competitive rental market.

- In May 2025, Vandalia Rental announced the launch of its brand-new Specialized Onsite Services (SOS) focused on Trench Shoring equipment. This significant expansion underscores the company's commitment to meeting the evolving needs of the construction industry while prioritizing safety and efficiency on job sites.

- In December 2023, Mycrane and Equip9 signed a Memorandum of Understanding (MOU) at Excon, South Asia's largest construction equipment event in Bengaluru, India. The collaboration aims to advance technical and commercial projects, with a strong focus on leveraging artificial intelligence (AI) for recommendation and selection models in the crane rental and heavy equipment sector.

- In March 2025, BigRentz, an online construction equipment rental marketplace, entered into a strategic agreement with construction permitting platform PermitFlow, designed to tackle pre-construction project inefficiencies. With the agreement, BigRentz and PermitFlow aim to integrate project permitting and equipment procurement during the pre-construction process

- In February 2024, Case Introduces New Machines and Hip-Pocket Support to Advance Rental Businesses. Case will display its most recent models and product lines, which include tiny articulated loaders, micro track loaders, backhoe loaders, and more. Along with a variety of innovative attachments, equipment such as the Utility Plus backhoe loader, which has won numerous awards, will be showcased for the rental market.

- In October 2023, Komatsu is prepared to introduce new electric excavators in the 20-ton class. Additionally, Komatsu intends to progressively launch these electric models in Australia, Asia, and North America. As part of its goal to become carbon neutral by 2050, Komatsu sees this new model's release as a chance to jumpstart the market for electric construction equipment.

Construction Equipment Rental MarketSegments Covered in the Report

By Product

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting