What is the Construction Equipment Market Size?

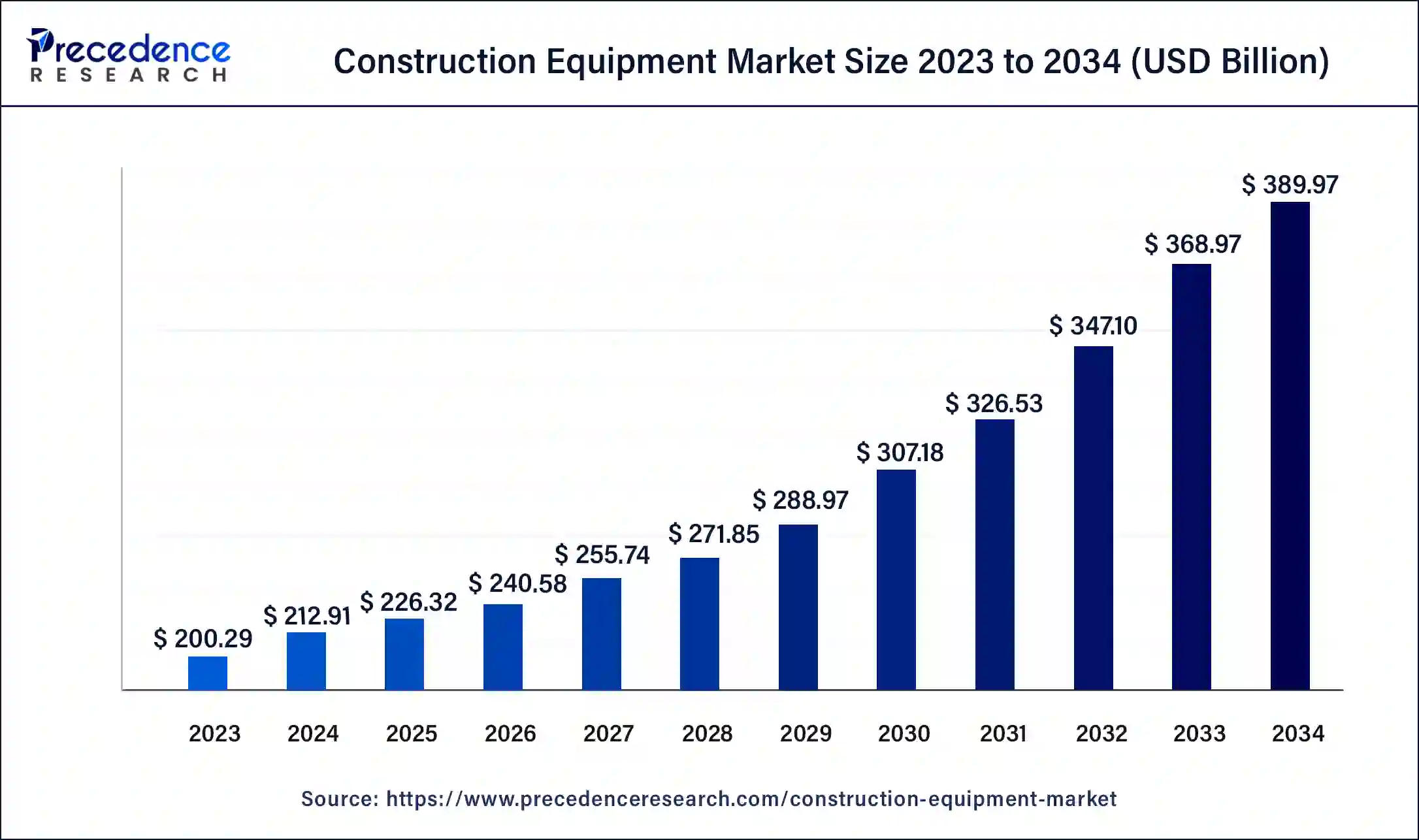

The global construction equipment market size accounted for USD 226.32 billion in 2025 and is expected to reach around USD 411.55 billion by 2035, expanding at a CAGR of 6.16% from 2026 to 2035

Market Highlights

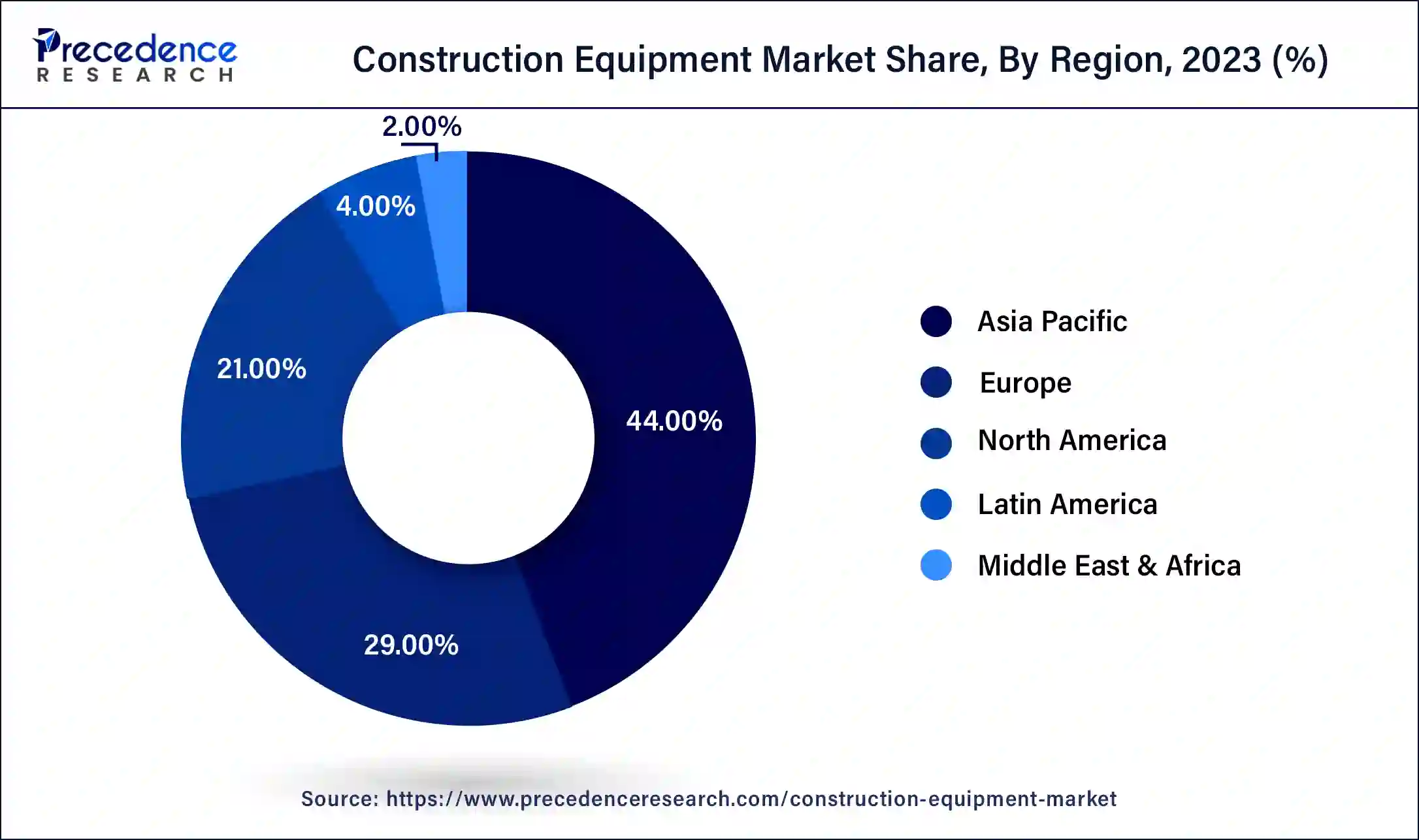

- Asia Pacific led the global market with the highest market share of 44% in 2025.

- Europe region is estimated to expand the fastest CAGR between 2026 and 2035.

- By Equipment Type, the earthmoving segment has held the largest market share of 52% in 2025.

- By Equipment Type, the material handling segment is anticipated to grow at a remarkable CAGR between 2026 and 2035.

- By Application, the residential segment captured the biggest revenue share in 2025.

- By Application, the industrial segment is expected to expand at the fastest CAGR over the projected period.

Construction Equipment Market Growth Factors

The global construction equipment market is majorly driven by the factors such as rapid urbanization, rapid industrialization, rising government investments in the development of infrastructure, and expansion and growth activities of the real estate and construction companies across the globe. The increased investments by the market players in the research and developmental activities to develop new automated equipment to replace traditional construction equipment is expected to drive the market growth in the upcoming future. The construction equipment manufacturers are constantly engaged in securing the supply chains to improve efficiency that will increase productivity of the construction industry. The global construction equipment market is expected to be driven by the increasing government expenditure on various infrastructural projects in Asia Pacific in the upcoming years. According to the Asian Development Bank, Asia is rapidly being urbanized as compared to rest of the world. East Asia is developing (Urbanizing) at a CAGR of 3.7%, followed by South-East Asia at 3.6%, South Asia at 3.3%, and Central Asia at 1.6%. The Pacific region is urbanizing at a CAGR of 2.9%. Therefore, the increased urbanization of Asia Pacific region is a major factor that is expected to drive the growth of the global construction equipment market in the upcoming future.

The adoption of smart automated construction equipment is another major factor boosting the demand for the construction equipment across the globe. The automated smart construction equipment are fuel-efficient, reduces labor cost, increase productivity, and reduces the overall operational costs. The introduction of Internet of Things (IoT) and ICT is boosting the demand for the latest advanced construction equipment. These cost saving benefits and advanced technologies installed in the latest construction equipment is expected to drive the global construction equipment market all over the globe. Further, the growth of the construction equipment rental services industry is fostering the development of the construction equipment market. The nations such as China and India, where the urbanization rate is highest is expected to witness a significant demand for the construction equipment rental services during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 226.32 Billion |

| Market Size in 2026 | USD 240.58 Billion |

| Market Size by 2035 | USD 411.55 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.16% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Equipment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Equipment Type Insights

Based on equipment type, the earthmoving segment dominated the global construction equipment market, accounting for a market share of over 52% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The earthmoving equipment includes excavators, loaders, and others. The emphasis of government to support the transport by investing heavily in the development of a strong and well-connected roads network has fostered the growth of this segment. Further, the extensive need for digging at confined spaces during the construction has led to the extensive use of excavators that significantly contributed towards the growth of this segment. Moreover, the government regulations regarding the emissions and noise is fostering the development of less noisy and eco-friendly excavators, which is expected to drive the growth of this segment in the upcoming years.

On the other hand, the material handling segment is expected to witness a significant growth rate during the forecast period. This is attributed to the rising demand for the machinery handling equipment like cranes in developed economies owing to the construction of skyscrapers and commercial buildings. Further, the government investments on building highways in developing nations is expected to boost the demand for the material handling equipment during the forecast period.

Application Insights

Based on application, the residential segment dominated the global construction equipment market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributed to the increased number of housing projects in the developed and developing nations in the past years. Rising urbanization is a major factor that fueled the growth of this segment.

On the other hand, the industrial segment is estimated to be the most opportunistic segment during the forecast period. The rising government policies to attract Foreign Direct Investments and rapid industrialization in the developing and underdeveloped economies is the major factor that is expected to drive the growth of this segment in the forthcoming years.

Regional Insights

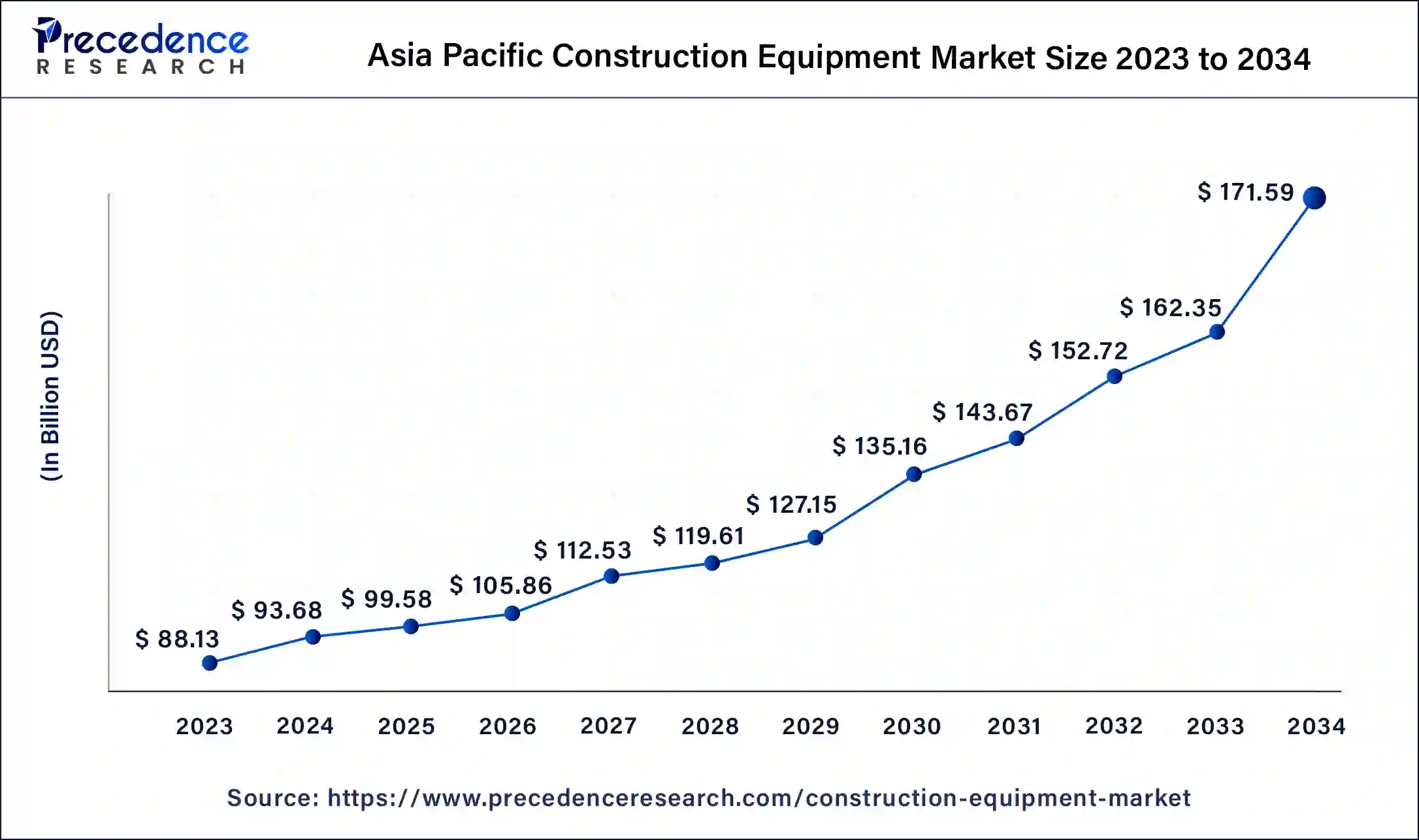

Asia Pacific Construction Equipment Market Size and Growth 2026 to 2035

The Asia Pacific construction equipment market size is estimated at USD 99.58 billion in 2025 and is predicted to be worth around USD 181.09 billion by 2035, at a CAGR of 6.16% from 2026 to 2035

Based on region, Asia Pacific dominated the global construction equipment market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. According to the Asian Development Bank, Asia Pacific is the fastest urbanizing region in the globe. The Asia Pacific region has witnessed an increase in urbanization by five-folds since 1970. The increased government expenditure on the development of infrastructure in major economies like India and China has had boosted the growth of the Asia Pacific construction equipment market. In fact, according to the Asian Development Bank, India and China are the two most prominent economies that augments the growth rate of the Asia region.

On the other hand, Europe is estimated to be the most opportunistic market during the forecast period. Europe has shown a positive growth in the construction sector. The development of various skyscrapers, industrial and commercial buildings, and residential units is expected to foster the growth of the Europe construction equipment market. Further, the rising popularity of advanced and latest technologies installed in the construction equipment is a prominent factor that will drive the growth of the market in this region.

Construction Equipment Market Companies

- Caterpillar Inc.

- Komatsu

- Hitachi Construction Machinery

- Liebherr

- Volvo Construction Equipment

- Doosan Infracore Co. Ltd.

- J.C. Bamford Excavators Ltd.

- CNH Industrial NV

- SANY Group

- Hyundai Construction Equipment Co.

Recent Developments

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

- In November 2018, Caterpillar, Inc. launched the new Next Generation D6 dozer that has improved fuel efficiency.

- In December 2019, Hitachi Construction announced the product development of a battery operated mini-excavator.

- In January 2020, Volvo Construction Equipment launched a new excavator with enhanced productivity, improved fuel efficiency, and installed with boom down motion that can reduce the operational cost.

The various developmental strategies like new product launches with latest and innovative features fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Equipment Type

- Earthmoving

- Material Handling

- Concrete

- Road Building

- Civil Engineering

- Crushing & Screening

- Others

By Application

- Commercial

- Residential

- Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content