What is Forklift Market Size?

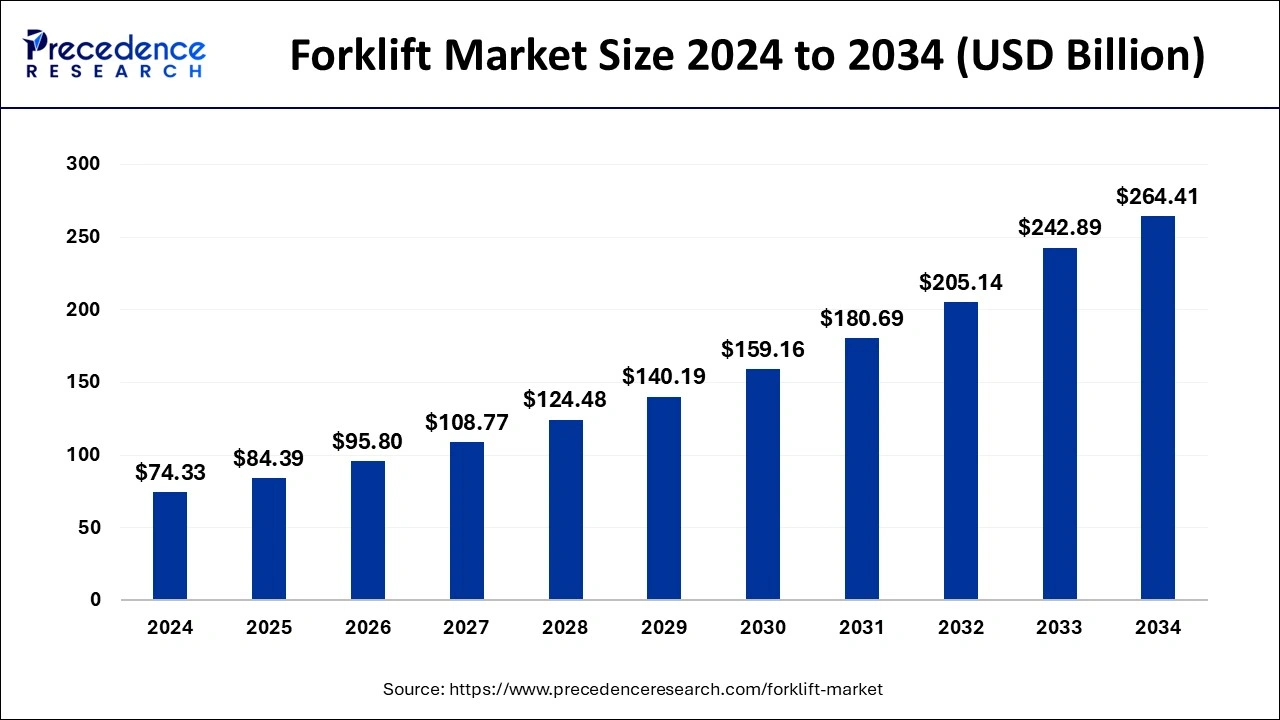

The global forklift market size accounted for USD 90.97 billion in 2025 and is predicted to increase from USD 97.09 billion in 2026 to approximately USD 173.35 billion by 2035, expanding at a CAGR of 6.66% from 2026 to 2035

Market Highlights

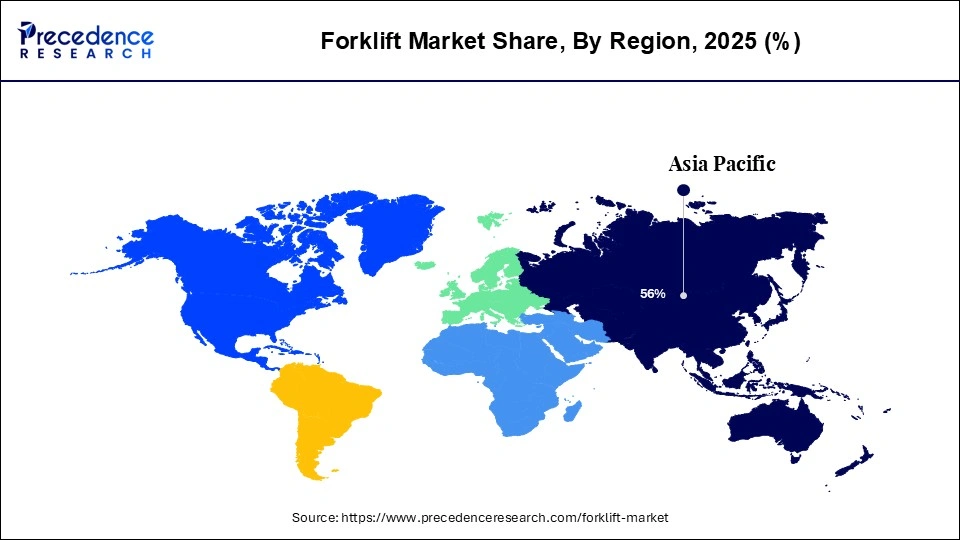

- Asia-Pacific dominated the global market with the largest market share of 56% in 2025.

- By class, the class 3 segment contributed the highest market share of 44% in 2025.

- By power source, the electric segment captured the biggest market share in 2025.

- By load capacity, the 5-15 ton segment generated the major market share in 2025.

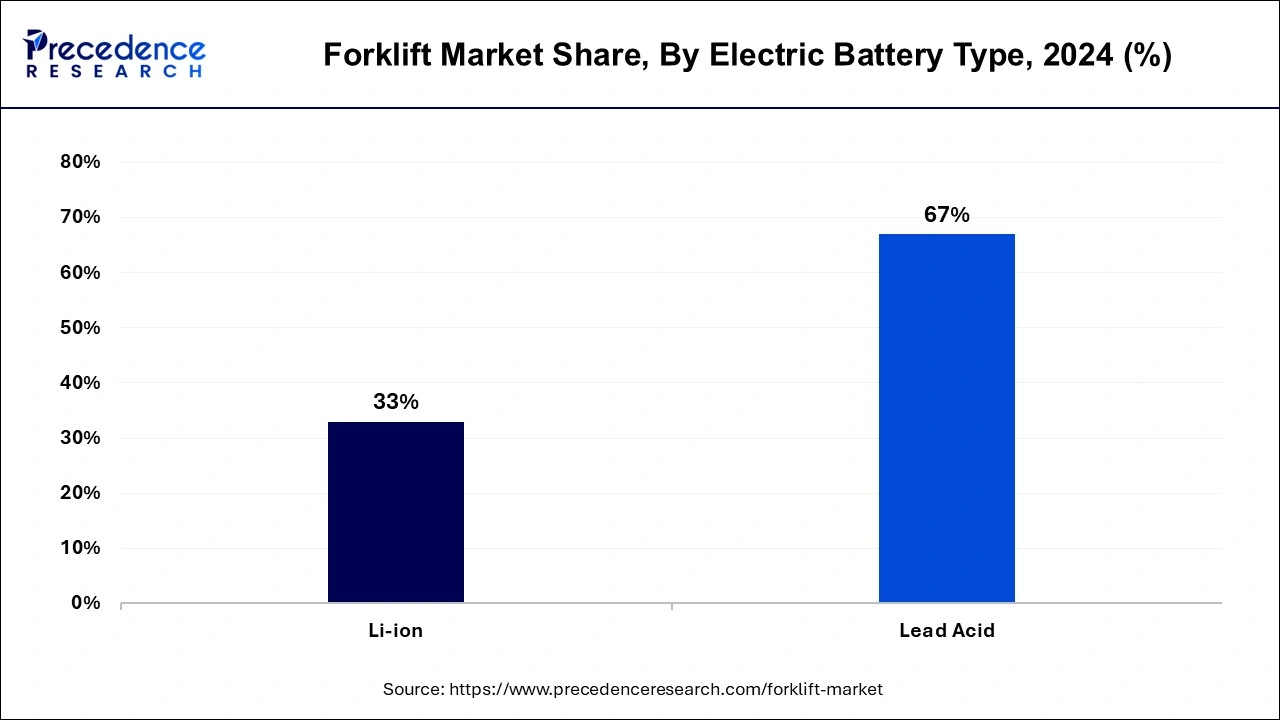

- By electric battery type, the lead-acid segment has held the largest market share of 67% in 2025.

- By end-use, the industrial has captured more than 25% of market share in 2025.

Market Overview

The industry that produces, markets, and distributes powered industrial trucks (PITs), commonly called forklifts, is known as the forklift market worldwide. These industrial vehicles are primarily used in factories, warehouses, shipping yards, and construction sites for short-distance lifting and transporting items.

In factories, forklifts move components, finished goods, and raw materials between manufacturing lines and storage locations. Trailers are used in mines to carry rocks, minerals, and other resources. They are also utilized in shipping ports and logistical hubs to load and unload containers. Businesses are searching for ways to automate processes as labor costs grow, which has increased the use of automated guided vehicles (AGVs) and other automated forklift solutions.

- In August 2023, Jungheinrich AG purchased the automated solution provider Magazino. The previous business improved its standing in the market for autonomous mobile robots and associated software through the acquisition.

Forklift Market Growth Factors

- The demand for effective material handling systems is driven by rising production levels and increased e-commerce activity.

- Businesses are implementing integrated management systems and automated forklifts to increase operational effectiveness and safety.

- This region's expanding infrastructure and quick economic expansion are generating a lot of opportunities.

- Customized and specialist forklift solutions are increasingly in demand due to specific needs across multiple sectors.

- Flexible rental solutions meet enterprises' short-term requirements and financial constraints.

- Forklifts are necessary for transportation and lifting operations in growing cities and construction projects.

- The market is growing in certain regions due to incentives for adopting sustainable forklift technology.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 90.97 Billion |

| Market Size in 2026 | USD 97.09 Billion |

| Market Size by 2035 | USD 173.35 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.66% |

| Bae Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Class, By Power Source, By Load Capacity, By Electric Battery Type, and By End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for forklifts for lean warehouse operations

The primary goals of lean warehouse operations are to reduce waste, increase productivity, and preserve flexibility in response to shifting customer needs. Forklifts are essential to these operations because they make it easier to move and store things in an efficient and well-organized manner. Forklift demand is further fueled by the increased emphasis on optimizing warehouse processes brought about by the growth of e-commerce and just-in-time inventory systems. Furthermore, forklifts are more prevalent in lean warehouse environments due to technological improvements like automation and integration with warehouse management systems, which facilitate smoother operations and greater resource use.

Increased demand for efficient material handling

The need for efficient material handling and transportation grows as enterprises strive to increase production and optimize their operations. For lifting, moving, and stacking items in warehouses, distribution centers, manufacturing facilities, and other industrial settings, forklifts offer a flexible and effective option.

Restraint

Lack of trained professional operators

Companies may find it challenging to operate forklifts effectively and safely without trained operators, increasing the danger of mishaps, product damage, and possible employee injuries. Inadequate training can lead to lower production and increased maintenance costs because of incorrect equipment use. The lack of qualified workers may restrict the use of forklifts across various industries, impeding market expansion and possibly lowering overall operational effectiveness.

Opportunity

Expansion of road networks

Road networks improve regional connectivity as they grow, which boosts economic activity and raises the need for effective logistics solutions. Forklifts play a critical role in material handling in transportation hubs, distribution centers, and warehouses, making them indispensable for fulfilling increasing logistics needs. Due to improved road networks, businesses may move goods easily to and from various areas. The efficient loading and unloading of commodities is made possible by forklifts, which boosts supply chain efficiency. The greater accessibility of more extended road networks also fuels the need for forklifts.

The growth of e-commerce and online retailing

The growth of e-commerce has increased the need for effective distribution and warehousing facilities to manage the movement and storage of goods. For these tasks, forklifts are necessary since they make loading, unloading, and transporting items around warehouses easier. As automation and technology advance, the forklift market changes. E-commerce organizations are increasingly using forklifts with advanced features like automation software, sensors, and telematics systems to increase safety, optimize inventory management, and boost warehouse productivity.

Forklift MarketSegment Insights

Class Insights

The class 3 segment contributed the highest market share of 44% in 2024. Hand trucks with electric motors are included in this section. These are hand-controlled forklifts, with the operator controlling the machine from the front of the vehicle using a tiller. Hand trucks are often steered while the driver rides or walks to the destination using a handle at the back of the vehicle. These forklifts can easily move goods throughout the warehouse floor without needing the product to be placed on a high shelf or rack, and they are usually used for transporting objects that require minimal elevations.

The class 1 segment witnessed significant growth in the forklift market during the forecast period. It is anticipated that the strong demand for electric rider trucks in end-use sectors like manufacturing, food service, retail, and chemical plants would fuel the segment's expansion. Because these forklifts often have fewer moving components, they require less maintenance and cost less overall. Class 1 forklifts are ideal for various work environments, including manufacturing plants and warehouses, where noise levels and available space are important factors. This is because of their quiet operations and simplicity of maneuverability.

Power Source Insights

The electric segment captured the biggest market share in 2024. An environmentally beneficial substitute for forklifts driven by gasoline and diesel is electricity. The demand for long-lasting, sustainable forklifts is driven by growing environmental concerns and the depletion of fossil fuel supplies. These forklifts also guarantee a cleaner, healthier work environment for employees. Throughout the forecast period, advancements in battery technology and the growing emphasis on providing a healthy working environment for employees are likely to play a significant role in boosting the segment's growth. Several suppliers are creating new types of electric forklifts to broaden their range of material-handling products.

Load Capacity Insights

The 5-15 ton segment generated the major market share in 2025. Forklifts in the 5–15 ton category were made to perform various jobs, such as moving large items in manufacturing facilities and loading and unloading warehouse pallets. Their adaptability makes them invaluable in a variety of industries. Customers were provided Forklift modification options to customize the machines to meet their demands. Due to this flexibility, businesses could adjust to changing operating requirements and optimize their material handling procedures.

The below 5 segments show significant growth in the forklift market during the forecast period. Due to their great versatility, these small forklifts enable enterprises to manage a range of load sizes effectively. These little forklifts make transferring goods across constrained floor areas easier and safer. Applications for these forklifts include manufacturing, warehousing, freight handling, material handling, and logistics. These forklifts help safeguard the workers when they are utilized in small warehouses to move hazardous items.

Electric Battery Type Insights

The lead-acid segment has held the largest market share of 67% in 2025. Although lead-acid batteries can deliver a high-power burst, they might be regarded as a dependable energy source. For this reason, they are frequently seen in electric forklifts. Electric forklifts require high current output to carry out heavy lifting and moving duties. Lead-acid batteries are ideal for these applications because they can provide the required power output without experiencing any noticeable voltage decreases or fluctuations.

The li-on segment shows a significant growth in the forklift market during the forecast period. Growing environmental concerns are pushing companies to look for environmentally responsible ways to lower their carbon footprint. Lithium-ion batteries present a more environmentally friendly substitute to traditional lead-acid batteries, which include harmful substances like sulfuric acid and lead. Vendors show their dedication to sustainability by complying with the stricter environmental requirements by using lithium-ion technology in their electric forklifts, encouraging the segment's growth.

- In September 2023, Hangcha Forklift introduced an electric rough terrain forklift powered by high-voltage lithium batteries. The forklift has a 2.5–3.5-ton weight range, no noise, no emissions, and quick charging.

End-Use Insights

The industrial segment has captured more than 25% of market share in 2024. In industrial settings, forklifts are widely utilized for material handling and warehousing duties. Forklifts are essential in manufacturing plants because they move raw materials, intermediate products, and final goods along production lines. Their capacity to move large objects and maneuver in confined spaces contributes to a smooth material flow, which lowers production bottlenecks and boosts operational effectiveness.

The retail & e-commerce segment shows significant growth in the forklift market during the forecast period. Over the past few years, the retail and e-commerce industries have changed tremendously due to shifting consumer tastes and an increasing inclination toward online buying. Forklifts are now an essential part of the industry in an ever-changing landscape since they provide specialized applications that facilitate effective material handling and logistics processes. Forklifts are crucial to efficiently running warehouses because they facilitate the smooth transfer of items from order receipt to storage & order fulfillment. Their precise control and compact form allow for quick and easy mobility in confined locations, which maximizes space usage and speeds up inventory management.

Forklift MarketRegional Insights

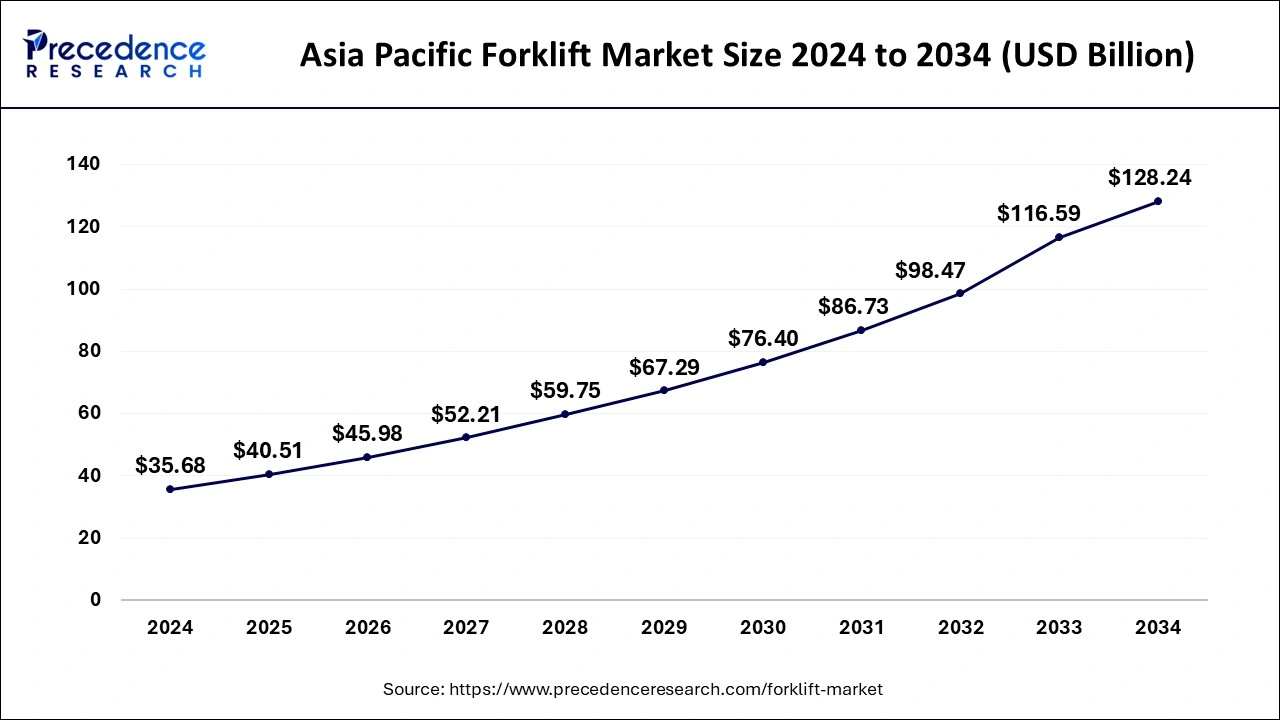

The Asia Pacific forklift market size is expected to be worth USD 12.95 billion by 2035, increasing from USD 6.76 billion by 2025, growing at a CAGR of 6.71% from 2026 to 2035

Asia-Pacific held the largest share of 48% in the forklift market in 2024. The segment is observed to sustain the position with an impressive growth rate during the forecast period. Several well-known forklift manufacturers, including Doosan Corporation and Hangcha Forklift, are based in the Asia Pacific area, which promotes technological advancements and increases industry competitiveness. To stay competitive and productive, end-use industries upgrade their fleets in tandem with corporations as they consistently develop cutting-edge electric forklift models with improved performance and features. Governments, manufacturers, and companies working together are anticipated to be crucial in promoting further developments and the extensive use of forklifts in Asia as the market develops.

Asia-Pacific Powerhouses

- China: A vast and robust manufacturing ecosystem, complemented by government-supported industrial zones designed to foster innovation and growth.

- India: A sprawling and dynamic manufacturing hub, characterized by an extensive network of factories and production facilities. This energetic base is further enhanced by strategically established industrial zones, underpinned by government support, which provide an environment ripe for innovation, collaboration, and economic advancement.

- Japan: The market is characterized by a robust presence of Original Equipment Manufacturers (OEMs) that are increasingly prioritizing automation in their operations. This focus not only enhances efficiency but also drives innovation across various sectors, creating a dynamic landscape for technological advancement.

- South Korea: The seamless integration of advanced logistics and cutting-edge technology within manufacturing facilities enhances operational efficiency and productivity. This fusion not only streamlines supply chain processes but also optimizes inventory management, enabling real-time tracking and intelligent decision-making. As a result, factories become agile ecosystems, capable of adapting to market demands with speed and precision, all while minimizing waste and reducing costs.

Major Market Contributors: Driving Forces of the Forklift Frontier

- Original equipment manufacturers (OEMs) are increasingly concentrating their efforts on developing electric and autonomous forklifts to enhance efficiency and sustainability in material handling.

- The explosive growth of e-commerce, coupled with the rising prominence of third-party logistics (3PL) providers, is creating new opportunities and challenges in the supply chain.

- The demand for smart warehouses is driving the need for advanced handling systems that incorporate automation, robotics, and sophisticated inventory management technologies.

- Governments are making significant investments in the establishment of modern manufacturing and logistics parks, aimed at bolstering infrastructure and enhancing supply chain capabilities.

- There is a noticeable rise in rental services that offer flexible and cost-effective fleet options, allowing businesses to optimize their logistics operations without the burden of large capital expenditures.

Europe is expected to grow at a significant rate in the market during the forecast period. This is mainly due to increasing industrial automation, e-commerce growth, and rising demand for efficient material handling solutions across warehouses and manufacturing facilities. Stringent workplace safety regulations and a shift toward electric and eco-friendly forklifts further drive adoption. Additionally, investments in smart logistics, IoT-enabled fleet management, and advanced warehouse technologies are accelerating market growth in the region.

Germany leads the European forklift market due to its strong industrial base, export-oriented manufacturing, and state-of-the-art intralogistics systems. France follows with steady demand from retail logistics, manufacturing, and food processing sectors. The UK shows a growing trend in the adoption of automated and lithium-ion powered forklifts, particularly in distribution centers.

The forklift market in Latin America is potentiated by rapid industrialization, expanding warehousing and logistics infrastructure, and growing e-commerce activities. Rising demand for material handling solutions in manufacturing, retail, and food & beverage sectors further drives market growth. Additionally, investments in modern distribution centers and the adoption of electric and automated forklifts are enhancing operational efficiency and fueling market expansion across the region.

The Middle East & Africa (MEA) presents immense opportunities for the forklift market, driven by rapid industrialization, expanding warehousing and logistics infrastructure, and the growth of e-commerce and retail sectors. Rising adoption of electric and automated forklifts, along with investments in ports, distribution centers, and smart material handling solutions, further supports market growth. Additionally, government initiatives promoting industrial modernization and efficiency in supply chains create significant potential for market expansion in the region.

Value Chain Analysis

- Raw Material Sourcing

This stage involves the sourcing of essential materials such as steel, batteries, electronic components, and hydraulic systems required for forklift manufacturing.

Key Players: ArcelorMittal, Nucor Corporation, BASF (batteries & chemicals), Samsung SDI (battery components). - Component Manufacturers

Components such as engines, electric motors, transmissions, hydraulic systems, and tires are produced and supplied to forklift assemblers.

Key Players: Toyota Industries (engines & transmissions), Bosch Rexroth (hydraulic systems), Dana Incorporated (drivetrain components), Michelin (industrial tires). - Forklift Assembly & Manufacturing

At this stage, forklifts are assembled by integrating raw materials and components into complete units tailored for various applications like warehouse handling, industrial operations, and port logistics.

Key Players: Toyota Material Handling, KION Group, Jungheinrich, Mitsubishi Logisnext, Hyster-Yale Materials Handling.

Forklift Market Companies

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha

- Forklift Co., Ltd.

- Toyota Motor Corporation (Toyota Material Handling)

- Hyster-Yale Materials Handling, Inc. (Hyster-Yale Group, Inc.)

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnex

Recent Developments

- In February 2024, ArcBest announced the introduction of remote-operated autonomous reach vehicles and forklifts. Vaux Smart Autonomy is an expansion of the business's existing warehouse freight management technology.

- In November 2023, the leading innovator in material handling technology, Toyota Material Handling (TMH), is introducing a new range of electric pneumatic forklifts, including 48V and 80V variants. This sturdy line is perfect for retail applications, including landscaping, home centers, lumberyards, and shop support applications, because it is made to resist outside terrain and operate in various weather conditions.

Forklift MarketSegments Covered in the Report

By Class

By Power Source

By Load Capacity

By Electric Battery Type

By End Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting