What is the Lithium-ion Battery Market Size?

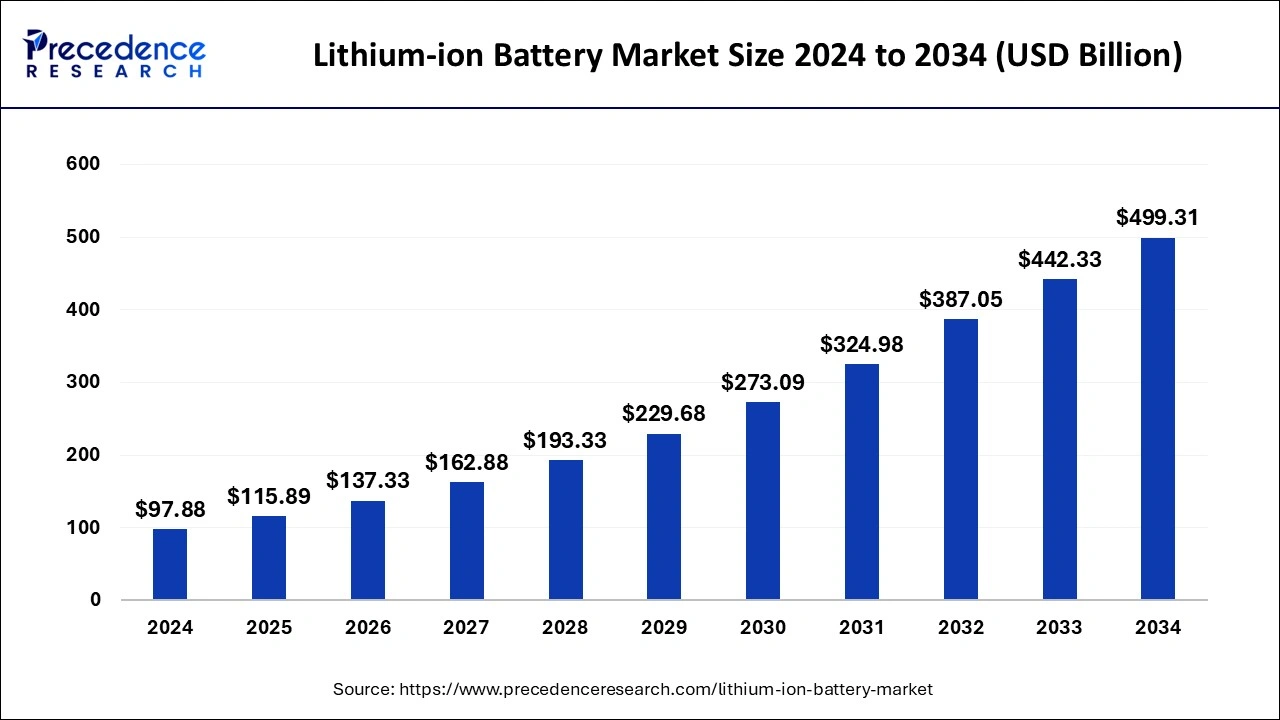

The global lithium-ion battery market size is valued at USD 115.89 billion in 2025 and is predicted to increase from USD 137.33 billion in 2026 to approximately USD 555.15 billion by 2035, expanding at a CAGR of 16.96% from 2026 to 2035. The increasing demand for electric vehicles, the rising adoption of smartphones, and growing disposable income drive the lithium-ion battery market.

Market Highlights

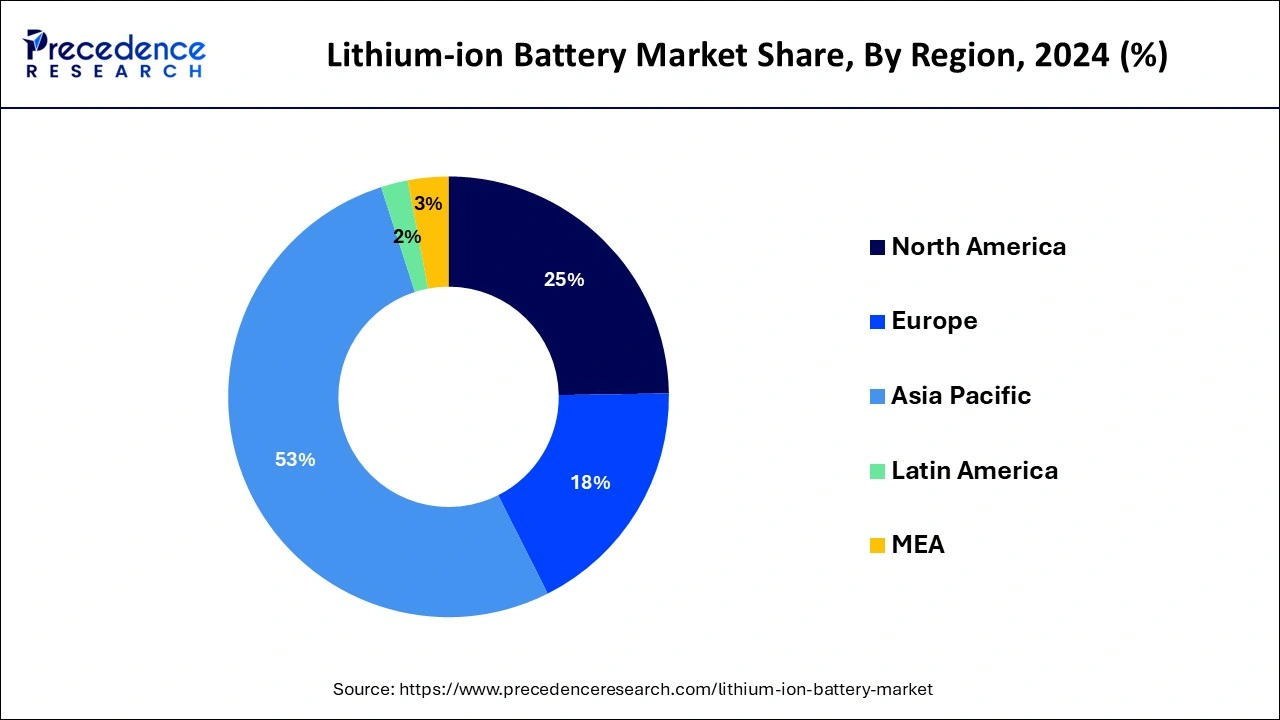

- Asia-Pacific dominated the global lithium-ion battery market with the largest market share of 53% in 2025.

- By product, the lithium iron phosphate segment contributed the biggest market share in 2025.

- By product, the lithium nickel manganese cobalt (NMC) segment is expanding at a solid CAGR during the forecast period.

- By application, the electric and hybrid electric vehicle segment dominated the market in 2025.

- By application, the energy storage systems segment is expected to grow at a significant CAGR during the forecast period.

Impact of AI on the Lithium-ion Battery Market

Artificial intelligence (AI) has been proven to revolutionize several sectors, including the development of lithium-ion batteries. AI can be used to detect compounds that can be mixed with lithium to enhance its efficiency and optimize its performance. AI can also be used in bulk manufacturing of lithium-ion batteries, improving reproducibility and reducing human intervention. Integrating AI and machine learning (ML) algorithms into conventional battery systems results in smart battery systems. Smart batteries can provide real-time monitoring, predictive maintenance, and adaptive control strategies. AI and ML can also be used to assess the properties of lithium-ion batteries, enhancing transparency and interpretability.

Market Outlook

- Industry Growth Overview: The lithium-ion battery market is expanding rapidly due to surging global demand for electric vehicles, renewable energy storage, and high-performance consumer electronics. Advancements in energy density, fast-charging technology, and declining battery costs further accelerate adoption across automotive, industrial, and grid applications.

- Sustainability Trends: The sustainability trend is reshaping the market by driving demand for low-carbon materials, responsible mining practices, and recycling technologies that reduce environmental impact and strengthen supply security. Manufacturers are increasingly adopting greener production methods, closed-loop recycling systems, and next-generation chemistries to meet regulatory pressure and support global decarbonization goals.

- Major Investors:Major investors in the market include leading battery manufacturers such as CATL, LG Energy Solution, Panasonic, Samsung SDI, and BYD, along with raw material suppliers like Albemarle, Ganfeng Lithium, and SQM. These companies contribute by expanding global production capacity, securing critical mineral supply chains, and investing heavily in R&D to advance battery chemistries, improve energy density, reduce costs, and accelerate the transition to electric mobility and energy storage systems.

Lithium-ion Battery Market Growth Factors

- Burgeoning Electronics and Automobiles Sector: Lithium-ion batteries are predominantly used in the electronics and automobiles sector, boosting market growth.

- Increasing Sales of EVs: The growing demand for electric vehicles increases the demand for lithium-ion batteries.

- Rising Disposable Income: One of the key factors driving the growth of the global lithium-ion battery market is growing consumer spending on consumer electronics.

- Growing Demand for Renewable Energy: The rapidly expanding renewable energy sector due to government investments in energy and infrastructural development projects.

- Increasing Collaborations: Major market players collaborate with government agencies to expand the lithium-ion battery market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 115.89 Billion |

| Market Size in 2026 | USD 137.33 Billion |

| Market Size by 2035 | USD 555.15 Billion |

| Growth Rate from 2026 to 2035 |

CAGR of 16.96% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Capacity, Voltage, Component, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Burgeoning Automobile Sector

The burgeoning automobile sector is a major growth factor for the lithium-ion battery market. The growing demand for EVs and increasing sales are responsible for rapidly expanding the automobile sector. According to the International Energy Agency, approximately 14 million electric cars were sold globally in 2023. This increases the demand for lithium-ion batteries. These batteries are highly preferred in EVs due to their high power-to-weight ratio, high energy efficiency, good high-temperature performance, and long life. The increasing investments in automobile R&D to drive the latest innovations boost the market.

Restraint

Metal Alternatives

The major challenge of the lithium-ion battery is the presence of alternatives to lithium. Several researchers are investigating the use of different metals to reduce the use of lithium due to scarcity, high prices, and safety concerns. Other metals, such as calcium and sodium, are being investigated as they are more efficient and less expensive energy storage systems.

Opportunity

Growing Demand for Environmental Sustainability

The future of the lithium-ion battery market is promising, driven by the growing demand for environmental sustainability. The use of internal combustion engines (ICE) consumes carbon-based fossil fuels, emitting significant pollutants such as carbon dioxide into the environment. This poses a significant threat to the environment. Several government organizations have released guidelines and launched initiatives to reduce the environmental burden of harmful pollutants. This increases the demand for lithium-ion batteries, replacing ICE. Additionally, lithium-ion batteries are highly recyclable. It is estimated that approximately 95% of a lithium-ion battery can be recycled into new batteries.

Segment Insight

Product Insights

The lithium iron phosphate (LFP) segment dominated the lithium-ion battery market in 2025. The factors such as the surge in demand for lithium iron phosphate (LFP) batteries in devices such as which are portable in nature and growing need for durable and efficient batteries are driving the growth of the segment. In addition, the advantages provided by lithium iron phosphate (LFP) batteries such as long shelf life and safest solution is also boosting the segment growth.

The lithium nickel manganese cobalt (NMC) segment is fastest growing segment of the lithium-ion battery market in 2022. The lithium nickel manganese cobalt (NMC) is widely used in various equipment such as electric powering trains and electric bikes. The benefits of lithium nickel manganese cobalt (NMC) such as long life and reduced cost is paving new ways for the growth of the segment.

Application Insights

A push toward sustainability and renewable energy sources is growing, with governments providing subsidies and incentives to switch to electric and hybrid vehicles. As the climate crisis looms, the United States, China, India, and countries in the European Union are lowering taxes and building the required infrastructure to charge electric vehicles.

- In November 2024, the Indian government unveiled Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI), in a bid to promote the adoption of electric cars and vehicles in the country by reducing tariffs on their imports.

Regional Insights

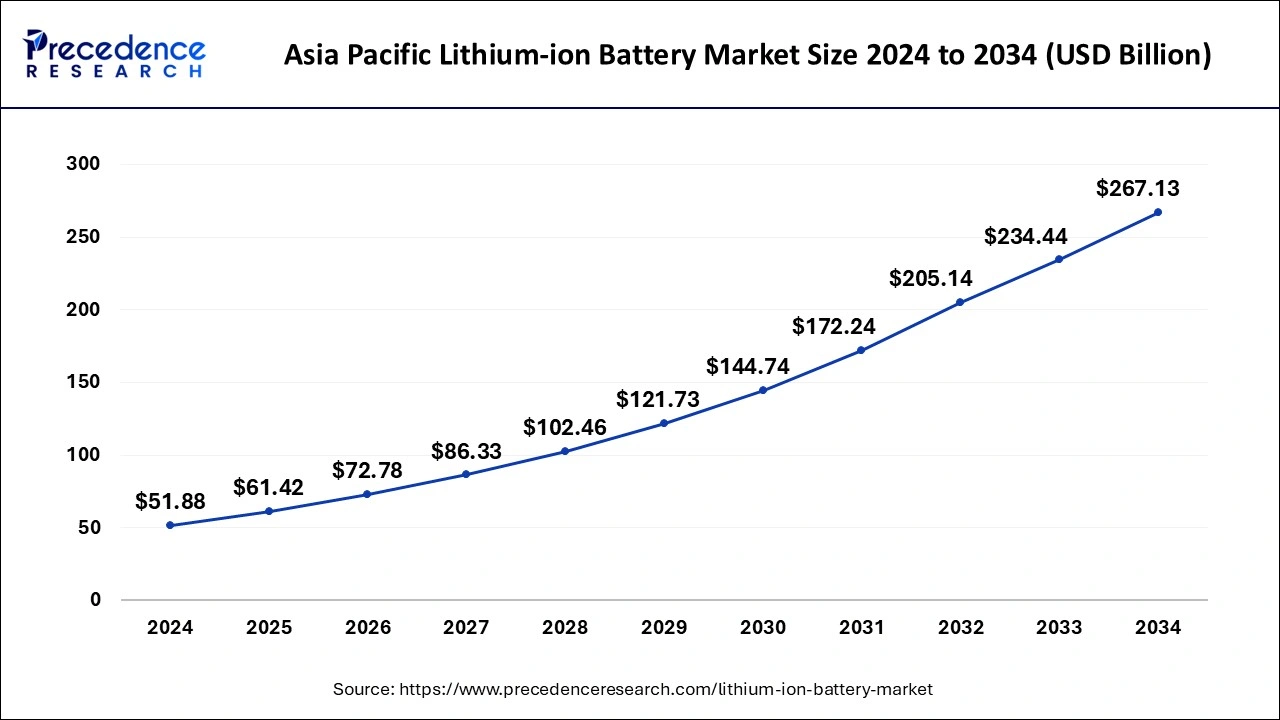

Asia Pacific Lithium-ion Battery Market Size and Growth 2026 to 2035

The Asia Pacific lithium-ion battery market size is evaluated at USD 61.42 billion in 2025 and is predicted to be worth around USD 298.23 billion by 2035, rising at a CAGR of 17.12% from 2026 to 2035.

Asia-Pacific dominated the global lithium-ion battery market with the largest market share of 53% in 2025. China leads the lithium-ion battery market in Asia-Pacific region. China is considered as production hub for the lithium-ion battery. The lithium-ion battery market in Asia-Pacific region is being driven by the surge in demand for smartphones and tablets in emerging countries such as China, Japan, and India. Another factor driving the growth of the lithium-ion battery market in the region is rising disposable income and growing consumer awareness regarding lithium-ion battery in the market during the forecast period.

Technological improvements, exploitation of economies of scale through mass production, particularly in China, and increased competition between the manufacturers are the principle reasons behind the price decline. The decline in prices is leading to the widespread use of Li-ion batteries, in turn, driving the Asia-Pacific lithium-ion batteries market.

With increasing lithium-ion battery manufacturing, demand for the principal materials required for manufacturing Li-ion batteries, i.e., lithium and cobalt, is increasing. The lack of production growth and geographical concentration of production of these materials is expected to be a significant restraint for the market in the coming years.

- In January 2025, MDIndia Health Insurance TPA Pvt Ltd announced its sponsorship of the General Insurance Agents Federation Integrated National Conclave. The incident brings together over 200 active insurance agents, manufacturing experts, and stakeholders to foster professional growth and improve the experience for both policyholders and agents.

- In January 2025, Care Health Insurance, one of the leading Health Insurers of India, announced the launch of Ultimate Care, a ground-breaking health insurance designed to set novel benchmarks in health coverage. Ultimate Care combines extensive benefits tailored to address unforeseen medical emergencies and rewards consumers for staying healthy.

Due to the rapid growth of the EV industry, the automobile sector has become the dominating and fastest-growing consumer of lithium-ion batteries globally, as well as in the Asia-Pacific region. China alone accounted for over 50% of the global EV sales in 2018. A similar trend is expected to continue during the forecast period. Hence, the automobile sector is expected to remain a dominating consumer sector during the forecast period.

China, India, and Malaysia are the biggest three markets for lithium-ion batteries during the forecast period. China alone, accounted for about 44.9% of the Asia-Pacific lithium-ion battery market, in 2018. Asia-Pacific accounted for around 55% market share in the global lithium-ion battery market.

What Makes North America the Fastest-Growing Market?

North America is expected to develop at the fastest rate during the forecast period. The U.S. dominated the lithium-ion battery market in North America region. The factors such as the surge in sales of automobiles and electric vehicles all around the region and rising demand for lithium-ion battery for mobile phones are boosting the expansion and development of the lithium-ion battery market in the North America region.

North America is witnessing a rapid rise in demand for electrolyte solvents driven by accelerated EV adoption and multi-billion-dollar investments in gigafactories. A strong focus on localized supply chains is encouraging manufacturers to develop high-purity solvent production capabilities within the region. Advancements in battery chemistries, especially high-nickel cathodes, are increasing the need for solvents with superior stability. Strategic collaborations between chemical companies and cell manufacturers are accelerating innovation

- In March 2025, Prudential plc. Announced a partnership venture with HCL Group for Health Insurance in India. The partnership goal to address the rising healthcare requirement of the Indian consumer and contribute to the Indian Government's vision of Insurance for All by 2047.

The U.S. leads the North American market with its extensive EV manufacturing ecosystem and increased lithium-ion cell production capacity. A growing focus on thermal stability and safety is driving solvent manufacturers to develop fluorinated and ultra-high-purity blends. Partnerships between chemical giants and gigafactories speed up scale-up and specialization. Government-backed incentives and advanced R&D centers bolster U.S. leadership in electrolyte solvent innovation.

What Potentiates the Growth of the Market in the Middle East & Africa?

The lithium-ion battery market in the Middle East & Africa is steadily growing, driven by rapid industrial diversification and increasing interest in renewable energy storage. GCC countries are leveraging their top-tier petrochemical industries to compete in the market. Demand is climbing from utility-scale storage projects and emerging EV adoption. Additionally, government-led industrial diversification programs, rising adoption of electric mobility, and expansion of local mineral resources like lithium and cobalt are strengthening regional interest in battery manufacturing and supply-chain development.

The market in the region is also driven by rapid advancements in electric mobility, renewable energy integration, and grid modernization, as lithium-ion batteries are a crucial component for the clean energy transition. National strategies and expansion plans across the region are encouraging investments in energy storage solutions to support solar, wind, and hydrogen projects. Countries such as Saudi Arabia, the UAE, and Egypt are leading players in the region, actively creating diverse demand across various sectors.

How is the Opportunistic Rise of Europe in the Lithium-Ion Battery Market?

The regional market growth is also driven by the European Union's active efforts to reduce carbon emissions and promote sustainable energy sources. We can see that manufacturers in the region are investing heavily in research and development to enhance battery performance, longevity, and safety. Additionally, Europe benefits from a strong and supportive regulatory framework. Initiatives aimed at standardizing battery specifications and improving supply chain transparency have emerged in recent years. This environment is most likely to foster collaboration among stakeholders, manufacturers, researchers, and policymakers, thereby leading to rapid growth and development.

Europe's rise in the lithium-ion battery market is driven by strong government policies supporting electrification, large-scale investments in gigafactories, and stringent emissions regulations that accelerate EV adoption. The region is also capitalizing on opportunities in localized supply chains, advanced battery R&D, and sustainable production practices, positioning itself as a global hub for next-generation, low-carbon battery technologies.

What Opportunities Exist in Latin America?

Latin America presents substantial opportunities in the lithium-ion battery market, driven by rising adoption in electric vehicles, renewable energy storage, and consumer electronics across the region. Recent advancements in battery technology and manufacturing processes are further speeding up market growth throughout the area. Brazil and Mexico are key players, showing strong potential due to their proximity to North American markets and developing EV manufacturing ecosystems. The region also benefits from local raw material resources and increasing investments in battery manufacturing infrastructure.

Value Chain Analysis

Raw Material Extraction

This stage involves mining and sourcing key minerals such as lithium, nickel, cobalt, and graphite, which form the foundational inputs for battery chemistry.

- Key Players: Albemarle, Ganfeng Lithium, SQM, Glencore.

Material Refining & Processing

Extracted minerals are refined into battery-grade materials like lithium hydroxide, nickel sulfate, and high-purity graphite to meet strict performance and safety standards.

- Key Players: Umicore, BASF, Livent, POSCO Future M.

Cathode, Anode & Electrolyte Production

Refined materials are engineered into cathode active materials, anode materials, electrolytes, and separators that define the battery's energy density and durability.

- Key Players: Contemporary Amperex Technology (CATL), LG Energy Solution, Panasonic, Sumitomo Chemical.

Cell Manufacturing

Processed materials are assembled into individual battery cells through precise coating, stacking, formation, and quality-control processes.

- Key Players: CATL, Samsung SDI, BYD, Panasonic.

Lithium-ion Battery Market Companies

- Panasonic Corporation

- BYD Company

- Samsung SDI

- LG Chem

- Contemporary Amperex Technology Co. Ltd

- Saft Group S.A.

- Toshiba Corporation

- BAK Power

- Automotive Energy Supply Corporation

- A123 System

Latest Announcement by Industry Leaders

- Avik Roy, Managing Director and CEO of Exide Industries, stated that the company is constructing a 12 GWh lithium-ion plant in two phases of 6 GWh each, and the first phase is expected to be completed by March 2025. He envisioned that the demand for lithium-ion batteries would be near 150 GWh by 2030. Around 70% of it will be driven by the mobility sector and 30% from industries.

Recent Developments

- In March 2025, LG Energy Solution, Ltd. announced the opening of a large-scale lithium-ion battery assembly plant in the UAE, aimed at meeting the region's growing demand for energy storage and electric mobility solutions. The plant specializes in producing high-capacity battery packs for renewable integration projects, electric buses, and grid stabilization efforts.(Source: https://www.bing.com)

- In March 2025, Life Insurance Corporation of India (LIC) is set to enter the health insurance sector, with the acquisition of a health insurer in the final stages, CEO Siddhartha Mohanty told CNBC-TV18, marking a significant expansion into the growing health insurance market.

- In March 2025, The Doctors Company, the nation's largest physician-owned medical malpractice insurer, and ProAssurance Corporation, an industry-leading specialty insurer with extensive expertise in medical liability, products liability for medical technology and life sciences, and workers' compensation insurance, announced that they have entered into a agreement under which ProAssurance acquired by The Doctors Company.

- In January 2024, HCSC signed to acquisition agreement with Cigna Group for its Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses. The acquisition benefits HCSC's present and future members by improving the company's capabilities and reach, specifically in the growing Medicare sector.

- In April 2025, Transcarent announced the effective completion of its merger with Accolade, the leading health advocacy, expert healthcare opinion, and virtual primary care company in the market. The combined organization serves over 20 million members and more than 1,700 workers and health plan clients in one place for health and care.

- In January 2025, a research team in Paul Scherrer Institute announced the development of a new process that improves the performance of lithium-ion batteries while still remaining sustainable. This process also improves the operational voltage on the batteries and is poised to substantially improve the efficiency of these lithium-ion batteries.

- In January 2025, Mazda Motor Corporation announced its plan to build a new module pack plant for automotive cylindrical lithium-ion battery cells in Iwakuni, Japan. The new plant is developed to manufacture automotive cylindrical lithium-ion battery cells procured from Panasonic Energy.

- In September 2024, Imec announced the development of a lithium-metal solid-state battery with an energy density of 1070 watt-hours per litre. The new battery can save more energy compared to conventional ones, leading to longer-lasting and more powerful electric vehicles.

Segments Covered in the Report

By Product

- Lithium cobalt oxide (LCO)

- Lithium iron phosphate (LFP)

- Lithium nickel cobalt aluminum Oxide (NCA)

- Lithium manganese oxide (LMO)

- Lithium titanate

- Lithium nickel manganese cobalt

By Application

- Consumer Electronics

- Smartphones & tablet/PC

- UPS

- Others

- Automotive

- Cars, Buses, & Trucks

- Scooters & Bikes

- Trains & Aircraft

- Industrial

- Energy Storage System

By Component

- Cathode

- Anode

- Electrolytic Solution

- Others

By Capacity

- 0–3,000 mAh

- 3,000–10,000 mAh

- 10,000–60,000 mAh

- 60,000 mAh and Above

By Voltage

- Low (Below 12V)

- Medium (12V – 36V)

- High (Above 36V)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting