What is the Pulp and Paper Market Size?

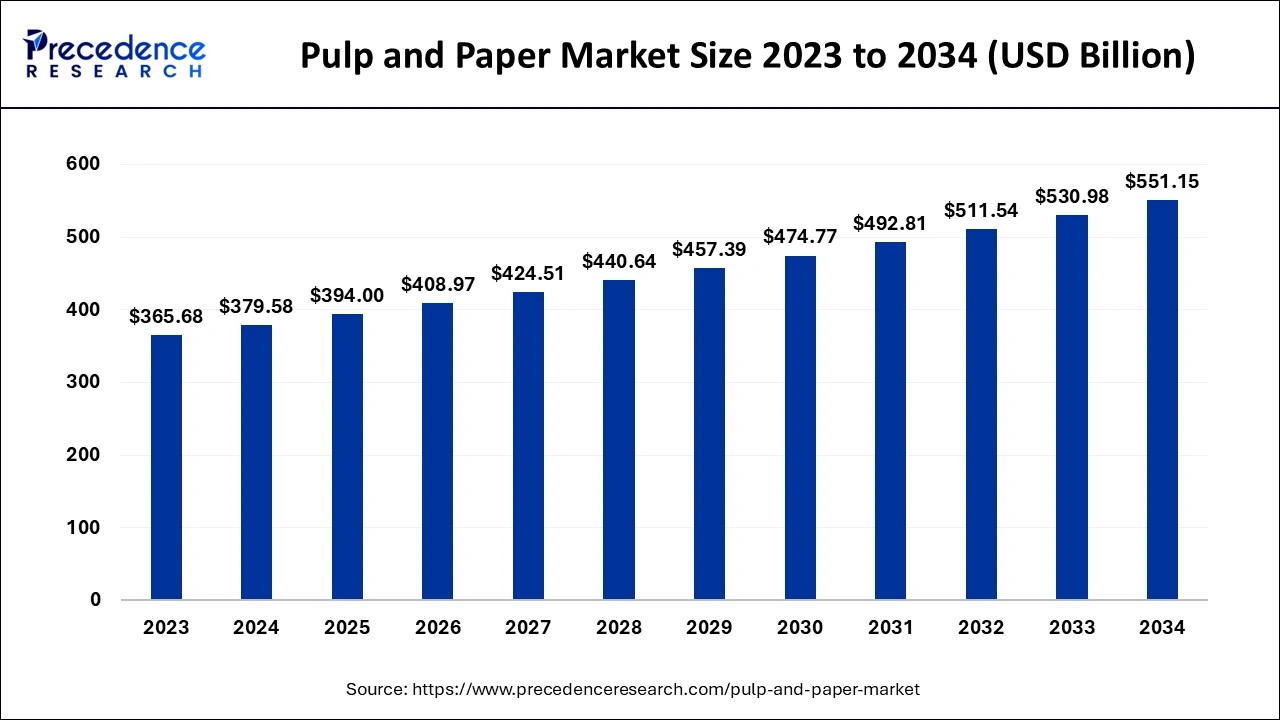

The global pulp and paper market size is accounted at USD 394.00 billion in 2025 and predicted to increase from USD 408.97 billion in 2026 to approximately USD 551.15 billion by 2034, representing a CAGR of 3.80% from 2025 to 2034.

Market Highlights

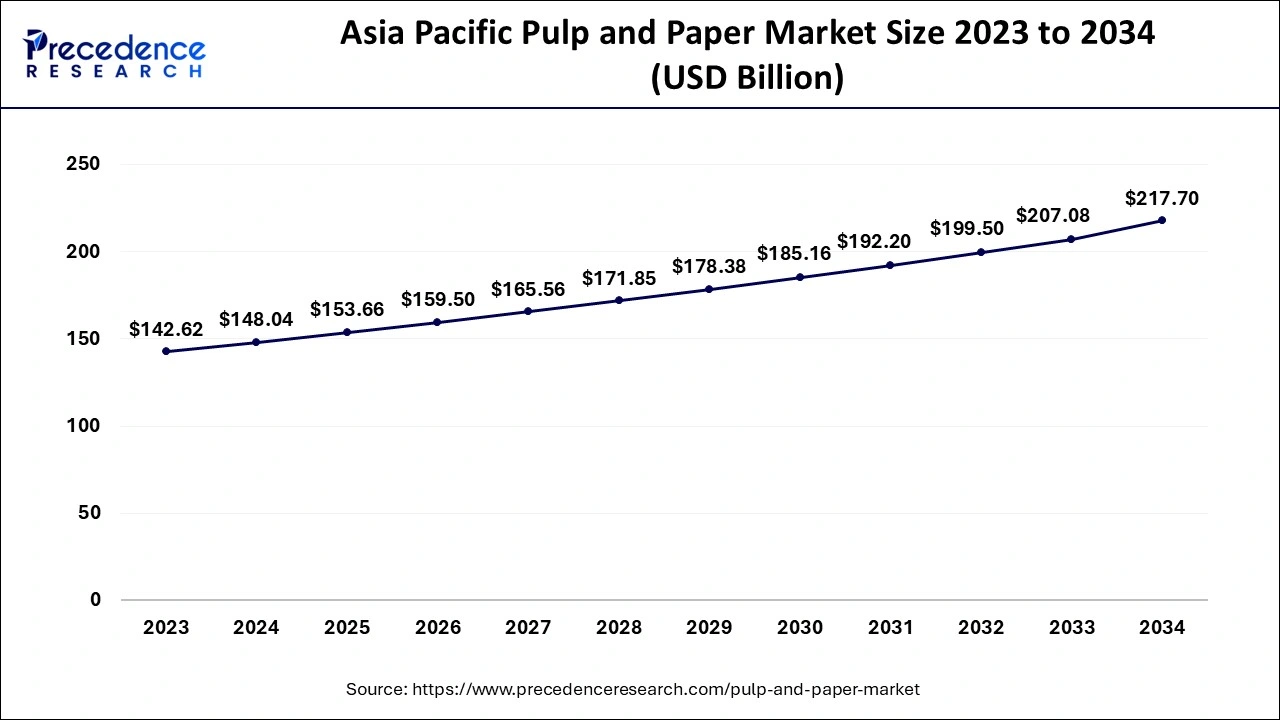

- Asia Pacific pulp and paper market was valued at USD 142.62 billion in 2024.

- The wrapping & packaging segment accounted market share of 53.1% in 2024.

- The pulping process segment is growing at a registered CAGR of around 4% from 2025 to 2034.

- The packaging segment is expected to grow at a CAGR of 5.3% from 2025 to 2034.

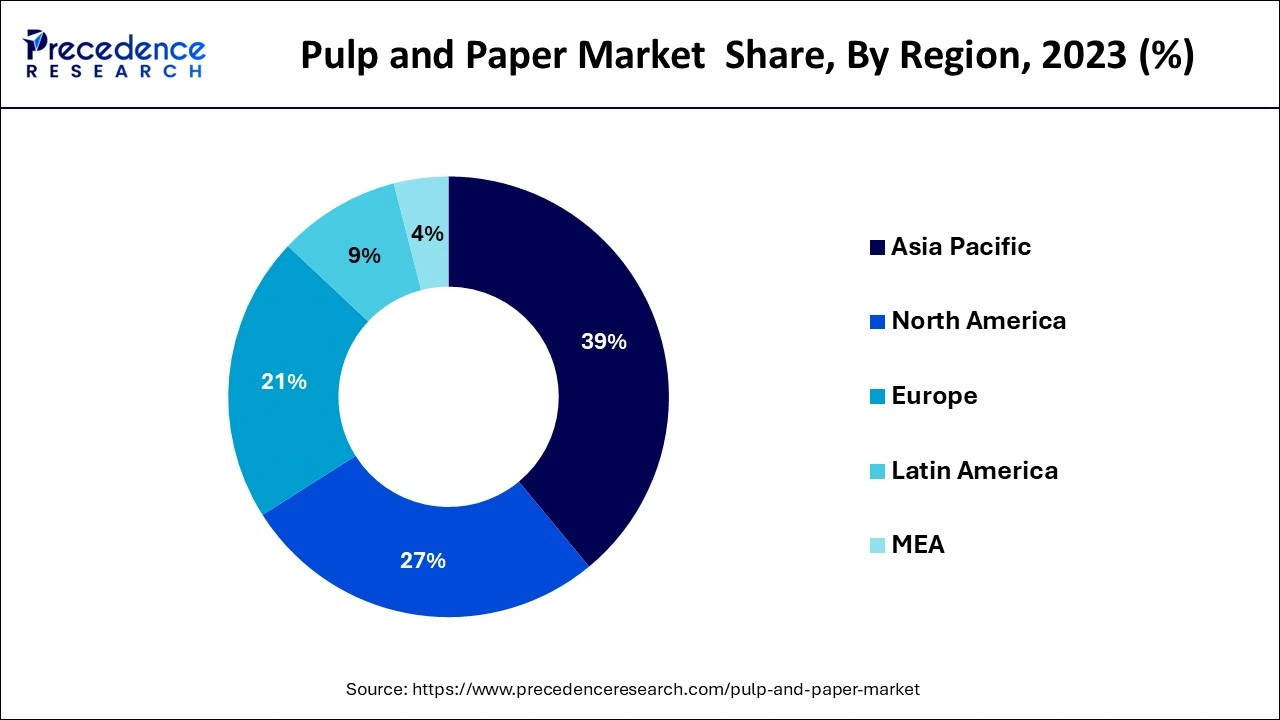

- The Asia-Pacific region accounted largest revenue share 39% in 2024.

Market Overview

The pulp and paper sector is the largest and most significant forest-based sector in the world. The environmental impact of producing paper is substantial. Paper manufacture takes a significant amount of water, depending on the effectiveness of the mill, and uses more water than other industries like steel and gasoline. The sector is the fourth largest industry in terms of energy consumption. Indisputable advantages of pulp, paper, and packaging production, such as job creation, infrastructural enhancement, and economic growth, should not be disregarded. However, the manufacture and consumption of unsustainable paper contributes to the destruction of natural ecosystems and deforestation.

Cellulases and hemicelluloses have been used in the pulp and paper industry for biomechanical pulping. Enzymes are used in wood pulping to significantly reduce the energy needed. Enzymes are used in wood pulping to significantly reduce the energy needed. The necessity for environmentally responsible de-inking of printed paper is growing as recycling of paper is given more and more importance. In order to remove ink, coating, and toner from paper, cellulases are used.

How is AI Transforming the Pulp and Paper Market?

The pulp and paper industry is witnessing a major change with artificial intelligence as it is making the production, quality, and sustainability part of the ecosystem more efficient. AI power allows for preemptive maintenance, which in turn cuts down the periods when the machines are not working and the failures of equipment to a great extent. The production processes are also made to be highly efficient, and product quality is also guaranteed to be very good through continuous monitoring and analysis of data. The consumption of chemicals by AI has gone down, and the cost has also reduced; the operations have been well supported, and the management of raw materials has also led to a reduction in the negative influence on nature. Moreover, the great technological inventions as digital twins and smart mills, that are to come in the future will not only cut down the need for human intervention and run the entire process, but also allow the practice of green manufacturing.

Pulp and Paper Market Growth Factors

Online retailing is on the rise in developing countries like India, China, Brazil, and other places due to the growing number of smartphone users and the quick internet adoption. This increases the demand for pulp and paper for packaging, as well as the rise of the e-commerce industry. Therefore, it is anticipated that the rapid expansion of online retail in developing countries will support the expansion of the pulp and paper market globally.

Consumers and manufacturers must now use sustainable paper packaging options due to the escalating environmental concerns. Advanced paper packaging solutions are likely to help the market because paper is an excellent recyclable and sustainable packaging material. Therefore, the market's expansion in the upcoming years is anticipated to be boosted by the rising demand for eco-friendly packaging materials. Moreover, it is currently the most recyclable and environmentally friendly packaging material available. Customers and producers are both adopting more environmentally friendly paper packaging solutions as a result of increased environmental concerns. To achieve their sustainability objectives, leading companies in the food, cosmetics, and FMCG sectors collaborate closely with paper manufacturers to develop cutting-edge paper packaging solutions. This should aid in the expansion of the pulp and paper sector over the foreseeable future.

In an effort to create a sustainable method of being environmentally friendly, a number of foreign countries have enacted a variety of regulations restricting the usage of conventional plastics. The demand for paper bags has also increased as a practical and cost-effective substitute for plastic bags. Because of all these restrictions and regulations, stores, supermarkets, and storage providers are more inclined to accept paper-based packaging.

- Rising E-commerce Expansion: the fast-paced adoption of online shopping in less developed countries is one major factor that contributes to the need for paper-based packaging solutions.

- Shift Toward Sustainability: Environmental concerns are getting stronger and they are the main reasons why both consumers and producers are switching to recyclable and eco-friendly paper packaging materials.

- Regulatory Push for Plastic Alternatives: Plastic bans and prohibitions worldwide are opening the way for industries to move toward the use of paper-based packaging.

- Collaborations for Innovation: Joint ventures between packaging producers and consumer industries are speeding up the advent of superior, eco-friendly, and sustainable paper products.

- Increased Preference for Recyclable Materials: The recyclability and biodegradability of paper are making paper the most favored material for packaging and further processing in industry.

Pulp and Paper Market Outlook

- Industry Growth Overview: The pulp and paper market is poised for robust growth from 2025 to 2034, driven by the global expansion of the packaging industry. Factors such as the surge in e-commerce, rising demand for sustainable packaging solutions, and heightened hygiene awareness are fueling this growth.

- Shift Toward Sustainable and Eco-Friendly Solutions:A significant trend is the growing move toward sustainable and eco-friendly options, driven by consumer preferences and stricter regulations on plastic use. There is also an increasing adoption of alternative fibers like agricultural residues and bamboo to lessen reliance on traditional wood pulp, aiming to improve efficiency and optimize production.

- Global Expansion: The market is expanding worldwide, driven by rising industrialization and increasing consumer demand for packaging and hygiene products. Emerging regions offer significant opportunities driven by increased investments in local production, infrastructure development, and the adoption of modern manufacturing technologies.

- Major Investors: The major investors in the market include global corporations such as International Paper, Stora Enso, UPM-Kymmene, and Georgia-Pacific, which lead in large-scale production, technological innovation, and sustainable practices. They contribute to the market by developing high-quality paper products, investing in eco-friendly, recycled pulp processes, and expanding production capacity to meet growing global demand.

- Startup Ecosystem: The startup ecosystem is thriving, with emerging players emphasizing niche innovations and sustainable solutions. Startups are creating unique products, such as bamboo-based toilet paper, customizable hemp paper bags, and smart paper with embedded sensors, to develop biodegradable, eco-friendly items.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 394.00 Billion |

| Market Size in 2026 | USD 408.97 Billion |

| Market Size by 2034 | USD 551.15 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.80% |

| Dominating Region | Asia Pacific |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Manufacturing Process, End Use, Category, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segments Insights

Raw Material Insights

On the basis raw material, wood based segment hold the major share in pulp and paper market. Wood pulp is currently the most widely used material for making all types of high-quality paper. It has a sizable amount of cellulose fiber, which has the consistency of thread and serves as the foundation for the finished product. To improve the pulp's brightness, stability, water resistance, and capacity to remove impurities, it is combined with various chemicals and papermaking agents.

The agro based raw material is widely used in papermaking. High-quality paper is created using stronger and more durable materials, such as cotton, linen, or hemp fibers. The paper is strengthened and stiffened using these raw components. Straw, bamboo, and esparto grass are alternative materials accustomed to manufacture fibers.

Manufacturing Process Insights

Depending upon the manufacturing process, the pulping process segment is expected to have the highest growth in the pulp and paper market in the forecast period. The main source of effluent in the manufacturing process is pulping. This method allows for the separation of impurities and cellulose fibers. The pulp processing system that gives the most versatility is the Kraft/Sulphate process. Long, thick cellulose fibers and little lignin are produced in the pulp. Its primary advantage is the production of long, dense pulp fibers using chemical pumping. Paper products that are substantially stiffer and stronger can be made using these extended cellulose fibers. Premium white paper and other high-quality paper goods are made using chemical pulp.

The other is bleaching process which is the removing or slightly modifying the pulp's colouring components. In order to get high-quality pulp with specific whiteness, cleanliness, purity, and superior physical and chemical features, pulp bleaching procedure is mostly used to improve the lightness of paper pulp. Applications for pulp bleaching processing expand. High-quality paper and refined pulp can be produced using bleached pulp.

End Use Insights

On the basis of end use industry, the packaging segment is expected to maintain its dominance in the pulp and paper market. The packaging category continued to hold the largest position in the worldwide pulp and paper market due to the rapid globalization of the e-commerce and retail sectors, there is a great need for both wrapping and packaging paper. Additionally, consumers and businesses in developing economies are embracing paper packaging items due to a growing awareness of the environment. Paper packaging is in greater demand in the food and beverage industry due to its ease of recycling, potential to reduce air pollution, and ability to clean the environment. The development of packaging has had a considerable impact on soft drink consumption. The pulp and paper sector is expected to thrive as a consequence of an increase in consumer knowledge of the adverse environmental effects of plastic and the eco-friendliness of paper packaging made from fiber crops.

During the forecast period, the printing segment is anticipated to increase significantly. Due to a predicted uptick in the education sector, including rising enrollment, bettering literacy rates, and an increase in the number of schools and colleges, the need is likely to increase. Newsprint demand growth is anticipated to be supported by rising literacy rates, expanding circulation, and an increase in the quantity of newspapers and magazines. Food production in Russia has increased by 4.8% and beverage production raised by 3.2% in 2019.

Regional Insights

Asia Pacific Pulp and Paper Market Size and Growth 2025 to 2034

The Asia Pacific pulp and paper market size is evaluated at USD 153.66 billion in 2025 and is predicted to be worth around USD 217.70 billion by 2034, rising at a CAGR of 3.92% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Pulp and Paper Market?

The Asia-Pacific region accounted largest revenue share 39% in 2024. Due to the rising need for food packaging and commercial printing in the region, Asia-Pacific currently controls the pulp and paper industry. Furthermore, it is projected that the rise of the regional market will be aided by the robust economic growth of developing countries like China, India, and Japan. The world's greatest user and producer of pulp and paper is China. Due to the increasing demand for paper-based products and the rising standard of living in Malaysia, Indonesia, and Vietnam, the industry is predicted to experience profitable expansion. Additionally, the increasing urbanization and population in APAC are the main factors driving the demand for commercial printing and food packaging.

What Potentiates the Growth of the Pulp and Paper Market in North America?

The growth of the market in North America is fueled by rising demand for packaging materials, tissue products, and specialty papers, driven largely by the e-commerce boom and increased consumer awareness of hygiene and convenience. Strong investments in sustainable practices, including recycling and eco-friendly pulp production, are enhancing the market's environmental credentials. Additionally, technological advancements in manufacturing processes are improving efficiency, reducing costs, and supporting the expansion of high-quality paper products across various industries.

The mature markets of Europe and North America are anticipated to grow slowly over the projected period. Growth in North America is predicted to be boosted by rising fast-moving consumer goods consumption, rising packaging paper demand in the U.S., and significant companies like WestRock, Georgia-Pacific, and International Paper. The rising emphasis on attaining sustainable goals by recycling paper-based products is likely to spur growth in Europe at the same time. Moreover, the presence of leading market players is anticipated to drive the market.

The mature markets of Europe and North America are anticipated to grow slowly over the projected period. Growth in North America is predicted to be boosted by rising fast-moving consumer goods consumption, rising packaging paper demand in the U.S., and significant companies like WestRock, Georgia-Pacific, and International Paper. The rising emphasis on attaining sustainable goals by recycling paper-based products is likely to spur growth in Europe at the same time. Moreover, the presence of leading market players is anticipated to drive the market.

India Pulp and Paper Market Trends

The pulp and paper market in India is expanding due to rising domestic demand driven by population growth, increasing literacy rates, and the rapid growth of the e-commerce and packaging sectors. The country is leveraging recycled fibers and agro-residues to meet this demand sustainably, reducing dependency on virgin pulp. Additionally, government initiatives promoting industrial development and investments in modern manufacturing technologies are further accelerating market growth.

U.S. Pulp and Paper Market Trends

The U.S. holds a strong position in the North American pulp and paper industry, shifting its focus toward sustainable packaging, hygiene products, and advanced recycling technologies. Driven by strict environmental regulations and the dominance of major industry players, the U.S. remains a key producer and net exporter of high-value, eco-friendly paper products, adapting effectively to the digital age. The market in the U.S. is also driven by strong demand for packaging, tissue, and specialty paper products, largely fueled by e-commerce, retail, and hygiene needs.

What Makes Europe a Notably Growing Area?

Europe is experiencing notable growth in the pulp and paper market due to strong demand for sustainable packaging, tissue products, and specialty papers driven by e-commerce and consumer preference for eco-friendly solutions. The region benefits from strict environmental regulations that encourage recycling, the use of alternative fibers, and investments in green manufacturing technologies. Additionally, technological innovations and the presence of leading paper manufacturers support high-quality production and continuous market expansion across Europe.

Germany Pulp and Paper Market Trends

Germany is a significant market in Europe, recognized for its strong domestic paper industry and high per capita consumption. The market is greatly influenced by sustainability trends and shifting demand for packaging and household paper, which offsets the decline in graphic papers. The country is home to leading agrochemical and paper manufacturers and is committed to investing in technologies that improve sustainability and efficiency.

How Does Latin America Contribute to the Pulp and Paper Market?

Latin America plays a crucial role in the global pulp and paper industry, acting as a major supplier of pulp, especially hardwood pulp from its large and rapidly expanding eucalyptus plantations. Although production faces fluctuations due to factors like currency depreciation, the region is seeing increased demand for packaging driven by the growth of e-commerce and consumer trends focused on sustainability. Leading companies such as Suzano and Klabin in Brazil and CMPC in Chile are fueling growth, reaffirming the region's significance as a global supplier.

Brazil Pulp and Paper Market Trends

Brazil is a powerhouse in the pulp and paper industry, ranking as the third-largest producer in the world after China and the U.S. It is a leading exporter of pulp, especially bleached eucalyptus kraft pulp, thanks to its extensive and efficient plantations. The market in the country is also boosted by strong domestic demand for packaging and tissue paper, with major companies like Suzano and Klabin investing heavily in new and expanded production facilities.

What Potentiates the Growth of the Market in the Middle East & Africa?

The pulp and paper market in the Middle East and Africa is propelled by increasing urbanization, a rising middle class, and heightened hygiene awareness. The market is experiencing strong demand for tissue and packaging products, driven by e-commerce expansion and efforts to develop sustainable, plastic-free packaging. Although many countries still depend on imports, investments in recycling infrastructure and integrated capacity are rising, with regional trade hubs like the UAE playing a central role.

UAE Pulp and Paper Market Trends

The UAE is a significant player in the pulp and paper industry, with a focus on sustainable packaging. The government's push for eco-friendly initiatives and plastic bans is fueling strong demand for biodegradable and recyclable paper products. As a regional trade and logistics hub, the UAE is positioned to serve both its domestic market and re-export to other MEA countries, leading to substantial investments in recycling infrastructure and domestic production facilities.

Value Chain Analysis

- Feedstock Procurement: This involves the sourcing and management of the necessary raw materials, like wood or recycled fiber, for the production of pulp and paper.

Key Players: International Paper, Suzano S.A. - Chemical Synthesis and Processing: The procedures of pulping, bleaching, and refining involve the transformation of materials into usable pulp.

Key players: Kemira, Solenis, and BASF - Compound Formulation and Blending: The pulp is mixed with other materials or chemicals to produce a final product with the desired properties, such as strength, texture, and finish.

Key Players: Solenis and Kemira - Quality Testing and Certification: The products are subjected to testing to ensure that they meet all required standards, performance criteria, and customer specifications.

Key players: SGS and Intertek - Packaging and Labeling: Finished paper products are made ready for the market with protective packaging and clear labeling.

Key players: Uflex and TCPL Packaging Ltd. - Distribution to Industrial Users: Paper products, after being processed into their final form, are then delivered to converters, manufacturers, and industrial customers.

Key players: International Paper and Oji Holdings Corporation - Waste Management and Recycling: The practice of recovering, reprocessing, and reusing paper waste in support of circular manufacturing is referred to as waste management and recycling.

Key players: Re Sustainability Limited, KRecycling Private Limited - Regulatory Compliance and Safety Monitoring of Pulp and Paper: The process of securing the observance of environmental, safety, and quality regulations in the production operations is called regulatory compliance and safety monitoring of pulp and paper.

Key Players: Central Pollution Control Board and State Pollution Control Boards

Top Companies for the Pulp and Paper Market and Their Offering

- International Paper: Packaging (corrugated), Market Pulp, Printing and Writing Papers.

- Kimberly-Clark: Consumer Tissue (Kleenex, Scott), Personal Care Products (Huggies, Kotex).

- Smurfit WestRock: Corrugated Packaging, Containerboard, Specialty Packaging.

- Stora Enso: Renewable Packaging Board, Biomaterials, Wooden Products, Paper.

- UPM-Kymmene: Communication Papers, Specialty Papers (labeling), Market Pulp, Biofuels.

Other Key Players

- Georgia-Pacific Corporation

- Nine Dragon Paper (Holdings) Ltd.

- Sappi Limited

- Svenska CellulosaAktiebolaget (SCA)

- Oji Holding Corporation

- Nippon Paper Industries Co., Ltd.

- WestRock

Recent Developments

- In August 2025, Tissue World Ho Chi Minh City partners with Vietnam Pulp and Paper Association for its November 2025 event, marking a key step in expanding into Southeast Asia and enhancing Vietnam's global pulp and paper presence.(Source: https://www.pulpapernews.com)

- In August 2025, CMPC and MIT launch "The Salmon Packaging Design Competition" for sustainable packaging innovations in the salmon industry. (Source: https://www.seafoodsource.com)

Segments covered in the Report

By Raw Material

- Wood-Based

- Agro Based

- Recycled Fibre Based

By Manufacturing Process

- Pulping Process

- Chemical Pulping

- Chemi-Mechanical Pulping

- Others

- Bleaching Process

- Chlorine Bleaching

- Elemental Chlorine Free (ECF) Bleaching

- Total Chlorine Free (TCF) Bleaching

- Others

By End Use Industry

- Packaging

- Healthcare

- Food & Beverages

- Personal Care

- Other

- Printing

- Commercial Printing

- Packaging Printing

- Publication Printing

- Building and Construction

- Residential

- Commercial

- Industrial

- Infrastructural

- Others

By Category

- Wrapping & Packaging

- Printing & Writing

- Sanitary

- News Print

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting