What is the Cellulose Fiber Market Size?

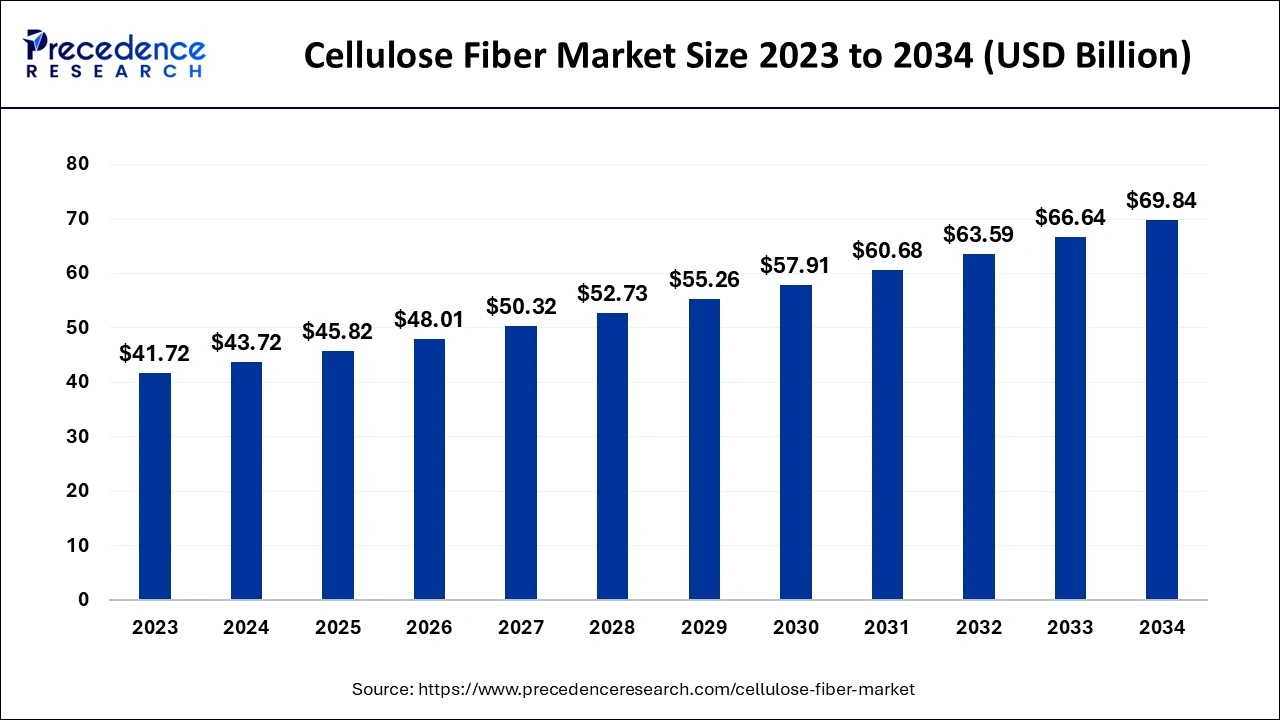

The global cellulose fiber market size is calculated at USD 45.82 billion in 2025 and is predicted to increase from USD 48.01 billion in 2026 to approximately USD 72.94 billion by 2035, expanding at a CAGR of 4.76% from 2026 to 2035.Increasing environmental concerns across industries is the key factor driving the growth of the market. Also, the rising demand for sustainably sourced material, along with the technological advancements in cellulose fiber production, can fuel market growth shortly.

Cellulose Fiber Market Key Takeaways

- The global cellulose fiber market was valued at USD 45.82 billion in 2025.

- It is projected to reach USD 69.84 billion by 2034.

- The cellulose fiber market is expected to grow at a CAGR of 4.76% from 2026 to 2035.

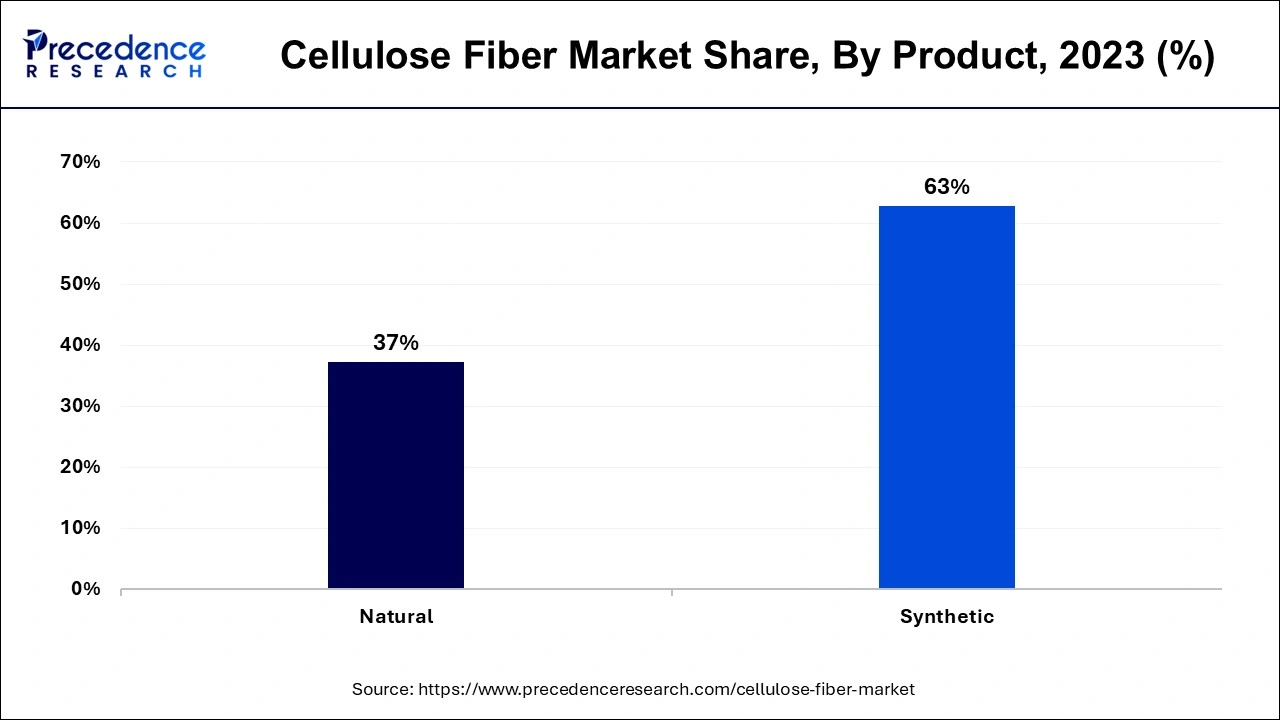

- By product, the synthetic products segment has dominated the market with a revenue share of 62.8% in 2025.

- By product, the natural products segment is anticipated to grow at a significant rate over the projected period.

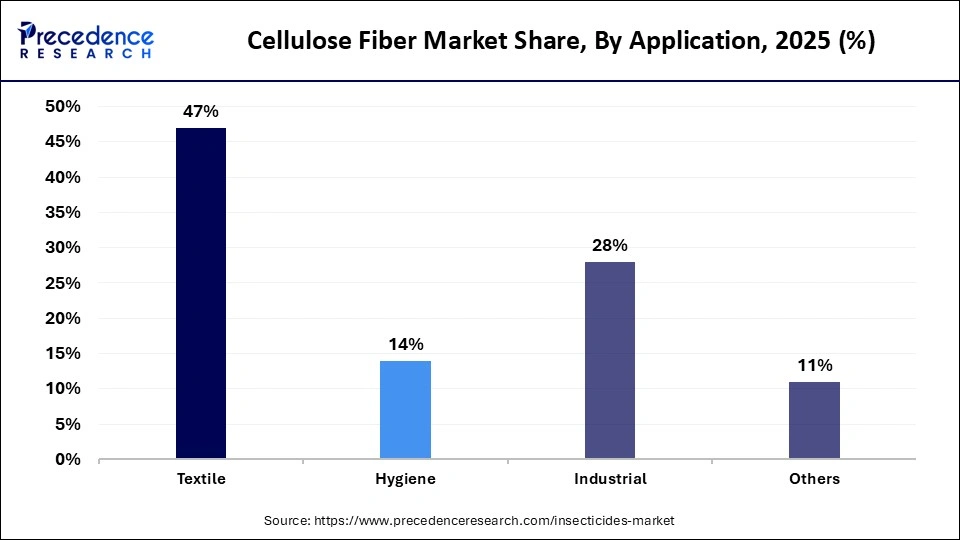

- By application, in 2025, the textile segment led the cellulose fiber market by holding the largest market share of 47%.

- By application, the industrial segment is expected to witness notable growth during the projected period.

Market Overview

Cellulose fiber is a natural fiber extracted from cellulose, the key element of plant cell walls. Generally, it is obtained from wood pulp, but it can also be obtained from flax, cotton, and hemp. This fiber is known for its renewability, biodegradability, and environmental friendliness. Cellulose fiber can be used in textiles to design technical textiles that have a special purpose and involve physical properties. Future environmental issues have shifted toward more eco-friendly practices over the technological textile supply chain.

Biggest Textile Exporter Countries Statistics (2022)

| Country | Value of export in billions |

| China | $303 billion |

| Bangladesh | $57.7 billion |

| Vietnam | $48.8 billion |

| India | $41.1 billion |

| Germany | $40 billion |

| Italy | $36.71 billion |

| Turkey | $36.7 billion |

| US | $29.8 billion |

| Pakistan | $22.1 billion |

| Spain | $20.3 billion |

How is AI Impacting the Cellulose Fiber Market?

Artificial Intelligence (AI) is increasingly revolutionizing the market by improving production quality and efficiency. AI-driven technologies are used to optimize production processes, reduce operational costs, and enhance supply chain management. Furthermore, the advancement in AI technology enables consumers to fulfill rising consumer demand and adapt to changing industry standards.

- In September 2024, India launches AI-powered fashion forecasting with VisioNxt. The bilingual web portal, developed by the National Institute of Fashion Technology (NIFT), is meant to offer trend insights catered specifically to India's diverse fashion market.

Cellulose Fiber Market Growth Factors

- Increasing demand for technical textiles in various industries is expected to boost the cellulose fiber market growth soon.

- The rapidly expanding paper and construction sectors can propel the growth of the market further.

- The growing global need for versatile, biodegradable, and cost-effective fibers will likely help in the market expansion over the forecast period.

Market Outlook

The cellulose fiber market is expanding due to rising demand for eco-friendly textiles, nonwoven fabrics, and sustainable packaging solutions across multiple industries. Growing consumer preference for natural, biodegradable, and renewable materials is fueling innovation and adoption globally.

The sustainability trend is reshaping the market by driving demand for biodegradable, renewable, and low-carbon footprint fibers, pushing companies to innovate and adopt circular economy principles. This trend also encourages manufacturers to replace synthetic fibers with natural alternatives and integrate environmentally responsible production practices.

The market is growing worldwide due to increasing awareness of sustainable materials, rising textile and apparel production, and demand for biodegradable alternatives to synthetic fibers. Emerging regions present significant opportunities as governments and manufacturers invest in green textiles, bio-based composites, and renewable fiber production to meet environmental regulations and consumer demand.

Major investors in the market include large textile and chemical manufacturers, private equity firms, and sustainable materials startups who fund R&D, production scale-up, and global distribution. Their investments enable the development of high-quality, eco-friendly fibers, enhance supply chain capabilities, and accelerate adoption in textile, packaging, and industrial applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 72.94 Billion |

| Market Size in 2026 | USD 48.01 Billion |

| Market Size in 2025 | USD 45.82 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.76% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising Demand in Textile Industry

The textile industry is a major driver of cellulose fibers, particularly in manufacturing fabrics like lyocell, rayon, and modal. The fashion industry's requirement for breathable, comfortable, and sustainable textiles has raised the utilization of cellulose fibers. Fashion labels also leverage cellulose fibers in their clothing lines, including Tencel. These fibers are convenient for performance and activewear textiles due to their breathability, softness, and moisture absorption properties.

- In October 2024, For the first time, the world-renowned Japanese denim manufacturer Kaihara Denim and the Lenzing Group, a major supplier of regenerated cellulosic fibers ROICA, a pioneer in premium stretch fiber, joined forces to co-create the SAISEI Collection, a premium stretch denim line. The strategic partnership is ideally positioned to offer a greater percentage of recycled materials in denim to the global market.

- In September 2024, Birla Cellulose, a leading player in sustainable fiber solutions, conducted the second edition of the hub meet at The Residency. The agenda was to highlight the transformational potential of sustainable MMCF (Man-Made Cellulosic Fibers) in the Home Textiles sector.

Restraint

Fluctuations in raw material prices

The fluctuating raw material prices have a significant negative impact on the growth of the cellulose fibers market. This, in turn, results in inconsistent prices, posing a big construed issue regarding market expansion. Moreover, changes in forestry methods, growing demand for wood pulp, and climate-related issues can negatively influence the overall supply chain of cellulose fiber.

Opportunity

Increasing awareness of biodegradability

The rising global awareness of environmental concerns, coupled with the increasing issues about the influence of non-biodegradable materials, creates substantial market opportunities. Furthermore, Consumers search for products with high biodegradability and less environmental footprints, which aligns with ongoing sustainability practices in the industry. Also, regulatory standards promoting eco-friendly practices encourage market players to utilize materials like cellulose fibers.

- In June 2024, Researchers Invent 100% Biodegradable Barley Plastic. Made from barley starch mixed with fiber from sugarbeet waste sees. Researchers hope that their invention can help to reduce plastic pollution. The material is made using natural plant material from crops and can be used for food packaging, among other things.

- In August 2024, an Indian entrepreneur created a biodegradable plastic-like carrier bag for small businesses using cellulose, sugar, and corn fibers. Mohammed Azhar Mohiuddin, the founder of Bio Reform, has replaced over 6 million plastic bags in checkout counters across India using his innovative product.

Segment Insights

Product Insights

The synthetic products segment dominated the cellulose fiber market in 2025. The dominance of the segment can be attributed to the scalability, cost-effectiveness, and superior performance provided by artificial fibers. Synthetic fibers have numerous advantageous characteristics, such as elasticity, low absorbency, durability, and resistance to atmospheric factors when distinguished from natural fibers. Additionally, the manufacturing of synthetic fibers depends less on environmental conditions and location than on natural fibers.

The natural products segment is anticipated to grow at a significant rate in the cellulose fiber market over the projected period. The growth of the segment can be driven by the rising focus on eco-friendly and sustainable practices by end users. Natural fibers are soft to the touch which makes them suited for textiles. However, they promote renewable methods in different industries like construction and fashion. Also, the breathability, biodegradability, and sustainability of these fibers are of high importance.

Application Insights

In 2025, the textile segment led the cellulose fiber market by holding the largest market share. The dominance of the segment can be credited to the wide consumer base offered by the textile industry to cellulose fibers, using them as a major raw material in the manufacturing of an extensive range of products, like home furnishings, apparel, and industrial textiles. Furthermore, these fibers are in demand because of their eco-friendly properties and natural feel, which contribute to comfortable and sustainable textile products ranging from high-end fashion to casual wear.

- In September 2024, Lenzing Groups launched the latest brand identity for its flagship textile brand, Tencel. Lenzing Group, which regenerates cellulose fiber suppliers for textile and nonwoven industries. The update aims to align Tencel with collaboration, sustainability, and innovation.

The industrial segment is expected to witness notable growth in the cellulose fiber market during the projected period. The growth of the segment can be credited to the development of cellulose fiber technology along with the sector's increasing demand for cellulose fibers. Cellulose fibers have unique physical properties, including absorbency, high strength, and biodegradability, which makes them important in applications ranging from filtration and paper production to construction and insulation.

Regional Insights

Asia Pacific dominated the cellulose fiber market in 2025. The region's dominance is attributed to the well-established textile sectors, which are major consumers of cellulose fibers. Furthermore, Asia Pacific contains abundant resources that are crucial inputs for cellulose fiber manufacturing. In Asia Pacific, China leads the market by holding the largest market share. This is due to increasing demand from neighboring economies like India and Bangladesh.

- In May 2024, Intertek unveiled iCare, a digital platform for swift textile testing management in India. iCare transforms quality assurance by providing real-time monitoring and interaction features. It improves transparency and efficiency in testing processes. With plans for global expansion, iCare sets a new standard for Total Quality Assurance.

China Cellulose Fiber Market Trends

China is a major contributor to the market in Asia Pacific due to its large-scale textile and apparel manufacturing industry, which heavily relies on both natural and regenerated cellulose fibers. The country benefits from well-established supply chains, advanced production technologies, and abundant raw material availability, enabling high-volume fiber production. Additionally, growing government support for sustainable and eco-friendly textile initiatives is boosting the adoption of cellulose fibers.

North America held a significant share of the cellulose fiber market in 2025. The growth of the region can be linked to the increasing demand for fashion apparel created from biodegradable fibers. The region also has wide forestlands that offer a sustainable and robust supply of wood pulp, which is the key raw material for fiber production. However, increasing the domestic market for these products, especially in sectors like textiles, hygiene, and construction, is fuelling the cellulose fiber market growth in the region.

U.S. Cellulose Fiber Market Trends

The U.S. is a major contributor to the North American cellulose fiber market due to its well-established textile, nonwoven, and packaging industries that demand high-quality natural and regenerated fibers. Advanced manufacturing technologies, extensive R&D, and strong investment in sustainable materials drive innovation and production efficiency in the country. Additionally, increasing consumer preference for eco-friendly products and regulatory support for sustainable textiles further bolsters the adoption of cellulose fibers in North America.

The market in Europe is driven by rising demand for sustainable and eco-friendly textiles, nonwoven fabrics, and packaging materials. Strict environmental regulations, growing consumer awareness of biodegradable alternatives, and investments in innovative fiber technologies are further accelerating market adoption. Additionally, European manufacturers are focusing on circular economy practices, boosting the production and use of cellulose fibers across multiple industrial sectors.

Germany Cellulose Fiber Market Trends

Germany is a major player in the market. There is a high adoption of cellulose fiber due to the country's commitment to sustainability and its excellent manufacturing capabilities. The country benefits from advanced production technologies, robust R&D capabilities, and government support for eco-friendly and circular economy initiatives. Additionally, Germany's focus on innovation and adoption of biodegradable materials drives the growth and application of cellulose fibers across textiles, nonwovens, and packaging industries.

Value Chain Analysis

By strategically acquiring plant-based raw materials, companies are able to produce cellulose fiber that is reliable and sustainable.

Key Players: International Paper and Stora Enso

In a series of chemical reactions, controlled processes occur where cellulose materials are transformed into usable fibers.

Key players: BASF SE and DuPont

Cellulose components are mixed with additives or polymers to get the desired performance characteristics.

Key Players: FKuR, BASF

The cellulose fibers finally obtained are inspected to verify their compliance with performance, safety, and regulatory standards.

Key Players: Global Organic Textile Standard (GOTS) and the International Organization for Standardization (ISO)

Finished cellulose fibers are distributed to apparel brands, textile mills, and industrial clients through global logistics and wholesale networks.

Key Players: Arvind Limited, Reliance Industries, Indo Rama Synthetics

Cellulose Fiber Market Companies

Produces high-quality, sustainable cellulose fibers such as TENCEL lyocell and modal fibers for textiles, nonwovens, and technical applications.

Manufactures viscose and blended cellulose fibers for apparel, home textiles, and industrial fabrics.

Specializes in large-scale production of viscose staple fibers for textiles, nonwovens, and hygiene products with an emphasis on sustainable sourcing.

Offers cellulose fibers and yarns tailored for textile manufacturing, focusing on quality, strength, and eco-friendly production.

Supplies specialty regenerated cellulose fibers for hygiene, medical, and technical applications with high purity and customizable properties.

Other Major Key players

- Grasim (India)

- Fulida Group Holding Co. Ltd (China)

- Sappi (South Africa)

- Tangshan Sanyou Group (China)

- Eastman Chemical Company (US)

- CFF GmbH & Co. KG (Germany)

- China Hi-Tech Group Corporation (China).

Recent Developments

- In October 2025, Birla Cellulose launched Liva Reviva M, India's first next-generation circular fiber made from up to 50% mechanically recycled post-consumer textile waste, tackling the growing issue of global textile waste projected to rise by 45% in five years.

(Source: apparelresources.com) - In January 2025, Panasonic Holdings Corporation developed a molding material that is fully biodegradable in marine environments by incorporating high concentrations of plant-derived cellulose fibers into resins, resulting in excellent mechanical properties along with biodegradability.

(Source:news.panasonic.com/) - In June 2024, Eastman unveiled the launch of Naia Renew for the denim segment to grow its sustainability objectives at the Denim Premiere Vision exhibition. This is a cellulosic acetate fiber that has been created from 40% certified recycled content and 60% sustainable wood pulp.

- In February 2024, Eastman and Cargill unveiled a partnership to develop bio-based packaging materials. This might affect the application of cellulose esters in eco-friendly packaging materials.

- In August 2023,Sateri (Nantong) Fibre Co., Ltd. began Lyocell fiber production, adding 10,000 tonnes to Sateri's yearly production capacity, bringing the company's total current capacity to 250,000.

- In May 2023, Daicel Corporation, a top cellulose manufacturer, announced a major investment to grow its production capacity in Japan, addressing the rising demand for cellulose esters in the region.

- In 2022, Sappi committed to being a part of the solution and is working to decarbonize its operations. It will cut using coal at its German location in Stockstadt as a next step, to develop sustainable products.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting