What is the Textile Market Size?

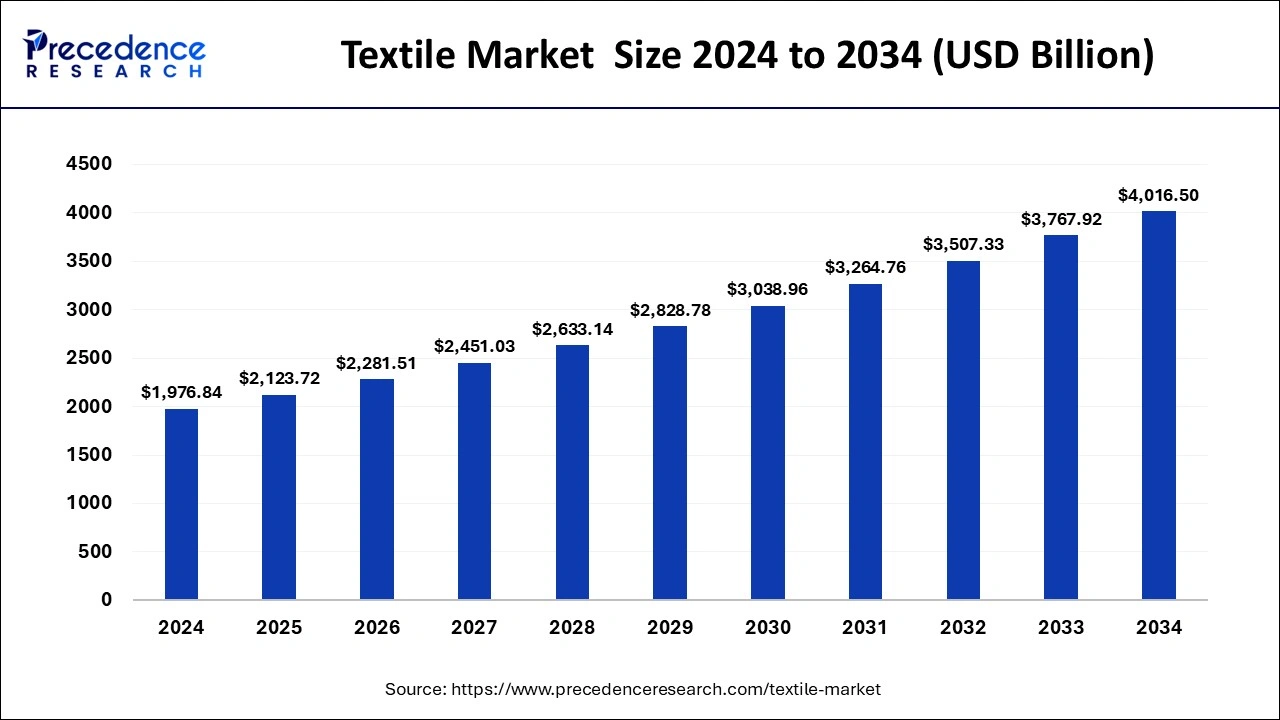

The global textile market size is estimated at USD 2,123.72 billion in 2025 and is predicted to increase from USD 2,281.51 billion in 2026 to approximately USD 4,016.50 billion by 2034, expanding at a CAGR of 7.35% from 2025 to 2034. The rising demand for natural fibers globally is driving the growth of the textile market.

Market Highlights

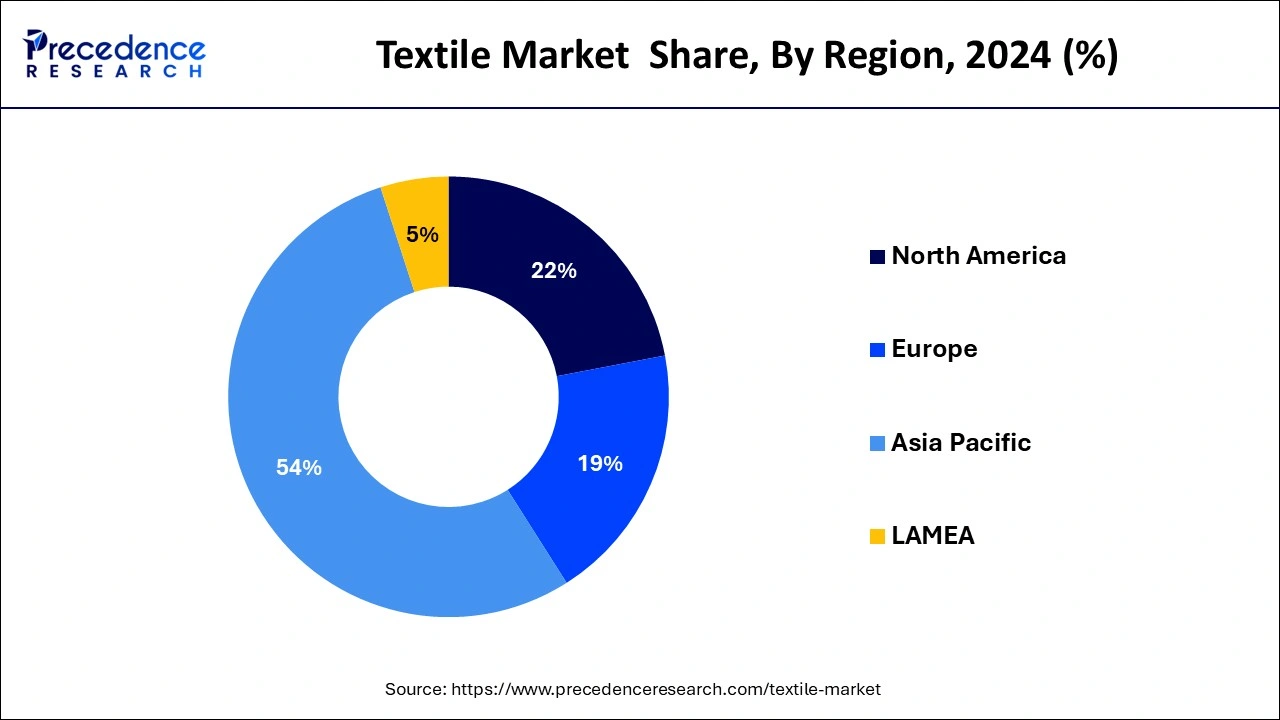

- Asia Pacific dominated the global market with the largest market share of 54% in 2024.

- North America is observed to experience the fastest rate of growth during the forecast period.

- By raw materials, the cotton segment dominated the textile market in 2024.

- By raw materials, the wool segment is expected to grow at the fastest rate during the forecast period.

- By product, the natural fibers segment led the market in 2024.

- By application, the fashion & clothing segment dominated the market in 2024.

- By application, the technical segment is estimated to be the fastest-growing segment during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 2,123.72 Billion

- Market Size in 2026: USD 2,281.51 Billion

- Forecasted Market Size by 2034: USD 4,016.50 Billion

- CAGR (2025-2034): 7.35%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The textile market is one of the oldest industries in the world. This industry mainly deals in the production, designing, and distribution of a wide range of materials, such as clothing, fabrics, and yarn. The textile industry has experienced gradual evolution due to cultural influences and technological developments. Globalization has further increased the growth of the textile industry as it allows the buying and selling of textile-based products throughout the globe. This market is highly fragmented due to the presence of large and small market players that deal in the manufacturing of products ranging from apparel and home decor to medicinal fabrics, industrial uses, and others.

Textile Market Growth Factors

- The rising demand for silk, due to its growing application in clothing, home furnishing, and surgical procedures worldwide, has boosted the market's growth.

- The upsurge in demand for woolen items such as sweaters, socks, caps, blankets, and others has driven the growth of the textile industry.

- The rise in the number of government initiatives to develop the textile sector will foster the growth of the textile market during the forecast period.

- Research and development activities related to advances in fabric manufacturing positively impact the textile industry.

- The growing demand for protective clothing from the construction sector also boosts the growth of the market.

- The ongoing trend of social media platforms involving buying and selling clothes online is further driving the market's growth.

- The rising use of synthetic and cellulose fibers for industrial applications also accelerates the growth of the textile market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2,123.72 Billion |

| Market Size in 2026 | USD 2,281.51 Billion |

| Market Size by 2034 | USD 4,016.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.35% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw-material, Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising awareness of people towards eco-friendly textile products

The rising demand for environmentally friendly and sustainable textiles is a prominent driver that has reshaped the textile industry. With the rising awareness regarding global environmental issues, buyers, regulatory bodies, and companies are adopting sustainable practices to minimize the environmental concerns related to textile production. Consumers have become highly aware of their purchasing choices and are opting for textiles that do not have any environmental impact. Thus, governments of countries such as the USA, India, China, and others have announced strict regulations and standards to encourage textile manufacturers to adopt clean production techniques and reduce chemical usage in the textile industry.

Restrain

High production cost

The rising prices of raw materials such as natural or synthetic fibers, yarns, and fabrics have negatively impacted the textile market. Also, high labor costs and the rising costs of machinery involved in the textile industry are challenges for market players to sustain in the industry. To maximize profits, companies tend to increase the cost of a finished item. This, in turn, is expected to restrain the growth of the textile market.

Opportunity

Adoption of smart clothing

Smart clothing is also known as e-textile or smart fabric and consists of embedded systems that monitor the functionalities of the human body. The growing adoption of smart clothes integrated with GPS and AI technology in sports and entertainment industries, along with their applications in mining industries, is an ongoing trend. Thus, the advent of smart clothing is expected to create ample growth opportunities for market players in the upcoming years.

Segments Insights

Raw Materials Insights

The cotton segment dominated the textile market in 2024. This segment is driven by the rising demand for cotton from several industries, such as apparel, medical dressings, and garments industry. Also, the high availability of cotton in countries such as the U.S., India, China, and others is boosting market growth. Moreover, the rise in exports of cotton for various applications such as diapers, home furnishings, and others, along with the rise in research and development projects to support cotton production, has further driven the growth of the textile market.

- For instance, in March 2022, Armor Seed launched two varieties of cotton. These varieties were termed ARMOR 9512B3XF and ARMOR 9442 XF and have several benefits, such as improved vigor, better fiber quality, and Xtendflex technology.

The wool segment is expected to be the fastest-growing during the forecast period. This growth is mainly driven by several factors, such as the manufacturing of insulation products and their application in carpeting and upholstery. Moreover, the rising use of wool in the manufacturing of musical instruments and the production of tennis balls and sports gear due to its high durability and thermal properties.

Product Insights

The natural fibers segment held the largest market share in 2024. This segment is generally driven by factors such as the rising use of apparel and fashion industry and increasing awareness regarding sustainable clothing. Also, the growing demand for natural fibers for designing the interiors of cars and the rising application of natural fibers for medical usage has also accelerated the growth of the textile market. Moreover, the increasing application of natural fibers for making ropes and paper production further drives the growth of the textile industry.

The polyester segment is expected to grow at a significant rate during the forecast period. The growing demand for polymers due to their cost-effectiveness, resilience, and durability has driven the growth of the market. Also, the rising use of polyester for the production of jackets, sportswear, and gym wear, along with its usage in the production of tires and safety belts for cars, has further boosted the growth of the textile market.

Application Insights

The fashion & clothing segment dominated the market in 2024. The market growth is attributed to factors such as the rising disposable income of people who tend to buy clothes regularly, along with the ongoing trend of wearing branded clothes. Also, the growing demand for formal clothes to wear at office and marriage parties coupled with the rising trend of t-shirts with custom designing has further boosted the fashion & clothing market, which, in turn, has driven the growth of the textile market. Additionally, the growing urbanized population across the world is likely to travel from one place to another, which in turn increases the demand for casual wear, thereby driving the growth of the textile industry.

The technical segment is estimated to be the fastest-growing segment during the forecast period. The growth of this segment can be attributed to factors such as increased demand for textiles with high-performance properties, along with its rising application in transportation, automotive, and protective clothing. Also, rising developments in the production and supply of construction and medical apparel by companies have also boosted the market growth.

- For instance, in November 2023, Cardinal Health launched a SmartGown. This gown comes with a pocketed design that helps minimize contamination outside the sterile area and helps in the storage of surgical instruments that are used repeatedly.

Regional Insights

Asia PacificTextile Market Size and Growth 2025 to 2034

The Asia Pacific textile market size was estimated at USD 1,146.81 billion in 2025 and is predicted to be worth around USD 2,188.99 billion by 2034 at a CAGR of 7.45% from 2025 to 2034.

Asia-Pacific dominated the textile market in 2024. The growth of the market is generally driven by the easy availability of raw silk along with rising demand for fashionable clothes and home furnishing commodities. Moreover, the rising use of e-commerce for buying apparel, along with the rising young age population that tends to buy designer and fashionable clothes, is driving the growth of the textile market. Also, the rising interest of people in modeling and fashion designing, coupled with the increasing trend of wearing imported clothes, further accelerates market growth positively. Additionally, increased investments from the governments of countries such as India, China, Bangladesh, and others have also boosted the market growth. Furthermore, the presence of prominent market players such as Arvind Limited, Vardhman Textiles Ltd., Welspun India Ltd., Reliance Industries Limited (Textiles), Aditya Birla Group (Textiles), Raymond Ltd, and others are adopting strategies to strengthen their customer base and maintain their dominance in the industry.

- For instance, in February 2024, Reliance Industries launched ECOTHERM. This product comes with several benefits, such as lightweight, soft feel, versatility, high dyeability, thermal properties, and high longevity.

- For instance, the government of India announced an investment of USD 1.6 billion in the union budget 2021-22 for the development of the textile sector. This investment will be monitored by the Ministry of Textiles and was aimed at boosting growth and innovations in the textile industry.

North America is estimated to be the fastest-growing region during the forecast period. The growth of the market is generally driven by the rising per capita income of people, a large number of warehouses for storage, a high standard of living, an increasing working population, and an upsurge in demand for durable clothes from the armed forces. For instance, in February 2024, GALLS, a leading supplier of America's military goods, acquired LVI.

This acquisition aimed to deliver clothing and textile functions, military logistics, and supply chain solutions to ensure accurate delivery in tough situations during warfare. Moreover, the availability of raw materials at low prices, along with rising demand for premium clothes from the sports sector and Hollywood, has also driven the market growth.

- For instance, in January 2024, Lilysilk launched a 2024 spring collection named "A Laidback Luxe." This new collection features modernity and sophisticated looks and will be used by premium customers and Hollywood actresses. Also, a rise in investment from private and public sector entities in the textile industry is further expected to drive textile market growth in this region.

- For instance, in March 2022, ThinkHUGE announced that it would invest 340 million USD 140 million in the Northern Triangle region, which comprises Guatemala, El Salvador, and Honduras, to develop the textile industry.

Europe is estimated to grow at a significant rate during the forecast period. The growth of the market is generally driven by the increasing demand for organic fabrics along with the rising trend of consumers towards online shopping. Moreover, the implementation of government policies and trade agreements such as the Euro-Mediterranean Dialogue and free-trade agreements that are favorable for textile manufacturing, in turn, boost the market growth.

Also, the market's growth can be attributed to factors such as growing awareness regarding the latest fashion trends and an upsurge in demand for designer clothes from the cinema industry. Furthermore, the presence of several market players such as Inditex, Tirotex, Salvatore Ferragamo SpA, Koninklijke Ten Cate NV, Chargeurs SA, and others that are engaged in research & development of textiles and adopting several strategies such as acquisition, product launches, and partnerships to maintain their dominance in the market.

- For instance, in May 2022, TIROTEX, a leading European textile brand, announced the acquisition of Dilmenler. This acquisition aimed to use Dilmenler's textile equipment to produce dry and saturated fabric with necessary finishing solutions.

Textile Market Companies

- BSL Limited

- INVISTA S.R.L.

- Lu Thai Textile Co., Ltd.

- Heytex Bramsche GmbH

- B.D. Textile Mills Pvt. Ltd.

- DBL Group

- IBENA Inc.

- Levis

- Lakhmi Woollen Mills

- Wilh. Wülfing GmbH & Co. KG

- Wuxi Xiexin Group Co., Ltd.

- O'Formula Co., Ltd.

- The Bombay Dyeing & Mfg. Co., Ltd

- Adidas AG

- Mayur Fabrics

- Huafu Top Dyed Melange Yarn Co., Ltd.

- Nike Inc

Recent Developments

- In May 2024, Nike launched the jersey kit for Paris Saint-Germain men's and women's soccer teams for the 24/25 season. This new jersey is based on an old retro look and has the signature Hechter stripe that symbolizes a traditional presentation to the Paris Saint-German soccer team.

- In April 2024, Adidas announced team wear sponsorship for the Paris Olympic and Para Olympic games. These team wear kits will serve the fifteen competing teams and the French athletes. They feature uniqueness, signature flairs, quirky colors, repeated lines, and detailed graphics.

- In April 2024, Successori Reda S.p.A partner with the shirt dandy. This partnership aimed at introducing 3D configuration and AI features in the textile industry to enhance the efficiency of designers, develop unique products, scale operations, and accelerate market outreach.

- In January 2024, Levis launched 517 Bootcut jeans for men. These jeans are designed in retro style and will provide high durability and comfort, which you can wear in spring or summer.

- In April 2023, BSL Limited launched a cotton spinning unit in Rajasthan, India. This new unit was set up in the Bhilwara district and has a capacity of 30,000 spindles that can produce 700 tonnes of cotton yarn every month that will be sold commercially in domestic and global markets.

- In January 2023, Invista S.R.L. launched Navy Blue CORDURA TrueLock Fabric. This new fabric comes with abrasion resistance, color fastness resistance, UV fade resistance, and long-lasting color vibrancy. It will mainly used for Tactical, Military, and Law Enforcement applications.

Segments Covered in the Report

By Raw-material

- Cotton

- Chemical

- Wool

- Silk

- Others

By Product

- Natural Fibers

- Polyesters

- Nylon

- Others

By Application

- Household

- Bedding

- Kitchen

- Upholstery

- Towel

- Others

- Technical

- Construction

- Transport

- Medical

- Protective

- Fashion & Clothing

- Apparel

- Ties & Clothing Accessories

- Handbags

- Others

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting