What is the Textile Chemicals Market Size?

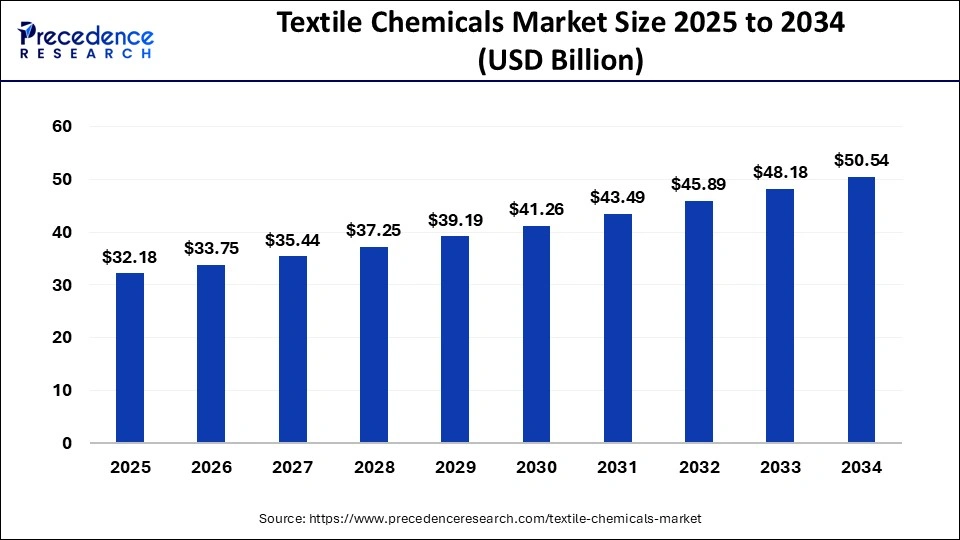

The global textile chemicals market size accounted for USD 32.18 billion in 2025 and is predicted to increase from USD 33.75 billion in 2026 to approximately USD 52.85 billion by 2035, expanding at a CAGR of 5.09% from 2026 to 2035. The textile chemicals market growth is fueled by changing consumer preferences, technological advancement, and the rising interest of key players toward innovation.

Textile Chemicals Market Key Takeaway

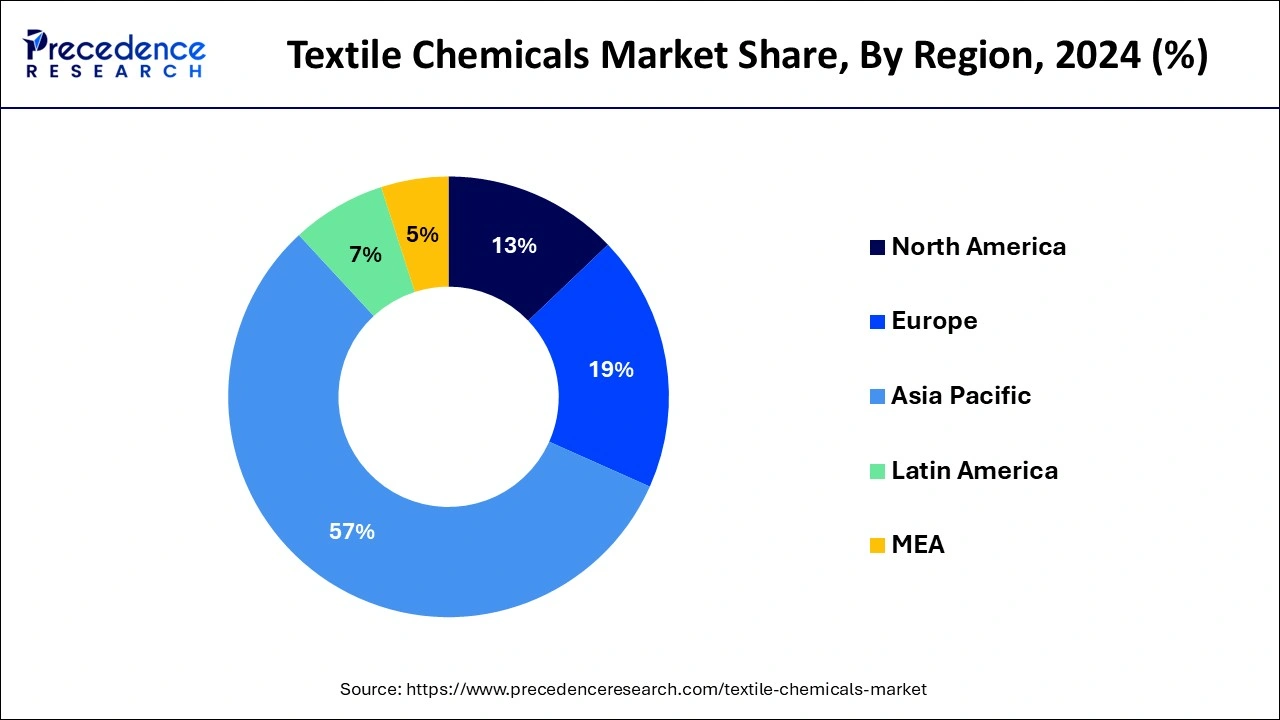

- Asia Pacific dominated the global market with the largest market share of 57% in 2025.

- By process, the coating process segment has held a revenue share of over 71.5% in 2025.

- By product, the coating & sizing chemicals segment has held a revenue share of over 50.8% in 2025.

- The colorants and auxiliaries product segment has held a revenue share of around 28% in 2025.

- By application, the apparel segment has accounted revenue share of over 44.8% in 2025.

What are Textile Chemicals?

Rapid growth of the apparel industry along with increasing penetration of online retail shops has bolstered the textile chemicals market growth. These chemicals are added in the fabric during its processing to impart specific characteristics to the apparel. Some of the specific features imparted by textile chemicals to the apparel include antimicrobial properties, sweat absorbent, stain resistance, wrinkle resistance, finish to the fabric, and desired texture.

However, release of harmful chemicals in the environment during the manufacturing process negatively impact human health, thereby restricts the market growth. Further, various regulations imposed by the government on the usage of textile chemicals expected to hinder the growth of the market. Nonetheless, a shifted focus of the manufacturing companies towards green chemicals i.e. bio-chemicals anticipated to open up new opportunities for the market growth in the coming years. These bio-chemicals are environmental-friendly as well as cost-efficient as they are made from plant and animal fat oil.

How is AI Transforming the Textile Chemicals Market?

The textile chemical industry can use artificial intelligence (AI) to dig deep into its vast databases to identify patterns and trends. Predictive maintenance, cutting waste streams, improving product quality controls, developing sustainability metrics for chemicals, and optimizing supply chains can all be achieved using AI. Identifying the different machinery and related equipment with great detail allows for anomaly detection, energy use reduction, and optimization of resource use. AI can ensure that any potential defect will be caught before an item leaves the line. AI can also look at existing chemical composition and find ways to create ecologically sustainable chemicals. This domain will witness an increasing boost as the textile industry gradually turns up toward A.I. to achieve maximum competition in terms of sustainable environmental conditions and efficiency.

Worldwide product highlights:

| Country | Company | Product Name | Advancements |

| Japan | Toyota | Series electric | Electric, high energy efficiency, advanced safety controls KION |

| Germany | Hunstman | Textile dyes, performance | High-performance dyeing systems |

| U.S. | Dow Chemical | Coating polymers, softeners | Silicone-based textile finishing |

| Germany | Dystar | Auxiliaries, Pre-treatment chemicals | Resource-efficient dyeing technologies |

| India | Sarex Chemicals | Flame retardants, finishing agents | Sustainable textile auxiliaries |

Textile Chemicals Market Growth Factors

- The surge in demand for biodegradable, non-toxic textiles as sustainable and eco-friendly products is the major driver of the textile chemicals market.

- Advances in technology in processing textiles widen their scope and efficiency.

- A growing global fashion industry drives an increased demand for textiles and chemicals used in dyeing, finishing, and functional treatments.

- The increased demand for home textiles and upholstery is accompanied by demand for finishing and care products.

- Regulations continue to push for safer and less toxic textile chemicals for example, through sustainability and health compliance.

Recent Technological Advancements

- Enzyme-based processing: This innovative approach replaces harsh chemicals in the dyeing and sourcing stages, utilizing natural enzymes to achieve desired effects while promoting sustainability.

- Nanotechnology: The cutting-edge development of anti-microbial and UV-protective coatings through nanotechnology enhances product longevity and durability, offering advanced protection without compromising safety or environmental integrity.

- Waterless dyeing technologies: Utilizing CO2-based dyeing methods, this technology revolutionizes the dyeing process by eliminating the need for water, significantly reducing waste and environmental impact, while achieving vibrant and lasting colors.

- Digital finishing systems: These sophisticated systems enable precise chemical application, minimizing resource waste and ensuring that chemicals are applied only where needed, resulting in greater efficiency and a reduced environmental footprint.

- Bridgeable surfactants: Designed to minimize environmental impact, these innovative surfactants facilitate effective cleaning and processing while being less harmful to aquatic ecosystems, aligning with sustainable practices in textile production.

Textile Chemicals Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to grow significantly due to the rising emphasis of chemical companies for manufacturing a wide range of chemicals along with rapid investment by government for strengthening the chemical sector.

- Major Investors: Numerous chemical manufacturers and strategic investors are actively entering this market, drawn by collaborations, R&D and business expansions. Several textile companies such as Raymond, Zara, Denizen and some others have started investing rapidly for developing advanced chemicals to manufacture high-quality garments.

- Sustainability Trends: The growing focus of garment manufacturers to use eco-friendly chemicals for manufacturing different types of dresses is an ongoing trend in this industry.

- Startup Ecosystem: Several startup companies are engaged in manufacturing chemicals for the textiles industry. The top startup brands dealing in textile chemicals comprises of Scimplify, Terradote, CIWI and some others.

Market Scope

| Report Highlights | Details |

| Market Size by 2035 | USD 52.85 Billion |

| Market Size in 2025 | USD 32.18 Billion |

| Market Size in 2026 | USD 33.75 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.09% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Process, Product, Fiber Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

- Growing demand for industrial textile usage

- Increased consumer spending in the fashion industry

- Increasing demand for furnishing and modern home decor items

- Rise in demand for coating and sizing agents

Restraint

- Textile wastewater disposal is subject to strict environmental restrictions and health hazards

Opportunity

- The rise in the use of low VOC and biodegradable ingredients in textile manufacture

- Manufacturing of non-hazardous textile chemicals

Segments Insight

Process Insights

Coating is dominant for the textile chemicals processing segment, since it imparts unique functional properties such as antimicrobial protection, water resistance, and conductivity, which cannot be imparted through standard treatments. This versatility allows it to be customized to meet specific requirements of the end-user; thus, being capable of serving both apparel and technical textile needs.

The treatment of finished products is the fastest-growing process segment, which involves the treatment of textiles so that they meet market expectations in aesthetic appearance, functions, and durability. Newer treatment methods result in experienced consumer appeal, and the adoption of treatment methods incorporates sustainability regulations.

Product Insights

Coating and sizing chemicals dominated the market, having been applied in fabric performance enhancements such Are strength, abrasion resistance, and water repellent. Their role goes towards enhancing comfort and durability, making their applications indispensable for both fashion and industrial textiles.

Finishing agents constitute the fastest-growing product category as they improve and maintain softness, drape, and stretchiness, while bestowing UV defense, flame-retardant properties, et cetera, as functional attributes. The high expansion has contributed to increased demand for high-performance and multifunctional textiles.

Application Insights

In textile chemical applications, the apparel segment led the market because of the huge demand for treatment to adequately enhance colorfastness, softness, and durability. Evolving constantly with fashion trends and consumer preferences, chemical application is required in every stage of blending, welding, and finishing to improve performance and aesthetic appeal.

Home furnishing is the fastest-growing application segment, with higher demands for upholstery, carpets, curtains, and bedding that have superior comfort, durability, and sustainability. Growing consumer preference for finishes in the specter of textile processing stimulates chemical innovation.

Regional Insights

What is the Asia Pacific Textile Chemicals Market Size?

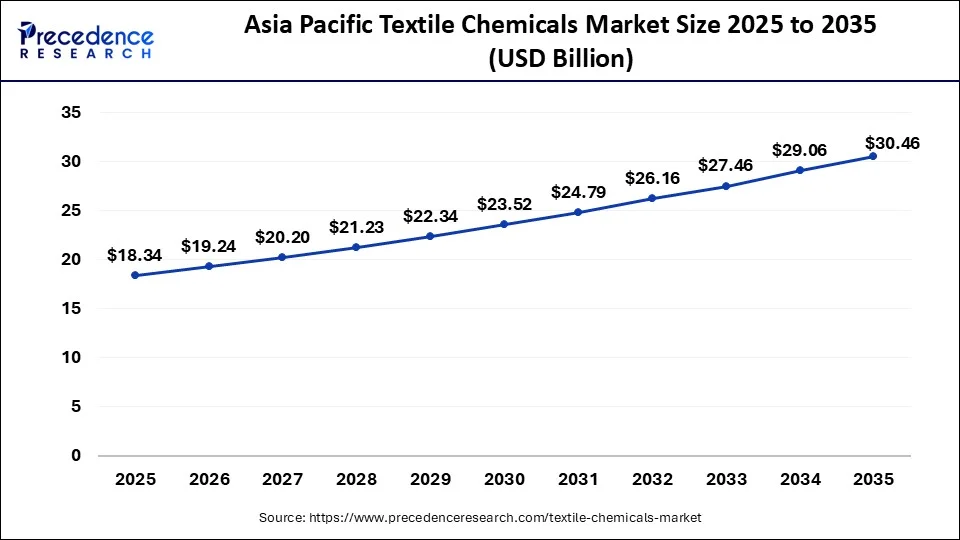

The Asia Pacific textile chemicals market size is exhibited at USD 18.34 billion in 2025 and is projected to be worth around USD 30.46 billion by 2035, growing at a CAGR of 5.20% from 2026 to 2035.

What was the dominating Position of Asia Pacific in the Textile Chemicals Market in 2025?

Being largest textile producer in the world, the Asia Pacific held attractive revenue share in the global textile chemicals market in 2023 and expected to offer substantial growth in the near future. China collective accounts for more than 60% of the regional share and nearly 35% of the global share. Prime factor attributed to the significant growth of the region is large production capacity of textiles. Total revenue conquered by China through textile export business was USD 206 Billion in 2016.

India Textile Chemicals Market Analysis

India is advancing in the textile chemicals industry due to abundant raw materials, a rise in technical textiles, and sustainability. The PPF Scheme of India aims to simplify compliance, address industry challenges, attract fresh investments, and boost employment in the textile sector.

- In January 2026, the Ministry of Textiles, India, announced major amendments to the Production Linked Incentive (PLI) Scheme for man-made fabrics, man-made fibre apparel, and technical textile products.

R&D innovation: Pioneering advancements in the development of bio-based, non-toxic, and multifunctional chemicals designed to enhance performance while prioritizing environmental safety.

- Sustainability shift: Strategic formulation of products that adhere to prominent certification standards such as GOTS Global Organic Textile Standard,

- REACH Registration, Evaluation, Authorisation and Restriction of Chemicals, and ZDHC Zero Discharge of Hazardous Chemicals, ensuring a reduced ecological footprint.

- Vertical integration: A growing trend where numerous stakeholders are harmonizing chemical production processes with textile manufacturing, fostering greater efficiency and sustainability throughout the supply chain.

- Smart textiles: Cutting-edge chemicals that enable advanced textile features such as superior moisture management, effective odour control, and enhanced temperature regulation, elevating comfort and functionality for end-users.

- Customisation: The provision of on-demand chemical solutions meticulously tailored to meet specific niche textile functionalities, allowing brands to innovate and differentiate in a competitive market.

How will North America Grow Rapidly in the Textile Chemicals Market?

However, rising demand for apparels in North America expected to raise the consumption of textile chemicals during the forecast period. In addition, rising number of vehicle production along with increasing trend for advanced vehicles trigger the growth of automotive textiles in the region. The region is an industrial home for different types of industries that too promotes the use oftechnical textiles in the region.

North America

U.S. Textile Chemicals Market Analysis

The U.S. boasts a robust domestic market, coupled with prominent research and development centres, that supports innovation and growth. Additionally, stringent sustainability regulations promote environmentally responsible practices across industries.

Canada Textile Chemicals Market Analysis

Canada's emphasis on the development of organic and innovative textiles, coupled with significant governmental backing for clean technology initiatives, this approach embodies a commitment to sustainability and forward-thinking practices in the textile industry.

Why Europe held a significant share of the industry?

Europe held a significant share of the market. The growing demand for bikers jackets in numerous countries such as Germany, Italy, France, UK and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the chemical manufacturing sector is expected to drive the growth of the textile chemicals market in this region.

The UK Textile Chemicals Market Trends

The UK market is experiencing steady growth, driven by increasing demand for functional and sustainable textiles in fashion, home textiles, and technical applications. Rising consumer preference for eco-friendly and non-toxic fabrics is pushing manufacturers to adopt biodegradable, water-based, and low-impact chemical formulations.

What made Latin America to held a considerable share of the market?

Latin America held a considerable share of the industry. The increasing sales of designer shirts in several nations such as Brazil, Argentina, Peru and some others has driven the market growth. Also, rise in number of chemical startups coupled with technological advancements in the textile industry is expected to propel the growth of the textile chemicals market in this region.

Brazil Textile Chemicals Market Trends

Brazil's market is growing steadily, fueled by increasing demand from the apparel, home textile, and industrial sectors as the country's textile industry expands. Rising consumer awareness of sustainable and eco-friendly products is driving the adoption of biodegradable, low-impact, and water-based chemical formulations. Functional textile treatments, including anti-microbial, stain-resistant, and wrinkle-free finishes, are gaining popularity to meet performance and quality expectations.

How did Middle East and Africa to hold a notable share of the industry?

Middle East and Africa held a notable share of the market. The rising demand for branded jeans in various countries such as UAE, South Africa, Saudi Arabia, Qatar and some others has boosted the market expansion. Additionally, rapid investment by chemical manufacturers for developing a wide range of textile chemicals is expected to foster the growth of the textile chemicals market in this region.

The UAE Textile Chemicals Market Trends

The UAE market is expanding, driven by growing demand from the apparel, home textile, and industrial sectors as the country strengthens its textile manufacturing and re-export capabilities. There is an increasing focus on sustainable and eco-friendly chemical solutions, including water-based, low-impact, and biodegradable formulations, to meet regulatory requirements and consumer preferences. Functional finishes such as anti-microbial, stain-resistant, and moisture-wicking treatments are gaining traction, especially in high-performance and luxury textiles.

Value-Chain Analysis

- Raw Material Procurement - The raw materials for textile chemicals include natural resources such as cotton, wool, and flax and petroleum-based products for synthetic fibers such as polyester and nylon.

Key Companies: Reliance Industries Ltd., Indorama Ventures, Unifi and others. - Production Methodology - Textile chemicals are produced through a process that begins with the synthesis of raw materials in reactors, followed by purification steps like distillation and crystallization to separate components and achieve the desired purity.

Key Companies: Archroma, BASF, Huntsman Corporation and others. - Distribution Channel - Textile chemicals are distributed globally through a supply chain where manufacturers produce chemicals, often in Asia Pacific, and supply them to textile production hubs, which then ship finished goods to consumers worldwide.

Key Companies: DOW, Kiri Dyes and Chemicals Ltd, Clariant and others.

Textile Chemicals Market Companies

- Archroma: Archroma is a global specialty chemicals company headquartered in Switzerland that provides dyes, and chemical solutions for the textile, paper, and packaging industries. The company focuses on creating sustainable and high-performance products, operating across various divisions including brand & performance textile specialties, packaging & paper specialties, and coatings, adhesives & sealants.

- Lonsen Inc.: Lonsen is a major global player in the chemical industry, and its subsidiaries such as Lonsen Kiri Chemical Industries Limited in India, which is a joint venture focused on manufacturing reactive dyes, and Lonsen Inc. in the US, a wholly-owned subsidiary established in 2018.

- Evonik Industries AG: Evonik Industries AG is a German specialty chemicals company headquartered in Essen, with a global presence in over 100 countries. It is one of the world's largest specialty chemical companies, formed in 2007 from a restructuring of the mining company RAG AG.

- Huntsman: Huntsman is a global manufacturer and marketer of differentiated and specialty chemicals headquartered in The Woodlands, Texas. The company produces thousands of chemical products, including polyurethanes, amines, and epoxy-based formulations, for a wide range of consumer and industrial markets such as textiles, automotive, aerospace, and construction.

- Solvay: Solvay is a Belgian chemical company headquartered in Brussels, founded in 1863, that produces and distributes essential chemicals, polymers, and specialty materials for a wide range of industries. The company is known for its historical innovation with the ammonia-soda process and now focuses on sustainable solutions for products used in areas such as healthcare, textiles, consumer goods, and automotive.

Leadership Announcement

- Dr. Dhara Choksi, MD, Global Nanotech, enlightens one of the advances made by the company in pigment powders, dispersions, and textile inks. Indeed, the newfound affordability now made possible through digital printing makes it possible for smaller businesses and families to produce their own print patterns on fabric. Global Nanotech has its interests at the forefront of textile innovation that marries sustainability with cutting-edge technology. It also plans to move into cutting-edge fashion with clothing.

Recent Developments

- In November 2025, DuPont launched Tyvek APX. Tyvek APX is an advanced chemical designed for manufacturing protective garments. Source: Dupont

- In October 2025, Clariant launched a titanium-based catalyst solution. This catalyst solution is used for manufacturing polyester garments. Source: EcoTextile

- In September 2025, Archroma launched Siligen D2W LIQ C. Siligen D2W LIQ C is a high-quality chemical that finds application in producing cotton garments. Source: EcoTextile

- In July 2025, the CSIR-CRRI, in collaboration with BPCL and NHAI, launched India's first-ever road trial using end-of-life waste plastic technical textiles. Source: Chemical Industry Digest

- In March 2025, Aquafil in Slovenia launched the first demonstration plant for chemical separation of elastic fiber from nylon, advancing research and development in the textile fiber sector. Source:Indian Textile Magazine

Segments Covered in the Report

By Process

- Pre Treatment

- De-sizing Agents

- Bleaching Agents

- Scouring Agents

- Others

- Coating

- Anti-piling

- Water Proofing

- Protection

- Water Repellant

- Others

- Treatment of Finished Products

- Softening

- Stiffening

- Others

By Product

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Dispersants/levelant

- Fixative

- UV Absorber

- Other

- Finishing Agents

- Repellent & Release

- Flame Retardants

- Antimicrobial Or Anti-inflammatory

- Other

- Surfactants

- Wetting Agents

- Detergents & Dispersing Agents

- Emulsifying Agents

- Lubricating Agents

- Denim Finishing Agents

- Enzymes

- Resins

- Softeners

- Defoamers

- Bleaching Agents

- Curesh Resistant Agents

- Anti-back Staining Agents

- Others

By Fiber Type

- Natural Fiber

- Synthetic Fiber

By Application

- Apparel

- Sportswear

- Outerwear

- Innerwear

- Others

- Home Furnishing

- Furniture

- Drapery

- Carpet

- Other

- Technical Textiles

- Agrotech

- Buildtech

- Geotech

- Medtech

- Mobiltech

- Packtech

- Protech

- Indutech

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting